So, what’s happening this week?

$ETH is underperforming $BTC while Arbitrum continues to trend up and people begin farming the next airdrop: ZKSync.

TLDR

- Since the Merge, $ETH's supply growth rate has become deflationary, making it more attractive to long-term investors.

- $ETH’s price is close to the $2,200 target, but the risk/reward ratio is poor for short-term gains.

- Futures market health is bullish; a short squeeze might push the price higher.

- DeFi TVL jumped by $880M, with Curve Finance and Aave as top gainers.

- Layer-2 TVL is growing, with ZKSync gaining traction due to airdrop farming after Arbitrum’s announcement.

- Weekly NFT trades continue to trend downward except for Blur, which relies on incentives.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

$BTC > $ETH?

You are probably wondering, why is $BTC pulling a better performance than $ETH. Isn't $ETH supposed to be more volatile and go up more during a bullish rally? Let's dive in![caption id="attachment_265523" align="aligncenter" width="2556"] BTC/ETH Chart | Source: TradingView[/caption]

BTC/ETH Chart | Source: TradingView[/caption]

[caption id="attachment_265508" align="aligncenter" width="1323"] BTC/ETH Chart | Source: TradingView[/caption]

BTC/ETH Chart | Source: TradingView[/caption]

Check out the $ETH/$BTC chart above. In a nutshell:

- Chart rises = $ETH is beating $BTC.

- Chart falls = $BTC is winning against $ETH.

It's simple. With the US banking crisis creating uncertainty, people are turning to safe options, and Bitcoin is one of them. That's why $BTC is stealing the crypto spotlight.

But don't worry! $BTC is our secret weapon. As it gets more popular, it'll pave the way for the rest of the crypto world, including $ETH. So keep an eye on developments, and let's ride the crypto wave together!

ETHonomics

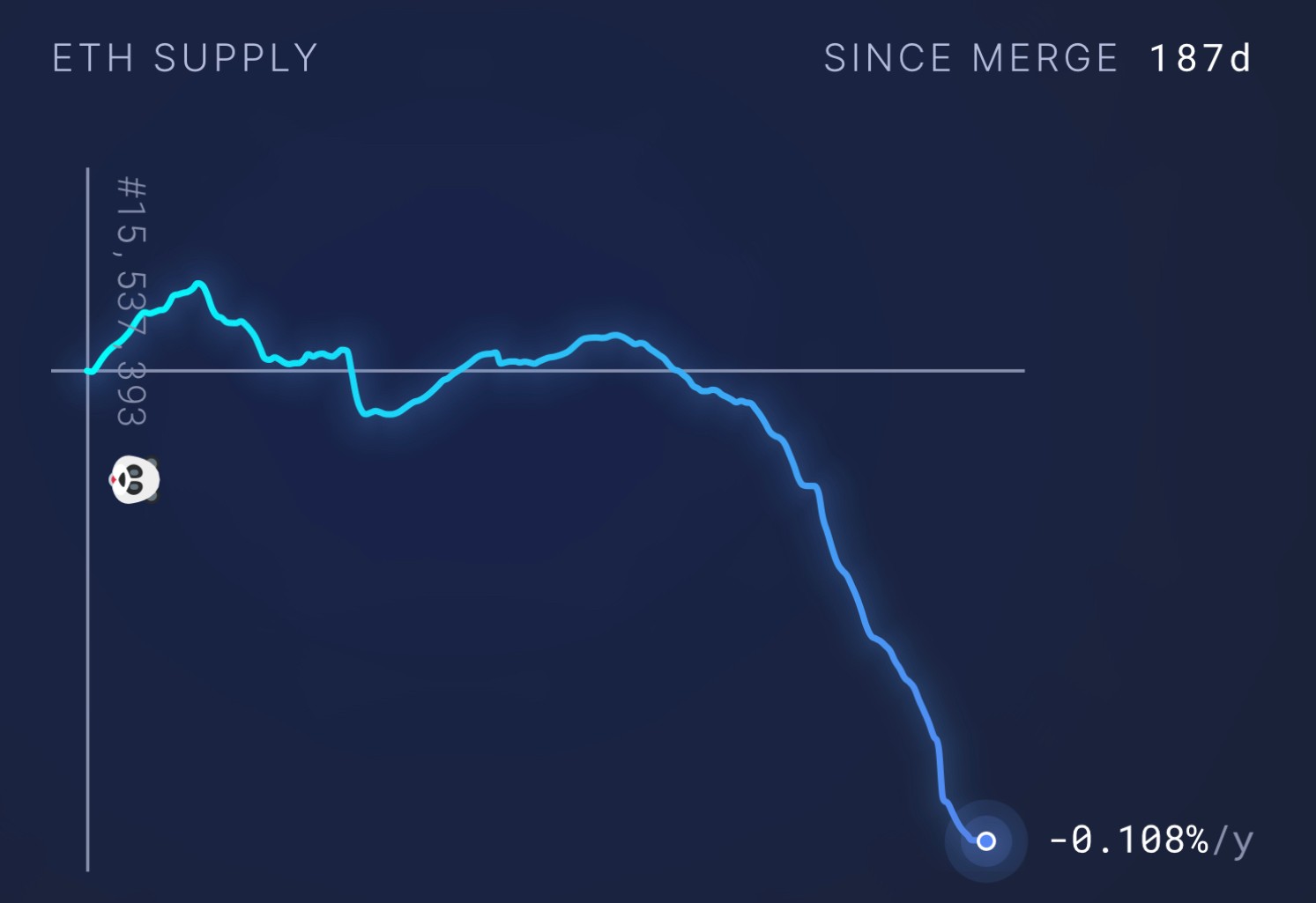

Now let’s dive into the economics of $ETH once again to view the state of the supply from another angle.[caption id="attachment_265517" align="aligncenter" width="1493"] ETH Yearly Supply Growth %[/caption]

ETH Yearly Supply Growth %[/caption]

Check out this Ethereum ($ETH) supply growth chart! Ever since the Merge happened 187 days ago, the growth rate has dropped quite a bit (to -0.10%).

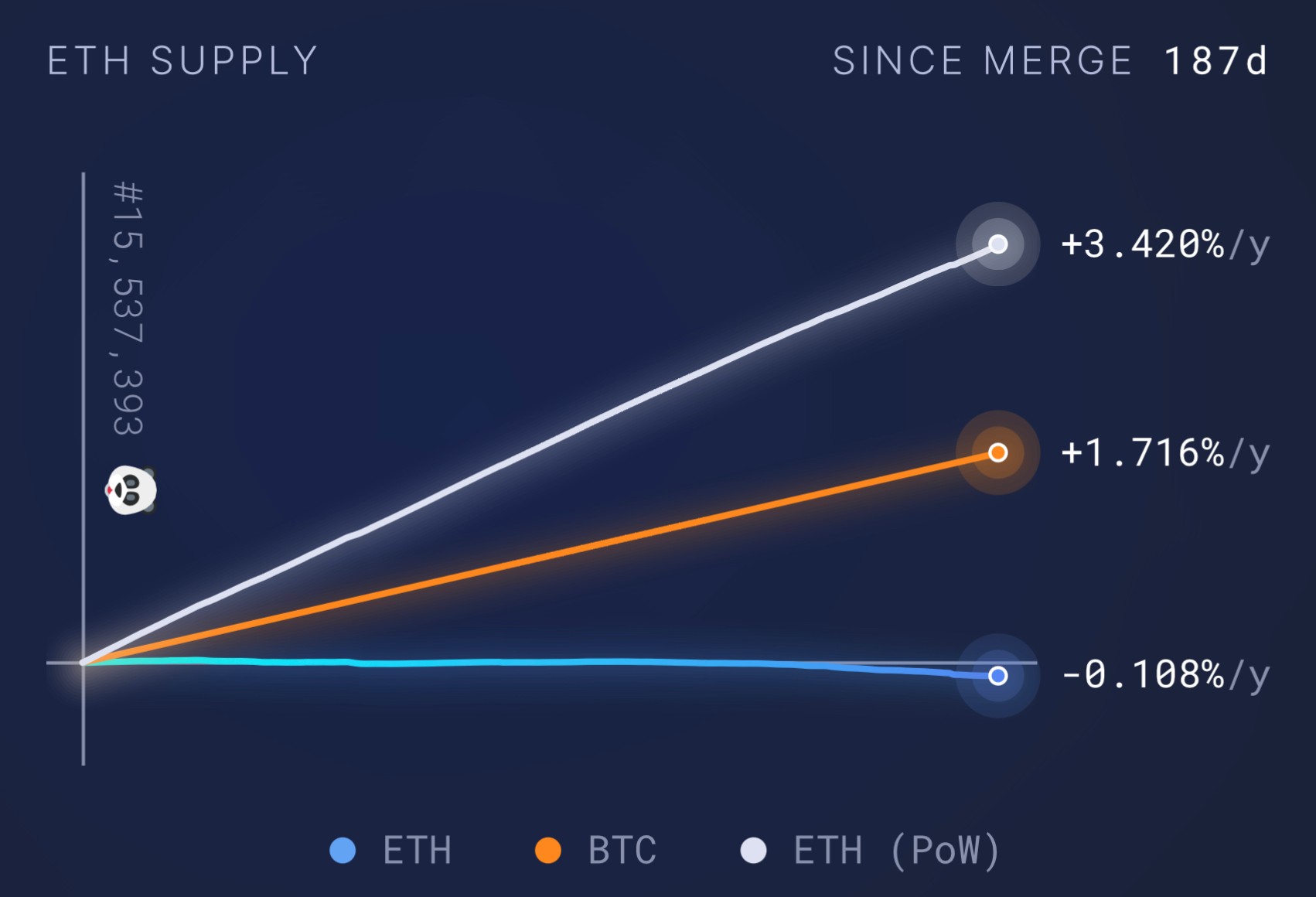

To get a better picture of this, let's compare that growth rate with both $BTC and $ETH before the Merge.

[caption id="attachment_265516" align="aligncenter" width="1702"] ETH (PoS), ETH (PoW) & BTC Yearly Supply Growth %[/caption]

ETH (PoS), ETH (PoW) & BTC Yearly Supply Growth %[/caption]

Prior to that big event, $ETH's supply growth rate was +3.4% per year, while Bitcoin's is +1.7%. Now that it's negative, it means $ETH's supply is actually shrinking – it's deflationary! In fact, $ETH’s supply has dropped by -66,400 ETH ($117M) in the past six months alone.

Assuming this deflationary trend continues, $ETH will become a much more attractive investment for long term investors.

The State of $ETH

Price chart

[caption id="attachment_265522" align="aligncenter" width="2556"] ETH/USD Chart | Source: TradingView[/caption]

ETH/USD Chart | Source: TradingView[/caption]

[caption id="attachment_265509" align="aligncenter" width="1390"] ETH/USD Chart | Source: TradingView[/caption]

ETH/USD Chart | Source: TradingView[/caption]

$ETH is now just 20% away from our $2,200 target. While we think the price might reach that level soon, buying now may not be a great move for short-term gains due to the poor risk/reward ratio. It's a better option if you plan to be a long-term investor.

Interestingly, many people are still betting against it, which can give it another boost to reach $2,200 soon. Let's dive deeper.

Futures’ market health

[caption id="attachment_265526" align="aligncenter" width="2556"] ETH/USD + Funding Rate & Open Interest (on perpetual futures)[/caption]

ETH/USD + Funding Rate & Open Interest (on perpetual futures)[/caption]

[caption id="attachment_265513" align="aligncenter" width="1636"] ETH/USD + Funding Rate & Open Interest (on perpetual futures)[/caption]

ETH/USD + Funding Rate & Open Interest (on perpetual futures)[/caption]

The open interest (value of current open positions) dropping as the price rises suggests that traders are closing their short positions. If OI were increasing alongside the price, it would indicate too many people going long, meaning we'd be running out of buyers – but that's not happening now.

Another clue is the negative funding rate as the price increases. This rate shows shorts are adamant about their positions, and are even willing to pay just to stay short. This stubbornness can lead to a price increase through a short squeeze (market liquidating shorts, causing a sharp move to the upside).

In summary, the market is showing even more bullish signs than we anticipated, with the current trends suggesting further growth.

With that being said, it is crucial to keep a close eye on the market in the midst of this uncertainty, as a pullback from $2,200 becomes increasingly likely.

The smart money

[caption id="attachment_265519" align="aligncenter" width="1026"] ETH/USD Orderbook Visual (on chart)[/caption]

ETH/USD Orderbook Visual (on chart)[/caption]

As mentioned in our last digest, whales had placed sell orders at $1,878.75, creating a hurdle for the price to overcome. This level was expected to act as short-term resistance.

This week, those whales have adjusted their sell orders, moving them up by $200 to $2,078.75. This change gives the price more room to grow.

Everything is pointing towards our $2,200 target being just around the corner!

The Ethereum ecosystem

Decentralised finance (DeFi)

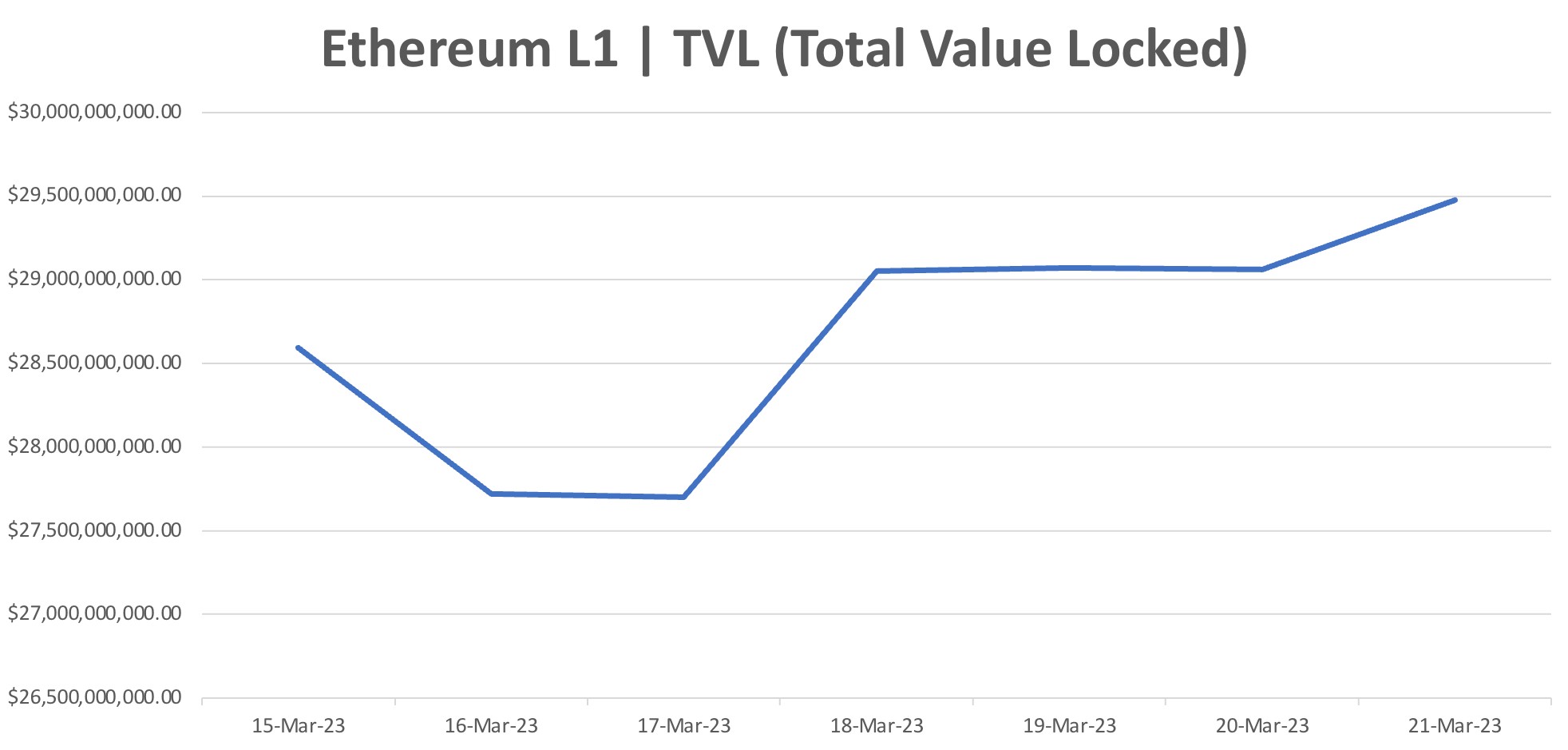

[caption id="attachment_265524" align="aligncenter" width="1964"] Ethereum L1 TVL | Source: DeFiLlama[/caption]

Ethereum L1 TVL | Source: DeFiLlama[/caption]

This week, DeFi total value locked (TVL) jumped by $880M (+3.1%). The big winners were:

- Curve Finance ($CRV): +$430M, up 10.9%.

- Aave ($AAVE): +$400M, up 9.7%.

Sure, $ETH's price bump played a part, but there are some significant updates to share:

- NFTfi (no token): This champ made our top gainers list two weeks in a row, soaring by +$14M (107.2%). Check out our detailed report here. Farming an airdrop without a token is a sweet deal, and NFTfi is climbing up that ladder.

- Solidly ($SOLID): It lost nearly half its TVL ($35M) this week. We warned you back on March 5 about the risks of jumping into Solidly. Specifically, we stated “We feel a responsibility to tell you that if you do decide to ape into Solidly or one of its forks, be careful as they are a game of musical chairs, and you must sell before the music stops or you’ll get rugged.” It pays to keep up with Cryptonary’s digests, as $SOLID is down -60% in the past two weeks despite the recent crypto rally.

- DeFi volume dominance (DeFi share of total volumes; incl. CeFi): 2%

- DeFi market cap: $50B (even lower than BNB's market cap)

Layer-2s

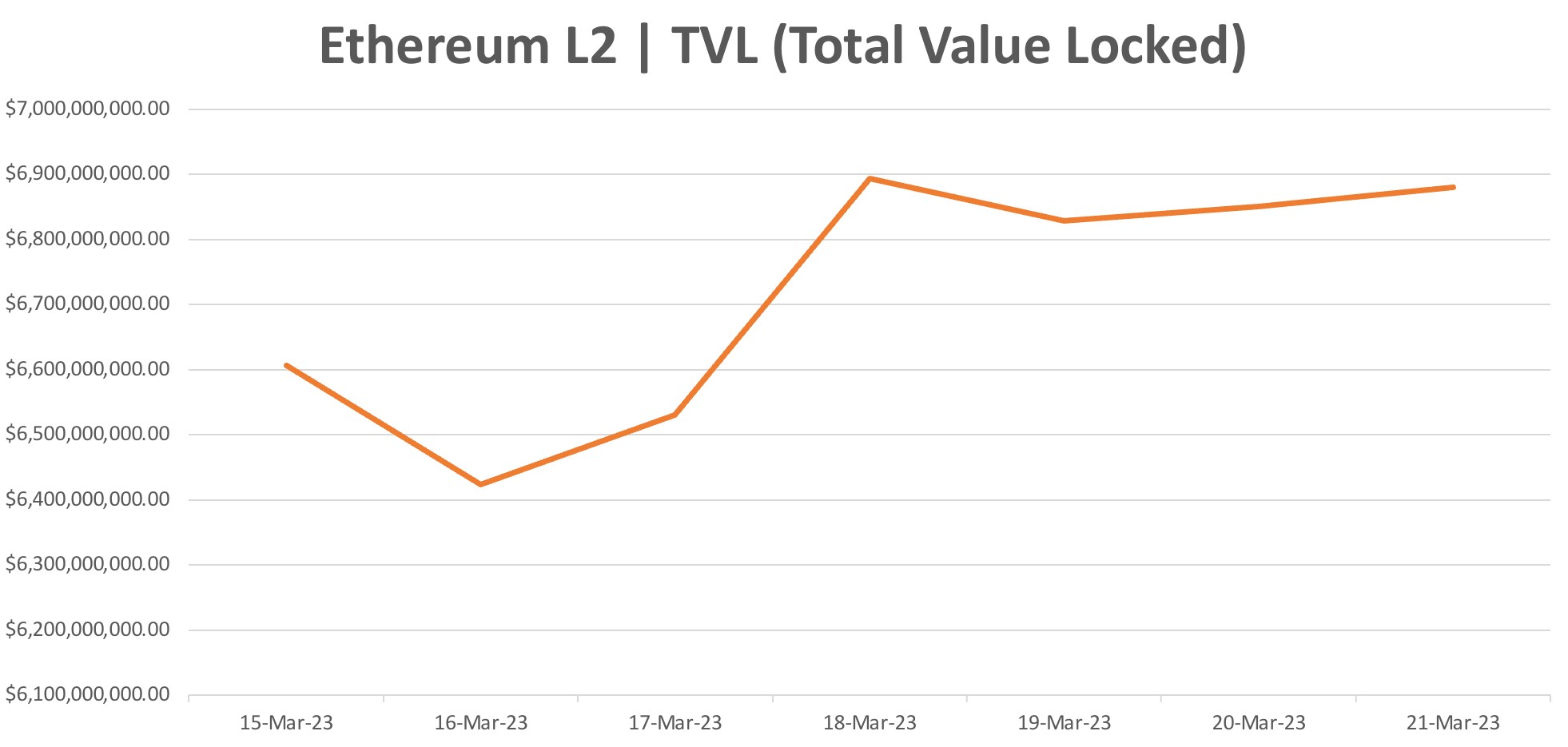

[caption id="attachment_265525" align="aligncenter" width="1962"] Ethereum Layer-2 TVL | Source: DeFiLlama[/caption]

Ethereum Layer-2 TVL | Source: DeFiLlama[/caption]

L2 (Layer-2) TVL is on the rise too, gaining $273M (+4.1%). Let's dive into the top ecosystems and their transformations:

Optimism (+$0, +0%)

Optimism has been chilling in the shadows since Arbitrum dropped their $ARB token. Neither their users nor TVL have grown. We predict they'll stay quiet for a while, at least until the Arbitrum buzz begins to fade.Arbitrum (+$235,000,000, +6.50%, )

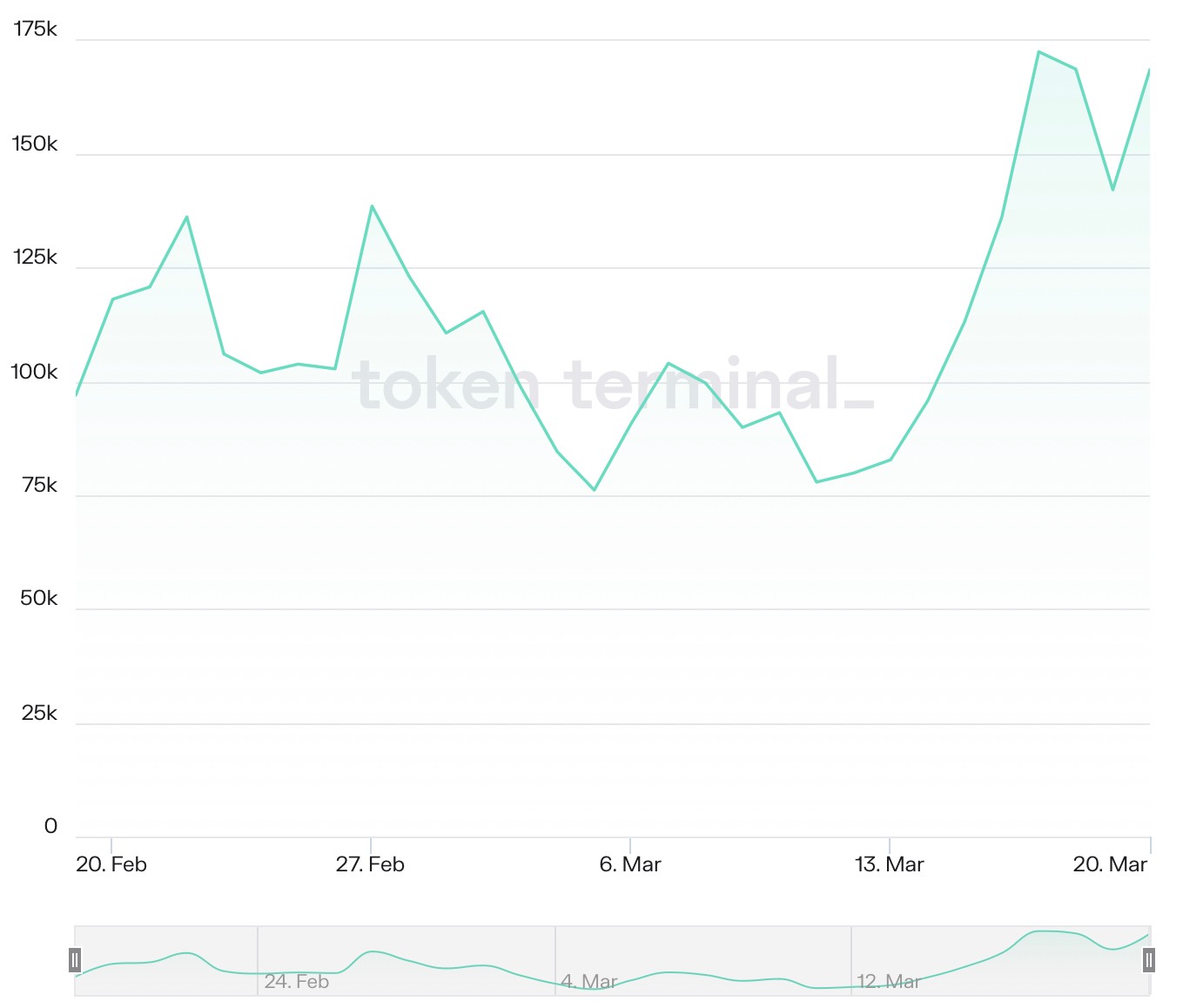

Arbitrum is riding high after announcing their token launch, with user numbers hitting record levels.[caption id="attachment_265510" align="aligncenter" width="1359"] Arbitrum Daily Active Users | Source: TokenTerminal[/caption]

Arbitrum Daily Active Users | Source: TokenTerminal[/caption]

$ARB can be claimed on Thursday and trading will go live! See if you're eligible here.

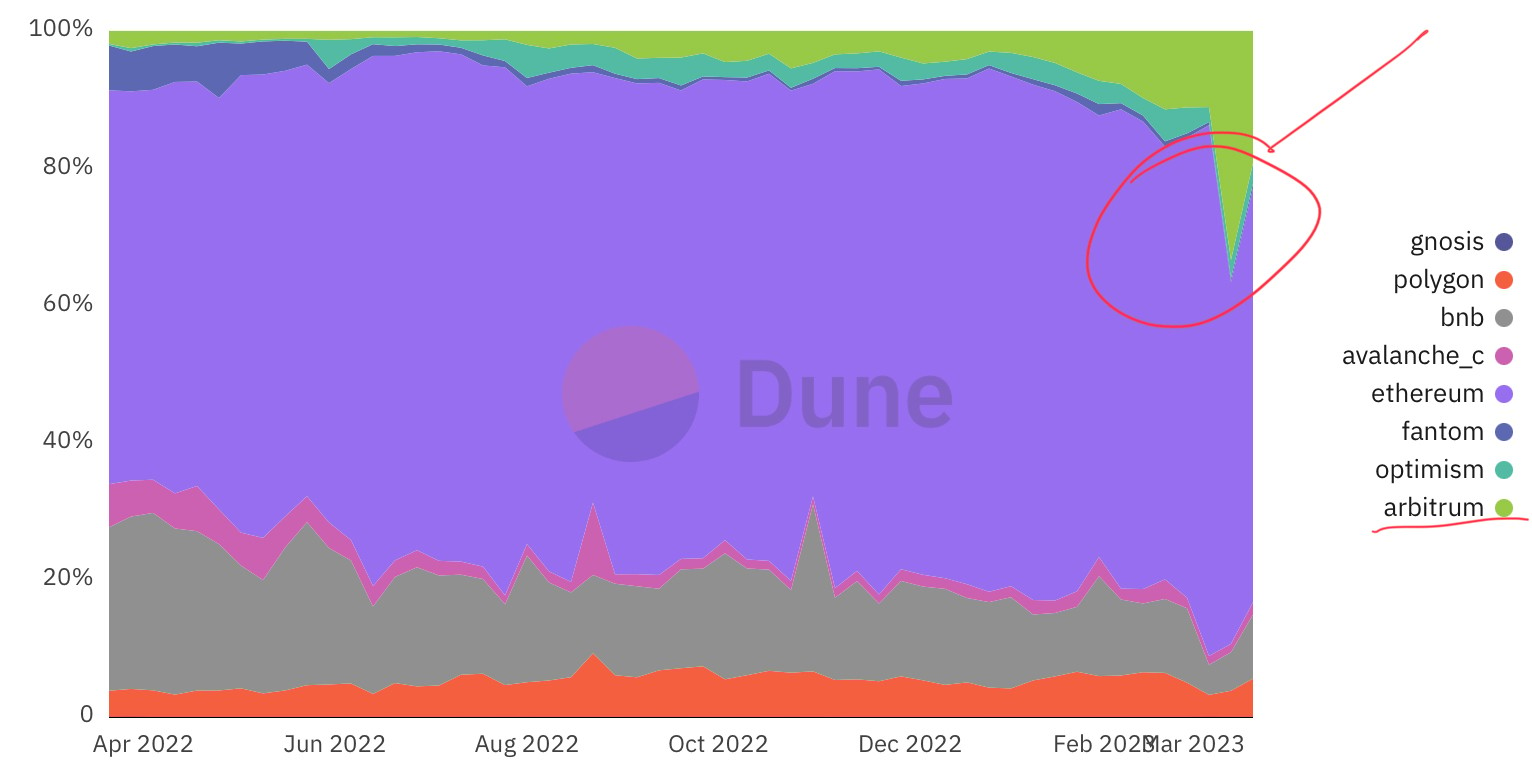

Arbitrum's share in decentralised exchanges has also skyrocketed, jumping 3X from 11% to 33%!

[caption id="attachment_265514" align="aligncenter" width="1532"] Decentralised Exchange (DEX) Market Share per chain | Source: Dune.com[/caption]

Decentralised Exchange (DEX) Market Share per chain | Source: Dune.com[/caption]

Oddly, this surge started just before the airdrop news. Could it be insider trading? Hmmm...

ZKSync (+$7,000,000, +10.4%)

ZKSync's TVL is growing, and its mainnet hasn't even launched! It's all thanks to the buzz around ZKSync's airdrop after $ARB's announcement. We recommend trying to farm the ZKSync airdrop, as it could be a big one. Want to learn how? Just click here!Ethereum NFTs

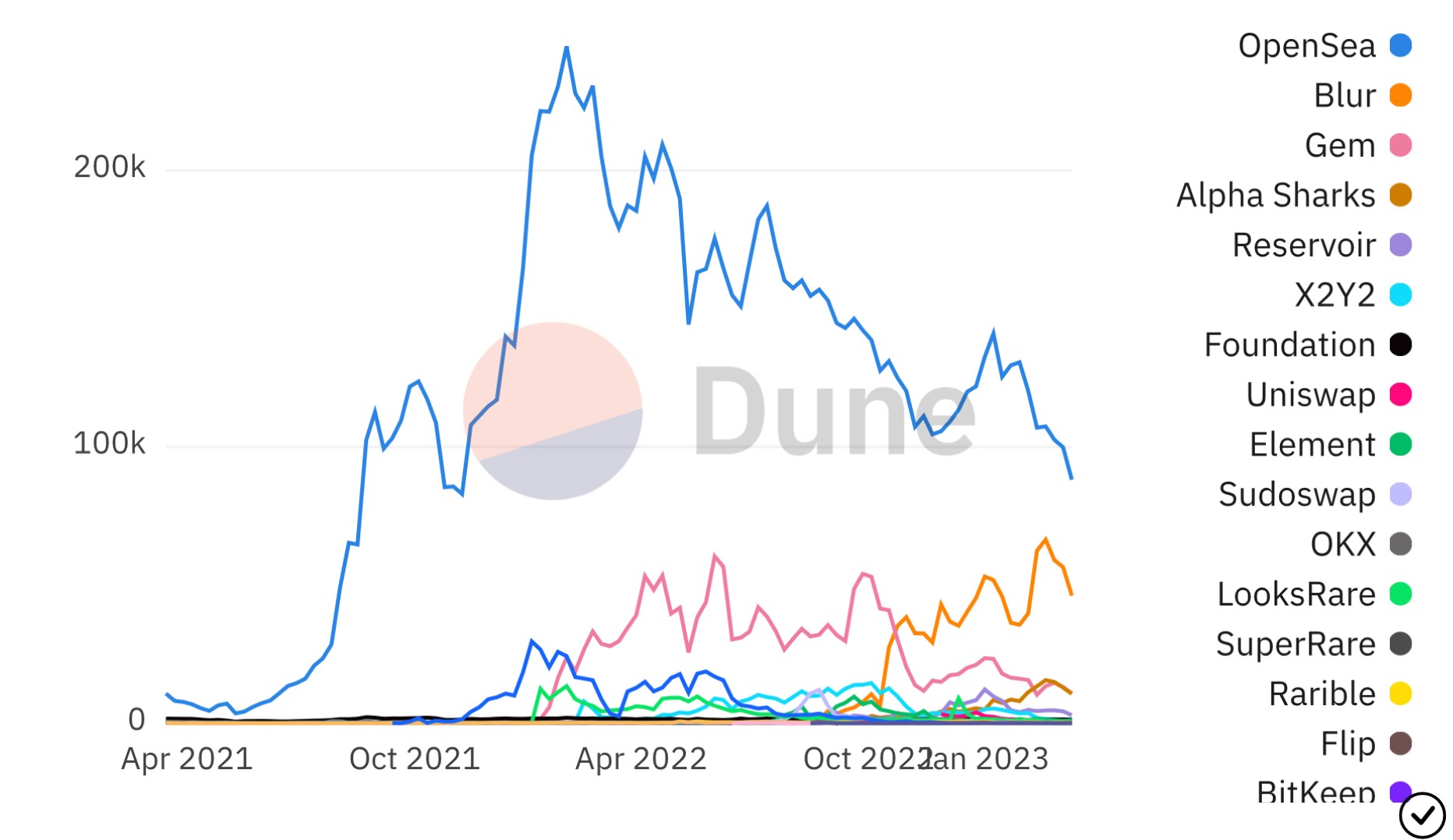

[caption id="attachment_265515" align="aligncenter" width="1864"] Weekly NFT Marketplace Trades | Source: Dune.com[/caption]

Weekly NFT Marketplace Trades | Source: Dune.com[/caption]

NFT trading volumes are still sliding down each week, hinting that excitement hasn't fully bounced back. The one exception is Blur, but don't bank on it lasting – their uptrend relies on incentives they're giving out right now.

Cryptonary’s take

The crypto market is showing strong signs of growth, with DeFi and layer-2 ecosystems gaining momentum.$ETH's deflationary trend makes it a more attractive investment for long-term investors. However, it's crucial to keep an eye on the market, as the current uncertainty might lead to pullbacks or changes in trends.

The price continues to gravitate towards our $2,200 target, but we will handle this with care as a temporary pullback is expected.

As always, thank you for reading 🙏

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms