Strap in for a wild ride this week in crypto as Bitcoin and Ethereum chart contrasting courses, Solana makes waves, DeFi soldiers on, and Asia & Middle East continue breaking ground. There's no shortage of exciting news to delve into.

We'll ride the twists and turns from futures ETF mania to spot ETF letdowns. And follow the money to see where markets may turn next - will emerging trends persist or get flipped on their head?

October could prove a pivotal month. So, fasten your seatbelts as we dive into a week filled with intrigue and potential.

TLDR 📃

- ETH Futures ETF Launch: Ethereum futures ETFs are set to debut in the U.S., potentially igniting a buying frenzy and boosting ETH's performance.

- Historical October BTC Performance: October historically favours Bitcoin with fewer red days, potentially pointing to a bullish trend.

- Curve and Convex Developments: Curve founder settles debt, while Convex launches cvxFXN staking, strengthening its position in CRV governance.

- Crypto Market Capital Flows: Leverage on ETH surges with Ethereum Futures ETF announcement, while BTC's volatility drops after Spot Bitcoin ETF delays.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the R:R trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

The biggest news of the week 🔑

Good news for ETH, Bad news for BTC 🚦

We are experiencing a dynamic shift, with contrasting developments for two leading digital assets. While Ethereum (ETH) enthusiasts have reason to celebrate, the Bitcoin (BTC) camp faces unexpected challenges.

The upcoming launch of ETH Futures ETF next week

Ethereum enthusiasts - brace yourselves! Ethereum futures ETFs are expected to launch in the U.S. as early as next week after the SEC made a surprise request for applicants to expedite their filings.This impending arrival could further propel Ethereum's recent price gains, with ETH already starting to outpace BTC recently. Some analysts predict these new ETH futures ETFs could accelerate momentum by fueling a buying frenzy ahead of schedule.

2023 BTC Spot ETF Launch Chances Slimmed by Delay

Meanwhile, Bitcoin faces new hurdles after the SEC delayed its decision on several spot BTC ETF applications until 2024. This unusual delay, which affects filings with deadlines far in the future, has sparked speculation within crypto circles.Some believe it signals heightened scrutiny or strategic concerns from the SEC. Regardless, it has slimmed the chances of a 2023 spot BTC ETF approval.

Mark Your Calendar for January 10, 2024

But one key date for BTC investors to mark - January 10, 2024. That's the final verdict day for ARK's spot BTC ETF filing, the first to reach this advanced stage. We eagerly await the SEC's ultimate decision.

Cryptonary’s take 🧠

The SEC's surprise delays have thrown us for a loop, proving the need to stay nimble. Speculation swirls that political factors are at play, with pressure on SEC Chair Gary Gensler.Regardless of the cause, Ethereum seizes the moment - outperforming Bitcoin on the heels of upcoming ETH futures ETFs. This momentum shift makes October an intriguing period to watch.

For now, Q4 looks less promising for a spot Bitcoin ETF. But we remain confident in a Q1 2024 launch, with an 80% chance of kickstarting the new year on a high note.

The SEC holds the cards for now, but we’ll stay alert and ready to ride the waves whenever the landscape shifts.

WTF is happening with Solana?💣

What's Up With Solana? 💥

Solana made some waves this week in the crypto market. Let's dive into the latest developments.

The Solana v1.16 update just rolled out after nearly ten months of work. It brings some neat enhancements like better support for confidential transfers and less data usage when starting up. Validators will also see reduced computer memory needs.

Additionally, Solana's Total Value Locked (TVL) recently surged to $319 million, up big from $210 million at the start of the year. The community is showing strong support, especially for Jito Protocol's liquid staking pool. Over seven days, TVL rose 9% to $48 million thanks to Jito's new staking rewards program.

Cryptonary’s take 🧠

The v1.16 update and growing adoption of Solana liquid staking have us feeling bullish on Solana's prospects for a Q4 rally.As we head into Q4, it's an opportune moment for you to consider staking your SOL tokens with Jito Protocol. This allows you to participate in a rewarding staking program and positions you for potential airdrops and additional benefits down the road.

The winds of change are blowing for Solana. Will you ride the wave and see where it takes you?

Chart of the week 📊

Will October be bullish?

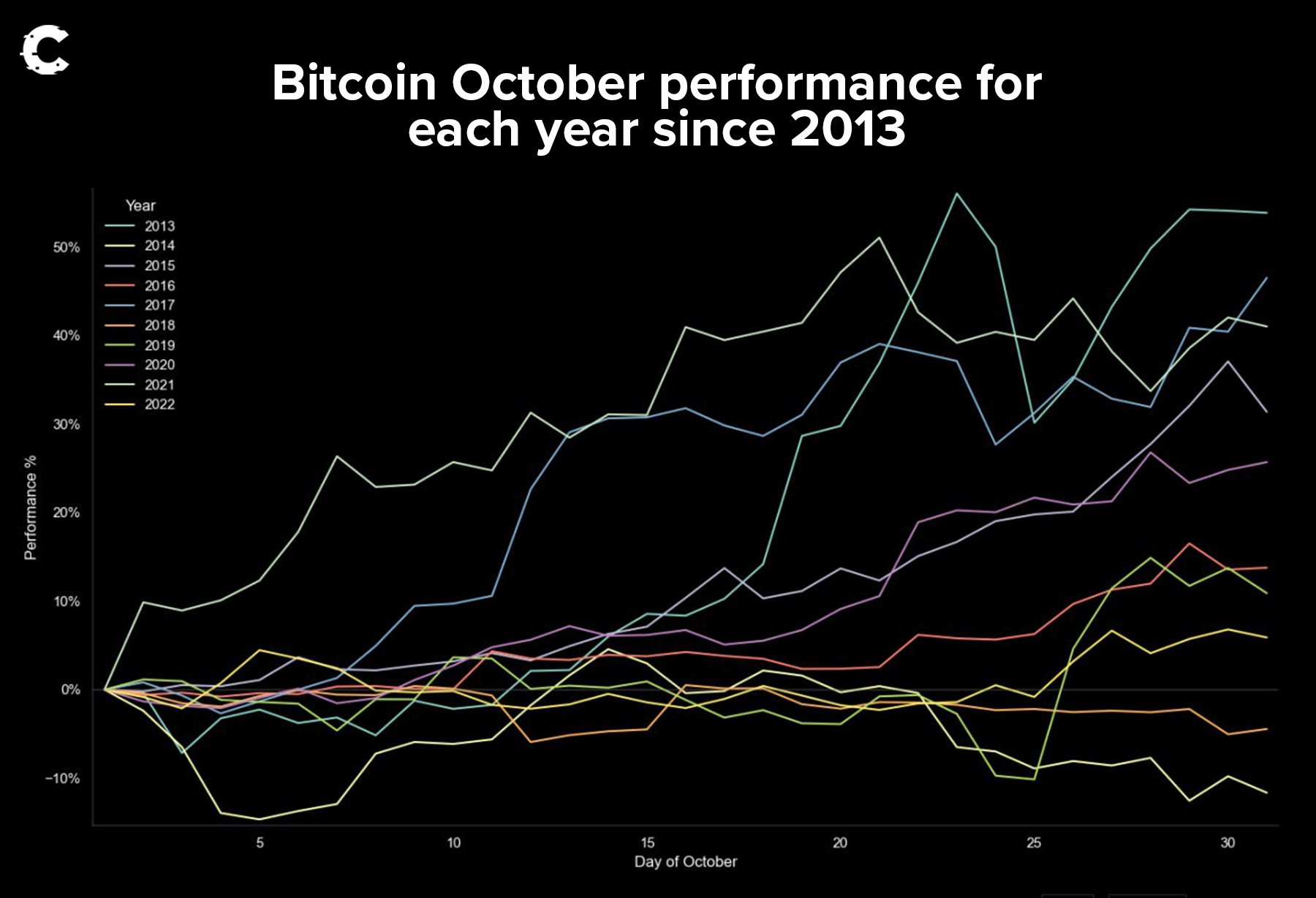

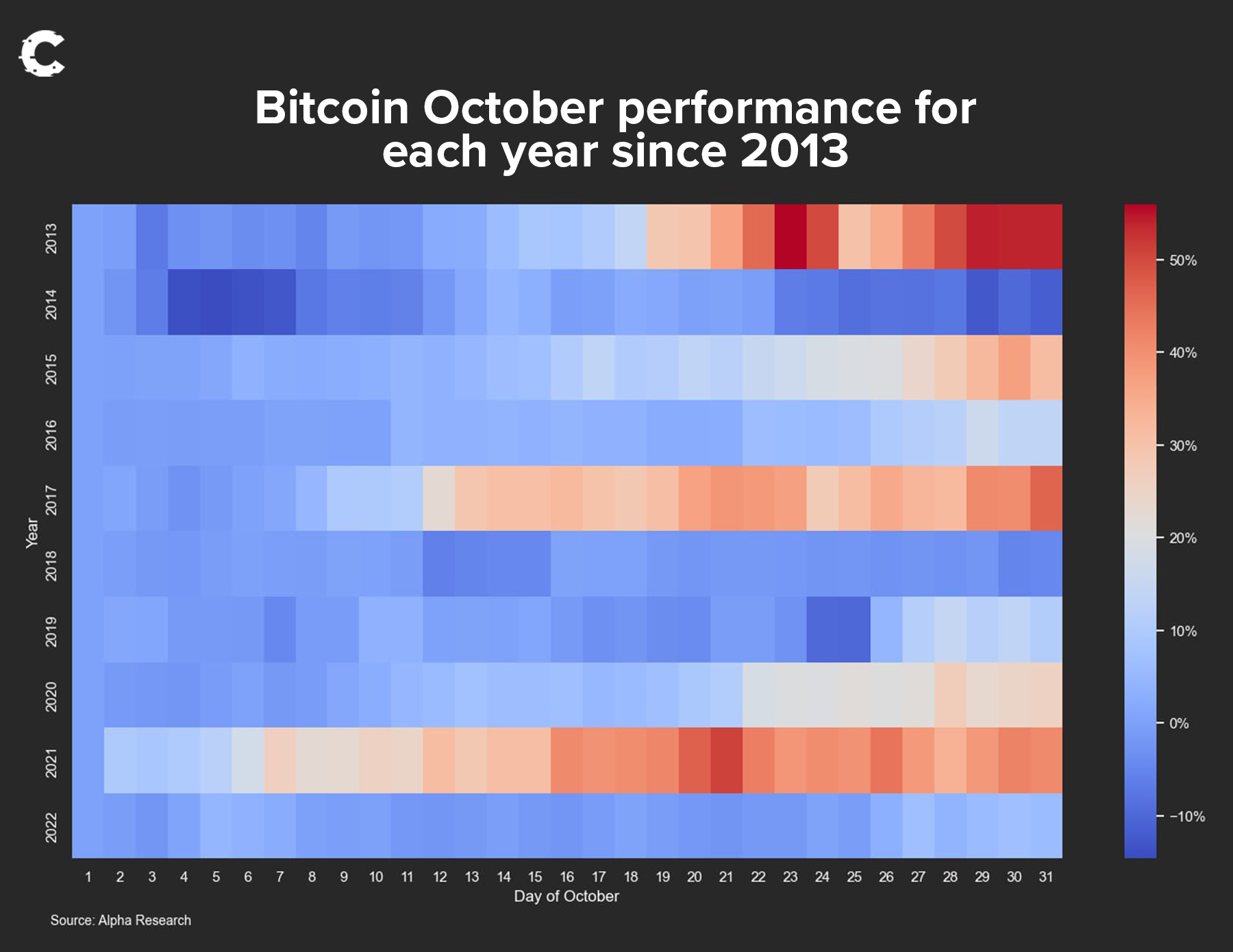

As we approach the horizon of October, it's worth pausing to reflect on the historical performance of Bitcoin during this pivotal month. Over the years, October has emerged as a favourable period for the world's leading cryptocurrency.

This historical trend, as depicted in the forthcoming chart, reveals a consistent pattern of bullish activity during October.

As you can see, historically, October has consistently had fewer red days for Bitcoin than most other months. It remains to be seen whether this trend will continue.

Cryptonary’s take 🧠

As the chart demonstrates, Bitcoin has a track record of exhibiting robust upward momentum during October, which has not gone unnoticed by traders and investors. This historical data paints a compelling picture and instils a bullish bias as we enter the upcoming month.This week in DeFi 🏦

A lot is happening in the Curve ecosystem

First up, Curve founder Michael Egorov has settled his remaining debt on Aave by exchanging CRV tokens for stablecoins. This follows his $46 million CRV sale in August to reduce liquidation risks across DeFi platforms.Curve also introduced StableSwap-ng, an enhanced stablecoin swap designed for simplicity and lower gas fees. A nice upgrade for users!

Meanwhile, Convex launched cvxFXN staking and the new FXN token. FXN introduces fETH, a "floating stablecoin" that closely tracks ETH prices even in volatile markets.

By integrating cvxFXN staking, Convex aligns user incentives with veFXN holders, strengthening its ecosystem governance.

Cryptonary’s take 🧠

Egorov paying off Curve's debt offers a chance for stability after earlier challenges. But we remain cautious about CRV's tokenomics.Convex, on the other hand, shows strong potential to grow its influence in DeFi. Adding another asset to its toolkit is a power move. On the other hand, Convex Finance holds significant potential for growth and influence in DeFi as a prominent player in CRV governance.

For deeper insights, check out our detailed Convex report. DeFi stays exciting!

Regulations and mass adoption 📜

The Middle East and Asia continue to surprise us

In Hong Kong, authorities busted the JPEX crypto exchange in an operation called "Iron Gate," arresting at least 11. Yet HK also plans guidance on tokenising investment products - a major step towards regulated crypto integration.Bahrain's Bank ABC will leverage JPMorgan's blockchain for cross-border payments, starting with USD between the Middle East, Asia, the UK and the US. They eventually plan to expand across more currencies and locations.

Cryptonary’s take 🧠

Despite the bear market, traditional finance players in Asia and the Middle East actively exploring crypto integration is bullish.With steps like the JPEX bust, HK shows its nuanced approach - policing and advancing crypto. As we look to 2024, these regions seem poised as hubs of tokenisation innovation and regulatory leadership.

Follow the money 💰

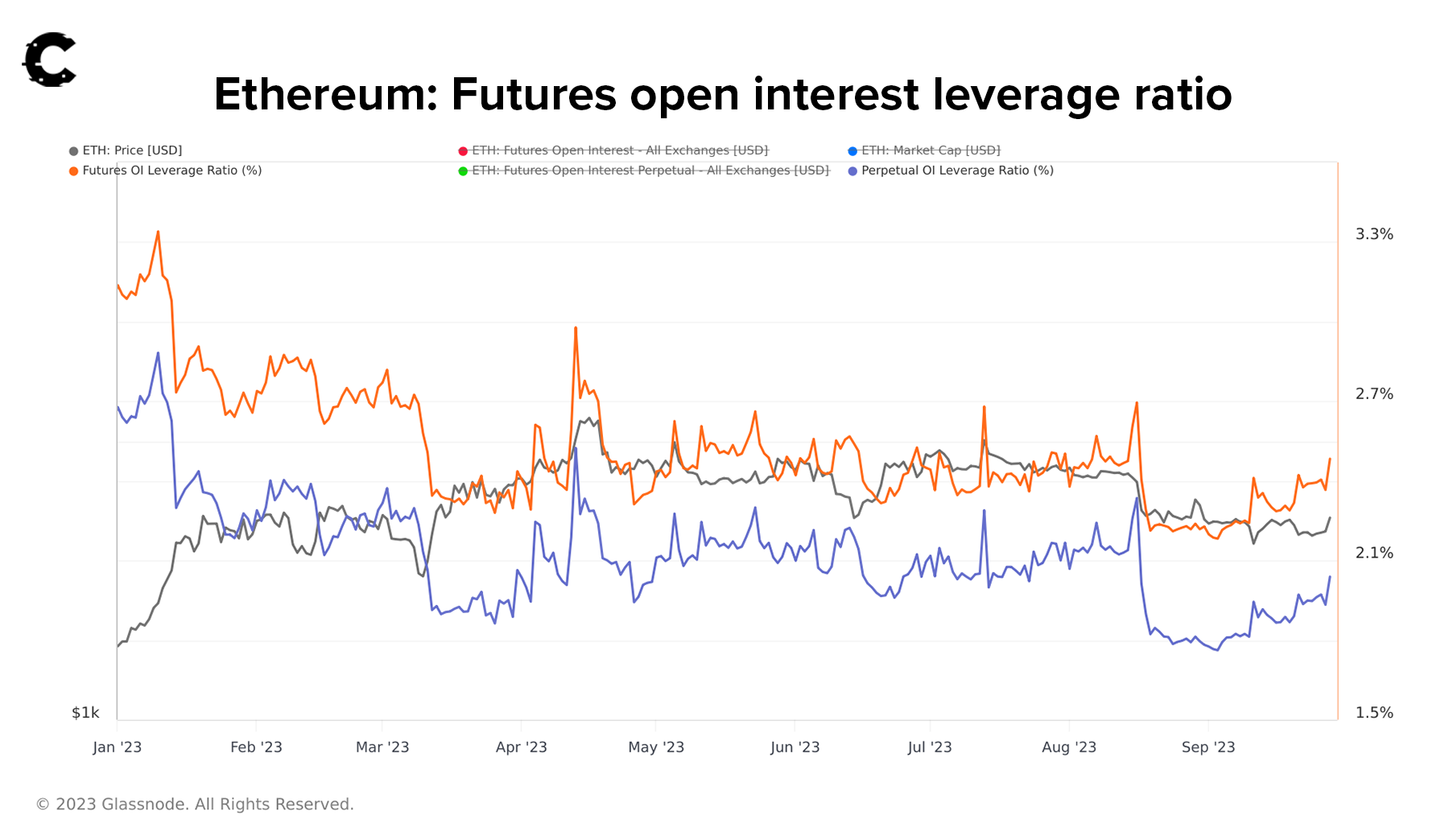

Let's dig into some data for clues on where crypto markets may head next. Two charts have our attention right now.Ethereum: open Interest leverage ratio

First up, ETH leverage versus price. With the ETH futures ETF coming, leverage has grown faster than price.

This suggests a potential overheating in the market. Ideally, we want to see leverage grow in tandem with price next week, as it could signal a bullish trend for ETH. However, if leverage increases excessively, we might witness a reversion after the Futures ETF is announced. Monitoring this situation will be crucial.

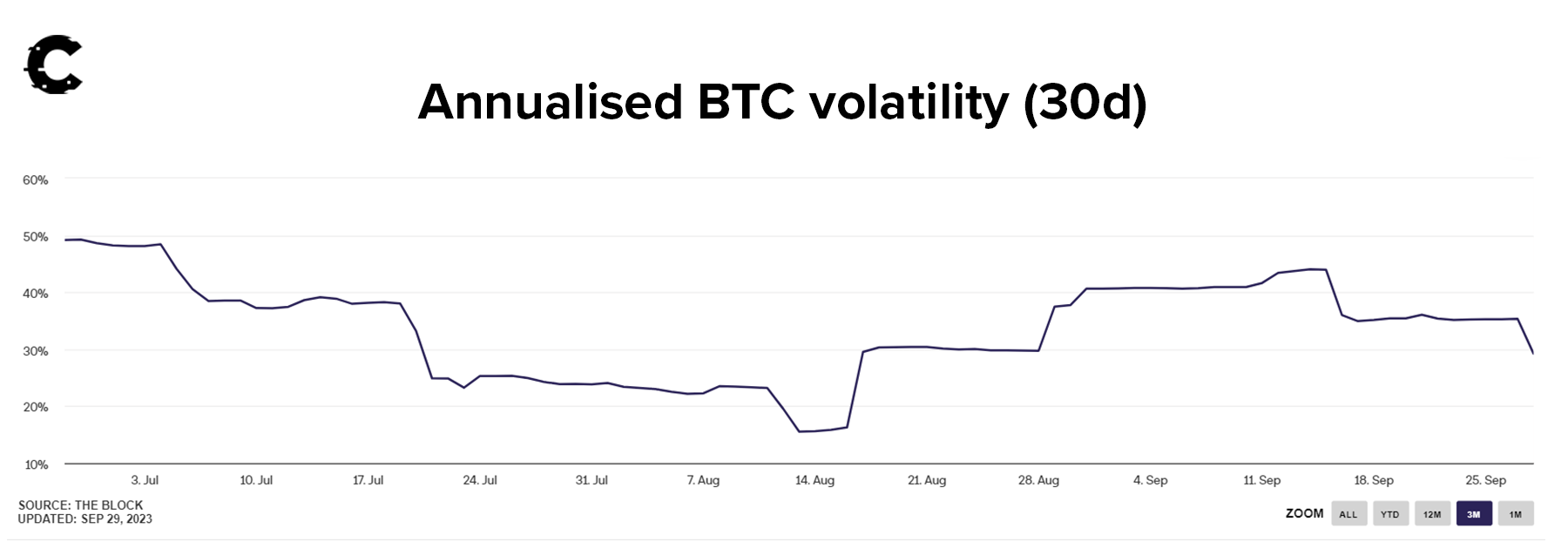

Annualised BTC Volatility (30D)

Volatility in Bitcoin, however, has sharply decreased following the delay of the Spot Bitcoin ETFs. This trend is concerning, as we expect Bitcoin to take the lead in markets like these. If BTC volatility remains low, while it might provide momentum for altcoins, it could eventually exert a downward pull on prices.

If BTC volatility stays low despite altcoins rising, it could eventually drag prices down overall.

Cryptonary’s take 🧠

With this ETH/BTC shift, next week is critical. We'll be tracking whether ETH leverage rises with prices for a bullish sign or gets overheated and risks reversal.Low BTC volatility amidst altcoin strength is also worrying. If these trends persist into October, ETH may lead, but BTC weakness could spell trouble. Or BTC could regain momentum and set the stage for altcoin opportunities.

It's a pivotal moment - we'll monitor closely to see where markets turn next. Data provides clues, but prices write their own story. Time to buckle up!

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms