As you probably know, the BNB Chain and Binance have always been like two peas in a pod, supporting and propelling each other to new heights. But now, there's trouble brewing on the horizon. The ominous clouds of a large legal storm cast a shadow of doom and gloom for a key piece of the global crypto market.

We will dive deep into the treacherous waters of BNB's security status and its effect on the price action, the Binance ecosystem, and the rest of the market.

So, fasten your seatbelts and tighten your grip on reality. Are you ready? Let’s go!!!

TLDR 📃

- The dust is settling over SEC’s lawsuit against Binance, but things aren’t looking great on the Binance side of the battle.

- BNB's price took a nosedive, plummeting by a staggering 25% to mark the most significant price decline since June 2022.

- BNB's status as an exchange token adds complexity, so the outcome of Ripple's ongoing case may not apply here.

- BNB lost support at $260, indicating a potential decline to $185

- It’s too early to make firm conclusions, but a few metrics can help you make informed decisions.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

How are things looking for Binance? 🌡

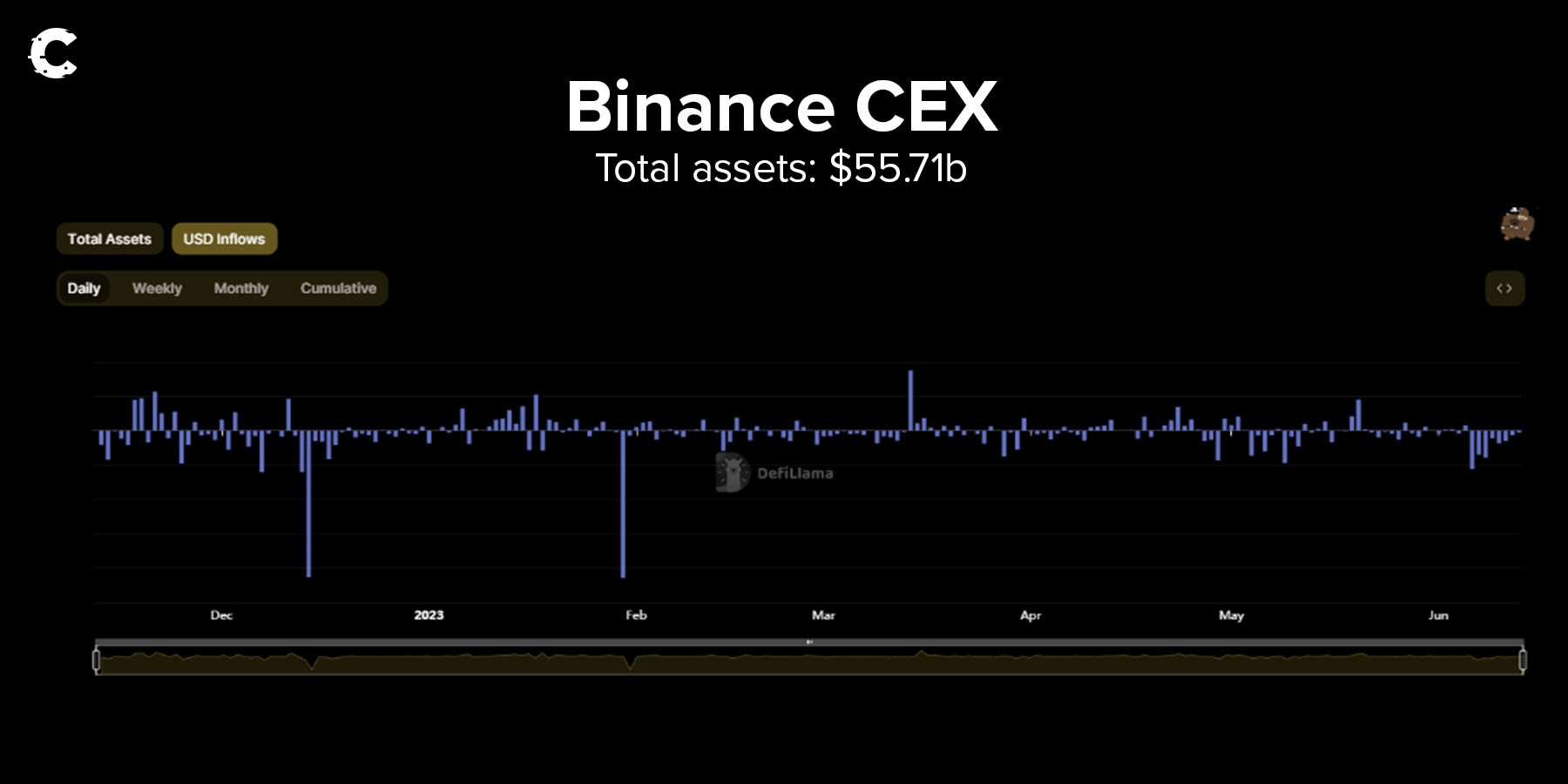

With the dust settling and Binance and the market digesting the SEC's accusations, if we are keeping it real, things aren’t looking great on the Binance side of the battle.First things first, the withdrawal level from Binance. You can think of it as a pulse that tells us how the SEC's accusations have affected the platform – and the prognosis is worrisome. We've seen about $3.749 billion being withdrawn since the news broke. Now, don't get too alarmed just yet. There have been days when $4 billion flew out of Binance within 24 hours. But if this trend continues, we might have reason to worry.

Most of these withdrawals are coming from Binance US users. In response, Binance’s banking partners hit the pause button on US dollar withdrawals. To make matters worse, Binance has been urging its US users to withdraw their funds before June 13.

Now, let's switch gears to another crucial piece of the puzzle. Binance US is in a legal tussle with the SEC, and today's hearing is a big deal.

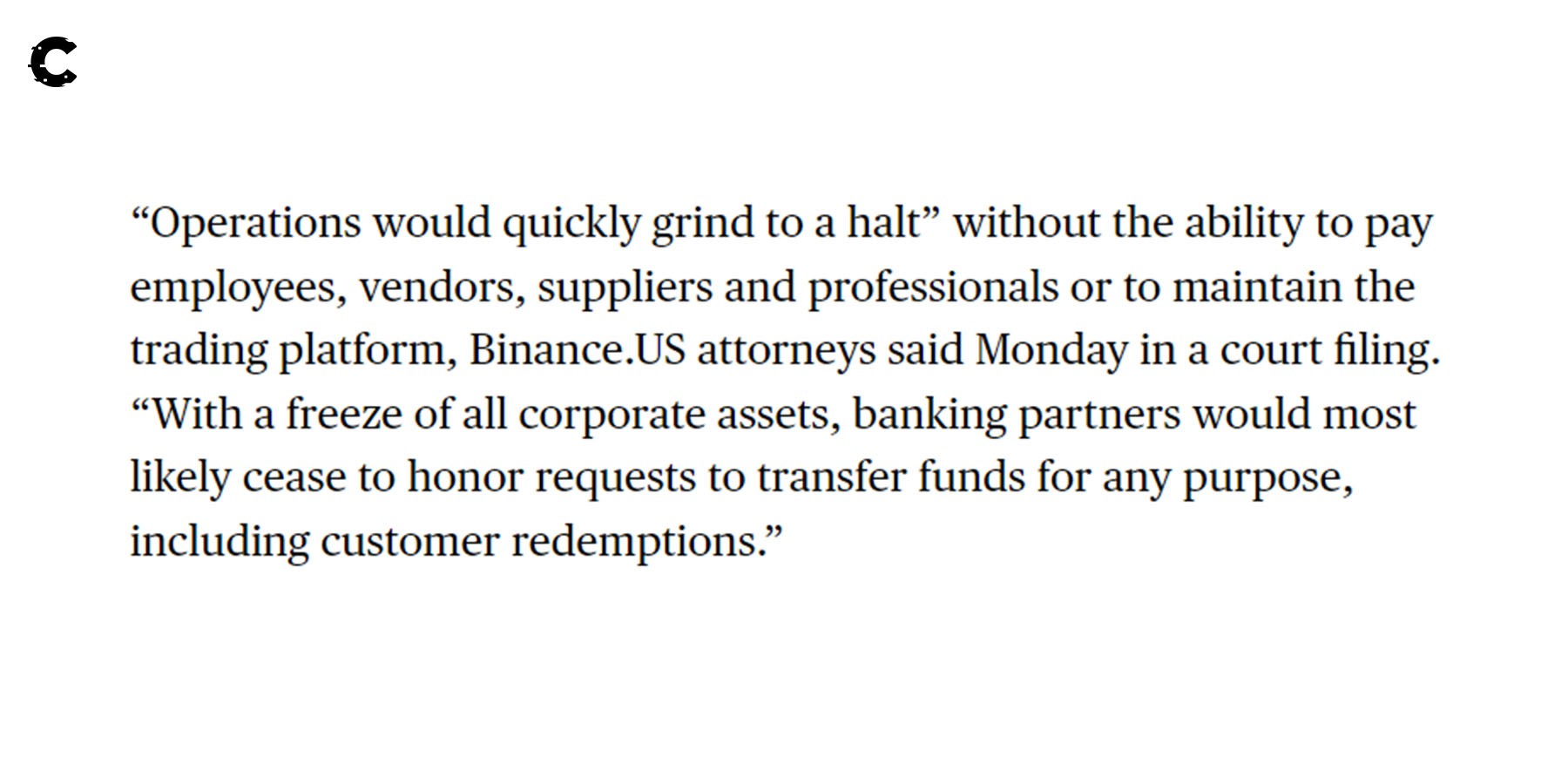

The SEC has requested a freeze on billions of dollars in Binance's assets. If that freeze gets approved, it could have severe implications for Binance US and its operations. The hearing is scheduled for 2:00 PM Washington time, so mark it on your calendar.

If the assets are frozen, it would be a significant blow to Binance's case, giving the SEC a stronger foothold. This means more uncertainty for Binance and its day-to-day operations.

But here's the twist: the lawsuit doesn't just impact Binance—it also affects the BNB Chain. Unfortunately, the close ties between Binance and the BNB Chain make it collateral damage in this legal battle.

But the story is far from over.

SEC's attempt to classify BNB as security 📂

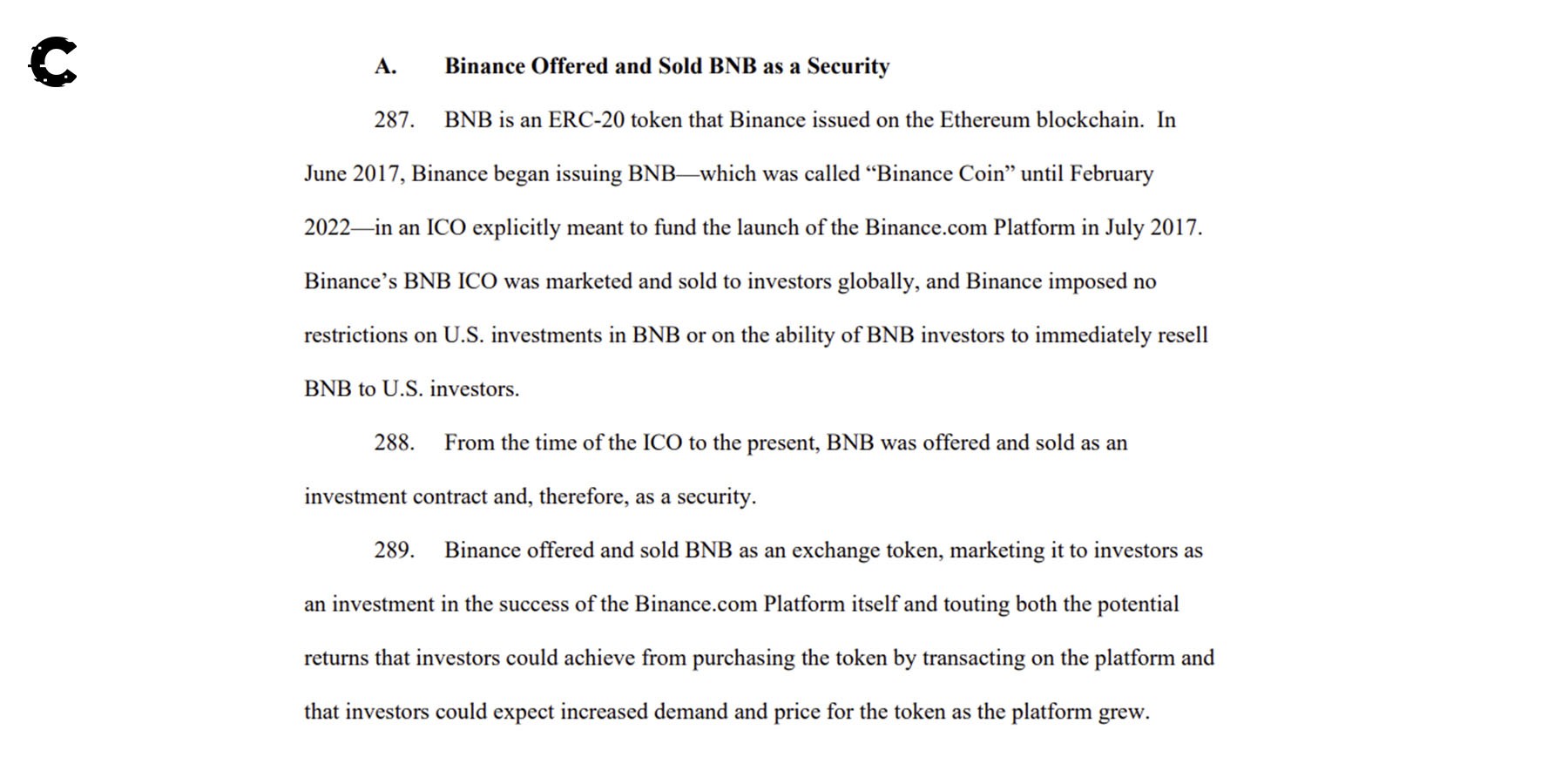

Now, let's step outside Binance's uncertainties, which we've delved into in another article, and focus on what's crucial for the BNB Chain ecosystem. Brace yourself for a revelation: the SEC has labelled BNB security.The SEC is capitalising on the fact that BNB serves as both a layer -1 token and an exchange token, slapping it with the security label. And to be frank, that's a significant challenge to overcome.

Hold on a minute! The SEC doesn't dive deep into the specifics of the BNB Chain in its lawsuit, but this little detail creates a big headache for the ecosystem. BNB plays a dual role—it serves as the currency for the entire BNB Chain ecosystem while acting as Binance's exchange token.

This duality has been a boom for BNB and the BNB Chain, bringing added utility and making it a breeze for Binance users to hop on board. But this smart design choice has unintended consequences for Binance and the BNB Chain.

Binance's legal team knows that a judge might see BNB more as a security than a utility token within the BNB Chain.

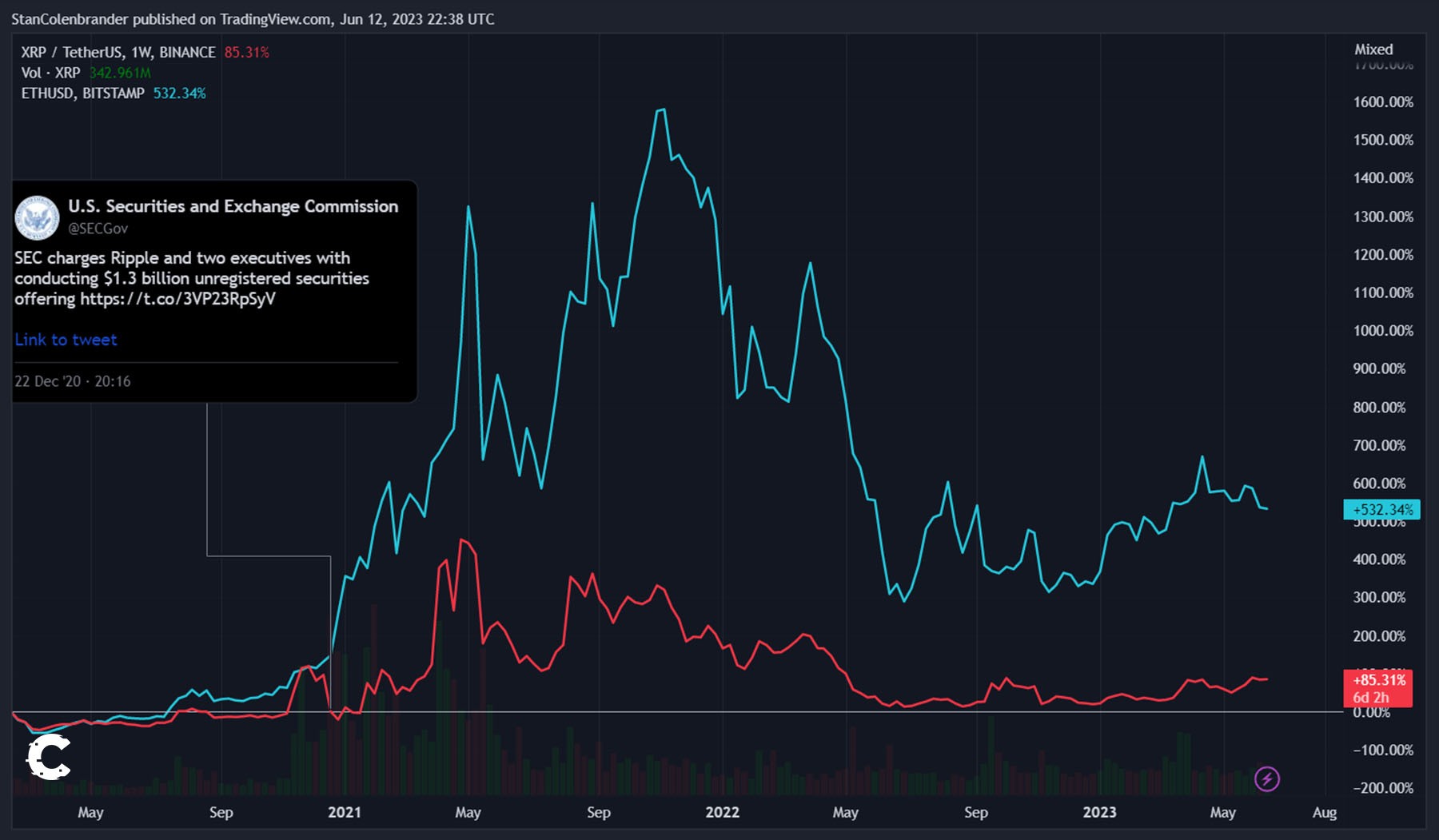

Now, don't confuse this with the Ripple case. The BNB case differs from what's going on with XRP, which is expected to reach a verdict later this year. While XRP is mainly a layer 1 token, the BNB case revolves around the role of BNB within the BNB Chain and its significance in the broader Binance ecosystem.

Now, don't confuse this with the Ripple case. The BNB case differs from what's going on with XRP, which is expected to reach a verdict later this year. While XRP is mainly a layer 1 token, the BNB case revolves around the role of BNB within the BNB Chain and its significance in the broader Binance ecosystem.

So, even if the Ripple case ends with XRP not being classified as a security, it doesn't automatically mean the same outcome for BNB.

So, what does this mean for BNB? 📉

Well, since the news of the Binance vs SEC battle broke out, the price of BNB took a nosedive, plummeting by a staggering 25% to mark the most significant price decline since June 2022. There's no escaping the FUD swirling around Binance and BNB right now. It's like a neon sign flashing "Stay away, don't buy"—at least for now.

BNB lost support at $260 last week, suggesting a potential decline to $185. While a weekly closure above $260 would negate the downside technically, our focus is primarily on the fundamentals due to the seriousness of the situation.

Regulatory uncertainty encircles BNB like a dark cloud, which could result in diminished attention and a dip in market performance—just like what happened to XRP after the SEC launched their lawsuit.

Now, here's the intriguing part: we need to ponder whether the impact will be confined to BNB alone or if the entire BNB Chain ecosystem will feel the tremors. It won't be long before we find out because, unlike XRP, BNB has a sprawling ecosystem wrapped around it, adding an extra layer of complexity to the equation.

What does the future hold for BNB chain?🔮

Full disclosure, it's tough to predict precisely how much the lawsuit will impact the BNB Chain since it's still relatively fresh.The outcome largely depends on how well Binance handles the situation and whether the SEC's accusations hold water. That's why, instead of making predictions, these key metrics can help assess the health of the BNB Chain ecosystem as the lawsuit unfolds.

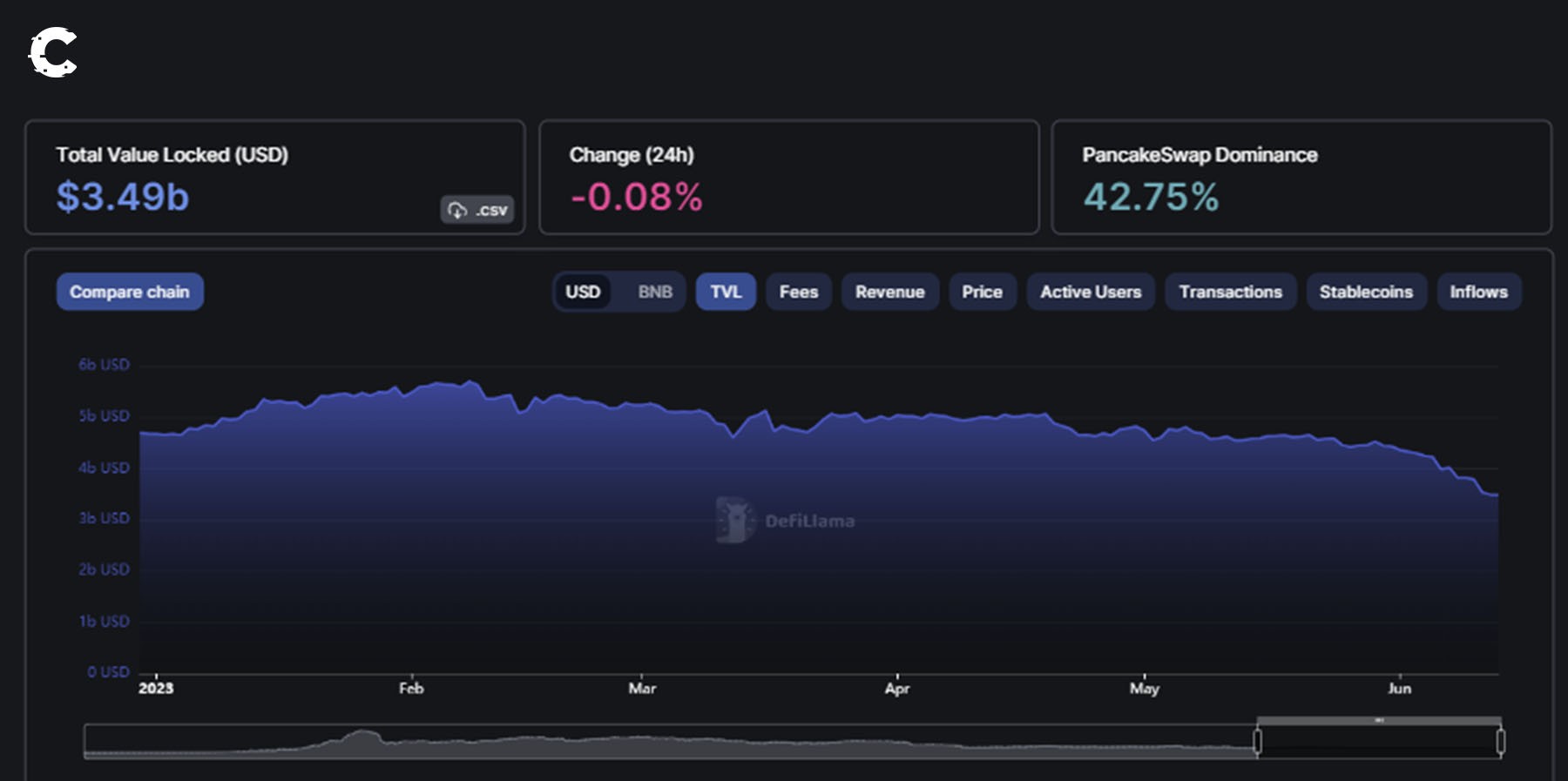

Total value locked (TVL)

Since the lawsuit, the TVL has declined from $4 billion to $3.5 billion.

However, this decline is not yet problematic, as the BNB Chain remains the third-largest chain regarding TVL.

The focus should be on whether the Total Value Locked (TVL) starts to decline relative to other chains. With Arbitrum currently holding the fourth spot with $2 billion TVL, we want to see the BNB Chain maintain a comfortable distance from Arbitrum.

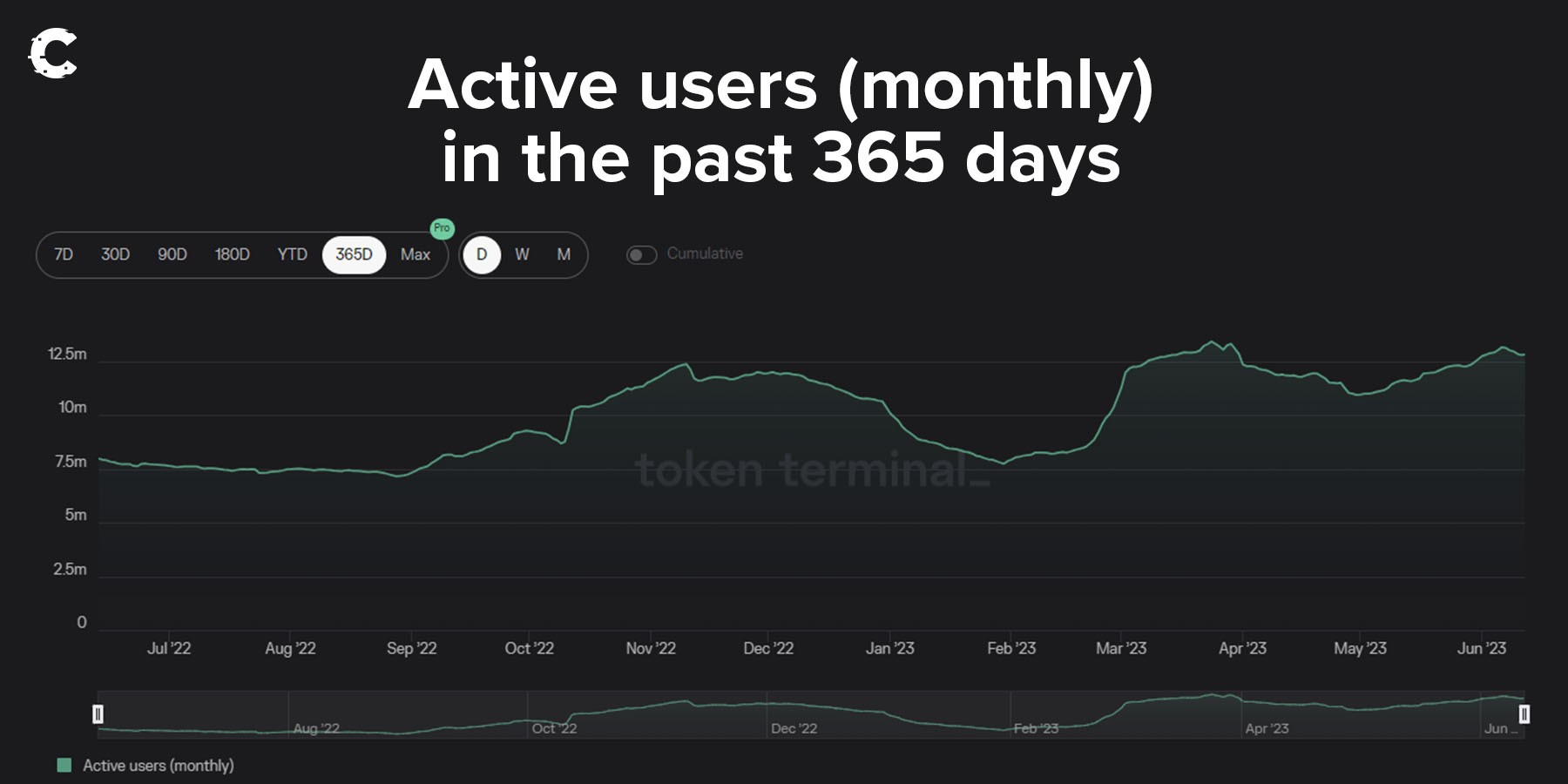

Monthly active users

Tracking monthly active users complements TVL by measuring the chain's user engagement. This number remains very high, with almost 13 million monthly active users.

As the lawsuit continues, this number must stay above its low at the start of the year, which was 8.6 million.

Interestingly, if monthly active users on other chains are increasing, a decline in the number of users on the BNB Chain could indicate that users have chosen to migrate to other chains.

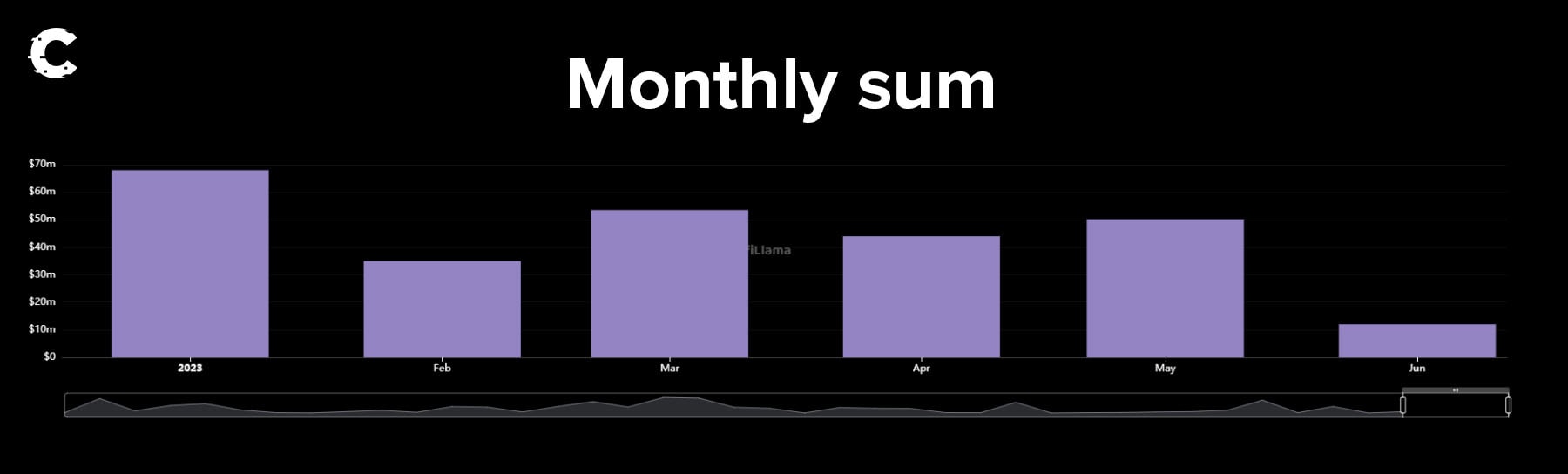

Private funding data

The average monthly funding allocated to projects on the BNB Chain stands at $50 million. This demonstrates a strong flow of capital into the ecosystem.

However, if this number starts to decline while the overall funding market remains active, it would raise concerns. It would indicate that VCs are becoming hesitant to invest in new projects on the BNB Chain due to the legal uncertainty surrounding it.

Cryptonary’s take 🧠

In the ongoing legal battle between Binance and the SEC, we find ourselves at the one-week mark, and it's shaping up to be quite an interesting and eventful ride. As we closely follow the proceedings, one key focus for Binance right now is monitoring the withdrawal activity, which appears to be stable.But here's the real nail-biter—the upcoming hearing determining whether Binance US's assets will be frozen. If the assets get frozen, it could spell bearish consequences for the market. On the flip side, if there's no freezing, it would have a more neutral impact.

As for BNB, there might be short-term relief with a positive hearing outcome, but we're not planning to engage with it for now. BNB lost support at $260, indicating a potential decline to $185. Caution is preferred.

As for the BNB Chain ecosystem, it's facing challenges, no doubt about it. But it's too early to draw any firm conclusions. We'll be closely monitoring specific metrics to assess its health. And guess what? The metrics we've outlined earlier can also help you draw your own conclusions.

Thanks for reading; Cryptonary out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms