So, what’s happening this week?

The SEC targets major crypto players, the zkSync Era (layer 2 protocol) has launched on mainnet, opening up new opportunities for DeFi protocols, and Arbitrum protocols have acquired significant $ARB airdrops, with an Arbitrum stimulus package en route. What are these protocols doing with their airdrop?

Let’s dive in…

TLDR

- zkSync Era has gone live on mainnet, and we've discovered two interesting DeFi protocols on it.

- dYdX announced the launch date of its V4 private testnet.

- Coinbase and SushiSwap are served subpoenas as US regulators continue to probe crypto-related entities.

- Arbitrum dropped $ARB tokens to key projects within its ecosystem to boost decentralisation and encourage DAO (decentralised autonomous organisation) participation.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

DeFi Overview

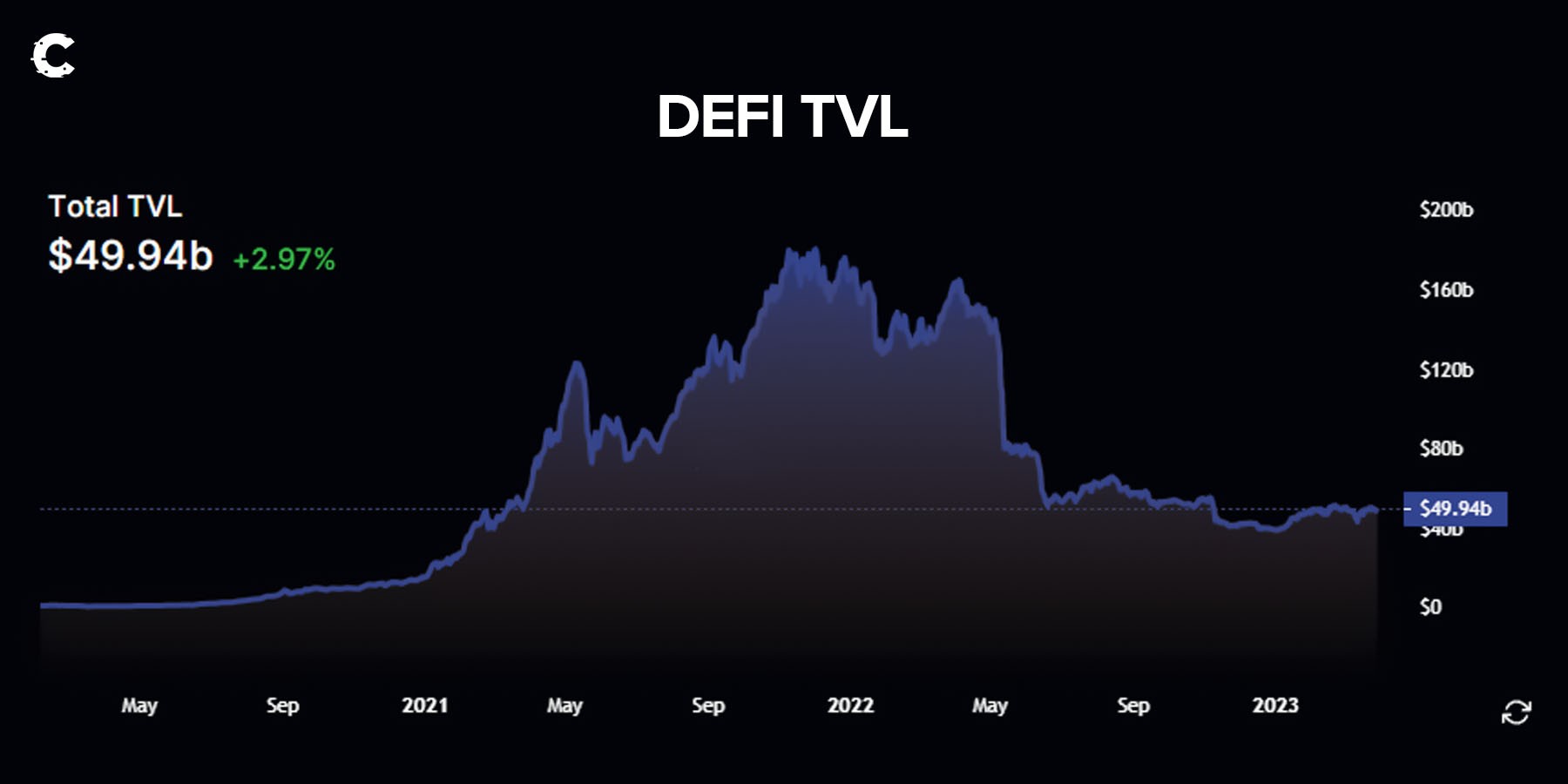

DeFi TVL (total value locked) is approaching $50B, but as shown in the graph, DeFi TVL remains relatively flat month to month. With increased regulatory scrutiny on crypto exchanges, there may be more activity in DeFi, although nothing suggests a significant inflow at this moment.

Due to the limited growth in TVL, much of the activity observed within the DeFi space involves established players moving their funds across existing protocols, rather than new capital flowing in. This means that while some ecosystems are experiencing a surge in activity, others are losing out, resulting in a zero-sum game.

Now, let’s dive into the news.

Key Developments 🔑

- Binance sued by CFTC over evading US rules: The US Commodity Futures Trading Commission (CFTC) sued crypto exchange Binance and founder Changpeng Zhao, claiming the company knowingly offered unregistered crypto derivatives products in the US against federal law.

- dYdX reveals launch date for move from Ethereum to Cosmos: dYdX announced the launch date of its V4 private testnet, a significant step that will see the decentralised exchange (DEX) leave Ethereum by the end of September. The platform will then run fully on Cosmos.

- Euler hacker returns majority of funds: Less than two weeks after Euler Finance was hit by a nine-figure exploit, the attacker returned nearly half the stolen assets, sending 51,000 $ETH ($90M) back to the lending protocol’s deployer wallet.

- Nasdaq’s digital asset strategy revealed: Nasdaq expects its custody services for digital assets to launch by the end of the second quarter. The project, which was initially announced in September, will mark the first major foray into crypto for the exchange operator.

Hot Narratives 🔥

The SEC gets frisky

Coinbase is served

There was considerable speculation about how crypto regulation would take shape this year. With the US government in deadlock and congress seemingly impotent, many feared it would be a story of regulation by enforcement, with the SEC taking aggressive action to force rules into place.

Sadly, it’s become a reality. The most notable example isn’t directed at DeFi, but in our view, it certainly plays a role.

1/ Today Coinbase received a Wells notice from the SEC focused on staking and asset listings. A Wells notice typically precedes an enforcement action.

— Brian Armstrong (@brian_armstrong) March 22, 2023

The SEC issued a Wells Notice (a notification that they intend to prosecute) to Coinbase despite confirming they were happy with how the company operated two years ago when it went public (listed on the stock exchange).

Strange timing… this occurred shortly after Coinbase announced Base, a permissionless layer 2 blockchain set to bring DeFi to institutions and Coinbase users… Coincidence? We think not.

Base flies in the face of the SEC. It’s a clear attempt to bridge the gap between TradFi and DeFi, which is exactly what the SEC is trying to prevent.

In a Twitter thread posted in response to the Wells Notice, Brian Armstrong (CEO of Coinbase) made it clear that he’s ready to go to battle with the SEC. This is a defining moment for crypto and DeFi. If anyone has the resources and power to put the SEC in its place, it’s Coinbase.

What will happen? Time will tell…

Sushi DAO and Head Chef (Jared Grey) served subpoena

We don’t have much detail about this one, unfortunately.

The news was shared in a forum post, which stated quite straightforwardly that “Sushi, and Head Chef Jared Grey, were recently served an SEC subpoena.”

A subpoena is essentially a court summons. Sushi DAO can be served as it operates under a legal entity.

The purpose of the post was to authorise creation of a “Sushi DAO Defense Fund", making $3M in $USDT available to “cover legal costs for core contributors”.

The reasoning and the subpoena itself haven’t been shared.

Without more details it’s impossible to comment. However, this clearly demonstrates a more aggressive SEC taking aim at DeFi.

What does this mean?

These enforcement actions are frustrating, especially as Coinbase goes to painstaking lengths to be as compliant as possible. The SEC is forcing things to a head.

We’ve been waiting for clear boundaries in crypto regulation for some time. Coinbase beating the SEC in court would establish legal precedent that could massively benefit DeFi and crypto, and clear those hazy legal boundaries.

zkSync Era launches, unleashing new possibilities for DeFi protocols

Exciting developments were brewing in the Ethereum community as Matter Labs launched the public mainnet for zkSync Era - the second iteration of its layer 2 network.

After successfully testing on a closed testnet and mainnet, zkSync Era is now available to the public and has already attracted over $19M in TVL!

This is huge for DeFi, with major players like Uniswap, Curve, and MakerDAO already gearing up to deploy on the network. zkSync Era's speed and scalability are expected to revolutionise the DeFi space by enabling faster, cheaper transactions.

However, it's not just the established players who stand to benefit from this launch. The emergence of zkSync Era also paves the way for new DeFi protocols.

Here's an overview of some exciting new DeFi protocols worth exploring on zkSync:

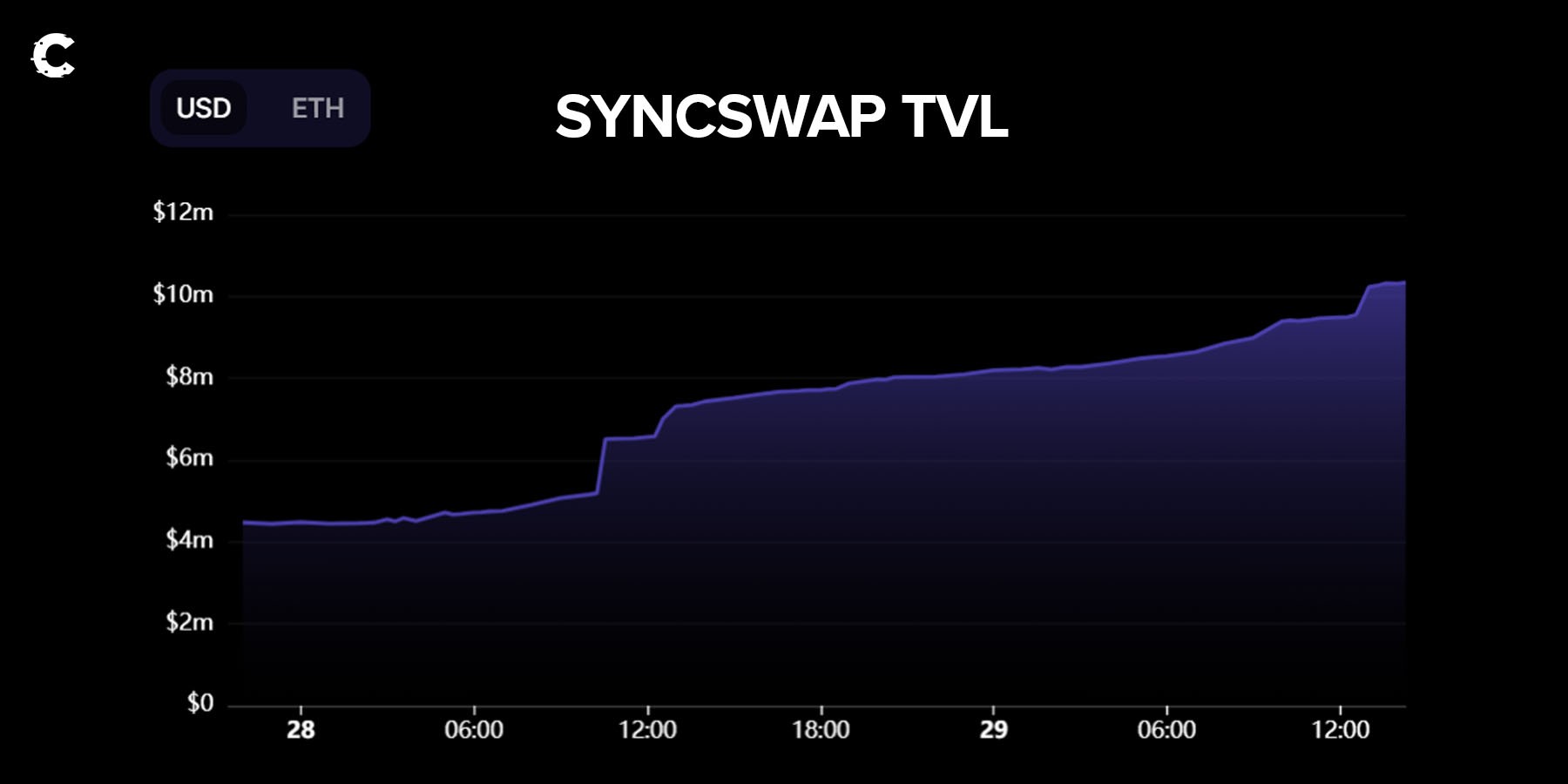

One of the first DEX platforms to launch on zkSync, Syncswap allows users to easily swap assets or provide liquidity.

It’s now the DEX with the highest TVL on zkSync, but this doesn't mean much as it’s still low, hovering around $10M.

The Syncswap team recently revealed that they would launch a token, which might lead to an airdrop opportunity, but no official details about the token's design are currently available.

Increment offers multi-currency perpetual swaps on the zkSync 2.0 network. Users can leverage a variety of crypto assets or yield-bearing assets as collateral to go long or short global exchange rates. The protocol utilises pooled virtual assets and Curve V2’s AMM (automated market maker) as its trading engine.

Increment raised $1.56M in a seed round funding led by ParaFi Capital, Delphi Ventures, Dialectic, AngelDAO, LedgerPrime, and SkyVision Capital in 2022, and is planning to deploy on the zkSync Era mainnet soon.

Important note: There are many other new DeFi protocols and tokens that have launched on zkSync, but it’s important to keep in mind that we’re still early in the game. As we’ve seen with other ecosystems, this attracts scammers. We’ll share more protocols as the ecosystem matures and it becomes easier to identify legitimate builders from dubious schemes.

Crypto investment corner

GoldenTree moves $5M of $SUSHI, sparking fear it’s exitingGoldenTree Asset Management made waves last year with a $5.2M bet on decentralised crypto exchange SushiSwap. But the firm just moved the majority of its $SUSHI token holdings, sparking fears in the SushiSwap community that it is exiting its position.

Solana-based derivatives protocol Cega raises $5M to expand on Ethereum

Cega, a DeFi derivatives protocol focused on exotic options (option contracts with structures and features that are different from plain-vanilla options) raised $5M in a new funding round led by Dragonfly Capital that also saw participation from Pantera Capital and Robot Ventures.

The main reason for this round of capital raising was to expand the protocol on Ethereum (the launch is scheduled for next week). I

Arbitrum ecosystem DAO airdrop

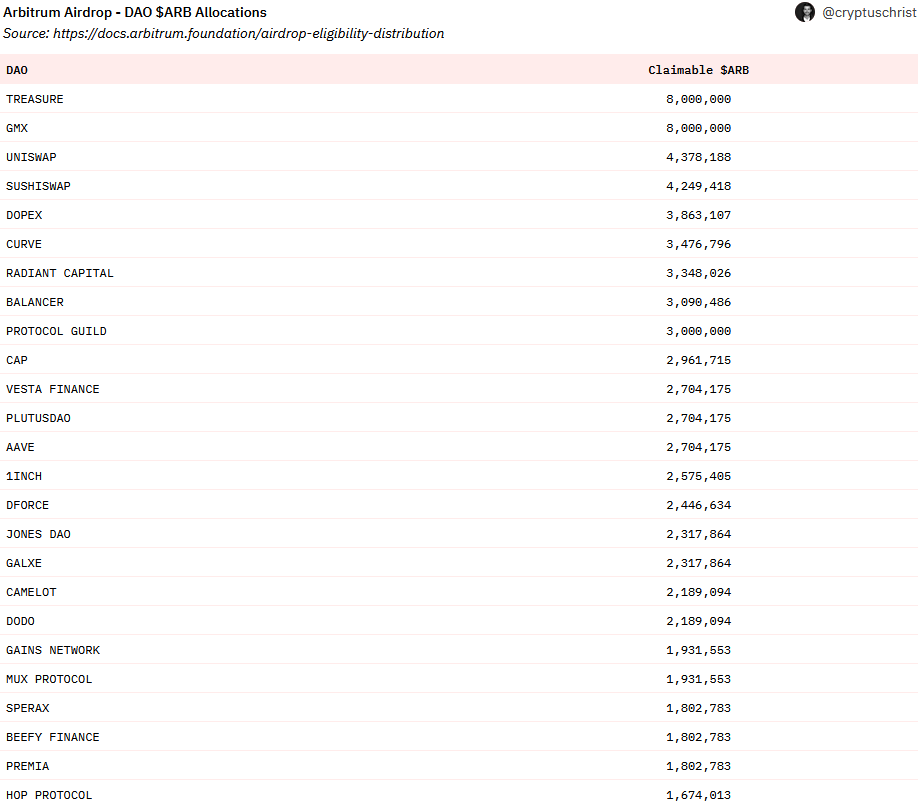

In addition to airdropping $ARB tokens to eligible addresses, Arbitrum also airdropped 10% of the 1.15B $ARB (112 million $ARB) earmarked tokens to DAOs within the ecosystem. Eligible DAOs represent key projects within the ecosystem - DEXs, loan markets, etc. This improves the decentralisation of Arbitrum, as key protocols in the ecosystem will have a voice in the Arbitrum DAO.

Notable recipients include:

- GMX and Treasure (a gaming ecosystem) received 8 million $ARB each.

- Uniswap and SushiSwap were to receive ~4.3 million $ARB each.

- Curve received 3.5 million $ARB tokens.

Overall, around 44 million $ARB went to the top projects. It’s unlikely the large projects listed in the table above will sell their $ARB, as a vested interest in Arbitrum governance outweighs any monetary gains. So for those investors fearing a dump, there’s unlikely to be any additional selling pressure from this source.

Decentralisation is important for any crypto project because it protects it from regulatory attack, as there is no single entity to sue or bring a case to. This is true only to a certain degree, however - DAOs are not immune. But it’s very hard to prove intent with a whole group/conglomerate.

Other News 📰

- Telegram users can now send $USDT through chats.

- Ribbon community leader states Aevo (its new options exchange) launch is imminent.

- Sector Finance IDO scheduled for March 29. Tokenomics have been announced in advance.

- Uniswap V3 to be deployed on Avalanche.

- Yama Finance launches to Arbitrum on March 29.

- Dolomite launches full support for GLP.

- Timeswap Labs launches first lending and borrowing market for $ARB token on Arbitrum.

- BlackRock CEO says ‘Next Generation for Markets’ is tokenisation.

Cryptonary’s Take

We’ll be keeping a close eye on how the new zkSync Era ecosystem evolves. It’s still in its infancy and there are a lot of scams to be cautious of. However, we anticipate the launch of more mature protocols within the ecosystem over the next few months.The other key takeaway is the increase in regulatory scrutiny. With Coinbase and now Binance under investigation and the SEC gunning for DeFi, there’s a tough battle ahead. However, we think it’s unlikely that the majority of cases against both centralised and decentralised crypto entities will bear much fruit in the near future as we have seen with the Ripple case that these regulatory entities do not as easily win in court. And, if they do, there are several crypto-friendly states outside of the US.

Another interesting week in DeFi! Stay tuned for the next one!

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms