Today, we're diving into real gains. The idea is simple: if you're not making fresh gains, at least safeguard the profits you've already bagged.

You may be one of those who sold the top when BTC hit $69,000. You’re up 20x, 30x, maybe 50x from your initial $5k investment.

But now, you've got a pile of stablecoins just sitting there, not doing much in this bear market.

The solution?

Sure, you could start DCAing choice altcoins - but the market tends to go much lower than anyone predicts.

While waiting for an opportune time to reenter the market, there’s an opportunity to park some stables in the safest yield-bearing strategies.

Sounds interesting? Today, we feast!

TLDR 📃

- Parking capital in a bank is counter-productive.

- MakerDAO's DAI Savings Rate: Get up to 5% APY on DAI deposits backed by real assets.

- Leverage stablecoins in DeFi to increase exposure and yield potential by up to 4.3x.

- Dive into a world of possibilities with a new DeFi protocol, leveraging collateral for higher returns, all without liquidation risk.

- Discover how to earn up to 10% yield on stablecoins, outperforming traditional bank savings.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

It’s not all about profit; it’s mainly to beat inflation 📈

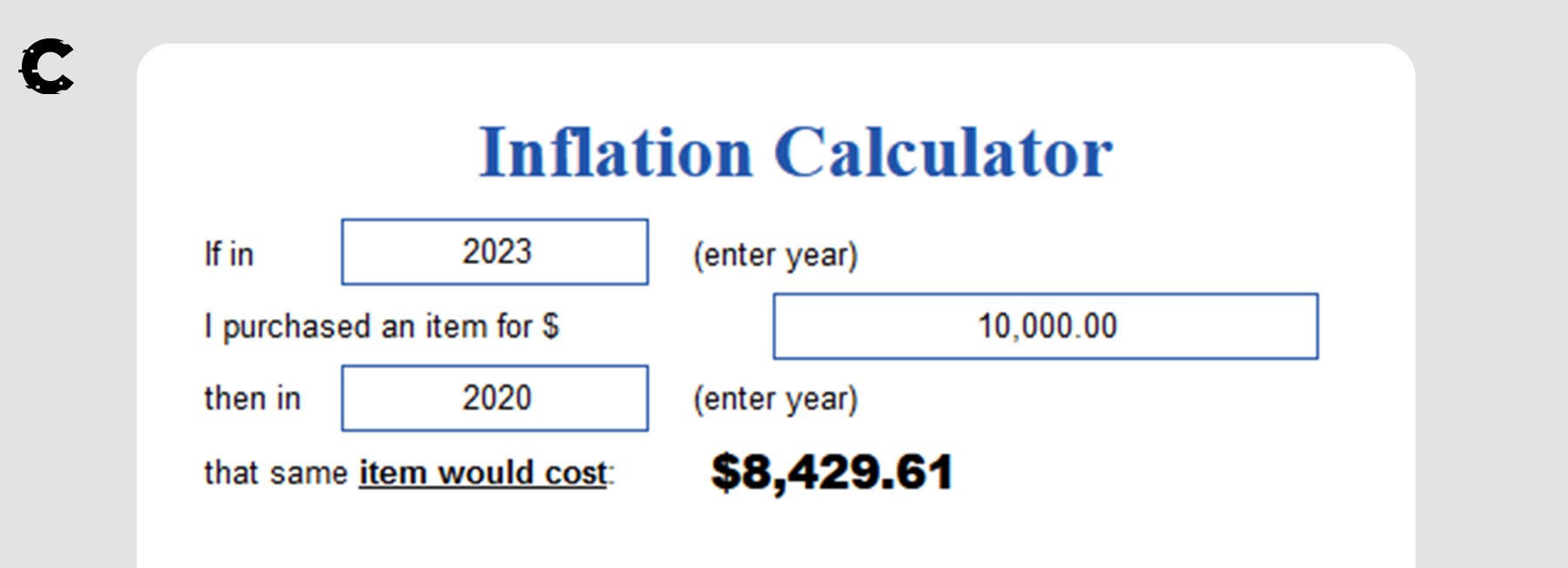

Inflation is an absolute killer!If you’ve held $10,000 Between 2020 and 2023, the value in relative terms would have declined to about $8,400 in actual buying power.

The dollar (and most fiat currencies) is rapidly losing value, and you have two options to prevent significant loss of wealth.

- Invest in appreciating assets.

- Earn yield.

This brings us to the second option -- earning yield.

We’ll be honest - during a bull market, there’s no point in trying to earn a 5-10% yield on stablecoins. There will be tons of opportunities in a bull market for investment and making much higher returns.

But during the inevitable bear markets, knowing where to park your stablecoins while figuring out where next to invest your money is an important strategy.

Even if you are parking your money in stables just for a month or two, getting the highest yield possible is an important milestone in your journey from a rookie investor to an elite degen.

But why park your money in DeFi via stablecoins?

TradFi is scamming you 🤬

Traditional means for fighting inflation include investment in treasury bonds, depositing cash in high-yield savings accounts, real estate investment trusts, etc.But all these assets are centralised, which means that most of the time (almost 100%), the bank, the fund, or anyone else in TradFi is scamming you - that’s just how that industry works.

Think about it - you deposit $10,000 into a high-yield savings account, earning 6% APY.

The bank takes that and lends it to some struggling families on a credit card for 30% APY.

Who keeps the profit? Certainly not you.

And all that rhetoric about “the bank taking all the risk” is hogwash. When the bank goes under, the government tends to bail them out, and it’s your taxes that foot the bill.

The verdict? Literal scam.

Now, it’s time to regain control of your finances and stop putting money in the banker’s pocket.

DeFi yield strategies🤑

Direct yield from MakerDAO is one of the best, safest, and highest among the baseline stablecoin yields.

The DAI Savings Rate offers 5% APY on DAI deposits - but where does this come from?

You may be surprised that most of this comes directly from the US government.

MakerDAO has been backing DAI with US treasuries and other RWAs - the yield offered by the Fed is allowing DAI to match TradFi yields.

The deposit process is fairly straightforward:

- Get some DAI. The stablecoin is one of the most liquid stables and can be traded almost anywhere.

- Connect MetaMask to the Spark dApp. You’ll need some ETH to pay gas fees.

- Deposit DAI and receive sDAI. sDAI is like an on-chain coupon for your DAI deposit.

But MakerDAO is fast becoming the Federal Reserve of the Ethereum DeFi, super-charged by the real Federal Reserve’s high-interest rates.

Now, 5% doesn’t sound like a lot - are there any ways to increase this yield?

Leveraging a stablecoin position 🏛️

Most degens leverage Bitcoin, Ether, or some other asset they should not be leveraging.However, stablecoins are different.

There is something beautiful about DeFi, and that is stacked yield.

sDAI is a fully tradeable token in its own right. When you deposit DAI for sDAI, the sDAI doesn’t actually accrue any yield. Rather, the value of the sDAI compared to DAI increases over time as yield is accumulated by MakerDAO and distributed proportionally to DAI deposits.

This means we can go out and buy/sell/spend/lend/borrow that sDAI wherever we want.

The implication is that we can increase our exposure to sDAI without adding more capital.

This leads us to Summer.fi.

How to supercharge your yield strategy

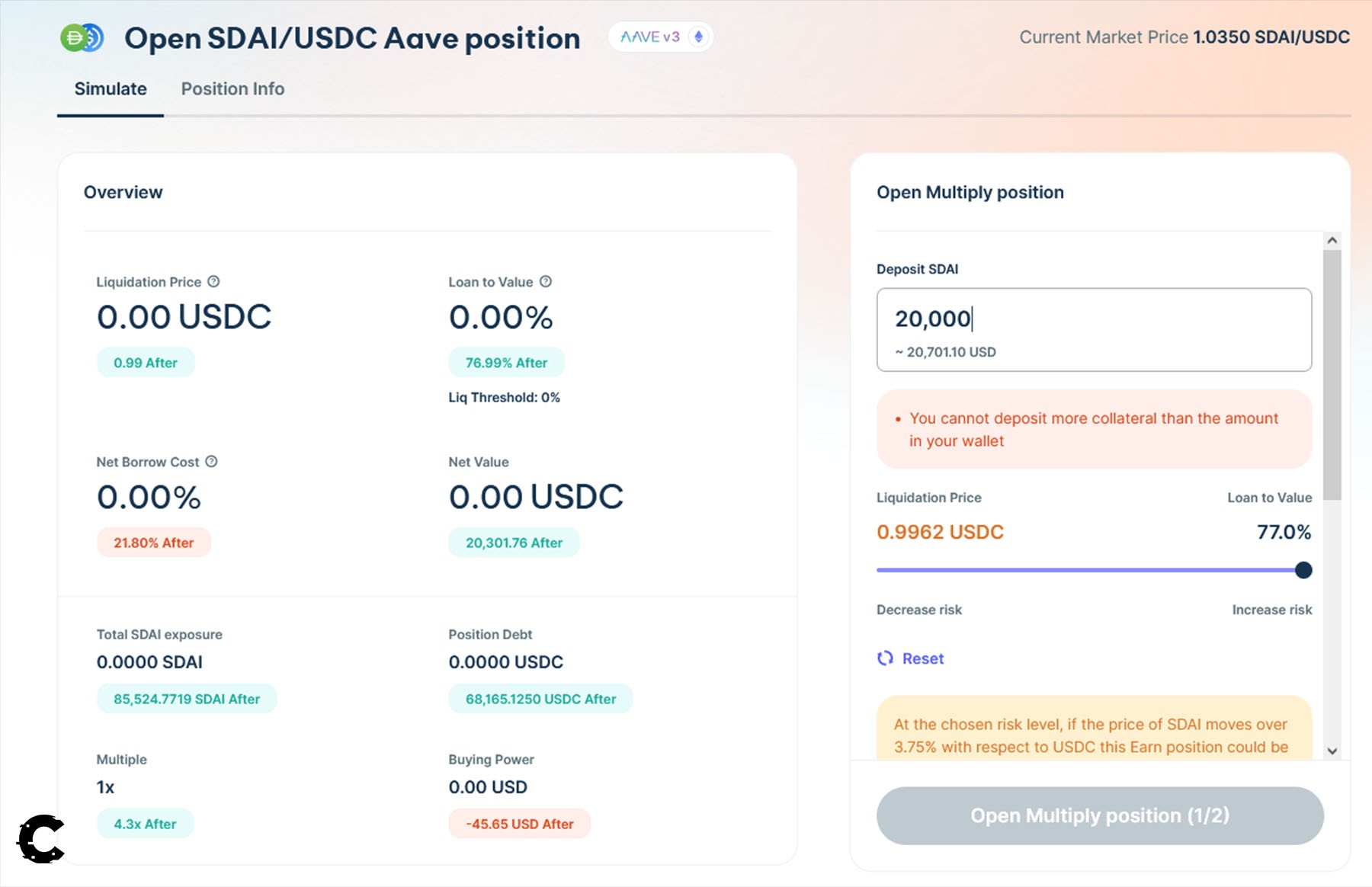

Summer.fi is a DeFi protocol that provides a pseudo-front end to access liquidity markets like Aave and MakerDAO.Through Summer.fi, users can leverage their position by depositing collateral and using the borrowed funds to buy more of the collateral asset.

For example, if someone is bullish on ETH, they could deposit ETH as collateral, borrow USDC at a 50% Loan-to-Value ratio (LTV), and use that USDC to buy more ETH to increase their overall ETH exposure by 50%.

Now, ETH is very volatile. Obviously, borrowing against it comes with liquidation risk - because it is essentially leverage.

But what if you use a stablecoin as collateral to borrow more stablecoins?

Liquidation is unlikely (but not impossible).

sDAI inherently increases in value over time - it cannot go down in value unless there’s some black swan Oracle issue. This means a loan position to borrow a stablecoin against sDAI cannot be liquidated.

Knowing this, Summer.fi allows us to leverage our position up to ~4.3x, allowing us to earn more yield.

BUT there is interest on the loan.

Again, the process is fairly straightforward:

- Get some sDAI via the process above.

- Check out this Dune tool to find the most profitable pair. Instructions are on the dashboard.

- Click a pair - for instance, the sDAI/USDC Aave position is the most profitable at the time of writing.

- Connect a wallet and follow the instructions on the screen to open a position.

Points to note:

- Make a copy of this tool to get an editable version that you can test out with various amounts to see how much yield you could potentially earn.

- Inputs go on the left (you can find the data Summer.fi).

- Note that the DAI Savings Rate, sDAI value, and borrow costs are subject to change. For the next six months, they shouldn’t change too much.

- You can also use this tool for any sDAI stablecoin leverage strategy.

Cryptonary’s take 🧠

Summer.fi is by no means the only place to execute this sort of play.DeFi is filled to the brim with various methods to make money. This article aims to enlighten you about the possibilities that DeFi presents.

10% interest on savings per year beats what any bank can offer anywhere.

Knowing and understanding how to apply various yield strategies might not seem important now, especially if your portfolio is only in the hundreds of dollars. But if you’re reading this and plan to “make it” in crypto, these strategies will be your bread and butter as your portfolio grows.

So, there you have it - there’s still a way to earn more money in crypto even when you have parked your funds in stablecoins during a bear market.

As always, thanks for reading.🙏

Cryptonary out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms