Starting with Uniswap v4 being power-packed with hooks and custom actions that many DeFi traders have been dreaming of.

But that's not all. On the other side of the ring, we have MakerDAO, the pioneers of decentralised stablecoins, turning up the heat by raising their savings rate to a jaw-dropping 3.49%.

Hop in for a ride into the latest yield opportunities Ethereum’s got to offer.

TLDR 📃

- Uniswap v4 is introduced with hooks, custom actions, gas savings, and more

- Curve Finance’s volume is up 78% this week, giving Uniswap a worthy challenge.

- MakerDAO raises savings rate on the DAI stablecoin to 3.49%

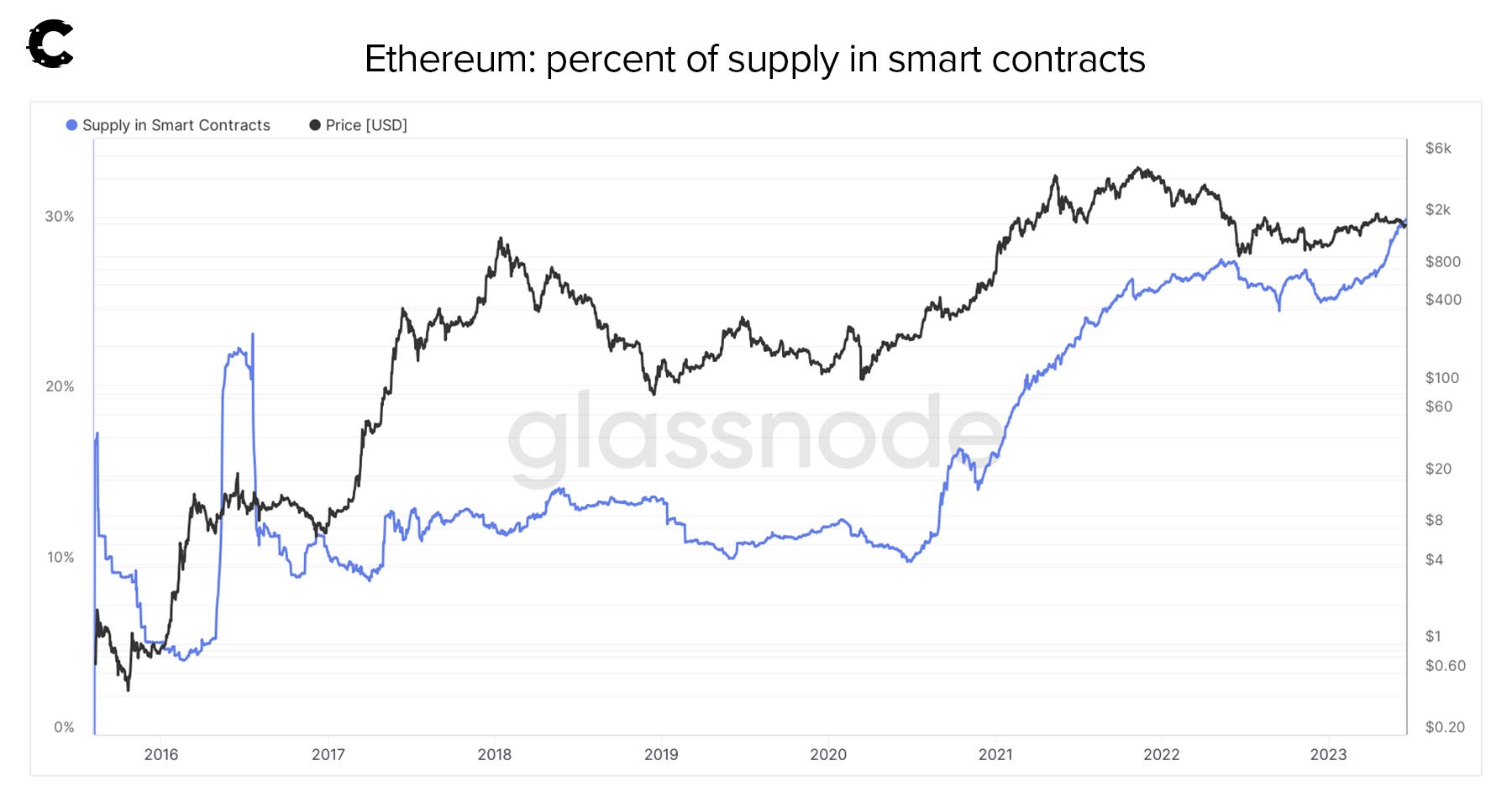

- A record-breaking 30% of ETH is currently locked in smart contracts.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

Exodus of ETH from exchanges into DeFi 🗾

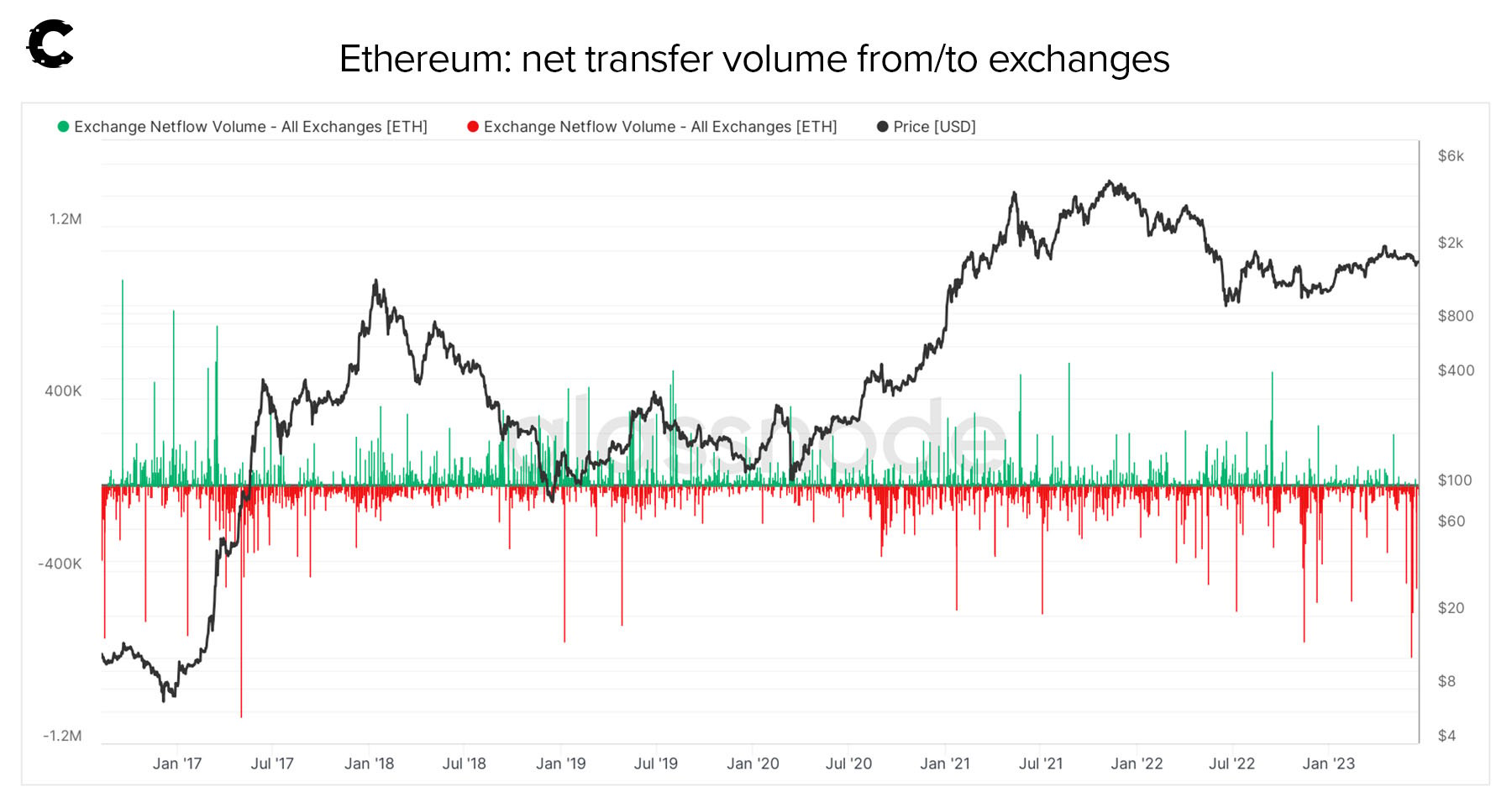

There’s an ETH exodus underway. It's like everyone's rushing to get their ETH out of exchanges. In the past two weeks alone, a massive amount of ETH has left exchanges. The last time we had so much exit on one of those days was in 2017.

Now, here's the juicy part. With more and more ETH leaving exchanges, where is it all going? We can see it being put to work like never before. Get this: the amount of ETH held in smart contracts hit an all-time high, surpassing 30%. Across staking, liquidity farming, and other sources, people are creating creative ways to generate yield with ETH.

But here's another exciting tidbit contributing to this surge: the rise of smart contract wallets. These wallets are like turbo-charged versions of your regular wallets. They open up a whole new world of possibilities and capabilities. We actually covered this exciting development in a previous digest; you can check it out right here.

Uniswap v4 makes DeFi more customisable 🛠

So, what's the big deal with Uniswap v4? Well, Uniswap has introduced something called "hooks" that will allow you to execute custom actions during token swaps. This seemingly ordinary feature opens the door to various possibilities, including limit orders, automatic rewards, and protection against miner extractable value (MEV).But here's what makes them even more awesome: each hook is a smart contract created when a new liquidity pool is established. This means that there are endless opportunities for innovation and experimentation.

Uniswap v4 does a few other cool things, all aimed at making swaps cheaper. Instead of deploying a new contract for each liquidity pool, v4 consolidates all the liquidity into a single contract. Starting a new liquidity pool will cost you a fraction of what it used to, estimated to be a whopping 99% reduction in costs!

Last week, we discussed all the upgrades coming to Ethereum. One of these upgrades, transient storage, will supercharge the cost efficiency of Uniswap v4. With transient storage, you'll experience "flash accounting," leveraging temporary space in blocks to facilitate trades between multiple tokens.

Now, here's the scoop on the release of Uniswap v4. It will go through a thorough community review process, just like they've always done. Once it's deployed and ready to rock, the governance of the $UNI DAO will decide when to expand v4 to other chains, such as Arbitrum – we shared alpha on Arbitrum this week; check it out.

Is there a threat to Uniswap’s monopoly? ❄️

Among DEXes, Uniswap is the undisputed king, handling over 50% of all the DEX volume on the mainnet. However, competition, they say, keeps things interesting!Uniswap's closest contender in the ring is Curve Finance, which allows you to swap between different pairs of stablecoins and offers some mouthwatering yield opportunities.

Here's the kicker: the recent surge in stablecoin yields might shake things up and give Uniswap a run for its money. In fact, activity on Curve had skyrocketed by a massive 78% from when the DAI savings rate was increased.

Savings rates are going up, even in DeFi! ↗️

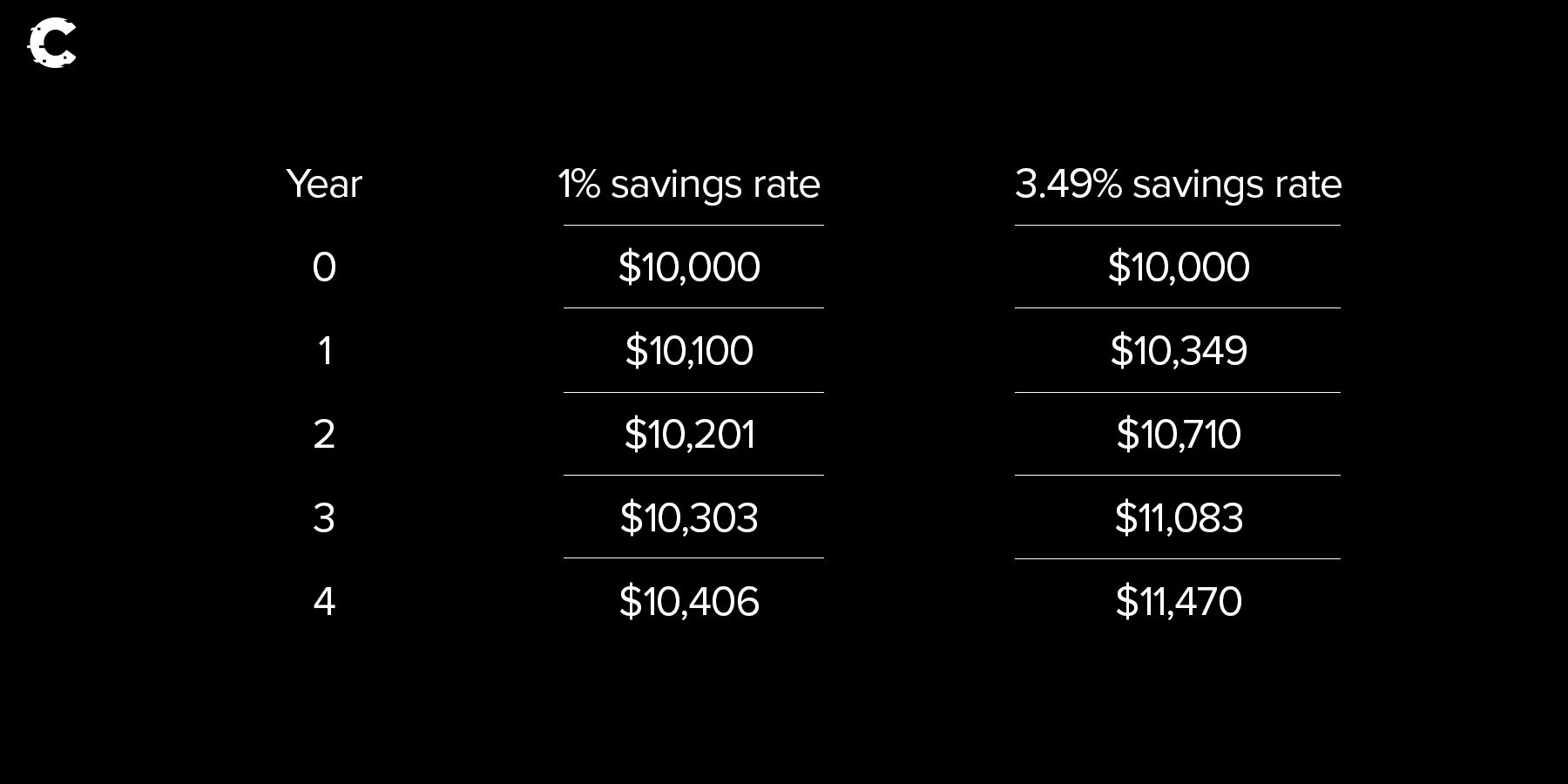

MakerDAO is offering an opportunity to profit by parking your funds. If you hold some DAI, you can earn a sweet 3.49% yield on your DAI savings.And how can you participate? Simple! Just grab yourself some sDAI, a version of DAI that accumulates these fantastic savings rewards.

Now, let's talk numbers. The extra returns can be decent, with the savings rate raised from 1% to a juicy 3.49%. Here's an idea of how the power of compounding can work over time!

But wait, there's more! Just before MakerDAO raised its savings rate, Coinbase, the popular centralised exchange, announced that it would be boosting its rate to an impressive 4%.

Here's the thing about savings rates in DeFi. They come with their perks, like no impermanent loss to worry about. However, stablecoins don’t go up in price, but they only generate a small return.

Is this tempting enough? Maybe, maybe not.

Price analysis 📈

The market is in a good spot for more upside, but ETH still needs to reclaim $1,740 before heading higher. Staying under this level puts ETH at risk of going down to $1,420, which is why that's one of the potential trajectories it can embark on.

Of course, a weekly closure above $1,740 will invalidate the downside and put the asset on track for $2,000

With Bitcoin's dominance on the rise, it's safe to assume that ETH will not outperform in the coming weeks if the market starts pumping again. Most of the attention will be placed on Bitcoin instead of the altcoins market, so consolidation is likely.

Cryptonary’s take 🧠

Uniswap v4 is ushering in a new era of possibilities in the wild world of DeFi. With hooks, cost-saving measures, and future enhancements like transient storage on the horizon, we're witnessing a revolution in how we swap and trade tokens.MakerDAO's bold move to increase the DAI savings rate and even Coinbase stepping into the game are shaking things up and giving users more options to earn some sweet yield. It's like the tables have turned, and DeFi is showing the world that it means business.

However, it doesn’t look like ETH will stop playing second-fiddle to BTC in the coming weeks – and we’ll probably be seeing more consolidation than a breakout.

That said, DeFi is on an upswing on Ethereum, and exciting times are ahead.

And as always, thanks for reading. 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms