Well, it might not necessarily be true, especially when it comes to airdrops. 🌟

Of course, you may still need to put in some work.

But suppose you are one of those who ARB airdrop tokens with an average of $1500 earlier this year. In that case, you’ll agree that money from airdrops is essentially free money.💰

Our exciting new series brings you three potential airdrop opportunities every month, offering a chance to enhance your portfolio through cutting-edge protocols.

Whether you're a curious beginner, an intermediate enthusiast, or an advanced trader, we've tailored something special for everyone.

Let’s start digging.

TLDR 📃

- You can get up to $300 in free tokens through a potential airdrop from a popular cross-chain protocol.

- Another cross-chain competitor hints at a similar airdrop potentially worth around $200.

- A Layer 2 focused on NFTs recently raised $50M at a $600M valuation, signalling a high chance of an airdrop worth an estimated $700.

- Learn strategies to maximise your eligibility for these three exciting airdrop opportunities.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What are crypto airdrops? 🪂

A crypto airdrop is a method crypto projects use to distribute free tokens or cryptocurrencies to a specific group of people.The beneficiaries of the airdrop receive these tokens without making any direct payments to purchase them. The project chooses the airdrop beneficiaries based on specific eligibility criteria or requiring people to perform specific tasks to qualify.

While you can build a crypto portfolio by purchasing tokens from a CEX or DEX, airdrops presents exciting opportunities to build your portfolio from scratch without paying for the tokens.

Let's dive into what they entail and why airdrops hold a special place in crypto culture.

Why do Web3 projects deliver airdrops?

Marketing: Airdrops are used as a marketing tool to increase brand awareness and attract new users.

Decentralisation: If a project aims to achieve decentralisation, it must take intentional action to prevent the majority of the tokens from ending in the hands of just a few people. An airdrop campaign can help create a wider token distribution.

Reward early users: Projects may want to reward their early users and community members.

Engagement: Airdrops encourage community engagement and participation. This engagement could trigger market effects for the project.

Now, let’s dive into three of the most exciting airdrop opportunities in the market right now.

Jumper Exchange

Jumper Exchange is a cross-chain protocol enabling the seamless transfer of assets and liquidity between different blockchain networks. By aggregating all the different routes you can take to bridge your assets, it chooses the best route for you. For example, it allows you to go from Ethereum to Arbitrum, selecting the route with the least cost to save fees.

In the back end, Jumper Exchange’s bridge aggregation service is powered by the Li.Fi Protocol. Actually, Li.Fi created Jumper Exchange partly to showcase what its technology could do. Long story short, by using Jumper Exchange, you can become eligible for the Li.Fi airdrop.

Airdrop potential: Medium

Li.Fi has not directly confirmed plans to organise an airdrop for users of Jumper Exchange, but several hints have led us to believe that an airdrop campaign is in the works.The first obvious and important hint of an airdrop is that Li.Fi has recently raised a $17 million funding round. As we know, investors do not invest in crypto projects just for charity - 90% of the time, a token is part of the deal.

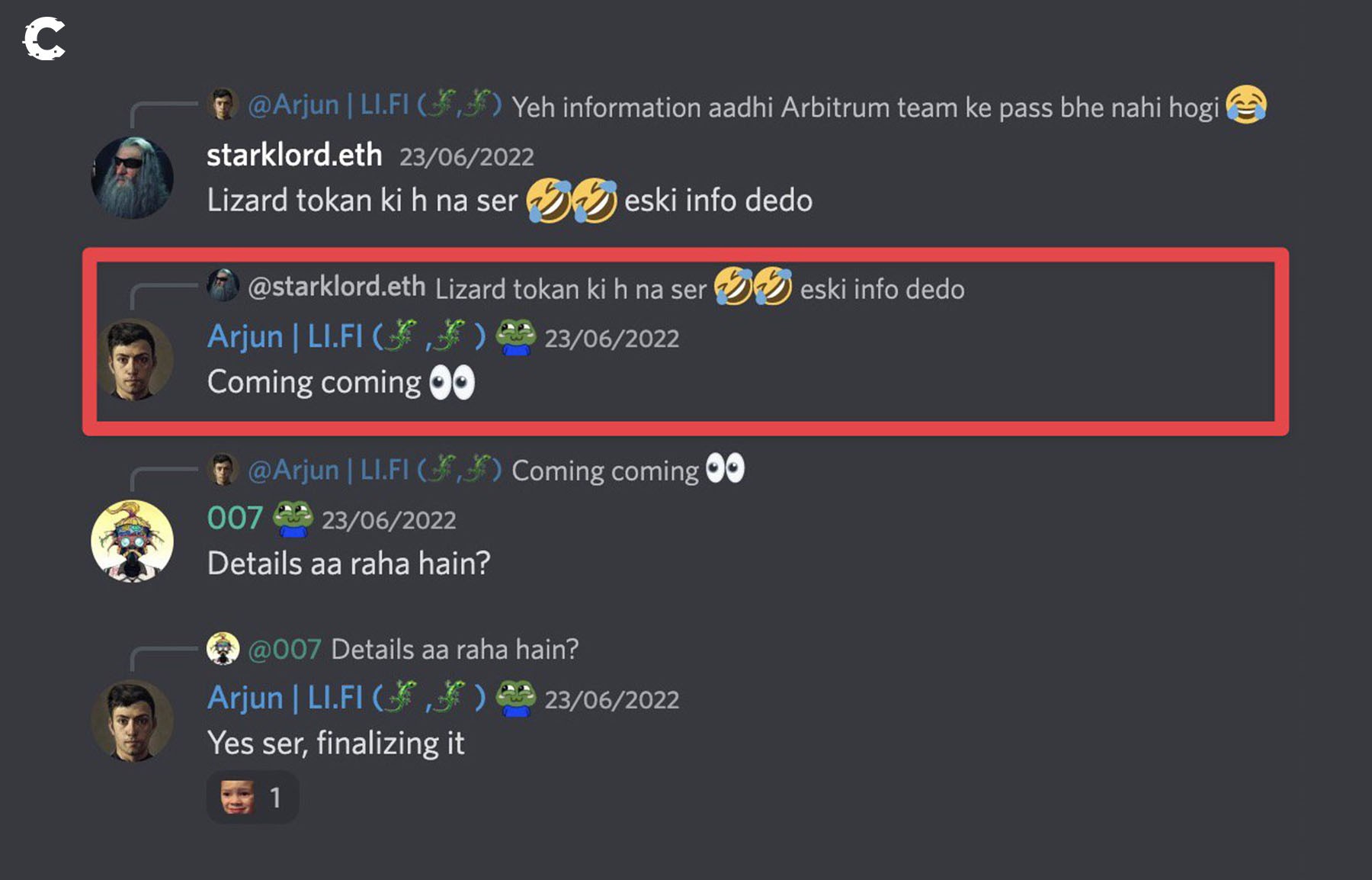

The second hint of an airdrop goes back to a circulating screenshot of a Li.Fi team member who hinted at their token launch in 2022. So, we have confirmation that the Jumper Exchange plans to launch a token; the timing may have changed.

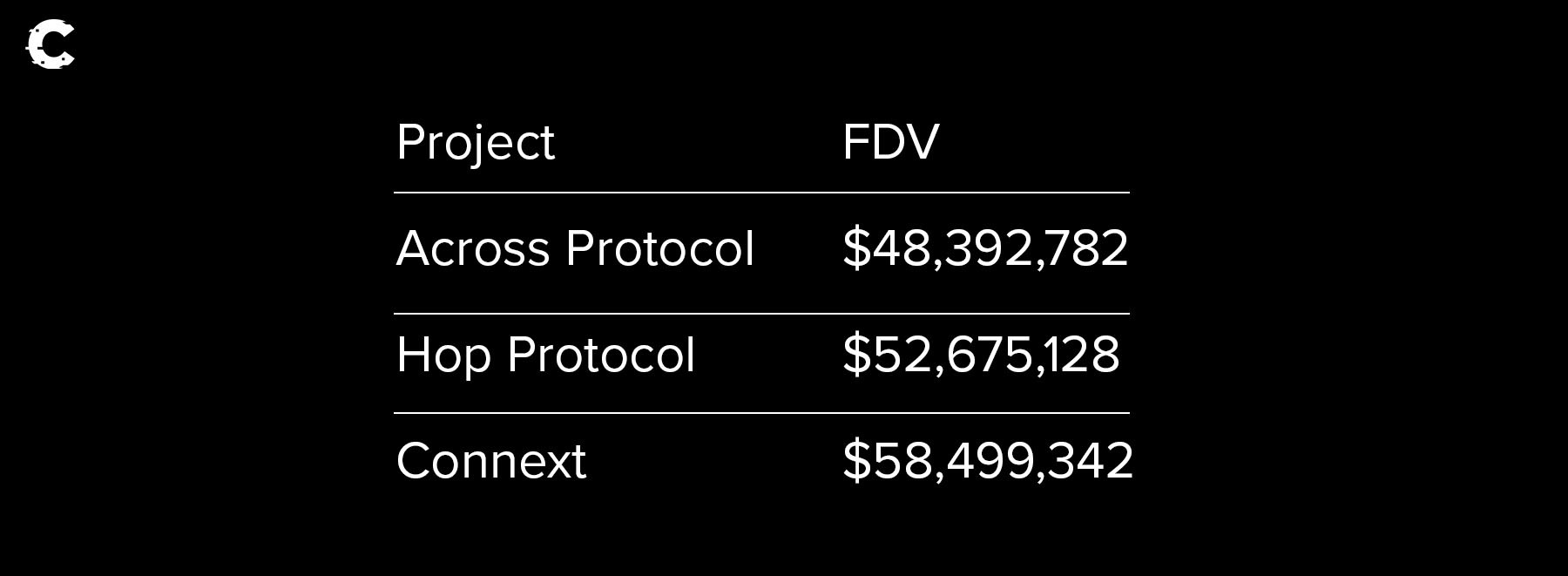

It is important to mention that there’s no way to be 100% certain that a project will do an airdrop. However, given that Jumper Exchange’s competitors like Connext Network and Hop Protocol have done airdrops, and VC firms often exit their crypto investments during token sales, we have a medium-level conviction that the Li.Fi protocol will launch a token and possibly run an airdrop campaign.

What would an airdrop from Jumper Exchange be worth?

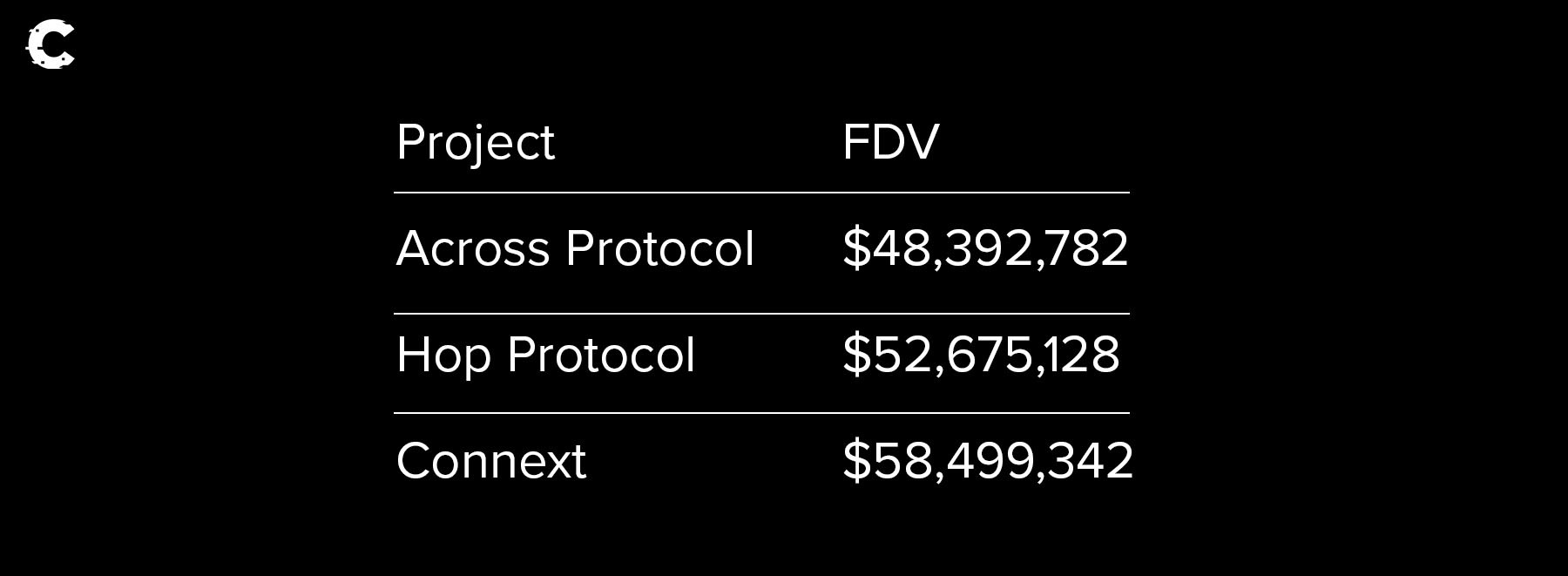

It is hard to predict the potential value of an airdrop because we need the token distribution details. Yet, we can look at competitors and previous examples to get a good idea of what the airdrop could be worth.Let's look at the sector of cross-chain communication and bridges specifically. They usually launch at a fully diluted valuation of around $50M, our base case.

Since Li.Fi, however, is more than just one bridge protocol and back-end provider of multiple bridges; we can also imagine an optimistic scenario where it launches at a higher valuation of around $100M, given that it should earn more revenue if it scales.

Also, if we look at previous bridges that have done airdrops like Connext Network or Hop Protocol, the lowest amount users received usually ranged between $150 and $300.

That should be our base case if you are eligible for the minimum criteria.

How to potentially qualify for an airdrop on Jumper Exchange

So, how do I use Jumper Exchange to be potentially eligible for an airdrop?You are in luck; we created a tutorial to walk you through it.

https://youtu.be/8GGg2036t1I

The volume of transactions you’ve made on the bridge will likely be the main factor to qualify for the airdrop. Airdrop campaigns from other bridges based their criteria on users who had made at least five transfers, with an average value of at least $15 per transaction and a total volume exceeding $200. We think Li.Fi will set similar criteria for Jumper users.

Bungee Exchange

Bungee Exchange is a protocol that helps you find the best routes to bridge your assets and pay the lowest possible fees. It is quite similar to Jumper Exchange; it was developed by Socket, the same way Li-Fi created Jumper Exchange. Bumper and Jumper are direct competitors, so we have a similar perspective on both projects.

Airdrop potential: Medium

Socket recently announced a strategic investment from two significant VCs, Coinbase Ventures and Framework. Coinbase Ventures is known for advising projects to launch their tokens with an airdrop. For this reason, there is a good chance that Socket will also launch an airdrop.What would an airdrop from Bungee Exchange be worth?

It is hard to predict the potential value of an airdrop because we need the token distribution details. Yet, we can look at competitors and previous examples to get a good idea of what the airdrop could be worth.The potential valuation here is the same as with Jumper because we are working with a protocol that solves the same problem, so the comparisons are identical.

If we look at previous bridges that have done airdrops like Connext Network or Hop Protocol, the lowest amount users received usually ranged between $150 and $300.

That should be our base case if you are eligible for the minimum criteria.

How to potentially qualify for an airdrop on Bungee Exchange

So, how do I use Bungee Exchange to be potentially eligible for an airdrop?You are in luck; we created a tutorial to walk you through it.

https://youtu.be/dIi54UQKls4

Just as with Jumper Exchange, the volume of the bridge is likely to be the leading indicator, as previous bridge airdrops based their criteria on users who had made at least five transfers, with an average value of at least $15 per transaction, and a total volume exceeding $200.

Zora

Zora is a Layer 2 network that aims to facilitate the transfer of media assets on the blockchain quickly and cost-effectively. It was initially focused on assisting musicians and artists in selling digital tokens linked to physical objects, such as cassettes. The goal was to empower creators and artists by enabling them to tokenise physical items and media content.

However, the company has shifted its focus to developing an open-source protocol. This protocol allows anyone to create their own NFT (Non-Fungible Token) marketplace. In essence, Zora wants to provide the tools and infrastructure to make it easier for people to develop NFT marketplaces.

Airdrop potential: Medium

In May 2022, Zora successfully raised $50 million in funding, led by Haun Ventures, and achieved a $600 million valuation.Again, this signals that there will be a token launch, as we doubt these venture capital firms would have ever invested in Zora without the expectation to exit their position.

Given that Zora Network is also a layer 2 network, there is a clear need for a token – again, a token launch often increases the odds that an airdrop will happen.

If you want to have governance for layer 2, you need to distribute your tokens fairly, which is why both Arbitrum and Optimism have done airdrops.

This is a good enough reason to give Zora a medium potential for an airdrop.

What would an airdrop from Zora be worth?

Given that Zora has already raised $50M at a valuation of $600M, we can assume that venture capital firms are betting on a higher valuation at launch.However, Zora is a layer 2 network, so we can compare it to other layer 2 solutions and their valuations to get a good idea.

Since we don't expect Zora ever to become as big as Optimism or Arbitrum, ImmutableX provides a fairer comparison because it is also a layer 2 solution focused on NFTs.

Therefore, we assume that a $1B valuation for Zora is reasonable. On the optimistic outlook, a valuation of $1.5B is on the table if Zora gains more traction than ImmutableX.

If we look at previous bridges that have done airdrops like Arbitrum or Optimism, the lowest amount users received was $1200.

Since Zora will likely launch at a lower valuation, the lowest amount could be around $400-$700.

That should be our base case if you are eligible for the minimum criteria.

How to potentially qualify for an airdrop on Zora

Here is a video on how to use Zora so you can be potentially eligible if it launches an airdrop campaign.https://youtu.be/N9w5ke2XXtQ

Bridge to Zora Network and mint an NFT or buy NFTs from creators using Zora, as this is the main activity Zora values.

Cryptonary’s take 🧠

Whether you're a beginner or a seasoned trader, exploring Jumper Exchange, Bungee Exchange, and Zora Network could be worthwhile.For a more passive approach, consider using networks like Bungee Exchange or Jumper Exchange whenever you need a bridge; this way, you can earn airdrop through your regular activity.

If you want to maximise your chances, you can take a more professional approach by using multiple wallets and exploring our airdrop mastery article, where we detail strategies for farming airdrops with multiple wallets while staying undetected.

Remember that these opportunities are not highly capital-intensive, making them accessible for many. It's worth exploring all three to see which aligns best with your crypto portfolio goals.

As always, thanks for reading. 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms