Mt. Gox's $3.9b BTC sale, Arbitrum's $42m airdrop, and more

Welcome to another edition of Cryptonary’s crypto news roundup. As is our custom, we go beyond news headlines to delve into untold stories behind the biggest events of the week and their potential impact on the crypto market going forward.

We haven’t heard the last of MT Gox and its ghosts, almost ten years after it died. Why are institutions jostling for a piece of the DeFi piece? But the plot thickens. One layer 2 project raises money through a private sale, while another gives money away via airdrops.

This is a long read, but one thing is for sure: it is a riveting story on everything that has happened in crypto this week.

Are you ready to make sense of crypto news headlines? Let’s get clarity!

TLDR 📃

- MT Gox delays $3.9 billion BTC sale, Grayscale eyes Ether Futures ETF, and Binance secures minor legal victory.

- Arbitrum offers $42 million in incentives, while Optimism plans a $160 million private sale, shaking up Layer 2 dynamics.

- BTC volatility stabilises, ETH inflation resurfaces, and DEX volume hits 2021 levels, signalling market uncertainty.

- Banks like Citigroup and Nomura lead the crypto adoption charge with new services and Bitcoin Adoption Fund for institutions.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the R: R trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

The biggest news of the week 🔑

Will Mt. Gox sell $3.9 billion worth of BTC?

Mt. Gox announced a delay won’t flood the BTC market yet. Grayscale is filing for an Ether Futures ETF, and Binance had a minor legal victory.

Mt. Gox's $3.9 billion worth of BTC

- Background info: After shutting down in 2014, Mt. Gox still holds 142,000 BTC ($3.9 billion), 143,000 BCH ($31.3 million), and 69 billion Japanese yen ($467 million).

- Creditor repayment plan: Mt. Gox was supposed to start repaying its creditors next month.

- Deadline extended: Mt. Gox has extended the creditor repayment deadline from October 31, 2023, to October 31, 2024. Some creditors may receive repayments by the end of 2023.

- Reason for extension: Rehabilitation creditors need more time to provide essential information to the rehabilitation trustee.

- Repayment timing: Creditors who provide the information may get repayments by year-end. Repayments will be sequential.

Grayscale enters the ETH ETF race

- On Tuesday, Grayscale Investments submitted documents to the Securities and Exchange Commission for a novel exchange-traded fund tracking ether futures.

- This development follows Grayscale recent victory in its ongoing application for a traditional Bitcoin ETF.

- There’s been a surge in applications on Ethereum futures ETFs from various asset managers. The list includes Bitwise, ProShares, VanEck, Roundhill, and Valkyrie.

- Many expect the SEC to approve the first Ether Futures ETF in October.

Cryptonary’s take 🧠

The delay in the distribution of Mt. Gox's BTC is good news – at least for the broad market; we can’t say the same for Mt. Gox creditors. The news of Mt Gox’s BTC liquidation, FTX’s liquidations, and the uncertainties in Binance had cast dark shadows over the market.Even though we are kicking the can down the road, a win is a win. This delay and a potential Bitcoin Spot ETF and an Ether Futures ETF may set the stage for a positive October.

WTF is happening with Layer 2s? 💣

Arbitrum raises money, while Optimism gives it away

While new layer 2 solutions spring like wildflowers in spring, Optimism and Arbitrum remain giants. In the past week, both networks have seen significant have been our crosshairs.

Arbitrum to give out $42 million and revive Arbitrum Odyssey

- Arbitrum DAO has approved its inaugural incentive program to attract more liquidity to the ecosystem. The program will distribute 50 million ARB tokens, valued at $42 million.

- Arbitrum will also be home to Chainlink's CCIP protocol; the new project will empower developers to create cross-chain decentralised applications.

- Arbitrum is reviving the Arbitrum Odyssey campaign to attract more users and liquidity.

- Starting September 26th, for seven weeks, you can explore 13 different projects by completing missions within the Arbitrum ecosystem.

Optimism to sell $160M in OP tokens via private sale

- Optimism wants to sell 116 million OP tokens to private buyers as part of its treasury management strategy.

- The tokens in this sale are subject to a two-year lockup period, prohibiting buyers from trading them on secondary markets. So, the private sale won’t lead to an immediate token dump.

- However, Optimism’s third airdrop, which distributed 19.4 million OP, has already added some selling pressure.

- Optimism plans to distribute $570 million worth of OP through airdrops over the coming years – you've got to keep tabs on the airdrop schedule.

Cryptonary’s take 🧠

When comparing Arbitrum and Optimism, it's evident that Arbitrum is taking significant steps to defend its #1 position, especially with new networks like Base entering the arenaThe recently launched incentive program is expected to provide opportunities, potentially boosting token prices for projects receiving grants. The new Arbitrum Odyssey campaign is also worth participating in.

On the other hand, Optimism's private sale might generate negative sentiment.

Follow the money 💰

Now, let's examine data that reveals capital flows in crypto to gain insights into what’s in store for the market in the coming weeks.

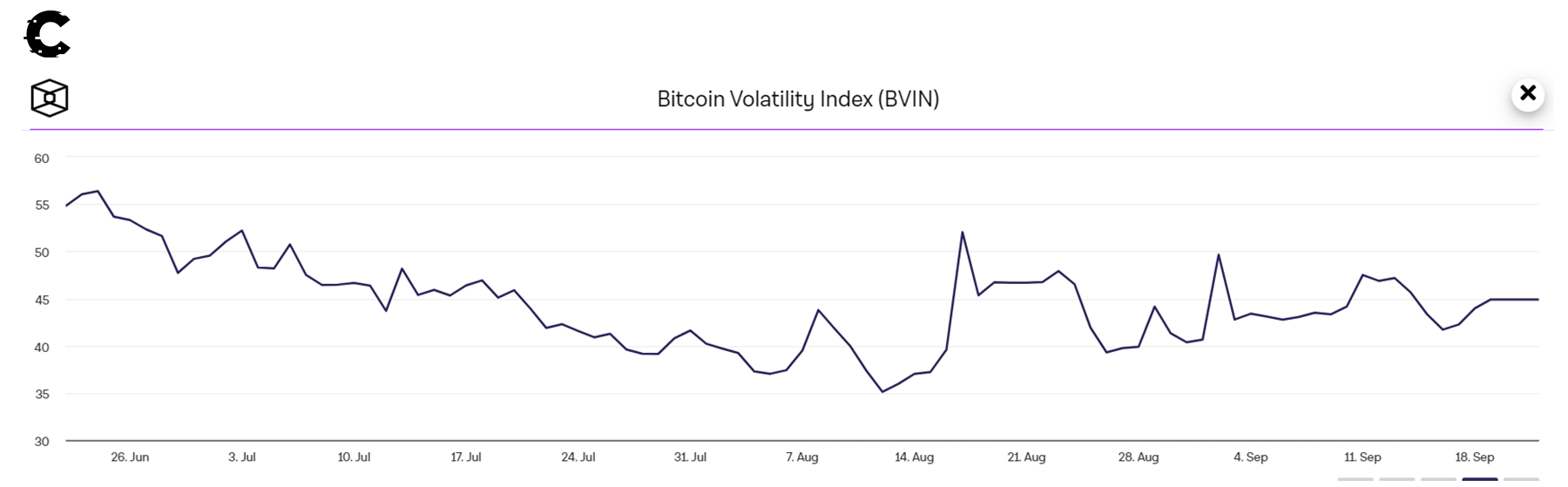

BTC volatility stabilises

The volatility of BTC has stabilised somewhat, but it still exhibits positive signs, as it has not returned to the previous levels seen in August. We anticipate that volatility will increase due to crypto-specific events in October, whether negative or positive.

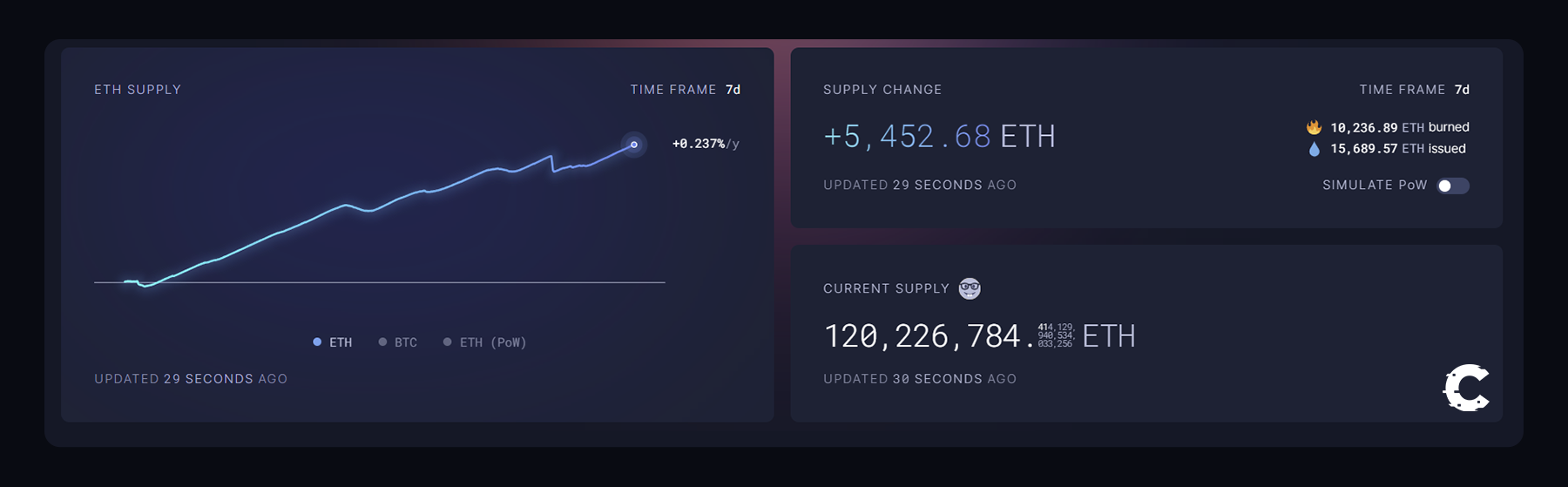

Ethereum turns inflationary

The key signal for the lack of opportunity in the market right now is that ETH has become inflationary again. In September, users spent less ETH on gas, indicating that on-chain opportunities are becoming less prevalent.

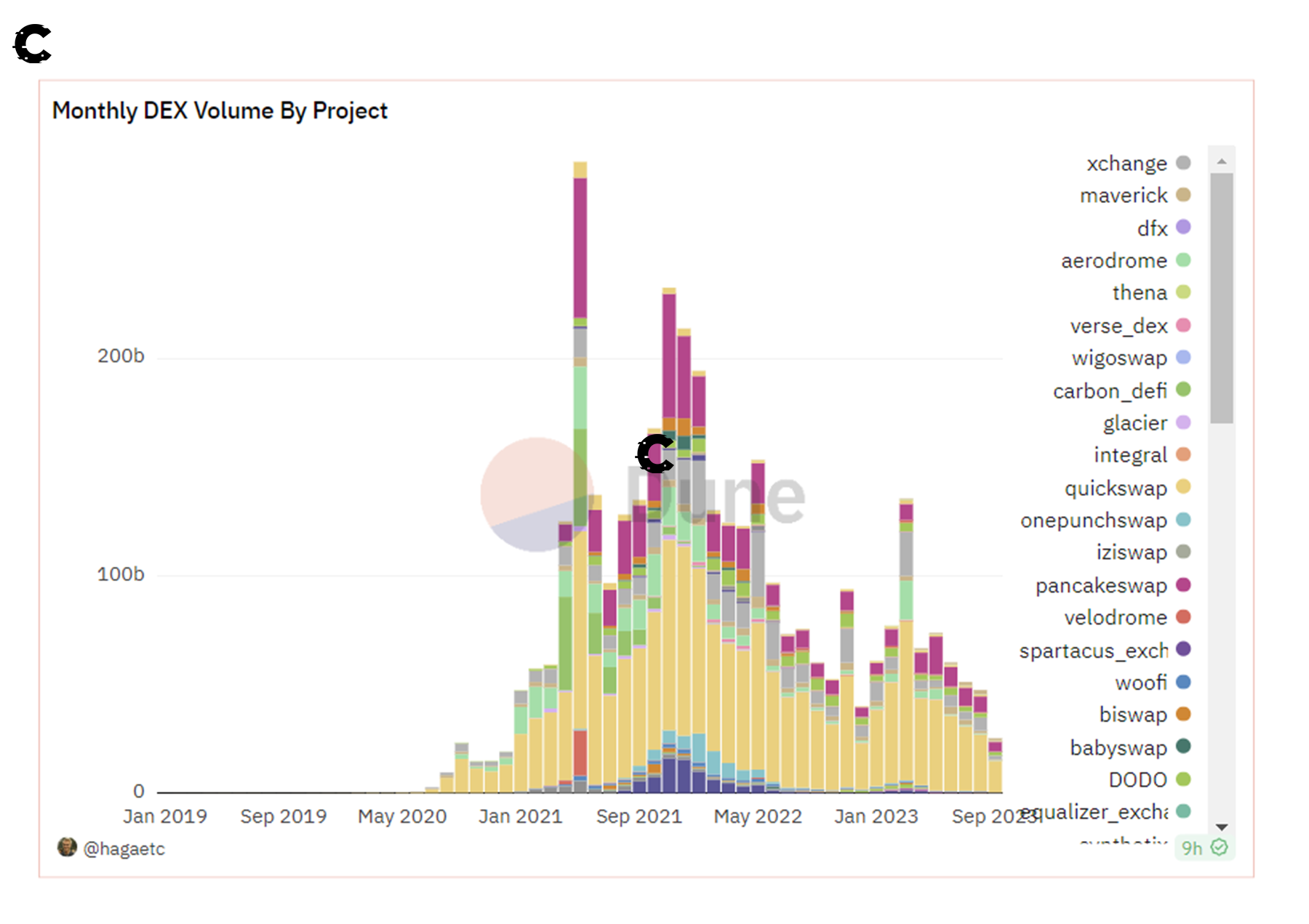

Monthly DEX volume drops

Another signal is that not many new participants are entering DeFi right now. Monthly DEX volume is on track to reach a new low this year, bringing it to levels not seen since 2021.

Cryptonary’s take 🧠

The market is undeniably uncertain, with many participants experiencing apathy or perceiving a lack of opportunities. For a change in fortunes into a more positive trend, we need catalysts to reignite interest in BTC and propel a potential rally in Q4.The primary catalyst is the Bitcoin Spot ETF, which is expected to have a decision in October. This development could facilitate increased liquidity in the market and set us up for a positive Q4.

However, the focus should be on long-term accumulation until we see the signs of increased volatility and heightened on-chain usage.

Chart of the week 📊

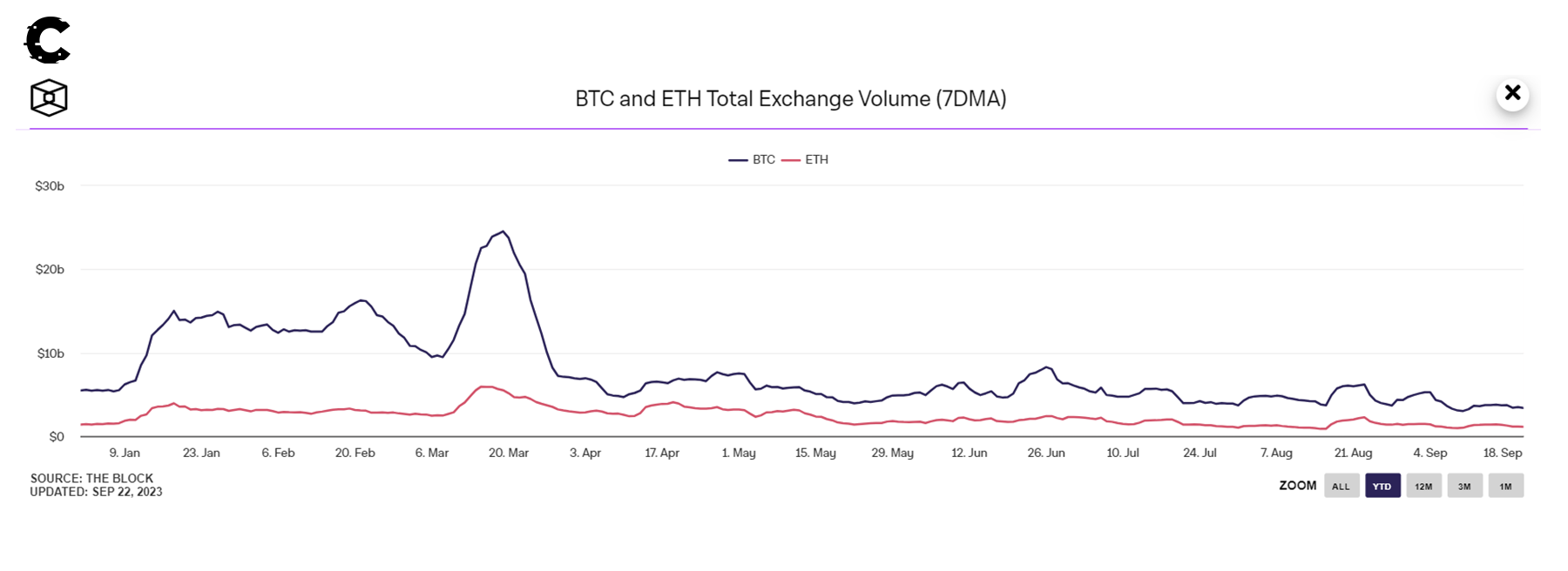

The impact of Binance's uncertainty on trading volumes and liquidity

We've extensively discussed Binance and its unending uncertainties, which significantly impede market growth. The opacity of the situation breeds indecision since nobody has enough information to make educated decisions.

Unfortunately, the Binance situation continues to impact trading volumes and activities because Binance constitutes a significant portion of the total crypto exchange volume. The legal challenges currently confronting Binance from the DOJ and SEC may be causing market makers to exercise caution when considering trades on the platform.

Cryptonary’s take 🧠

The market's lack of trading volume and liquidity is a major concern, and Binance's uncertainties play a significant role in this. It is a key negative factor that could hinder a positive Q4. The hopes of a positive Q4 hinge on a rebound in trading volumes and on market makers regaining confidence in providing liquidity on the exchange or elsewhere.This week in DeFi 🏦

Liquid staking and real-world assets dominate DeFi right now

Last week, Token2049 concluded one of the year's largest institutional crypto conferences, where the brightest minds gathered to discuss the industry's future. The two hottest trends from the event are Liquid Staking and Real-World Assets.

Liquid staking

- Stader Labs launched rsETH on testnet, a token for enhancing ether staking rewards.

- ClayStack launched an Ethereum liquid staking service to combat staking centralisation,

- This service eliminates the minimum capital requirement for Ethereum validator nodes.

- Cosmos Hub, a part of the Cosmos Network, upgraded to include a liquid staking module.

- Users can now unstake ATOM without the previous 21-day unbonding period.

Real-world assets

- Over the last week, MakerDAO has added $100 million worth of Real-World Assets (RWAs) via BlockTower Andromeda.

- The founder of Frax Finance announced on its Telegram channel that they have been conducting tests with their banking partner, FinresPBC, using USDC to prepare for offering treasury yields on the FRAX stablecoin.

- The Federal Reserve has published its first study on Real-World Assets, highlighting the risks and opportunities of asset tokenisation.

- However, the fact that the Federal Reserve is studying this sector highlights that it is becoming a more significant part of crypto.

Cryptonary’s take 🧠

With the EIP-4844 upgrade coming up in Q4 or early 2024, it is no wonder that projects like Stader Labs are exploring opportunities like restaking to increase the yield that stakers can earn. EIP-4844 is expected to slightly reduce staking yield, as layer 2 networks will pay fewer gas fees.We expect this to present opportunities as the liquid staking protocols figure out how to increase their yield. We are keeping an eye on Stader Labs.

Real-world assets will continue to be a prominent theme in crypto as long as interest rates remain high. We are most excited about FRAX V3, which you can read about here, but as long as interest rates remain high, this sector is worth exploring.

Regulations and mass adoption 📜

Banks are doing more crypto experiments

Banks in the United States and Asia are leading the charge on institutional adoption for crypto despite the bear market.

Citigroup to clients transform deposits into digital tokens

- Citigroup has unveiled Citi Token Services, a new service tailored for institutions.

- This service uses blockchain and smart contract technology to enable swift cross-border money transfers for institutional clients.

- This announcement reflects ongoing bank interest in blockchain experimentation, even amid market challenges.

Nomura, Japan’s largest investment bank, launches Bitcoin fund

- Japan's largest investment bank, Nomura, through its digital asset subsidiary, Laser Digital Asset Management, has introduced a Bitcoin Adoption Fund targeting institutional investors.

- This fund marks a significant step as it is Nomura's inaugural initiative of this kind.

- According to the official announcement, the Bitcoin-based fund represents the first among a series of digital adoption investment solutions that Nomura plans to introduce.

Cryptonary’s take 🧠

Investment banks' growing interest in crypto indicates that despite the current bear market, cryptocurrencies are here to stay. These banks are not embracing Bitcoin and tokenisation for charity; they are pursuing profits.These developments reaffirm the positive outlook for the next year, especially with the imminent launch of Spot Bitcoin and Futures ETFs. Additionally, as more institutions explore crypto, they are likely to discuss it with their clients.

And until we bring you another crypto news round-up next Friday, stay winning!

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms