The key? Real World Assets (RWAs), the quiet game-changer, ready to pump an unprecedented amount of capital 💵 into DeFi and supercharge our crypto bags 🚀.

Well, it's gone beyond hypotheticals into an unfolding 💡 So, buckle up! We're diving head-first into an exciting world where the best of TradFi meets the best of DeFi.🌊💰

TLDR 📃

- Real World Assets (RWAs) are infusing unprecedented capital into DeFi.

- Pioneers like Justin Sun's stUSDT and MakerDAO's DAI lead RWA utilisation.

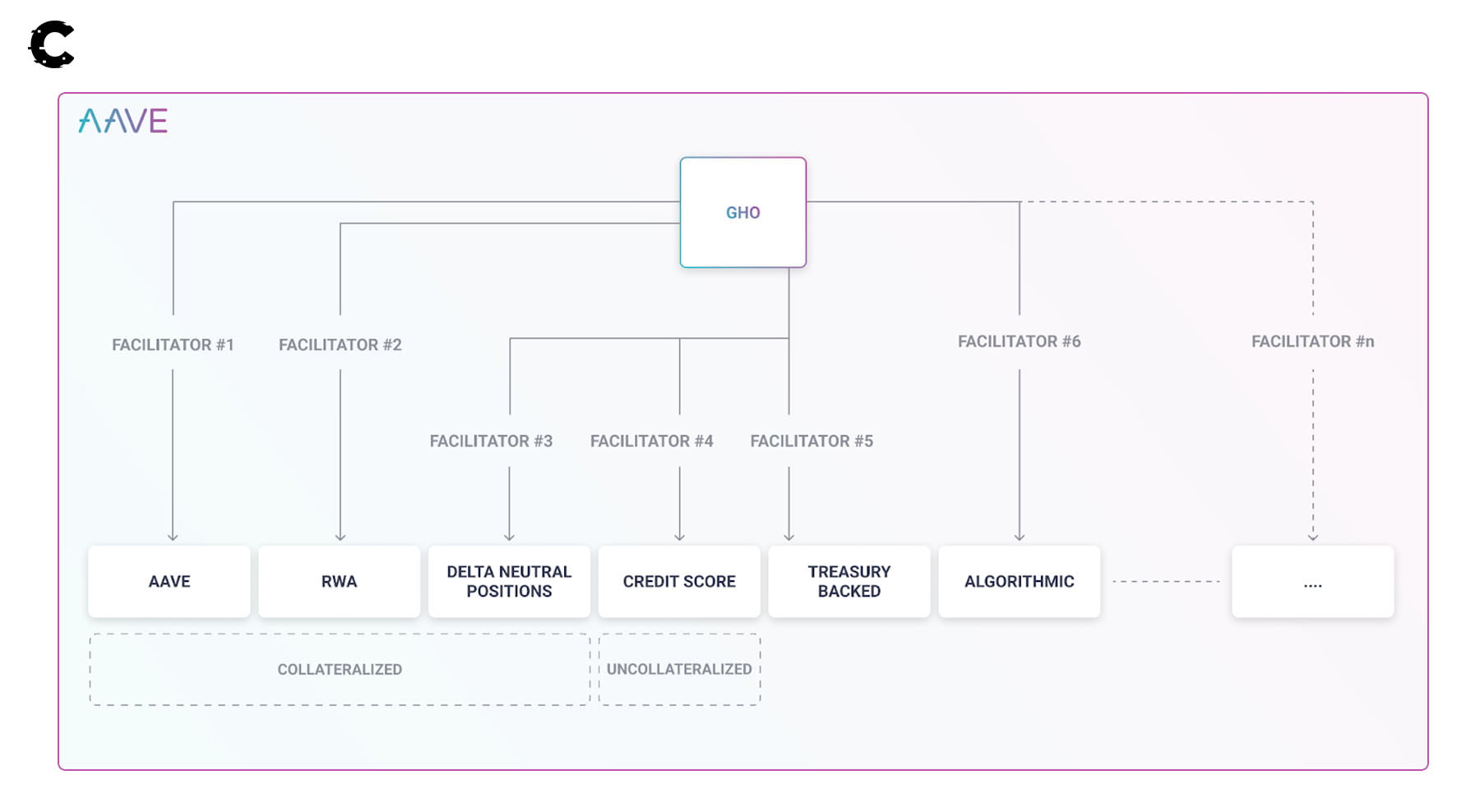

- Aave's GHO stablecoin, backed by RWAs, is a new entrant in this evolving field.

- The tokenisation of securities opens up multi-trillion-dollar opportunities, despite geopolitical challenges.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

RWAs are now getting attention 🔎

Real World Assets (RWAs)—be it your car, house, debt, or stocks—exist off-chain, but their potential within the DeFi economy is monumental.🌐🚗🏠📈The world's total net worth is around a staggering $430 trillion. That’s a number so incomprehensible that it’s pointless trying to explain.

Now, imagine the power of translating every dollar of this vast wealth into tokens on the blockchain. 💵

While the tokenisation of RWAs is an underexplored territory in DeFi, it's been a shining beacon of consistent growth in 2023, painting a hopeful trajectory. We’ve name-dropped some projects in this space before. 🚀🌱

Now that we've set the stage, let's serve some of the hottest sauces in the RWA kitchen.

Justin Sun has eyes on an RWA prize 🎯

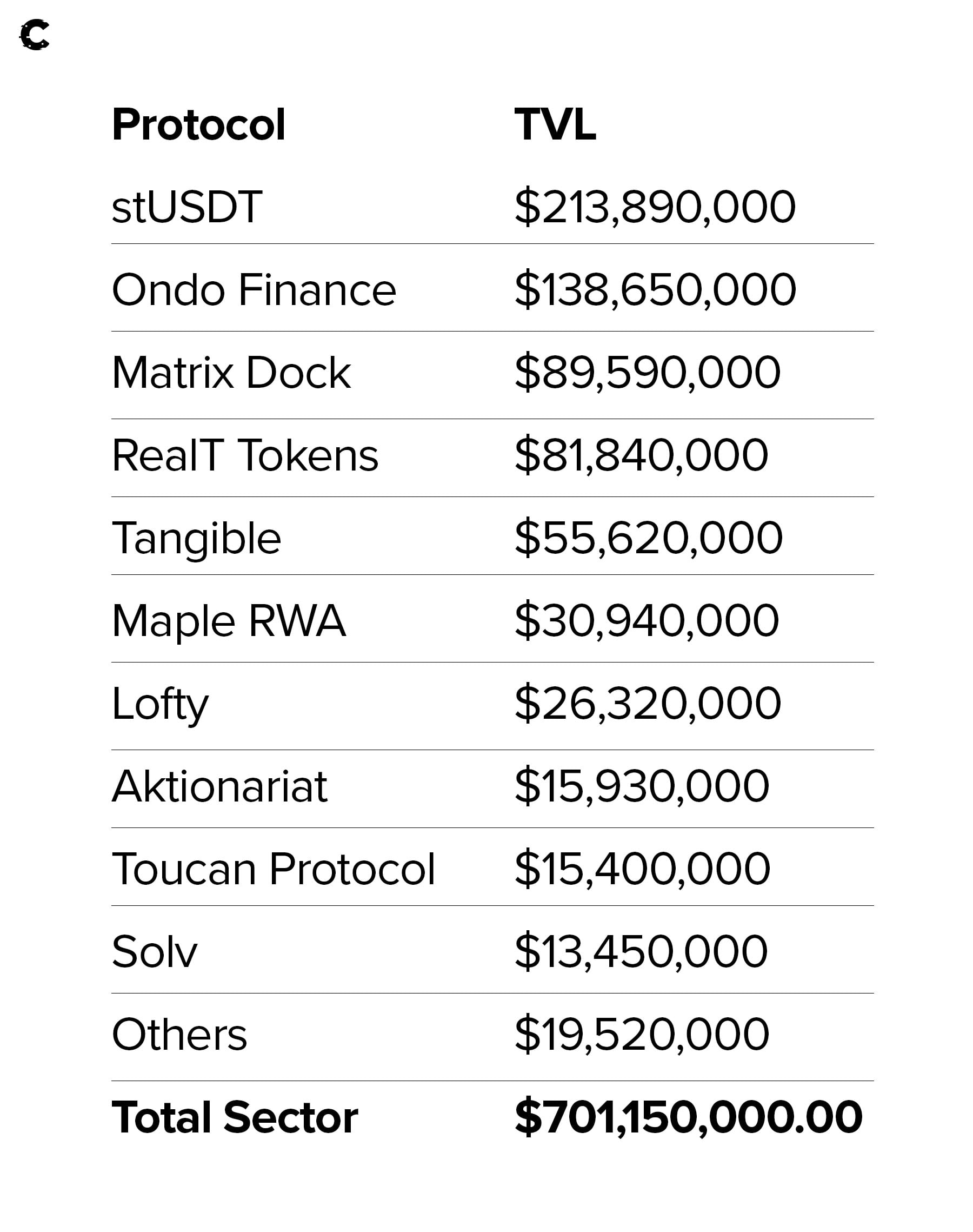

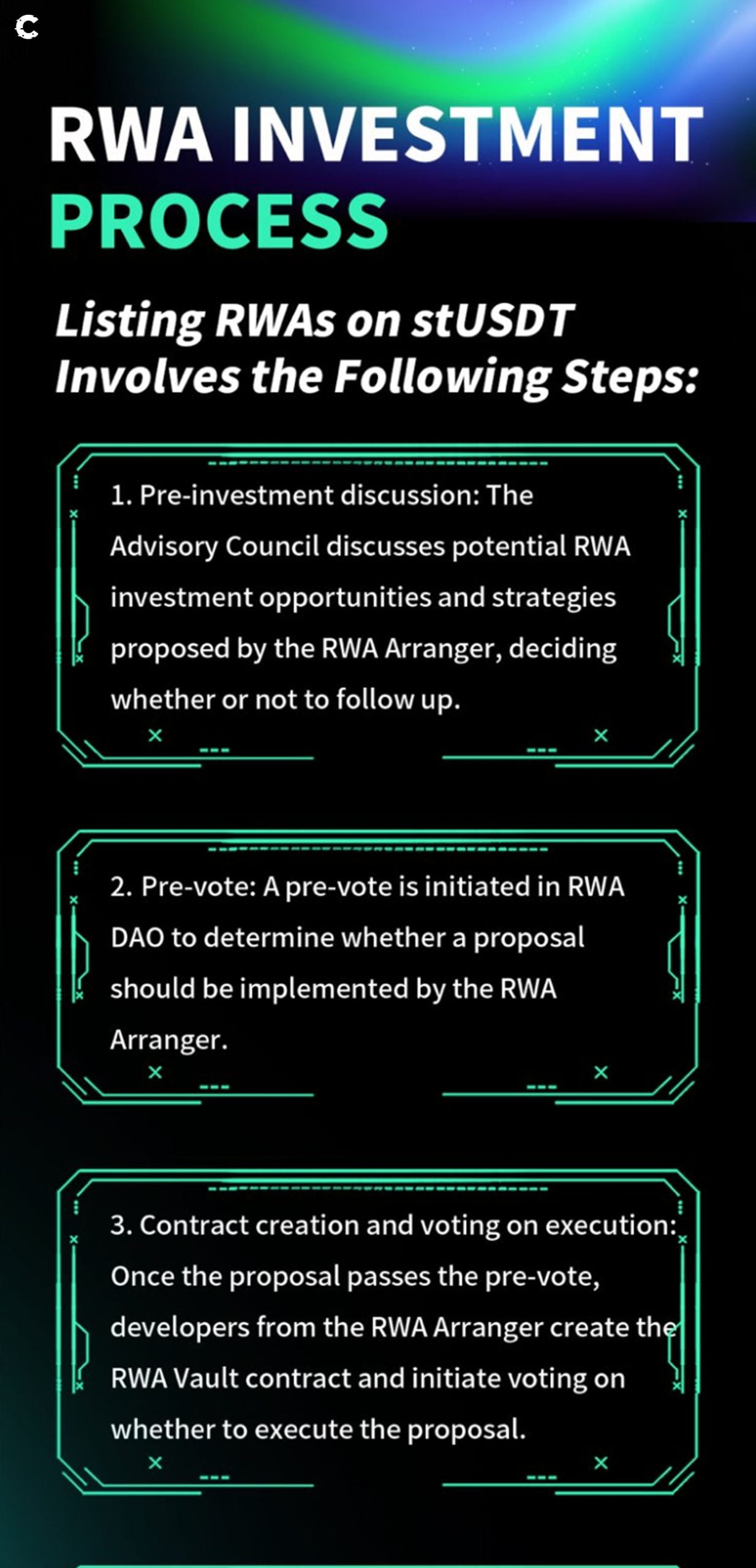

Justin Sun, the founder of Tron, has thrown his hat into the RWA ring, seizing the momentum from this surging trend. And he’s off to a flying start with stUSDT right at the top of the RWA TVL list.The premise is simple - users deposit USDT into the pool, and those funds are used to invest in RWAs. Depositors are paid rewards derived from the yield generated by RWAs bought by the fund.

The key point of failure is the link between DeFi and TradFi. Unfortunately, we can’t ignore that TradFi assets must be managed under TradFi regulations. This means the involvement of TradFi asset managers, outsourced by DeFi protocols to maintain RWA positions in the “real world”.

But more on that at the end.

For now, Justin’s bid is paying off - although we’re not fully convinced he hasn’t filled a significant portion of the stUSDT fund with his own money (only joking).😉

Speaking of RWA funds…

MakerDAO: the top RWA magnet 🧲

MakerDAO has been the top DeFi utiliser of RWAs, using $2.34 billion to back their DAI stablecoin.So far this year, RWAs have netted over $17.5 million in revenue for MakerDAO. 💼🚀 With the recent surge in investment, this figure is expected to leapfrog into the 9-figure range over the coming months. 📈💫

The fascinating twist? The MKR token has been riding the wave of these fundamental developments, witnessing a beneficial impact on its price.

But what do the charts tell us?

Fast forward to now, we're potentially staring at a double bottom pattern with targets ranging from $1630 - $1825, subject to validation. 🎯💹 To validate this pattern, MKR needs to flip the white line into support, known in trading parlance as a "neckline". From there, the asset can set its sights on the target. 🧭🔝

A market-wide bullish performance will also be necessary for MKR to pull this off. So make sure the king of crypto – BTC– is in good hands before getting deep into short-term trades.

Yet, the market remains competitive; a new stablecoin is on the horizon…

Aave's GHO: A new stablecoin star is born! 🌟

The hotly anticipated GHO stablecoin by Aave has been approved for launch after a DAO vote. The launch date is the 17th of July, on which GHO will be deployed on Ethereum.Mark your calendars, friends! The 17th of July 📅 is set to witness the thrilling launch of the much-anticipated GHO stablecoin by Aave following an affirmative DAO vote. 🗳️💥

GHO will launch on the Ethereum network and will tread the path of MakerDAO with the AaveDAO setting parameters such as base interest rate, supply, and other financial settings.

But what about AAVE? Has the unveiling stirred the price pot?

Notice something familiar in the pattern? It's a descending triangle, a classic continuation pattern. With the trend before the pattern being bearish, a break to the downside is more likely, though not a given. 📉🔻

Currently, AAVE's price is knocking on the upper channel's door, challenging it as resistance. A successful break could open up a smooth route to $115, mainly as volumes have been swelling recently.

However, there's also a deal breaker. Bitcoin losing $28,750 as support will result in AAVE returning to the bottom support region, potentially even below. This will invalidate the move to $115.

Navigating these targets could span weeks or even play out across the remainder of 2023. So strap in, folks. We're in for a wild ride! 🎢

Cryptonary’s take 🧠

As we near the end of the bear market and the dawn of a fresh bull season, the symbiotic dance between TradFi and DeFi is set to amplify. Expect the capital rivers to flow more forcefully, energising the entire financial ecosystem. 💵🔄🔋But beware of the thorns among the roses. RWAs, while promising, grapple with challenges, mostly stemming from the centralised management of TradFi. ⚠️🌹

The RWA link becomes an avenue of attack on DeFi, especially with the US government's stance on crypto.

However, the one saving grace is that MakerDAO has distributed its RWA investments across multiple jurisdictions to remove any one point of failure, and Aave will follow suit.

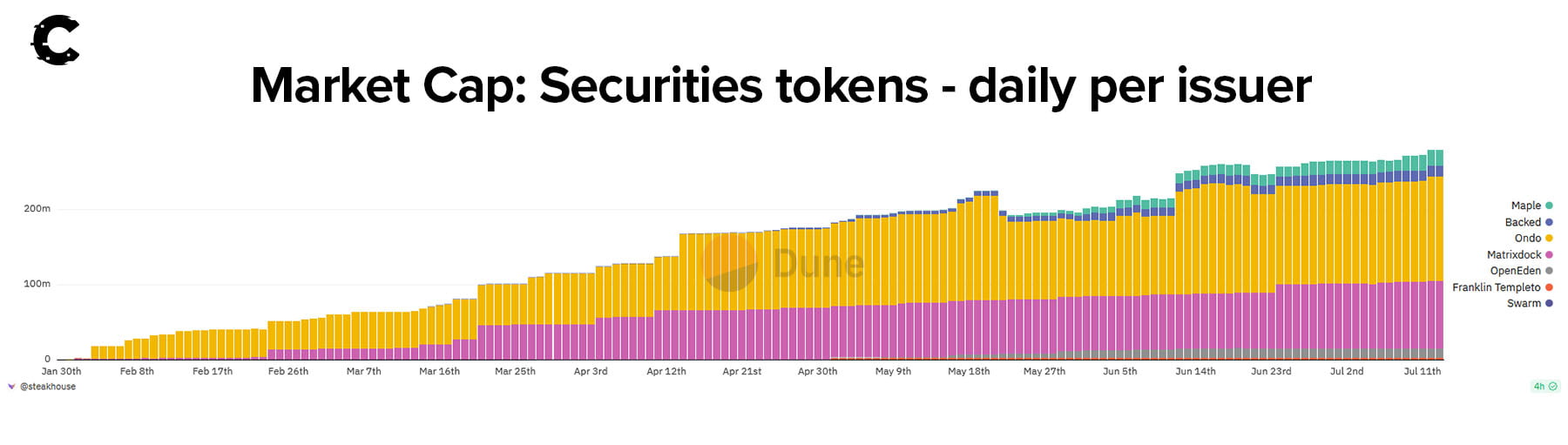

The successful tokenisation of securities and adoption within that sector opens up a multi-trillion-dollar market and vast opportunities for yield generation.

We are closely monitoring tokens like MKR and AAVE, who are on the pioneering edge of this new DeFi trend.

As always, thanks for reading.🙏

Cryptonary, out!

Other news

- Synthetix has broken volume records through Q2 2023. Cheap fees on Optimism have been the key driver, as well as UX updates.

- Infrastructure overtakes gaming as the hotbed for VC investment. After 23 months in the lead, infrastructure has taken the top spot (about time).

- Grayscale has bet big on LDO, making the liquid staking protocol its second-largest DeFi holding.

- RWA protocol Ondo Finance expands its treasury product to Polygon.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms