Hold on one second before you crucify us. We are big on Bitcoin. We know that Bitcoin is king – its brand, security and scarcity have made it a prime store of value.

But beyond price speculation, the lack of smart contracts limits what you can do without selling your BTC. And that’s because Bitcoin doesn’t fully support smart contracts – a blessing and a curse!

It is a curse because smart contracts are the bedrock for building DeFi products like liquidity mining, yield farming, and staking.

What if there was a way to create Bitcoin smart contracts? Bitcoin DeFi? Or even Bitcoin-powered dApps!

It sounds far-fetched, but that’s exactly what Stacks (STX) is doing. If it succeeds, you can use Bitcoin seamlessly in a new generation of Bitcoin DeFi products and other Web3 apps.

If you’re bullish on Bitcoin but want more utility, Stacks is worth a hard look. This is an incredibly bold attempt to rebuild Bitcoin. Will it work? Can it work?

There’s only one way to find out!

Let’s dive in.

TLDR 📃

- Bitcoin, while valuable, lacks smart contract capabilities, limiting its use to being a store of value.

- Stacks (STX) aims to enable Bitcoin DeFi and smart contracts, potentially unlocking significant latent capital.

- STX is the native token of the Stacks blockchain, serving various functions, including network operations, consensus, governance, and developer incentives.

- STX's potential lies in its ability to activate Bitcoin DeFi without centralisation risks and attract developers to build high-utility dApps for the Bitcoin ecosystem.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

What is Stacks, and how does it work? 📚

If you’ve never heard of Stacks, you might be surprised to learn it’s the oldest smart contract platform. It’s been developing since 2013, making it much older than Ethereum.And while it has mostly operated under the radar, Stacks has a pretty unique track record. It was the first crypto to receive a green light from the SEC for its ICO. There is no regulatory risk whatsoever.

On the technical side, Stacks is anchored to Bitcoin, enabling the Stacks ecosystem to benefit from the same security guarantees that Bitcoin provides.

And since it’s anchored to Bitcoin, you can move BTC back and forth seamlessly - and without the centralisation risk inherent in wrapped Bitcoin.

And to the part that will interest you, Stacks brings smart contracts to Bitcoin. Its programming language, Clarity, enables developers to write smart contracts that can read and react to Bitcoin’s state.

With Stacks, developers can build a wide range of Web3 apps for the Bitcoin ecosystem without needing BTC hodlers to sell their BTC or bridge them to altcoins.

What exactly is STX? 🧐

STX is the native utility token of the Stacks blockchain. It is designed to serve several key functions:- Fuel network operations and transactions: STX tokens are used to pay for deploying smart contracts, running DApps, sending transactions, and more on Stacks.

- Consensus mechanism: Miners "stack" (similar to staking) STX to participate in block creation.

- Governance: STX holders can vote on network upgrades and other governance matters.

- Developer incentive: Used to incentivise developers to build apps and grow the ecosystem.

Stacks investment thesis 🤑

To properly contextualise an investment thesis on Stacks, we must start with the relationship between Stacks and Bitcoin. The core investment thesis is that Stacks allows Bitcoin's massive market cap to flow into decentralised finance without sacrificing decentralisation. This could unlock significant latent capital, given Bitcoin's brand and security.Pent-up demand for more utility in BTC

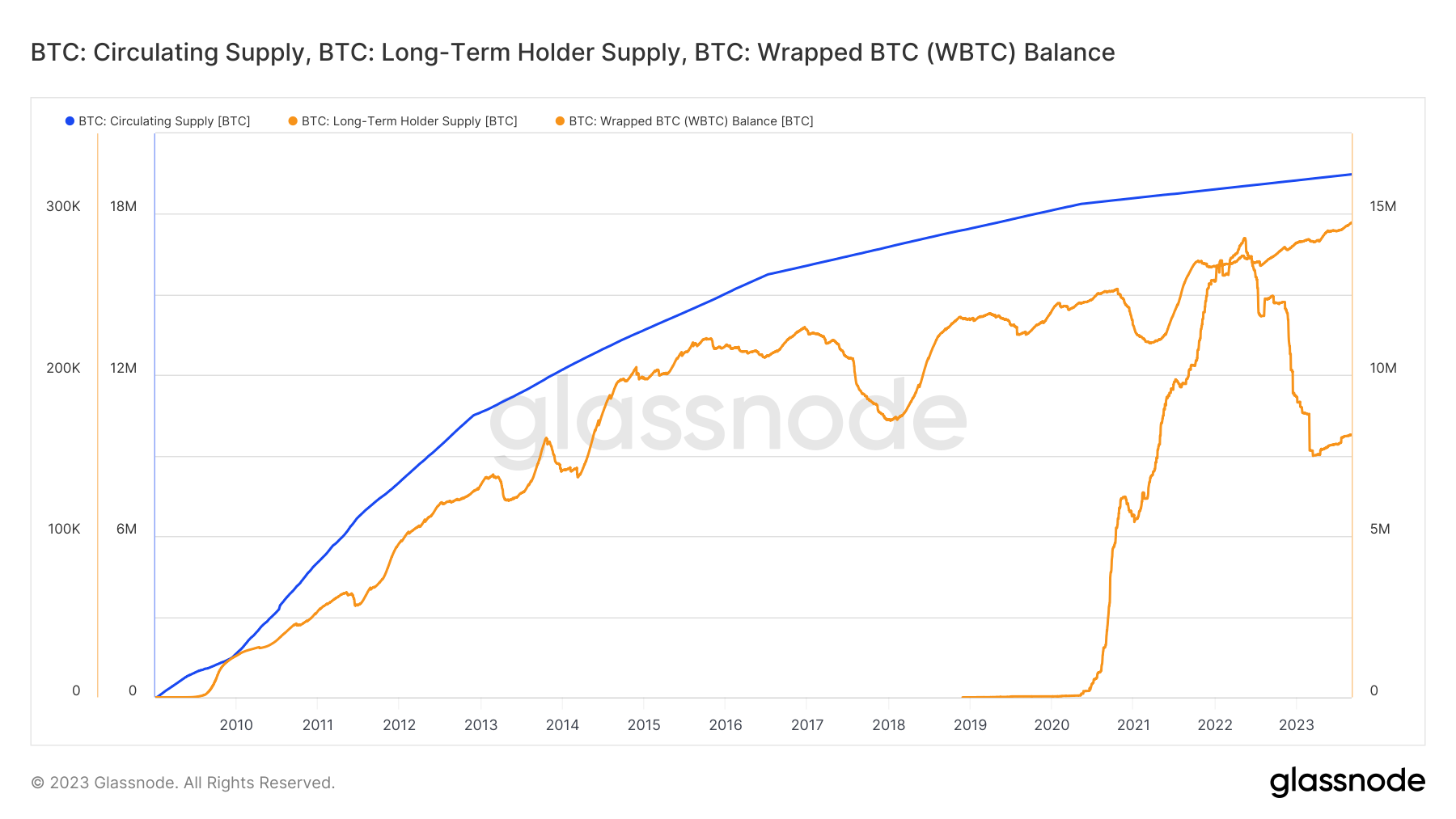

Stacks uniquely allow access to decentralised yield without centralised risks. With Stacks, Bitcoin holders can gain DeFi exposure with real BTC, not wrapped tokens, to maintain Bitcoin's ethos.Out of the 19.45M BTC in circulating supply, 14.64M BTC are held by long-term holders, and only about 163K BTC is deployed for use in DeFi via wrapped BTC.

So, an incredibly large portion of the BTC in the market is mostly sitting idly in wallets. Now, what makes Stacks special is that it provides a way for the Bitcoin community to put a massive proportion of that latent patient capital to work.

They don’t have to choose between DeFi or Bitcoin; they can do both with Stacks.

But why would BTC holders opt for Stacks over wrapped Bitcoin?

Wrapping BTC happens through a centralised party, but Stacks allows you to participate in DeFi without handing over BTC to a third party. And looking at the current size of the wrapped BTC market, we can extrapolate the potential demand for a Bitcoin-native DeFi ecosystem.Wrapped BTC is currently at a $4.2 billion market cap with about 163K WBTC. Stacks’ market cap is currently around $670 million. If Stacks can pull the same amount of WBTC (163K) into its ecosystem from the 19M BTC in circulating supply, and nothing else grows, the Stacks network would see at least a 5X growth.

Stacks as a pseudo-L2 to Bitcoin

Even though Stacks says, it is neither a layer 1 nor layer 2 solution – mostly because of how it is designed. But for all intent and purposes, it functions similarly to Ethereum scaling solutions like Optimism and Arbitrum. Therefore, it makes sense to have an investment thesis that considers how potential revenue generation, usage, and TVL increases impact L2 valuations.Arbitrum currently has almost 400 projects built on its platform. This has helped drive significant usage, resulting in a TVL of about $1.68B. Similarly, Optimism has presently over 150 DeFi projects built on its platform. This has helped drive significant usage, resulting in a TVL of about $665M.

Stacks currently has 5 DeFi projects and a TVL of about $19.33M. If Stacks can achieve similar developer traction, generating 400 DeFi projects on par with Arbitrum or 150 projects like Optimism, it would likely drive substantial adoption and TVL inflow from Bitcoin holders.

However, while it is easy to fall into the trap of evaluating Stacks based on the number of projects it could host, it is important to consider the Bitcoin effect. The question is not really about the number of dApps but whether Stacks can enable high-utility dApps that leverage Bitcoin's brand and liquidity.

One or two "killer apps" with compelling use cases could drive substantial adoption and TVL by Stacks. For example, a BTC-backed lending platform with attractive yields could be a breakthrough product, even if it's the only dApp on Stacks.

Could Stacks attract developers?

Developer activity is also crucial, mirrored by usage and TVL. Since 2018, Stacks has less than 100 developers. In contrast, Optimism and Arbitrum have 180 and 220 developers, respectively. If Stacks can attract similar developer traction, generating hundreds of dApps, it would drive substantial adoption and TVL inflow from Bitcoin holders.Beyond DeFi, Ordinals and inscriptions also revealed a strong appetite for more functionality on Bitcoin. Inscriptions surged from 660,000 in Q1 to over 14.4 million by Q2 end. New asset types like stamps and infrastructure like Hiro's Explorer fueled growth.

This is where Stacks fits in, enabling functionality through Clarity contracts and trust-minimized bridges. Stacks is positioned to meet this demand with its added functionality and Bitcoin compatibility.

Kickstarting the Bitcoin DeFi ecosystem ⛳️

Stacks has full smart contract functionality and an impressive programming language. It is gradually attracting developers who want to build apps for the Bitcoin ecosystem.Jumping into Stacks 💨

Stacks is just a quick hop away from Bitcoin. BTC can be moved back and forth seamlessly, and while BTC is on Stacks, BTC can be used to generate yield. The best way to access Stacks is through Hiro’s Leather wallet.

The DeFi economy on Stacks 💰DeFi is bustling on Bitcoin, with options to trade and farm BTC, STX, or new tokens built entirely on top of Stacks. Here are some handy platforms to get your feet wet with.

- Stackswap - Swap tokens and farm yield. Good old liquidity pools.

- Arkadiko - Access loans on Stacks.

Just because Ordinals are dead doesn’t mean it's the end of NFTs on Bitcoin. On the contrary, NFTs were alive on BTC before the Ordinal frenzy, and they have continued to survive afterwards. There are a bunch of platforms to trade NFTs on Stacks, but Gamma’s the biggest, so it makes sense to start there.

- Gamma - Buy and sell Bitcoin NFTs.

Stacks’ competitive landscape 🖲️

Stacks isn’t the only company working on bringing smart contracts to Bitcoin, but they’ve got plenty of advantages over the competition. Competitors include SmartContract Thailand, Courtyard, Dharma, and NiftyApes. All of those competitors are younger and not as well-funded as Stacks.Stacks remains the price choice for people experimenting with Bitcoin DeFi. Ordinals is the only other potential competitor in terms of brand recognition. However, volume across Ordinals projects was short-lived and has almost evaporated. More so, Ordinals doesn’t support fully expressive smart contracts and can’t support the same complex operations possible on Stacks. In essence, the competitive landscape certainly awards the crown to Stacks.

Price analysis 📊

Whilst Stacks might’ve slipped under everyone’s radar this year, it surely was a golden gem.Stacks has a strong relationship with Bitcoin, technically and in activity and price trends. For instance, at the start of 2023, STX surged by a whopping ~500% - that’s a 5x in 70 days! This trend tracked Bitcoin's dominance over crypto markets, suggesting that Stacks follows Bitcoin's larger ecosystem trends.

Since peaking inside the $1.27 - $1.08 resistance region in March, the asset has been on a slow descent for months, creating what seems like a falling wedge. If you’re unfamiliar with a falling wedge, know that this bullish price pattern signals a trend's continuation. In this instance, STX’s price is charging for the bull!

A key takeaway that helped us identify this pattern as a falling wedge is STX’s volume - see how it decreased gradually after its price peaked.

Since peaking inside the $1.27 - $1.08 resistance region in March, the asset has been on a slow descent for months, creating what seems like a falling wedge. If you’re unfamiliar with a falling wedge, know that this bullish price pattern signals a trend's continuation. In this instance, STX’s price is charging for the bull!

A key takeaway that helped us identify this pattern as a falling wedge is STX’s volume - see how it decreased gradually after its price peaked.

That’s usual behaviour for a falling wedge. But peep this - its volumes will have to surge upon breakout. Otherwise, the price can easily retrace back inside the pattern! With the Bitcoin halving just around the corner (April 2024), we expect the price of STX to break out during November and the first target of $1.27 to be tested again sometime during April. That’s a wonderful 180% gain from its current price, with the potential for more. 🐂

Invalidation criteria 🛑

Now, there’s a possibility that DeFi on altcoins will continue to capture all the liquidity the market isn’t particularly interested in Bitcoin DeFi or Bitcoin-native Web3 applications. This could happen due to network effects because liquidity begets liquidity. Our thesis will also be invalidated if developer activity grows more rapidly on other platforms in the coming years.We will monitor how DeFi on Stacks performs relative to other L2s, especially during the next BTC halving in 2024.

Similarly, if Stacks cannot attract and incentivise developers to build Web3 apps within its ecosystem, there won’t be any decent TVL growth. Here’s where Stacks faces the chicken and egg paradox. Developers have little incentive to build dApps on a network unless there are users, and users have no incentive to stay in a network unless there are dApps.

Thankfully, for Stacks, it is not starting from scratch. There’s a large community of Bitcoiners waiting to be convinced – we would be watching developer activity within the network as a proxy for how well the team is succeeding in building the ecosystem.

Cryptonary’s take 🧠

Bitcoin users aren’t migrating to other L1s; you can bet on that.If they’re going yield farming, it’ll be in their backyard. Stacks offer those opportunities and that proximity, allowing dormant BTC to be used to generate additional yield.

We’ve shown how massive the total addressable market can be, and that number only balloons further as Bitcoin grows. BTC hodlers are sticky, but that doesn’t mean they like compromises.

Newer entrants into the BTC system in the future are likely to search for yield opportunities they may be accustomed to accessing. And those that seek them out successfully can grow their BTC stacks even faster.

And what about those bankers and ETF applicants accumulating BTC already? They like one thing, and one thing only: making money. Stacks is their path to doing so on Bitcoin, and they will likely take it.

Stacks is attempting an incredibly daunting undertaking – there are still many things in flux. But this is one project with an amazing asymmetrical risk-reward potential. The downside is limited, but the upside is potentially unlimited if it delivers on its promise.

As always, thanks for reading! 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms