This major crypto bank is on the brink of collapse. What does it mean for your portfolio?

One of the most crypto-friendly banks in the world, Silvergate, is in the midst of a crisis. Depositors are fleeing and its stock price plummeting. Its fate is extremely uncertain.

Today, we take a deep dive into Silvergate’s role in the crypto industry and explore the implications of its potential collapse for your crypto portfolio.

Let’s dive in!

TLDR:

- Silvergate, a crypto-friendly bank, is in crisis mode with depositors leaving and its stock price plummeting.

- The bank's decline began in late 2022 due to challenges from investments and its relationship with FTX and Alameda.

- The bank has shut down its Silvergate Exchange Network, indicating its end may be near.

- The potential decline of crypto-friendly banks like Silvergate could reduce options for cryptocurrency-related businesses to access banking services.

- For the time being, investors should exercise caution when investing in crypto companies that are heavily reliant on traditional banking.

The rise of Silvergate

Silvergate’s journey from a small savings and loan association to a major player in the crypto industry is a remarkable one. Founded in 1988, it initially had just three branches in Southern California.However, in 2013, its CEO Alan Lane personally invested in Bitcoin, and Silvergate began serving crypto clients. (It’s important to note that this was unique as many banks at the time, and still to this day, do not want anything to do with cryptocurrencies).

The bank quickly grew to $1.9B in assets and 250 clients by 2017, as it gradually became the main bank for crypto firms alongside Signature Bank.

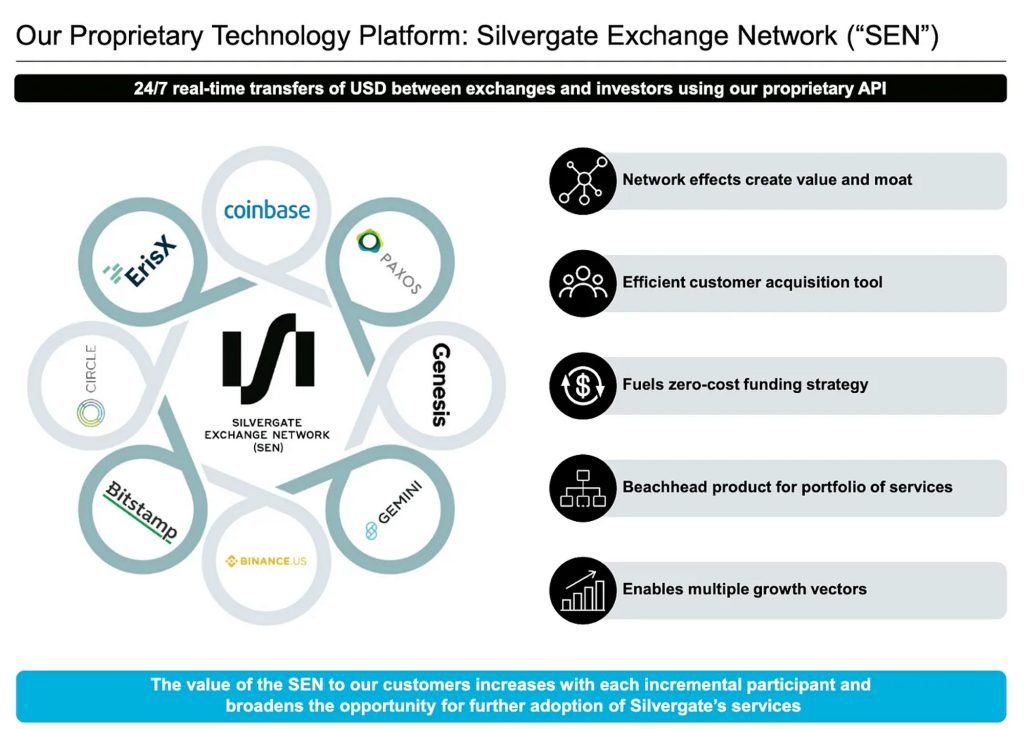

But it was the launch of the Silvergate Exchange Network (SEN) that really put the bank on the map…

This real-time payment system allowed crypto exchanges like Coinbase, and other customers to transfer money at any time. It made Silvergate the first regulated bank to develop such a payment system. By Q3 2022, the bank had $12B in deposits from 1,677 SEN customers, including all major cryptocurrency exchanges and over 1,000 institutional investors.

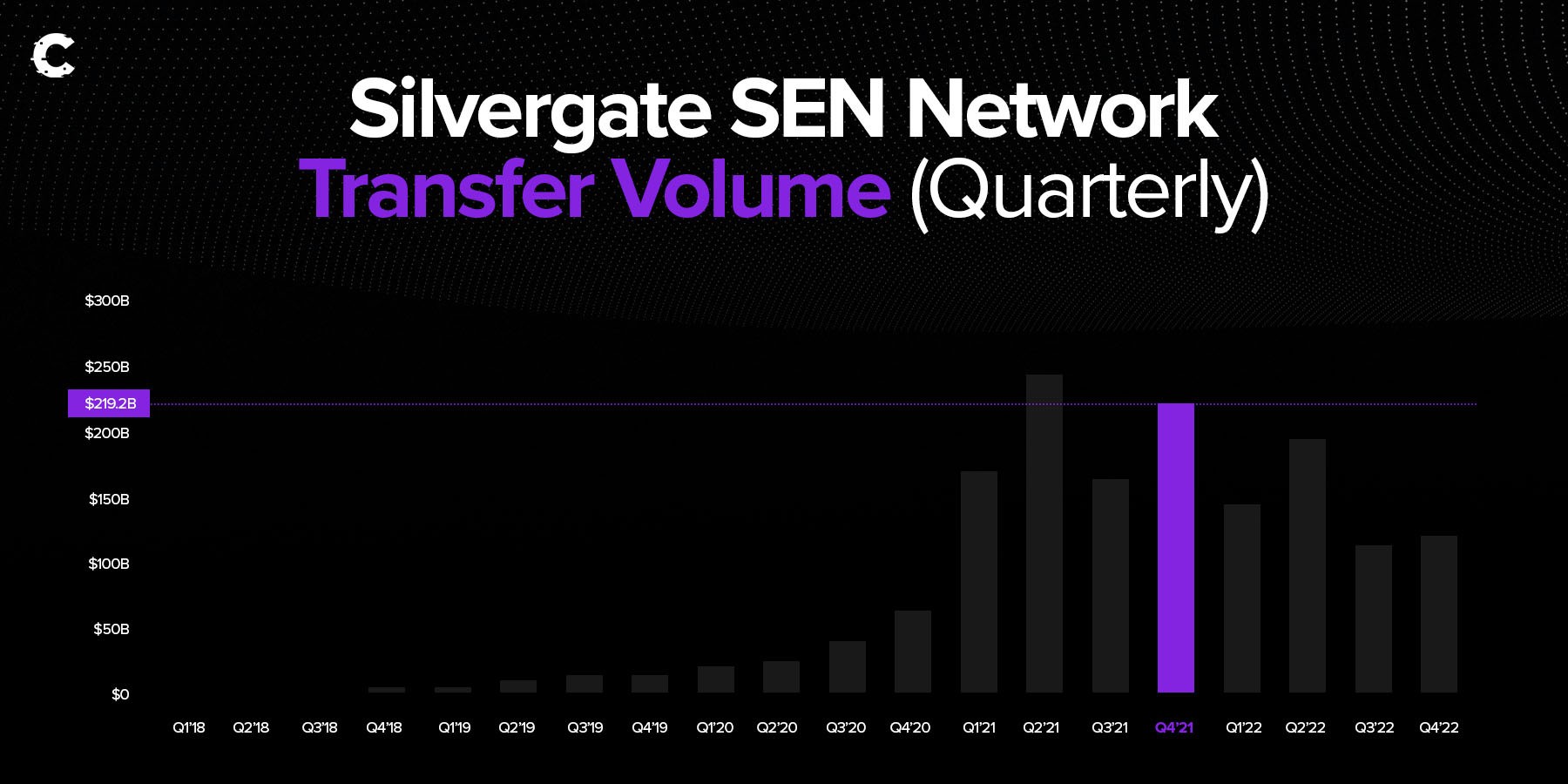

Despite the initial success of Silvergate's crypto-focused strategy, the bank began to face challenges because of the highly volatile nature of the crypto market. The bank's reliance on crypto caused fluctuations in its own volumes.

Silvergate's raw figures illustrate this trend, with the volume on the Silvergate Exchange Network peaking in the first half of 2021 at $239B in transactions in Q2, then falling to $112B by the second half of 2022.

This decline marked the beginning of the end…

Where did it go wrong?

Silvergate's downfall began in the latter half of 2022 when it faced challenges due to investments in U.S. Treasuries. The decline in value of these Treasuries (due to an increase in interest rates) had a very negative impact on the bank's financial standing.Plus, the bank had provided services to FTX and Alameda, further adding to its woes. The collapse of FTX resulted in an $8.1B run on Silvergate in just one quarter, causing the bank to lose 60% of its deposits. The bank was forced to sell off securities and derivatives at a significant loss of $718M to mitigate the impact of the run.

In 2023, the bank's situation took a nosedive. On March 1, Silvergate filed a regulatory report, which disclosed that its quarterly results were even worse than previously reported. This news raised concerns about the bank's future.

Coinbase, Paxos, Circle, Galaxy Digital, and Circle have stated that they have ended their relationships with Silvergate. Coinbase even publicly announced its move to Signature Bank.

The bank has also shut down its Silvergate Exchange Network. Its website states that other deposit-related services remain operational. But can Silvergate survive as a “going concern” (an accounting term for a company that has the resources needed to continue operating indefinitely until it provides evidence to the contrary) given the bankruptcy risk?

There are three ways this could go…

Best-case: Silvergate is acquired by a larger bank, helping to maintain its reputation and customer trust. Customer deposits and assets are smoothly transitioned, mitigating the risk of bankruptcy. Shareholders receive some value from the sale of the company, and the crypto industry is largely unaffected.

Mid-case: Silvergate continues to face financial difficulties, resulting in some shareholders losing part of their investment. This may cause concerns within the crypto industry about relying on traditional banks, but other banks are likely to continue working with crypto companies as usual. Crypto exchanges may shift their business away from Silvergate, but this is not expected to have a significant impact on the wider industry.Worst-case: Silvergate Bank goes bankrupt, causing shareholders to lose their entire investment. The fallout from this could have far-reaching implications for the crypto industry, as it heavily relies on the stability and legitimacy of traditional banking.

If trust in the banking system erodes due to Silvergate's collapse, this could lead to increased regulatory scrutiny and cause other banks to cut ties with crypto companies. This would significantly impact the operations of many crypto exchanges.

Cryptonary’s take

As the crypto industry continues to grapple with the aftermath of a tumultuous 2022, regulators are paying closer attention to its ties with traditional financial institutions.With Silvergate on the brink of collapse, major crypto players are desperately seeking alternative banking options, resulting in an increasing reliance on Signature Bank. Although Signature Bank has been crypto-friendly in the past, recent events, such as Binance's issues and Kraken's departure, suggest a shifting stance.

Despite some crypto companies turning to Swiss banks for support, the loss of Silvergate means there are now fewer options available, likely discouraging other banks from entering the crypto space and further compounding the challenges already faced by the industry in the US.

Overall, the situation underscores the need for greater regulatory clarity and stability to ensure the long-term viability of the crypto industry. Crypto’s relationship with big banks is critical to its survival in the US.

Action points

- For the time being, investors should exercise caution when investing in crypto companies that are heavily reliant on traditional banking, such as crypto exchanges in the United States.

- During periods of regulatory uncertainty and turbulence, it may be worth considering exploring investment opportunities in the more crypto-friendly Asian market as an alternative to the US market.

- Mark your calendar and watch the congressional hearing on March 9th, which will cover the ongoing regulatory issues and challenges facing the crypto industry.

- Get up to speed on the regulatory scrutiny surrounding Binance and Paxos by reading our report.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms