And in crypto, as in other industries, past events often help make sense of what’s ahead.

So, what happened this week and more importantly, what do they tell us about what’s in store for us in the coming weeks?

One crypto project is running a $41M largesse; another is burning $100M tokens, yet the bears have the market in a chokehold.

So again, let’s go beyond the headlines to uncover motivations and understand the prevailing narratives in crypto.

TLDR

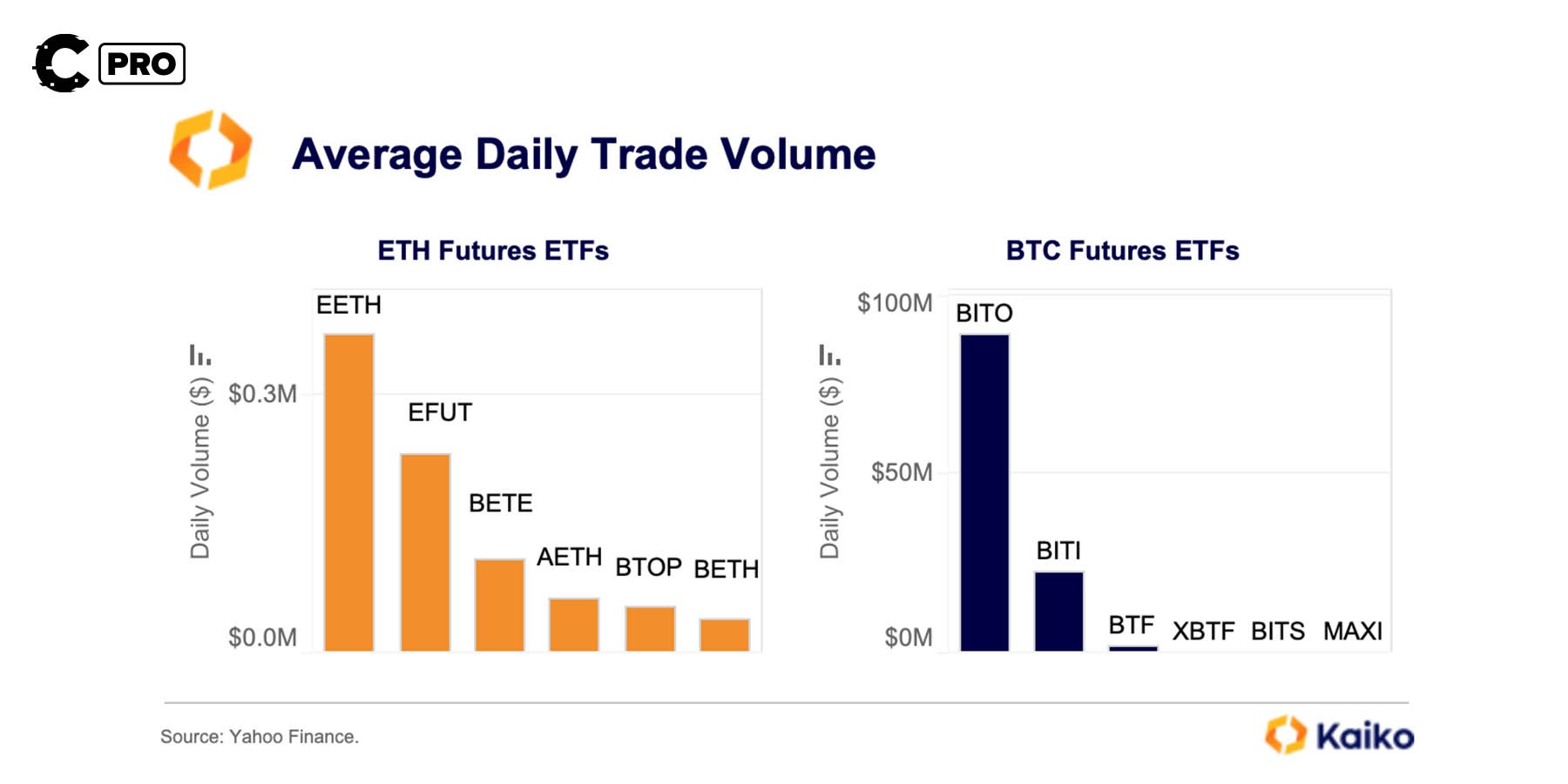

- Sparse interest in new ETH futures ETFs compared to Bitcoin's

- Arbitrum invests $41 million in active projects and hints at a second round.

- BTC's rising correlation with risk assets and potential impact on its price.

- Rollbit introduces on-chain buybacks and burns, aiming for a $100 million annual burn.

- Thorswap resumes operations after addressing illicit activities.

The biggest news of the week

Nobody cares about ETH Futures ETF; BTC is still king

A clutch of ether futures ETFs have traded for nearly a whole week. Quick maths, and it turns out that they struggled to achieve an average daily trading volume of a mere $500K. This is despite being powered by the most prominent players in this ETH futures game – VanEck's EFUT and ProShares EETH.

Just by the numbers, ether futures ETFs haven’t seen inflows near what their Bitcoin futures predecessor reeled in. For context, the first-ever BTC futures ETF, ProShares Bitcoin Strategy (BITO), managed to rake in over $1 billion in trade volume on its first day of trading.

Of course, the broader crypto market is moored in reduced volumes and bearish conditions; yet, it's hard to excuse the disappoint from ether futures ETFs. They’ve failed to meet expectations that they’’’ stimulate trading or lift crypto markets.

Cryptonary’s take:

We had high hopes for ether futures ETFs, but demand just isn't there. While Ethereum has long-term potential, Bitcoin simply has better branding and institutional traction right now.Given ongoing market uncertainty and pending Bitcoin spot ETFs, we favour BTC over ETH in the near-term. This doesn't diminish ETH's prospects down the road, but acknowledges likely slower institutional adoption. BTC should maintain dominance for now, especially with the halving and possible spot ETFs just over the horizon.

WTF is happening with Arbitrum

$41M ARB up for grabs: What's the big deal?

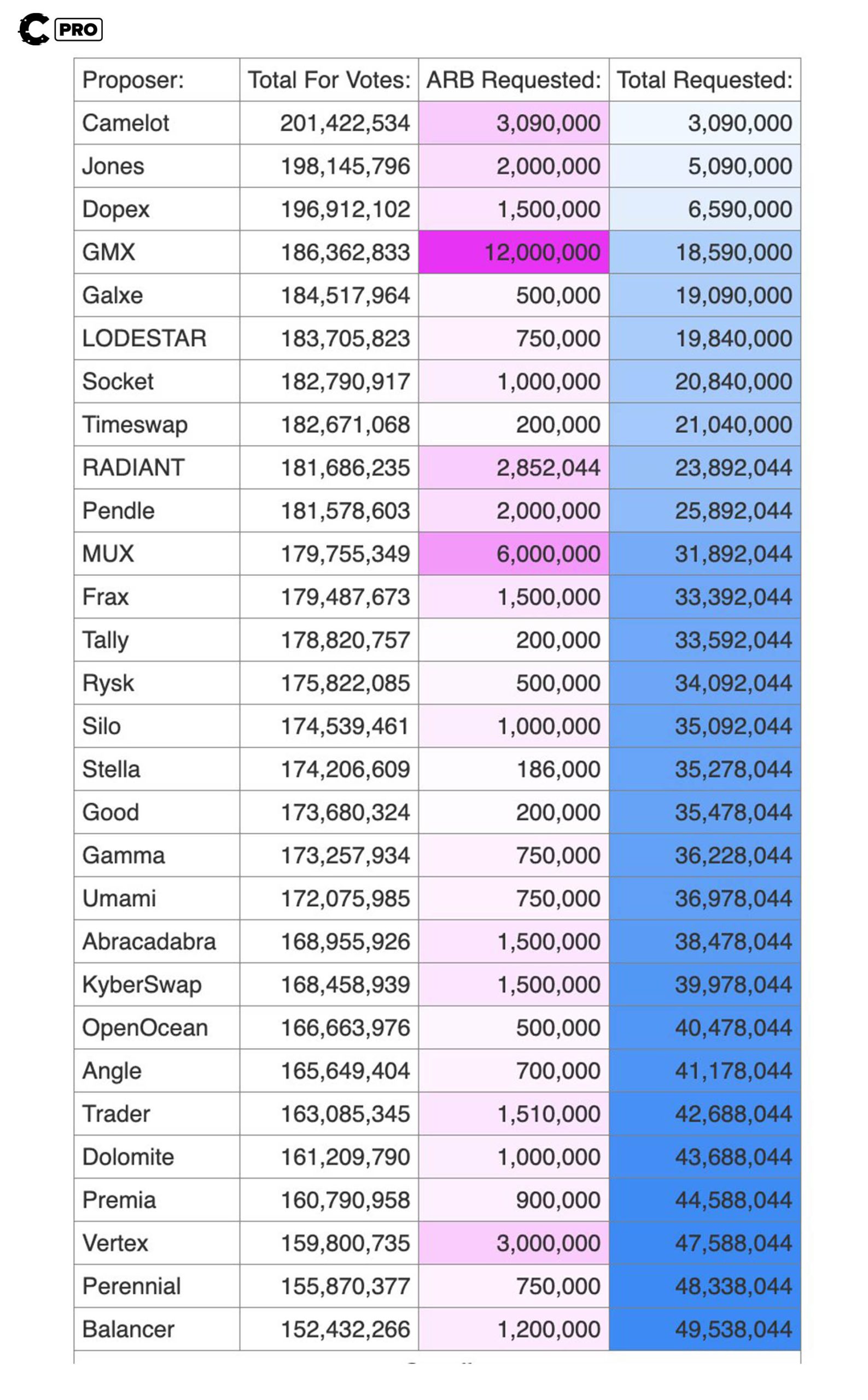

Arbitrum is poised to invest $41 million (50 million ARB) in active projects within its flourishing ecosystem. Even more interesting is the diverse array of projects that have received fresh funding from the DAO.

The spotlight shines brightly on two standout sectors – Perpetual protocols Decentralised exchanges– and that have emerged as the frontrunners in this exciting initiative.

The spotlight shines brightly on two standout sectors – Perpetual protocols Decentralised exchanges– and that have emerged as the frontrunners in this exciting initiative.

Perpetual protocols received 44% of the pie, with GMX and MUX getting 12M and 6M ARB tokens. But the story doesn't end here. Decentralised exchanges have also had their moment in the sun, with projects like Camelot receiving a 3 million ARB grant.

More funding rounds are coming down the pipeline, ensuring opportunities for promising ventures. A proposal seeks an expanded incentives program with more ARB allocation.

Cryptonary’s take

Now's a great time to dive into the Arbitrum ecosystem. THESE PROJECTS MUST USE the ARB set to be distributed in three months. So, you can expect some pretty attractive yields on Arbitrum when you provide liquidity or use their products. This is because these projects will offer ARB tokens as incentives to attract more users.Another strategy we're enthusiastic about is identifying projects with a notably low market cap that received a disproportionately high allocation of ARB compared to their market cap.

In our most recent Smart Money report, we've spotlighted one such project on Arbitrum that presents an opportunity you can capitalise on

Chart of the week

BTC's rising macro correlation

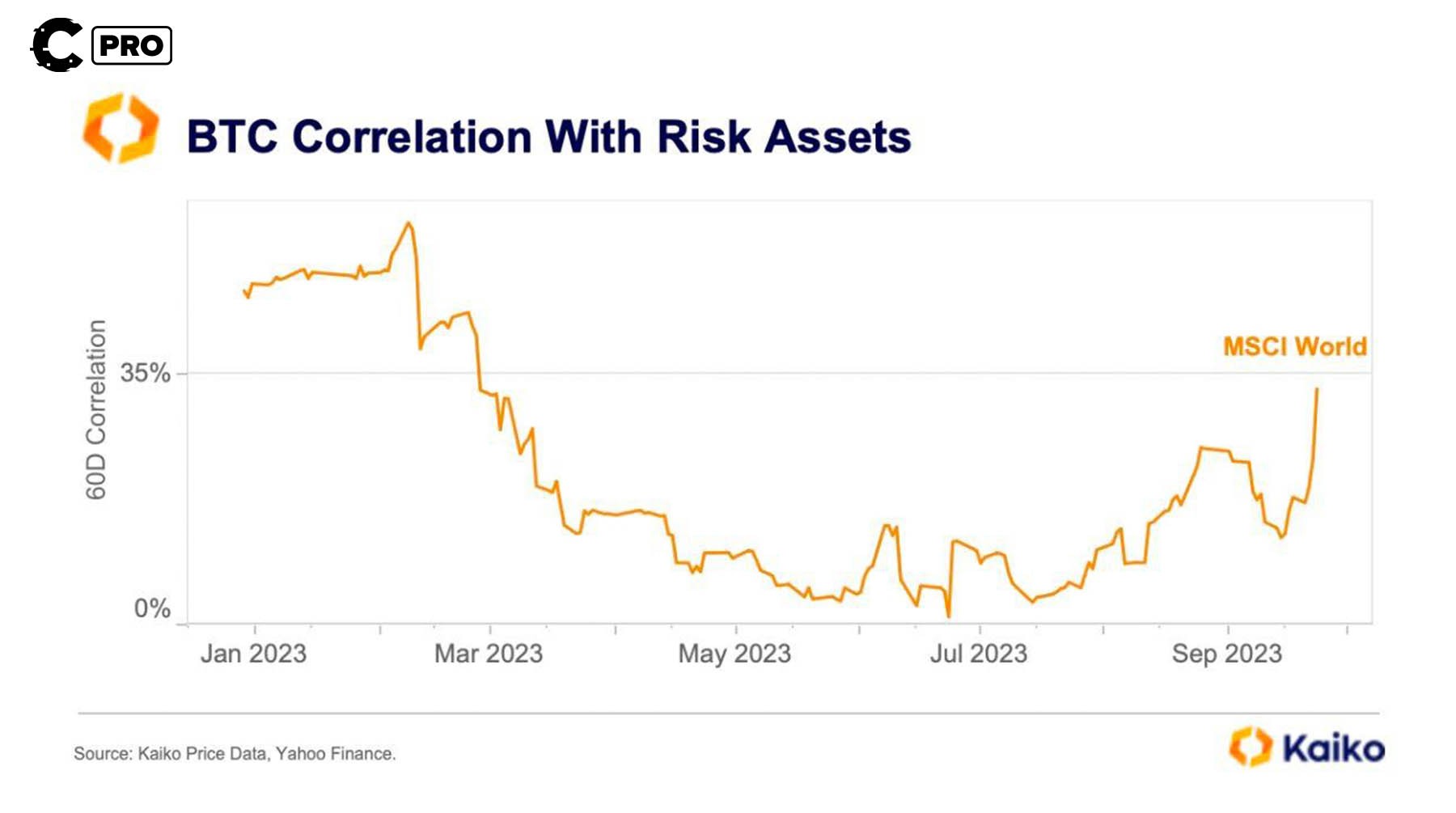

While BTC's 60-day correlation with risk assets has been on the rise, it remains significantly lower than its 2022 average, which exceeded 50%.

While BTC's 60-day correlation with risk assets has been on the rise, it remains significantly lower than its 2022 average, which exceeded 50%.

Notably, BTC exhibited impressive resilience amid escalating borrowing costs and mounting macroeconomic uncertainties in September.

During this period, it outperformed major indices such as the S&P 500 and the Nasdaq 100

Cryptonary’s take

But here's the thing: as we step into October, it looks like those big-picture macro conditions are starting to play a more noticeable role, with the correlation trending upwards. This is definitely something worth keeping a close eye on.Given the ongoing economic uncertainties and the situations in the middle east there's a real chance that further macroeconomic shocks in Q4 could rock our markets if this correlation continues to climb.

For a deeper dive into how these macroeconomic factors might influence BTC's price, check out the article that delves into the details here.

This week in DeFi

Rollbit token buyback, Thorswap relaunch, and Level Finance's hint!

- In a significant move, Rollbit has initiated on-chain buybacks and burns, a strategic endeavour funded through a portion of its purchase revenue. The objective is clear: reduce the available supply and attain an annual burn rate of $100 million in RLB.

- Good news for Thorswap! The exchange is now back online after temporarily suspending its services due to illicit activities on the DEX. The team has implemented changes to enhance security and prevent future illicit activities

- Perpetual DEX, Level Finance, is taking a cue from Dydx as it hints at the launch of its own app chain, intending to create a more robust, efficient, and transparent trading system similar to leading protocols. This strategic move has the potential to enhance the utility of the token.

- Frax Finance has launched FRAX V3, or sFRAX, an ERC-4626 staking vault. This allows people to stake their $FRAX and earn a yield similar to what you might get from a savings account. Think of it like how $DAI has the DSR. Initially, this yield is likely to be around 10%, providing an appealing opportunity for FRAX holders

Cryptonary’s take

DeFi has seen some fascinating developments this week, with particular attention on Rollbit and Frax Finance. In the current market, we believe that what truly matters for project success is sustainable cash flows and revenue.Rollbit and Frax Finance stand out as their real-world revenue streams provide sustainable cash flow.

We're super bullish on Rollbit and Frax right now. Read our Frax Finance deep dive and expect a hot Rollbit report coming your way soon.

Level Finance has potential but isn't a priority yet. We have more confidence in Rollbit and Frax currently.

We're pumped about Thorswap's relaunch and security improvements. Our thesis explains why we remain bullish despite recent issues.

Follow the money

Bull vs Bears: Who wins this week?

- This week, the S&P 500 and NASDAQ saw gains due to a dovish macro outlook.

- Surprisingly, Bitcoin, which is typically highly correlated, sold off instead of following the S&P and NASDAQ.

- Hopes of reaching $29K from $27.1k were dashed as Bitcoin couldn't maintain support, but it found some stability at the $26.5k level.

- Bitcoin has shown an inverse correlation to risk assets, disregarding political risks and moving lower despite the gains in traditional markets.

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms