Something big happened today! $587.5 million worth of OP tokens were unlocked. Understandably, token holders are feeling a bit anxious about a potential sell-off.

In this report, we'll tackle these concerns head-on and explore whether this could be a prime opportunity to consider buying some OP tokens. After all, fear can sometimes create exciting chances in the market!

But wait, there's more! We'll also dive into the world of Arbitrum and see if it might face a similar challenge this year. To do that, we'll take a close look at the tokenomics of ARB and compare it with OP.

And that's not all! We'll also analyze the highly-anticipated V2 upgrade of GMX. Is it worth considering getting your hands on some GMX tokens before this exciting upgrade takes place?

Let's find out!

TLDR 📃

- $587.5M worth of OP tokens unlocked, causing concerns among token holders.

- OP needs to stay above $1.40 to maintain investor interest, but that’s unlikely.

- ARB's tokenomics position is more favourable than OP, with no unlocks or airdrops planned this year. Small and short-term dip on the horizon.

- GMX V2 upgrade could be a catalyst for Arbitrum's growth.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

The impact of the $500M+ OP unlock 🔒

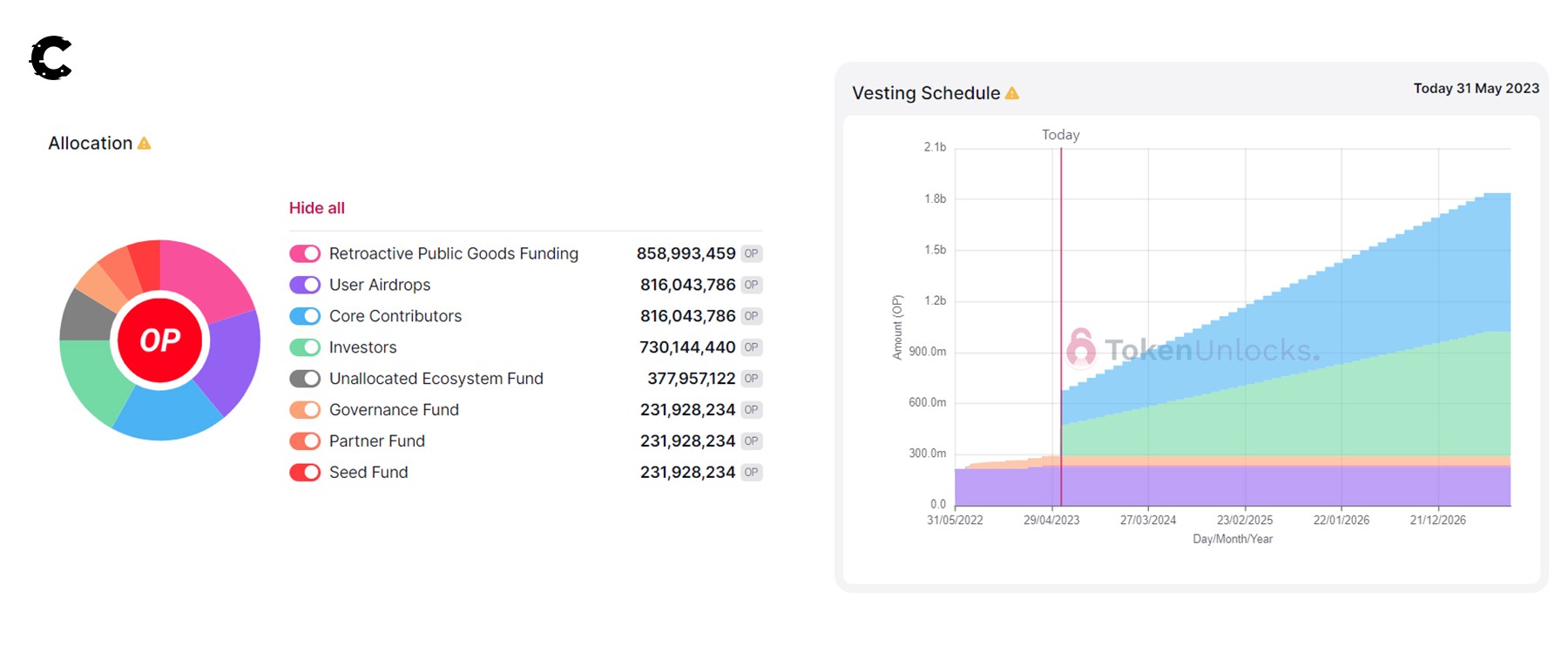

Hey, OP token holders! It's May 31st, and today is a big deal for you. Why, you ask? A cool 386 million OP tokens have just been unleashed for early backers, and investors already sitting on pretty profits.

This bulk makes up 9% of the total supply and is valued at about $587 million. Yep, that's a huge number. And no surprise, it's given some investors the jitters.

Why the cold feet? A sudden flood of tokens in the market can be scary. The fear of a potential 'dump' is real. It's a reasonable worry, given that the circulating supply doubled overnight, sending Optimism's market cap soaring from $496M to a whopping $962M.

The big question now - if many early investors cash out in the coming weeks, can the market hold its own?

But let's remember, the Bedrock upgrade is just around the corner on June 6th. We chatted about this upgrade a few weeks back and how it's set to boost Optimism. With this, could the current fear also be a golden opportunity to dive deeper into OP?

Should we be buying fear or feeling it? 🩸

Token unlocks are a regular occurrence. Remember the SOL unlocks in 2021? We had heaps of liquidity and a bullish market, so the price hardly flinched.Fast-forward to today, and the landscape has shifted. This time, OP unlocks are earmarked for investors and employees - and let's be honest, they're probably gearing up to pocket their profits.

Amid the buzz and worry around the OP unlock, guess what? OP hit our forecasted target of $1.40.

We first flagged this three weeks back when OP was trading at $1.81.

Now you must be thinking, "Cryptonary, what's up next?"

Here's the deal: We'd like to invest in OP, provided it holds above $1.40. If the unlock pushes it below this level, it will tumble to $1.25, a 10% dip from its current standing - which seems more likely given the overall market situation.

This OP situation makes us think of ARB and whether something similar is coming for it, so let’s dive into that.

Is ARB in a better position than OP? 🤔

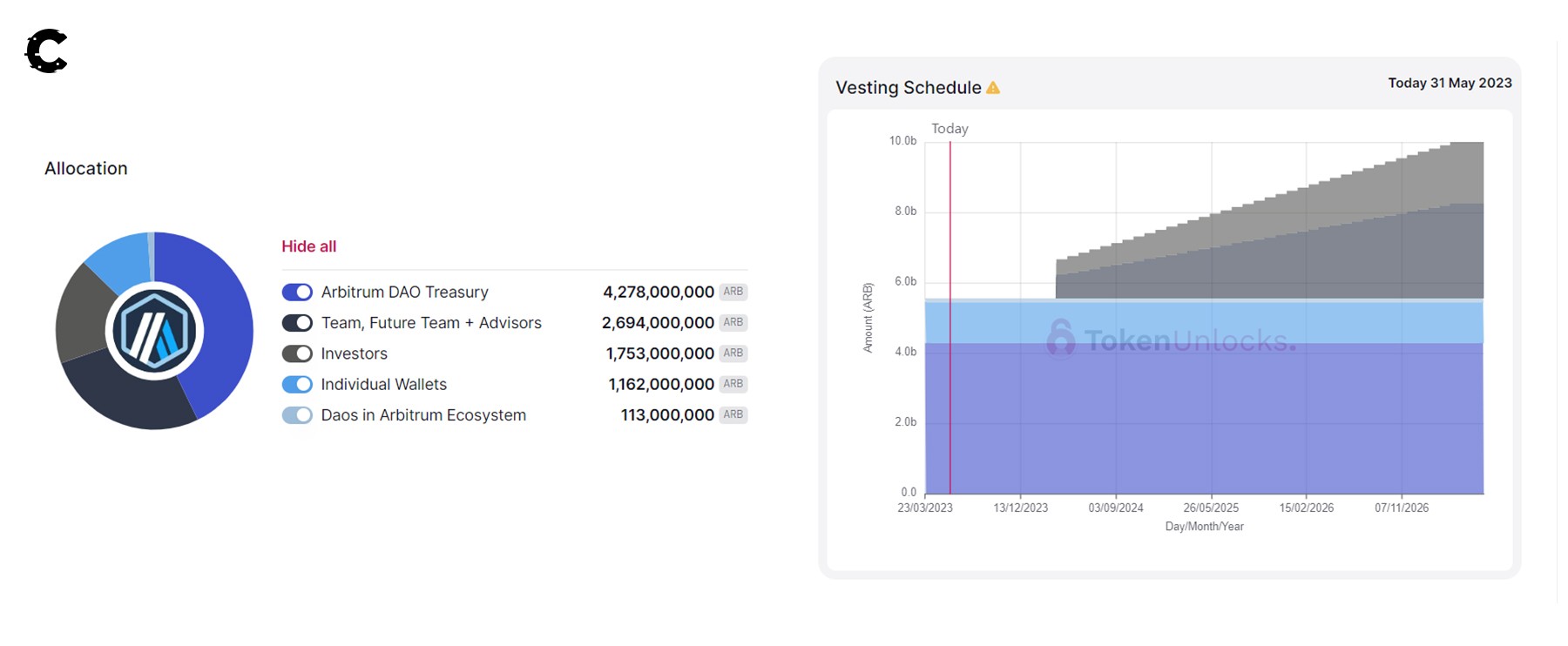

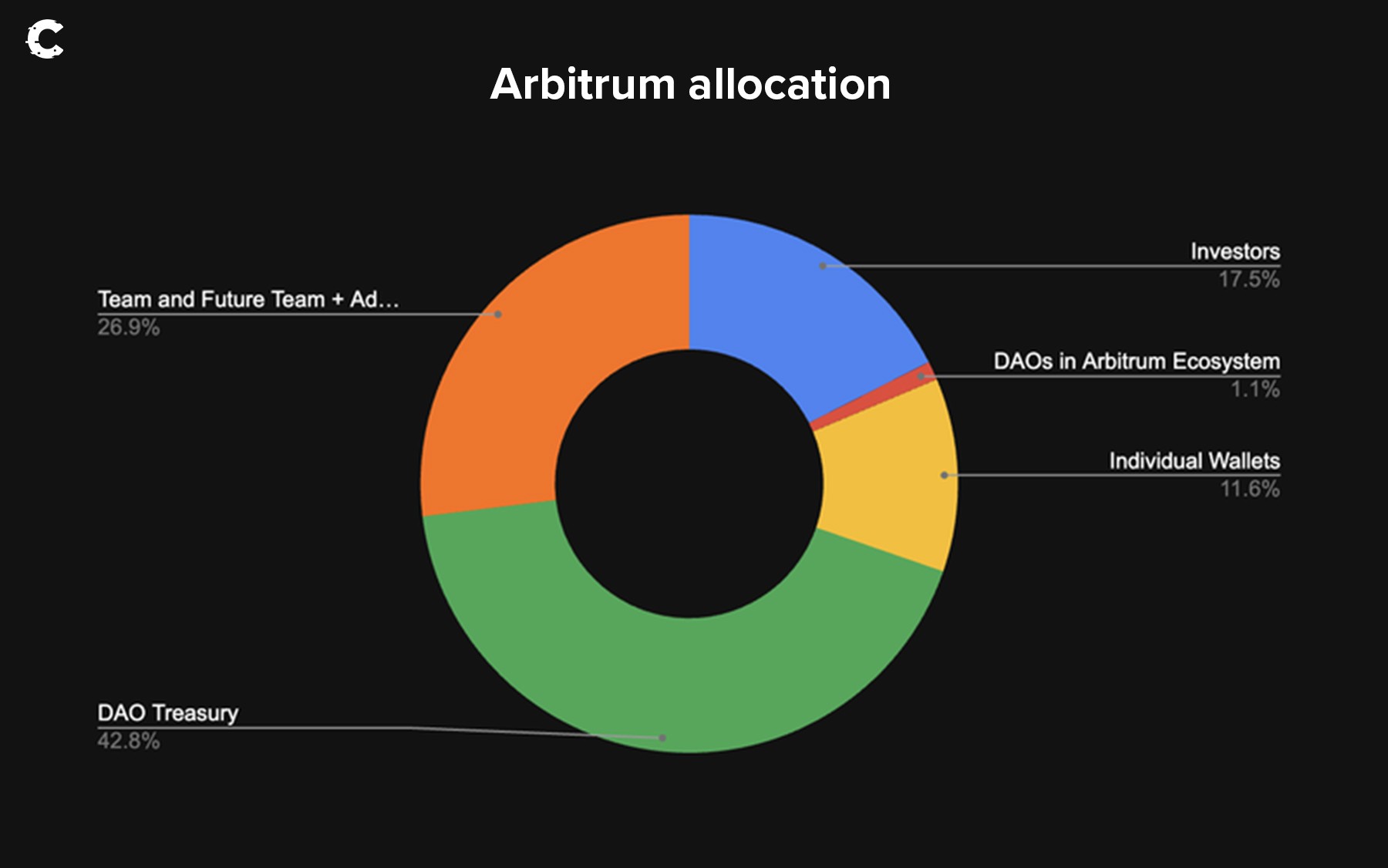

Just like Optimism, Arbitrum also raised funds from investors and has a team allocation but the unlocks are quite far away. They’re coming on March 23rd 2024 - a date you want to remember.

Around 11.118% of the total supply is reserved for the team and investors – that's about $1.28 billion worth! A big number, right? But here's some relief. When these tokens unlock, it won't shock the supply as OP did. We're talking a mere 20% increase versus a jaw-dropping 132% for OP. So while you might be a little worried, ARB's unlock won't pack the same punch as OP's did.

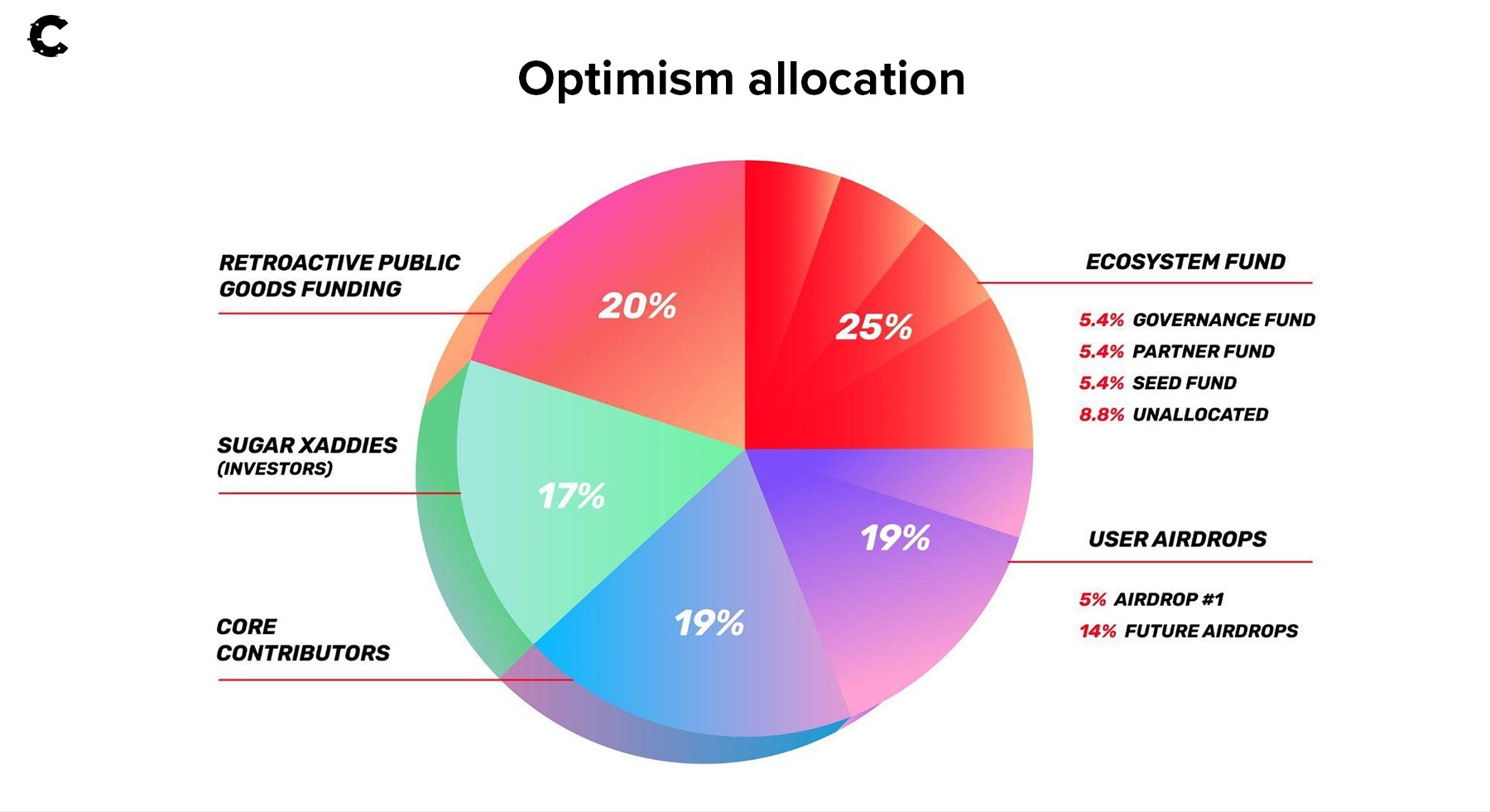

Now, for more good news about ARB! For the rest of this year, there will be no token unlocks. OP, on the other hand, is slowly releasing the rest of its tokens at a rate of 1/48 monthly.

But there's a twist in the tale. You see, OP keeps showering users with free tokens from its treasury. "Free tokens? Awesome!" – you might think. Well, not so fast.

While it's always nice to get freebies, the downside is that it could dilute the value of the existing tokens. Too many tokens can decrease their individual worth. So, if you're holding OP, it's a bit of a mixed bag.

The good news for ARB? No airdrops this year. So you can breathe easy knowing your ARB tokens aren't about to be diluted with a sudden influx.

Another thing about ARB: about 42.8% of its tokens are in the DAO treasury. That's a hefty chunk. There's a risk that a sudden release of these tokens could rock the market. But remember, ARB's plans aren't final yet. That means token holders have a say in what happens next. This flexibility could give ARB an edge over OP.

Let's dive deeper into ARB's technical analysis to see if it's a promising investment, given what we've just unpacked.

Does ARB look any better price-wise? 📈

In the long haul, Arbitrum (ARB) looks solid. Right now, it's trading between two prices: $1.10 and $1.28.Given the market's current shakiness, we’ll see ARB take a little dip in the coming weeks.

But hey, this could be a great chance for us! Once ARB hits the grey area at the bottom, we're likely to see buyers jumping in, pushing the price back up to around the $1.26 - $1.2850 range.

Now, aside from the tug-of-war between OP and ARB, there's something else on the horizon that could give Arbitrum an upper hand over Optimism.

Heard about the forthcoming release of GMX V2? It's the largest decentralised exchange (DEX) on Arbitrum. Let's dive in and see how this upgrade could boost the growth of the Arbitrum ecosystem.

All eyes on GMX V2 👀

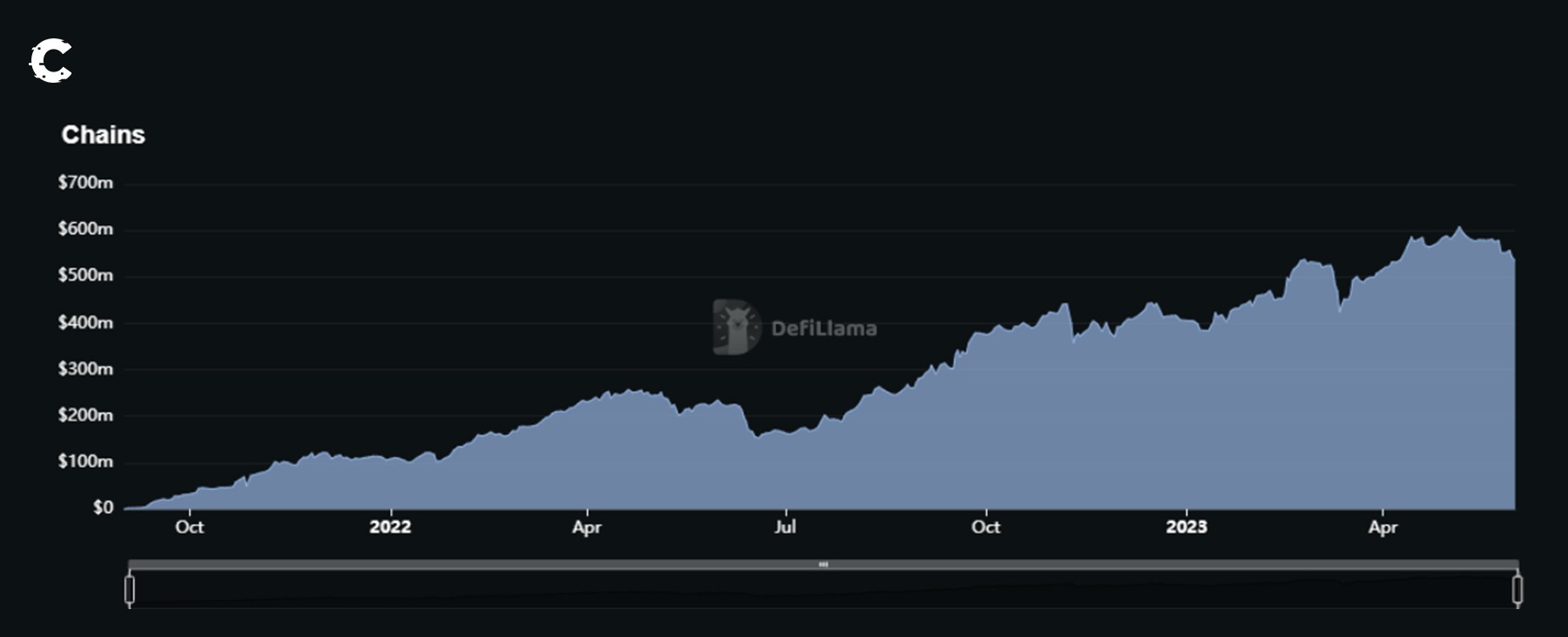

GMX helped Arbitrum outpace Optimism by offering leveraged trading on popular cryptocurrencies and sharing trade revenues with GMX token holders. It holds the largest Total Value Locked (TVL) on Arbitrum, accounting for 22% of the total TVL, a whopping $534 million.

Though it's been overshadowed by newer projects, GMX plans to reclaim its glory with GMX V2, a major upgrade. Highlights include:

- Improved tokenomics: Reducing risk for liquidity providers.

- Better user experience: More intuitive and friendly for traders.

- Expanded markets: New additions like BNB/USD, spot-only markets, etc.

- Introduction of synthetic assets: Offering more trading opportunities.

Now, the question is - how will GMX V2 impact GMX's price? 👇🏼

Currently, GMX is just above its $53 support level. If GMX holds this, we might see a price rise. If it breaks, it could fall towards $40.50. So, keep an eye on GMX and BTC's prices before making your move.

Cryptonary’s take 🧠

We've already mentioned our belief that Arbitrum will outshine Optimism, right?But there's more. If you consider tokenomics, ARB seems to have a significant upper hand over OP. With ARB's unlocks a fair way off and no airdrops coming up, it's pretty clear why we're leaning heavily towards it.

Plus, GMX V2 could be a major game-changer for Arbitrum. So, we strongly suggest giving the testnet a whirl to see the updates firsthand!

Other news 📰

- Bad news for Arbitrum-based Jimbos Protocol: According to PeckShield, it was hacked on May 28. This led to a loss of around 4,000 Ether, worth about $7.5 million at the time. Quite a blow!

- Fibrous Finance is going strong: Fibrous Alpha, the first DEX aggregator built on Starknet, is now live on the Starknet mainnet. Sounds promising!

- Polygon zkEVM dodges a bullet: A vulnerability was recently found in Polygon's zkEVM. But no worries! The Polygon zkEVM team acted quickly and resolved the issue, ensuring the safety of all funds. They also appreciated and rewarded the researcher who discovered it. Good on them!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms