7 high-conviction coins to DCA into right NOW

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

The recent market environment has been very tough for risk assets. While majors have performed relatively well, memecoins and altcoins have suffered significant pullbacks. The turmoil has tested even the most seasoned investors. However, despite all the negative sentiment, it is not a time to be fearful.

Being successful in crypto investing can be a tough nut to crack, especially in discerning when to enter, hold, or exit positions. Today, we unveil our blueprint for navigating the storm – seven high-conviction picks that we think you should be DCA-ing into at current prices.

Let's dive in…

Key questions

- Is this bloodbath in the streets actually setting the stage for unprecedented opportunities? Discover why the current turmoil might be a blessing in disguise for strategic investors.

- Which carefully selected crypto assets are poised to weather the storm and potentially lead the next bull run?

- Beyond the Basics: What overlooked factors in the Solana ecosystem could propel certain assets to new heights?

- Can lightning strike twice in the world of memecoins? Find out which furry favourites we're eyeing for explosive growth potential.

- Where are the hidden support levels that could signal the perfect entry points? Our in-depth chart analysis reveals critical zones you won't want to miss.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Blood on the streets

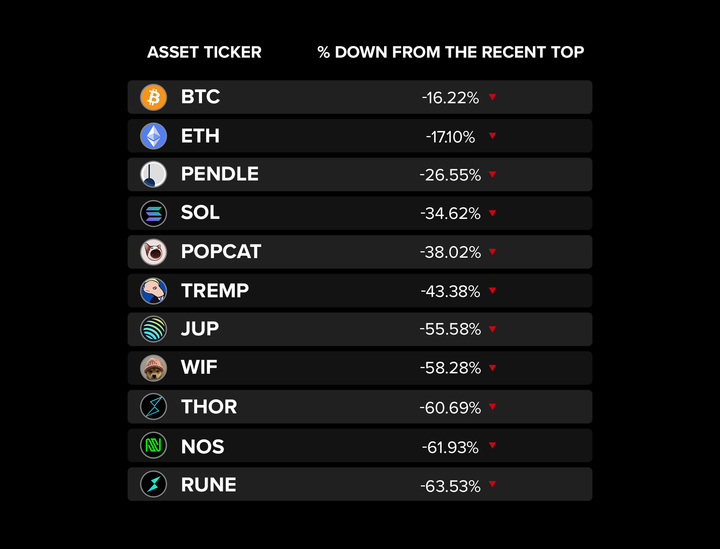

The current market environment has seen a significant downturn in prices across almost all crypto assets.Here are some examples:

Recent market volatility has been intense, causing significant financial stress for investors. The wild price swings have tested the nerves and emotions of even the most seasoned market participants.

The constant barrage of news and information has only added to the stress: Germany selling BTC, Mt Gox planning to pay its creditors, BItcoin miners selling BTC, and FUD on Twitter.

The negative sentiment, uncertainty and unpredictability of the market have made it difficult for investors to make rational decisions, often leading to impulsive actions driven by fear. While it may be tempting to panic during such a downturn, it is crucial to maintain a level-headed approach and avoid succumbing to fear.

What many people often forget is that bad news sells, and it is often exaggerated for shock value. The media tends to focus on sensational stories that capture our attention, which can lead to a skewed perception of reality.

Hence, so while negativity is the prevailing sentiment on crypto Twitter, don't forget that we have serval positive catalysts lined up as well. In reality, we are in a healthier environment than a couple of months ago. We have seen excessive leverage to flush out, months of consolidation for majors, and significant discounts for quality assets.

From a macro perspective, the US government is embracing crypto, Trump and Larry Fink providing free marketing for crypto assets, potential rate cuts, and ETH ETF approved. Despite short-term price fluctuations, medium to long-term prospects look promising.

Strategic investment approach

As our latest monthly macro report highlights, the market is expected to remain choppy and volatile as we head into the summer months. This period can present investors with both challenges and opportunities.One such opportunity came up earlier this week. We said it is time to start getting greedy with WIF when others are fearful. If you took that call, you got an overnight 23% gain.

However, it is important to note that it is not yet the time to go all-in on high-risk investments—the time will come, and we will be here to tell you.

For now, the strategic thing to do is to start deploying your dry powder into high-conviction bets using dollar-cost averaging (DCA). This approach has several benefits, particularly during periods of market volatility.

By investing a fixed amount at regular intervals, you can take advantage of price fluctuations, buying more tokens when prices are low and fewer tokens when prices are high. Over time, this can help reduce the average cost per coin and potentially increase overall returns in a stress-free manner.

High conviction bets

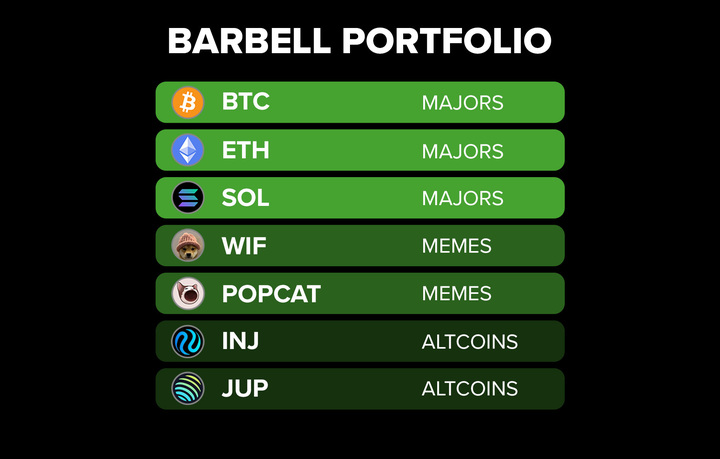

Cryptonary's high-conviction bets refer to coins we believe have the strongest fundamentals/virality and long-term growth potential based on the current state of the market.These high-conviction bets are a handful of the assets in our Cpro Picks, and they represent the collective votes of the research team. Historically, our collective picks in Cpro Picks have performed better than our individual picks. Therefore, we believe there is a collective wisdom in play that can benefit our users.

Please note: It doesn't mean that other Cpro Picks not on this list are no longer great assets. Likewise, if there are other coins on which you have convictions that are not on the list, it doesn't mean it's time to sell them. Our list of high-conviction bets simply profiles the coins we think are relatively safe and attractive to start DCAing at current prices.

If you are just coming into the market or haven't been strategic about building your crypto portfolio, DCA-ing into our high-conviction bets is a great way to get started.

BTC is the king

Bitcoin's position as the leading cryptocurrency and its network effects make it a relatively safer investment compared to other altcoins, which may have higher risks and uncertainties.Bitcoin has a proven track record of resilience and has outperformed many other assets in the long run. Despite short-term price fluctuations, Bitcoin has consistently shown an upward trend over the years.

Bitcoin is widely regarded as a store of value and a hedge against inflation/money supply. Many investors believe Bitcoin's limited supply and decentralised nature make it a reliable long-term investment.

Bitcoin dominance has increased significantly over the last months, indicating stronger demand for BTC relative to the rest of the market.

We believe the king will remain the king; therefore, it is one of the strongest candidates to gradually deploy capital over the summer.

Technical analysis

BTC is currently respecting and maintaining its range floor at the round number of $60,000. This has been a key level of demand for the asset since its reclaim in late February.This exciting and accelerated move pre-halving has found price action at a bit of a standstill within this range due to the lack of significant further bullish catalysts and a few minor bearish speed bumps, preventing price action from moving back into price discovery.

Regardless, we are at key support, and we don't expect much lower, if any lower, around this price point.

So, accumulating the asset class giant would be a great move at the bottom of this well-respected higher time frame range.

ETH is oil

ETH is the second biggest asset in crypto. Love it or hate it, ETH has a strong community and the largest pool of developers and applications. It has long established itself as a blue-chip crypto asset.Similar to Bitcoin, ETH can attract institutional interest and adoption. The approval of a US Ethereum ETF is expected to bring billions of dollars of spot buying pressure.

This increased demand from institutional investors could drive the price of Ethereum higher.

Furthermore, Ethereum is a global settlement layer. Over 100 layer-2 blockchains are built on top of Ethereum, and most use ETH as a gas asset.

ETH is oil, without which no economic activity on these blockchains is possible.

Even though we favour SOL over ETH in the current market cycle, ETH is undoubtedly a blue-chip asset. It is a great asset to DCA in times of uncertainty and turmoil, especially with the upcoming ETF.

Technical analysis

While it wasn't with the same velocity as BTC, Ethereum also charged early in the cycle, reclaiming a key inflection point set in the market in April-May '22.Since this move into prices around $4,000, we saw ETH have a healthy corrective sell-off back into the key support of $3,000 before a nice 30% increase in price due to the ETH ETF catalyst, which has definitely brought more interest back into the largest ecosystem in our market.

With this newfound institutional adoption and price action holding a strong higher time frame structure, we see this new pullback within this recent 30% move to $3,225 as a really good area to bid the asset or look to dollar-cost average in.

Prices could trade lower, and it's good to welcome that possibility, but that would only increase conviction as it's back into a key area and scene of the crime with a more attractive ROI.

SOL is a gem

Solana is one of the highest-conviction bets for this cycle. We have been fans of Solana for a very long time.Solana has demonstrated resilience and adaptability in the face of challenges, particularly following the FTX collapse.

Despite scepticism and doubts about its viability, Solana has emerged as a strong contender in the blockchain space, showcasing impressive user growth and technological advancements.

As Solana continues solidifying its position as a viable alternative to Ethereum, it will likely attract more attention from investors, developers, and users seeking a fast, efficient, and cost-effective blockchain platform.

Solana's future looks promising, and its ability to adapt and innovate will be crucial to maintaining its competitive edge in the rapidly evolving blockchain industry.

Technical analysis

One of the most promising ROI-to-risk ratios in the market, SOL has been one of the leading performers among the majors.We have chosen to view this chart on a weekly to show how well the respected higher time frame bullish structure has been maintained.

The market has fallen to the swing low set at $120 at the end of April, and this area looks like one where we can anticipate a move higher.

This would be a great region to look to build your $SOL position at the $120 mark.

WIF has a hat

WIF has emerged as the foremost memecoin within the Solana ecosystem, distinguished not only by its popularity but also by its impressive price performanceIt is a blue chip and the biggest memecoin in the Solana ecosystem. It is a once-per-cycle phenomenon backed by the die-hard Solana community.

WIF is one of the best and highest conviction bets by Cryptonary and has the strongest price action in the market.

It has experienced a significant pullback, and we believe it is currently trading at a decent discount.

So, we believe that if you have dry powder, gradually deploying capital in WIF can remove the uncertainty associated with the market's timing while retaining a significant upside.

The hat stays on.

Technical analysis

WIF displayed a very strong pre-cycle, which naturally will form a standstill in price action and further upside.Buyers will naturally be exhausted, and profit-taking will happen, both of which coincided with the overall market selling off; yet, WIF has shown resilience.

No asset is immune to macro and global influences, so we have seen a lack of further upside since the recent all-time high print.

However, because this is well justified and has shown resilience in price action against the bears, this falls back into the key level of $1.50, which is a very attractive price point to bid the token.

It looks and feels as though WIF has bottomed out here based on how the chart reflects, and the recent bullish bounce reinforces that.

POPCAT keeps popping

Despite its relatively low market capitalisation, currently under $1 billion, we believe POPCAT will become the first cat-themed memecoin to cross the billion-dollar mark.This milestone would solidify its position as a preferred cat memecoin for multiple market cycles to come.

The price action of POPCAT closely mirrors that of WIF, and during the recent correction, we have seen a strong bounce, indicating strong demand for POPCAT.

Technical analysis

Another monster in the making, POPCAT, again shows resilience similar to what we saw off the back of the global tensions.POPCAT actually disrupted a higher time frame bullish structure before pivoting to its second-highest bullish move since inception, which shows the nature of this token.

It's a highly volatile asset with large swings in each direction, and it requires patience and discipline when holding and trading it through tough times. That's the nature of these more illiquid community-driven assets.

So, where do we bid?

Looking at this move, it isn't absurd to think we can't continue higher based on the nature of this particular token, so accumulating where we are would be a good decision.

You may experience a drawdown, but it would be a looser way to get exposure in the grand scheme of things.

We also have cause to anticipate a retracement back down to $0.3650, which would be a key support for a bid if that did play out.

JUP and INJ

Both JUP and INJ are the only altcoins that got sufficient votes. Both are promising assets with strong fundamentals.Jupiter is Solana's main dex aggregator and a strong beta asset for SOL. It has a strong market positioning and is essential to the Solana ecosystem.

It is hard to be bullish on SOL without also being bullish on JUP, especially given the recent proposal to burn 30% of the supply from dev allocation and the upcoming airdrop allocation in January.

Injective, on the other hand, is a sovereign chain in the Cosmos ecosystem, specifically built for DeFi. Its tokenomics are very investor-friendly, and its price action has been very strong since the beginning of the bull market.

Both of these assets have received sufficient votes and can be considered high-conviction bets to DCAing during the summer.

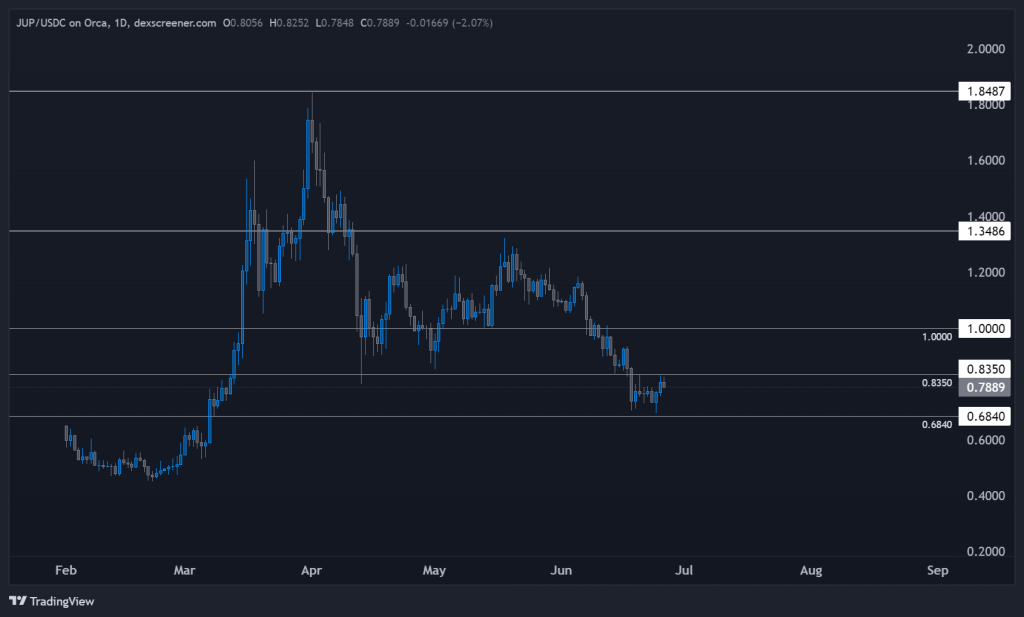

Technical analysis-JUP

JUP was viewed as very undervalued at the $1 mark. With the continued downside market-wide slide, we have seen JUP pull back even further to $0.6840.Because this continued downward move was macro-driven and affected the whole market, it doesn't reflect JUP's true value.

It's just another asset that took a hit. JUP found support at a previous low of a daily range it printed back in early March, which was viewed as the key scene of the crime for the stretched bullish move that unfolded.

Since we are trading at almost 60% pullback from all-time highs, this asset has the potential to generate great returns. Based on the price action now, this is a solid area to bid the DEX.

Technical analysis-INJ

Injective has formed a really nice double bottom at the price point of $18, where the market fell after the global tensions it faced in early April.This sign of strength in demand and selling weakness at this price point has led to this level being a clear player in INJ for our current thesis and past opportunities we have presented since.

When levels find floors like this and show buying pressure, we can anticipate this will be where we will see further market-wide bidding and an area we, ourselves, as investors, can look to take advantage of.

This price point also lies within a key Fib range of 61.8%, which is something we love to see when building our conviction.

Cryptonary's take

We have seen a significant drawdown in the market, which can be stressful and frustrating. However, a couple of months ago, many were begging for pullbacks.Now, we finally have that correction. Therefore, current prices should be considered as a second chance to get exposure to assets you wished you had entered earlier.

Despite significant discounts on many assets, the macro environment is still lacking -- and liquidity is essential for the crypto market to continue growing.

Therefore, it is not yet time to be fully risk-on; we recommend adopting a conservative approach to deploying capital into the market.

We don't think you'll go wrong with these seven BTC, ETH, SOL, WIF, POPCAT, INJ, and JUP; if you have capital on the side and the market gives us more opportunities to buy them at discounted prices, don't miss that opportunity.

Don't fumble the bag!

Cryptonary, OUT!