Do you really know what is backing USDT with absolute certainty? You don't!

And if you think you do, you might be slightly delusional.Centralised stablecoins are old news.

But what if we told you there was a burgeoning market for completely decentralised stablecoins that are end-to-end detached from any regulators?But who are we backing in this space?

Key takeaways

- Lybra is revolutionizing LSD-Fi by using liquid staked ETH as collateral to generate yield for its stablecoin eUSD

- Lybra’s crypto native eUSD leaves old-fashioned stablecoins yielding nothing in the dust.

- Lybra sidesteps regulatory meddling with a stablecoin without a TradFi component.

- Lybra’s LBR token puts staking yields right in holders’ pockets through fee revenue share.

- We see LBR's price growing 5x in the worst case and 23x in the best-case scenario.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

What is Lybra?

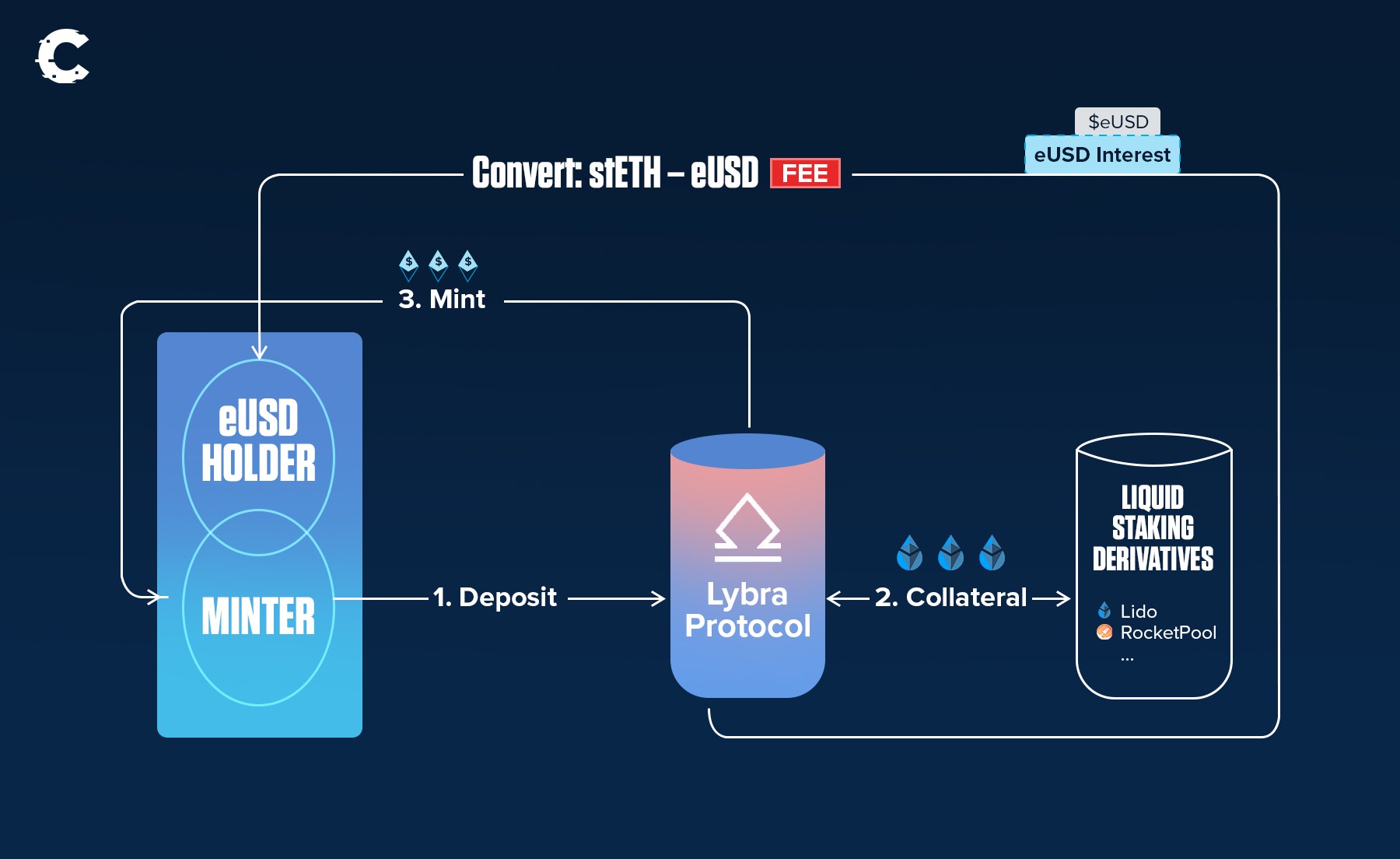

Lybra is a decentralised stablecoin (eUSD) issuer that uses deposited liquid staked ETH (from protocols like Lido - think stETH) as collateral to back the stablecoin and generate yield. As part of the burgeoning LSD-Fi space, protocols like Lybra, along with Pendle, are leading the charge to provide not only more yield to LSD participants but new utility to the wider DeFi space.

Like all LSD-Fi protocols, participants can deposit their ETH derivative tokens into the protocol to earn additional yield. But where does that yield come from? Well, those tokens are used as collateral to mint eUSD - Lybra’s native stablecoin.

The neat part is that ETH derivative tokens are yield-generating, with yield coming from ETH staking. This means that eUSD holders benefit from this yield - consider it like “trickle-down” economics.

1.5 stETH (or other ETH derivatives) is required to back the equivalent of 1 ETH worth of eUSD. Thus, $1000 worth of eUSD benefits from an outsized share of the Ethereum staking yield compared to simply staking $1000 worth of ETH—50% more yield, to be exact.

Another key factor is that Lybra V2 leverages LayerZero’s omnichain communication protocol to enable peUSD to exist natively on all chains that LayerZero supports. peUSD is the multi-chain version of eUSD and is backed directly 1:1 by eUSD.

So, we end up with a multi-chain, decentralised, yield-generating stablecoin with no ties to centralised entities or TradFi yield products.

Why is Lybra important?

This is a fairly revolutionary approach to stablecoins.The key issue that stablecoin issuers face is that by taking in fiat USD on a 1:1 basis, that money becomes unproductive.

Inflation is a killer - it’s why the likes of MakerDAO (DAI) and Tether (USDT) have been backing their stablecoins with US T-Bills, which offer a yield.

By using staked ETH as collateral, which is already yield-generating, eUSD becomes entirely crypto-native. Backed by crypto and crypto-native yield.

Where’s the value?

Other stablecoins backed by TradFi securities (like US Treasuries) are unavoidably centralised. Regulated entities must be set up to coordinate the management of these centralised securities, which is a point of failure if regulators decide to freeze those assets.With Lybra, there is no centralised point of failure. One can make the argument that reliance on LSD providers, like Lido and Frax, etc., for collateral, could be a “centralised” point of failure. But we would much rather take our chances with them than with the US and other regulators.

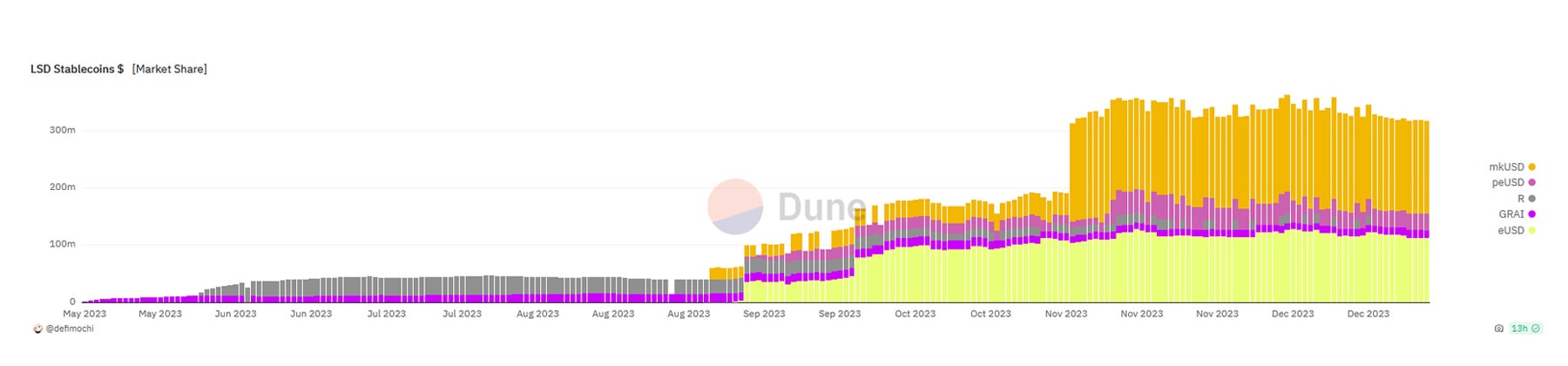

Launching a few months into the LSD-Fi trend in 2023, eUSD was the top dog within the LSD stablecoin sector until November 2023, when Prisma’s mkUSD overtook it. Although the entire LSD-Fi sector has not been at the forefront of attention in recent weeks, it’s clear demand is constant as there are still over $105 million eUSD circulating.

TVL has remained consistent (the dip was caused by the migration from V1 to V2, as many tokens were stuck in V1 and were not registered on DeFiLlama). This reflects the quantity of eUSD in circulation, multiplied by 1.5x, plus LBR staking.

Do the Lybra tokenomics make sense?

Lybra utilises two key tokens - LBR and esLBR.- LBR is a multi-chain token (thanks to LayerZero) that acts as the main utility and liquidity token for the protocol.

- esLBR is the governance token issued whenever an LBR holder stakes their tokens. Think THOR and vTHOR. Holding esLBR facilitates participation in governance.

How is this possible? Where do the fees/revenue come from? How does the protocol maintain operations?

Although it doesn’t cost anything (other than gas) to mint/burn eUSD, a 1.5% fee is applied to all eUSD in circulation. Lybra can offer all fees to esLBR token holders because of the revenue generated by Ethereum staking. Essentially, the Ethereum network fuels the LBR economy.

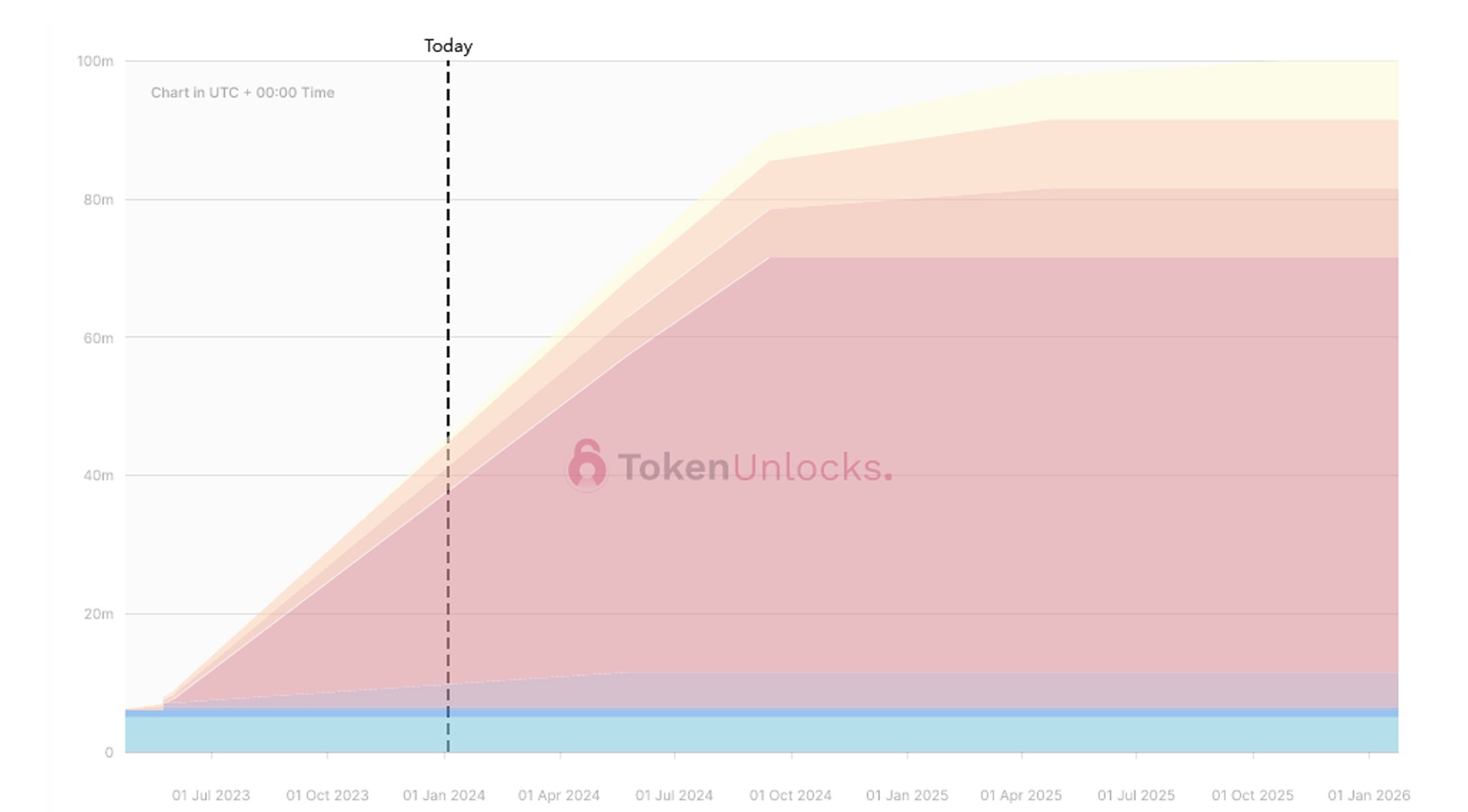

The LBR tokenomics are as follows:

- Circulating supply: 24.3 million LBR.

- Max supply: 100 million LBR.

- Market capitalisation: $27 million.

- FDV: $54.5 million.

Token emissions are fairly linear, and the majority of emissions should be complete towards Q3/4 of this year. We’re not too concerned about inflation due to the low market cap/FDV. However, in the valuation calculation, we will base targets on FDV.

Overall, tokenomics are sound, and we think it’s fair to consider the relationship between LBR and Lybra to be similar to that between LDO and Lido. As TVL grows, the desire/necessity to participate in governance grows. Hence, people buy LDO (LBR, in this case), and the price increases.

Lybra's valuation

To project a valuation for LBR, we’ll make the following assumptions:- LSD-Fi is still in a bear market, so participation/activity is low.

- BTC will get a US-registered ETF approved, releasing sidelined cash into the crypto market.

- Confidence in LSD-Fi will grow over time - it’s important to remember the sector has only existed for less than a year, and liquid staking participants are hesitant to participate this early.

- The ratio between LBR’s market cap and Lybra’s TVL will be similar to LDO’s market cap and Lido’s TVL.

- LDO has a market cap of $2.7 billion and a TVL of $20 billion, giving a ratio of 0.135.

- LBR has a market cap of $27.3 million and a TVL of ~$300 million, giving a ratio of 0.091.

- Since LBR actually generates revenue, and LSD-Fi is in a bear market, we’ll use the higher figure of 0.135 as a base.

- We’re using the FDV of LBR for targets since the emissions schedule mostly plays out this year.

The total value of all LSD-Fi protocols is only around $1.6 billion. Compare this with the $50.3 billion TVL for LSD protocols (Lido, Frax, RocketPool, etc.), and it becomes clear that there is still a considerable amount of sidelined capital waiting to be deployed into LSD-Fi that already exists in LSD protocols (across all chains).

LSD-Fi represents a mere 3.8% of the total liquid staking market.

This is without any further price appreciation.

LBR’s current FDV is $54 million, and Lybra TVL is $300 million. Lybra currently has an LSD-Fi TVL market share of around 18.75%.We feel it is a reasonable assumption that LSD-Fi participation will increase to 20% of all LSD TVL, which translates to an LSD-Fi TVL of $10.1 billion.

Assuming that Lybra will retain the same market share of 18.75%, this gives a projected Lybra TVL of $1.89 billion.

Given a ratio of 0.135 (as explained above), this suggests that LBR’s market cap can reach $255 million, purely based on increased LSD-Fi participation.

Since we’re using a base of ~100 million circulating LBR, we can conservatively project a price per LBR of $2.55.

Now, this seems low - because it is.

We haven’t considered the stablecoin market - Lybra’s target market - which stands at a total market cap of $131 billion. Additionally, we expect the total crypto market to increase 2-3x this year, which means increased participation across the board and a higher demand for stablecoins.

Given these figures, we will apply some multiples to the initial valuation to reach the final figures:

- Bull (10x multiplier): $25.50 per LBR, a 23x gain from current prices.

- Base (5x multiplier): $12.75 per LBR, a 12x gain from current prices.

- Bear (2x multiplier): $5.10 per LBR, a 5x gain from current prices.

Cryptonary’s take

The crypto market is gearing up for an exceptional year. Degens love yield! And they love it even more when they don’t have to do anything and can just earn it by holding a stablecoin.When the market takes a turn for the worst, as it will occasionally, everyone exits to stablecoins.

Lybra has a first-mover advantage in the LSD-Fi stablecoin game, and we’re confident they won’t let that slide.

Remember - LSD-Fi is in its infancy. If you are reading about it now, you are very likely an early adopter.

Bitcoin started 2024 with a strong move up, but what does the rest of 2024 have in stock for your portfolio?Check out Cryptonary's 2024 projections.