Are We Headed to Goblin Town?

Bitcoin had an ETF, hype pushed it to the generational meme price of $69,000 from which it started tumbling down. Now if you paid attention, you would have seen the change in tune via the market structure. You see, one thing that has been consistently valuable in this market is monitoring BTC’s market structure - as soon as it begins creating lower lows and lower highs, danger arises.

What is Goblin Town you ask? The antonym of “The Citadel”.The Citadel is the place we all hope to reach once our bags have rocketed, a paradise filled with money and a bunch of Vitaliks. Goblin Town on the other hand is where we hope we don’t end up, where Wojak is now working: McDonald’s with all coins trading near 0.

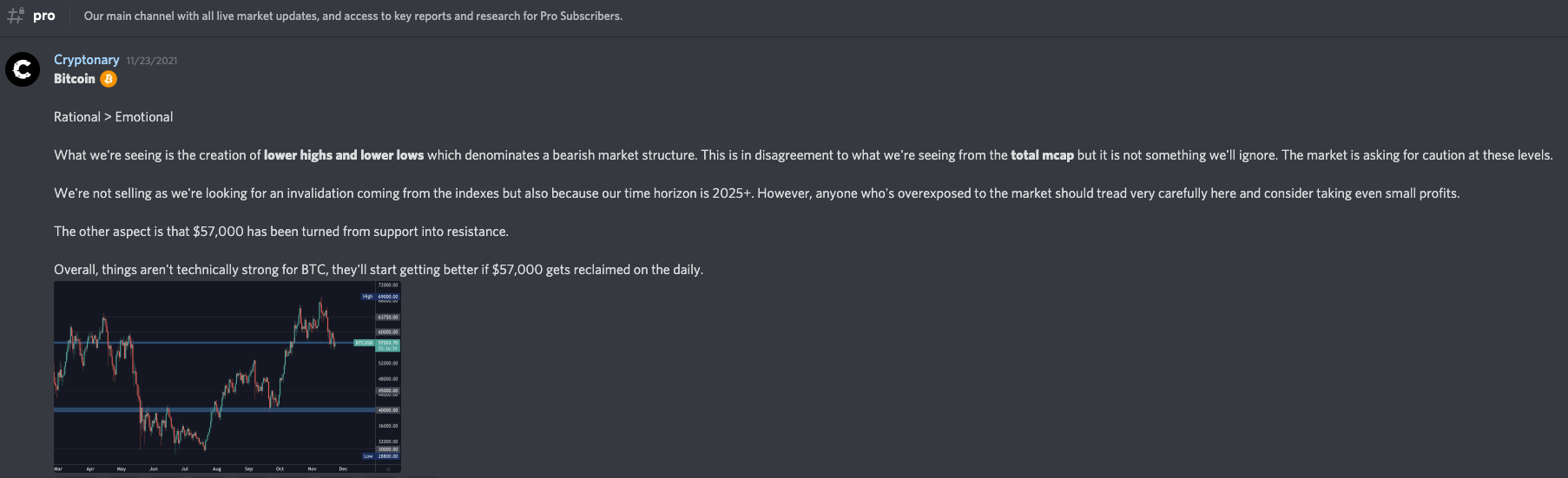

Here is a screenshot from Discord Pro from 23 November 2021.

Since then BTC has fallen by over -25% all the way down to $40,500 but why?

Disclaimer: This is not investment nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Uncle Sam

No not our beloved Sam Bankman Fried who freed our wealth with SOL, we’re talking about the good ol’ Uncle Sam, this one 👇

In late 1913, a new entity was formed, known the world over as “The Printer” or “The Federal Reserve”.

Before we dig in, there are two terms you have to be familiar with:

- Hawkish: Want to limit inflation, limit USD supply, raise interest rates, basically turn the money tap off.

- Dovish: Want economic stimulation, increase USD supply, lower interest rates to encourage borrowing - i.e. turn the money tap on.

The billions of dollars in asset shopping expenses leads to increased investor confidence: if the biggest institution with the deepest pockets is buying, why wouldn’t every other investor? This is where you see sharp drops instantly being bought back up resulting in downside wicks on the charts.

The excess printing led to an increase in inflation all the way up to 6.2% - way above the 2% target. Now that asset prices have rebounded and set new ATHs, it became important to “look wise” once again and “care” about inflation. To discourage, or at least reduce, the excess stimulation, the Fed can simply raise interest rates and it was expected to happen throughout 2022 and slow down the pace at which they are buying (known as tapering) but when the meetings minutes were released we also found out they are considering Quantitative Tightening (QT) which is the process of reducing the size of the Fed’s balance sheet.

You’re now thinking: what the hell does this have to do with crypto? And why is my portfolio down again?

After all, the Fed’s list of assets does not include crypto, at least yet. But we know one thing since the pandemic started, Bitcoin has become institutionalised whether that be for speculation or inflation hedging purposes. These institutional players all trade to the Fed’s melody and right now it isn’t a pretty one. Then of course you know the link between Bitcoin and every other altcoins: where Bitcoin flows, Alts follow - still is the case for the most part.

One thing to note is that QT has not been confirmed but has been hinted towards. Additionally, tapering is scheduled to end in March. We’ll likely receive more information during that time.

Crypto Cycles

Now that you have an idea about the Federal Reserve’s connection to crypto prices dropping let’s take a look at where we are in the cycle. By no means do we mean the 4 year bull cycle and this nonsense that gets circulated on social media to farm engagement, we mean the cycles of growth in crypto.Proof of Concept

We saw the rise of a decentralised “internet money” that was censorship resistant, called Bitcoin in the 2010s.Throughout the decade, the gargantuan increase in BTC’s price proved that this was a much needed solution by society. This type of technology served a great proof of concept and over the years even became a Store of Value (SoV) but the offering was limited.

Base Layers

This is where things started to change, the proof that decentralisation + censorship resistance was in demand was there, it became time to build further: enter smart contracts.Ethereum was introduced to the world in 2015 and was the pioneer to this offering. Despite the euphoric price runs, there wasn’t enough development until the 2020s - this is where we saw the application layer start to rise with DeFi. Trying it for yourself will give you the feeling of what true financial freedom is like.

There was an issue, scalability. This opened up the door for competition and the obvious assumption that we’d have a multi-chain world began occurring IRL. First we had Binance Smart Chain, followed by Solana and then Avalanche, Terra. There are already five competitors with a decent market share but the ultimate players that will be part of this multi-chain universe have not been finalised yet. In terms of L1s there are two more that stand out: Near & Mina. In addition to L0s such as Polkadot and Cosmos and L2s such as Starkware, ZKSync, Optimism and Arbitrum.

Infrastructure

We suspect the base layer race will keep going through 2022 in addition to the entry of the “infrastructure apps” that will ensure those base layers have the tools necessary to fully support the application layer. This ranges from decentralised storage to cross-chain communication solutions such as THORChain.Application Layer

The market is following a very logical path in growth terms. Once the base layers are chosen and equipped, then it makes sense to see the application layer boom in an unprecedented manner.When you think of how we’re only in the first half of the second inning out of 4 total innings, it becomes tough to think: “Yes my balls have dropped and I will paper hand”.

Technicals

One chart and one chart only: The Total Market Cap

Overall you can simply think that crypto has an MCap of $2T which is less than what Apple or Microsoft are worth individually. This alone tells you that selling here (for long term investors) makes no sense - not investment advice nor a suggestion, you do you.

Over the short-term we can see though that more pain is on the way with $1.75T being highly likely in the coming weeks, this represent a -10% drop which would set BTC down to $37,000 and ETH to $2,800 approx.

So to sum up, yes we see some more incoming pain but we don’t consider being sellers here for our long-term bags, our eyes are set on The Citadel.

Areas of Focus

Discounts are great to deploy sidelined cash, which we’re being very patient with at the moment. This allows us to buy fundamentally sound assets for pennies on the dollar so which ones are we most interested in:- LDO: liquid staking is an important infrastructure play and Lido is king here.

- MINA: new ecosystem, new tech in the midst of a base layer race.

- NEAR: new ecosystem will under $200M in TVL and strong incentives, the most interesting of which being the 30% network fee share that developers get from smart contracts they deploy, this is a unique value proposition.

- XDEFI: faith required in the team here because it can only go big if they deliver, but a multi-chain wallet seems like a no brainer play in a multi-chain universe.

- DOT: new type of base layer offering a new type of architecture, looking to double down by buying lcDOT that will likely trade a big discount to DOT and then be redeemable 1:1 in 96 weeks (there is a risk of the IOU turning worthless of course).

- ZKSync: no token yet but big fan of the user experience of this L2.

Projection

Lengthy piece filled with alpha and wisdom? Let’s summarise.The Fed printed too much which increased investor confidence leading to a strong bullish trend in asset prices - indirectly affecting crypto. Now that they have to back off the printer, things are on shaky grounds. Then we have the fact that the market structure is still bearish and it looks like further pain is on the line. By March, the hope is that the economy shows signs of weakness canceling the Fed’s plan of quantitative tightening.

Our projection is that the market will drop a little more but mainly chop throughout this quarter. We plan to buy assets at a discount, with a special emphasis on new ecosystems and infrastructure plays but that is secondary. Our primary plan is to connect with builders whom are building even when the chips are down because these are often the winners - not the “crypto is about up only so I’m going to create my sunshine and rainbows copy pasta protocol”.

If you’ve read this far, thank you and looking forward to communicating with you in our Discord fellow diamond hander.