This breakthrough signifies the institutional embrace of digital assets and opens the door to a wealth of investment opportunities.

This report zeroes in on the transformative impact of ETFs on Bitcoin and the broader crypto ecosystem.

We'll spotlight six strategic investment opportunities (from solid DeFi plays to memecoins) emerging from the alliance between a $9 trillion TradFi behemoth and the No. 1 crypto exchange in the US.

Curious to learn more? Let's dive in…

TLDR

- Base is one of the leading scaling solutions for Ethereum. Recently, it has been gaining popularity.

- The potential for Base is huge since Coinbase is a No. 1 crypto exchange in the US and a custodian for most BTC ETFs, including Blackrock's

- Blackrock, a $9 trillion giant, intends to tokenise assets on the blockchain, and Base is one of the potential candidates for it.

- Therefore, Base has massive upside potential. However, there is no direct way for crypto users to capitalise.

- We present six crypto assets that can act as proxies for Base's success

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Base

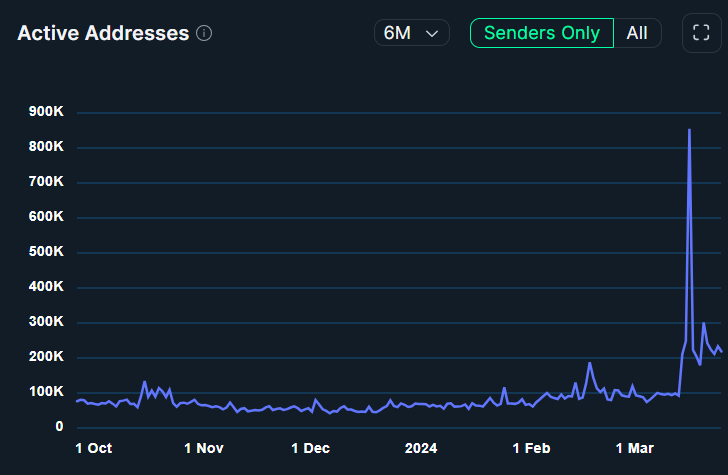

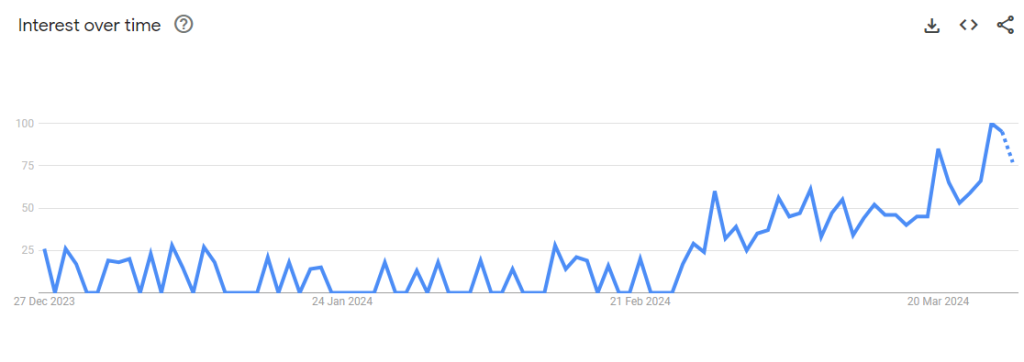

Base is a layer 2 (L2) solution built on the Ethereum blockchain, designed to improve scalability and efficiency. It is developed and maintained by Coinbase, one of the largest crypto exchanges; Base is part of Optimism's Superchain, which aims to bring billions of non-crypto users into the crypto market. So, it uses Optimism's OP Stack, making it compatible with the Ethereum Virtual Machine (EVM).We have previously covered Base during its early days. However, over the last few weeks, Base has been gaining popularity. Both the number of active addresses and web searchers has been trending up.

We have also observed that Base has been trending on Twitter, with many people making posts and engaging in commentary.

Why is keeping track of social sentiment important?

Remember the report we recently published on capital rotation in crypto? There's a decent chance that Base will get some of that rotation as the narrative continues to shift during this cycle.

Why?

ETFs and Coinbase

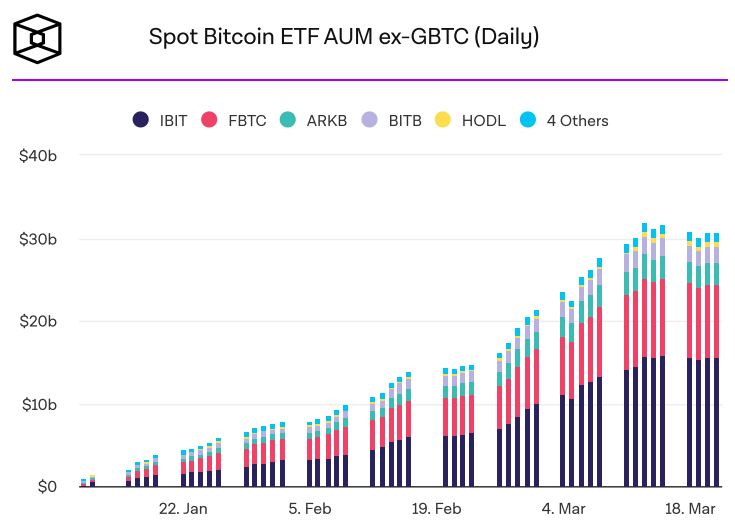

The approval of Spot Bitcoin ETFs in the US marked a significant milestone in the cryptocurrency industry. It brings institutional acceptance and mainstream exposure to digital assets. One key impact of the BTC ETF launch is that traditional investors and financial institutions could now gain exposure to Bitcoin without directly owning or managing the underlying asset.As a result, we have seen a consistent institutional TWAP (Time-Weighet Averega Pricing) in Bitcoin.

We can see from the graph above that Assets Under Management (AUM) by all ETFs have been consistently increasing except for the last few weeks, when it was relatively constant.

However, we can see the general trend of demand is trending up.

But who stands to benefit the most from the fresh institutional demand?

The answer is Coinbase.

Coinbase is the custodian for 8 out of 11 approved spot Bitcoin ETFs, including the most popular one, the iShares Bitcoin Trust by BlackRock.

Additionally, Coinbase is the biggest crypto exchange in the US, with almost 100m active users.

Previously, we wrote about Coinbase launching Base as its Layer 2 chain on Ethereum.

Long story short, Base is an L2 built using Optimism Stack. Due to the direct connection with Coinbase, Base has great potential to onboard many new users on-chain directly from Coinbase's exchange.

You can think about it like this – Bitcoin ETFs are bringing a new cohort of investors into crypto. Once these investors experience the performance of Bitcoin relative to other asset classes, they'll want more exposure to crypto and use Coinbase for the CEX experience. But when they want a fuller crypto experience than Coinbase offers, Base will be their next port of call.

EIP-4844 and Blackrock

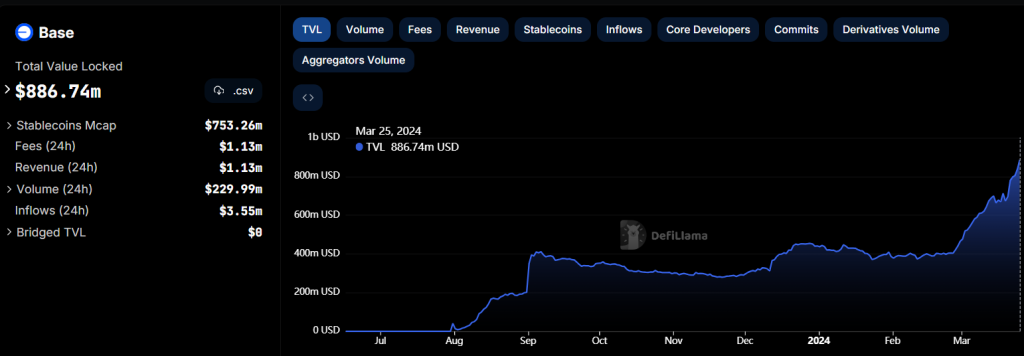

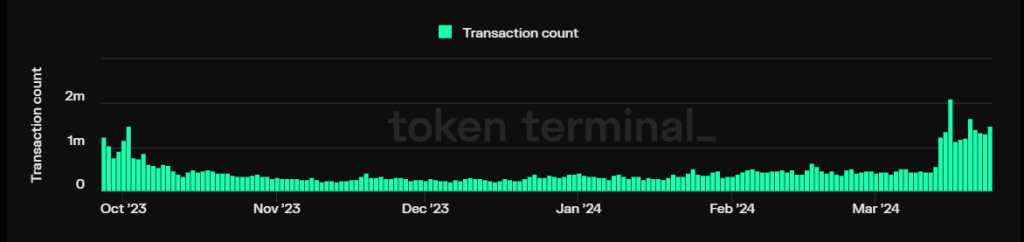

Recently, we have seen the TVL of the Base surging significantly; money is starting to flow into Base.

Additionally, we observed that the transaction count has seen a dramatic increase.

So what is happening?

There are multiple reasons…

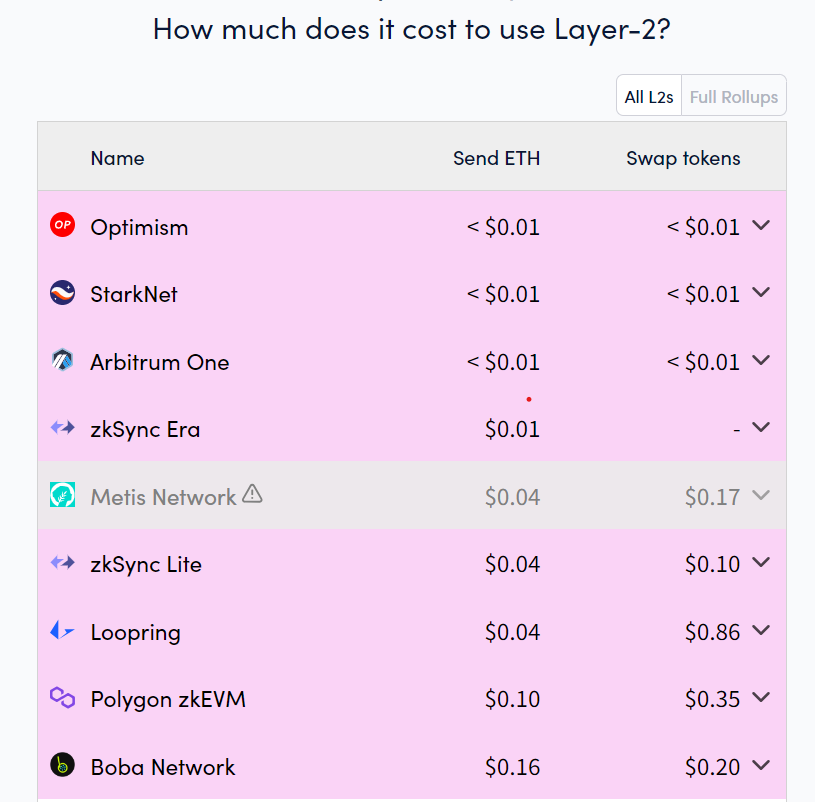

First, the long-awaited EIP-4844 has been a huge success for L2s.

After EIP-4844, the transaction cost on most L2s is less than $0.01. This is cheaper than Solana and drastically improves the UX of all L2s.

Since Base is built on OP stack, both Base and Optimism are among the cheapest L2s to transact on.

Secondly, BlackRock, one of the world's leading asset management firms, has recently launched a new tokenised fund called BUIDL on the Ethereum blockchain. This fund is designed to offer investors important benefits by enabling the issuance and trading of ownership on a blockchain, expanding investor access to on-chain offerings, providing instantaneous and transparent settlement, and allowing for transfers across platforms.

The fund is fully collateralised by cash, U.S. Treasury bills, and repurchase agreements. BlackRock has partnered with several key digital assets and traditional banking players, including Securitize as the tokenisation platform and BNY Mellon as the asset custodian.

The ecosystem also includes Anchorage Digital Bank NA, BitGo, Coinbase, and Fireblocks, which provide infrastructure to the fund. We can see that BlackRock is heavily into crypto. Larry Fink said the next logical step after the Bitcoin ETF is the "tokenisation of assets". He didn't come into space just for ETFs; he came here to win big.

BlackRock manages over 9 trillion dollars of assets. "Tokenising" 10% of that is almost a $1 trillion inflow into crypto markets.

CoinBase is the most regulated exchange and most likely partner for Blackrock to build whatever Larry Fink meant by "tokenisation of assets", and if that tokenisation is to happen on-chain, which chain do you think CoinBase will be recommending? Obviously, Base

Long story short

- Coinbase is the No.1 exchange in the US and custodian for 8 out of 11 BTC ETFs, including BlackRock's.

- CoinBase has its own chain that is cheaper to transact than almost any other layers and has a self-custodial wallet. Additionally, their chain is centralised, so any errors can potentially be reversed.

- CoinBase is a shareholder of Circle and the issuer of one of the most widely used and regulated stablecoins, USDC.

- We might expect some big partnerships and announcements related to Coinbase x Blackrock – these will likely involve Coinbase's L2 Base.

We have a potential winning ecosystem, but there is no direct way for crypto investors to participate in the upside. Since Base is powered by Coinbase, one way to get exposure to it is simply by buying Coinbase's stock.

But we don't do that here; we are crypto folks.

So, how else can you get exposure?

Here's how to get exposure to Base

Low risk: Optimism OP

As we mentioned earlier, Base is an L2 blockchain built on the open-source OP Stack developed by Optimism. We covered Optimism extensively here.Coinbase and Optimism Collective have very tight relationships, shared governance and revenue-sharing frameworks.

2.5% of Base's revenue or 15% of Base's profit (whichever is greater) is shared with Optimism Collective.

Therefore, we think OP is the best option in terms of risk-reward to gain exposure to the success of Base.

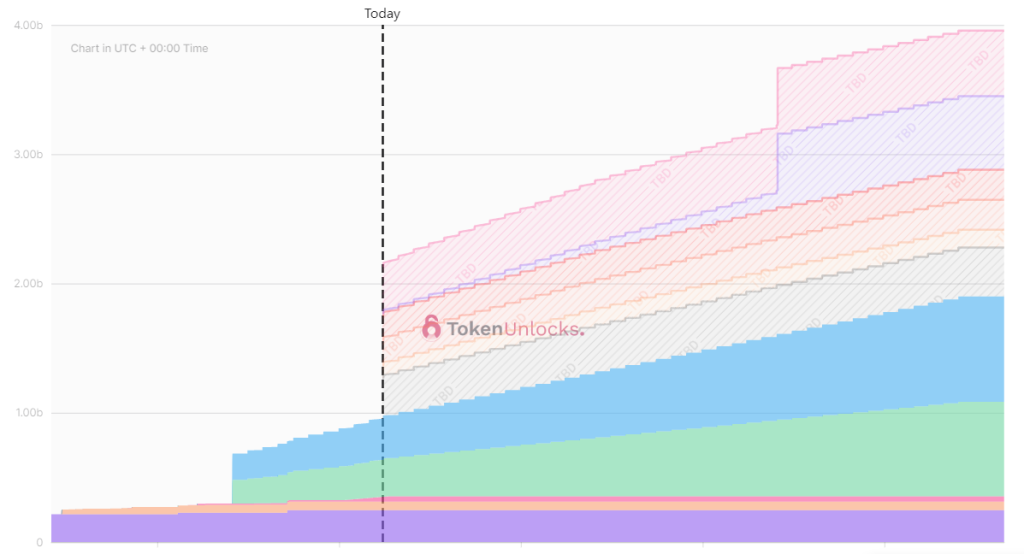

Additionally, since we last covered OP, the tokenomics look more investable since the team's and early investors' tokens were unlocked almost a year ago.

Mid risk: Base ecosystem projects

Another way to gain exposure to the Base is through its ecosystem projects: SNX, Kwenta, and Aero.We covered our OG 20x tokens many times. In the latest update, we discussed the Andromeda upgrade, expansion to Base and its significance.

Open Interest is still capped on Base, but recently, it has been lifted from $1m to $10m. So, the upgrade is still being tested and not fully implemented.

We believe if activity and capital start flowing into Base, money will also flow into the only Perps platform on Base. Therefore, SNX can also act as a good proxy for the success of Base.

Another project expanding to Base along with Synthetix is Kwenta. We covered Kwenta here, and our thesis has been playing out perfectly since then.

Since Kwenta is a front-end for Synthetix, the increased activity and market on Base can benefit Kwenta as well. Therefore, Kwenta remains another proxy for the success of Base.

The last ecosystem project that can potentially be a proxy is AERO. Aerodrome is a central trading and liquidity marketplace on Base, the main DEX on Base. It is hard to imagine Base's success without the equal success of the chain's main DEX.

Therefore, AERO can be another proxy for Base's success. However, since AERO is inflationary, investors are recommended to stake it and participate in governance to avoid dilution.

High risk: Base memecoins

Lastly, Base memecoins are a high-risk way to get exposure to Base's success.These are high-risk plays. However, they offer potentially high returns as well.

We have two Base ecosystem meme tokens on our radar: Rock and Mochi

Rock

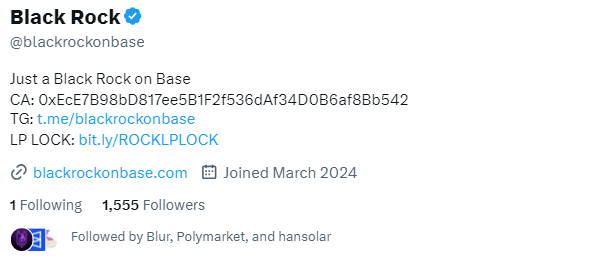

Rock is a memecoin inspired by the recent launch of BlackRock's tokenised fund. Like other memes, it has no deep meaning; it is just a rock on Base.

Many are speculating on the potential collaboration between Coinbase and BlackRock using the memecoin.

The chart speaks for itself:

- Fully diluted value: $56m

- LP tokens: Forever locked

- Ownership: Has been renounced

- Holders: 1.7k (Top 10 holders collectively own only 13%)

- Token address: 0xEcE7B98bD817ee5B1F2f536dAf34D0B6af8Bb542

Black Rock caught the attention of other industry participants as well:

Mochi

The meme is named after the pet cat of Brian Armstrong, the CEO of Coinbase. According to their Twitter and the website, the devs are KYC'd to Coinbase and have received a grant from them.

Mochi is "crypto's cutest cat" and wants to help Coinbase onboard the next billion users. Multiple cat memes have emerged this cycle (e.g., Wen, Popcat). In this cycle, cats may finally reach their full potential and enter the Top 100 CoinMarketCap.

If so, Mochi will benefit substantially from the cat narrative. The success of Coinbase will further amplify Mochi's price action.

Thus far, the price action has been incredible.

- Fully diluted value: $61m

- LP tokens: Locked but can be unlocked

- Ownership: Not renounced

- Tax: 3% on Buy/Sell (cannot be increased; only lowered; proceeds used for the development)

- Holders: 15k

- Token address: 0xF6e932Ca12afa26665dC4dDE7e27be02A7c02e50

However, this case resembles more of a corporate meme with devs KYC'd and "backed" by a single entity.

Backed by Coinbase, Mochi has more following compared to Rock.

Mochi has been gaining traction on Social Media as well. It is not that difficult since Mochi is cute and cuddly

Therefore, despite some red flags, we believe Mochi is a good bet for Base meta and Cats meta.

Cryptonary's take

Coinbase is positioned to benefit the most from the institutional demand for ETFs, as it is the custodian for most approved spot Bitcoin ETFs.Since Coinbase has a large userbase of nearly 100m, Base, L2 developed by Coinbase, has a strong potential to onboard many new users directly from the Coinbase exchange on-chain.

This, along with other advantages of Coinbase, opens up room for potential partnership with Blackrock, who openly expressed an intent to tokenise assets on-chain.

Therefore, the future of Base looks very exciting.

Despite not having a token, we presented three ways – depending on your risk profile – to get exposure to Base's success. If Base does well in the future, we believe these tokens are poised to rip.

However, it is worth noting that Coinbase is a centralised entity, and Base doesn't have fraud proof, which can lead to potential security issues. Additionally, any transactions on Base can potentially be censored.

Recently, we have also seen the Base being congested and unable to process transactions. Nevertheless, despite the early days and centralisation issues of the Base, we remain bullish and excited about its future.

Overall, we can see Base becoming one of the few L2s that will capture a significant market share in terms of on-chain activity and capital. Cryptonary, OUT!