Binance's $4.3B settlement: What does it REALLY mean for crypto?

For much of 2023, we kept our pulse on the legal hurdles Binance faced–a hot topic for us. We saw the challenges as a big deal for the crypto industry, especially with a bull run looming, and we published many reports to track the developments.

You can track some of our earliest coverage here, here, and here. It turns out our instincts were right on the money, as Binance is now grappling with a hefty $4.3 billion fine, and CEO Changpeng Zhao (CZ) has pleaded guilty to a slew of felony violations – but this is no longer news.

The dust has settled, and the initial frenzy around the news has faded.

Yet, a crucial question arises: What implications does this hold for Binance and the broader crypto market?

Key takeaways

- Binance settled with regulators for a $4.3B fine, and CZ resigned.

- There's another dark cloud on the horizon for Binance.

- New CEO Richard Teng has regulatory experience. Likely to focus on Middle East and Asia markets after losing US/UK business.

- The settlement removes systemic risk and clears the way for renewed optimism in crypto.

- Liquidity leaving Binance will likely flow into Spot BTC ETFs, Coinbase/Base Layer 2, and DeFi exchanges.

- If you trade on Binance, there's no evidence that customer funds are at risk, but some outflows are happening.

- BNB's outlook depends on EU license by 2024. Bullish if acquired; otherwise, the bearish trend continues.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Decoding Binance's legal settlement

Let's start with a quick review of the specifics of Binance’s settlement.- Admission: Binance and CZ admitted to felony charges, including violating the Bank Secrecy Act, failure to register as a money services business, and neglecting an effective anti-money laundering program.

- Fine and settlement: Binance agreed to a significant settlement of a $4.3 billion fine to resolve lawsuits from the U.S. Department of Justice, the U.S. Treasury Department, and the Commodity Futures Trading Commission.

- Operational changes: Binance will cease offering services to U.S. customers. External observers will oversee its operations to ensure strict adherence to the settlement terms and to confirm that no U.S. customers are being served.

- CZ’s resignation and penalties: Binance CEO CZ resigned. He also faced substantial personal consequences, including a $50 million fine and a three-year ban from managing the company. In addition, a potential 10-year prison sentence looms over him, but the dynamics of a plea deal suggest a more limited term, at most 18 months.

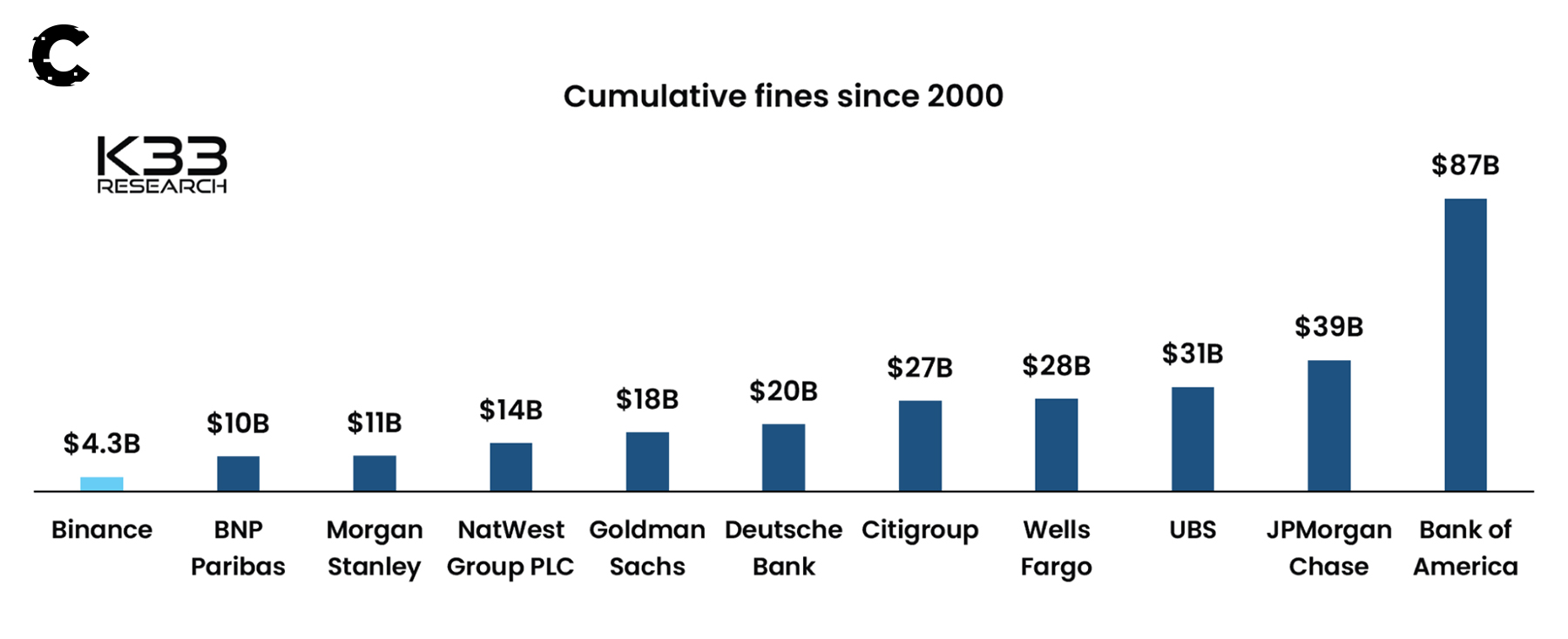

For instance, in 2012, HSBC agreed to a $1.9 billion settlement for its involvement in facilitating money laundering for drug cartels. In 2020, Goldman Sachs paid $2.9 billion over bribery charges involving Malaysian government officials.

More importantly, neither of these companies saw the departure of their chief executive as part of their settlements.

While both incidents were much larger than the violations of Binance, the U.S. government has sent a clear message that crypto will not receive the same treatment as systemic banks.

Another dark cloud looms over Binance

Binance has successfully resolved cases with the U.S. Department of Justice, the U.S. Treasury Department, and the Commodity Futures Trading Commission.Does this settlement mark a new chapter for Binance?

Yes, from one perspective; however, from another, not just yet. There’s yet another dark cloud looming over Binance.

The SEC's case against Binance remains unresolved

The SEC is still investigating Binance.The allegations include classifying BNB as a security, attributing a suspicious flow of funds between Binance and Binance US to entities controlled by CZ, and accusing these entities of engaging in market manipulation. You can find more details about the lawsuit here.

A deadline of December 15 has been set for Binance and the SEC to find a resolution regarding the ongoing investigation in response to the settlement.

While most of the legal troubles surrounding Binance may have concluded with this DOJ settlement, the SEC’s case is the final hurdle Binance must cross to truly end this chapter.

Thankfully, the case with the SEC is civil, not criminal, so we don't expect it to be as big of a spectacle as the previous settlement.

The only potential wildcard is if the SEC uncovers FTX-like practices at Binance. So far, that doesn’t seem to be likely. However, the resolution of this case is crucial for Binance to start its new chapter.

Binance and its new leadership: What it means for the exchange

Whatever the outcome of the SEC case, Binance is starting under new leadership with the appointment of Richard Teng as the new CEO.Who is Richard Teng

Teng, who initially joined Binance as the CEO of Binance Singapore, was appointed as the head of regional markets only recently, in May of this year. However, it is hardly surprising that he is the chosen person to steer Binance toward a new direction, given his extensive regulatory experience.Before his role at Binance, Teng was the CEO of the Financial Services Regulatory Authority at Abu Dhabi Global Market. Before that, he was the Chief Regulatory Officer at the Singapore Stock Exchange (SGX). Teng brings a wealth of experience to his role.

What do we expect Teng’s focus to be?

With the change in leadership at Binance, we anticipate a shift towards a less fast-paced operation, especially because the company is under monitoring – this shouldn’t be a challenge since Teng has regulatory experience.The bigger challenge will be compensating for significant losses in market share—specifically, the U.S. market and earlier setbacks in the Canadian and United Kingdom markets – three of the largest markets available.

To maintain its dominance and offset these losses, we could expect a strategic focus on major financial hubs in the Middle East, such as Abu Dhabi, Dubai, and Bahrain. The emphasis would be on onboarding financial institutions.

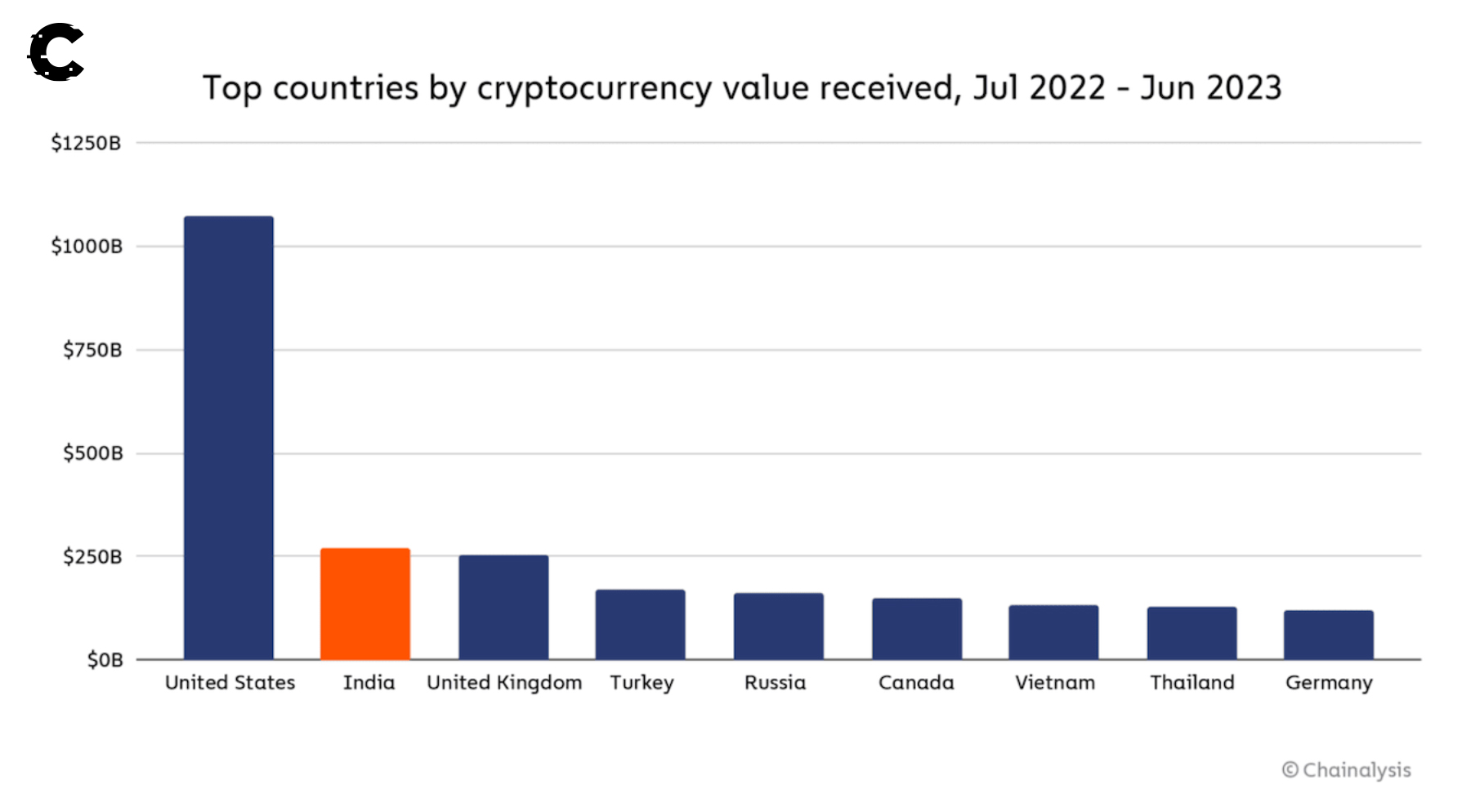

Additionally, the attention is likely to extend to vital Asian markets, encompassing both retail and institutional hubs in countries like India, Turkey, Thailand, Singapore, Hong Kong, South Korea, and Japan.

However, the critical challenge for Binance lies in Teng's ability to secure an EU-wide license. This critical factor will determine whether Binance can regain access to the European market. With the Markets in Crypto-Assets framework set to replace national-level crypto legislation by the end of 2024, obtaining this license becomes crucial.

Failure to acquire the EU-wide license by next year diminishes the possibility of retaining dominance. In such a scenario, Binance then be forced to compete in highly competitive markets in emerging regions—Asia, the Middle East, and South America.

What does Binance’s settlement mean for crypto?

Binance’s settlement deal is overall favourable for the crypto market. It has removed a potential systemic risk about the hypothetical Binance collapse. This was a worst-case scenario that had suppressed the bullish appetite in crypto for much of this year.Another potential impact of Binance’s settlement is where the liquidity that was previously at Binance would go. With Binance now in a less-dominant position, who benefits?

Spot Bitcoin ETFs, Coinbase, and DeFi to absorb U.S. liquidity from Binance

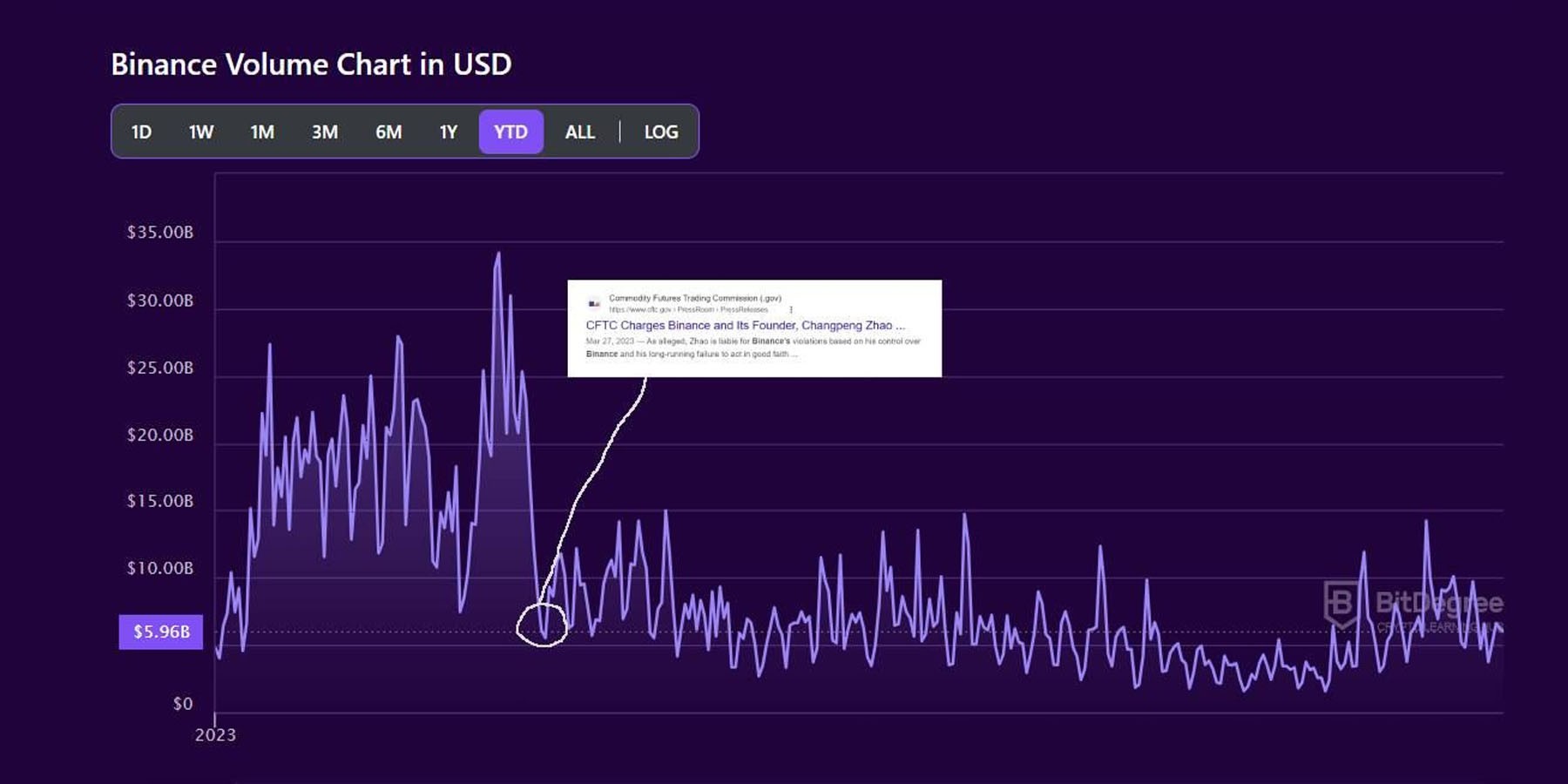

One of the key cases against Binance was the revelation that Binance continued to have U.S. VIP clients despite claiming to block U.S. customers from its exchange. This indicates that some crypto liquidity from the United States, including U.S. market makers, were trading on Binance.Of course, many of these U.S entities must have exited Binance when the news about the lawsuit broke earlier this year. See the volumes on the exchange before and after the lawsuit in the chart below.

With Binance now under monitorship and unable to onboard U.S. entities through the VIP program, this portion of liquidity is poised to move elsewhere. We identify three potential avenues that could absorb U.S. liquidity rather than necessarily leaving the market.

Spot Bitcoin ETF

The potential approval of the Spot Bitcoin ETF comes at the perfect time to fill the gap for BTC. There are reports that market makers, including Jane Street, Virtu Financial, Jump Trading, and Hudson River Trading, have been in talks with BlackRock about a market-making role to provide liquidity to the Bitcoin ETF.This development signals a positive shift for crypto because firms like Jane Street Group and Jump Trading had pulled back from crypto trading in the US earlier in the year amid heightened regulatory scrutiny.

If the Spot Bitcoin ETF launch is successful, and other potential crypto ETFs, such as an Ethereum Spot ETF, follow, this could be a potential avenue to absorb liquidity from Binance. So it seems like BlackRock is the first beneficiary of this lawsuit." at the end of this section.

Coinbase

Coinbase is another entity that arguably benefits from Binance’s exit from the U.S. Of course, Coinbase couldn't always move as quickly as others due to its more cautious approach than Binance. However, this approach could pay off now.And especially for tokens not yet available through regulated products like a Bitcoin Spot ETF, Coinbase is well-positioned to become the avenue for U.S. entities and customers to access crypto.

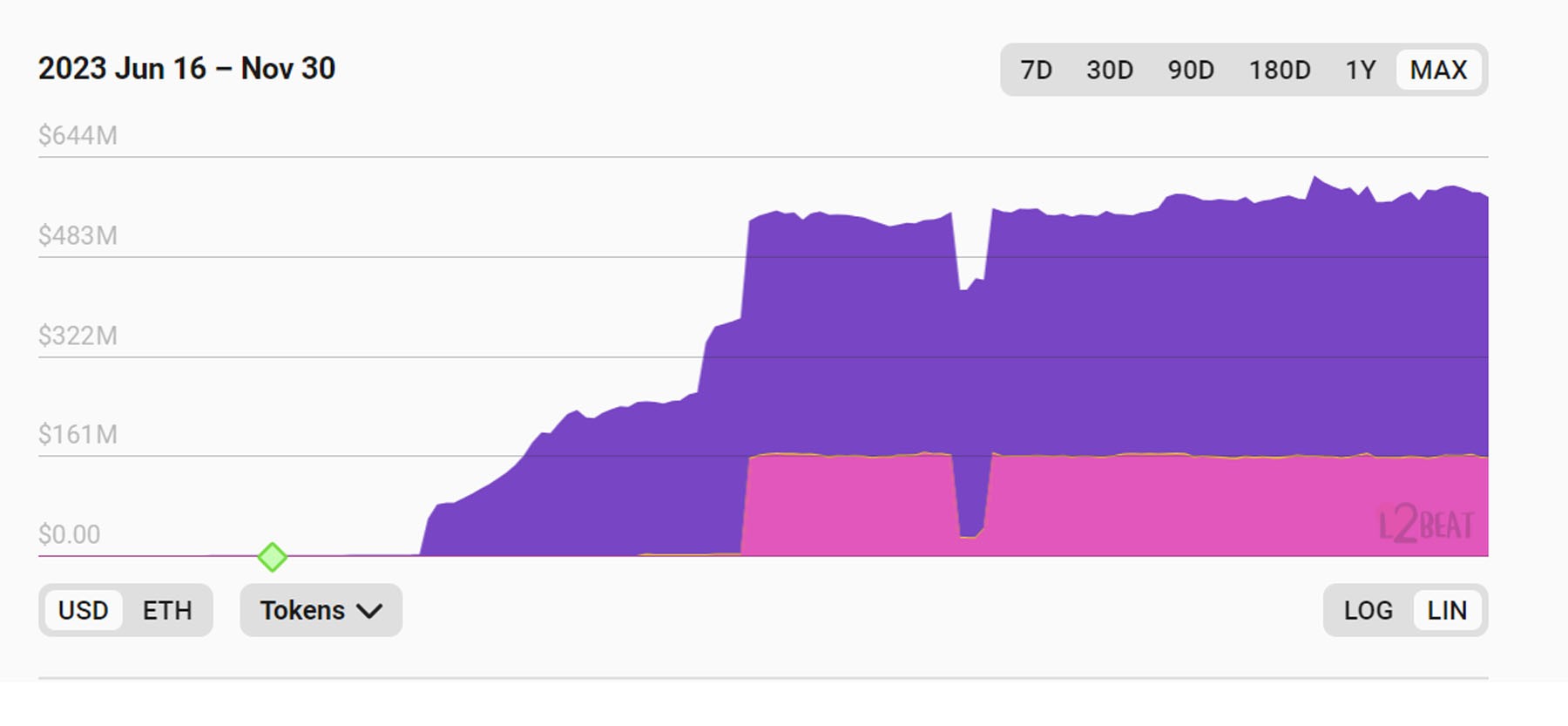

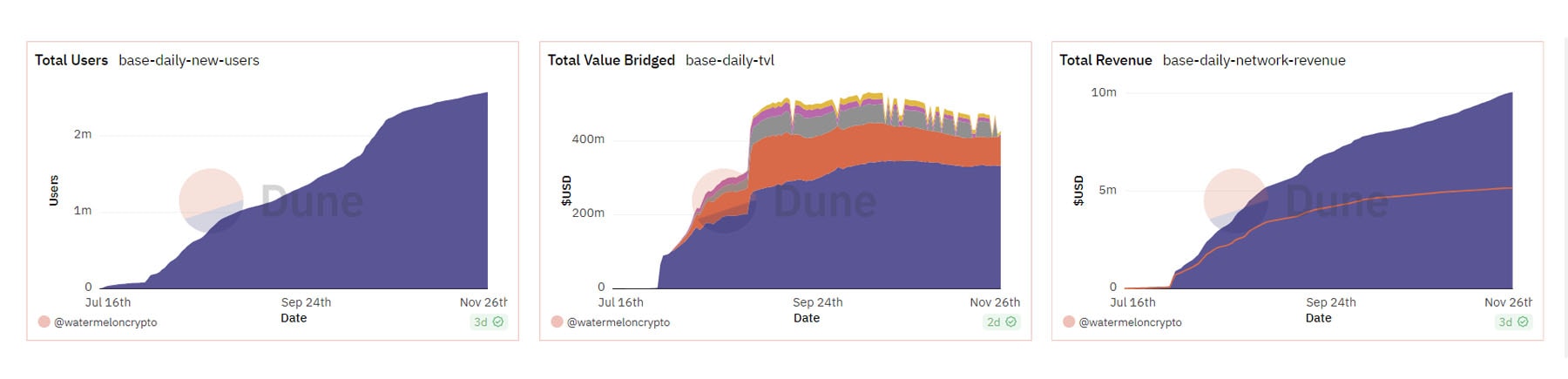

For this reason, Coinbase's Layer 2 network, Base, has the high potential to onboard many U.S. customers. We have already seen Base reach a TVL of $584 M, making it the third-largest Layer 2 solution in the space.

This TVL was reached with a total of 2.5 million unique wallet addresses using Base, and the network has already generated Coinbase a total profit of $5 million this year, thanks to sequencer fees.

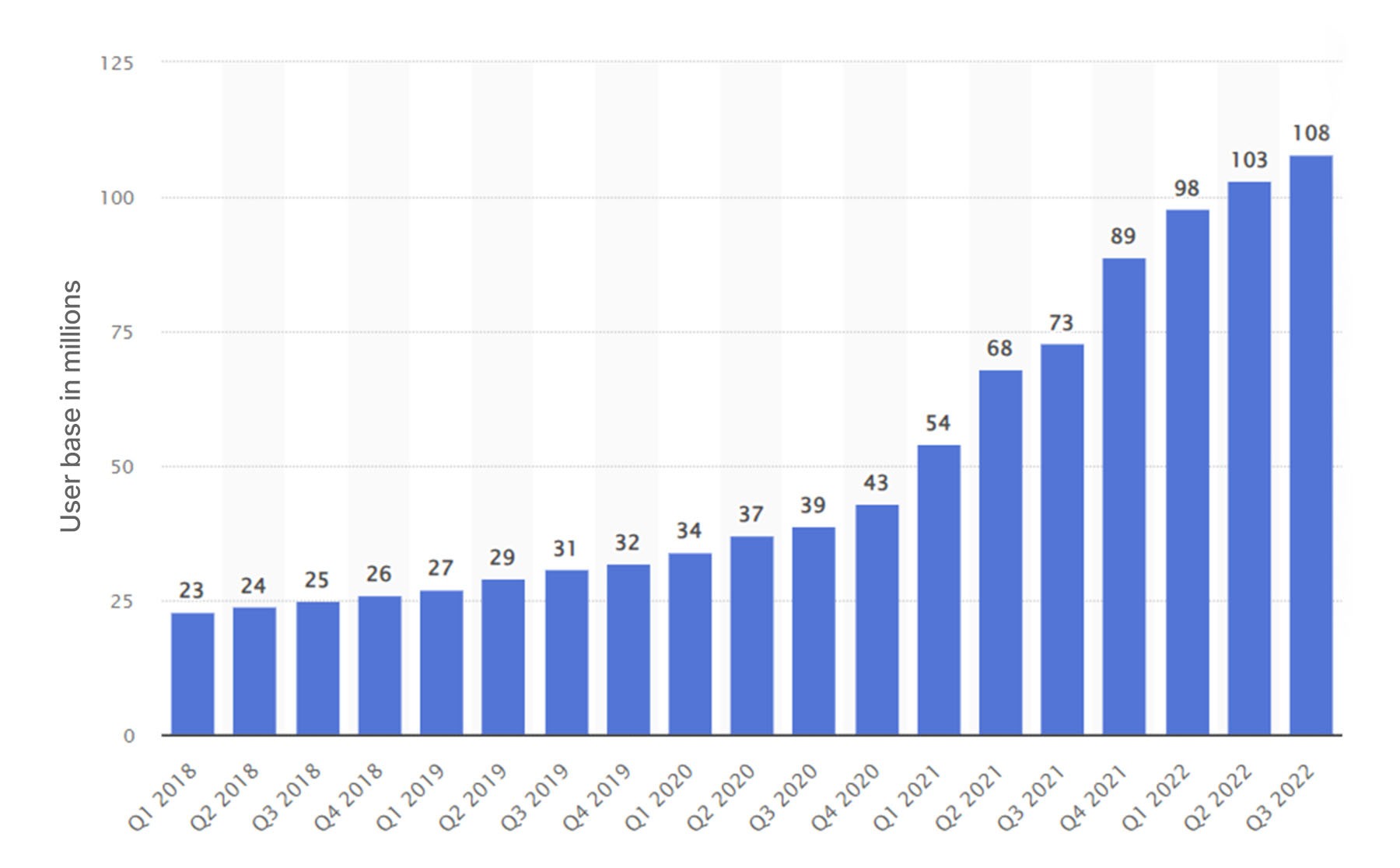

However, this number of unique addresses is still a drop compared to Coinbase's number of users on its centralized exchange, which claims to have more than 100 million unique users.

In 2021, we observed that Binance successfully onboarded many customers to BNB Chain, and we could see a similar scenario unfolding now that Coinbase appears to be in a strong position with Base for this bull market.

DeFi

However, one thing both a Bitcoin Spot ETF and Coinbase won't be able to offer is access to the perpetual market that Binance had and the wide variety of altcoins that were traded on Binance. So, DeFi, and in particular, decentralised derivatives exchanges (DEXs) stand to benefit and absorb liquidity from Binance. Unsurprisingly, CZ himself mentioned DeFi as something he would like to focus on after his resignation.As DeFi currently operates in a regulatory grey area, we anticipate users who traditionally access perpetual exchanges through loopholes, like the VIP program on Binance or non-KYC centralised exchanges, to shift towards decentralised exchanges. This could enhance on-chain liquidity and boost trading volumes for decentralised perpetual exchanges.

To prepare for this shift, make sure to visit our research reports, where we highlight some of the promising DeFi projects that stand to benefit from it.

Should you be concerned if you currently have funds in Binance?

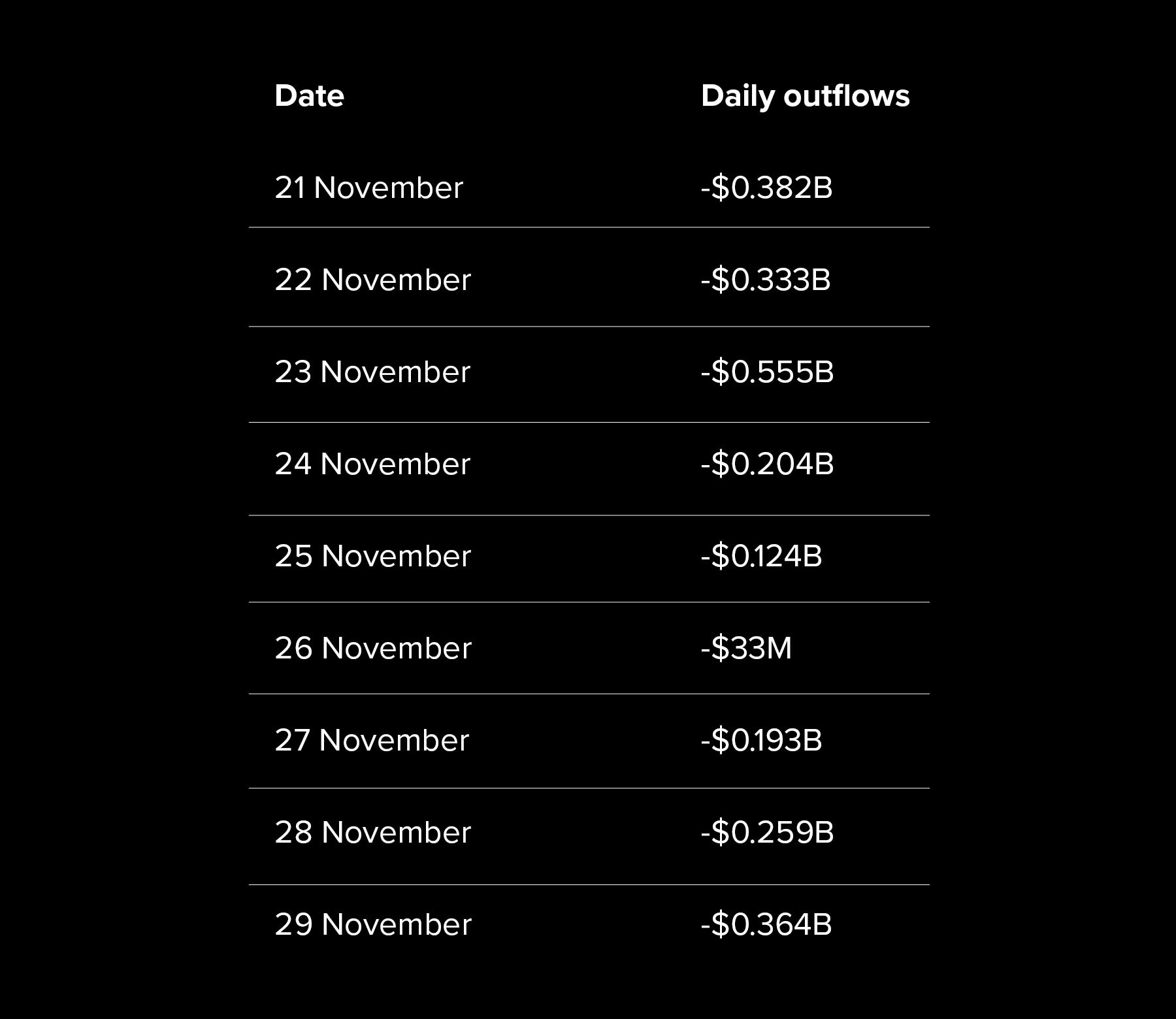

So, what if you are a user of Binance? Should you be concerned about holding your funds on the exchange?Since the news of the settlement, Binance has experienced continuous outflows.

It saw an outflow of $2.667 billion, clearly indicating that users are leaving the exchange. It will be important to monitor this number to see if Binance will continue to lose users or if it can reverse this trend.

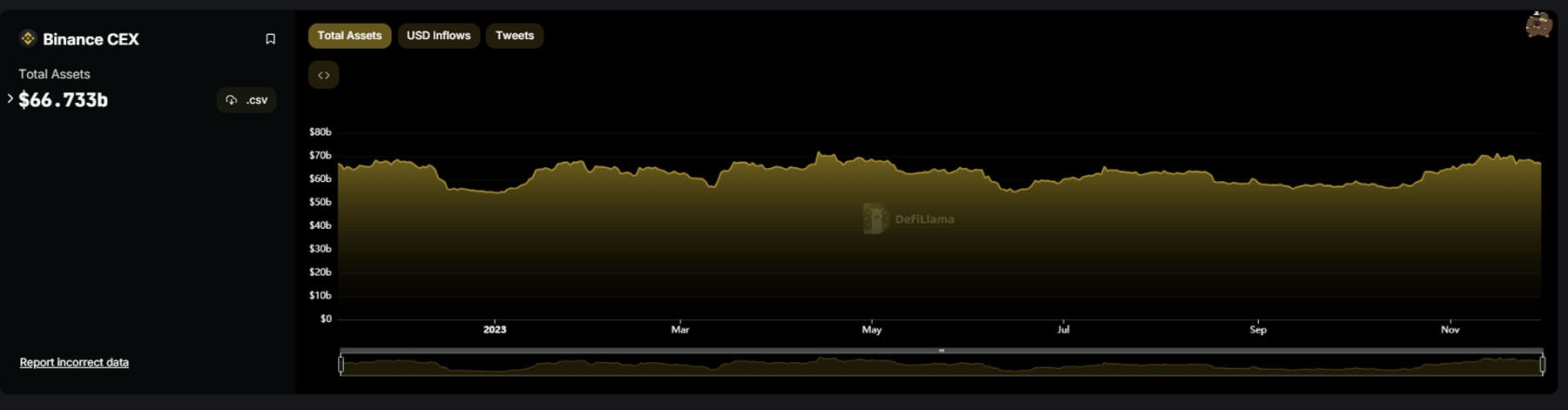

However, Binance still has a total of $66.733 billion in assets on its exchange, and the outflows it is experiencing are nowhere near as severe as the ones we saw with FTX.

While Binance has been accused of breaking many laws in the United States, the investigation did not allege theft of customer funds or insolvency. Therefore, there is no clear indication that having your funds on Binance is currently at risk.

However, there is still a pending SEC lawsuit, which accuses Binance of inappropriately using customer funds. If you are very risk-averse, we would suggest keeping the majority of your funds outside of Binance until that lawsuit is resolved.

We consider the chances low for Binance to be found misappropriating customer funds on a large scale, as the exchange has withstood multiple bank runs without much trouble.

Cryptonary’s take

If you currently hold BNB, it is important to note that the outstanding SEC investigation will need to be concluded before Binance can turn the page. And if you want to take a position in BNB, we’d advise monitoring European regulatory access before turning bullish on BNB again.As Binance's dominance declines, three pathways emerge to backfill the liquidity vacuum. Institutional flows into Spot Bitcoin ETFs will offset some loss of liquidity from Binance. Meanwhile, Coinbase stands to gain US market share. Its Layer 2 network Base has strong potential to onboard new crypto investors.

And lastly, some traders will migrate to DeFi in search of perpetuals, leverage, and other altcoins unavailable on regulated platforms. DEXs will fill the gap to provide services and features that regulatory-compliant CEXs can’t offer.

There is one project this year that we have highlighted as poised to benefit from this shift. Make sure to read the report about it here.

Nonetheless, the settlement between Binance and regulators removes a systemic risk overhanging the broader crypto ecosystem. With the legal clouds dissipating, this clears the path for renewed optimism entering 2024.

More importantly, several tailwinds line up to catalyse a potential bull run. These include the upcoming Bitcoin halving, prospects of rate cuts, and the increased likelihood of a Spot Bitcoin ETF approval.