Bitcoin ETF: What's the outlook?

For the past few months, there has been speculation and rumour surrounding the potential approval of a US-based Bitcoin Exchange Traded Fund (ETF). ETFs provide a means to bridge the traditional financial market with that of the crypto market, and the approval of a US-based crypto ETF would further fuel the ongoing adoption of cryptocurrencies by providing an avenue of investment for much of the side-lined institutional capital.

There has been difficulty in figuring out exactly what the SEC wants, and there have been many rejected applications in 2021 alone. Recent comments by the Chairman of the SEC, Gary Gensler, have provided some clarity on the subject. Consequently, a new wave of filing has begun and with many ETFs under review, we believe it is only a matter of time before one or more of them is approved.

In this journal we will explain what an ETF is, the possibility of a US ETF approval in Q4 2021, and the implications of a crypto ETF on the wider crypto market.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

TLDR

- An ETF is an easy way to get exposure to some asset through the purchase of a stock.

- A Bitcoin ETF increases the "investability" into Bitcoin because it's easily accessible.

- ETFs are mostly backed by either futures contracts, or the physical asset.

- Gary Gensler, SEC Chairman, has stated that he is “looking forward” to reviewing Bitcoin Futures ETF filings - hinting they are favouring this structure of physically-backed ones.

- SEC approval for a Bitcoin Futures ETF is likely before the end of 2021 – as early as mid-October.

- Approval for a physical Bitcoin ETF is likely at some point in 2022.

What is an ETF?

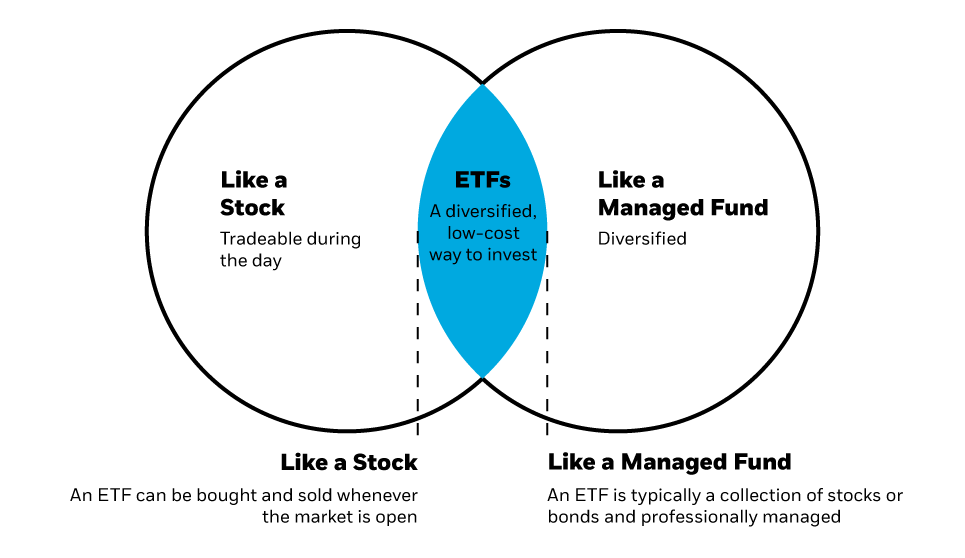

An ETF, or Exchange Traded Fund, is an investment vehicle that provides exposure to an asset, asset class, or entire sector, without the need to directly own the asset(s) in question. By holding ETFs an investor can gain exposure to a wide range of sectors without having to hold the hundreds or thousands of assets that make up those sectors.

Another benefit of ETFs is that investors can diversify their portfolio through a single investment vehicle, simplifying a portfolio whilst also providing access to exposure that would otherwise be impractical or impossible by any other means. Additionally, the number of taxable events is reduced making ETFs more tax-efficient and whilst simultaneously limiting all the associated commissions and fees when managing a portfolio consisting of tens/hundreds of assets.

An ETF is freely traded in the same way as a stock and comes under the same regulatory oversight. This is attractive to institutions because there are certain protections in place that are generally not present in the crypto market. Additionally, ETFs slot perfectly into the existing financial system and so no additional knowledge, or experience is required to interact with and trade them.

With respect to crypto, the most desirable ETF for institutional investors is a Bitcoin ETF that tracks the spot price of Bitcoin. A Bitcoin ETF allows investors to gain exposure to Bitcoin without having to deal with the associated sources of risk such as acquiring the Bitcoin, safely storing it, hacks, exploits, scams – anything that could happen when interacting with the blockchain.

There is also a key difference in ETF typing. A futures ETF purely tracks the price of an asset without any assets to back the contracts, whereas a physical ETF is backed by the underlying asset which is held in custody. A physical Bitcoin ETF would massively influence the price of Bitcoin if demand was high because BTC would be accumulated to back the issued ETFs, a futures ETF would still indirectly affect the market, but these effects would be more subtle.

This all sounds great – but why is there still no SEC-approved Bitcoin ETF?

SEC Concerns

The first application for a Bitcoin ETF was filed with the SEC in 2013. Since then, there have been many filings – and many rejections. Currently, there are 13 ongoing applications for a Bitcoin ETF, and it is unlikely that the SEC will approve a physical Bitcoin ETF anytime soon. The main concern that the SEC has is that the crypto market can be subject to market manipulation due to its unregulated nature. Additionally, the SEC has concerns surrounding the potential market impacts if there is a rush following any approval of a physical Bitcoin ETF.However, in a statement on the 27th of September, SEC Chairman Gary Gensler re-affirmed his openness to a Bitcoin Futures ETF that would trade under the protection of a 1940s law. The Investment Company Act of 1940 was signed into law by Franklin D. Roosevelt to provide a stable framework for financial markets after the disastrous stock market crash of 1929.

Canadian ETFs

There are already ETFs approved in the Canadian market that will no doubt be of interest to the SEC and could influence any decisions they make. There are several Canadian crypto ETFs, the first of which was approved in February 2021. Here are a couple of notable examples:- Purpose Bitcoin ETF (BTCC) – The first crypto ETF in the world, with over $1.3 billion AUM and a management fee of 1%. Purpose is a physical ETF meaning that Bitcoin is held in cold storage.

- 3iQ CoinShares Bitcoin ETF - $1.3 billion AUM with a 1% management fee.

- CI Galaxy Ethereum (ETHX.B) - $690 million AUM with a 0.4% management fee.

What’s the outlook?

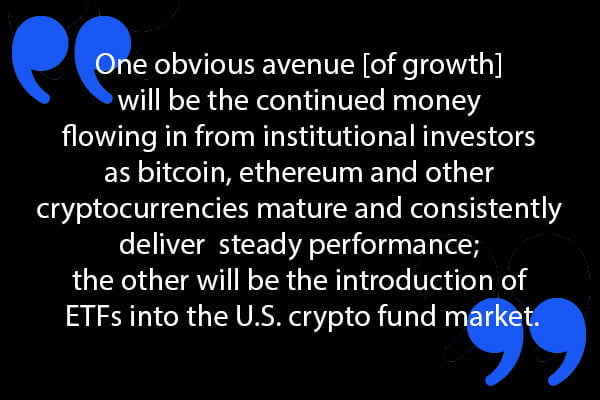

There is a chance that a Bitcoin Futures ETF could be approved as early as this month (October) if the rumours are to be believed – if not October, then some point during Q4. At the end of September, Coinbase stated in a GFM report that Gensler is more sympathetic to the integration of cryptocurrencies into the financial system than his predecessors were.

Additionally, Coinbase stated that they believe that further expansion of the cryptocurrency market will be fuelled by continued institutional investment – the introduction of a US based ETF will accelerate this expansion. As much as we don’t agree with the regulatory approach that the US has taken towards the crypto market, it is undeniable that the United States is where all the money is. All eyes have always been on US policy, and decisions made there always influence all aspects of the global economy - the crypto market is not insulated by any means.

After Gensler’s comments surrounding the Investment Company Act and futures preference, applicants refiled to ensure that their applications adhered to that law. There are a few of the ETF applications that could be approved in the coming weeks:

- ProShares Bitcoin Strategy ETF – ProShares had a Bitcoin Futures Mutual Fund approved and launched in July 2021, and the process for converting that to a fully transparent ETF is not too complex. Potential approval date 18th October.

- Valkyrie Bitcoin Strategy ETF – a Bitcoin Futures ETF that is limited in scope, filed under the 40s Act, and is similar to the already approved ProShares Mutual Fund. Potential approval date 25th October.

- Invesco Bitcoin Strategy ETF – another futures ETF that will hold contracts that track the price of BTC. Potential approval date 19th October.

Another possibility is that the SEC decides to approve multiple 40s Act ETFs on the same day. This would prevent any one single firm from gaining a first-mover advantage over the rest.

Further still, they could reject them all and postpone a Bitcoin ETF until some point in 2022. We would place our bets on one or more being approved by the end of this year - sooner rather than later.

Importance of an ETF

Many institutional investors, as well as older retail, find it difficult and in some cases impossible to invest into BTC, even though they are quite eager to get exposure to it. Since an ETF is traded on stock exchanges just like a stock, a Bitcoin ETF opens up a new door for capital to flow from - many expecting it to be quite large.For example, let's look at what happened to Gold's price when an ETF was finally approved.

As you can see, the price of Gold went up 6X after the ETF approval because it simply increased access to the asset. To be clear, futures-backed ETFs are not the perfect solution but a great starting point nonetheless.

We personally view the approval of a BTC ETF to be a highly bullish event for Bitcoin over the long-term. Perhaps more bullish than that of Gold.