Bitcoin strategy that beat the market: MicroStrategy playbook

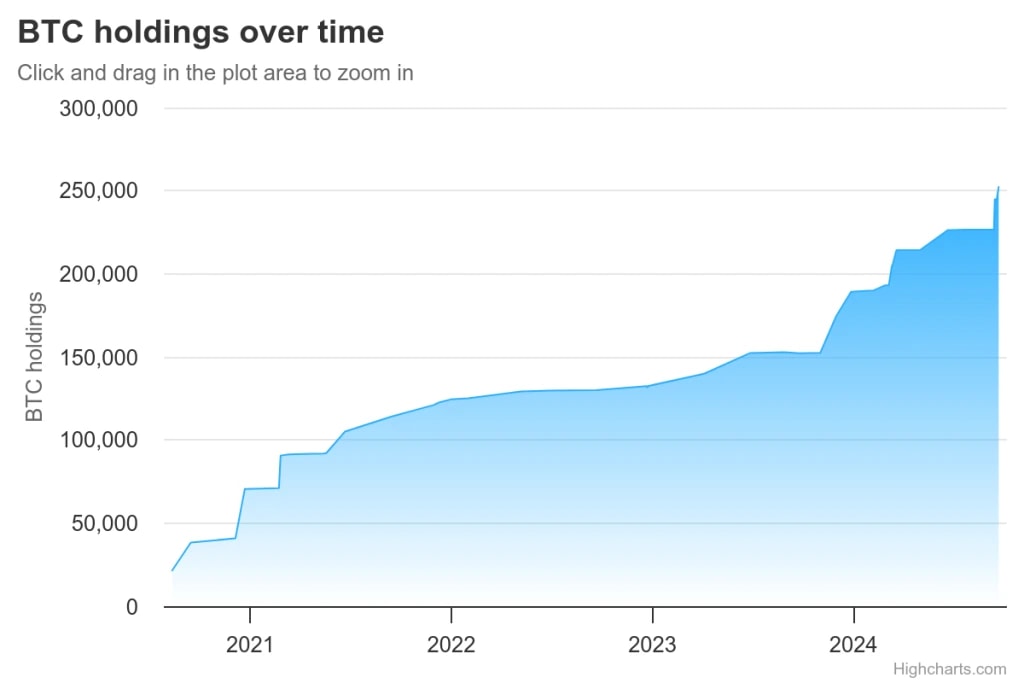

What if we told you that an early business intelligence AI company transformed itself into the world’s largest corporate holder of Bitcoin—amassing more than the entire U.S. government, with over $16 billion in assets—and it only took four years to pull it off?

Sounds unbelievable, right? But it’s true, and the company making waves is none other than MicroStrategy. In this article, we’ll dive deep into who MicroStrategy is, their audacious journey into the world of Bitcoin, how they accumulated such vast holdings, and what they envision for the future of crypto. This is one story you don’t want to miss, so grab a cup of coffee, sit back, and enjoy the read!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is Microstrategy?

MicroStrategy, a pioneering business intelligence and software company founded in 1989, has long been known for its innovative approach to data analytics. However, it wasn’t until 2020 that the company made headlines for a different reason—its bold entry into the crypto world.MicroStrategy burst onto the Bitcoin scene in August of 2020 when, in their SEC filing, it was revealed that they used $250m of their treasury to acquire about 21,504 BTC, which would now be worth just north of $1b. Michael Saylor, then CEO of Microstrategy, said that Bitcoin was a “reasonable hedge against inflation” and that acquiring it was part of a move that is part of our new capital allocation strategy, which seeks to maximize long-term value for our shareholders.”

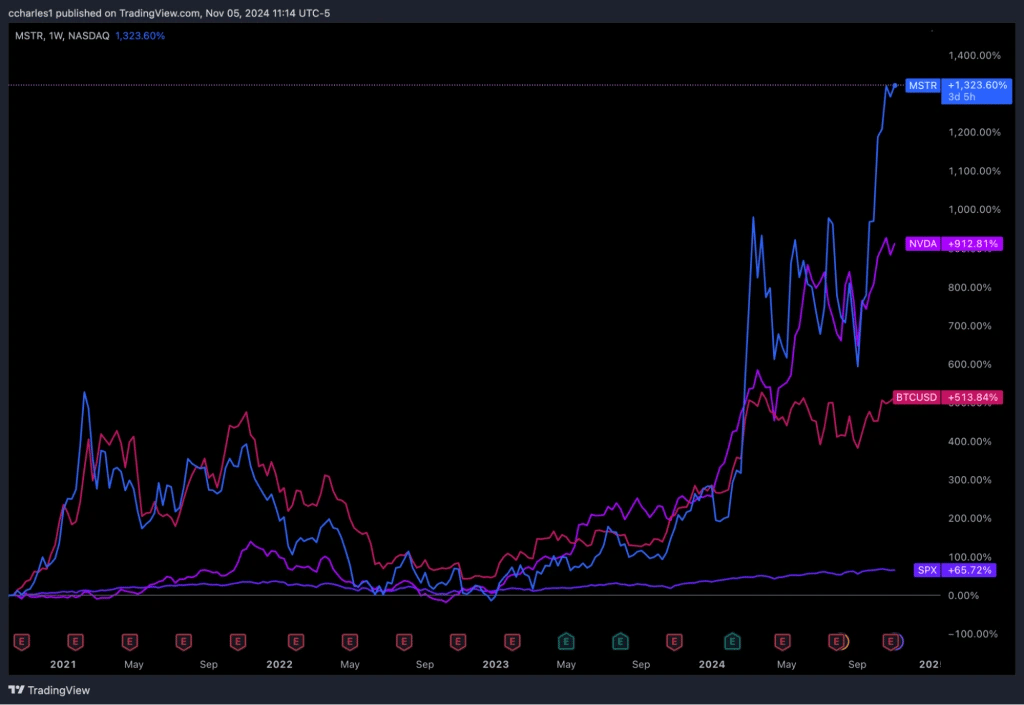

Since that day four years ago, Microstrategy now has 252,220, as of Sept 20th, 2024, Bitcoins, more than 10 times its original amount in 2020. Their average buy price now is $39,292 for all 252,220, making its stash valued around a mind-boggling 18 billion dollars… But that isn't all. MSTR's stock has also increased over 10x, outperforming Bitcoin and the AI giant of the year, Nvidia. Saylor even said in an interview, "We beat every single company in the S&P index using Bitcoin strategy.” As it would happen, the data agrees.

But why Bitcoin?

Even back in 2020, committing such a significant amount of capital to a relatively new asset required a solid thesis. As mentioned earlier, then-CEO Michael Saylor viewed Bitcoin as a hedge against inflation, but this decision was far from impulsive.During the pandemic, when uncertainty surged, and money printing was going through the roof, Saylor recognized an urgent need to safeguard MicroStrategy's cash reserves from the looming depreciation. His choice was bold and decisive, backed by the powerful conviction that “Bitcoin is digital gold – harder, stronger, faster, and smarter than any money that has preceded it.” This pivotal move transformed MicroStrategy’s legacy from a renowned business intelligence firm into the largest corporate Bitcoin holder in the world.

Saylor’s bullish view on Bitcoin extended even further as he actively sought to short the dollar by leveraging the company’s Bitcoin position. This strategic manoeuvre highlights his deep conviction in Bitcoin’s long-term potential to outpace traditional currency and protect the company’s assets.

Understanding MicroStrategy’s leverage

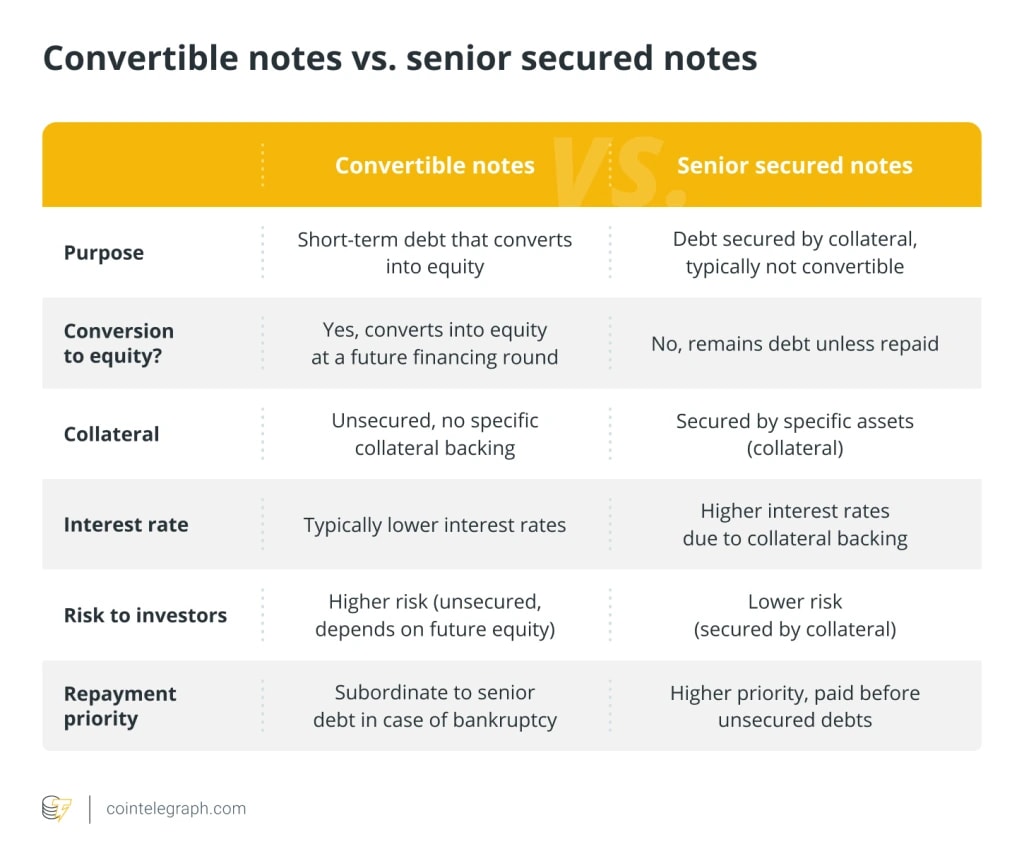

Digging deeper, we can see that MicroStrategy has cleverly structured its Bitcoin accumulation strategy. Instead of using cash, they issue convertible notes or bonds and use the proceeds to buy Bitcoin. They usually use either senior convertible notes or convertible notes, which are more deeply explained here.

These bonds are favourable as they can raise a lot of money at low interest rates and have flexible terms that allow the company to convert, redeem, or extend based on Bitcoin’s market performance. Using this “smart” debt, MicroStrategy can purchase Bitcoin without stressing its cash on hand, which can then be used for other business expenses.

A common fear is that a price crash could trigger forced Bitcoin sales from MicroStrategy, but a recent release from BitMEX Research shows otherwise, highlighting MicroStrategy’s debt structure is relatively healthy.

Overall, MicroStrategy’s game plan is built around strategic decision-making, not knee-jerk reactions.

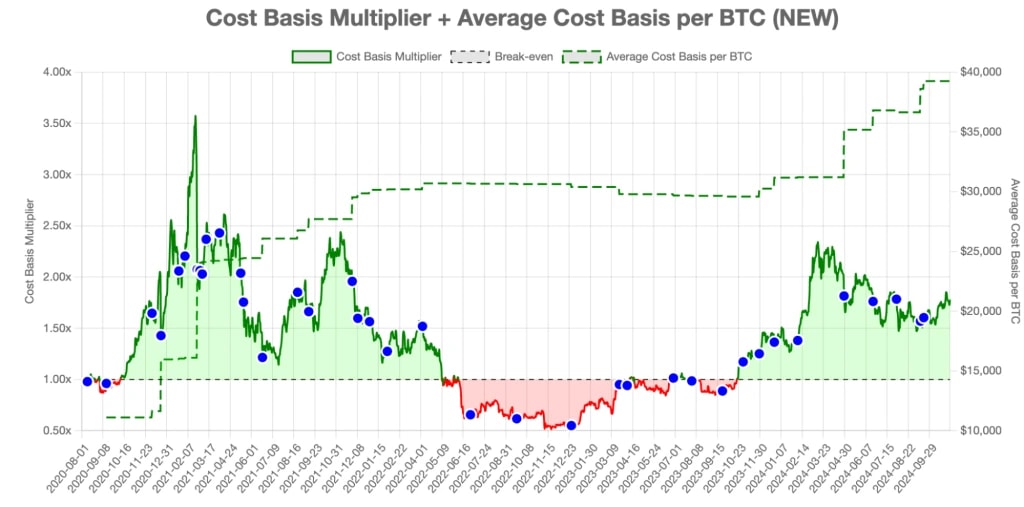

Do they hold too much Bitcoin?

One of Bitcoin’s core value propositions is decentralization and a fair distribution of supply. With their holdings of 252,000 Bitcoin and roughly 21 million Bitcoin in circulation, MSTR holds approximately 1.2% of the total Bitcoin supply. While this is quite a large number, we believe MicroStrategy isn’t a large market risk for 2 reasons: (1) the operators remain very long-term bullish on Bitcoin, and (2) while they are “leveraged,” they are noticeably under leverage and reports, say that Bitcoin would need to fall below 20,000 for Microstrategy to need to be a forced seller.Additionally, MicroStrategy has been battle-tested before, and in 2022, the company's Bitcoin holdings went down almost two billion dollars or 50% in the red. Amidst all of this, Microstrategy stayed strong and bullish while the rest of the finance industry danced on its grave. Fast forward two years later, and they are now up over 8 billion dollars. It is an actual master class in conviction and not being over-leveraged, as some have been in the past.

From this, we can piece together that they are at a very low probability of being a liquidation risk, but we will dig more into this in the next section.

From such a big play starting in 2020, MicroStrategy’s Bitcoin play has redefined treasury management, and big strides have been made in the holdings of Bitcoin, inspiring the likes of Tesla, Block, and some countries as well.

Below, we have a chart showing Microstrategy's holdings and performance since its inception, and we can see that the Bitcoin play is playing out quite well most of the time; with their average healthily below the current price, $71,000, it remains very much in profit.

What's a better investment?

So now that we have laid out the bull case for MSTR and how we think they are a solid company, let’s dig further into whether buying MSTR is better than buying the other BTC tradfi products or even BTC itself.When it comes to MSTR vs other BTC tradfi products, the win goes to MSTR. MSTR has no fee, and as it is correlated to Bitcoin, the best-case scenario if you buy the ETF over MSTR is that you underperform versus BTC. Compared to other Bitcoin companies, MSTR is above them all as they hold 1.2% of the BTC supply; this is called a moat, which, as Warren Buffet says, “A truly great business must have an enduring ‘moat’ that protects excellent returns on invested capital,”. We do think that MSTR holding this much supply gives them one.

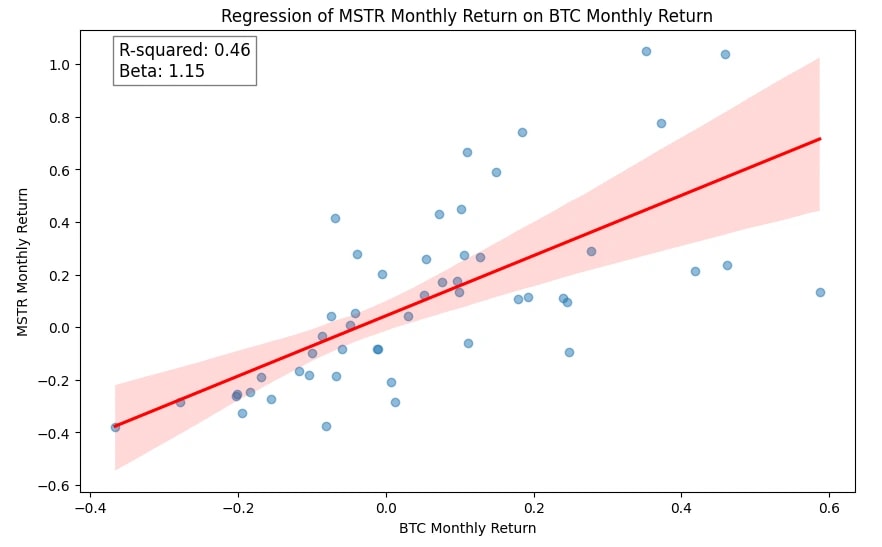

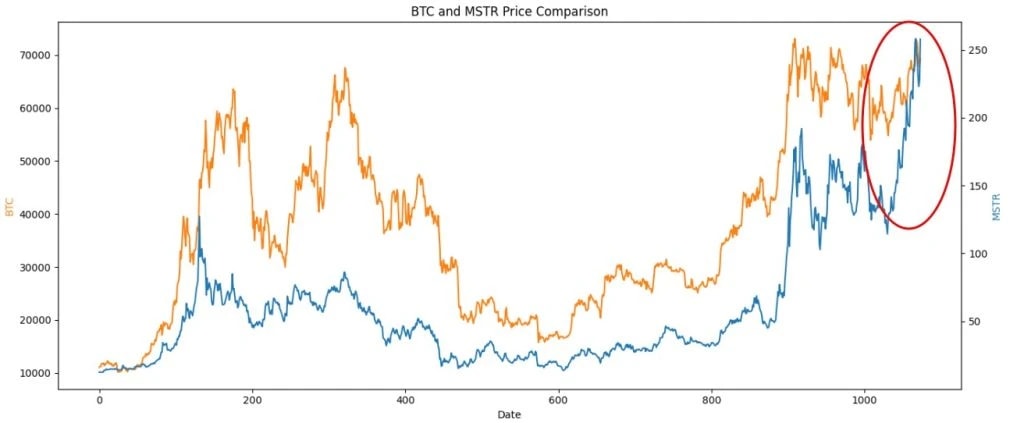

When deciding whether to invest in MSTR or BTC directly, it is essential to understand the relationship between these two assets and how they perform under various market conditions. The provided charts offer valuable insights into the dynamics of MSTR's performance relative to BTC.

First, a regression analysis of MSTR’s monthly returns will be performed against BTC’s monthly returns. This analysis reveals an R-squared value of 0.46, indicating that approximately 46% of the variability in MSTR’s returns can be explained by BTC’s monthly performance. Additionally, the beta value of 1.15 signifies that MSTR is more volatile than BTC. Specifically, for every 1% change in BTC’s returns, MSTR’s returns change by an average of 1.15%. This higher beta implies that MSTR amplifies the movements of BTC, making it a leveraged play both on the upside and downside.

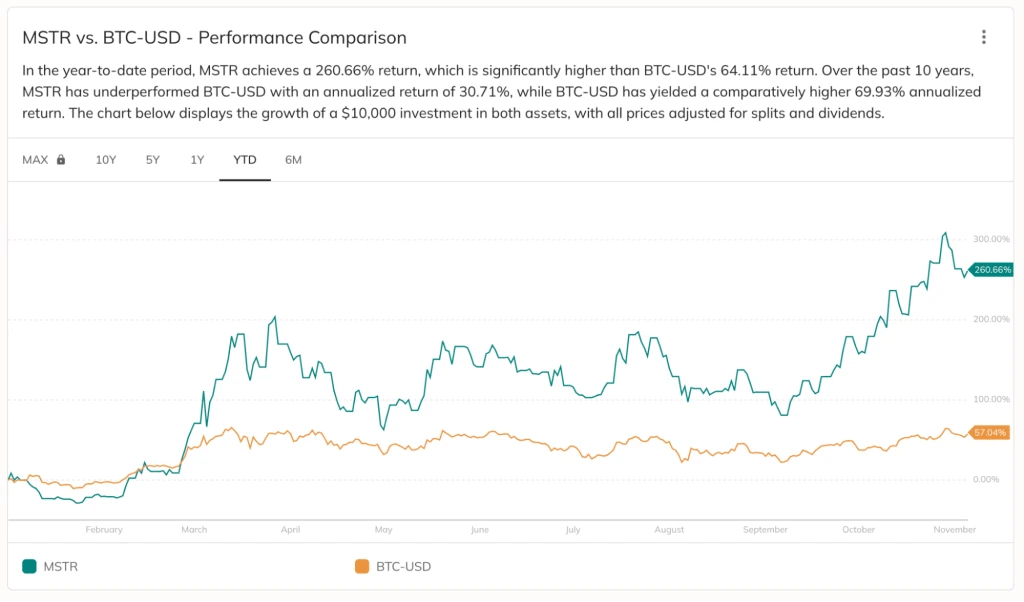

Secondly, let’s look at a year-to-date (YTD) performance comparison between MSTR and BTC. As of the current YTD period, MSTR has achieved a staggering 260.66% return, significantly outperforming BTC’s 64.11% return. This stark difference underscores MSTR’s potential to deliver superior gains when BTC prices rally. However, despite BTC’s impressive 10-year annualized return of 69.93%, MSTR’s annualized return over the same period is only 30.71%, indicating that while MSTR can offer remarkable short-term gains, it has historically underperformed BTC over the long term.

However, risks are not limited to just market-related risks. When you purchase BTC and hold your own private keys, only you have access to your assets—it is entirely yours. No one can take it from you as long as it remains secure. In contrast, buying shares of MSTR exposes you to the risk associated with the company's custody of their Bitcoin holdings. Additionally, there is the potential risk of dilution over time. As MSTR's stock price increases, the company may be incentivised to issue more shares to buy additional Bitcoin. While this strategy can be beneficial if they accumulate BTC at a rate that outpaces dilution, it still adds an element of risk.

Most importantly, holding your own Bitcoin provides unparalleled financial freedom. In the future, if regulations become more restrictive and limit how you can transact, having direct access to your on-chain Bitcoin ensures you can still manage and use your assets. This flexibility is not available when holding MSTR shares.

Overall, we believe MSTR is the best TradFI beta asset for gaining exposure to Bitcoin. However, when it comes to holding BTC itself, there is no debate: while MSTR may theoretically continue to outperform in certain conditions, considering all angles and potential risks, BTC remains the superior long-term hold.

Looking ahead

Recently, Microstrategy released their Q3 earnings call, and from it, we can tell that a majority of their numbers look good, including a 1.1 billion dollar raise to, you guessed it, buy more Bitcoin! One thing to note is that their revenue from the software business side of things is down 10% yearly.Additionally, they have announced a strategic plan to raise 42 billion dollars over the next 3 years to acquire more Bitcoin; realistically, this should turn into about 20 billion dollars worth of actual Bitcoin purchases. That is bullish!

In our view, MicroStrategy’s stance on Bitcoin remains solid. And their business plans echo that. They continue running with the idea that Bitcoin is “digital gold,” and the value will continue to rise with the adoption and technological advances they voiced back in 2020. Despite Bitcoin’s volatility and massive sways in price, the company remains committed to holding and increasing its Bitcoin balance sheet.

Lastly, although many feel MicroStrategy’s stock is trading at a ridiculous premium related to its holdings, we have found no reason to believe this is bearish or bullish.

Is there any alpha in MSTRs price movements?

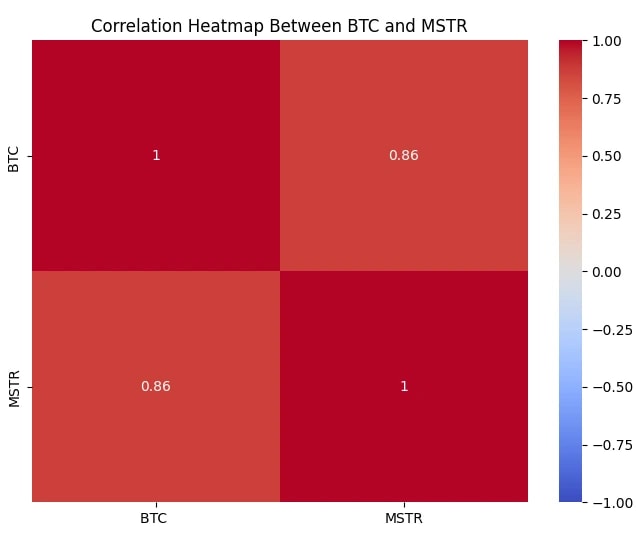

There is a strong relationship and connection between MSTR and BTC. The assets are correlated at a whopping ratio of 0.86 on a daily basis. Given this strong connection, what else can we learn about the relationship of these two assets?

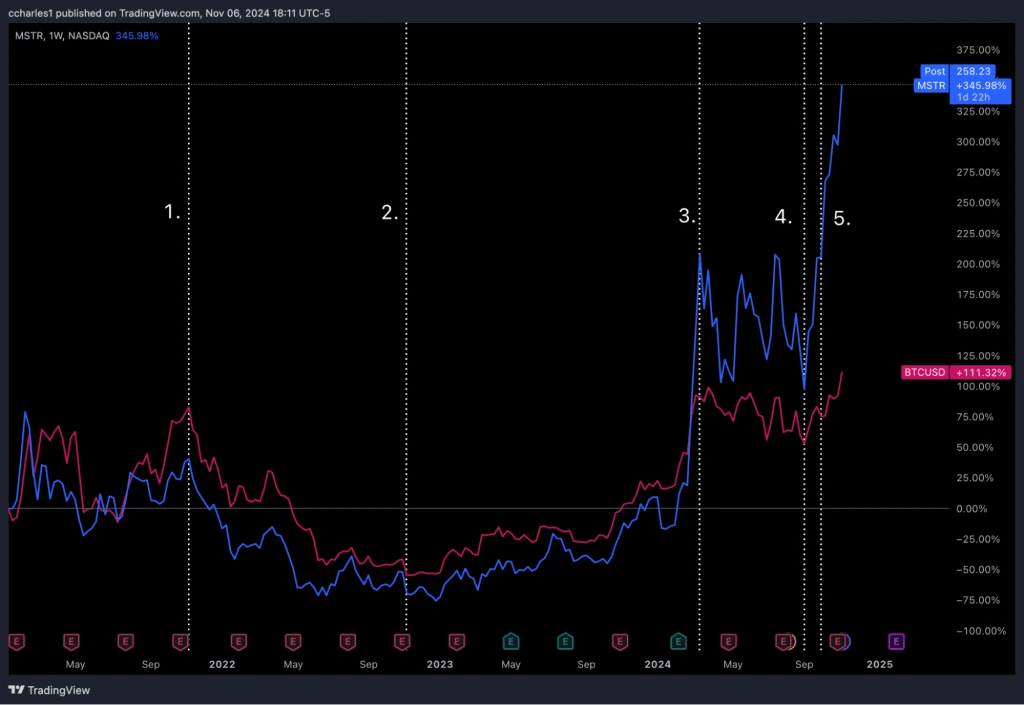

There have been discussions that MSTR is a “leading” indicator for BTC, meaning BTC follows MSTR’s price and interestingly enough when looking at the chart there could be some merit to these statements.

In the first vertical line, we see that both assets top in the same week of November 2021. However, in the second line, BTC ended up bottoming before MSTR. Then, in the third one, we see MSTR locally top a week before BTC did in March 2024; in the fourth one, we see that they bottomed within the same week in September.

Even though the data historically has been inconclusive, we believe there is something interesting here. If you look closer at how these assets behaved over the last months, we can see that MSTR broke out much earlier than BTC, and BTC is starting to follow that.

Assuming there is now a structural lag between MSTR and BTC, we can expect BTC to follow MSTR and demonstrate similar explosive moves in the coming weeks/months.

Cryptonarys take

Saylor’s relentless bullish stance on Bitcoin is evident in his public declarations, including his bold statement on CNBC: “My long-term forecast is that [Bitcoin’s] going to go to $13 million over 21 years.” His unwavering confidence, regardless of day-to-day price fluctuations, sends a powerful message to companies and investors alike: holding Bitcoin is not just speculative; it’s about securing a strategic position for the future.In the end, MicroStrategy's story isn't just about stacking BTC; they're setting a real-life example of what it means to have true conviction. There's a lot we can learn for retail investors like us.

When they first bought into Bitcoin in August of 2020, it wasn't just a small move where they were testing the waters. Instead, it was a powerful statement about protecting their future in a world where the dollar is weakening and traditional finance is losing its edge. They didn't waver when the market took a nosedive in 2022 either; despite being down 50%, they didn't sell just because things got wild. They had a plan and stuck to it, showing us all that genuine belief means riding out the storms, not abandoning ship.

MicroStrategy proves that when you back something you genuinely believe in, there's power to hold it steady. It's a reminder to look beyond the day-to-day market noise and volatility. When you have conviction in your choices, you play the long game, just like they did and continue to do. So, even though things look amazing now, next time the market gets rocky, think of MicroStrategy: if they can go all-in and stay the course, we should, too.

That’s it for us.

Cryptonary, OUT!