But a reality check every now and then is, again, a core part of being in crypto.

Having a plan and looking ahead is essential for succeeding in this market.

The damage is done, but what's in store going forward?

Let's examine the current state of the market and consider how headwinds and tailwinds could influence the market direction; you may be surprised!

Key questions

- What's really behind the recent crypto bloodbath, and could it actually be setting the stage for something bigger?

- Is this 27.6% drawdown just par for the course or a sign of something more ominous? The historical context might surprise you.

- Why are some analysts eyeing Q3/Q4 with anticipation despite the current market fear?

- What do dwindling exchange balances tell us about potential price action, and how might upcoming events create a perfect storm?

- Are we witnessing a complete reset of market mechanics, and what hidden opportunities might this present for savvy investors?

- How are miners' behaviours diverging from expectations, and what could this mean for Bitcoin's supply dynamics?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

State of the market

Since April 2024, the crypto market has been trying to find its footing. While there have been periods of recovery, the overall trend has been downward, with Bitcoin and other major cryptocurrencies experiencing significant price corrections.

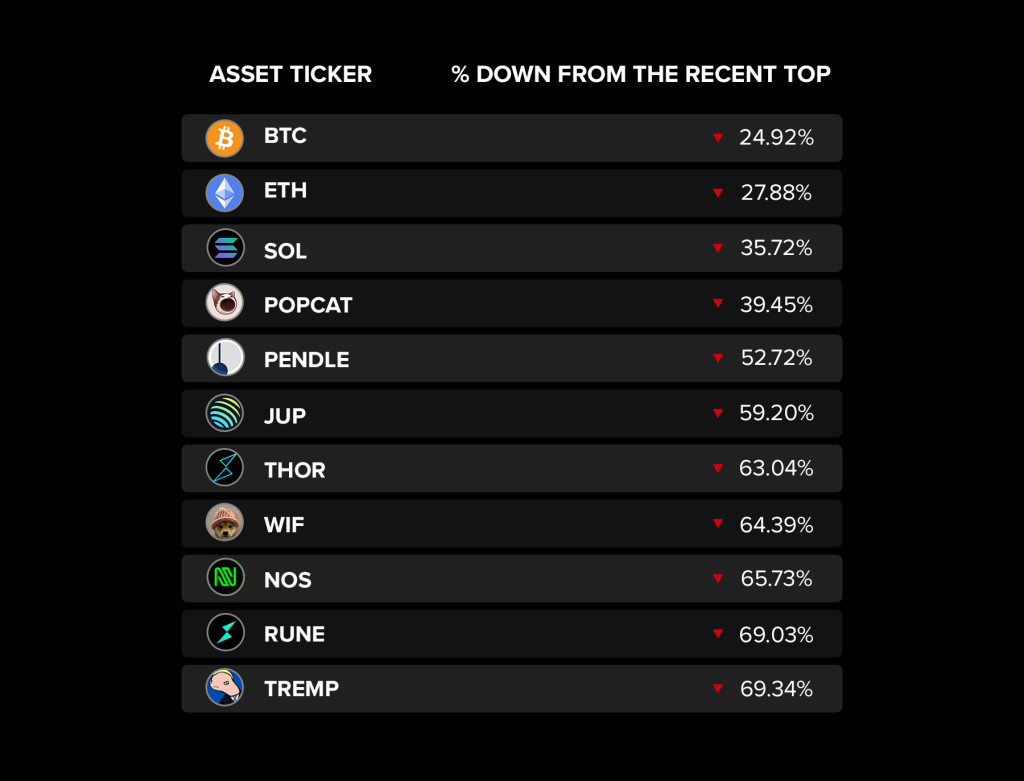

Alts have been hammered, with most down 30-70%. The picture gets worse the lower down the market cap rankings you go.

To summarise - a total bloodbath.

You might be asking…

Why is everywhere red?

Mt. Gox, a defunct Bitcoin exchange, is preparing to repay its creditors, which involves distributing 141,686 BTC (approximately $9 billion) to them. This repayment is part of a decade-long process following the exchange's collapse in 2014 due to multiple hacks.

On the other hand, the German government has been selling Bitcoin, which it seized from the film piracy website Movie2k.to operators. The government has transferred 1,000 BTC (500 BTC each) to Kraken Deposit and Bitstamp exchanges, worth about $65.14 million.

There are currently 47.859k BTC in the German Government address, worth about $3.1 billion.

Even though Justin Sun, the founder of Tron, has proposed purchasing all of Germany's Bitcoin holdings through an OTC deal, the low liquidity environment has caused cascading liquidations and a significant decline in prices.

When in doubt, zoom out

We were expecting BTC to break below the bearish flag we have identified here.We saw Bitcoin fall, but if we keep it real, we (nobody) didn't expect it to fall this far and so fast.

On the other hand, despite the 15.8% drawdown in Bitcoin's price over the past four days feeling heavy, this price drawdown is historically very typical in Bitcoin bull runs. In prior bull runs, 20% to 30% drawdowns were common. This current drawdown is a 27.6% drop from an all-time high to today's low of $53,300.

This correction was necessary. Today marks the end of the longest period Bitcoin has gone without a 25% correction; therefore, this current correction has been long overdue and arguably needed.

If we zoom out further, despite seeing a terrifying bloodbath today, if we compare prices to 1 year ago, most of the solid plays are up 400%-500% on average.

Market sentiment, despite being up on a yearly basis, is quite depressing. The pervasive negative sentiment, coupled with the market's uncertainty and unpredictability, has made it challenging for investors to make rational decisions. This often leads to impulsive actions driven by fear.

Notably, the Fear & Greed index has turned into "Fear" for the first time in 18 months. The last time the index was at 29 was in January 2023, highlighting the current level of unease in the market.

While it may be tempting to panic during such a downturn, it is crucial to maintain a level-headed approach and avoid succumbing to fear.

And here is why…

Positive catalysts

There are a number of positive things that we see in the market that can mark the bottom around current prices.We might see the price wicking to $52k—$53k as a result of liquidations; however, we believe the bottom might form around these prices over the next week or two, and a full risk-on environment in Q3/Q4 fueled by interest rate cuts and US presidential elections.

In addition, we see some other signs that the bull market will continue in the coming months.

Bitcoin supply on exchanges

Over the past 6-8 months, the balance of Bitcoin on exchanges has been steadily decreasing.This trend is usually a positive catalyst for Bitcoin's price. Those who want to hold BTC long-term usually withdraw it from exchanges so as not to be subject to the inherent risks of CEXs.

Therefore, the BTC balance on exchanges can usually be a proxy for how many potential sellers are there in the market.

As the supply of Bitcoin on exchanges decreases, it is a good indicator of sellers running out of coins, which is positive for the price of BTC.

Ethereum supply on exchanges

Same story with Ethereum; the balance on exchanges has been decreasing consistently. With the upcoming ETH ETF, we can expect some form of supply squeeze sometime in the future.The decreasing supply of BTC and ETH sets a good precedent for positive price action in the future.

Complete resetting in mechanics

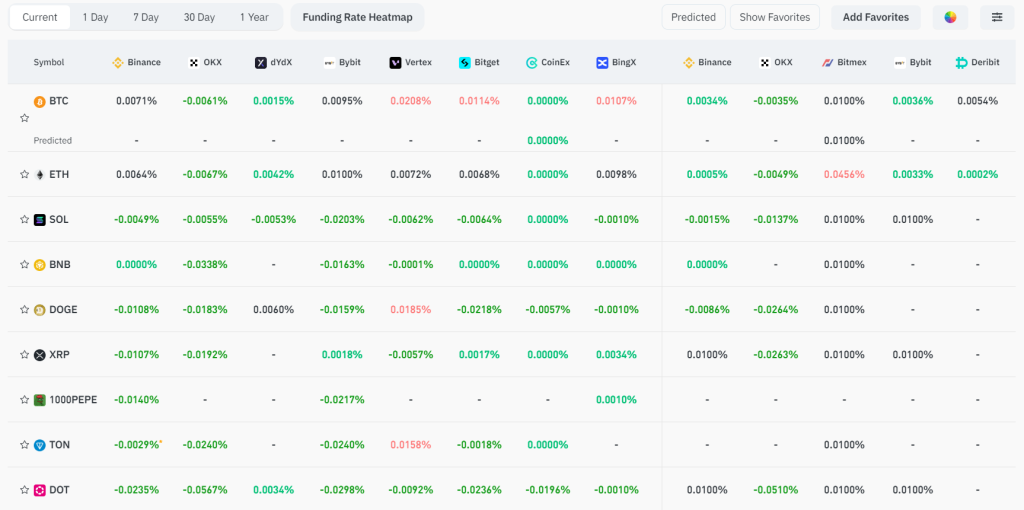

When we look at market mechanics, we want to examine the makeup of the leverage market. This involves examining Funding Rates (are traders biased to be Long or Short), Open Interest (how much leverage is on/are traders betting with), and positioning (what was the positioning then, and what is the positioning now?).So, starting with Funding Rates. We can see that BTC and ETH still have a positive 0.01% Funding Rate. This is a flat rate and means there is an even balance between Longs and Shorts, as neither side is overweight enough that it's pushing the Funding Rate higher or lower.

However, we can see that many of the altcoins have a very negative Funding Rate here. This is literally looking at the number and seeing that it is negative.

The more negative it is, the more traders are Short. Negative funding rates across the board open the door for a short squeeze.

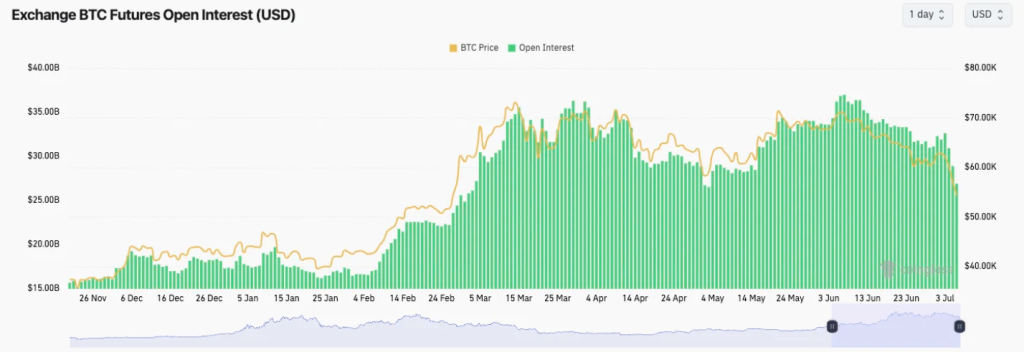

BTC open interest

Open Interest has seen a 27.30% decline, and positioning has now been more substantially reset as the market has seen over $600m in Long liquidations today.Previously, the market had been looking at opportunities for Longs, but now participants have pivoted to wanting to be net Short.

This setup tends to be a turning of the tide on a more zoomed-out view, i.e., we've had a long period where participants have wanted to be Long, and prices have pushed lower.

We're now potentially entering a period where participants want to be Short, which can help the price grind higher. These market cleansing events are healthy and are usually needed in a wider bull market.

Potential interest rate cuts

The European Central Bank (ECB) has already started its rate-cutting cycle, which is expected to continue throughout the year. Several more cuts are anticipated.This move is a positive development for the crypto markets, as lower interest rates can lead to increased liquidity and potentially drive more investment into assets further along the risk curve.

Additionally, the Federal Reserve has stated it "only" expects to cut interest rates once this year. However, this statement is already a huge backtrack on comments made last year that the Fed doesn't envision rate cuts till 2025.

Fed Chair Powell's comments were positive for the future of markets, indicating that the US economy was heading for disinflationary territory. This is worse for the economy than inflation and is an outcome that the Fed will be more than happy to turn the money printer back on to avoid, which bodes well for crypto in the latter half of this year.

Miners' balance

Lastly, Bitcoin miners' balance has been sharply declining since January 2024, even before the Bitcoin halving in April 2024.Miners are always on the sell side of the supply-demand equilibrium. Decreasing the balance of miners indicates that the sell side is getting weaker, which inevitably leads to a supply squeeze.

Therefore, we are confident that the bottom is in or very near, and it is just a matter of time before the game theory behind Bitcoin and the improved macro environment propel the prices much higher. This correction shows that it is the second chance for those who missed the first half of the bull cycle.

What can you do?

Our risk appetite is currently skewed towards higher caps, as the uncertainty doesn't bode well for lower caps/memes. Although we believe this is a buying opportunity, a high level of caution is necessary.Essentially, we're playing a DCA strategy of betting into higher caps and any high-conviction assets. If the market doesn't go lower, outsized returns can be expected on lower-cap assets. Subsequently, the team agrees that allocating a small amount to these assets is optimal.

On the other end of the spectrum, for those positions we've held on to, this is a poor area to be selling—we'll be holding on to those positions for the time being until market direction becomes clearer.

With that mindset, it is important not to get shaken out here. The more than a few favourable catalysts outlined above should positively influence the market in the coming weeks/months.

Cryptonary's take

Overall, there isn't a whole lot to panic about. Overwhelmingly, the key catalyst will be the return of a risk-on appetite amongst investors globally when central banks, more specifically, the Fed, turn back the cash taps.Market sentiment suggests we're in an oversold territory and borderline "panic" mode. However, given the data above, miner sentiment, and comments made by the major central banks, this is an overreaction by the crypto market to what is an essentially inconsequential sale.

Having a plan and handling down markets is just as vital a skill as managing a bull market. Everyone makes money in a bull market, but few hang on to those gains. This is because predicting anything with 100% accuracy is impossible, but considering possible outcomes and having reasonable projections of what might happen and why is all part of the game.