But why? The premise is the same as any other sector - decentralisation.

DePIN seeks to decentralise the basic networks that provide access to digital infrastructure for billions of people.

Helium is sitting smack dab at the centre of that decentralisation drive.

Helium's HNT is already up more than 200% in the last three months but is still 750% away from its all-time high.Is this project on the mend? Can it get back to winning ways?

Our research says it can do much more – if it delivers on its promise.

But can Helium deliver? If it succeeds, how big of an upside could it potentially get?

We answer all these questions and more in this report.

Let’s dive in.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

What’s the deal with DePIN?

DePIN is a relatively new term within the crypto space. It stands for Decentralised Physical Infrastructure Network.

Contributors are rewarded in tokens to provide some form of infrastructure as a service.

Google Maps, for example, has a monopoly on mapping the world’s streets. Hivemapper wants to decentralise the mapping business.

But even before decentralising specialized sectors like mapping, let’s take a step back to look at something as simple as internet connectivity.

Access to the internet is a crucial battleground between decentralisation and centralisation. Helium is on a mission to decentralise the global wireless infrastructure.

Built on Solana, Helium (HNT) is a decentralised network created to provide networking infrastructure. It rewards individuals and organisations for setting up and running wireless nodes anywhere in the world.

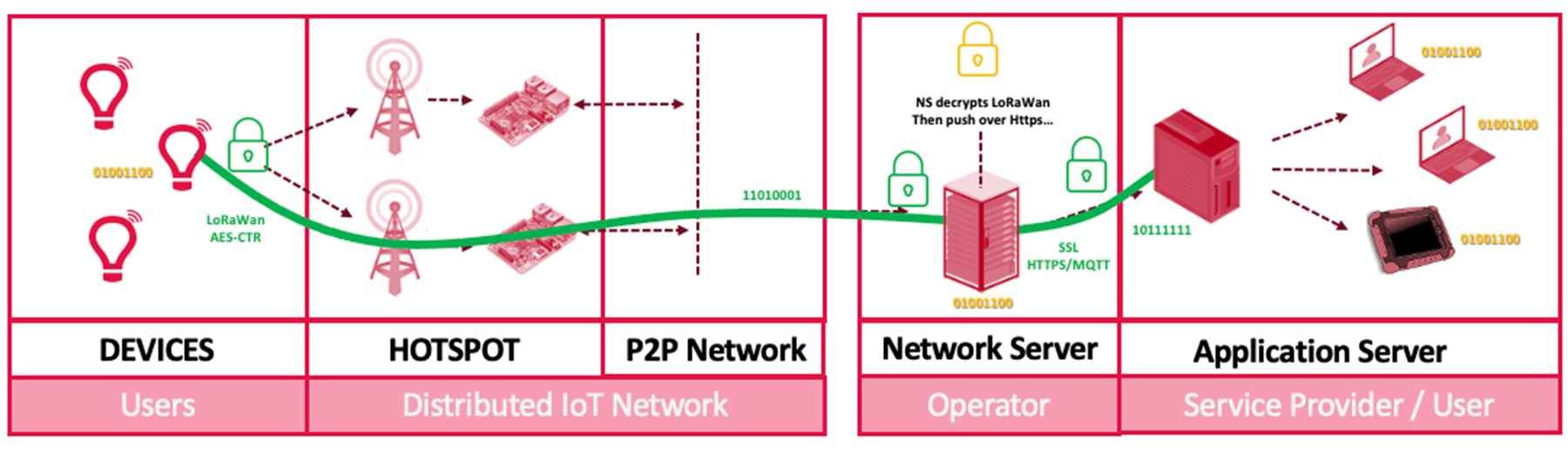

The infrastructure is fairly straightforward.

Operators run a Helium node/hotspot through which users connect, and the node operator then connects the user to the network provider or intended application.

In this way, previously uncovered areas can be connected to digital services without users waiting for centralised network providers to build and develop the infrastructure in that area.

Helium uses a radio technology called LoWaRAN (Low Power Wide Area Network), allowing each node operator to cover a large area. The actual range varies depending on the equipment the operator is using. But as a general rule, each operator can cover an area between 1 and 50 miles. The more overlapping node operators there are, the better the signal and connection quality.

It’s important to note that Helium does not replace the Internet in most cases. Rather, it provides users with a method of connecting IoT devices and basic communications between devices.

For their services, operators are paid in IOT tokens. The amount of tokens they receive is equivalent to the “work” they carry out.

Additionally, Helium runs a 5G mobile network (via the same LoWaRAN technology) that allows mobile users in areas that don’t have coverage to connect to WiFi hotspots.

Where’s the value?

Implementing this type of distributed wireless infrastructure might not sound too valuable in developed economies, where most cities offer free Wi-Fi as a standard.

Also, most households in developed countries have many providers to choose from.

But in rural communities and less-developed economies, these types of networks could potentially be the only way they can connect to the outside world.

A comparable centralised equivalent would be Elon Musk’s Starlink, except that in the case of Starlink, the nodes are thousands of satellites in space providing global coverage.

And therein lies the issue.

Even though Helium is offering what could be referred to as ‘public goods’ in a sense, it is up against stiff competition from traditional telecommunication service providers and new entrants like Starlink.

So, does Helium stand a chance?

Is Helium being used?

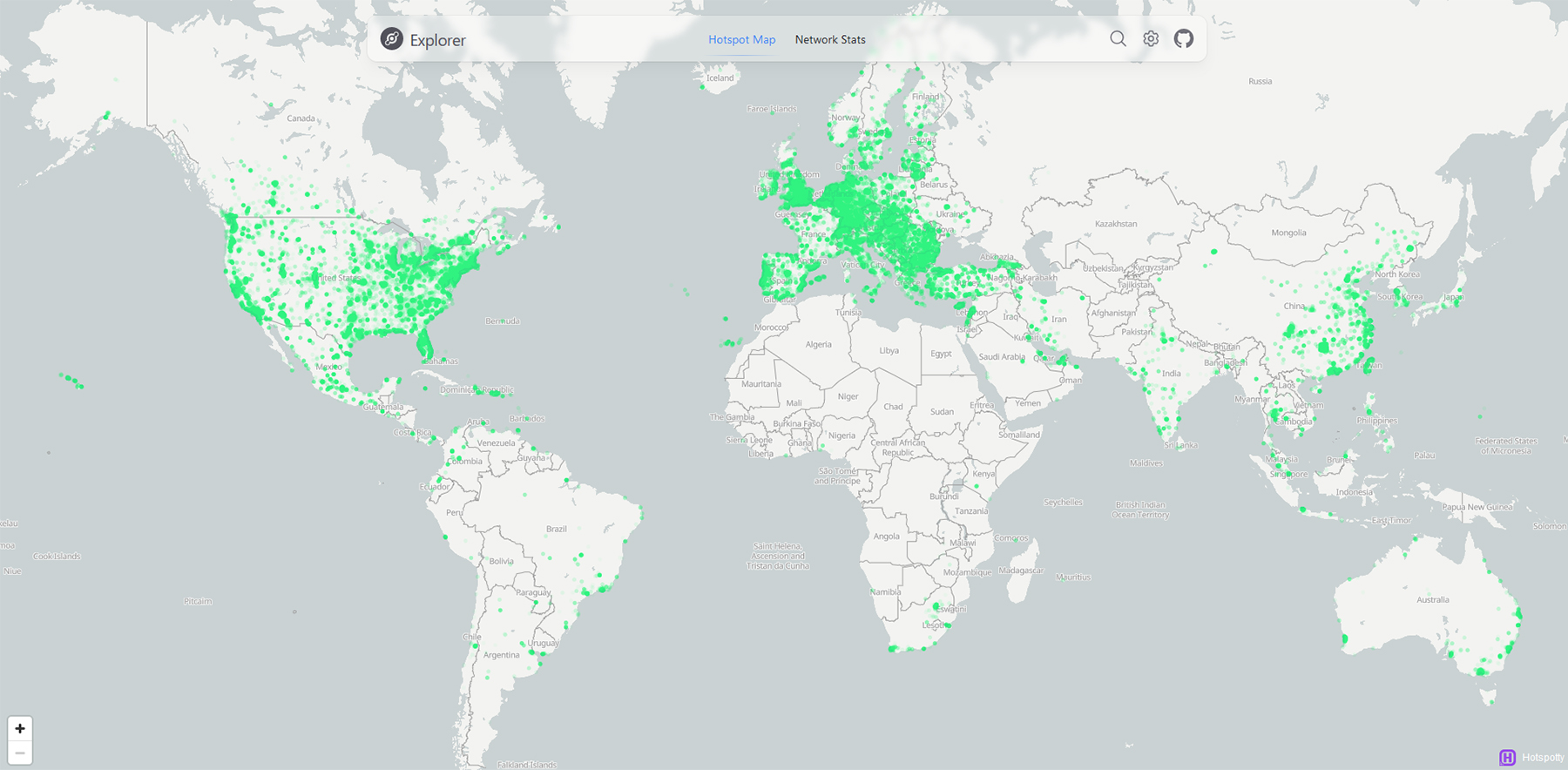

The Helium network currently has around 390,000 active hotspots globally.

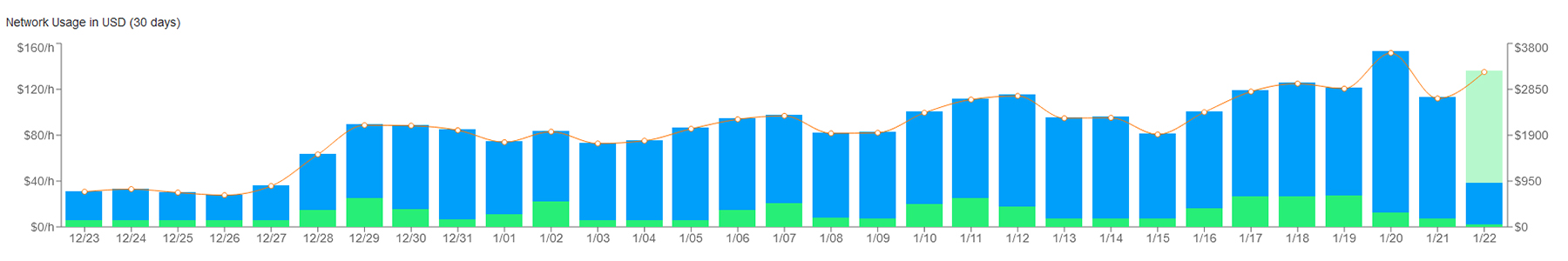

Helium has been averaging around ~$2000 in revenue daily, with a significant increase in usage over the last two months:

This increase in usage has largely been sustainable, with the vast majority (over ~80%) coming from mobile connections.

The mobile network is by far the Helium network’s most successful product.

For just $20 a month, U.S. customers can access unlimited internet, phone calls, text messaging, and more. This is highly competitive compared to more traditional providers. For context, Starlink’s prices start at $120 per month.

So, we’ve established that Helium is being used, it’s generating revenue, and it’s a viable product.

Now, is it a worthwhile investment?

Helium’s tokenomics

The Helium ecosystem relies on two key tokens, HNT and IOT:

-

HNT: Users looking for the access provided by Helium operators pay for their usage by burning HNT tokens. Burning HNT provides DCs (Data Credits), which can then be spent on data usage. DCs are pegged to the USD.

-

IOT: IOT is the token mined by the node operators and acts as the reward token gained for their services. IOT also acts as the governance token for the Helium network.

-

MOBILE: with essentially the same functionality as IOT, MOBILE is the token utilised by the (surprise, surprise) Helium mobile network. Mobile hotspot operators are rewarded with MOBILE tokens.

From an investment standpoint, the HNT token is the one we are interested in.

Why?

Since the other tokens (IOT and MOBILE) are used to pay operators, they are much more sensitive to inflation. The HNT token is actively burned, meaning it is far less likely to lose unit value, reducing supply as more users connect to the network and utilise the services.

The HNT tokenomics are as follows:

-

Circulating supply: 143.9 million HNT.

-

Max supply: 223 million HNT.

-

Market cap: $930 million.

-

FDV: $1.438 billion.

These figures show that HNT already has a large market cap, and its MCap/TVL ratio is reasonable (<2).

When considering HNT from a risk perspective, we consider it a “medium-risk" asset. It has a large MCap and an established ecosystem. This means the risk is lower, and the potential reward is lower as well.

So, how do we evaluate HNT, given its utility and the wider Helium network use case?

Valuation

Most of HNT's recent success stems from the mobile product launch in November/December 2023.

Based on this, the current valuation seems reasonably low.

HNT has an all-time high of ~$53, at which point the market cap was $5.3 billion, achieved in November 2021.

Currently, HNT has a price of ~$6.40 at a market cap of $940 million.

This gives us a baseline - since inflation has printed more HNT tokens over the years, we’re looking at closer to a 5x relative to market cap to achieve all-time highs again.

This places our base case at $30 per HNT.

Based on the increased usage of the Helium mobile network, growth will likely continue if Helium hits the mainstream and maintains the current trajectory.

However, we need to consider that Helium has already run from ~$2 to $6.40 since the mobile network launch.

The current price would have been our worst-case scenario if we had written the report when the mobile network launched).

Now we have some more data. HNT delivered an all-time high market cap of $5.3 billion MCap without the mobile network. Now, it has a mobile network that accounts for 80% of the current revenue; therefore, adding a 5x multiplier to the previous all-time high is reasonable.

This gives us a bull case target of $26.5 billion market cap, or $184 per HNT.

Therefore, our targets are:

- Base case: $30, a ~5x.

-

Bull case: $184, a ~29x.

Technical analysis

HNT has quadrupled between late October and mid-December. However, the price is now down 34% from the December highs. So, is now a good time to buy?

From the chart:

- HNT rejected at the main horizontal resistance of $8.64, and then price bounced from the yellow buy box. However, it rejected at the next local horizontal resistance at $7.49.

- Price is now in a general downtrend, with the target of this downtrend likely to be the converging levels of the local uptrend line and the horizontal support of $5.23.

- If price moves lower, the yellow box may provide another layer of support to slow the descent.

You could then layer heavier orders beneath this level down to $3.28, which is the last major horizontal support.

Cryptonary’s take

DePIN, along with RWA’s, are the key narratives that link the “normal” (boring) world to the world of cryptocurrencies.

DePIN represents a meritocracy - the operators providing the best services to the most people get the biggest rewards.

It is infinitely better than the monopolistic landscape that currently dominates the globe.

It is time to extend the financial revolution into the everything revolution.

Cryptonary, OUT!