Crypto narrative cycles are what drive the market. Today, we explore the intricacies of these cycles, starting with the concept of market reflexivity and how it shapes capital flows across various market sectors.

From the rise of memecoins to the dawn of AI and the resurgence of Web3 gaming, this is your roadmap for navigating the current market dynamics and capitalising on emerging opportunities for maximum ROI. Tools like a crypto narrative tracker can be instrumental in understanding these shifts and staying ahead of the curve.

If you play your cards right, you should be able to come out on the other side of this bull run with a marked upgrade in your net worth.

Sounds exciting?

Let's dive in.

TLDR

- Market reflexivity: Prices are driven by collective market sentiment, creating self-reinforcing feedback loops.

- The Solana effect: Solana's ecosystem has disrupted traditional capital flow patterns, attracting a significant influx of investment.

- Memecoin mania: Memecoins have taken centre stage, fueled by the Solana ecosystem's affordability and user-friendly interfaces.

- AI revolution: Advancements in AI technology are poised to reshape the crypto landscape, with Solana positioning itself as a frontrunner.

- DePIN: Decentralised Physical Infrastructure Networks are breaking down monopolies and enabling crowdsourced data collection for AI applications.

- Web3 gaming renaissance: Innovations like SPL-22/ERC-404 bring variability and replayability to blockchain gaming, reigniting interest in the sector.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Reflexive market

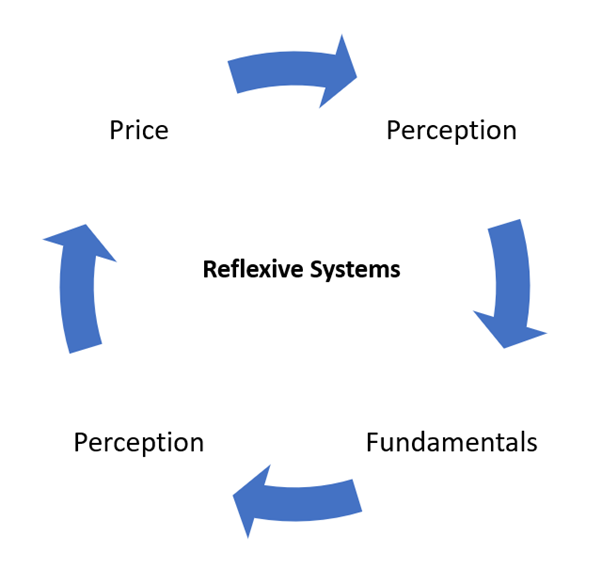

Within the context of economics, reflexivity is the idea that market sentiment is a self-reinforcing phenomenon. For example, a rising market will attract buyers, leading to further price appreciation, inspiring further investment, and so on. This is a positive feedback loop and is part of both herd behaviour within financial markets, and the tendency for people to believe what has previously happened is likely to continue happening in the future.Navigating these cycles becomes much easier with tools like a crypto narrative tracker, which help identify emerging trends and shifts in market sentiment, allowing investors to stay proactive rather than reactive.

To explain the concept further, it is important to define three key concepts:

- Market Sentiment - the collective attitude of all participants towards the market, which influences the action that participants take, which in turn influences the direction of the market.

- Herd Behaviour - investors follow what they see other investors doing rather than relying on their own research.

- Positive Feedback Loop: where a subtle event causes an effect, which in turn causes more of that event, amplifying the effect. For example, rising BTC prices cause FOMO buying, which leads to rising BTC prices, causing further buying.

Traditional theories state that markets always seek equilibrium and that all participants are rational and base their decisions on reality. Any fluctuations in the market, such as boom-and-bust cycles, bubbles, or capitulation events, are outliers, and prices will soon return to equilibrium. That equilibrium is determined by fundamentals, which are not influenced in any way by price.

On the other hand, market reflexivity suggests that prices do affect the fundamentals of the market and that all participants base their decisions on their perception of reality. If price influences fundamentals, then it stands to reason that a change in price is a change in fundamentals, which in turn changes investor expectations, which leads to a change in price as investors act on these new expectations - you can see where this is going.

This positive feedback component of market reflexivity leads to boom or bust cycles because the change in price is self-reinforcing through herd behaviour, causing prices to become increasingly detached from reality and, in fact, become the new reality, kind of like a self-fulfilling prophecy.

It all sounds complicated, but the ELI5 is that markets usually work based on how people think things are, not necessarily how they really are. When people believe something good will happen, they invest, and prices increase. When the opposite happens, prices fall. It creates a boom cycle where higher prices make people more optimistic, leading to even higher prices. The same happens in reverse for busts. This feeds on itself, like a snowball effect, moving prices away from what fundamentals suggest until a breaking point is reached.

Today's crypto market has a hugely different landscape than the last bull run from 2020 to 2022. Where there was a DeFi summer in 2021, we are now seeing memecoins take the mantle as the initial runner of this cycle.

Historical money flow in crypto

The standard thought around money movements over the last few cycles has been something like:Fiat -> Bitcoin -> Ethereum -> Altcoins -> Fiat

But with the current cycle showing fundamental shifts in capital flow, it's clear that tracking the right narratives is more critical than ever. A crypto narrative tracker becomes an invaluable resource in this context, helping investors pivot as the market does.

On a chart, "altcoin season" (alt szn) is generally preceded by a large positive price increase on Bitcoin, followed by a flow of capital to ETH/Ethereum ecosystem tokens. This can be seen in the above chart.

Generally, that is how participants try to play the market. It becomes a self-fulfilling prophecy if everyone is following the same roadmap. So, in the last few cycles, the way to make money in crypto was to buy Bitcoin, then move into Ethereum, and later Ethereum-ecosystem tokens.

BUT…

Times have changed, and we think the tides have too…

What does the flow look like in this cycle?

The interoperability between chains has enabled a fundamental shift in how we play the market. Sure, there will still be some level of the "jumping between chains" meta. But with the number of paths available to get between chains ever-growing, it no longer makes sense to play the maxi game of "my chain is better than your chain."Instead, we move where the people are and where the innovation is. Capital is becoming omnichain - and the narratives are moving away from conventional thought.

For this cycle, we think the capital flow moves something more like:

Fiat -> Bitcoin -> Memecoins -> AI -> DePIN-> Gaming -> Fiat

One ecosystem has facilitated this change in mindset, and the entire market has clocked on to it - Solana.

Before we delve deeper into the report, it is important to provide some context because many people still become apprehensive when they hear memecoins. You've probably heard or made the "memecoins are not fundamentally sound" argument.

People have this weird misconception that investing in "shiny new coins" will lead to financial ruin, even but this isn't necessarily true. Bitcoin was once a shiny new thing, and many TradFi investors looked down on Bitcoin holders as "speculators" -- whatever that meant.

Suppose your primary goal as an investor is to create wealth. In that case, part of your job description is adjusting your worldview, responding to shifting narratives, and ensuring you have the right amount of exposure to potential winners.

Whether you like it or not, memes have become a cultural phenomenon in the crypto industry -- AI is the next frontier -- DePIN decentralises the infrastructural layer, and gaming is a wildcard.

The Solana effect

Most of the money flow activity in this cycle takes place in Solana. Over the last 12 months, the SOL token has massively outperformed its peers with no sign of stopping.However, as market narratives shift, having a reliable tool like a crypto narrative tracker ensures that investors can anticipate where the next wave of capital might move and adjust their strategies accordingly.

In previous cycles, money would have flowed from Bitcoin to the Ethereum ecosystem. But we see a huge portion of that capital flowing into the Solana ecosystem, reflecting a break in the "traditional" money flow. There are a couple of key reasons for this:

- Drastically improved performance: Solana's downtime has been a problem in previous years. However, the chain has become significantly more reliable, and users are more willing to move large sums into the ecosystem.

- Cheap transaction fees, good UI/UX: Users are drawn to Solana's cheap fees (huge outperformance over Ethereum) and its shiny user interfaces, with the Phantom wallet easily being the most newbie-friendly wallet out there.

But, as stated above, the market is extremely reflexive.

That lends the question - where to go next?

Memecoins

The above catalysts in the Solana ecosystem have set the stage for a new paradigm in the memecoin saga. Users can switch from token to token very easily, quickly, and cheaply, bringing in the degens whilst also showcasing that blockchain doesn't need to be "hard" to understand or only for the nerds.The rise of memecoins, particularly on Solana, has demonstrated how quickly narratives can take hold and transform the market. Tools like a crypto narrative tracker are essential for identifying these trends early and capitalising on them before the mainstream catches on.

We caught WIF and POPCAT early on, which was the initial move of this thesis (after Bitcoin, led by the ETF catalyst.)

We have covered a few memecoins since then. Check here for what we think could be a big meta, PolitiFi.

We recently created a memecoin masterclass, which you can find here.

Artificial Intelligence

There have been huge advancements in AI technology over the last couple of years. Tools like ChatGPT have changed the game in terms of productivity and the way we use the internet. We have no doubts that the AI revolution has the potential to match or surpass the industrial revolution in its effect on humanity.

The crypto market is a high-tech space, and it is only a matter of time before the narrative shifts to AI-powered projects. But the current AI projects are mostly wet paper - there's nothing solid about them.

There are exceptions, of course, but we're not seeing the type of hype that would see a new AI project launch every other day.

As stated in a recent report, Solana is the obvious candidate for AI activity owing to its massive throughput and huge user base. Projects tend to launch where all the users are, and new launches bring in new users. This snowball effect keeps the narrative firmly on a specific ecosystem for an extended period.

Here are some additional thoughts on the Solana AI revolution:

- Solana integrates ChatGPT.

- Nosana is building the infrastructure required for high-capacity computing.

The innovation happening on Solana also brings us to our next point…

DePIN

DePIN (Decentralised Physical Infrastructure Network) is a broad term that refers to a long list of applications.Usually, big companies (like Google) pay extortionate prices to get good data (on anything). Still, the companies collecting the data are even more willing to charge obscene prices because they have a monopoly of sorts on data collection. This can range from Google Maps-type images of the world's streets to simple things like Wi-Fi hotspots.

Some people provide the service, and others pay them for it—and since the price is what people are willing to pay for anything, these data are often priced at extortionate prices. Now, training AI models requires huge amounts of data, computing, storage, and other resources.

DePIN breaks down the monopoly of these infrastructure providers through crowdwork, enabling everyday people to contribute data, compute, storage, and other resources as an infrastructural layer. In that sense, DePIN is one of the major AI x Blockchain applications we think will take off first. Hivemapper (HONEY) is a key example we have already covered, but we expect more reports in the future as opportunities present themselves.

Web3 gaming

Innovation within the AI sectors and the general crypto trend towards faster chains and lower transaction costs leads us to speculate that blockchain gaming will return with a vengeance.SPL-22/ERC-404 (and other similar standards) bring a new meta/utility to the gaming sector, especially from an investment standpoint.

Games are no longer "pay to win" in the sense that whoever owns the most expensive (usually the best) NFT has the best chance of success.

10,000 NFT mint? It's very hard to chase the meta there when it costs 10 ETH, and it can't be changed because the best tokens have already been minted.

The destruction and reconstitution of those destroyed NFTs into a potentially new "meta" brings the average person back into contention within these games.

Paying to win is fine - but there have to be other ways to win to maintain interest.

The possibility of being able to re-roll a never-before-seen NFT with ridiculous stats for a given game appeals to the masses and provides a reason to "grind" - something all gamers are known for.

The analogy used here to describe this phenomenon is this:

- Before, there was a recipe for success - if you buy the best ingredients (NFTs), you have the best chance of "winning".

- Now, it's more a case of "How many turns does it take to win a game of chess?".

There's a reason chess (and its predecessors) have been played for 1500 years and counting.

i.e. effort and skill become huge factors now - people have something to work towards, increasing replayability and maintaining attention span

The variability and randomness inherent in all "fun" games are what make them fun—this is what we were missing last cycle, and it's what SPL-22/ERC-404 brings to the table.

Expect on-chain games to become "funner" through variability. Games should inherently be more profitable and worth investing in in this cycle.

For our coverage, check out this report here.

Cryptonary's take

Revisiting the beginning of this article, here is the money flow we expect this cycle:Fiat -> Bitcoin -> Memecoins -> AI -> DePIN -> Gaming -> Fiat

For now, that's Solana memecoins. The Solana ecosystem has emerged as the epicentre of innovation and capital flow. The rise of memecoins, fueled by the ecosystem's affordability and user-friendly interfaces, has disrupted traditional investment patterns, ushering in a new era of accessibility and cultural relevance.

However, as the market's attention shifts, staying ahead of the curve will depend on leveraging tools like a crypto narrative tracker to stay informed and adaptable. Whether it's the next wave of AI projects, DePIN applications, or Web3 gaming innovations, being equipped with the right insights is critical.

As the cycle evolves, staying ahead of the curve and capitalising on emerging opportunities will be the key to success in this ever-evolving market.

Don't fumble the bag.