Unless you’ve been hiding under a rock this past year, you’ve probably heard of Arbitrum. Arbitrum is a rapidly emerging Layer 2 (L2) protocol that has taken the crypto world by storm. (An L2 is a secondary framework built on top of an existing blockchain.)

Last month, Camelot ($GRAIL), a decentralised exchange built on Arbitrum, and Radiant Capital ($RDNT), an Arbitrum lending protocol, hit all-time highs! While both are excellent projects, their risk-reward ratios aren’t worth an investment right now.

But don’t worry. We’ve found three projects currently flying under the radar with exciting growth potential (two of which could soar as much as 5X higher!)

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your full responsibility and yours only.

TLDR:

- Opportunity 1: CVI Finance ($GOVI), an incredible tool that’s bringing VIX from traditional markets into crypto. (VIX is a volatility index that represents investor anxiety and predicts future price changes in the wider financial market).

- Opportunity 2: Plutus DAO ($PLS) is establishing a powerful position and significant influence over governance proposals on Arbitrum.

- Opportunity 3: Umami Finance ($UMAMI) aims to provide retail and institutional investors with sustainable yield while allowing token holders to collect fees.

- We’ll be investing in $GOVI with a 5X price target this year.

- We’ll also be investing in $PLS, once again calling for a 5X return this year!

- We won’t be investing in $UMAMI just yet. We’re waiting for the developers to release some information. When they do, we’ll be the first to cover it, and perhaps we’ll even be buyers.

Opportunity 1: CVI Finance ($GOVI)

CVI was developed by COTI (a decentralised network that combines traditional payment methods with digital currencies) in collaboration with VIX creator Professor Dan Galai. VIX plays a crucial role in traditional markets, and we expect it to do so in crypto too.CVI allows traders to gain exposure to volatility, which involves trading a financial instrument’s volatility rather than its price. Traders can hedge their volatility exposure by purchasing CVI without having to speculate on whether an asset is going up or down.

With CVI, traders are prepared for any market changes, as a raincoat protects you from the rain regardless of the forecast.

Cryptonary’s Take

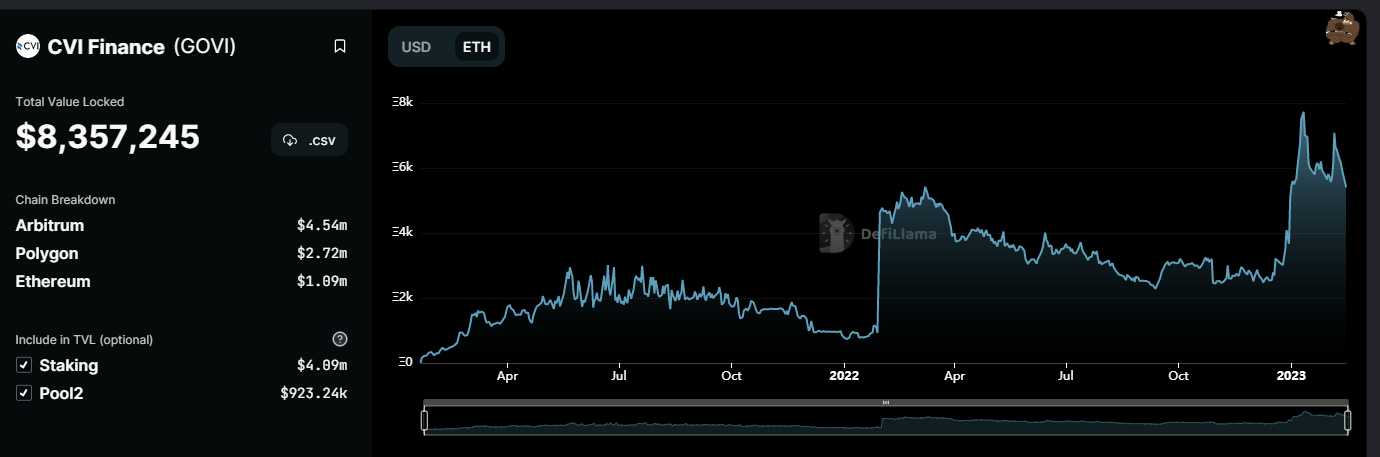

Live on Arbitrum (one of the most popular L2s) and planning to go live on ZkSync (the next step in Ethereum scaling), CVI is well-positioned to increase its TVL (Total Value Locked: a measure of all assets staked/bonded/deposited with a protocol) and revenue. An increase in TVL and revenue is good news for the token!

CVI doesn't have any stiff competition right now. And, with the creator of the VIX on board, it boasts a unique advantage over any potential competitor.

With plans to implement numerous upgrades (to user experience, tokenomics and governance structure) in Q1 and a team receptive to community recommendations, we have confidence CVI will continue to innovate.

Meet CVI's governance token, $GOVI.

CVI is a fair launch product, which means that there are no pre-mined tokens, no fundraising, and no allocations for VCs or whales. The entire supply of $GOVI tokens is limited to 32 million, with no option to mint more.

Holders of the $GOVI token can vote on suggestions to improve the product and benefit from revenue, since 85% of platform-generated fees are collected and used to purchase $GOVI tokens on the open market, lowering token supply.

The protocol also recently decided to limit token emissions, which often positively influences token values since less dilution occurs. Put simply, protocols give tokens to users who provide liquidity, but doing so causes inflation and thus the token value falls. By reducing emissions, inflation is tamed, benefitting the price.

Will we be investing in $GOVI?

With a market cap of $9 million and a fully diluted market cap (the theoretical market cap if all tokens were in circulation) of $19.3 million, we believe that CVI, which has the potential to become a very important tool for crypto traders, is significantly undervalued.$GOVI’s current price is $0.60. Given the reduction in emissions and the team's commitment to innovate both the product and tokenomics, we predict a $3 price point later this year.

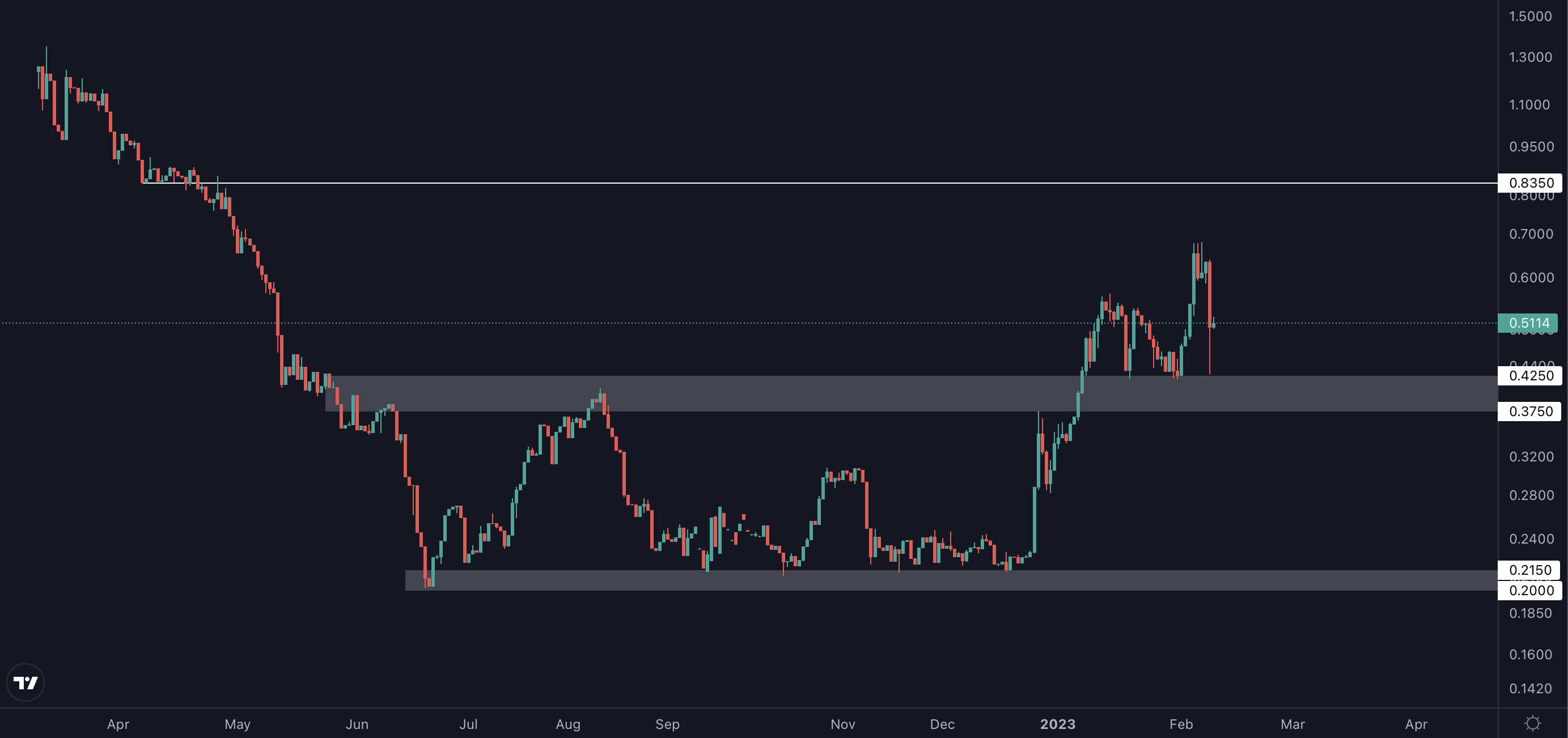

As for detailed timeframes, $GOVI is currently above support ($0.4250 - $0.3750) after breaking out from an accumulation area that took several months to form.

For the long term, accumulating within the range between $0.3750 and $0.2150 is ideal. When it comes to opportunities in the short term, the $0.3750 - $0.4250 support area is a good entry point for a move toward $0.8350 during Q1 or Q2 of 2023.

Stan from research: I will gradually put 5% of our portfolio into it through dollar cost averaging over the next 3-4 weeks, with the goal of exiting at the specified price targets before the end of the year.

What would it take for us to change our stance on $GOVI?

- We’ll be keeping an eye on CVI Finance’s usage - if traders don’t adopt the product, that'll be a sure-fire sign to pull out.

- If we see a drop in activity from the team, we’d also consider bailing.

Opportunity 2: Plutus DAO ($PLS)

Plutus DAO aims to become a central hub for the governance of various crypto assets in the Arbitrum ecosystem. And, as Plutus DAO already has majority ownership in several significant protocols on Arbitrum, the odds are in their favour.Investors can participate in governance by acquiring Plutus DAO’s $PLS governance token. By locking their $PLS tokens, investors can exercise voting power and earn rewards at the same time.

The platform has also built what’s known as a GLP vault (a GMX liquidity provider). The goal of the vault is to maximise revenue while simplifying the process for GLP stakeholders, who provide liquidity to GMX (a decentralised exchange) and receive trading fees from the exchange.

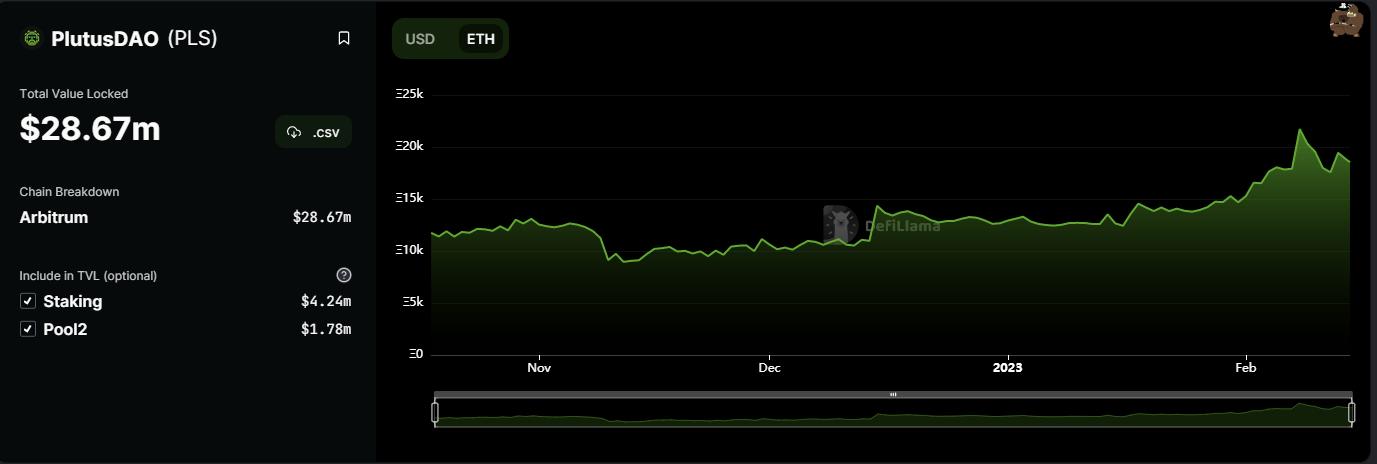

Plutus DAO generates income by collecting fees on revenue generated by both the governance tokens and the GLP vault. It intends to become Arbitrum’s answer to Convex Finance, with substantial influence over Arbitrum Protocols.

If you’re not familiar, Convex Finance is a yield optimiser with majority exposure to Curve Finance’s $CRV token. This means it effectively controls Curve’s governance. For protocols to make changes to Curve, they need to pay Convex money or purchase $CRV. This makes Convex an extremely valuable product.

Cryptonary’s Take

Plutus DAO is the best way to obtain exposure to the Arbitrum environment, in the same way that Convex was one of the best ways to invest in the Curve Finance ecosystem.As the protocol has accumulated governance tokens from significant Arbitrum protocols such as Dopex and Jones DAO, it will grow with the Arbitrum ecosystem.

It’s expected that as new protocols create governance, Plutus DAO will seek exposure to them. As Plutus DAO develops influence over Arbitrum protocols, users will need to buy $PLS to have a say in them. This would create a governance black hole, similar to Convex Finance and Curve governance. A ‘governance blackhole’ refers to when a single entity or protocol gains significant influence over the governance of multiple protocols. This makes it difficult for competing protocols or other entities to challenge or overcome that concentration of power. This can result in a "blackhole" effect where governance power and influence is sucked into the dominant entity, making it difficult for others to have a say or influence in governance decisions.

Another positive short-term catalyst for Plutus DAO is the impending launch of version 2 of its tokenomics. The upgrade will both significantly reduce emissions and offer a new token format for users who stake their $PLS. This will make it more appealing to lock tokens, as stakers get paid to vote in a particular way.

If Plutus DAO continues to strengthen its alliances and increase its power in governance, other protocols can build on it and accumulate $PLS to obtain influence in various protocols.

Will we be investing in $PLS?

Given Convex's market price of about $500 million, Plutus DAO has a lot of potential if it can fulfil its goal of becoming the Convex of Arbitrum. A target of $4 is achievable if it can deliver on this vaulting ambition. Given that this strategy has already proven successful for Convex, the chances are in Plutus’ favor. The question is whether its influence will be as significant as Convex's influence in Curve, but that will rely on the success of other protocols.With its current market cap of $14 million, we believe Plutus DAO will achieve a 5X gain and reach a market cap of around $70 million. This puts it at less than 20% of Convex's valuation.

As Plutus DAO's emissions will continue to be drastically reduced, it's difficult to anticipate the impact of token inflation (or the lack thereof). Still, a price target of $3.20 is realistic based on its current tokenomics.

In the short term, we can see that $PLS came back down to retest $0.48 as support after breaking above it about a week ago.

For long-term investors, accumulating as low as possible is obviously the best play. An ideal starting point would be when/if $PLS drops under $0.23. We believe anything under $0.23 is a good buy.

However, in the short term, an entry from anywhere between $0.3850 - $0.48 could provide a good return in Q1 and Q2 of 2023. This is where the previous weekly high formed, which has now been broken and replaced by a higher high. This means a change in weekly market structures is possible.

Stan from research: Similar to $GOVI, I will put 5% into $PLS through dollar cost averaging over the next 3-4 weeks, with the goal of exiting at the specified price targets before the end of the year.

What would it take for us to change our stance on $PLS?

- If the projects over which Plutus DAO has significant influence fail to gain popularity, Plutus DAO’s influence would weaken.

- If Plutus DAO's revenue is too low for the protocol to continue to reduce emissions and funding run out. This would indicate a failure of adoption.

Opportunity 3: Umami Finance (UMAMI)

Umami is a DeFi protocol that aims to make it easier for retail and institutional investors to earn yield. Users provide liquidity to GMX but hedge their exposure to volatile assets through staking GLP. This allows them to earn fees shared with GLP stakers while avoiding volatility.Its focus on regulatory compliance and transparency sets it apart from other DeFi protocols, making it more attractive to institutional investors in the US. Many DeFi projects are unwilling to comply with certain regulations, making it difficult to onboard institutions.

Cryptonary’s Take

Umami Finance is a one-of-a-kind bet on institutional adoption via DeFi. However, it’s also a high-risk, high-reward investment because Umami’s GLP vault is yet to go live.Put simply, GLP holders provide liquidity to the exchange while gaining exposure to crypto assets. The GLP vault tracks the value of the underlying asset at a 1:1 ratio, ensuring investors’ returns are closely tied to the asset’s performance. If you deposit ETH into the vault, you will remain exposed to ETH price fluctuations while also earning yield (70% of fee revenue).

We’ve spoken with the Umami team and are confident they'll succeed when the GLP vault goes live in March. Another Umami product expected to go live this year is an offering connected to ETH staking, although no details have been disclosed yet.

Will we be investing in $UMAMI?

While we’re bullish on Umami’s offering, we won't be investing right now…There was a disagreement among the team regarding whether token holders should get revenue from the project's product, and this disagreement finally led to the project's CEO leaving. When he did, he also sold a large stake in $UMAMI, causing the token price to fall.

This disagreement within Umami had a negative impact on the price. Fortunately, the remainder of the Umami team, who disagreed with the previous CEO's vision, control the treasury and the rest of Umami. Read the entire story here.

At Cryptonary, we didn’t have a strong connection with the CEO. Most of our discussions were with team members who have remained with the project.

The CEO was also not a developer, but rather a manager. Therefore, no technical expertise was lost with his departure.

We want assurance that the Umami team will keep its commitment to sharing revenue, which will be made official with the first DAO proposal. We also want to give them some time to restructure before we invest.

Despite the former CEO's departure, we believe the project will be able to recover if it manages the situation correctly. The product launch is still expected and in our opinion, will bring value back to the token. For the moment, though, there are too many uncertainties with this project.

We will share an update on Umami after the DAO proposal has been voted on and we are confident enough to invest.

Cryptonary’s Take

In short, Arbitrum is an extremely exciting ecosystem with impressive growth potential. We’ve got our eyes on CVI Finance ($GOVI), Plutus DAO ($PLS), and Umami ($UMAMI). Again, we’ll be investing in $GOVI and $PLS, calling for a 5X return on both this year while sitting out $UMAMI for the moment.Action Points

- We believe CVI Finance ($GOVI) and Plutus DAO ($PLS) have 5X potential this year and we will be investing.

- For $GOVI in the long term, accumulating within the $0.3750 and $0.2150 range is ideal. When it comes to opportunities in the short term, the $0.3750 - $0.4250 support area is a good entry point.

- For $PLS, when it comes to long-term investors, we believe anything under $0.23 is a good buy. In the short term, an entry from anywhere between $0.3850 - $0.48 could provide a good return in Q1 and Q2 of 2023.

- Umami has significant growth potential as long as current issues are resolved.

- Follow our coverage of Umami updates here (link Discord).

This, however, is only the tip of the iceberg. Stay tuned for our upcoming report, where we’ll explore an even bigger selection of promising Arbitrum projects that are gearing up for launch soon.