2022 UPDATE

When launched, the Cryptonary Portfolio was an aggregation of our combined portfolio would look like if we ran it jointly - we were two people. Now we many more, it is impossible to do that as each person has conviction in different places. Therefore this is now deprecated and no longer relevant.The question to ask is: Who do you trust more, code or humans?

Our answer is code because it is fair and it applies to everyone, regardless of their social status. It's a leveled playing field.

Structuring a portfolio is both a science and art that we take very seriously. We allocate carefully and make sure to not spread ourselves too thin (learn about correct diversification here). In addition, there are many scams that arise with new industries and the crypto-industry is not an exception. This is why robust research is an absolute must.

Fact: Our team spends the majority of their time researching different projects.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

This is Cryptonary's Portfolio 👇

Here is a breakdown of each asset we own as well as how much we own of it.Timeline: 2025

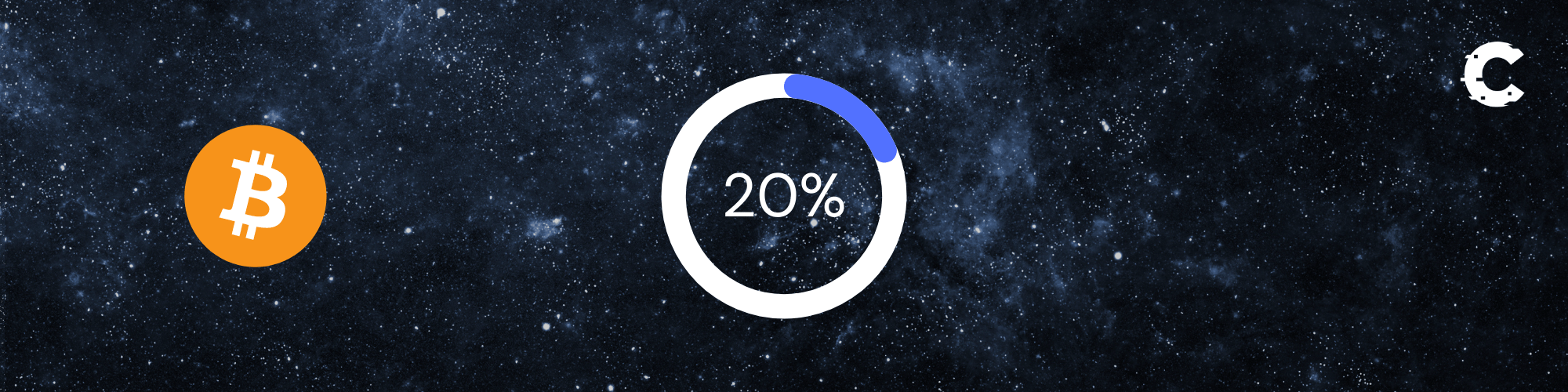

BTC

There is no doubt that we own some BTC. This asset was and still is the king of this market until this day. Without Satoshi’s creation we would not all be gathered here today.

Bitcoin is a revolutionary asset with a fixed supply schedule and that makes it very valuable when you consider the devaluation of fiat currencies which has doubled out minimum take profit level to $1,000,000!

Plus, institutions are pushing very large amounts of capital into it and we will certainly not be on the other side of those trades.

Average Entry: $7,000Take Profit: $1,000,000

Allocation: 20%

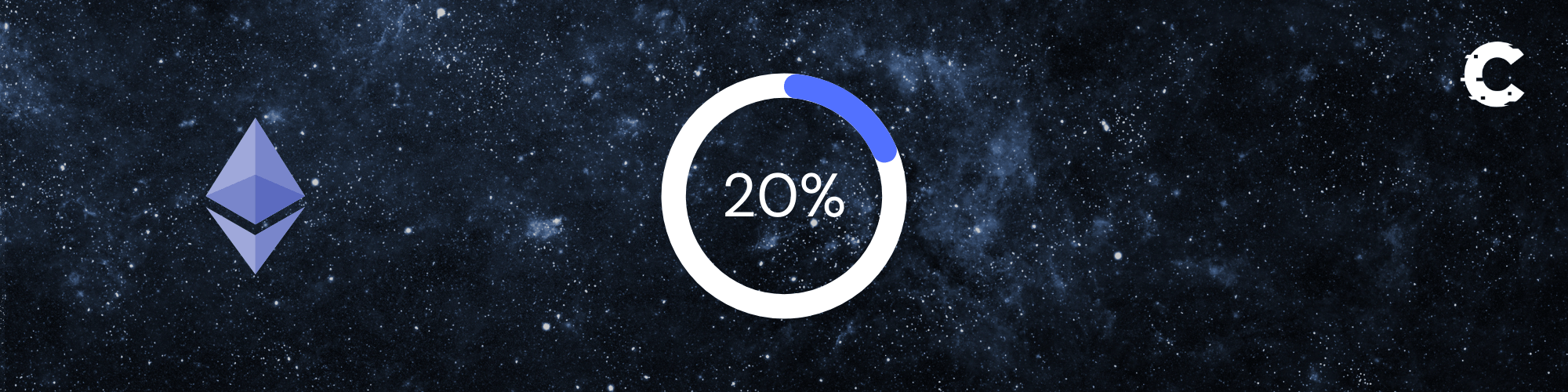

ETH

How can our portfolio ever be complete without the base currency of the World’s Financial Internet? The Ethereum blockchain hosts over $40 Billion in value locked in Decentralised Finance (DeFi).

Our prediction and minimum take profit level for our ETH is investment is $10,000 as we believe Ethereum is easily a $1 Trillion network.Average Entry Price: $350

Take Profit: $10,000

Allocation: 20%

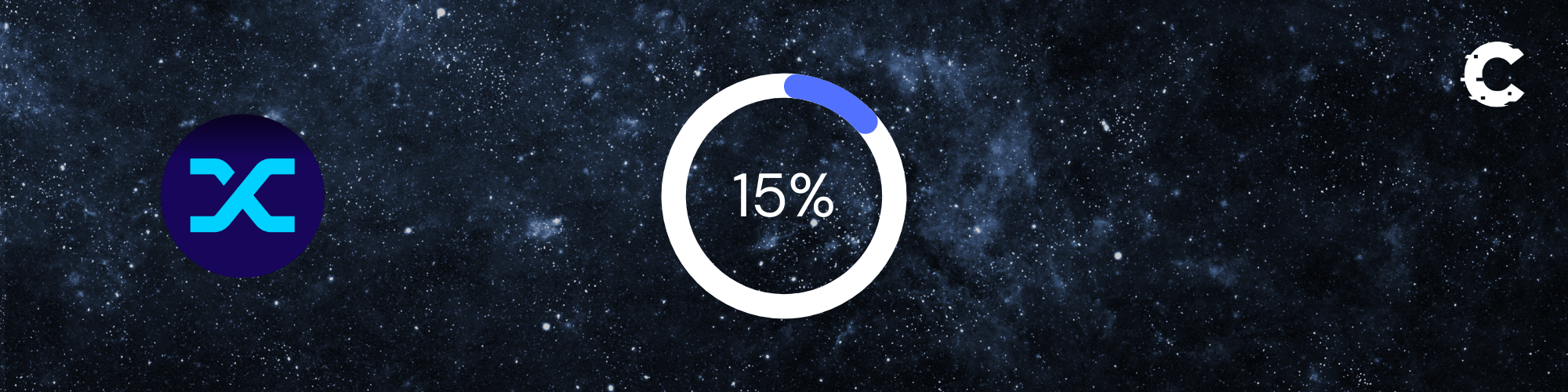

SNX

SNX is our 20X token, the reason we allocated a reasonable chunk of our portfolio to it is because derivatives ought to go on-chain for the higher efficiencies and censorship-resistance aspects. We bought SNX near the bottom of the crash post-DeFi 2020 summer and we have a $60 target at which we'll be taking 20/25% profits off the table. Realistically, SNX can get into the 3-digit zone easily over the next few years and we certainly want to be onboard that ship still.

Average Entry Price: $3.5

Take Profit: $60

Allocation: 15%

DOT

If there was a real competitor to Ethereum it would be Polkadot. Although, their existence will be complementary and not of competitive nature. It was launched this year with plans to integrate some decentralised protocols next year. Projects are already building, the delivery isn’t here yet but that’s exactly how we like it: us being early.

Our original target for DOT was $20 but as price approached it we realize how early it still was which is where we had to extend it to $100, nonetheless in August 2021 we decided to take off half of our allocation at $25 to cover our principal and put aside capital for further investments.

Average Entry Price: $3

Take Profit: $20 & $100

Allocation: 5%

RUNE

This is our 30X token as we believe most people will be using cross-chain swaps and RUNE is at the center of it. A preliminary target is $90 at which we'd be taking off 25% of our profits at the very least. If the market is excessively euphoric at that stage, we'd consider taking off as much as 70% profit. We would not fully sell our RUNE as it will become a key part of the financial system in our opinion.

Average Entry Price: $3.5

Take Profit: $90

Allocation: 10%

SRM

Serum is a brand new DEX that was mainly developed by Alameda Research (creators of FTX). If there was a team that understands what an exchange requires, it’s Alameda. We bought the listing and remain “HODL”ers of the token with reasonable profits and staking rewards.

Average Entry Price: $0.80Take Profit: $20

Allocation: 10%

MINA

MINA, the native token of Mina Protocol which dubs itself as the world's lightest blockchain, is our latest addition to our portfolio. We've reduced our XRP exposure, removed our OXY exposure and used up the remainder cash we've had to invest in MINA. You can read our fundamental view on MINA in the dedicated report. We originally has 7% in MINA but we reduced it down to 5% for opportunity cost and to free up capital for further investments.

Average Entry: $3.15

Take Profit: $100

Allocation 5%

Cash

Cash for investments & unique opportunities.

Allocation: 15%