Cryptonary's thesis on Chainlink

Blockchain promises to revolutionise trust and automation, yet it faces a critical hurdle: the inability to access secure, reliable real-world data. Chainlink is the game-changing solution bridging this gap, transforming smart contracts into powerful tools for real-world integration. Our thesis? Let's dive in...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is ChainLink?

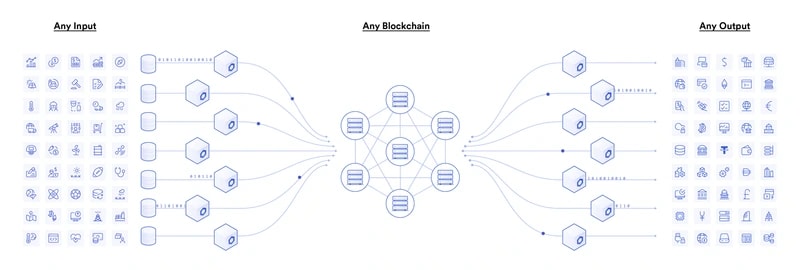

Smart contracts are a cornerstone of the crypto world, with the whole space running on them. However, they are constrained by a significant limitation: the inability to natively integrate secure, reliable, and accurate real-world data into on-chain environments. This was coined as the "oracle problem" and previously hindered smart contracts' broader adoption and utility, which rely on external data to execute effectively. But this is where Chainlink has emerged as the leading decentralised oracle network. It addresses this challenge by enabling smart contracts to access off-chain data, randomness, and external APIs securely. Because of this, Chainlink is one of those rare innovations that quietly powers so much of what makes blockchain work.At its core, it solves a huge problem: how to get reliable, real-world data into smart contracts without relying on a single supplier. Solving the oracle problem. Instead, it uses a decentralised network of independent nodes to securely pull, check, and deliver data, ensuring it's accurate and tamper-proof.

But its use cases don't stop there. With its new Cross-Chain Interoperability Protocol (CCIP) released just last year, it's taking blockchain to the next level, allowing blockchains to communicate and share data seamlessly—building a bridge to a genuinely interconnected decentralized ecosystem. Whether it's making DeFi apps work smoothly, automating insurance payouts, or introducing live real-world NBA stats into crypto apps, Chainlink is there to help and, over the years, continues to be the backbone of the DeFi world.

The token: LINK

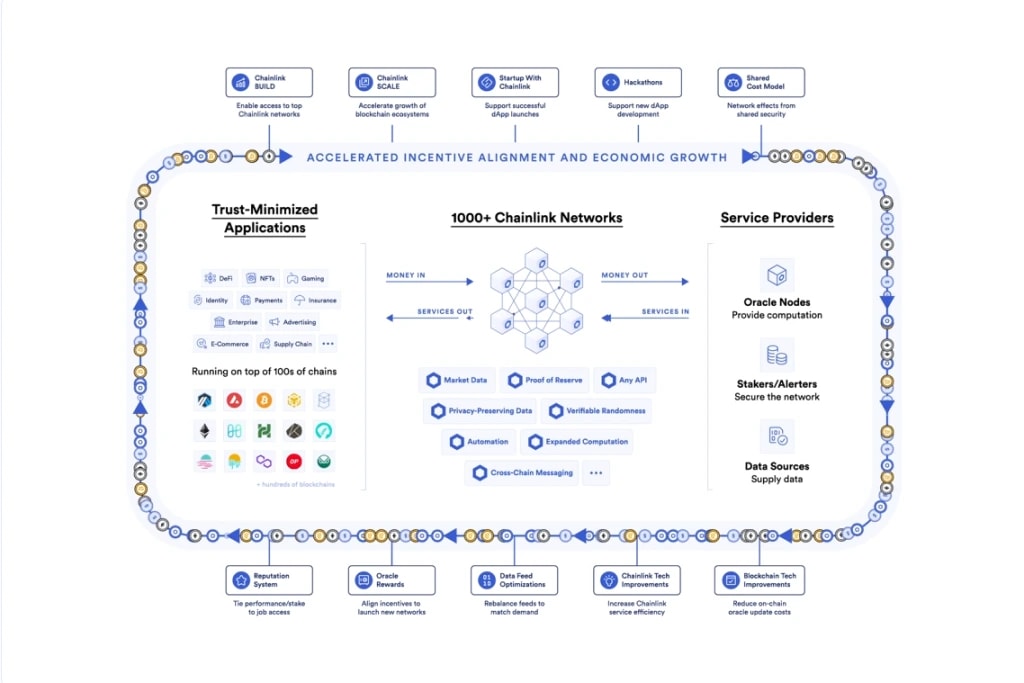

Now, let's get into the $LINK token itself. From what we can tell, it is a core component of the broad Chainlink ecosystem. In fact, it is actually the cornerstone when it comes to driving participation, maintaining security, and making sure the data Chainlink provides is reliable. While that is a lot, there is much more that is done with the token, as we can see in the data image below.So, without further ado, let’s explore what makes $LINK essential to the Chainlink network.

Tokenomics

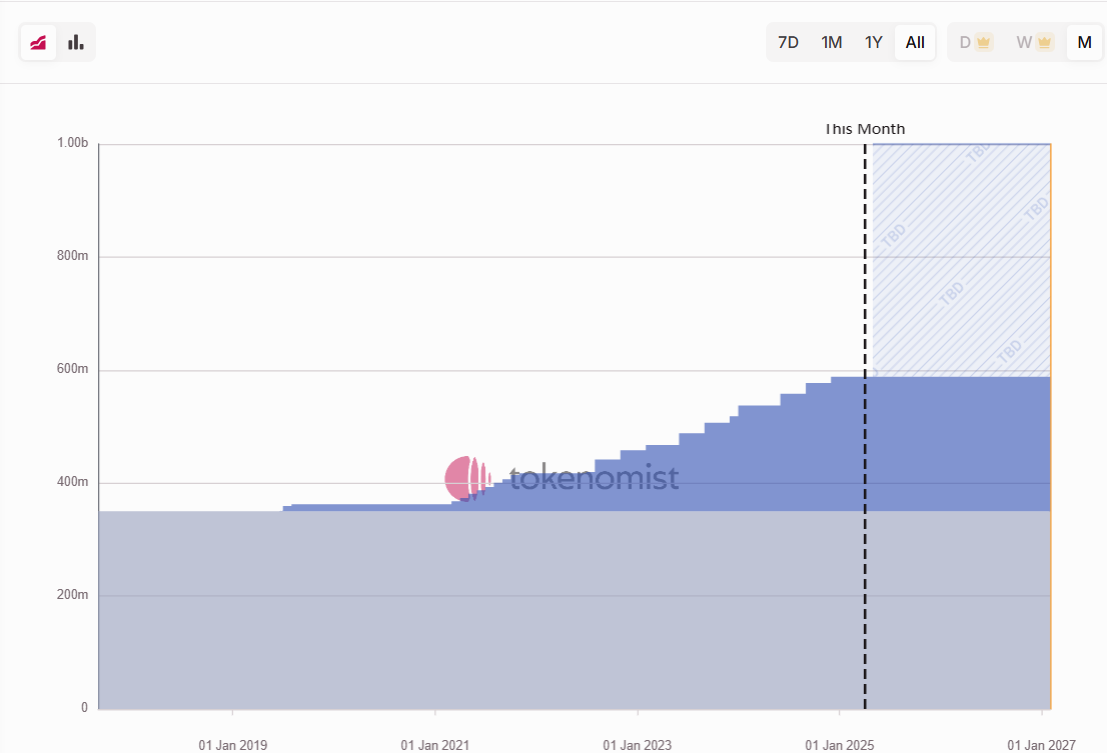

Chainlink’s native token, $LINK, has a fixed total supply of 1 billion tokens. To us, having a fixed supply is bullish as it brings scarcity and does not allow inflation, similar to Bitcoin. As of November 2024, approximately 600 million tokens are in circulation, as verified in the chart below.

Regarding the rest of the supply, it is unclear how it will be distributed going forward. However, from the data here, we can see 35% of the total supply was sold to investors and the public in the token distribution. The remaining 65% was kept for the ecosystem, node operators who maintain the network, and the development team for operational purposes. Because of the capped supply, decent distribution, and the fact that LINK has been around since 2017, we can assume that supply is not an issue with this token going forward.

Utility for the token

When we look at the utility of $LINK, we see that it plays a crucial role in the ecosystem. Firstly, it is used to reward node operators by rewarding them for delivering high-quality off-chain data to smart contracts, which in turn feed into DeFi apps.Secondly, $LINK can also be staked by node operators and token holders to help ensure that the information stays reliable. This creates a security mechanism that discourages dishonest behaviour by penalising nodes that provide inaccurate data.

Therefore, we can see that the token has utility as payment for node operations providing high-quality data and is also used to penalise bad actors. These all come together to show that $LINK is quite valuable in its ecosystem, giving investors additional reasons to get involved.

The thesis: essential role in DeFi

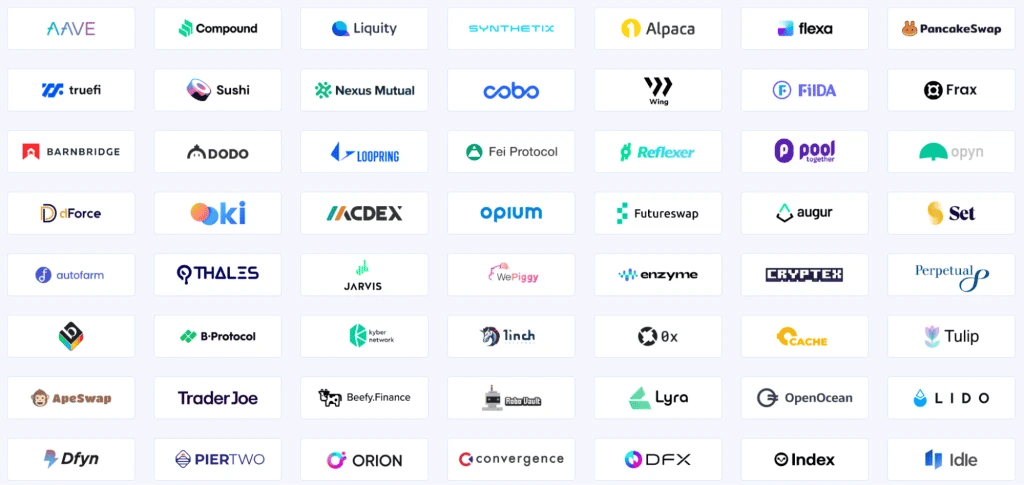

Chainlink is an OG in the DeFi space, but most do not know just how fundamental of a layer it is. Through its reliable and tamper-proof price feeds, platforms such as Aave and Compound use Chainlinks oracles to set col-lateralisation ratios and prevent liquidation risks. Chainlink is also used by automated market makers (AMMs) like Uniswap and 1inch, along with derivatives platforms like Synthetix. They all depend on Chainlink’s decentralised oracle networks to provide real-time, aggregated price data to ensure that transactions remain trustless, transparent, and accurate.By providing lightning-fast, precise, and decentralised data feeds, Chainlink is a cornerstone in enhancing the security, scalability, and reliability of DeFi protocols. In fact, in the image below, we can see some of the many protocols using Chainlink behind the scenes and relying on Chainlink to secure billions of dollars in value.

Use across sectors

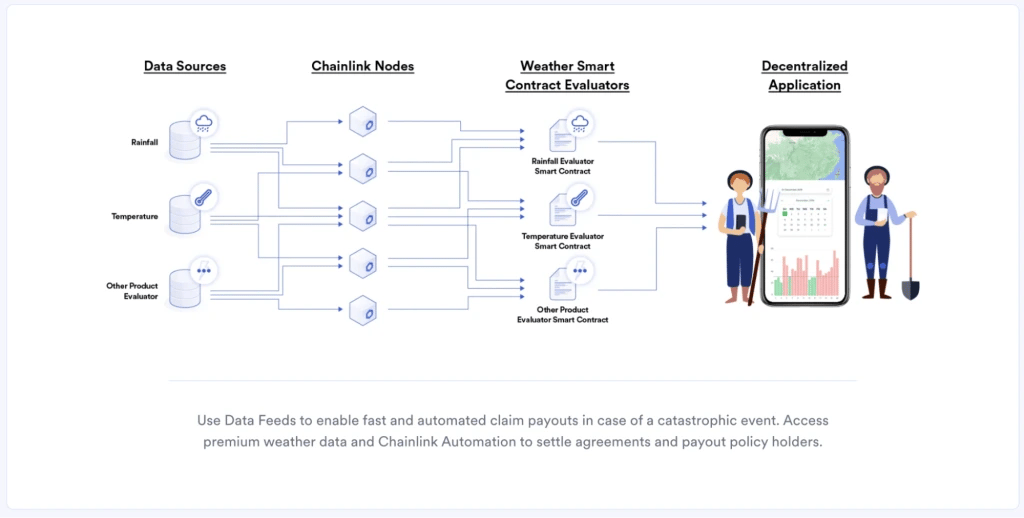

Beyond DeFi, Chainlink redefines how industries like gaming, insurance, and entertainment utilize blockchain technology. Chainlink partnered with the NBA to bring more fan engagement in gaming by powering dynamic NFTs for fantasy sports. Using its oracles, real-world player statistics are fed into NFTs, creating interactive experiences that bring the excitement of live games into the digital realm. Chainlink also enables automated and trustless insurance coverage by integrating real-time weather data into smart contracts.For example, weather-based policies use Chainlink oracles to automate claims for extreme weather conditions like hurricanes or droughts, as we can see in the image below. Through this, people can get fast and transparent insurance claims without needing to process the original long and drawn-out manual claims. While we only mentioned two popular examples, these alone effectively highlight Chainlink’s ability to bridge blockchain with real-world data, unlocking new possibilities across sectors.

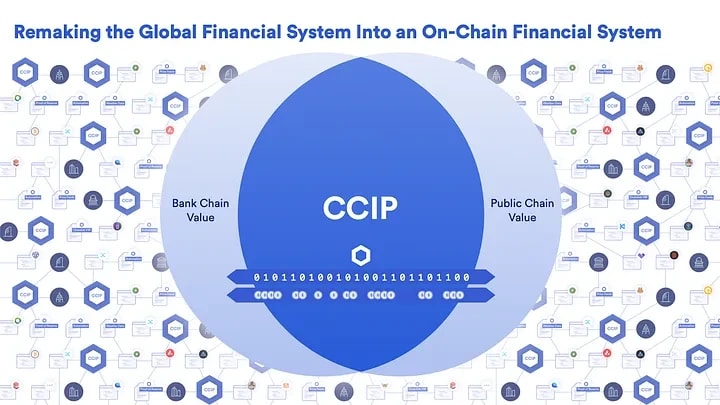

The CCIP product

Alright, so what is CCIP? It stands for Cross-Chain Interoperability Protocol, and this allows blockchains to operate less like their own isolated islands and more like connected cities with paths and routes everywhere. It does this by enabling secure, seamless communication between different blockchains.This is important because it makes blockchain ecosystems more flexible, opening up a ton of new use cases. For example, SWIFT, a messaging network for financial institutions, has done tests using CCIP to allow institutions to interact and move tokens across chains safely and securely. On top of this, another use case is cross-chain lending, which allows liquidity to no longer be fragmented across chains and instead be on whatever chain the lender or borrower prefers.

So, from powering cross-chain DeFi applications to facilitating enterprise-grade integrations, we believe that CCIP is not only a critical step toward a more interoperable blockchain future but also a key innovation in the ChainLink system.

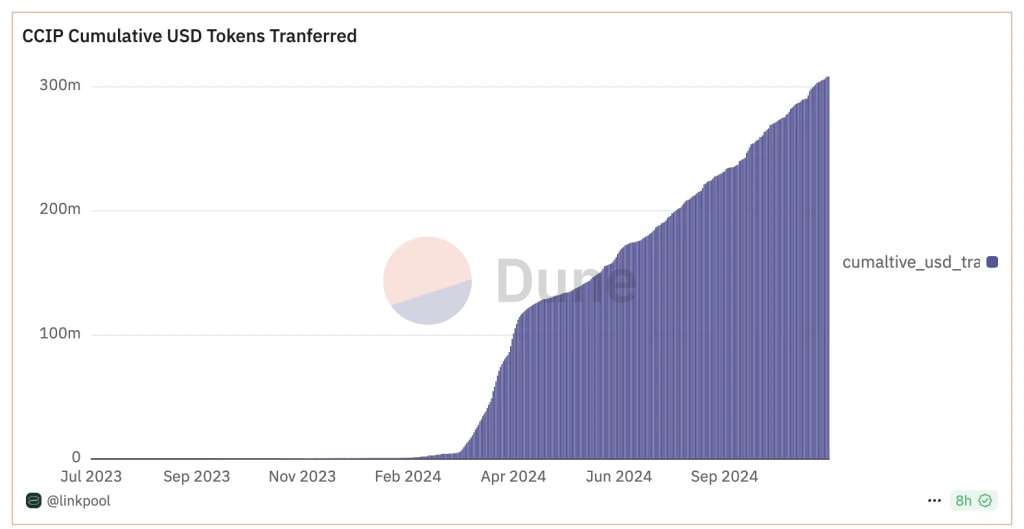

In fact, in the graph below, we can see that the rest of the industry would also agree with our take. Within just a few months, the amount of total tokens transferred has tripled, showing that not only is the tech good, but the adoption is on the rise.

Link valuation exercise + price targets

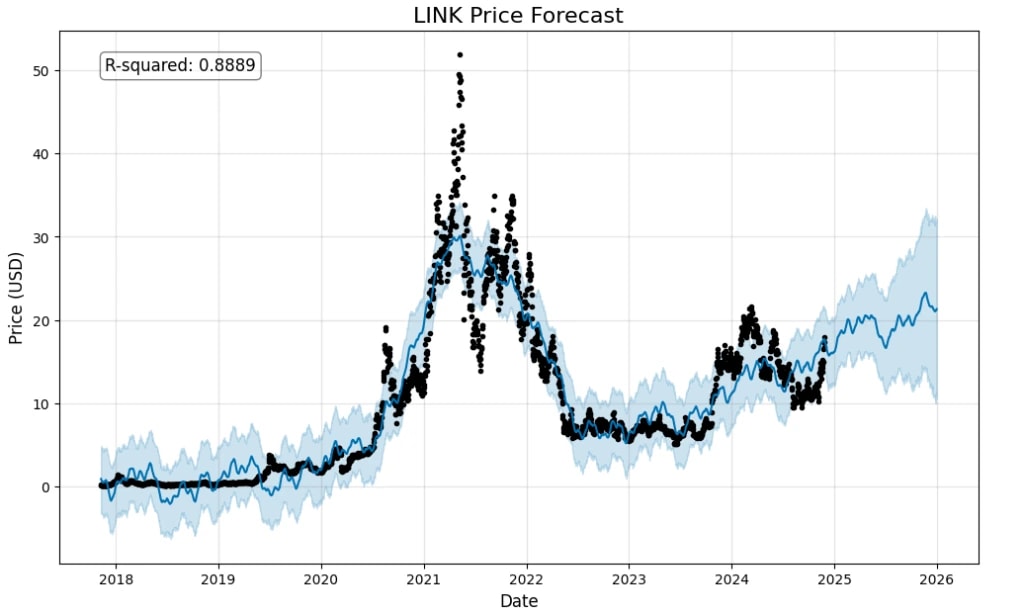

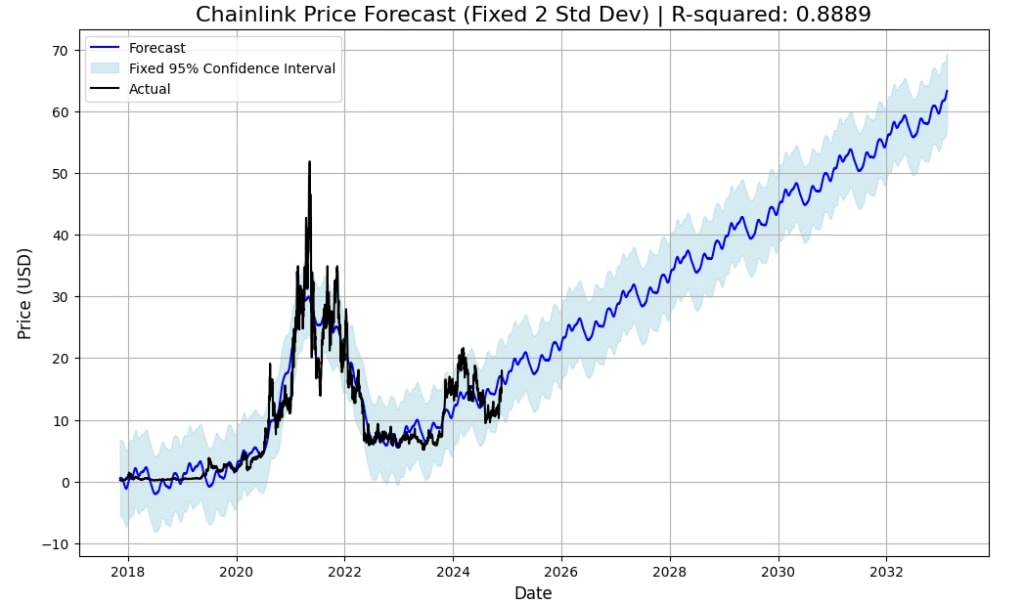

If you have been reading our thesis on assets, you might have noticed that we like using quantitative methods for our valuations. For forecasting, we downloaded the historical price of LINK and utilised a machine-learning model based on the Prophet library to forecast future prices, resulting in the following projections:For 24/25

The graph shows a time series forecast with actual values (black line) and predicted values (blue line) along with a confidence interval (shaded area).

Bearish scenario: This is a bearish scenario which suggests that LINK’s price action will be subdued, suggesting a potential price of roughly $13 by the end of 2025.

Base scenario: This is our base scenario, where we can expect the price of LINK to be around $30 as per our model.

Bullish scenario: In a bullish scenario, we can expect the price of LINK to test the previous ATH and reach roughly $50 per LINK by the end of 2025.

For 2032

We employed the same model to forecast our long-term targets as well. However, it is important to note that the longer we try to forecast, the less accurate the predictions become. Therefore, it will only be natural that the price action won’t follow the somewhat linear forecast presented below. However, it gives us an idea of where the long-term trend is headed. Here is our model:

We expect deviations from the trend as we have seen LINK doing occasionally in the past: both to the upside and the downside. Taking into account everything, we have the following predictions: Base case: We can expect LINK to reach approximately $60 by 2032 as per our model.

Bullish case: In the past, LINK was around 60% above the predicted area during the euphoric stages of the market. Therefore, in a bull-case scenario, we can expect LINK to do the same. Taking our $60 base target, that would result in $96.

Summary

Potential risks

While the data looks good, and there are real bullish cases and use cases for Chainlinks technology, we still think there are some possible risks when it comes to the tech itself and the overarching project. In this part, we will go over a potential competitor, a unique security problem, and a potentially bearish chart.Competition

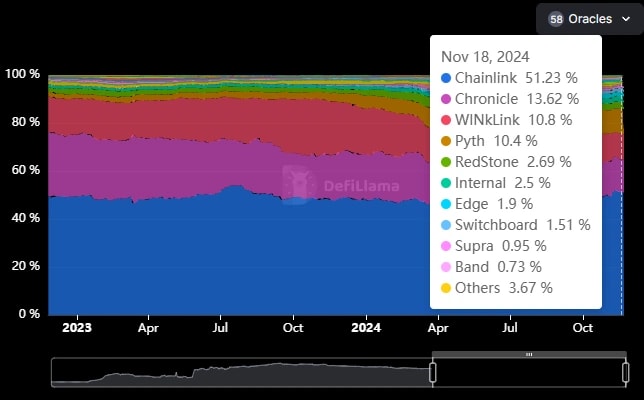

Firstly, we want to talk about Chainlink's most prominent competitor, Pyth. Growth-wise, Pyth has outperformed the rest of the Oracle market, so we believe it is important to talk about it. Let's dive in! Total Value Secured (TVS)Let's start with the total value secured (TVS); this metric is important to look at because it transparently shows just how much total trust and belief people put behind each oracle. As we can see from the chart below, Pyth (orange) has very quickly increased its share of the TVS among all the oracles. In fact, in the past two years, its TVS has surged from a mere $400m to over $7b, a nearly 2,000% gain. Meanwhile, Chainlink has gone from 11B to 33B, a 300% gain in the past two years. And yes, arguably, Chainlink's growth is bigger. However, we believe that Pyth's growth is more important as they actually increased their share of the TVS by oracles while Chainlink's dominance dropped.

Data sourcing and ownership

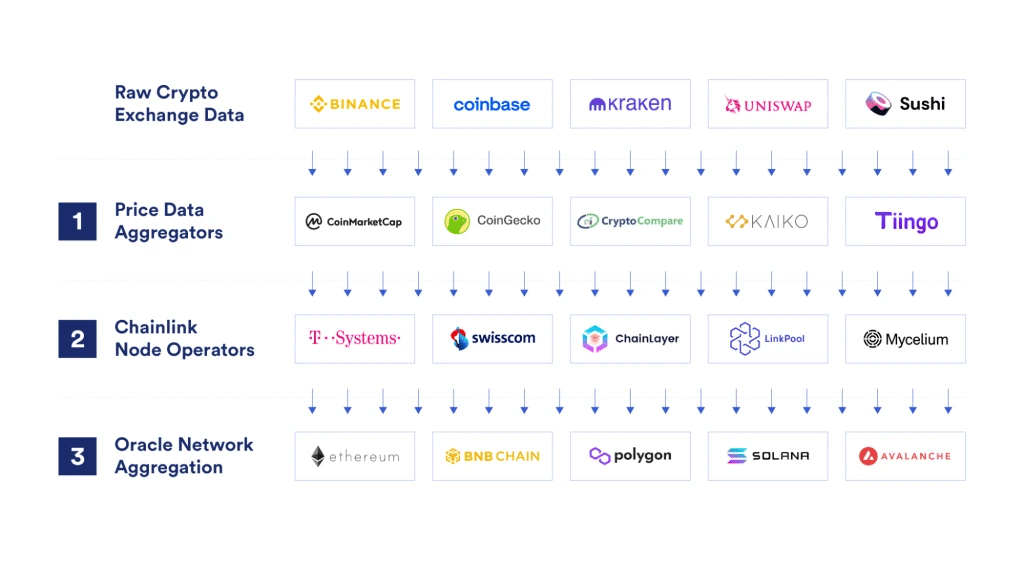

The next thing we think is relevant is how each platform receives its Data and the ownership of that data thereafter. When we look at Chainlink, we very quickly see, in the image below, that they actually do not get their price Data exclusively from the source but rather from third-party aggregators.

This means that node providers combine the third-party aggregated data from platforms like Coin Geko and CoinMarketCap to then feed into Dapps using the data feed. Because of this, Chainlink doesn't own the price data it aggregates; instead, it serves as a decentralised bridge between the data providers and the dapps. Therefore, if something were to happen to the third-party aggregators, ChainLink would struggle to keep offering its services to dapps.

Pyth data sourcing

When it comes to Pyth’s data, we get a completely different story. From their website, we can see that Pyth gets its data directly from providers, which happen to include large financial institutions, exchanges, and market makers like Binance, Jane Street, and CBOE, to name a few. This means that not only is their data better suited for high-frequency use because of the speed of getting it from the source, but they also have ownership over their data, unlike Chainlink. Pyth’s contributors generate and own the data, offering a higher level of trust and provenance for financial applications.So, with all this in mind, we can safely say that when it comes to financial data, Pyth takes the cake, as you cannot beat the high speed and efficiency of getting data from the source rather than an aggregator like Chainlink. When it comes to data ownership, we think that Pyth's direct rights to their data would give a higher level of trust and security to businesses and projects using the data themselves.

Overall, we can see that from a couple of points we brought up here, Pyth already has some things in favour of it over Chainlink, but that doesn't mean that Chainlink is obsolete. In fact, with its many products, we do believe that Chainlink is almost too big to be completely taken over, but when it comes to data speed and ownership, there seem to be better options.

Multisig problem

Another potential risk that comes with Chainlink is that they aren't fully decentralised. When reading their documentation, we can see that they have a multi-sig that, with 4/8 signers, can allow them to modify the on-chain parameters of Chainlink. Now, it is proper to note that the reason behind this is that it provides a less risky way to respond to black swan events quickly because, according to the team, other methods are long and drawn out and provide greater risk.However, at the end of the day, this is quite a powerful power to have, and it leaves them susceptible to bad actor attacks. But, from what we know, the signers are spread across many locations across the world and rotated periodically, making the risk that someone gets ahold of them quite low.

How to buy $LINK

- Buying on a Centralised Exchange

- Step 1: Choose a centralized exchange

- Step 2: Create and verify your account

- Sign up for an account on the chosen exchange and go through the verification process,

- Step 3: Deposit funds

- Deposit funds into your exchange account. You can typically use bank transfers, credit/debit cards, or cryptocurrency transfers.

- Check the exchange's supported payment methods if you are depositing fiat currency (like USD or EUR).

- Step 4: Buy $LINK

- Navigate to the trading section of the exchange.

- Search for the PRCL trading pair (e.g., LINK/USDT, LINK/USDC)

- Decide on the amount of LINK you want to purchase and choose between a market or limit order.

- Market order: Buy $ LINK at the current market price.

- Limit order: Set a specific price at which you want to buy $LINK. The order will be fulfilled once the market reaches your specified price.

- Review the order details and confirm the purchase.

- Step 5: Withdraw $LINKto your wallet

- After purchasing $LINK, it's a good practice to withdraw the tokens to a secure wallet like Phantom for safekeeping.

- Buying via Phantom Wallet

- Step 1: Install Phantom Wallet

- Download and install the Phantom wallet extension for your browser from the official Phantom website.

- Create a new wallet or import an existing one using your recovery phrase.

- Step 2: Secure your wallet

- Write down and securely store your recovery phrase. This phrase is crucial for recovering your wallet in case of loss or device failure.

- Step 3: Fund your Phantom wallet

- Deposit ETH directly into your Phantom wallet by transferring it from a centralized exchange where you've purchased $LINK.

- Alternatively, deposit other EVM-supported tokens stablecoins like USDC or USDT if you plan to swap them for $LINK.

- Step 4: Use the built-in swap feature

- Open the Phantom wallet and navigate to the "Swap" tab.

- Choose the token you wish to swap (e.g., USDC) and select $LINK as the output.

- Alternatively, enter the $LINK contract address.

- Enter the amount you want to swap and review the transaction details, including the estimated network fees.

- Confirm the transaction and approve it within the Phantom wallet.

- Step 5: Verify the transaction

- Once the transaction is complete, you'll see the updated $LINK balance in your Phantom wallet.

Cryptonarys take

Overall, we can see that Chainlink isn’t just your run-of-the-mill crypto project. It’s an irreplaceable bridge that has staying power as it solved the Oracle problem. But now it is known for much more than that; with recent innovations like CCIP, it continues to position itself as the backbone of countless DeFi and non-DeFi applications. While it’s not the most flashy crypto product, it plays a key role in the background of many applications in the crypto space.As businesses increasingly explore blockchain-based products, Chainlink’s solutions will likely be central to many integrations. Whether you’re a developer, a business owner, or just curious about where tech is heading, Chainlink offers a clear signal: the future of blockchain isn’t just decentralised—it’s connected, intelligent, and ready to solve real-world problems, and Chainlink is making that future possible.

Peace!

Cryptonary Out!