Cryptonary's thesis on PRCL

Imagine real estate as fluid as cryptocurrency, where you can trade property markets worldwide with the click of a button. Parcl shatters the barriers of traditional real estate, transforming a locked-up, illiquid asset into an accessible, dynamic market. Powered by Parcl Labs’ cutting-edge, real-time data, it’s more than trading — it’s a new era of property investment open to everyone, everywhere. Let's dig deeper.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is Parcl?

Parcl is bringing real estate trading onto the blockchain, aiming to make real estate investment more accessible, flexible, and liquid. Real estate is one of the most significant sources of wealth globally, exceeding $600 trillion in total market cap.However, the market is largely illiquid, making it very hard to capitalise on the rise or fall of real estate prices. Properties typically take considerable time to sell, with transactions involving lengthy processes and significant expenses. However, with Parcl it is possible to trade real estate in real-time.

Parcl allows users to speculate on the real estate markets of various cities worldwide through city indexes. These indexes represent the median price per square foot or metre, offering a way to invest in real estate without buying physical property. This approach democratises real estate investment, allowing users to take positions with as little as $1.

Further, Parcl's value proposition includes high-fidelity, real-time real estate price data. This data is meticulously crafted from millions of data points, offering a transparent and accurate reflection of city-specific real estate values.

It is developing a full-suite data platform focused on real estate. The application of the data platform can extend beyond the trading platform. For example, Parcl is targeting institutional players in the real estate industry. Furthermore, Parcl Labs offers comprehensive documentation and support to developers and data scientists interested in integrating real estate data into their applications, as well as facilitating access to their API and its features.

Key features of PARCL

One of the innovations that Parcl brought to the blockchain industry is the ability for individuals to trade real estate assets on-chain. Ranging from Los Angeles to London, for the first time, crypto users can go long or short on global real estate markets.This is an unprecedented product that can make a significant impact on the industry if it gets adopted. Imagine being able to short the housing market in 2008 or long/short residential areas during COVID-19 lockdowns. Add to that blockchain’s transparency, Solana’s high throughput and low cost.

Another significant flagship product of Parcl is its data platform. In fact, real estate trading platforms wouldn’t be possible without Parcl’s data platform. Traditionally, the average price of property in specific locations has been calculated using Case-Shiller Index. However, the problem is the index is updated every 1-2 months. However, for building a real estate trading platform, the team needed real-time, globally representative and scalable data .

Therefore, Parcl Labs created its own proprietary real estate price index that is fed to a trading platform to bring liquidity and efficiency into the real estate industry. More importantly, it was demonstrated that this index can actually predict the Case-Shiller Index before it is even out. If you are in real estate, that is a huge informational advantage if you are using Parcl Lab’s data instead of relying on conventional indexes.

However, the story doesn't end there. Apart from the price index, the platform has more in depth data points related to real estate such as behaviour of homeowners, trends, numbers and many more which Parcl can sell to anyone interested in them.

Therefore, the data platform remains one of the innovative products by Parcl that can be huge for the real estate industry, and it is at the core of our thesis.

Parcl has also expanded into perps and forex. Thus, Parcl also allows users to trade crypto assets and currencies with leverage.

These features enable traders to take long or short positions on various crypto assets such as BTC, ETH, SOL and currencies such as USD, EUR without needing to own the underlying asset. Even though there are many prep and forex platforms in crypto, the ability to trade any assets beyond real estate is a nice addition to the overall ecosystem.

The token: PRCL

This is where Parcl steps up. Its economic model is uniquely powerful — not just a trading platform but a real data engine that brings value directly to its $PRCL token. Parcl Labs provides real-time property data that outshines traditional benchmarks, and accessing this data requires staking $PRCL. With a capped supply and demand from institutional players, it is a really smart setup. And stick around because we go deeper into Parcl Labs a bit later in the article.Tokenomics

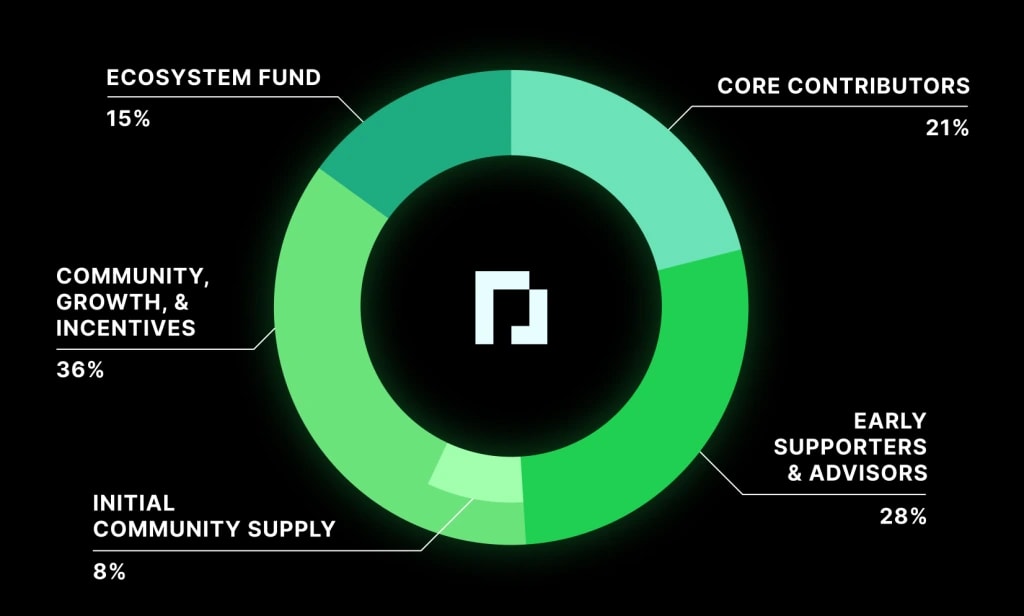

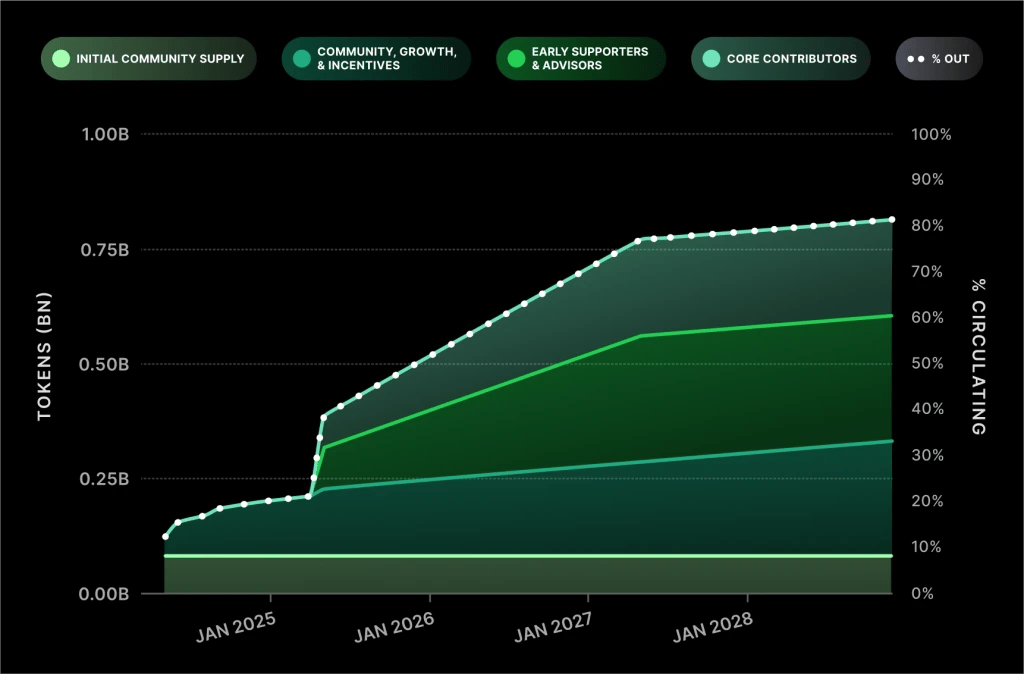

From the staking aspect, we see there is a real reason why demand will be there, but demand alone isn't enough if the tokenomics are predatory, so let's take a look.Similarly, PRCL has a considerable supply overhang to absorb in the coming years. As of now, only 13% of PRCL's total supply is circulating in the market. The supply is expected to grow over the coming years when the tokens allocated to VCs and team members will gradually start coming into the market.

And we see this with the following chart, the more time goes on the more supply comes into the market and we can see this will be a pretty large issue from now till about mid-2027.

We think it is important to take note that the big jump in supply, almost 20%, is coming up soon and is said to be on the 16th of April 2025 which is in approximately 5 months.

This being said, the market's ability to absorb the incoming supply will be a critical factor in determining PRCL's price trajectory in the future and for now it doesnt look good.

The case for PRCL

From all we have been talking about it is safe to say that there is a supply overhang but we would be wrong to say we are bearish on the product. The team is doing exceptionally well and have onboarded a few institutional players, on top of that TVL, chart below, continues to rise.Overall, Parcl, token-wise, suffers from the fate many crypto projects fall to, and that is predatory tokenomics. With so much supply overhang, it is nearly impossible for tokens like this to have substantial staying power.

Parcl’s success will hinge on its ability to attract institutional adoption and bridge the gap between traditional real estate and blockchain technology. If it can do so, the project could significantly impact the $600 trillion real estate market, potentially opening up new investment opportunities for users worldwide. As we look forward to seeing how Parcl evolves, our confidence remains high in its potential to redefine real estate investment in the blockchain space.

The Bull case

We think that Parcl as a product has a few things going for them, from opening real estate to smaller fish, to letting funds hedge their real estate risk.The real estate market is worth over $700 trillion, but it's been locked away behind high costs and complex processes. Parcl changes this by making real estate accessible — allowing you to invest in property markets without buying actual property. If Parcl can capture a bigger slice of this market, it could be a game-changer, giving everyday investors an easy way to get exposure to one of the biggest asset classes in the world.

Lastly, Parcl has a very good data platform, Parcl Labs, which is a full-suite data platform centred on residential data analytics.

The Bear case

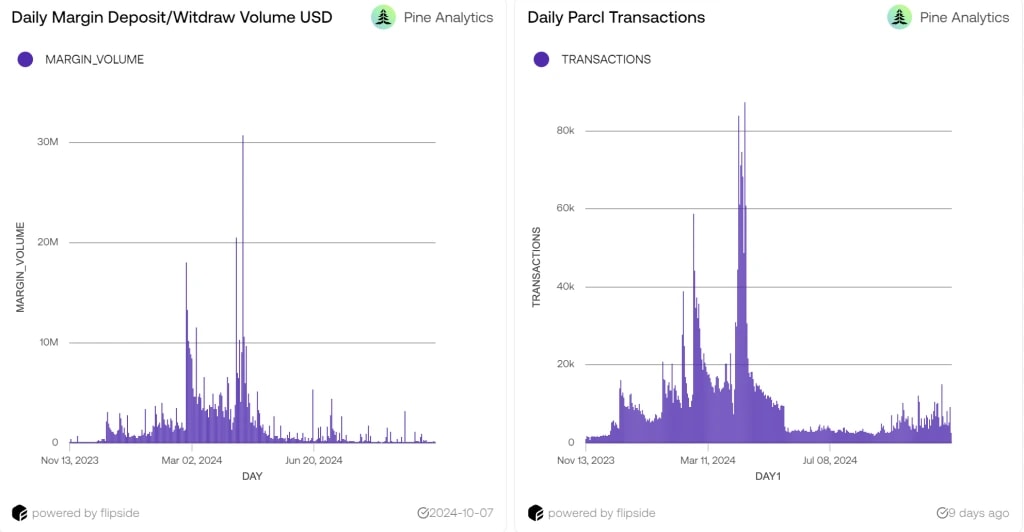

Admittedly, there is a lot of reasons to be bullish on PARCL overall but as we dig deeper we think there might be some underlying problems. Firstly we want to look at the TVL which we have just below in the chart.Next we see that the volume and daily transactions have dropped t as we can see from the data below. Almost all of the volume and transactions peaked when the airdrops were happening, and now that they are over it has gone down monumentally.

Parcl’s valuation exercise + price targets

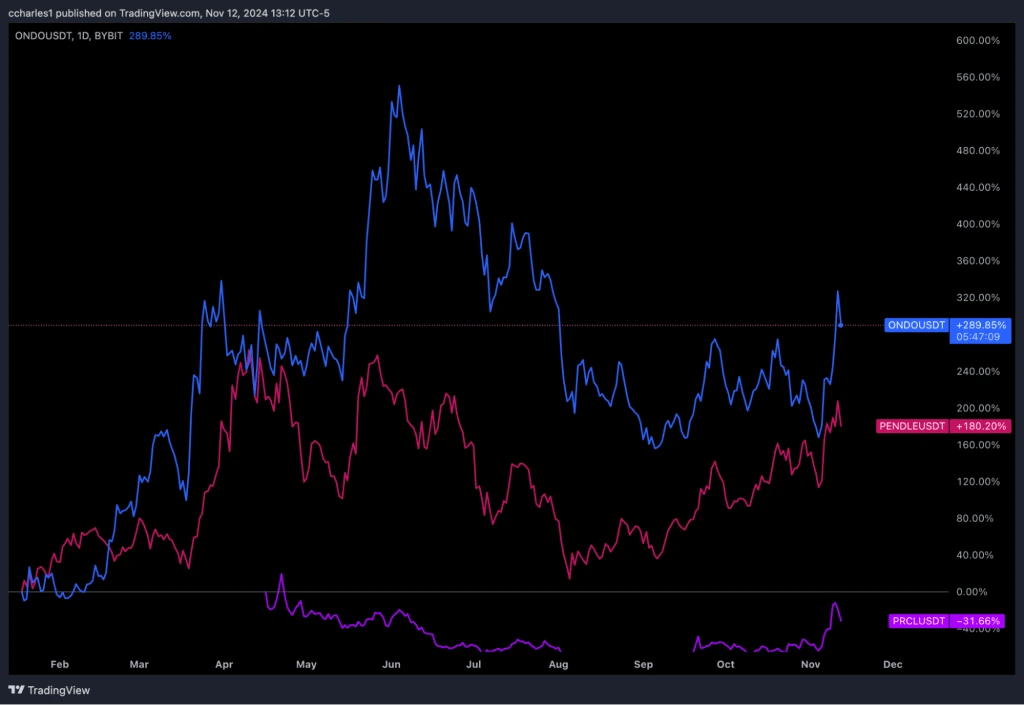

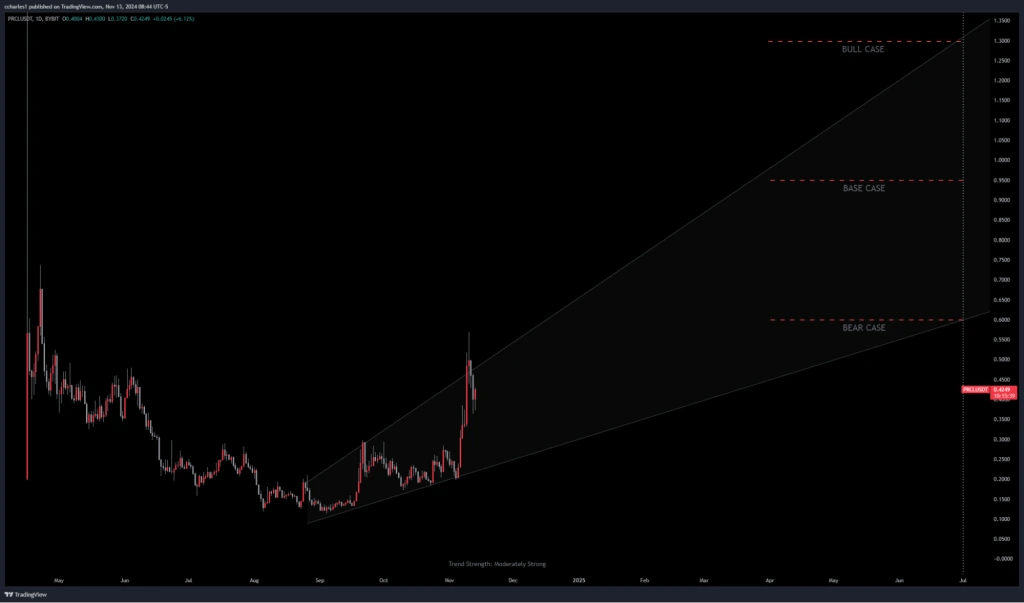

If you have been reading our thesis on assets, you might have noticed that we like using quantitative methods for our valuations. Unlike our previous valuation frameworks, Parcl doesn't have enough price action because it launched this year, so we have gone with a trend-based valuation exercise.For 24/25 cycle

From looking at the current trend, we can see that just recently, the price has changed into a bullish trend, and we can now have an idea of what the price might look like later in our 2025 cycle:Best case scenario: In this scenario, the market can exceed our expectations and things that we previously didn’t consider come up or believed were low-likelihood events. To account for this scenario, we are doubling our bullish scenario to account for euphoric scenarios where things can get crazy. Thus, we expect $2.6 per PRCL in our best case scenario, which would result in 400% increase.

For 2032

The most significant bull case for the token would be tapping into a slice of the $700 trillion real estate market — that’s the vision behind Parcl. By creating a way to trade property values without the usual barriers, Parcl could unlock massive opportunities as the market grows.If more people dive into Parcl’s platform, liquidity deepens, attracting even more traders and liquidity providers and strengthening the entire ecosystem. This creates a feedback loop where Parcl could start capturing real value from a tiny sliver of the global real estate market. If it takes off, Parcl might redefine property investing on-chain and bring a new wave of interest (and value) to the $PRCL token.

Therefore,in a bull case scenario where Parcl succeed in tapping into the real estate market, we are estimating that PRCL could be worth north of $3.00 per PRCL or a $3 billion fully diluted market cap.

Summary

How to buy PRCL

- Buying on a Centralised Exchange

- Step 1: Choose a centralized exchange

- Step 2: Create and verify your account

- Sign up for an account on the chosen exchange and go through the verification process,

- Step 3: Deposit funds

- Deposit funds into your exchange account. You can typically use bank transfers, credit/debit cards, or cryptocurrency transfers.

- Check the exchange's supported payment methods if you are depositing fiat currency (like USD or EUR).

- Step 4: Buy PRCL

- Navigate to the trading section of the exchange.

- Search for the PRCL trading pair (e.g., PRCL/USDT, PRCL/SOL)

- Decide on the amount of SOL you want to purchase and choose between a market or limit order.

- Market order: Buy PRCL at the current market price.

- Limit order: Set a specific price at which you want to buy PRCL. The order will be fulfilled once the market reaches your specified price.

- Review the order details and confirm the purchase.

- Step 5: Withdraw PRCL to your wallet

- After purchasing PRCL, it's a good practice to withdraw the tokens to a secure wallet like Phantom for safekeeping.

- Buying via Phantom Wallet

- Step 1: Install Phantom Wallet

- Download and install the Phantom wallet extension for your browser from the official Phantom website.

- Create a new wallet or import an existing one using your recovery phrase.

- Step 2: Secure your wallet

- Write down and securely store your recovery phrase. This phrase is crucial for recovering your wallet in case of loss or device failure.

- Step 3: Fund your Phantom wallet

- Deposit SOL directly into your Phantom wallet by transferring it from a centralized exchange where you've purchased PRCL.

- Alternatively, deposit other Solana-supported tokens stablecoins like USDC or USDT if you plan to swap them for PRCL.

- Step 4: Use the built-in swap feature

- Open the Phantom wallet and navigate to the "Swap" tab.

- Choose the token you wish to swap (e.g., USDC) and select PRCL as the output.

- Alternatively, enter PRCL's contract address.

- Enter the amount you want to swap and review the transaction details, including the estimated network fees.

- Confirm the transaction and approve it within the Phantom wallet.

- Step 5: Verify the transaction

- Once the transaction is complete, you'll see the updated PRCL balance in your Phantom wallet.

Cryptonary's take

Overall, we like what Parcl is doing by taking bold steps to bring real estate onto the blockchain and transform a traditionally inaccessible asset class into a flexible, tradeable digital market. On top of this, synthetic property trading through Parcl Labs opens doors for retail investors and institutions to speculate on property values without the usual costs and barriers. However, as we can see, the road to adoption isn’t easy, and it can fail altogether. The Real Estate space is an established and conservative industry, and bringing users on board, especially institutions, takes a lot of time and value to convince them. The upcoming token unlocks also present a challenge, with a surge in circulating supply that could weigh on $PRCL’s price in the near term. Additionally, the platform’s growth depends heavily on liquidity and consistent trading activity, which are tapering off and aren't showing signs of growth.In the long term, Parcl has the potential to redefine on-chain property investment, yet significant challenges remain. If institutional adoption falters or liquidity becomes scarce, the value of $PRCL could face downward pressure, putting Parcl’s ambitious vision at risk. Currently, our targets remain conservative, but given its low market cap, there is room for explosive growth. That said, Parcl is approaching some of our key invalidation thresholds, and we will monitor it closely over the next 1-2 months before making a final decision.

Cryptonary, OUT!