Cryptonary's thesis on Shadow (SHDW)

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

The rise of decentralised storage and computing has been a game-changer for blockchain infrastructure. Shadow (SHDW), powered by GenesysGo, is one of the most compelling plays in this sector, offering a scalable, cost-effective, and trustless alternative to centralised cloud services. But does it deserve a spot in your portfolio? Let's dive in.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is Shadow (SHDW)?

SHDW is a decentralised cloud storage and computing platform designed to challenge the $400 billion cloud industry giants. Powered by GenesysGo's cutting-edge D.A.G.G.E.R. technology, SHDW provides developers and businesses with a secure, efficient, and scalable infrastructure for both Web2 and Web3 applications.The flagship product, SHDWDrive, combines open-source object storage with Solana's Proof of History for unmatched speed and scalability.

Unlike traditional centralised solutions, SHDW's infrastructure is decentralised, with its revenue shared among network participants rather than corporate entities. This not only democratises the cloud industry but also creates strong incentives for users to contribute to the ecosystem.

Use cases & application

SHDW is one of the few tokens in the market that is strongly utility-driven. Here's the breakdown:- Web hosting: Decentralised and cost-efficient, ensuring websites and apps are secure and resilient.

- Social media: Secure storage for user content, empowering users by removing reliance on big platforms.

- AI & Machine Learning: Scalable storage solutions for training models and handling large datasets at low costs.

- Archiving: Reliable, censorship-resistant, long-term storage for critical research and historical records.

- Gaming: Protects game assets and player data with decentralised, tamper-proof storage.

- Mobile-centric storage: Utilizes Android and iOS devices for secure, eco-friendly decentralized storage.

Key developments: 2024 progress so far

Since showing off shdwDrive v2 at the Solana Crossroads event in May, the GenesysGo team has been laser-focused on making this thing real. That Proof of Concept demo proved shdwDrive could run entirely on mobile phones, turning them into part of a decentralised storage network. Fast forward to now (Dec 2024), and here's what's happened:1. shdwDrive v2 is nearly ready

The team has been working around the clock to make shdwDrive v2 go from a cool demo to a fully functional product. Final testing and checks are happening now, with the official release expected early next year. This version will bring everything from cheaper storage to higher security, all powered by regular Android phones.2. Expanding the mobile network

More Android devices are joining the network, making storage cheaper, faster, and more secure.3. Next steps: Compute services

After v2 launches, the focus shifts to compute services, enabling apps, websites, and decentralised DNS to run directly on the networkThe rollout of shdwDrive v2 has been pushed to early 2025, which raises some concerns about speed, but this extra time for testing could mean a much smoother launch. Timing-wise, this could actually be a win, lining up nicely with what could be a very bullish market.

If they can communicate these new features in a way that normal people understand, we could see solid demand kick in. The Android focus is smart, with a massive user base to tap into, but missing iOS does hold back adoption a bit. The computing services and decentralised DNS are exciting, but they rely heavily on v2 landing well. Overall, progress is slower than we'd like, but if they deliver, the potential here is big. Now, let's move to the token itself.

The token: SHDW

- Supply dynamics: SHDW has a total supply of 169.06 million tokens, with 161.64 million already circulating. SHDW has very little left to hit full circulation. That's a big positive and is in massive contrast to low-float VC tokens that flooded the market recently. Most of the supply is already out there, and the scarcity is already baked into the tokenomics.

- Revenue sharing: A portion of the fees SHDWDrive users pay is used to buy back tokens, increasing demand. It's putting a floor under the token, as more usage means more buybacks. That's a win for holders, but it's important to keep an eye on how much revenue the platform is pulling in. If the usage of SHDWDrive isn't scaling, the buybacks might not move the needle.

- Staking: Node operators stake SHDW to secure the network, creating a scarcity effect. Staking creates that scarcity effect, which is bullish because it locks up tokens and reduces the liquid supply. On top of that, node operators are incentivized to act honestly to secure the network. The downside here? If staking rewards aren't competitive or if there's low participation, it could weaken the network and reduce demand for SHDW.

- Sustainability: SHDW's tokenomics include mechanisms like slashing and recycling penalties back into the ecosystem, extending the token's lifecycle. Recycling slashed tokens back into the ecosystem is a smart way to extend the token's lifespan and keep emissions balanced. It ensures the system has longevity, which is key for long-term holders. On the flip side, slashing penalties could deter some smaller operators if they're worried about losing their stake, which could hurt decentralisation.

Thesis: SHDW - Can it truly capture retail attention?

SHDW presents a solid foundation with strong fundamentals and a decentralised storage solution aimed at solving real problems in the cloud industry. Its approach to mobile-first decentralization and hardware-backed encryption is forward-thinking, leveraging the potential of smartphones while moving away from traditional server dependency. However, the key question is whether it can truly capture retail interest.

The reality is that retail money flows to projects that are grabbing attention, and SHDW currently isn't standing out from that crowd. Daily trading volume has been low, even during periods of positive market sentiment, where older, established tokens have seen strong performances.

This raises a valid concern: is SHDW's utility struggling to gain traction because it's not seen as relevant or viable in today's market? There are other utility-focused tokens that feel more aligned with the current narratives and have better retail appeal.

That being said, SHDW does have potential. If the team can market the project effectively and clearly communicate the value of its use case, it could turn things around. Late last year, SHDW demonstrated it's capable of delivering significant price action, proving that demand exists for the token under the right conditions.

Looking ahead, the potential launch and success of SHDWDrive2 could serve as a key catalyst heading into 2025. If SHDWDrive2 delivers on its promises and gains traction, it could align perfectly with broader crypto adoption trends, presenting SHDW as a viable player in the space. The timing could be ideal, especially if the market rallies and the narrative around decentralized infrastructure strengthens.

Additionally, last year's massive price increase highlights that demand has been there before, and reclaiming key price points could reignite interest, giving SHDW a strong selling point for both traders and long-term holders.

With effective execution and timing, SHDW could position itself as a compelling narrative for the next cycle.

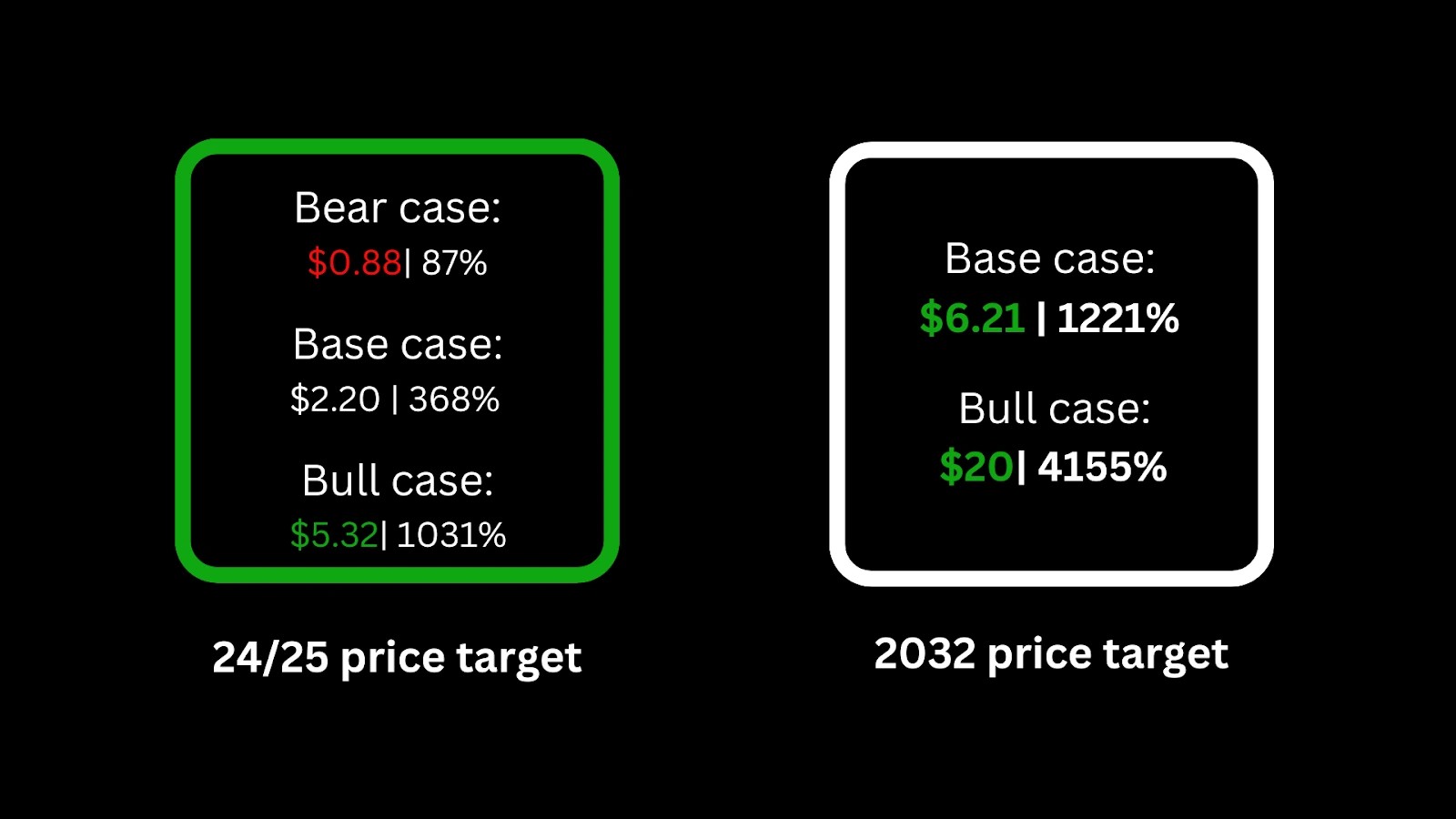

Valuation (for 24/25 cycle)

Shadow is an interesting case; therefore, we will use a multi-step process for the valuation of SHDW. Let's get started.Step 1: SHDW and competitors

These figures provide a benchmark for evaluating SHDW's market potential. If SHDW can achieve similar adoption and utility, it could aspire to comparable market valuations. However, it's crucial to consider factors such as technological differentiation, user adoption rates, and overall market conditions when projecting SHDW's future performance.

Step 2: Factors impacting valuation

Adoption of decentralized storage:- Filecoin and Arweave show strong demand for decentralised storage in AI, NFT metadata storage, and blockchain infrastructure. SHDW's mobile-first approach (targeting Android users) is a unique value proposition that could potentially attract a new market segment.

- SHDWDrive's success hinges on execution and the ability to onboard developers and enterprises.

- Unlike Filecoin and Arweaeve, Shadow's value accrual is very strong. SHDW tokens are required for staking, node operation, and paying for storage fees.

- Revenue-sharing mechanisms (buybacks, staking rewards) incentivise participation, increasing token scarcity over time.

- SHDW can align with bullish narratives like decentralised infrastructure, mobile-first decentralisation, and Solana ecosystem growth.

- Execution timing (e.g., SHDWDrive v2 in 2025) will likely coincide with broader market cycles; this is theoretical, but it could be achieved.

Step 3: Valuation scenarios

Bearish scenario:- SHDW captures 10% of Arweave's current market cap ($1.42B) due to slower adoption or execution delays.

- Market Cap Target: $142M

- Price target: $142M ÷ 161.64M (Circulating Supply) = $0.88

- SHDW captures 25% of Arweave's market cap if SHDWDrive v2 is adopted and demand grows moderately.

- Market Cap Target: $355M

- Price target: $355M ÷ 161.64M = $2.20

- SHDW achieves 25% of Filecoin's market cap ($3.43B), driven by the adoption of mobile-powered decentralized storage and a successful SHDWDrive v2 rollout.

- Market Cap Target: $857M

- Price Target: $343M ÷ 161.64M = $5.3

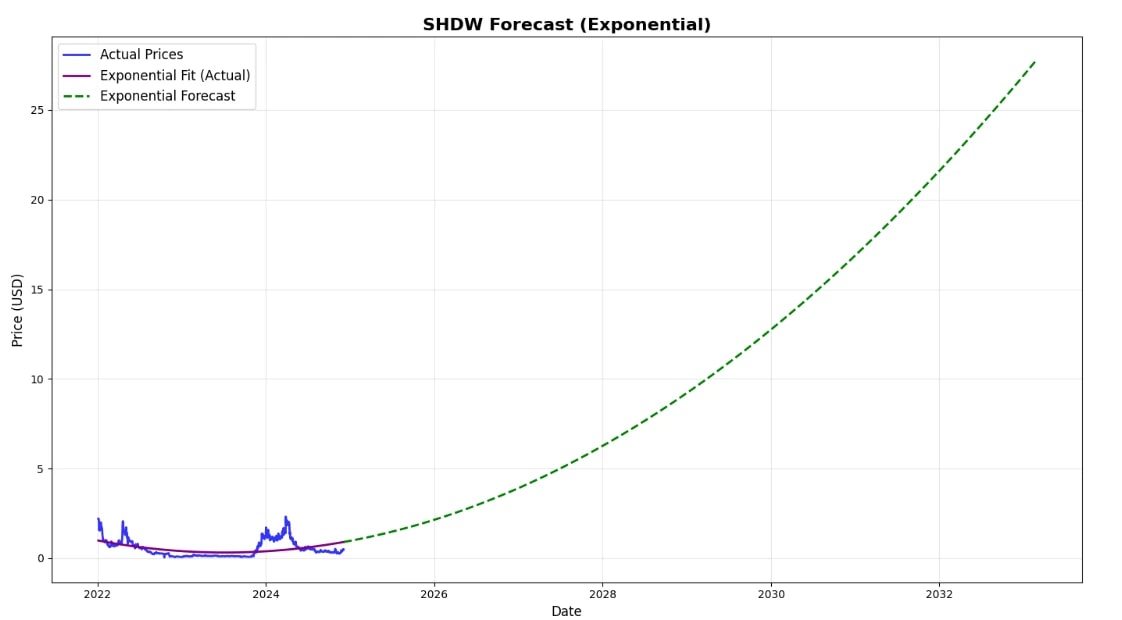

2032 targets

For our longer-term targets, we have employed our quantitative forecasting methods. It is high risk, but if our thesis is right, we can expect exponential growth over the coming years. So here is our model:

Based on this model, we expect SHDW to reach north of $20 per token in a bullish case by 2032. For the base, we expect to reach 1b dollar valuation by that time, which will translate into $6.21 per SHDW

Summary

Market behaviour and price action

Broad perspective

One thing we can't overlook is the massive demand SHDW experienced late last year. The market context, sentiment, and behavioural factors that fueled that explosive move are still present in the market today. That wasn't just any price swing-it was a powerful, attention-grabbing rally that required significant volume and interest to push it that far.It's a reminder that, despite SHDW's recent quieter price action, this token has proven it can deliver when the conditions are right. That past performance gives us confidence that SHDW can stand out again when the right narrative and momentum align. Let's break down its current setup next.

Analyzing Q1s range

During Q1 and heading into early Q2, before the market turned more bearish, SHDW set a strong range with the $1.75 level standing out as a key resistance. Price struggled to break above this zone, and while we did see a brief breakout, it didn't hold for long. There was a lot of selling pressure at that level, which isn't surprising given the massive rally that led SHDW up to this point in the first place.What made this level stand out was the unique price action SHDW displayed at the time - it almost felt like some big holders were offloading into this range, adding to the resistance. This is something worth keeping in mind, as we may see similar dynamics play out if the price trades back to that level in the future. Understanding how SHDW reacts around $1.75 will be crucial for navigating its price action going forward.

Today's price action

What we're looking at today is the key range SHDW is trading within, and it's not random. This is the same range we traded back in November before that massive move to the upside. That makes it historically significant, and it's something we need to keep in mind.

Buyers who stepped in back then at the lower end of this range were key in driving the price up, and there's a good chance some of them are still holding, especially if they're seeing potential in the fundamentals.

If the catalysts we've discussed in this report, SHDW Drive v2-can, be executed and marketed effectively, this range could once again prove to be a great buying opportunity, just like it was last time. It's a level worth watching closely.

Playbook

We've got two key buy boxes to consider. The first one is at the current range between $0.2780 and $0.4700, which was also the key range back in November. This level has historical relevance, but buying here would be considered more aggressive.Why? Because compared to the broader market, SHDW hasn't shown much strength since Trump's win. While we've seen major altcoins and meme tokens make significant moves on the back of bullish sentiment, SHDW hasn't followed suit. We always prioritize strength, and SHDW hasn't delivered in that regard.

Buying in this range means you're betting on the team's ability to deliver on next year's promises and hoping for a repeat of last year's impressive price performance.

The second buy box is around the $1 mark and is a more conservative option. This level was the key support for Q1's range and carries a lot of psychological importance in the crypto market. The $1 is often viewed as a milestone- and it's often seen as a strong support level and a nice, round "cheap" price point when it flips into support.

This area was the floor during SHDW's bullish context earlier this year. If the price can reclaim this level, it would signal a major shift in sentiment and could turn things significantly more bullish. With SHDW's potential, assuming the project executes well, buying at this level could still deliver great returns and set you up for solid profits down the line.

How to buy $SHDW

- Buying on a Centralised Exchange

- Step 1: Choose a centralized exchange

- Popular centralized exchanges that list $SHDW include Coinbase and Crypto.com.

- Step 2: Create and verify your account

- Sign up for an account on the chosen exchange and go through the verification process,

- Step 3: Deposit funds

- Deposit funds into your exchange account. You can typically use bank transfers, credit/debit cards, or cryptocurrency transfers.

- Check the exchange's supported payment methods if you are depositing fiat currency (like USD or EUR).

- Step 4: Buy $SHDW

- Navigate to the trading section of the exchange.

- Search for the SHDW trading pair (e.g., SHDW/USDT, SHDW/USDC)

- Decide on the amount of SHDW you want to purchase and choose between a market or limit order.

- Market order: Buy $SHDW at the current market price.

- Limit order: Set a specific price at which you want to buy $SHDW. The order will be fulfilled once the market reaches your specified price.

- Review the order details and confirm the purchase.

- Step 5: Withdraw $SHDW to your wallet

- After purchasing $SHDW, it's a good practice to withdraw the tokens to a secure wallet like Phantom for safekeeping.

- Step 1: Install Phantom Wallet

- Download and install the Phantom wallet extension for your browser from the official Phantom website.

- Create a new wallet or import an existing one using your recovery phrase.

- Step 2: Secure your wallet

- Write down and securely store your recovery phrase. This phrase is crucial for recovering your wallet in case of loss or device failure.

- Step 3: Fund your Phantom wallet

- Deposit SOL directly into your Phantom wallet by transferring it from a centralized exchange where you've purchased $SHDW.

- Alternatively, deposit other tokens, such as stablecoins like USDC or USDT, if you swap them for $SHDW.

- Step 4: Use the built-in swap feature

- Open the Phantom wallet and navigate to the "Swap" tab.

- Choose the token you wish to swap (e.g., USDC) and select $SHDW as the output.

- Alternatively, enter the $SHDW contract address.

- Enter the amount you want to swap and review the transaction details, including the estimated network fees.

- Confirm the transaction and approve it within the Phantom wallet.

- Step 5: Verify the transaction

- Once the transaction is complete, you'll see the updated $SHDW balance in your Phantom wallet.

Risks to consider

Competition

One of the biggest risks for SHDW is that it lives in a highly competitive environment filled with big players like Filecoin and Arweave, which have bigger user bases and many times higher market capitalisations. The competitors have already secured niches in decentralized storage by having strong ecosystems and partnerships in place.SHDW's value proposition via mobile-first decentralization sounds promising, but it has to compete against the head start these other projects have. Additionally, traditional centralized cloud providers like AWS and Google Cloud remain formidable adversaries with mature, scalable solutions. We think that to grow the team needs execution and continued innovation to be able to compete in this environment.

Narrative

As we all know, the crypto market loves a good story that brings in retail and institutional money. While there is a unique narrative with SHDW, the hype is not there from what we can see. We think that without a stronger bullish narrative than mobile-first, it's going to get lost in the noise among all the other competitors.Additionally, this issue could grow as it seems there could be a delayed release of the SHDWDrive v2 because, as we know, long times to ship out updates tend to kill excitement, which typically results in lowering investor interest.

Cryptonary's take

SHDW has a strong foundation with a unique approach to decentralised storage, especially leveraging mobile devices. The fundamentals are there, and the vision is solid, but the key challenge is whether it can grab the attention of retail investors. Right now, it's flying under the radar, with low trading volume and limited traction compared to more hyped narratives in the market.However, the upcoming rollout of SHDWDrive2 could change the game if the team executes well and markets the value effectively. Retail flows to projects that create buzz, and SHDW needs to showcase its utility and potential clearly. With the right timing and broader market sentiment turning bullish, SHDW could reclaim interest and deliver strong returns.

Execution and communication are everything they nail; SHDW has a real shot at standing out in the next cycle; it has been a highlight market performer once this cycle, and it can do it again. The true market remains dynamic. However, we still remain bullish on SHDW as one of our utility picks.

Peace!

Cryptonary, OUT!