Will your portfolio be better off with ETH, SOL, or a mix of both assets? And if you absolutely must pick only one asset, which of the two assets deserves a spot in your portfolio?

In this report, we dive into the hard numbers and key catalysts for both assets to offer a clear, data-driven perspective on where both assets are headed in 2024.

Let’s dive in!

Is money moving from Ethereum to Solana?

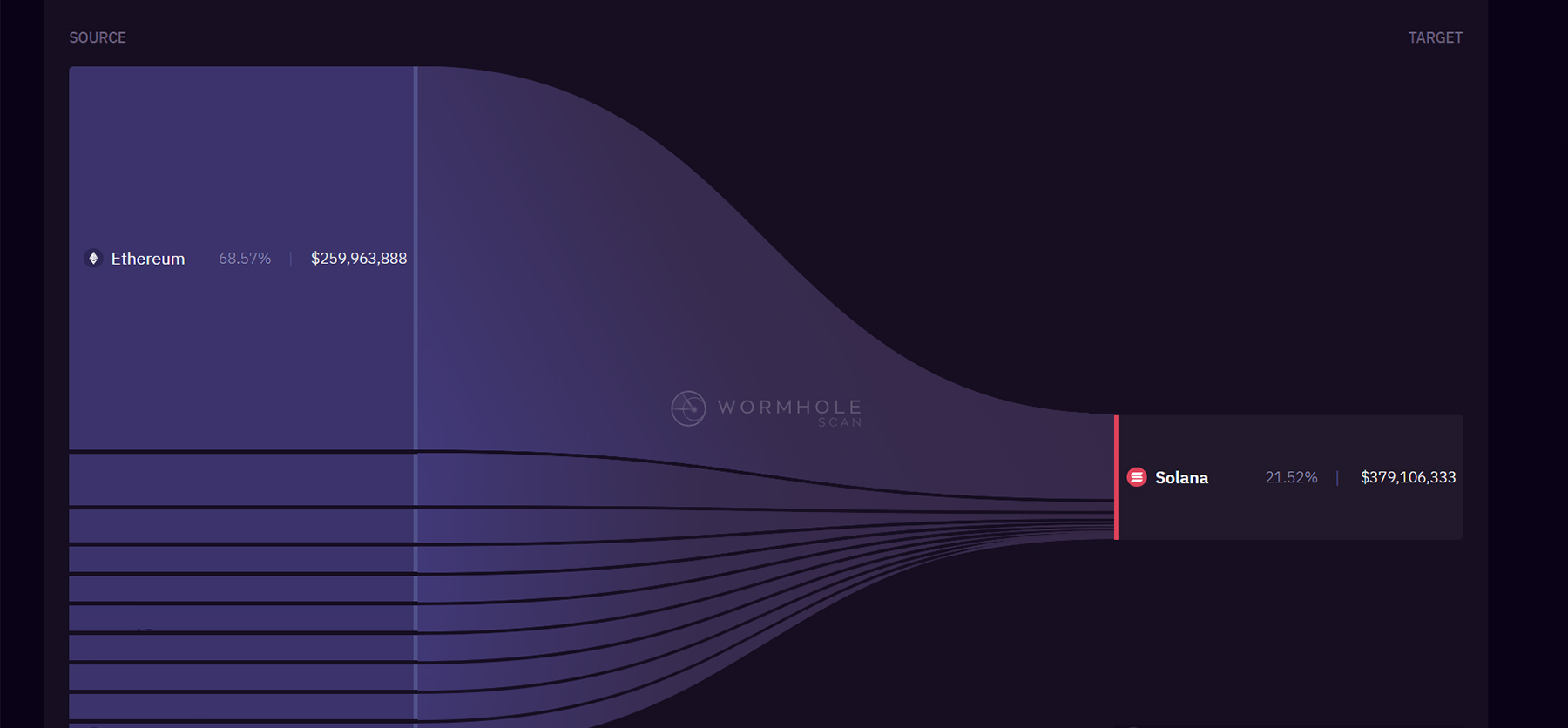

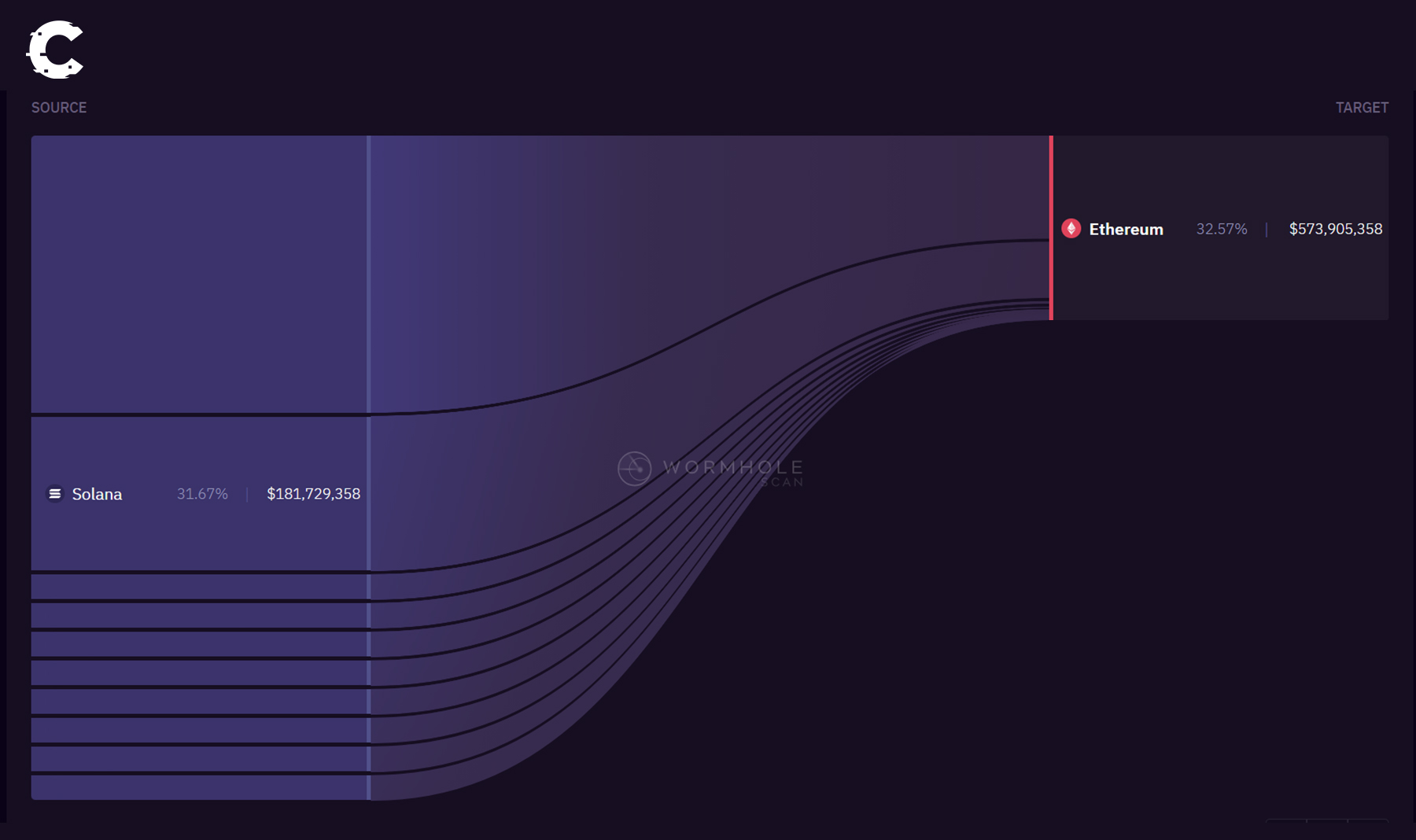

Let’s start by examining the bridge volume between the two networks over the past 90 days to determine whether capital has been flowing into or out of Solana from Ethereum.The Wormhole bridge facilitates the majority of fund transfers between the networks. Analysing Wormhole's data for the past 90 days reveals a net inflow into Solana.

In total, $181 million moved from Solana to Ethereum via Wormhole, while $259 million flowed in the opposite direction, from Ethereum to Solana. This results in a net inflow of $78 million into the Solana ecosystem.

This net inflow is telling - it indicates that despite movement both ways, more capital is being directed into Solana than is being withdrawn.

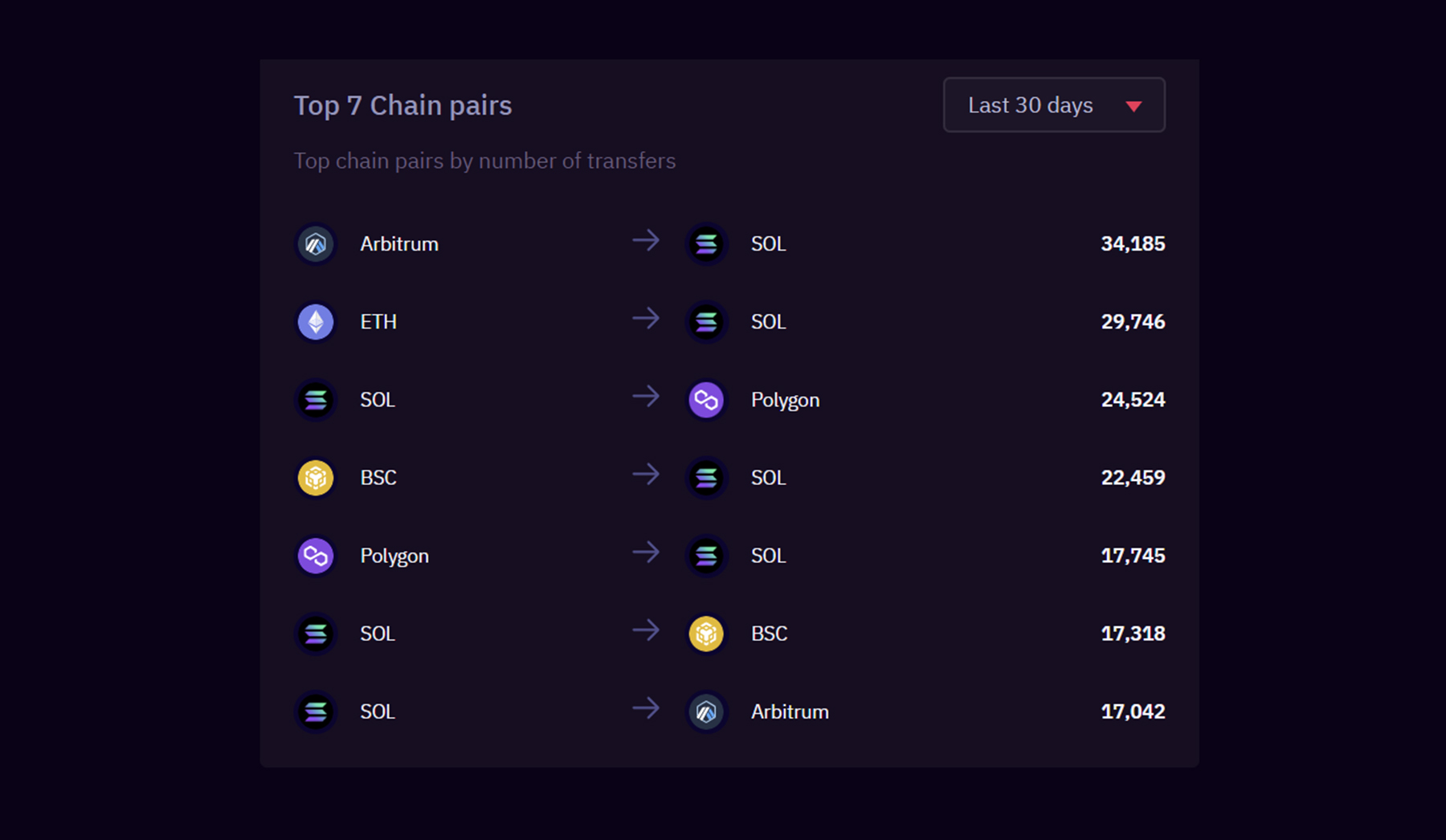

Zooming in on just the last 30 days paints an even clearer picture. Most of Wormhole's top transfer volumes in the past month involve bridging funds from Arbitrum and Ethereum into Solana.

Zooming in on just the last 30 days paints an even clearer picture. Most of Wormhole's top transfer volumes in the past month involve bridging funds from Arbitrum and Ethereum into Solana.

Examining the Mayan Bridge

Examining the Mayan Bridge

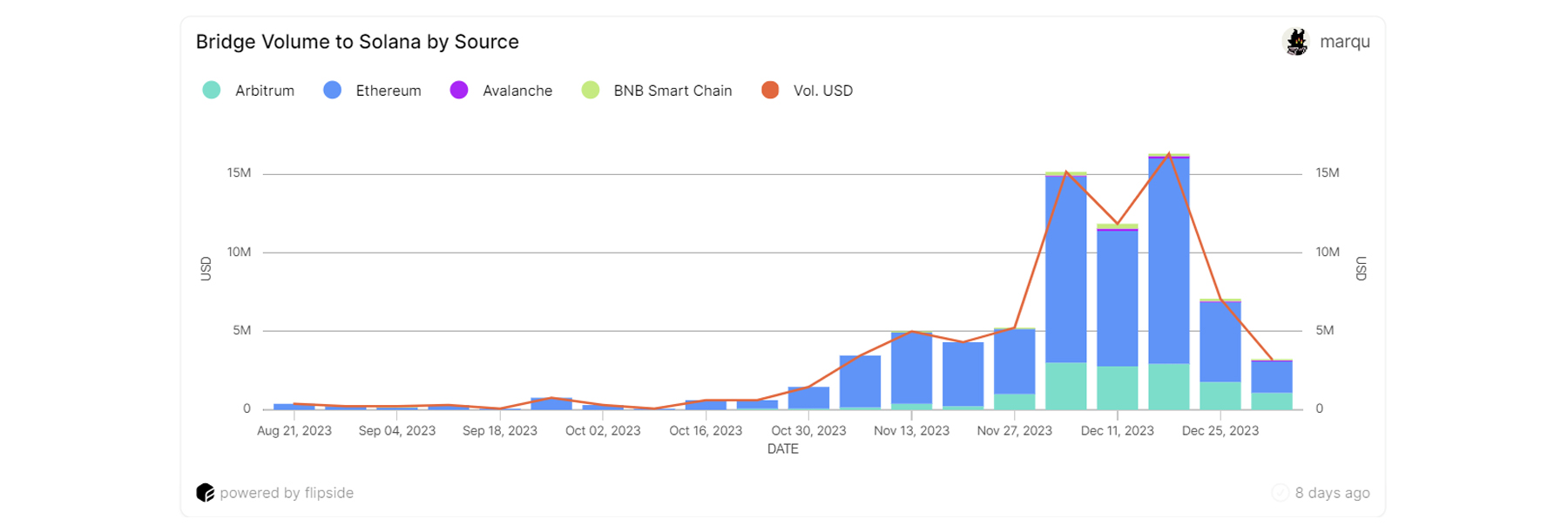

If we examine the Mayan Bridge, the second-largest bridge for moving funds from Ethereum to Solana, we also notice a significant increase in bridging volume.

Here, we can observe a major shift in activity towards Solana. At the start of October, in the week ending August 28, only $200K was bridged from Ethereum to Solana. However, this volume peaked in the week ending December 18, when $13M was bridged from Ethereum to Solana, marking a very impressive increase.

Now, as some of the hype around Solana has cooled down, we see volumes stabilising at around $2M. This is still a stark increase from the figures in August, with weekly volumes indicating that, while the trend has slowed, it remains significantly higher than earlier in the year.

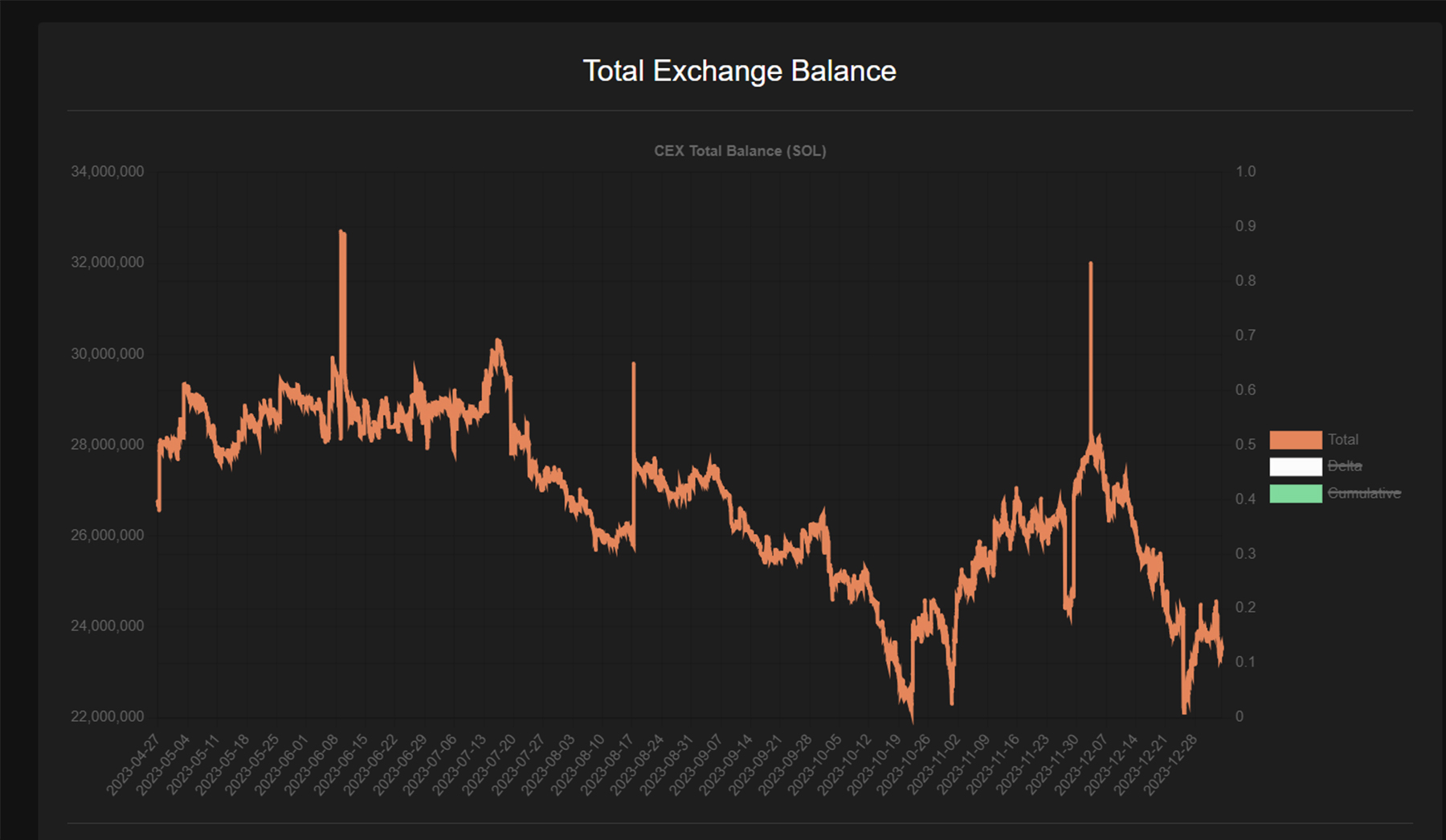

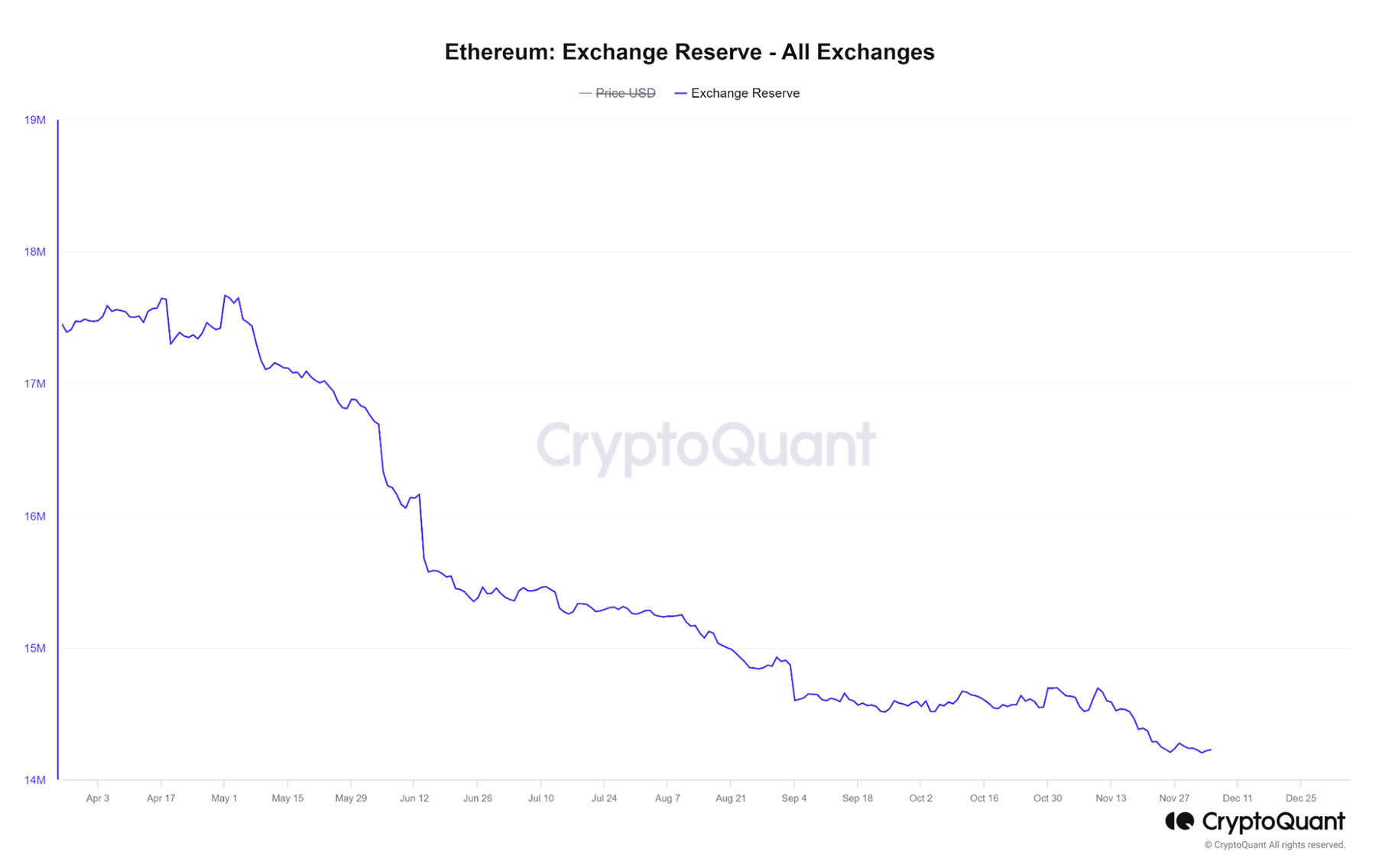

Exchange balances

Exchange balances reflect market sentiment and potential price movements.- High exchange balances suggest more investors are inclined to sell their tokens, indicating a bearish outlook.

- In contrast, decreasing exchange balances imply investors are holding onto their assets, signalling a bullish sentiment.

Interestingly, ETH saw an even larger drop, with balances falling from 17.4 million to 14.22 million ETH, an 18.27% decline.

One explanation is the FTX bankruptcy estate held substantial SOL, requiring deposits to exchanges, increasing volatility.

Overall, though, the declining exchange balances for both ETH and SOL are bullish signs. Withdrawals from exchanges show investors are confidently holding assets rather than selling.

SOL's exchange balances have depleted at a slightly slower rate than ETH, likely explained by the FTX bankruptcy estate needing to deposit SOL and investors taking profits on SOL's rapid price appreciation. However, the decreases in exchange balances are fairly similar between the two assets.

Comparing the important metrics

Now that we have compared the inflows and outflows on both blockchains let’s move on to fundamental analysis, look at the metrics of the chains, and compare them.We will compare Ethereum and Solana across the following metrics.

- Stablecoin transfers

- TVL

- DEX volume

- Usage

- NFT volume

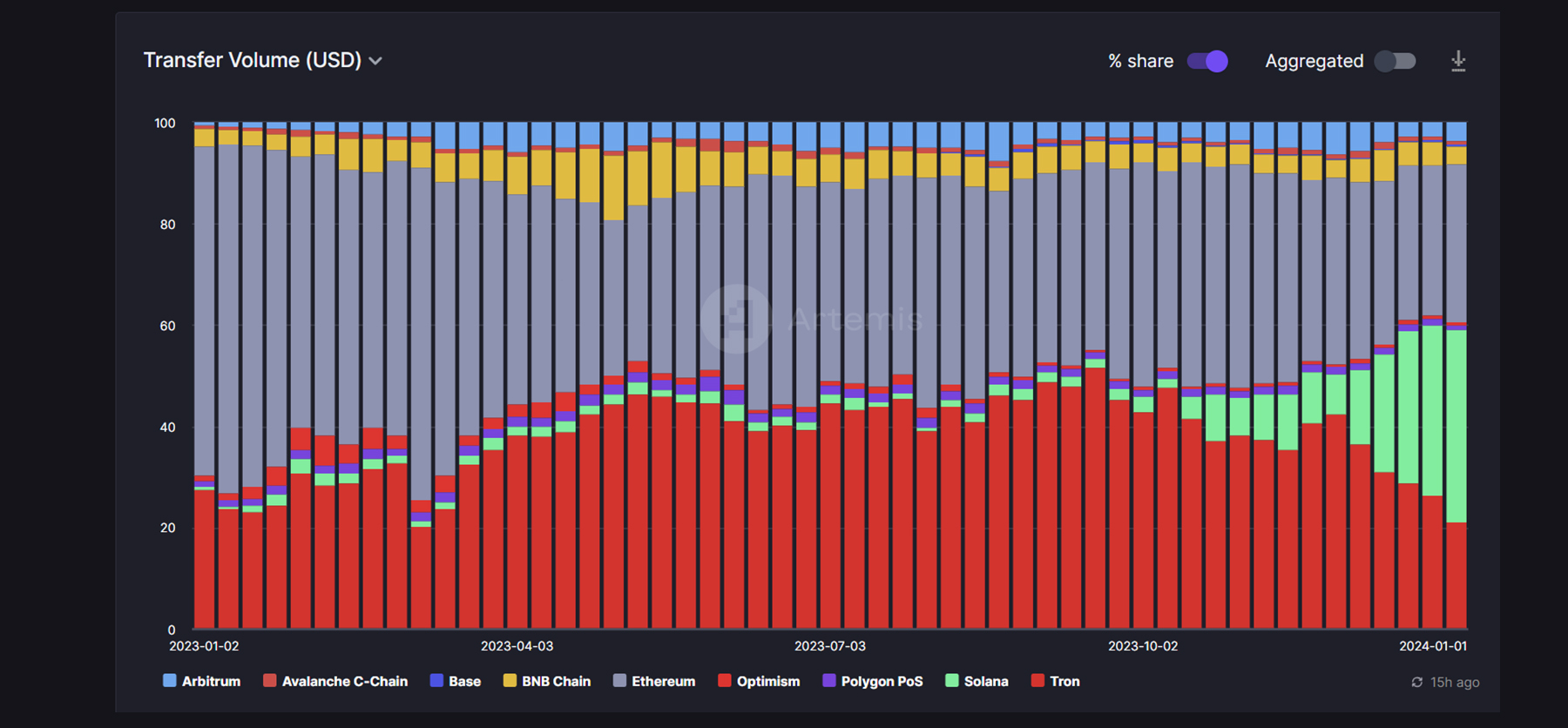

Stablecoin transfers

What is truly impressive and indicative of Solana's growth is that stablecoin transfer volumes on Solana have now surpassed those on Ethereum. Solana currently accounts for 37.88% of all stablecoin transfers, while Ethereum holds 31%.

This is particularly impressive considering that in October 2023, Solana represented only 1.7% of the total stablecoin volume, compared to Ethereum's 39% share.

The rapid rise in Solana's share of stablecoin transfers, now exceeding Ethereum's, demonstrates the growing adoption of Solana for payments. This is attributable to Solana's speed and low fees, making it highly suitable for stablecoin transactions.

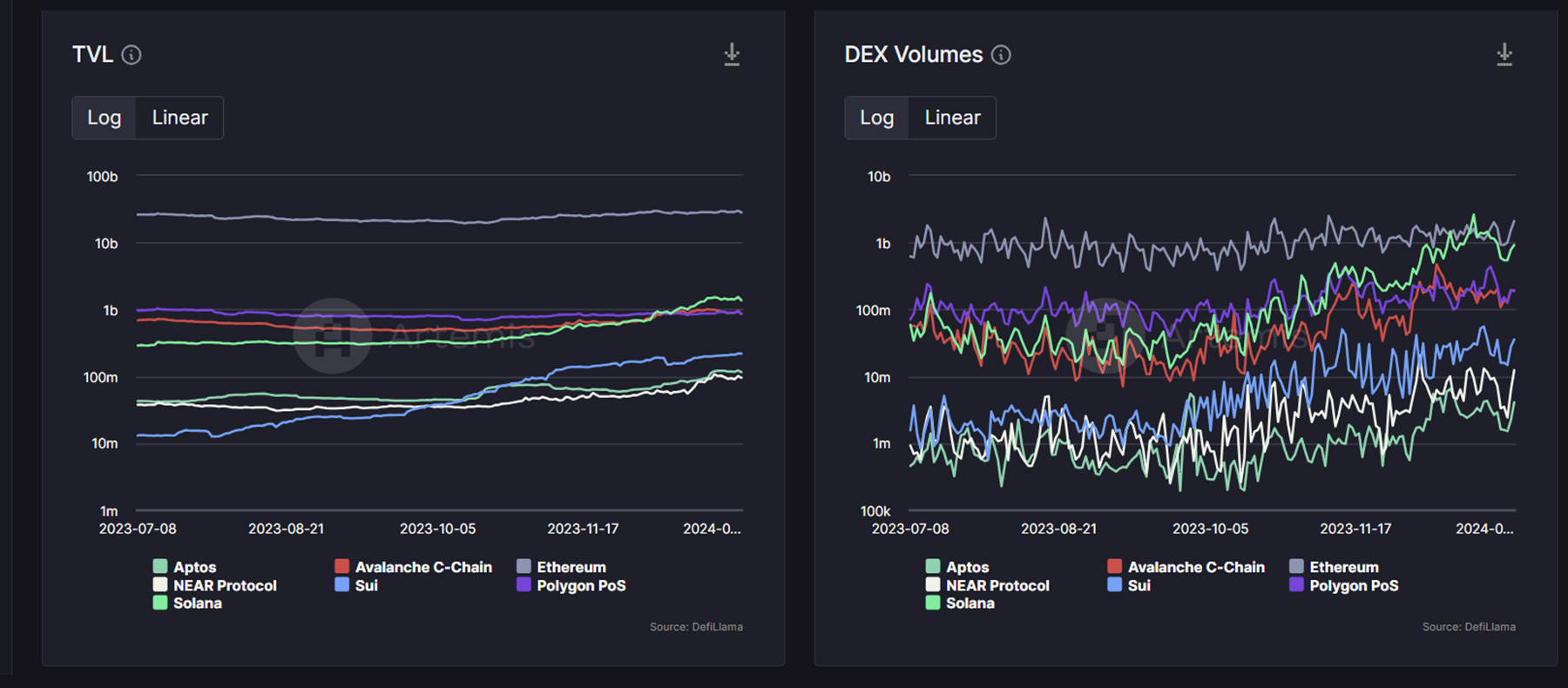

TVL & DEX volume

When we examine Total Value Locked (TVL), Ethereum is still the clear leader, but Solana has seen tremendous growth compared to Ethereum. Over the past year, Ethereum's TVL grew 24.7%, while Solana's TVL exploded 488.2%.However, where Solana really shines is in DEX trading volumes. Solana saw a massive 676% increase in DEX volumes, whereas Ethereum's grew 87.7%.

What's most impressive about Solana's volume growth is that it has caught up significantly to Ethereum in raw numbers. Ethereum DEX volumes currently sit at $2.9 billion, while Solana's are at $917 million.

Users

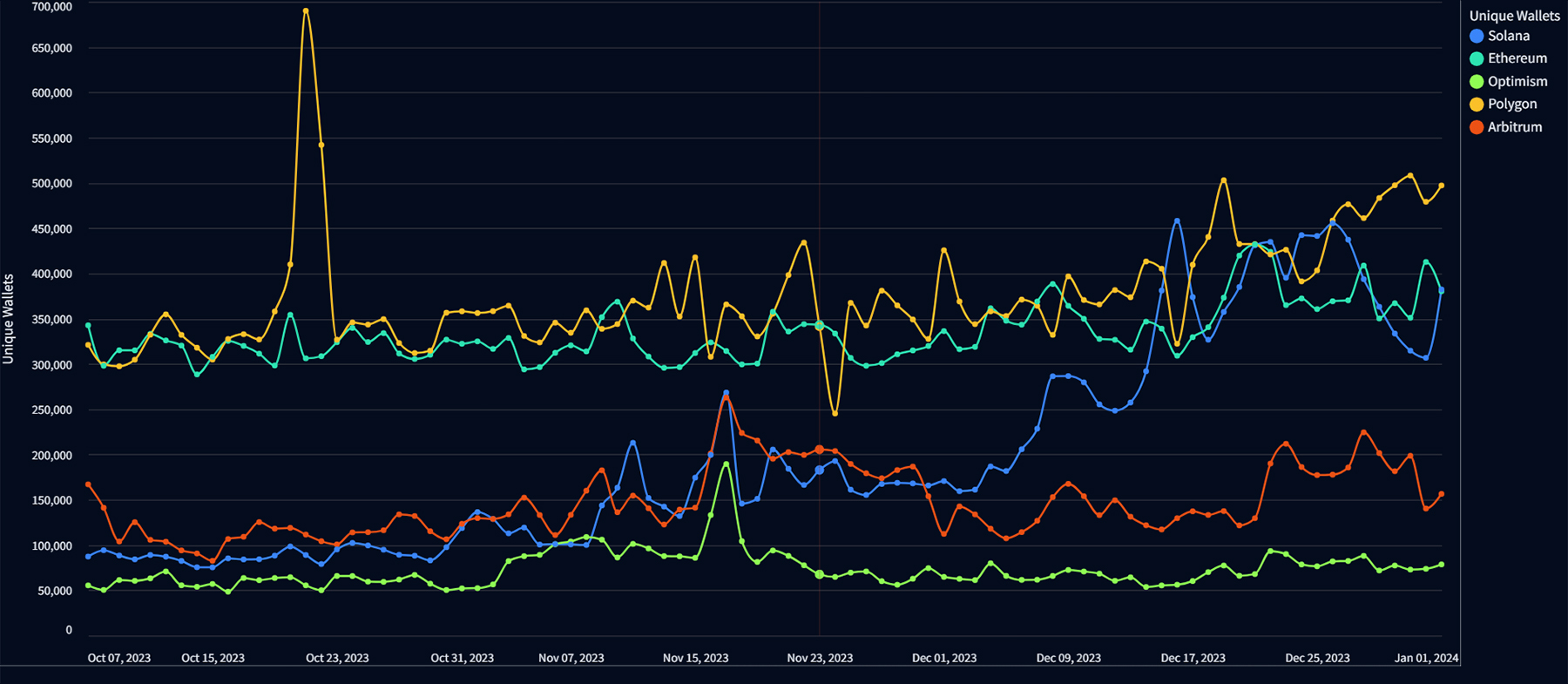

The number of unique wallets interacting with each chain shows Solana gaining ground on Ethereum. Currently, Ethereum has 380K unique wallets, with Solana slightly ahead at 382K.However, what's most impressive is Solana's growth rate in unique wallets. In early October 2021, Solana only had 87K unique wallets, compared to Ethereum's 342K at the time.

Solana's massive increase to surpass Ethereum can be partially attributed to growth drivers like the Jito airdrop. But it also demonstrates the rapid expansion of Solana's ecosystem and user base, now rivalling Ethereum's despite a lower total value locked.

The fact that Solana has attracted more unique wallet addresses than Ethereum, despite Ethereum's far greater size by TVL, is a major achievement. It speaks to the momentum and user traction Solana is gaining.

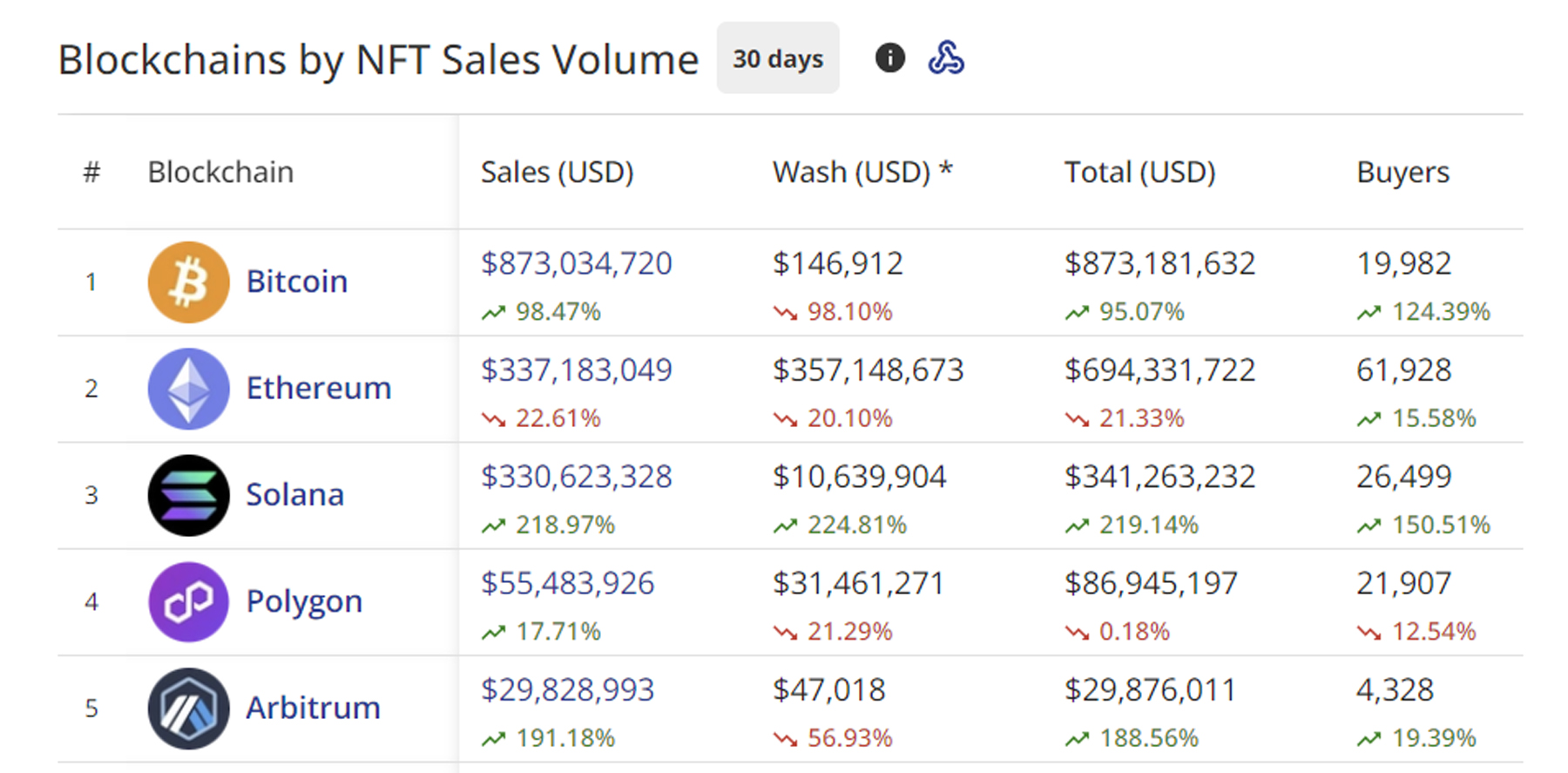

NFT volumes

NFT sales volumes over the past 30 days reveal an interesting dynamic between Ethereum and Solana.In total NFT sales, Ethereum still leads slightly with $337 million in non-washed volume, compared to Solana's $330 million. However, the growth rates differ significantly - Solana's NFT sales exploded 218% in the past month, while Ethereum's declined 22.61%.

This divergent growth is closing the gap between the two chains. If trends continue, Solana may soon surpass Ethereum in total NFT volume thanks to the rapid expansion of Solana's NFT ecosystem.

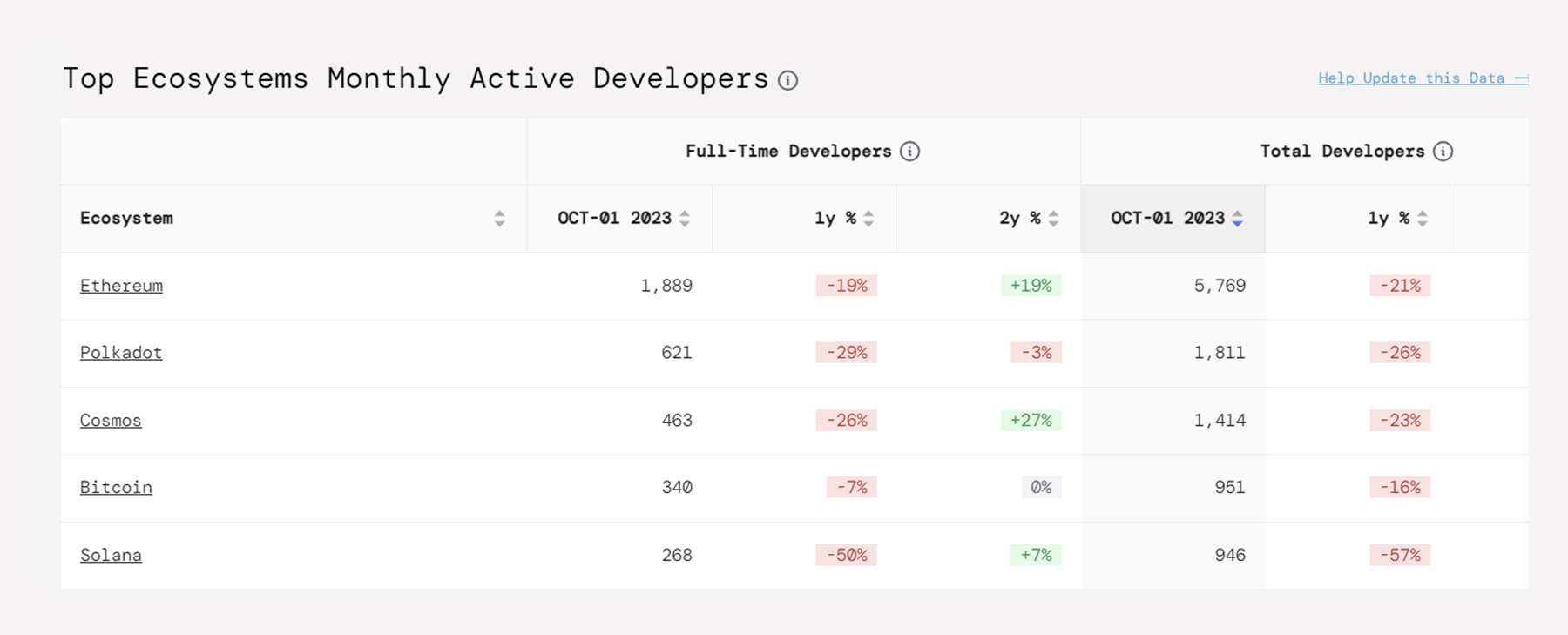

Developer activity

Electric Capital has not yet released its full 2023 developer report, but based on figures from October 2023, Ethereum still has a considerably larger developer community than Solana.At that time, Ethereum had 5,769 developers, while Solana had 946 - placing it 5th overall behind Ethereum, Polkadot, Cosmos and Bitcoin.

However, we expect these numbers to have grown substantially in the last 90 days. We will update the developer counts once Electric Capital publishes its 2023 report.

For now, we will hold off on factoring the developer numbers into the comparisons since the October figures likely understate Solana's current developer base.

Stay tuned for updates once the 2023 Electric Capital report is released, which will give us fresher data on how Solana and Ethereum's developer communities compare.

Important catalysts for ETH & SOL in 2024

Moving away from metrics, in this section, we'll introduce and briefly explore the pivotal catalysts awaiting both ETH and SOL, setting the stage for what could be a transformative year for these blockchain titans.Catalysts for Ethereum

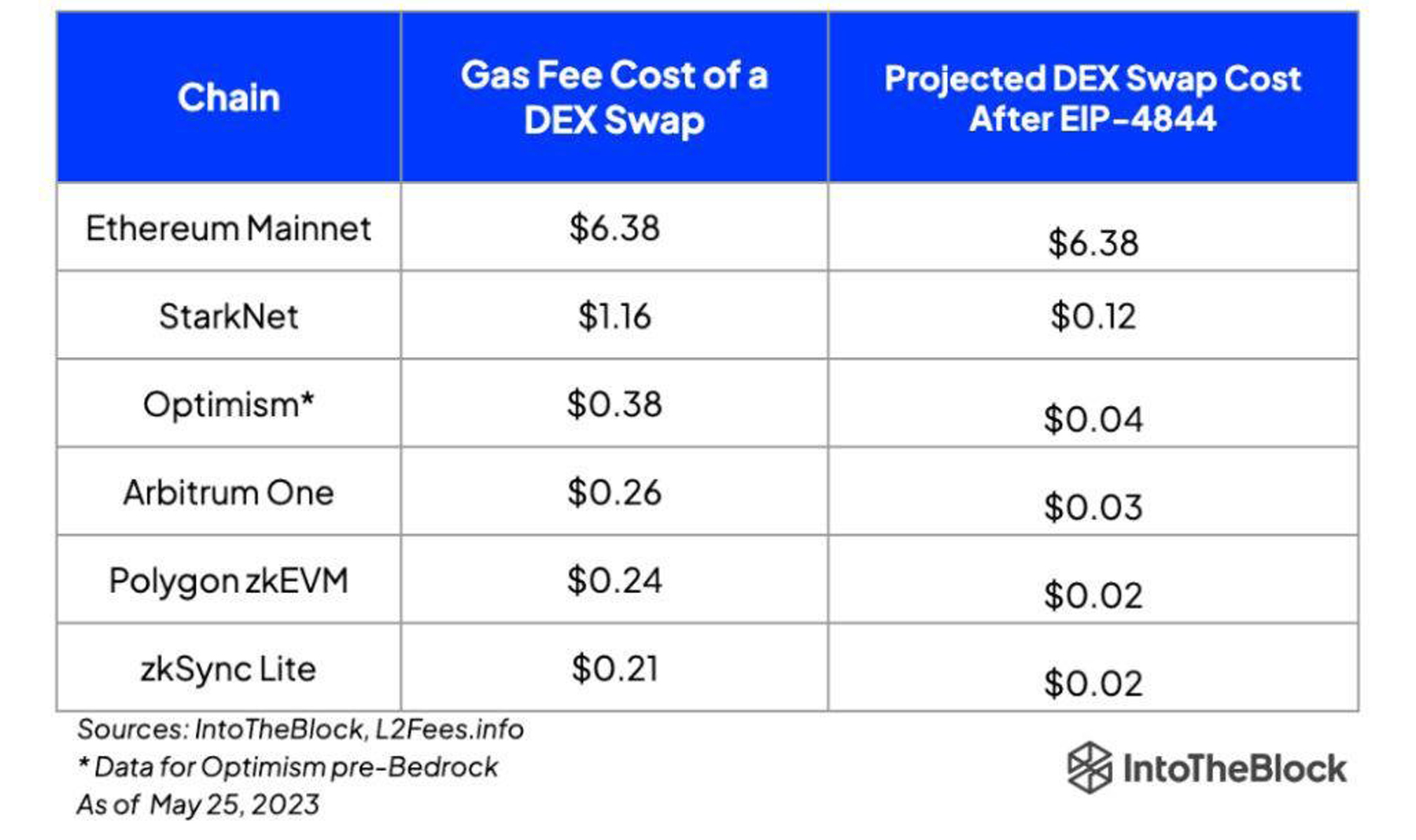

Ethereum has major developments on the horizon for 2024 that could fuel significant growth. The two biggest potential catalysts are the Cancun-Deneb upgrade and a potential spot ETH ETF.Cancun-Deneb upgrade

In Q1 2024, Ethereum will finalise its Cancun-Deneb upgrade, implementing several Ethereum Improvement Proposals (EIPs):- EIP-2322: Enhances Ethereum's Proof-of-Stake consensus for better efficiency and robustness.

- EIP-4844: The centrepiece of Cancun, implementing Proto-Danksharding to increase transaction throughput and scalability substantially.

- EIP-1153: Reduces data storage costs and optimises block space.

- EIP-4788: Improves cross-chain bridges and staking pool infrastructure.

- EIP-5656: Minor code tweaks to enhance EVM performance.

- EIP-6780: Removes SELFDESTRUCT function to increase smart contract security.

However, it's important to note that this upgrade mainly provides advantages to Layer 2 solutions, potentially benefiting tokens like Arbitrum (ARB) and Optimism (OP) more directly.

While the upgrade should improve Ethereum overall, the specific benefits to ETH itself are less direct compared to Layer 2-focused assets. Still, the upgrade may draw increased attention and interest to ETH by enhancing Ethereum's capabilities.

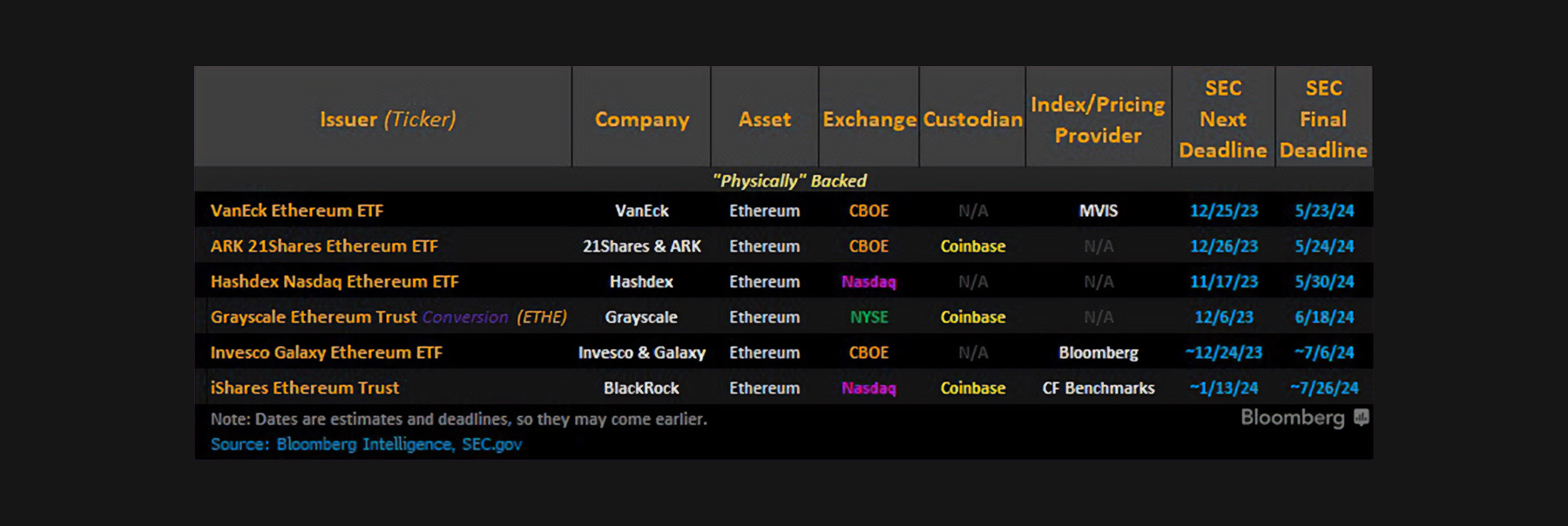

ETH Spot ETF

The other potential catalyst is an SEC-approved spot ETH ETF, following the upcoming spot BTC ETF.On November 16, 2023, BlackRock, manager of the pending BTC ETF, filed for an Ethereum Trust ETF. This signals confidence not only in a Bitcoin ETF but also in eventual ETH ETF approval.

The SEC deadline to decide on these ETF proposals falls between May and July 2024. Speculation and anticipation around potential approval could catalyse a major rally in ETH, similar to the run-up BTC saw before its ETF approval.

An SEC-approved, spot ETH ETF would be a monumental event for Ethereum - one that could drive significant ETH outperformance compared to BTC in the lead-up period.

Catalysts for Solana

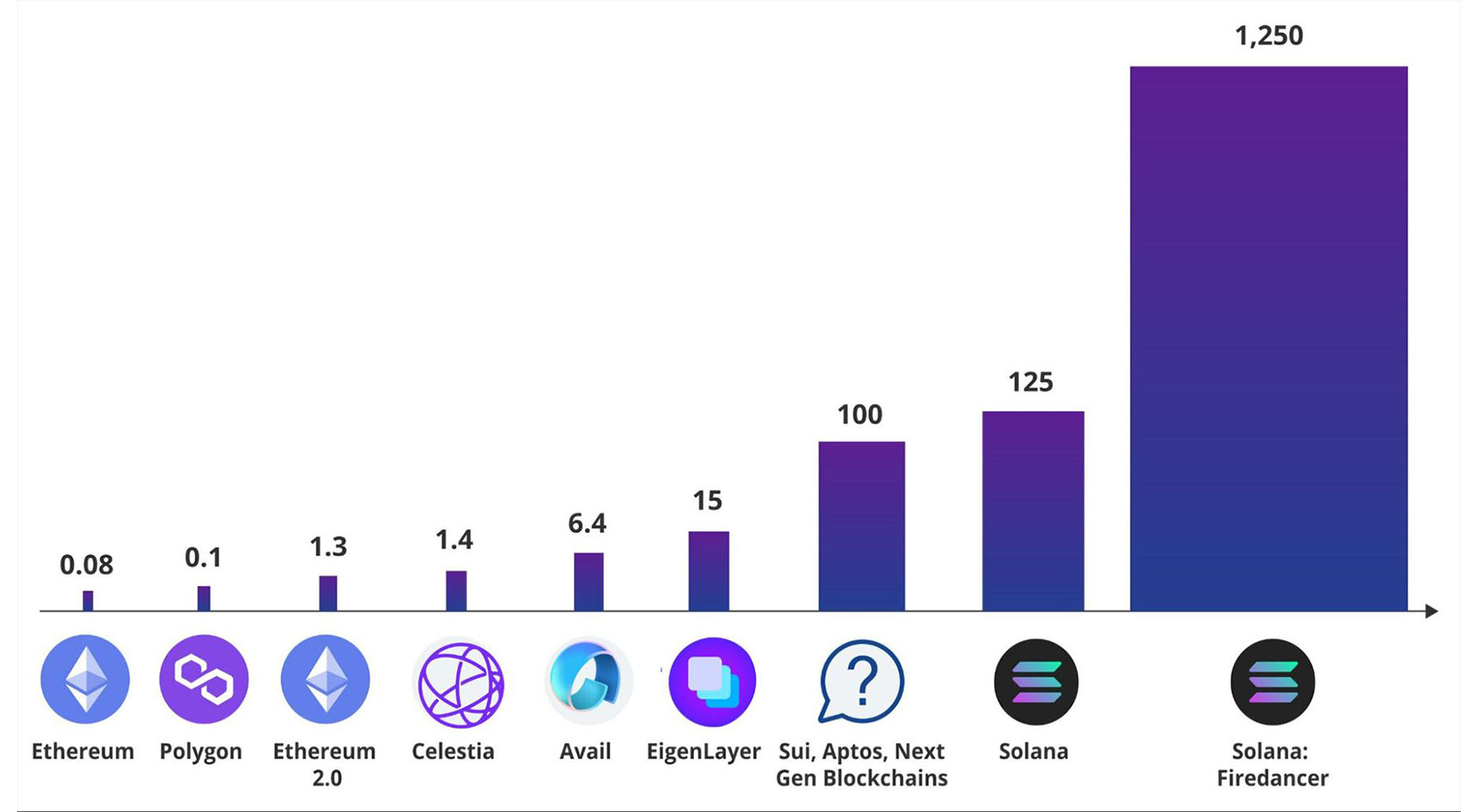

In Solana's case, two major catalysts are coming up this year, with the first being the $JUP airdrop and the second being the Firedancer client for Solana.Firedancer

Solana requires a transformative catalyst to scale transactions per second (TPS) and reduce block time. Firedancer, a revolutionary Solana validator client from Jump Crypto, presents a compelling solution.In testnet trials, Firedancer delivered a 10-100x performance leap over the existing Solana Labs client.

Firedancer is critical because it shifts Solana's scaling limitations from software to hardware, allowing TPS to rise with improving technology. While 1 million TPS may take time, Firedancer sets the stage for major scalability gains.

Tests show Solana's efficiency improves markedly with Firedancer, indicating room for more transactions as hardware advances. This positions Solana competitively, potentially reaching 5,000-10,000 TPS in the medium term—a big jump from the current 1,000 TPS for non-vote transactions and on the path to 100,000 TPS as hardware improves.

Firedancer now aims for a mainnet launch in the summer of 2024, presenting a timely breakthrough in Solana scaling.

$JUP airdrop

Then, the second biggest catalyst for Solana is the airdrop of Jupiter (JUP), which will be a massive stimulus package for the Solana ecosystem, likely to happen in January as the JUP token launches with more JUP airdrops expected over time.On the pre-launch futures market, JUP trades around $0.73, implying a fully diluted valuation of $7.4 billion.

In the first airdrop round, Jupiter will allocate 10% of its supply to users, which implies that $740 million would be given to Solana users at the current valuation.

If $JUP goes live at this valuation, it would result in a massive wealth effect in the Solana ecosystem, and 30% of the supply would still need to be airdropped. You can expect that at such a high valuation, quite a bit of this capital that users earn will flow further into the Solana ecosystem and boost SOL, so this is not something to ignore.

It would be a massive stimulus package for the Solana ecosystem if the JUP token were to go live at such a high valuation.

Should I DCA into SOL?

In the last seven days, the SOL/ETH ratio has fluctuated around 9.09091%, with the price of SOL ranging between 0.044 and 0.048. This indicates that you shouldn't swap large amounts of ETH to SOL in a single transaction.It is advisable to gradually exit your ETH position through Dollar Cost Averaging (DCA) if you're considering purchasing SOL.

Additionally, monitoring the SOL/ETH chart can help determine if you can buy at these lower levels.

Generally, it's wise to avoid buying around 0.050 and consider swapping your ETH for SOL when ETH outperforms SOL.

Spreading this process over a month can prevent you from converting some of your ETH into SOL during periods when SOL is relatively expensive compared to ETH, potentially avoiding a loss of about 9-15% in gains.

Moving your ETH to SOL

One option for swapping your ETH to SOL on-chain is using a bridge. We recommend DeBridge, which simplifies the process of converting ETH to SOL and transferring it to the Solana network.However, be aware that gas fees can be quite high when bridging, so this might not be the most cost-effective option.

Alternatively, you could use a centralised exchange where you have an account that supports both ETH and SOL deposits and withdrawals.

You can send your ETH to this exchange, incurring only a deposit fee, convert it to SOL on the exchange, and finally withdraw it to your Solana wallet, such as Phantom. This method, especially for smaller amounts, can save on fees as bridging is generally more expensive.

Cryptonary’s take

After thoroughly analysing the landscape and upcoming catalysts, we have identified SOL as a standout investment for 2024. Our conviction in SOL is grounded in several key factors:- The Jupiter (JUP) airdrop wealth effect

- Comparative metric analysis against Ethereum

- Firedancer as a catalyst

| Category | Ethereum (ETH) | Solana (SOL) | Winner |

| Bridge Volume | Net outflow of $78M | Net inflow of $78M | SOL |

| Exchange Balances | 18.27% decline | 15.8% decline | ETH |

| Stablecoin Transfers | 31% of all transfers | 37.88% of all transfers | SOL |

| Total Value Locked (TVL) | $61.425b, 24.7% growth | $3.812b, 488.2% growth | ETH |

| DEX Volume | 87.7% increase, $2.9B | 676% increase, $917M | SOL |

| Unique Wallets | 380K | 382K | SOL |

| NFT Volume | $337M, 22.61% decline | $330M, 218% increase | SOL |

However, we also advocate for a balanced portfolio approach, considering the inherent volatility and uncertainties in the crypto market. This strategy should include a mix of SOL, ETH, and possibly a Layer 2 token.

High-risk appetite portfolio: A composition like 20% SOL, 10% ETH, and 5% in a Layer 2 token (e.g., Optimism [OP], Arbitrum [ARB]) could be suitable for risk-tolerant investors.

Moderate-risk appetite portfolio: A more evenly distributed portfolio, such as 15% SOL, 15% ETH, and 5% in a Layer 2 token, may be appropriate for those seeking balance.

The inclusion of Ethereum (ETH) in the portfolio is justified by the potential impact of an ETH spot Exchange-Traded Fund (ETF). The launch of such an ETF could be a significant market catalyst leading to strong rallies in ETH or its L2 tokens.

We foresee an impressive year for SOL, but it's important to recognise that there will be periods where SOL's momentum may wane, and ETH or its L2 tokens could experience their own rallies. Therefore, a diversified portfolio approach is recommended.

For more detailed projections and analysis, including our price targets for ETH and SOL in 2024, please refer to our 2024 projections.

With over 12,000 crypto tokens out there, picking winners can feel like an impossible task.Cryptonary's Picks will help you cut through the noise and identify the most promising projects.