Ethereum ETFs: Approval, delay, or denial - what to expect

On January 10, 2024, the SEC approved Bitcoin's first spot exchange-traded funds (ETFs). The decision was a historical moment for the crypto industry, further legitimising the crypto economy.

However, the industry has an insatiable thirst for more because Bitcoin spot ETFs were barely on the market when the question "Is an Ethereum ETF next?" started trending.

As we write this report, we are approaching a deadline for the SEC to decide on nine submitted applications for an ETH ETF.

Now, there are three pathways forward: the first one is outright approval, the second path is further delay, and the third, albeit less likely option, is a denial.

We will identify the key aspects of these paths and elaborate on why the approval of an ETH ETF is significantly different from the recent BTC ETF.

Let's dig in!

TDLR

- The US SEC has approved the first Bitcoin spot ETFs, further legitimising crypto, and now the industry is eagerly awaiting a decision on proposed Ethereum ETFs

- 9 Ethereum ETF applications are currently under SEC review, with three possible outcomes: approval, delay, or denial

- While Bitcoin and Ethereum are both cryptocurrencies, Ethereum's staking functionality poses a unique challenge around the SEC's stance on securities

- Ethereum ETFs could be an attractive investment proposition due to Ethereum's deflationary supply and the ability to capture staking rewards

- An Ethereum ETF approval is expected to have a similar bullish impact on Ether's price as the Bitcoin ETF did for Bitcoin

- The current sentiment is that a delay in Ethereum ETF approval is likely in the near term, but the approval is not off the table.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

What are ETFs?

Exchange-traded funds (ETFs) are investment vehicles that track the value of an asset (such as a stock or commodity). They allow investors to gain exposure to the underlying asset without directly owning it. These investment products trade on exchanges and can be accessed like traditional stocks through a brokerage account.Crypto ETFs operate on the same premise; they provide a way for investors to gain exposure to cryptocurrencies without the hassles of managing the coins themselves. This goes against the entire ethos of digital assets, but capitalism or institutional money is here to stay, and they are not pally with the term 'self-custody'.

Crypto ETFs will continue to be a huge on-ramp for retail participation in the crypto economy. As of March 2024, the value of assets managed by exchange-traded funds globally is over $9.5 trillion.

Now, ETH ETFs are the new kids on the block, and as of April 5, Franklin Templeton, BlackRock, Fidelity, Ark and 21 Shares, Grayscale, VanEck, Invesco and Galaxy, and Hashdex have all submitted applications for an ether ETF.

But before delving into all the specifics of ETH ETFs, let's take a quick look at how BTC Spot ETFs have fared so far.

The impact of Bitcoin Spot ETFs

Unsurprisingly, the Bitcoin spot ETF was the first crypto ETF approved by the SEC. The launch has been widely successful; currently, the total asset under management for all Bitcoin spot ETFs is over $62 billion. Larry Fink, Blackrock CEO, recently stated that the growth sustained by IBIT is the fastest in the history of ETFs.

From a price action perspective, Bitcoin initially registered a 13% drawdown right after the ETF approval. However, after that, from a yearly low of $38,500, BTC witnessed a 90% in Q1 2024, reaching a new all-time high of $74,000.

There is no doubt institutional capital came pouring into BTC after the ETF approval, and the bullish rally has been indicative of that narrative. Now, the consensus is that the approval of ETH ETFs will have the same impact on the price action of altcoins.

However, before we dive into that, we need to understand why Ether's ETF approval has a different set of hurdles and may not necessarily follow the same pathway as Bitcoin ETFs.

BTC vs ETH: United by industry, divided by identity

While Bitcoin and Ethereum fall under the crypto umbrella, both assets have developed different pathways and functionalities over the years. Bitcoin was supposed to be a MOE or medium of exchange, but we can all agree that BTC has become a commodity over time.Conceptually, Bitcoin is now meant to be held, but Ether is supposed to be used. It is the native token to the world's largest blockchain and the foundational layer for several other crypto protocols.

However, its staking functionality is the main hurdle that plagues a potential delay or disapproval for the ETH ETF.

We all understand staking. It is an economic model where users are paid token rewards for locking up their coins on the network. The SEC believes that this falls under its securities model, so it continues to have a stance against the PoS token.

Now, here is the ironic part. The SEC or its Chairperson, Gary Gensler, has never singled out Ether as a security per se. They have mentioned that PoS model assets fall under the security banner and previously mentioned the likes of Cardano and Solana.

In fact, Kraken was forced by the SEC in 2023 to shut down its staking-as-a-service business. The exchange paid a hefty fine of $30 million. So, does that mean Ether is indirectly deemed a security? Maybe not.

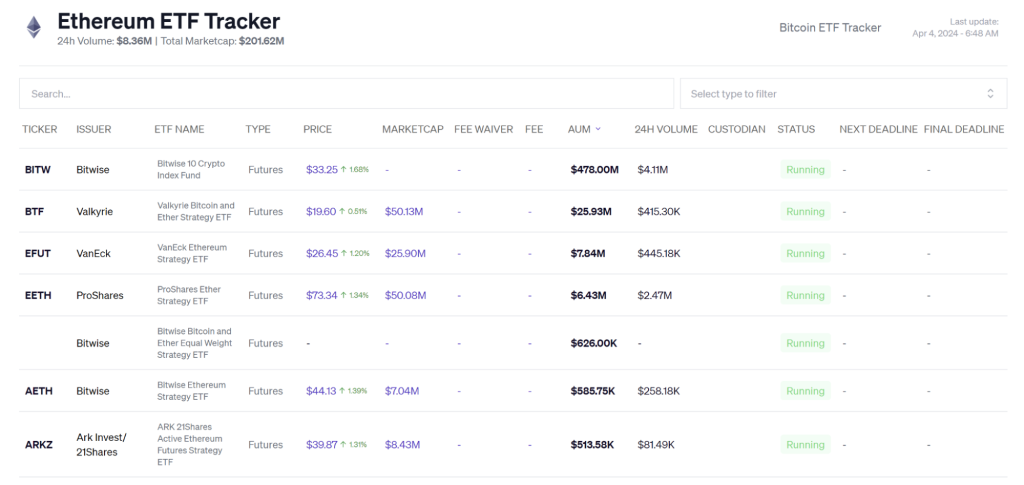

The Commodities Futures Trading Commission (CFTC) has maintained that Ethereum is not a security for years. Ethereum futures ETFs have been trading for years, and the SEC approved them in October 2023.

It is important to note that the volumes of Ethereum futures ETF are not impressive. Still, the case is that Ether cannot be declared as a security since there is already an investment vehicle around it.

CME Group launched its ETH futures ETF in 2021, and CBOE launched earlier this year, so if ETH is termed a security, there would be major implications for U.S. businesses and investors already involved in the ETH futures market.

Therefore, the traditional markets and the crypto community have largely dismissed the possibility of the SEC denying Ethereum ETFs based on security concerns.

Staking makes ETH ETFs more attractive

While staking could be a reason the SEC might reject an Ether ETF, it is also an intrinsic characteristic of the largest altcoin – the staking function is probably what makes Ether ETFs a unique investment proposition.Let us break that down.

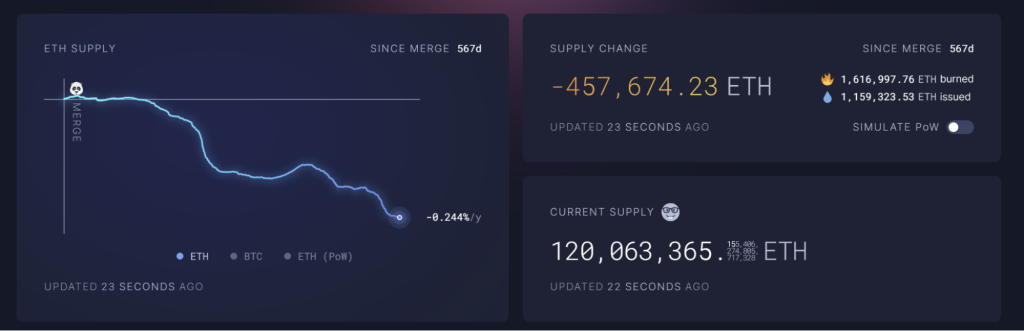

Since transitioning from Proof-of-Work to Proof-of-Stake consensus, Ethereum has undergone a significant shift in this supply model. One key aspect is that ETH is currently a deflationary asset.

The merge took place 569 days ago, and the total Ether burnt in that time is a whopping 1,616,988.18 ETH. The supply is currently reducing at 0.244% per year, and for context, without a PoS structure, the total circulating supply would have increased by 5.8 million ETH tokens.

If an ETH ETF gets approved, any ETF that stakes its ETH is essentially capturing an increasingly valuable asset. A staking-centric approach has also reinforced the security of Ethereum's network, as the cost of attacking Ethereum is much higher now than in 2022.

Now, in hindsight, staking does procure an unbonding period for Ethereum. This means any ETH staked is not immediately liquid anymore for a while. What can be done about that? Liquid staking has become a go-to option.

Liquid staking is a mechanism where users stake their ETH and receive a token representing their staked amount in return. These tokens can then be traded, sold or used in other decentralised finance (DeFi) protocols, essentially making them a liquid counterpart to an otherwise locked Ether.

The point we are trying to make is that staking should not fundamentally be an issue for the approval of the ETH ETF. If anything, it actually improves its case as an investment vehicle.

Will Ether ETFs be bullish for price?

Over 2024, Ethereum has registered a return of 81% in the market, but compared to other major altcoins, it has underperformed. The asset has yet to re-test its all-time high of $4877.

Now, the approval of the Bitcoin ETF has had a prolonged effect on BTC. We believe Ethereum should witness a similar impact. From a speculative and increased accessibility perspective, Ethereum ETF approval would increase retail and institutional interest.

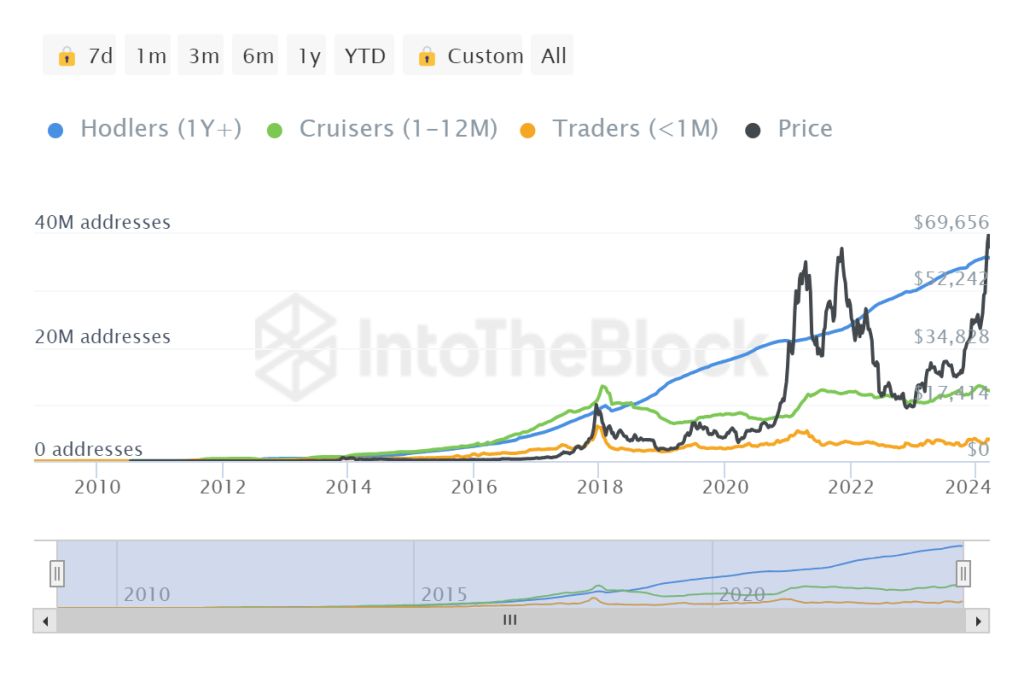

There is inherent data which indicates that the number of long-term holders for Bitcoin peaks at around 35 million addresses at the moment.

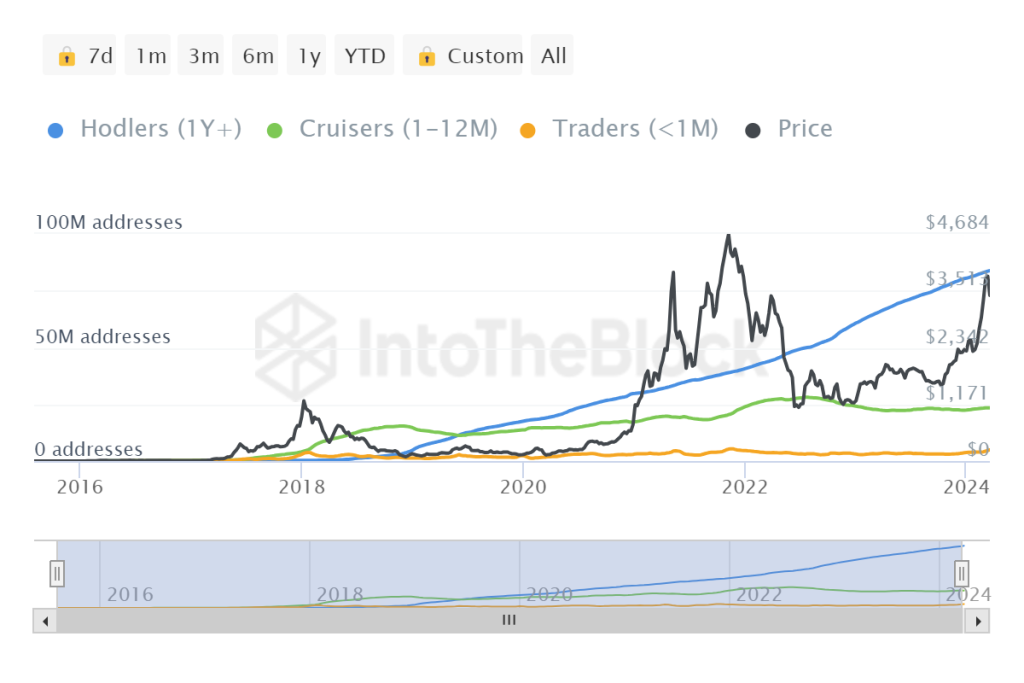

At the same time, Ether's long-term holders have more than doubled to 83 million addresses.

When the whale addresses were tracked, 4836 addresses held between 1,000 and 10,000 ETH, but only 2,016 addresses held between 1,000 and 10,000 BTC. So, there is definitely interest in Ethereum from an investment perspective, which was never doubtful. Hence, the network needs that one catalyst effect for the bulls to rally behind the largest altcoin, and an ETF approval seems like an appropriate event.

While Ether has staggered or progressed slowly in 2024, an ETF approval would attract stable long-term investment, which should also reduce price volatility.

Current odds of approval

While the SEC may not have any steadfast reason to decline the Ether ETF, the current sentiment is that a delay is certainly warranted. While the run-up to the Bitcoin ETF deadline caused many discussions between fund managers and regulators, the same has not been the case for the Ether ETF.Bloomberg Analyst James Seyffart believes that the SEC hasn't engaged proactively with issuers about the approval process. Eleanor Terrett, FoxBusiness Journalist, communicated a similar sentiment: optimism around an ETH ETF is underwhelming.

The odds were greatly dampened when the Ethereum Foundation faced an inquiry from a state authority on March 20. It was reported that the SEC sought to classify ETH as a security, but the regulators have not commented publicly on this.

What happens if the ETF isn't approved on May 23?

The current chatter and belief are leaning towards a Ther the ETF. May 23 will possibly not be the day of approval unless some major development breaks out. The SEC recently called for public comments on three Ether spot ETFs connected to Grayscale, Fidelity, and Bitwise, but we wouldn't read much meaning into those.Irrespective of the ETF approval, Ethereum's long-term value comes from its ongoing transition to Ethereum 2.0 to enhance scalability, security and sustainability.

The rejection of an ETF may affect price in the short term, but focusing efforts on decentralised finance (DeFi) and other blockchain applications that do not rely on traditional financial approval remains the network's key objective.

Cryptonary's take

We aren't quite sure that an ETH ETF will be approved in May 2024. However, there is a collective understanding that approval in this upcoming bull market is certain.This means it is a question of 'When' rather than 'If'.

We have already clarified why the SEC's argument to decline an ETH ETF is weak. After the approval of the Bitcoin ETF, it is even more difficult to deny the ETH ETF without regulation clarity.

An Ethereum ETF is coming and will likely take place in 2024. While the bets are against ETH for the moment, ahead of its immediate deadline, it is an inevitable outcome for the largest altcoin in the industry.

Cryptonary Out!