The token should belong to a relevant category or ecosystem that generates market engagement. It should be undervalued compared to competitors in the category and fundamentally possess strong on-chain data and tokenomics.

We found an under-the-radar project in the perpetual DEXs market that might make for an interesting investment case. The market cap of this Perpetual DEX is 100x less than dYdX’s market cap, yet it generates the same relative revenue based on market activity.

However, the project has a rather peculiar tokenomics, which at first glance might seem alarming.

But, not to worry, what it lacks in shiny tokenomics, it more than makes up for in traction.

Let’s dive in.

TLDR

- Let's talk about HMX, an under-the-radar perpetual DEX protocol that has generated $12B in trading volume since launching in July 2023.

- Despite having a market cap 100x less than dYdX, HMX generates similar relative revenue based on market activity.

- HMX offers up to 1000x leverage on crypto, forex and commodities trades on Arbitrum with fees between 0.01%-0.07%.

- Although 40% of tokens are allocated to community incentives, HMX's value accrual incentives promote holding instead of selling.

- HMX appears significantly undervalued at current prices based on its market cap to TVL ratio of 0.21, compared to over 3 for competitors.

- In a bull market, HMX could reach a market cap of $100M-$120M, representing a 15-20x upside from today's $6M market cap.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

What are Perpetual DEXs?

A perpetual DEX is a decentralised exchange that provides perpetual contracts to traders. It allows them to speculate on the token prices, but unlike a futures contract, there isn’t an expiration date.A couple of prominent perpetual DEXs at the moment are dYdX and GMX, which are incurring strong market activity. Both exchanges have an average trading volume of over $100M daily over the past quarter.

DEXs are an untapped market with huge potential

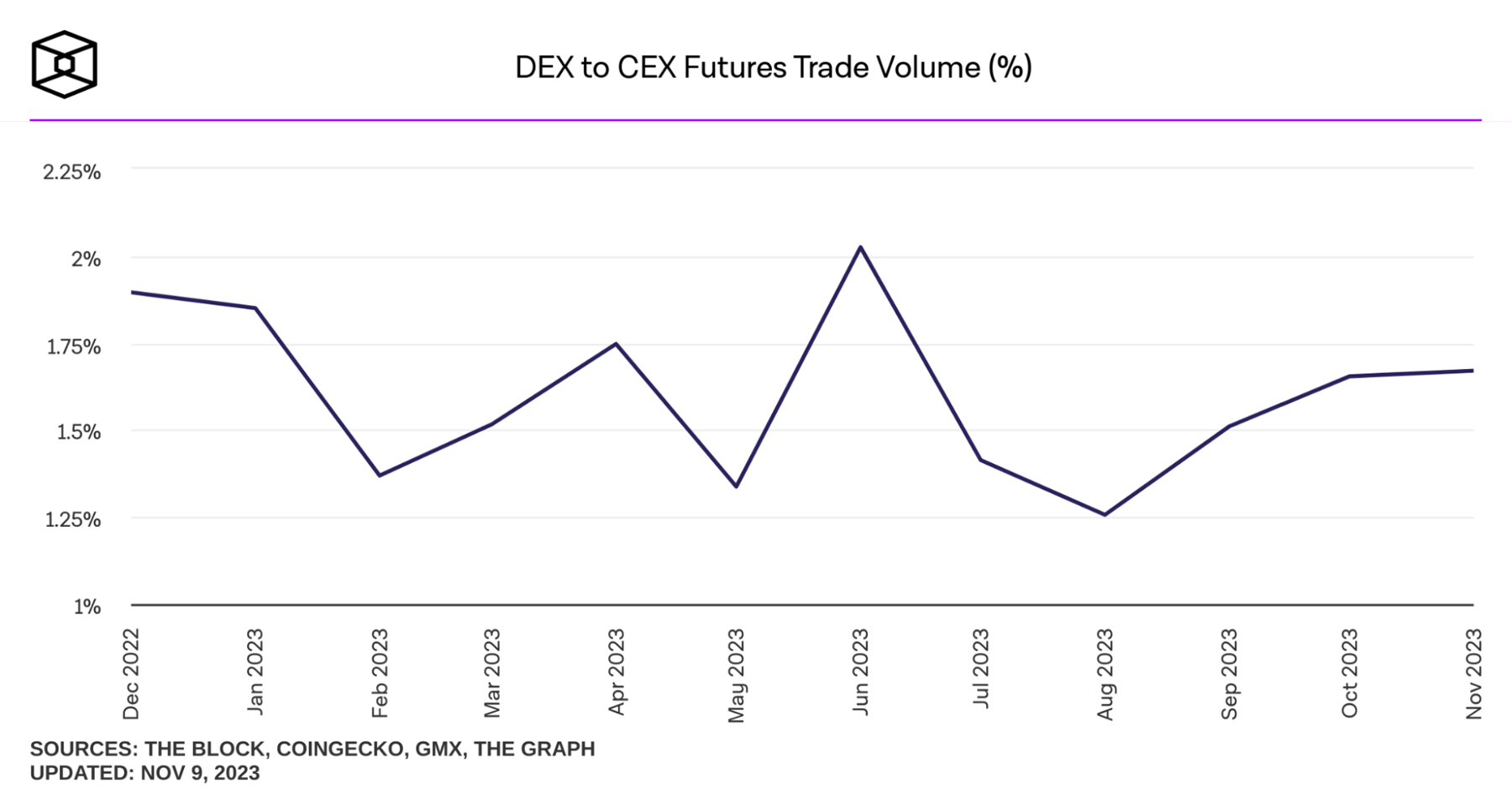

There is a clear disparity between the activity on CEXs and DEXs. Most crypto trading activity (spot or futures) occurs on CEXs, even though DEXs have a decentralized approach and privacy-centric features.

DEXs only account for 1.67% of the total futures trade volumes of CEXs, which is a glaringly small percentage.

However, times are evolving, and this statistic might even hint at the untapped potential for DEXs. If this is the case, perpetual DEXs will benefit as the DEX category gains market share.

Now, to the perpetual DEX that has caught our attention -- introducing HMX.

HMX Perpetual DEX

HMX is a perpetual DEX on Arbitrum with cross-margin and multi-asset collateral support.

It is one of the few perp DEXs offering up to 1000x leveraged positions across crypto, forex, and commodities. Its Adaptive Trading Fees mechanism also offers extremely competitive fees at the moment, which range between 0.01%-0.07%.

Why is HMX on our radar?

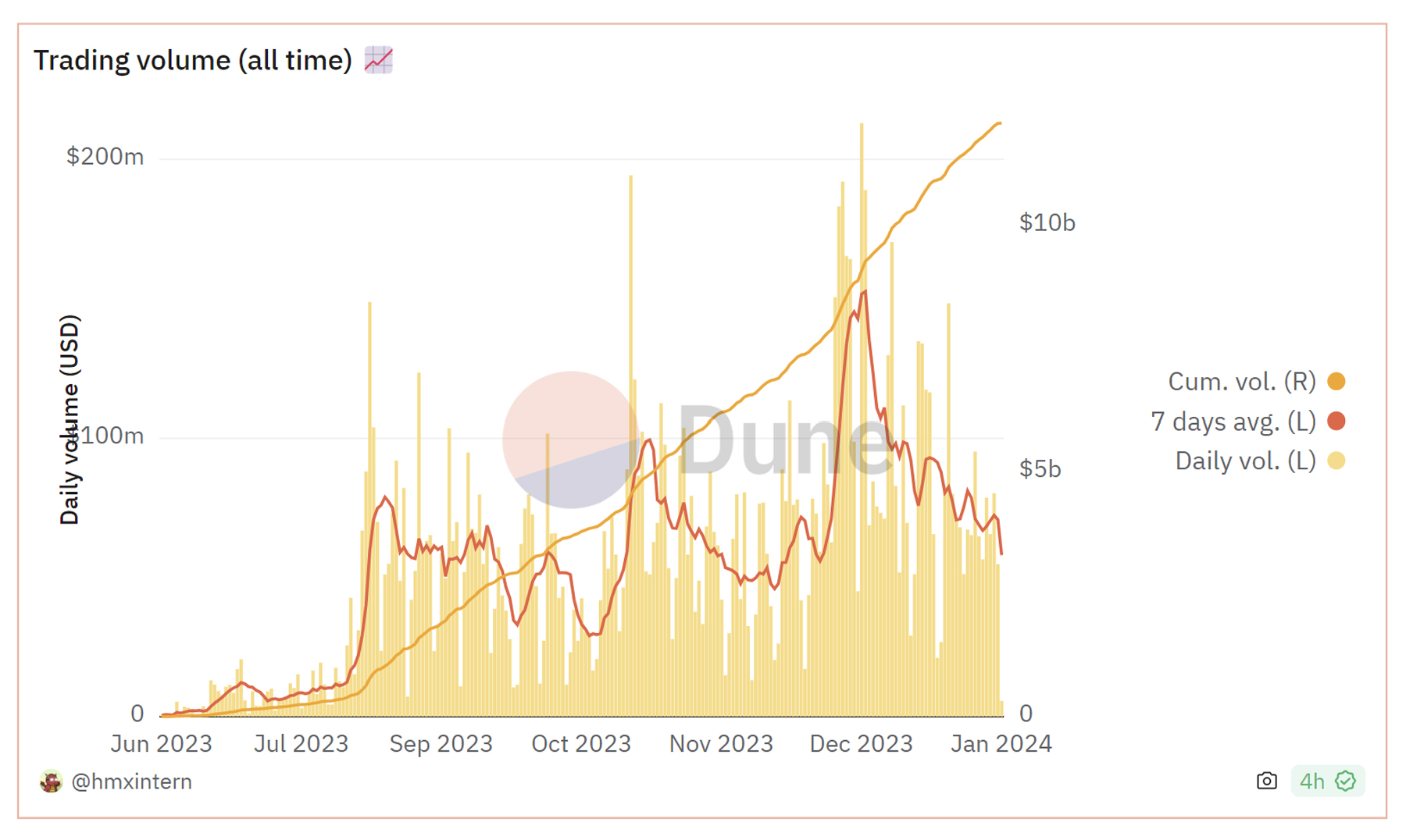

HMX is a relatively new perpetual DEX when compared to its counterparts. However, since its launch on July 1, 2023, the DEX has recorded significant market activity in the ecosystem.

The average trading volume on the exchange is currently $70.46M. Towards the end of 2023, the average volume peaked around $150M.

Overall, the total cumulative trading volume on the exchange is $12.13B. Considering the exchange has been active for less than a year, it is an impressive feat.

The current total value locked on the protocol is $27.71M, with assets under management for its HLP vault around $24.76M. Over $5M fees have been generated, with accumulated open interest of $38.02M.

These numbers look meagre compared to other major perps like Dydx or GMX.

However, an important point is that HMX currently facilitates those numbers with a market cap of only $6M. In essence, for the weight it pulls in terms of volume, there’s a huge market inefficiency that most investors haven’t noticed yet.

Can HMX keep up the momentum?

We’ve shown that HMX is pulling its weight in terms of volume.But can HMX actually succeed in the same sector already dominated by the likes of dYdX?

The answer is yes!

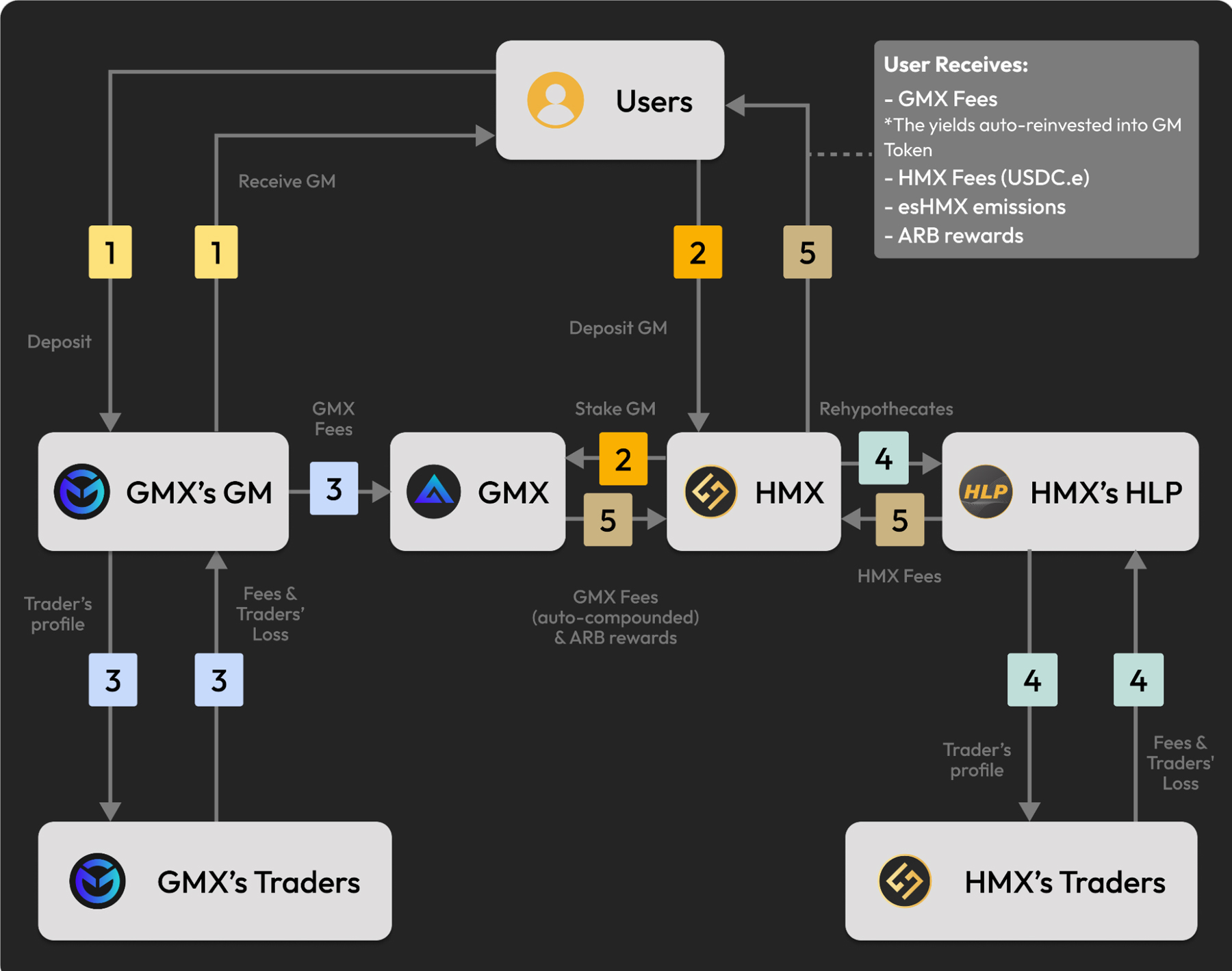

HMX is vying for increased relevance through a suite of innovative products. One of such HMX’s products that got our attention is its Leveraged Market Making.

HMX has its liquidity pool called HLP, where HMX users can deposit assets into the vault and become market makers on the exchange.

Now, the next part gets interesting.

HMX’s leveraged market-making feature was built on top of GMX for its deep liquidity pool, allowing liquidity providers (LPs) to maximise potential yields. So, any user that deposits assets into the HLP vault will be market-making for both GMX and HMX.

Depositors continue to earn 100% of the yields from GMX while also earning additional yields from fees generated on HMX.

The operational model of HMX is very similar to GMX, and objectively, the mechanism benefits both GMX and HMX users.

Now, since the process amplifies profits for GMX users as LPs on HMX, a case can be made that some GMX users could also move to HMX.

But are HLP depositors protected?

To avoid LPs taking too much exposure, HMX has multiple measures to mitigate risks.- Max utilisation limit: There is a max utilisation for HLP, beyond which new positions are not allowed to be opened

- Auto deleverage: Each trading position will have an in-profit price target where a position will be automatically closed for users.

- Profit reserve buffer: It tracks the net PnL of all traders against the HLP pool.

- Open interest limit: defines the maximum ongoing open interest that each asset can have on each side

However, we need to assess its tokenomics to evaluate its investment proposition.

Evaluating HMX from an investment perspective

As mentioned earlier, a good project can become a bad investment if the tokenomics are not balanced and investor-friendly.Looking at HMX’s token allocation and structure, we had some initial concerns.

HMX is currently priced around $5.11 with a market cap of $6M. While it appears undervalued, HMX has a fully diluted valuation of $52M.

The difference stems from the fact that its circulating supply is 1.15M, but the total supply is 10M.

Now, if the FDV/Market Cap ratio is calculated for HMX, it appears overvalued and susceptible to inflation pressure. The token allocation also appears questionable. According to the protocol, the tokens are distributed in the following manner:

- Community Incentives-40%

- Ecosystem Fund-25.6%

- HLP Surge-5%

- Token Generation event-8%

- Private Sale-6.4%

- Team-15%

HMX’s tokenomics breakdown

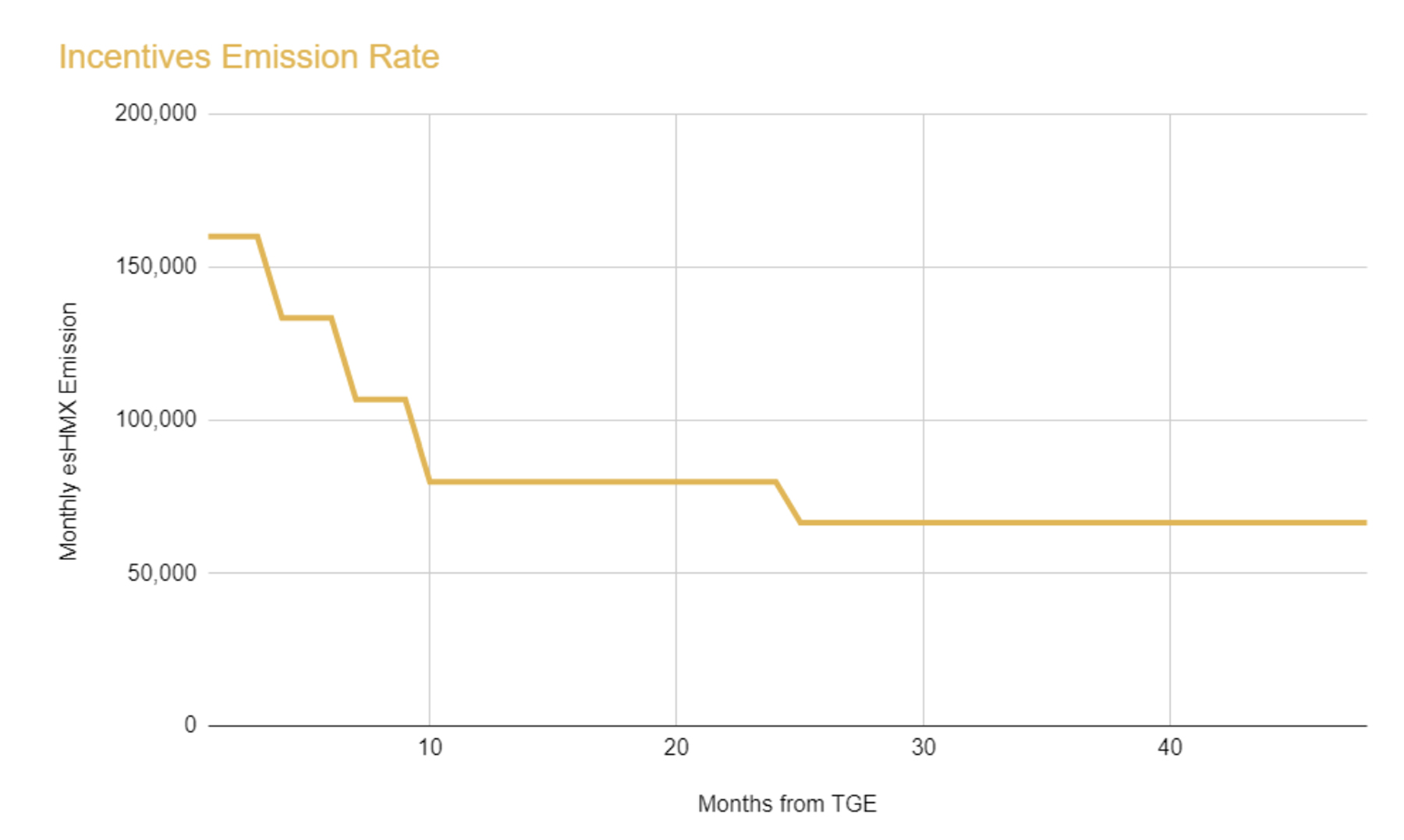

Let’s start with the emission schedule.The total number of tokens allocated for community incentives is 40% or 4M. Still, the emission schedule for these tokens is spaced over four years, and it follows a decay emission setup. It means that the incentives release would drastically slow down over time.

According to their monthly schedule, by January 2023, 880,000 or 22% of the total incentives would be released.

Theoretically, that isn’t ideal for the circulating supply, but there is a catch.The token incentives are released as esHMX token, an escrowed version of the HMX token, that cannot be traded.

It must first be vested before it can be traded. However, the esHMX tokens possess the same utilities as HMX tokens.

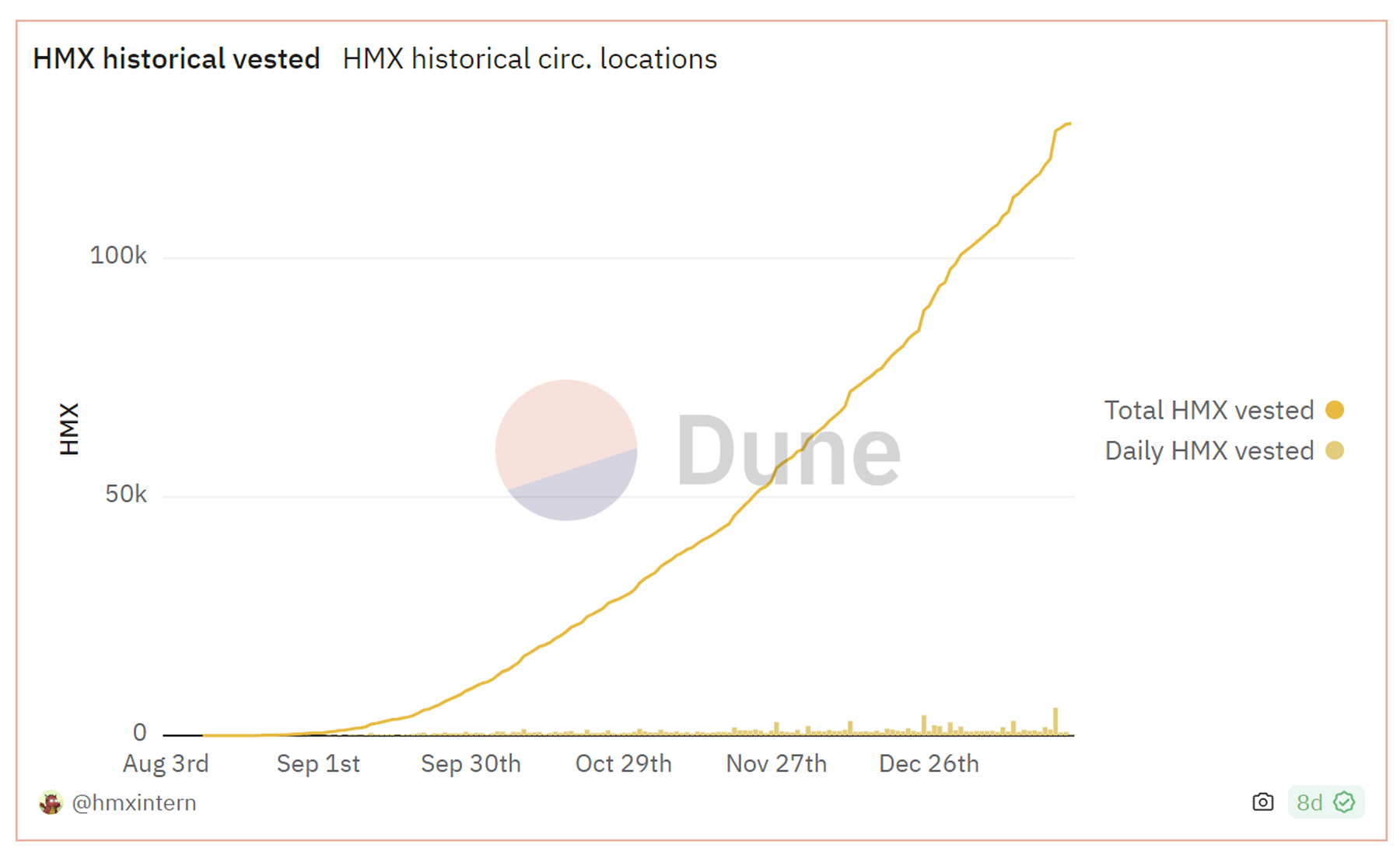

Now, out of a potential 880,000 tokens released from the community since August 2023, only 128,272 tokens have been vested and have become part of the circulation. That is 14.5% of the total incentives since August 2023. Now, remember that emission is expected to be even slower in the future.

Now, it is important to acknowledge that currently, over 720,885 esHMX tokens are in between the vesting process, so it may eventually create a surplus in supply, right?

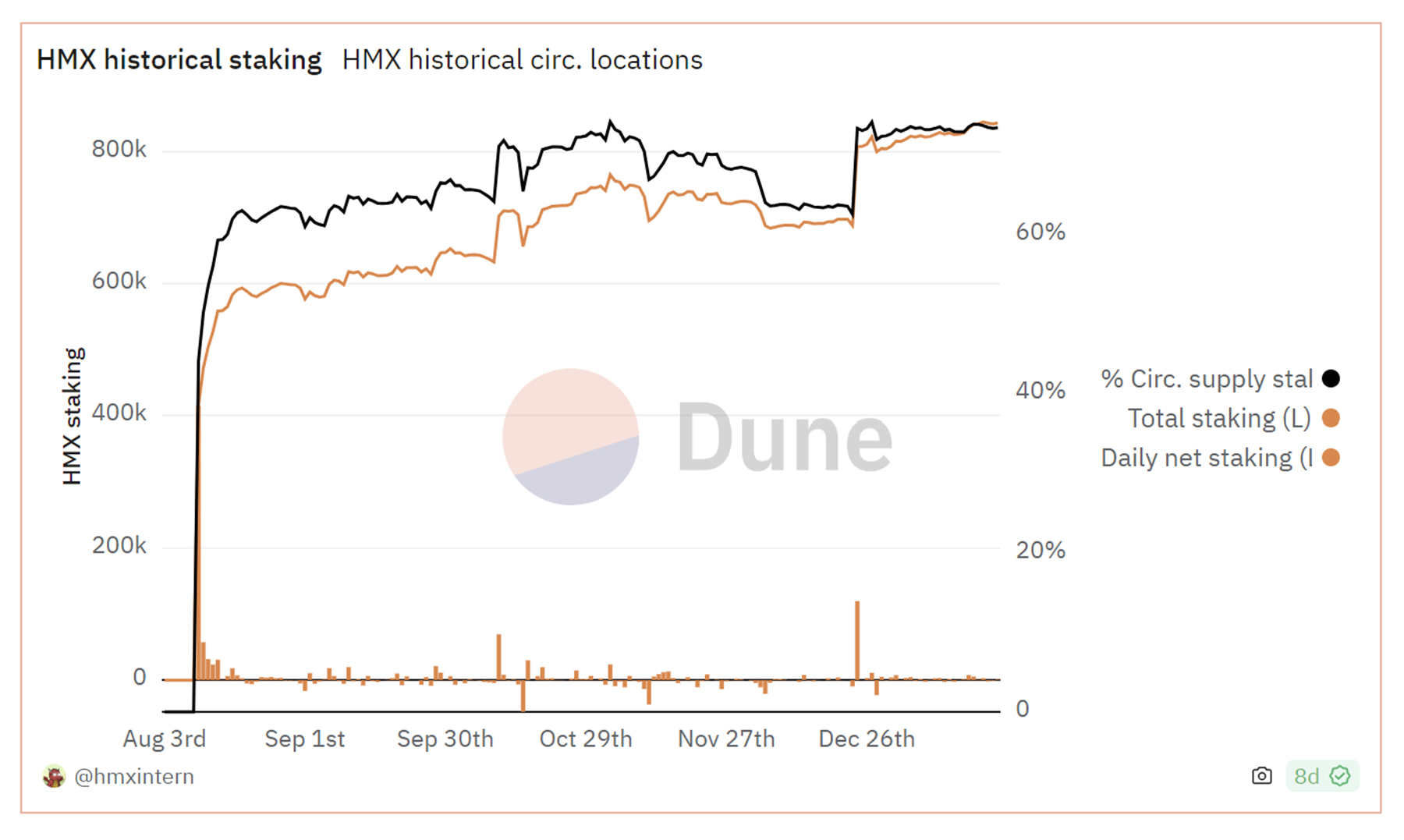

According to the protocol’s staking activity, that is not the current trend in place.

Currently, over 73% of the current circulation supply is undering staking.

Long story short: HMX’s value accrual setup is designed to make it profitable for users to hold the token and generate yield within the ecosystem.

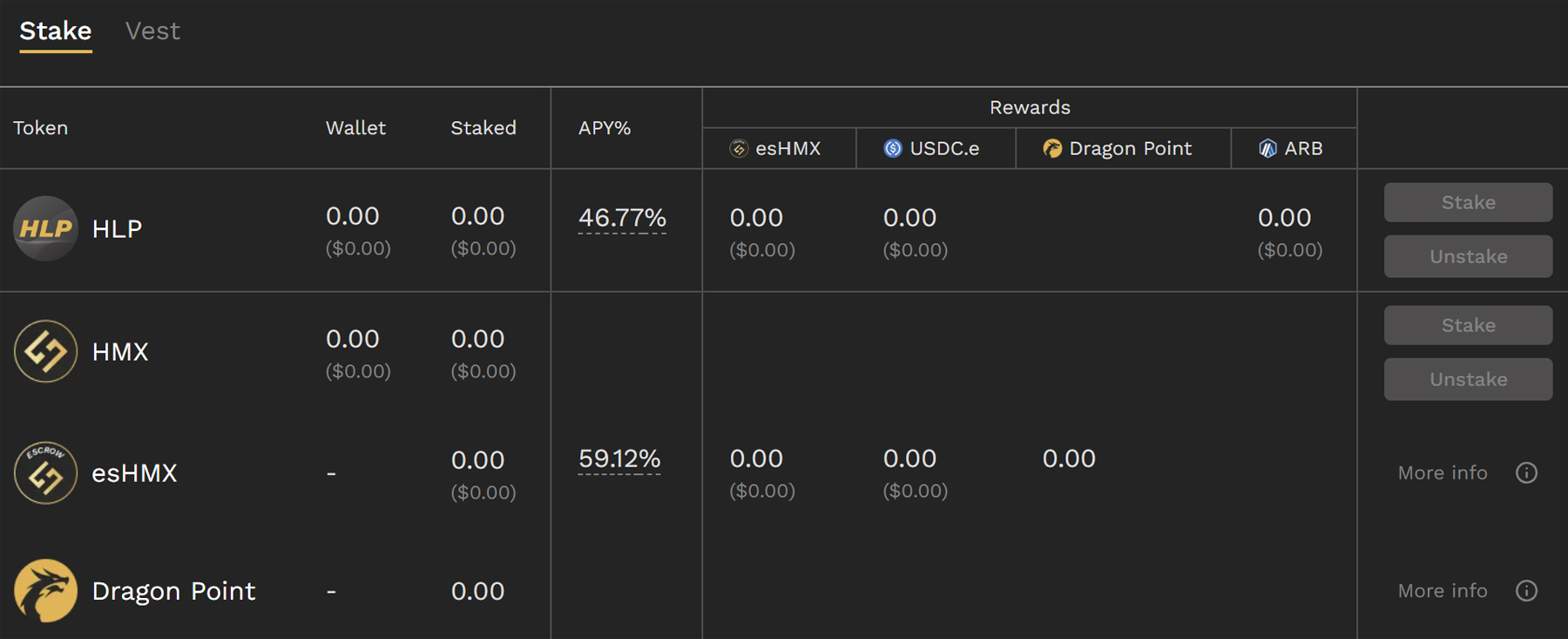

Right now, users are earning APY of around 59% for staking HMX and 46% for staking HLP tokens, which are assets users receive from depositing their assets into the HLP vault. An HLP token represents a share of the ownership of assets in the HLP vault.

As mentioned, the present total value locked on HMX is $27.7M, and the TVL value has rarely fluctuated much since Q4 2023.

So ideally, there is an incentive for HMX holders to hold the token on the protocol as long as there are token incentives, which are scheduled till July 2027. The token holders do not need to sell their tokens immediately since they are already generating yield from it.

Because the market cap is severely undervalued, HMX holders have identified that during a bull market in 2024, the token can undergo a reflexive bullish price action to emulate some of its underlying on-chain market strength.

After the above assessment, it is safe to conclude that even though HMX’s tokenomics appears concerning, its decay emission structure and holder incentives reduce any potential selling pressure in the market.

HMX valuation

Now, for market activity, HMX is doing well in generating revenue and fees. For perpetual DEXs, protocol revenue forms the main spine of its business model.However, for HMX, we will consider other metrics as well. We will assess its valuation relative to dYdX, GMX, Gains Network, and Perpetual Protocol, because these ecosystems are the current leaders in the category.

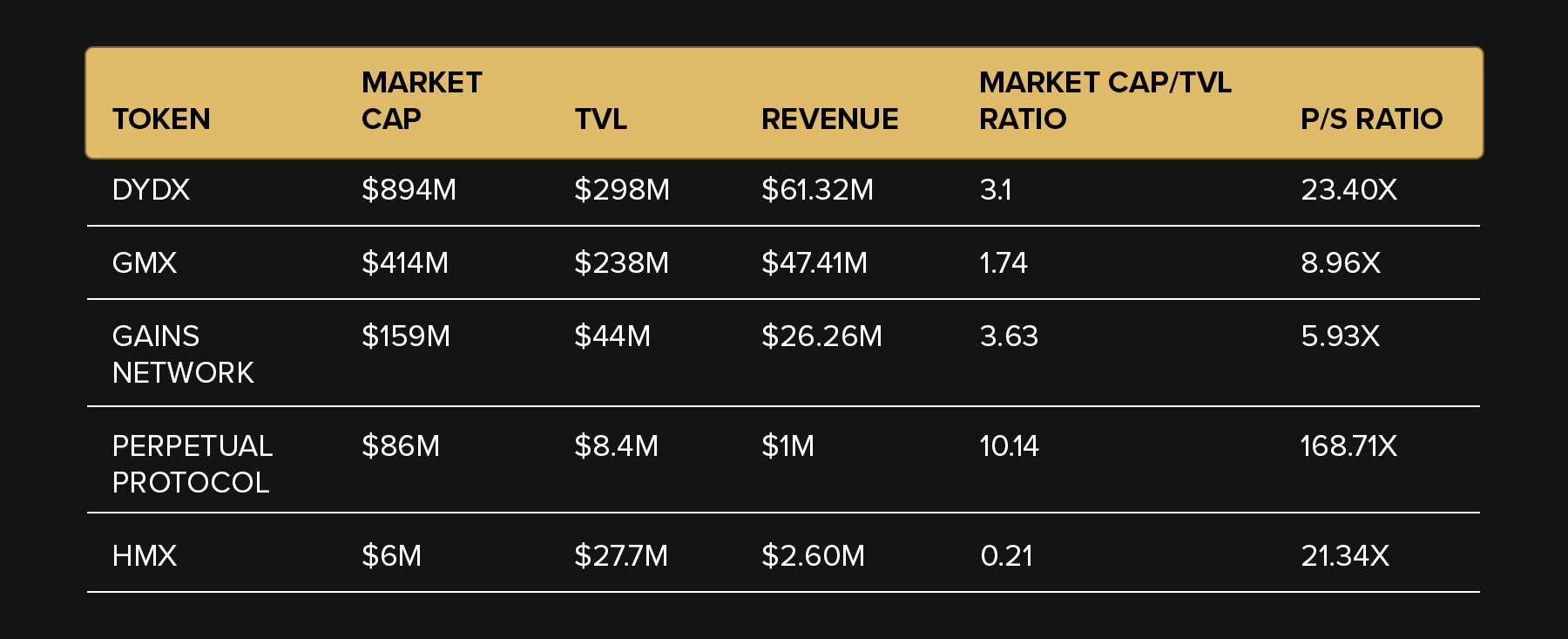

We have listed out key data points in the table below.

When the market cap/TVL ratio of the token is compared, HMX is the only asset that has a ratio under 1. Usually, when a market cap/TVL ratio is under 1, the protocol reflects an undervalued market price.

A DeFi protocol with a ratio under 1 is considered a good investment, but this is not a steadfast rule. So, we need to evaluate HMX on other metrics as well.

Now, regarding revenue, HMX is generating fairly lower than dYdX, GMX, and Gains. However, when the P/S ratio is compared, HMX’s ratio is on par with dYdX, and it outperforms GMX and Gains.

(Note: We have omitted Perpetual Protocol in this context because it is the only perp to register a very low TVL when compared to its Market Cap and revenue less than HMX)

The P/S ratio indicates that HMX is generating substantial fees relative to this market cap. dYdX is the largest perpetual DEX, and at the moment, it is almost on par with that protocol regarding relative market revenue.

So, how high do we think HMX can get?

Base case

As a base case, we expect HMX to easily recapture its previous high value of $16.36, about 3.09x higher than the current price.Bull case

For a bullish case, we need to compare GMX and HMX further.At the moment, it is difficult to assume the bullish ceiling of HMX beyond its previous high due to market volatility.

So, we are developing a historical comparison between the TVL status and market cap of GMX during its ascend. We have taken dYdX out of this comparison since its initial TVL during the beginning of the protocol stood at over $40 million.

Also, GMX has a fairly similar business and operational model to HMX. Therefore, during a bull market in 2024, capital rotation from GMX could influence the rise of HMX when market activity peaks in the perpetual DEXs.

Historically, when GMX’s TVL stood around $26M(similar to current HMX's TVL), its market capitalisation was around $70M. Over time, as the TVL gradually doubled to $50M, the market cap stood around $150M.

Considering HMX’s current market capitalisation lags behind a fair valuation relative to GMX and other data points such as the market cap/TVL ratio and revenue generated, a reasonable market catch-up would be around $100M-$120M market cap when its TVL reaches $50M.

Therefore, in the bullish case, HMX’s market cap can reach as high as $100-$120M – a 15x-20x from current levels.

Invalidation criteria

- If staking activity suddenly decreases, it would be considered a warning sign because it would mean HMX holders are cashing out.

- Lack of continued trading activity or lacking relevance during the bull market.

- A sharp decrease in APY percentage for HMX and HLP tokens.

- Any further changes in the token emission schedule leading to changes in supply dynamics.

Technical analysis

HMX is currently at a key long-term support zone which has been tested thrice since August 2023.

The token has bounced each time from the green rectangle zone, and right now, it is up by 7.32% on the daily chart on February 1.

From a DCA perspective, the current price is a good range to accumulate HMX, but considering the collective crypto market is still choppy, the asset might register a new low.

However, from a buy conviction standpoint, this is a good range for an initial entry. The price action will be reflexive and rapid over the next few weeks once the descending trend line is breached.

How one could buy HMX

HMX is only available on Uniswap; it is not listed on any centralised platform. So, people interested in the token will need to undertake a few steps.- Step 1: Use or create a DeFi Wallet

- You will need a DeFi wallet like Metamask. The wallet should be funded before undertaking any swap or buy function.

- Step 2: Connect wallet to HMX network

- Go to HMX’s official webpage and connect the wallet. The link will redirect to the Uniswap home page.

- Step 3: Select the network and token

- After connecting the Metamark wallet, select the Arbitrum network for a cheaper transaction fee.

- Select the preferred token you want to swap HMX for.

- Select network slippage if there is a lot of traffic or keep it at Auto.

- Click on the swap button, and the transaction will be completed after confirmation on Metamask.

Cryptonary’s take

HMX is currently one of the protocols in the perpetual DEXs category. At first glance, its token allocation can appear shaky. However, breaking down the token utility, its holding incentive and its emission structure dismiss this concern.At its current price point, HMX is an undervalued protocol that can undergo a significant price action during a peak bull market. It has a good product, credible data about market activity, and trader retention has been highlighted based on its TVL.

The team also announced that they expect a CEX listing in Q1 2024, which will bring a new cohort of market participants for the token.

From an investor's point of view, HMX can be a good asset for diversifying your exposure to perp DEXs as activity kicks off in the bull market.