Would you like to be the person who turned $10k into $20k, $100k, or $1million?

The power to choose is in your hands!

But here’s the thing: you make a profit when you buy and realise it when you sell!

Let that sink in.

The price at which you buy a coin is the main factor determining whether you get a 5x, 20x, or 50x.

Today, we share alpha on improving your odds of getting the maximum upside possible when you buy a coin.

Sounds exciting?

Let’s dive in.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

TDLR

- Identifying undervalued cryptos requires assessing the value discrepancy between price and fundamental growth metrics like usage and revenue.

- The top-performing coins in this bull run will include overlooked projects recovering from excessive bearish sentiment.

- Metrics indicating value discrepancy: on-chain activity exceeds price, community strength, smart money inflows

- We’ve previously called SOL and AVAX, but today, we give you alpha on how to find other gems.

Here’s how to spot winners

The top performers in a bull market are often a combination of both old and new tokens. Most people pay attention to the new tokens – exciting, innovative projects offering a first-mover advantage and being propelled by a strong narrative and hype.And there’s nothing wrong with that – we cover many of them at Cryptonary. Our most recent list includes OLAS, HMX, and DYM, among others.

But one often overlooked fact is that some old coins can also deliver an outperformance if you catch the wave of their resurgence just at the right point.

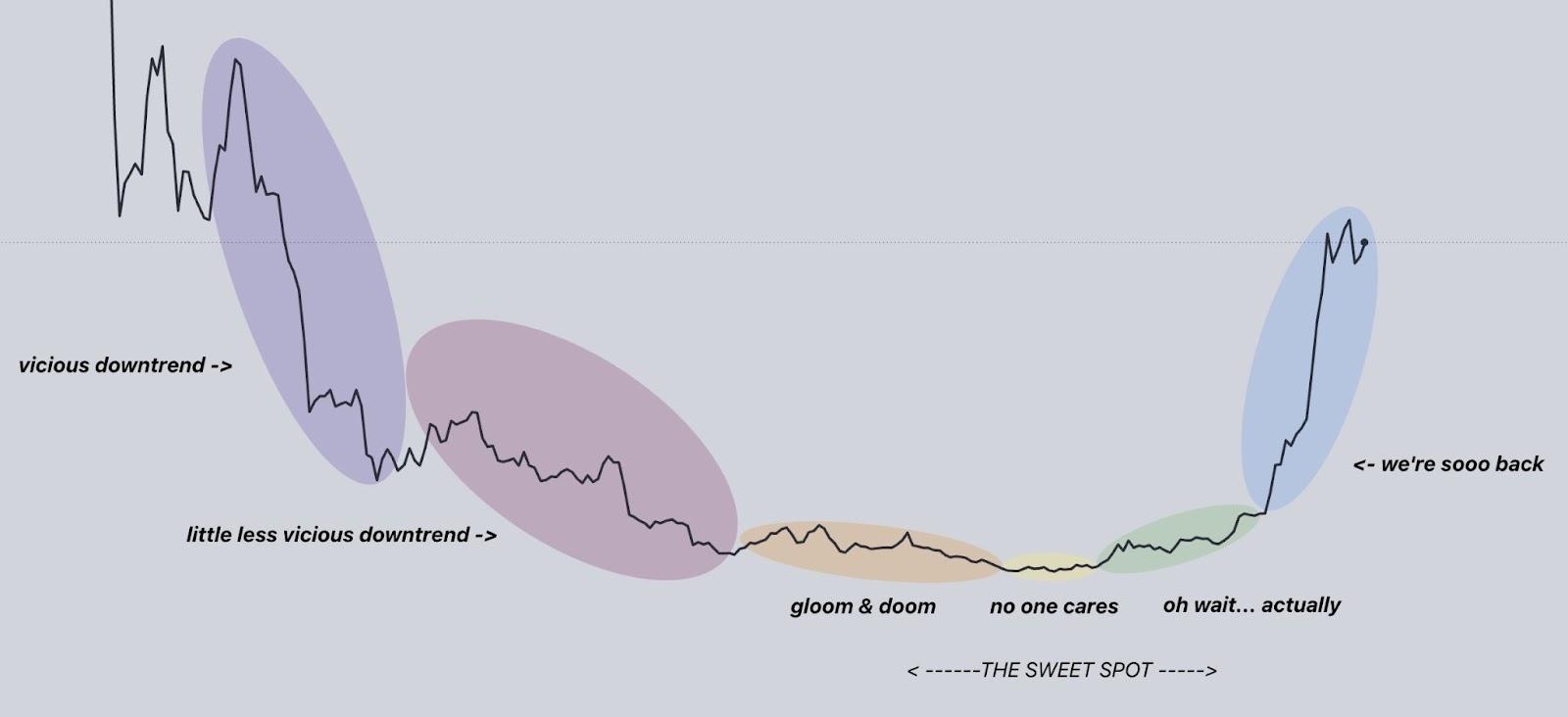

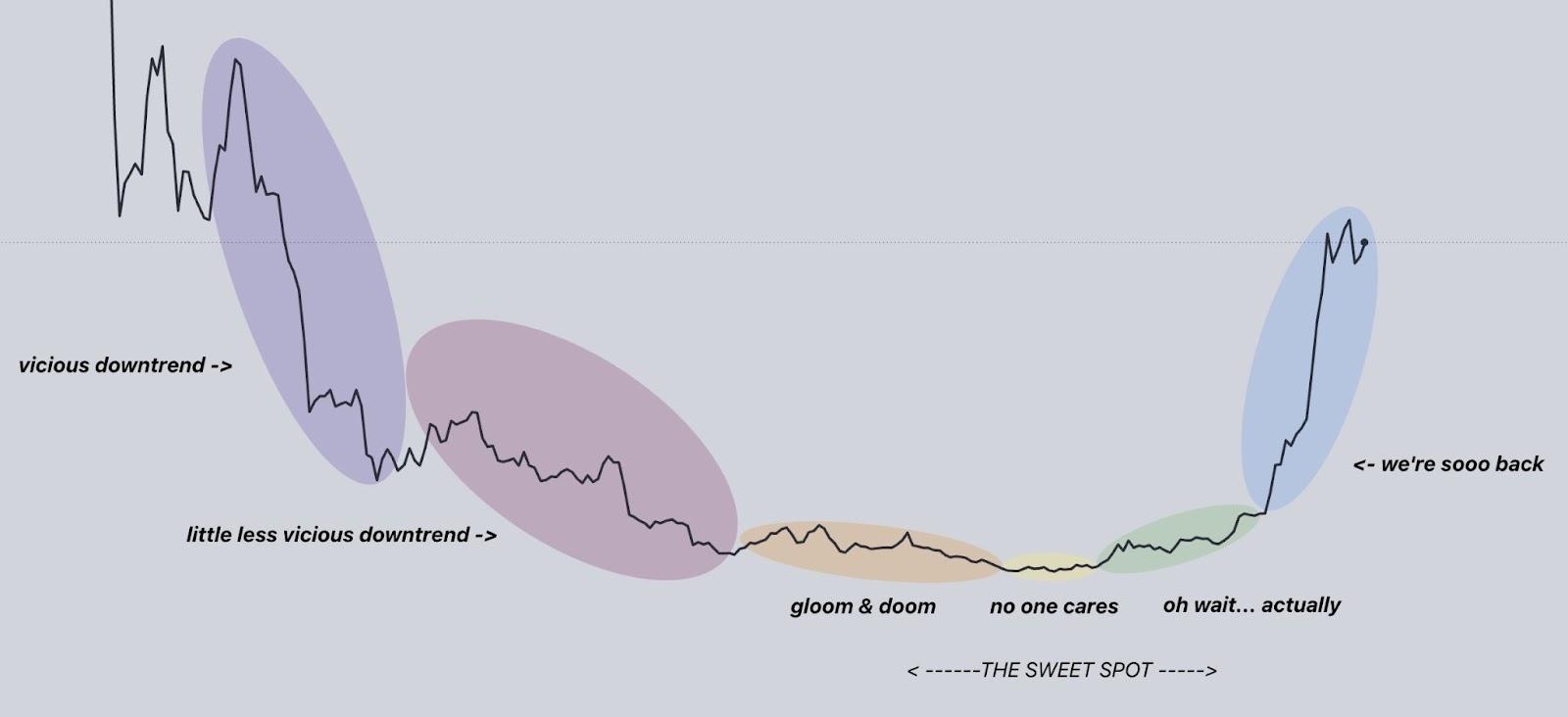

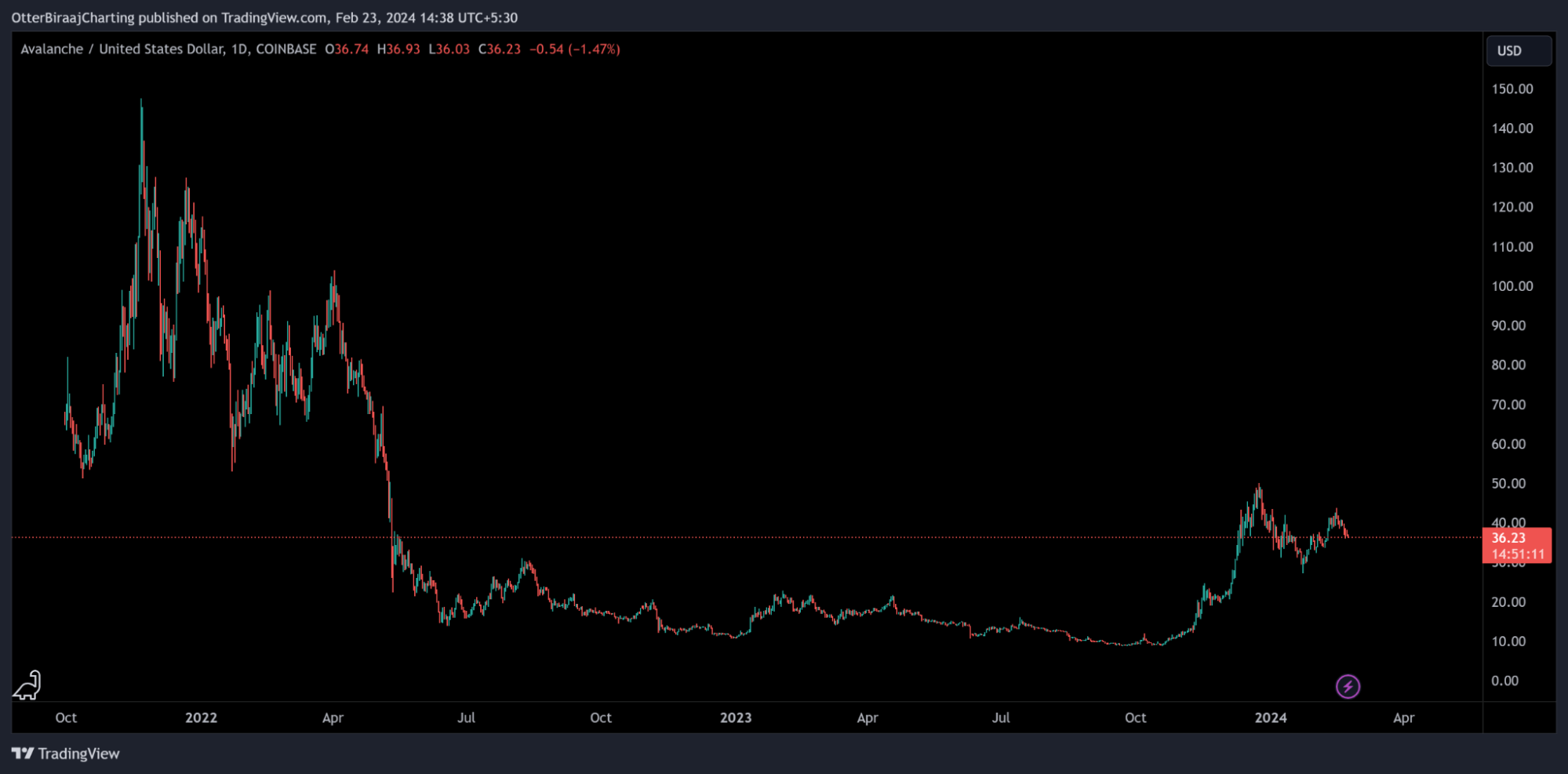

Take a good look at the chart below.

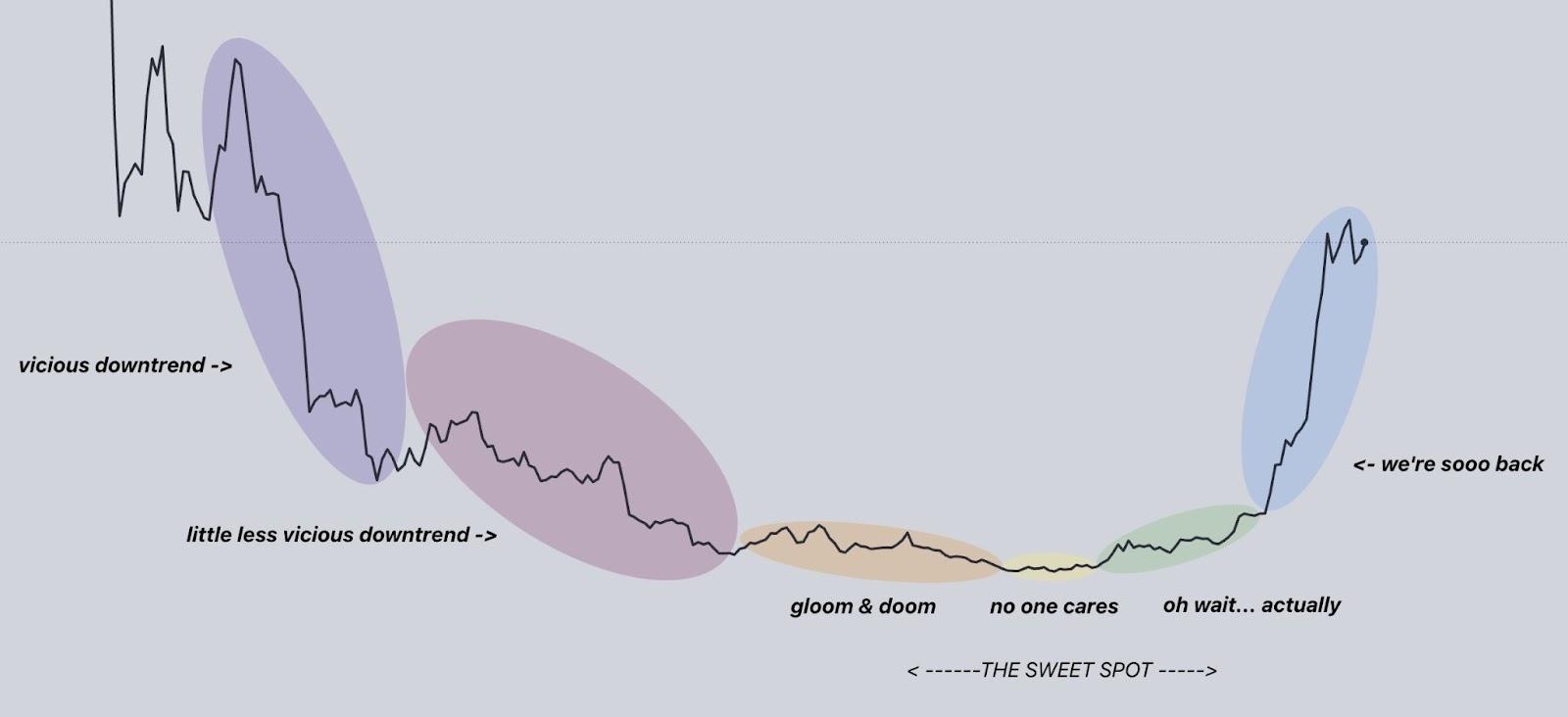

The stages start with a top-performing coin, getting a viscous downtrend, followed by a little less viscous downtrend, and then the gloom and doom when most people abandon the project. A no-one-cares period follows when the project could as well be dead, until the first signs of a recovery show – and then boom – it picks up, and we’re soooo back!!!!

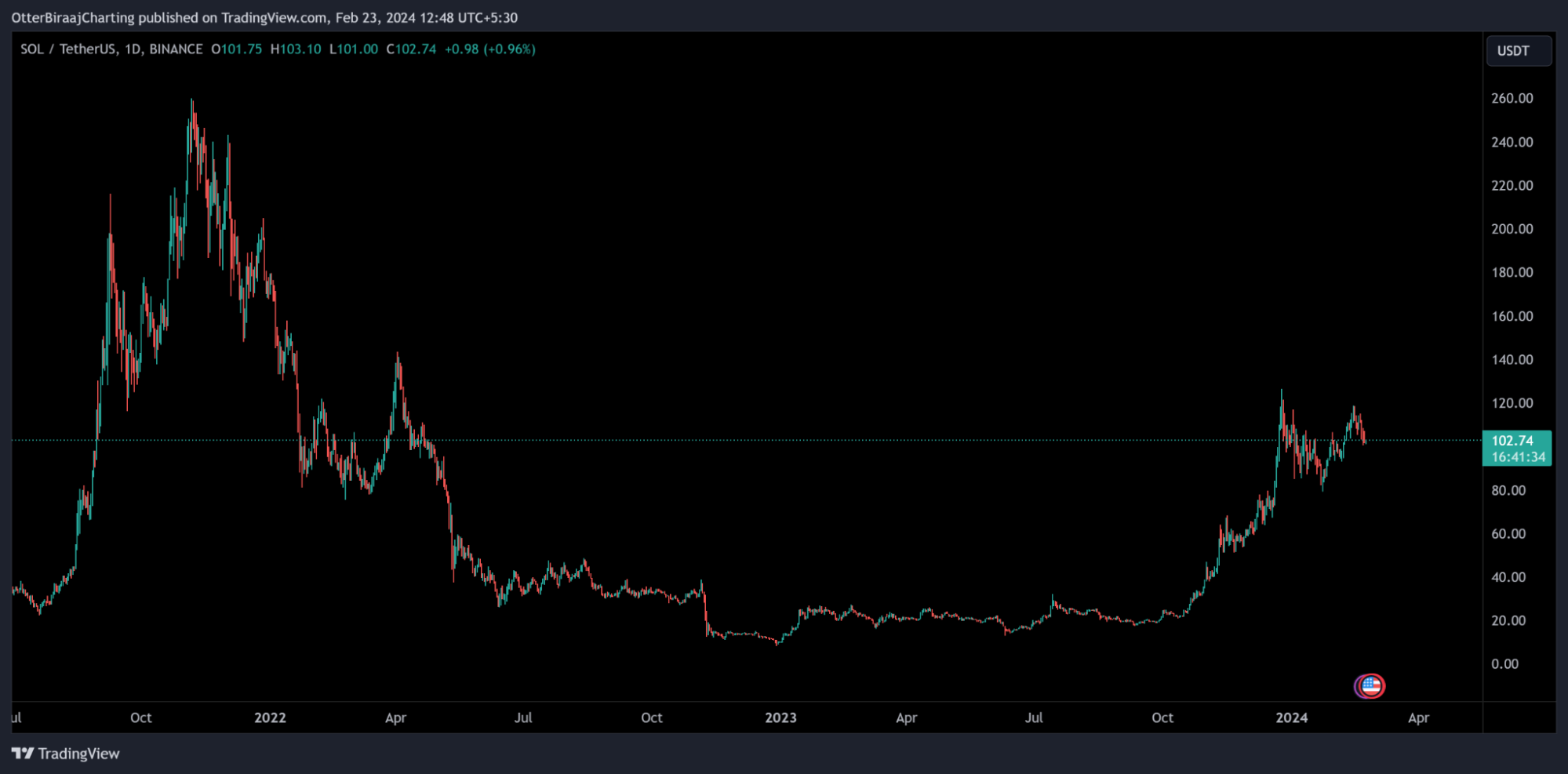

Let us take a real example of Solana right now.

Solana

Solana presented a strong emerging L1 narrative in 2021, which allowed its positive price action. It was competing with Ethereum and was slowly making waves. However, the FTX fiasco and the Alameda Research link almost killed the project.

As observed, Solana was down and out for most of 2023, but the wheels were moving behind the curtains. The technology was still legit, the community was retained, and although sentiment was quite negative initially, it presented the opportunity. At the end of 2023, multiple projects started launching on the Solana chain.

We told people to get back into Solana when it was trading around $22.91 in September 2023; it ended the year with a 400% gain. After a pullback, it is still up with more than 350% gains and is on track to hit a target of $500 when this bull cycle ends.

We’ve made another call; if you’ve been with Cryptonary for at least two months, you’ll know the project, but don’t worry; we will talk about it later in this report.

However, it is not just about buying coins that performed well in previous cycles. After all, the likes of XRP reached its ATH in 2018, but since then, it has never been close – so past performance is not a guaranteed indicator of future performance.

The key to picking the winners from among the older coins is understanding and applying value discrepancy.

Value discrepancy

Value discrepancy refers to a situation where there is a disconnect between a coin's current valuation/price and its underlying fundamental value or potential. Thisalue discrepancy can be positive (indicating undervaluation) or negative (indicating overvaluation), but we will keep this discussion focused on the type of value discrepancy showing a project is undervalued.You are essentially looking for a coin that has continued to show growth and relevance but that the market is still valuing against the prism of the bear market, thereby leading to a lag in price action.

How value discrepancy can help build conviction

Take another look at the chart.

The aim is not to enter a project after a breakout rally. The goal is to build a position before the project breaks a major consolidation or downtrend pattern. The value discrepancy is between price action and indicators or metrics.

However, value discrepancy can vary significantly from one crypto to another.

Based on the category, different factors can be valued more than others. For example, fees generated would be an essential metric for L2s or DEXs. Similarly, for the DeFi protocol, if TVL is leading price performance, it can be a valuable conviction.

Now, for topics like DePin and Gaming, you will not find open-source datasets. Hence, their adoption or fundamentals will be measured based on partnerships, funding, testnet activity, etc.

Below are a few additional metrics to double-check for value discrepancy.

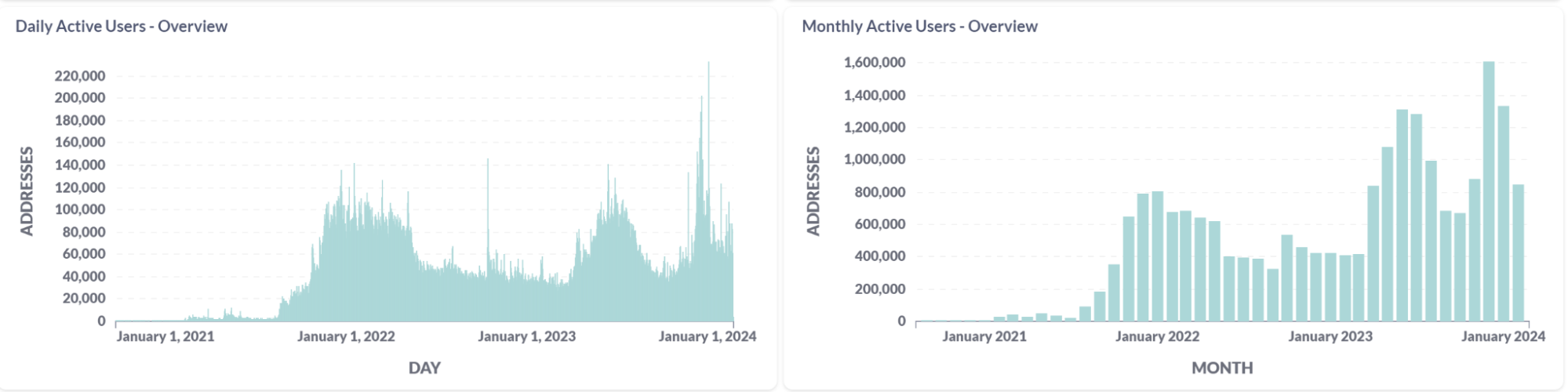

- On-chain activity: If the price lags on-chain activity, that is always a good sign. Transaction counts, daily active users, and trading volumes are metrics that indicate that there is relevant on-chain activity on a protocol.

- Smart money inflows: You may need to use specialized tools to find this. But if you can spot smart money inflows, it could be a good indicator that the smart money agrees with you that the token has a value discrepancy. Your Cryptonary membership includes our Smart Money series; make sure you read them.

- Revenue or business model: The project should be generating revenue for its services or the token should be involved in some form of utility on the network. It can be in the form of transaction fees being paid, governance, staking, etc. A good Price-to-Sales ratio also goes a long way.

- Community: The project should also have a thriving, vocal, and growing community. If the project has a significant following, there is education around the project online, and Twitter threads are being written, which is a major plus point.

Avalanche

One current example of a coin in which a value discrepancy is possible is Avalanche.

According to the available data, the network is currently registering strong network activity, with rising active users and daily transaction count. On the other hand, its TVL continues to hover under $1B after reaching around $11B in 2021.

The chart looks something like this: where the price has broken above its previous consolidation range.

Compare AVAX’s chart with the value chart from earlier in the report. Do you notice any similarities?

So, is there an opportunity there?

Our AVAX report has a detailed breakdown, but this is an example of what value discrepancy can look like.

Note: this isn’t a ‘one-size fits all’ approach, and the research pathway can be very subjective or personalised.

Taking a look at projects with value discrepancies

After going through the above conditions, you would have developed a strong opinion or investment thesis on why a token deserves a spot in your portfolio.Now, this is where you develop a strategy for building your positions.

While a deep knowledge of technical analysis is not required, it is essential to understand market structure, long-term resistance and support, and momentum for market entry.

Hence, chart analysis is required to identify the buy-in zone after building a conviction.

Let us take two examples.

Injective

Injective is one asset which has gone parabolic over the past few weeks.

Now, Injective was paired with a strong narrative from top to bottom. It is under a trending category with the “modular approach for decentralised finance” narrative. Its tokenomics is strong, it has strong on-chain activity, and the community is thriving.

Hence, once the asset underwent a breakout, it was a very easy trade to hold, and from the actionable range, an almost 4x increase in value was evident.

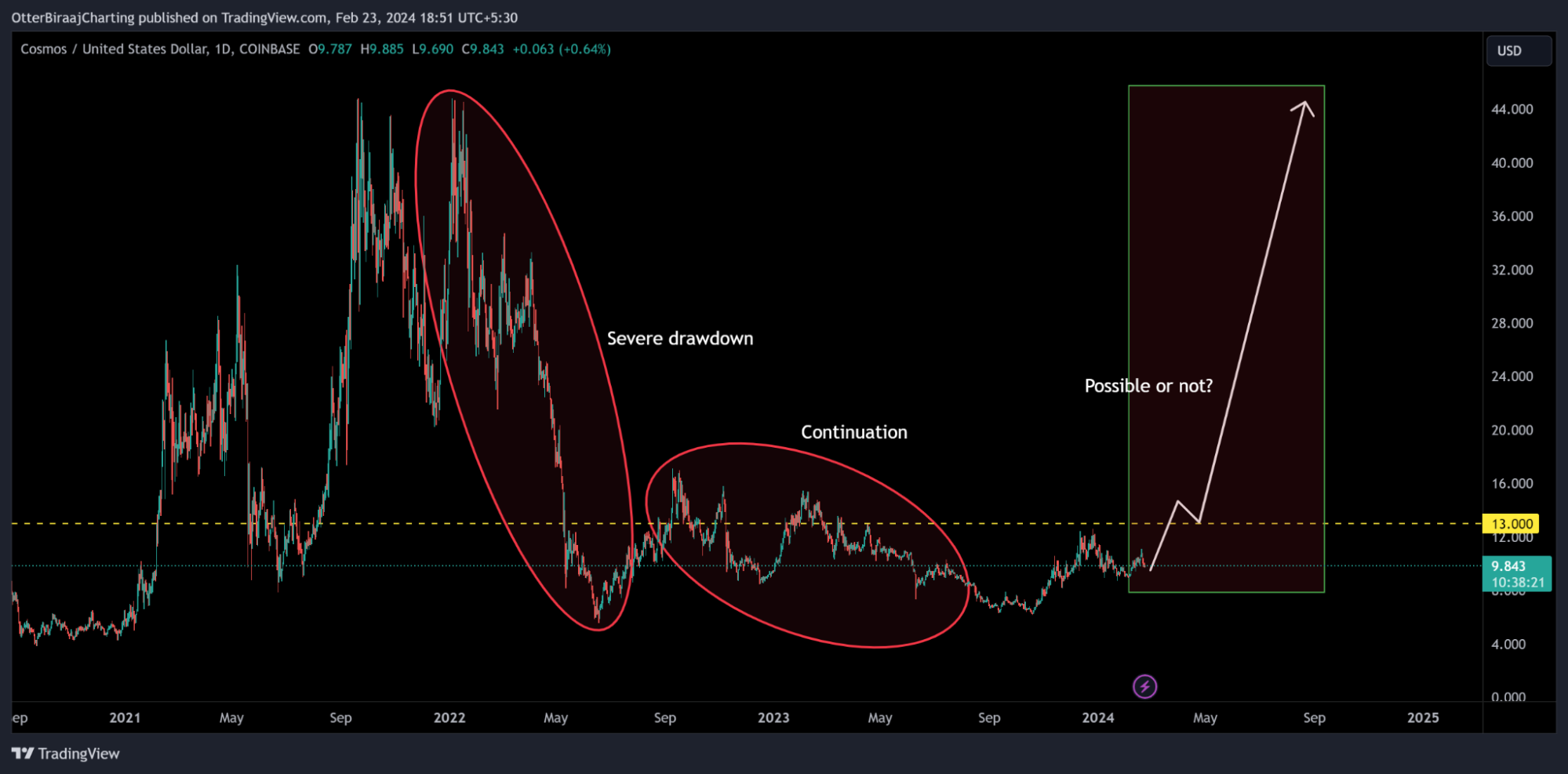

Cosmos

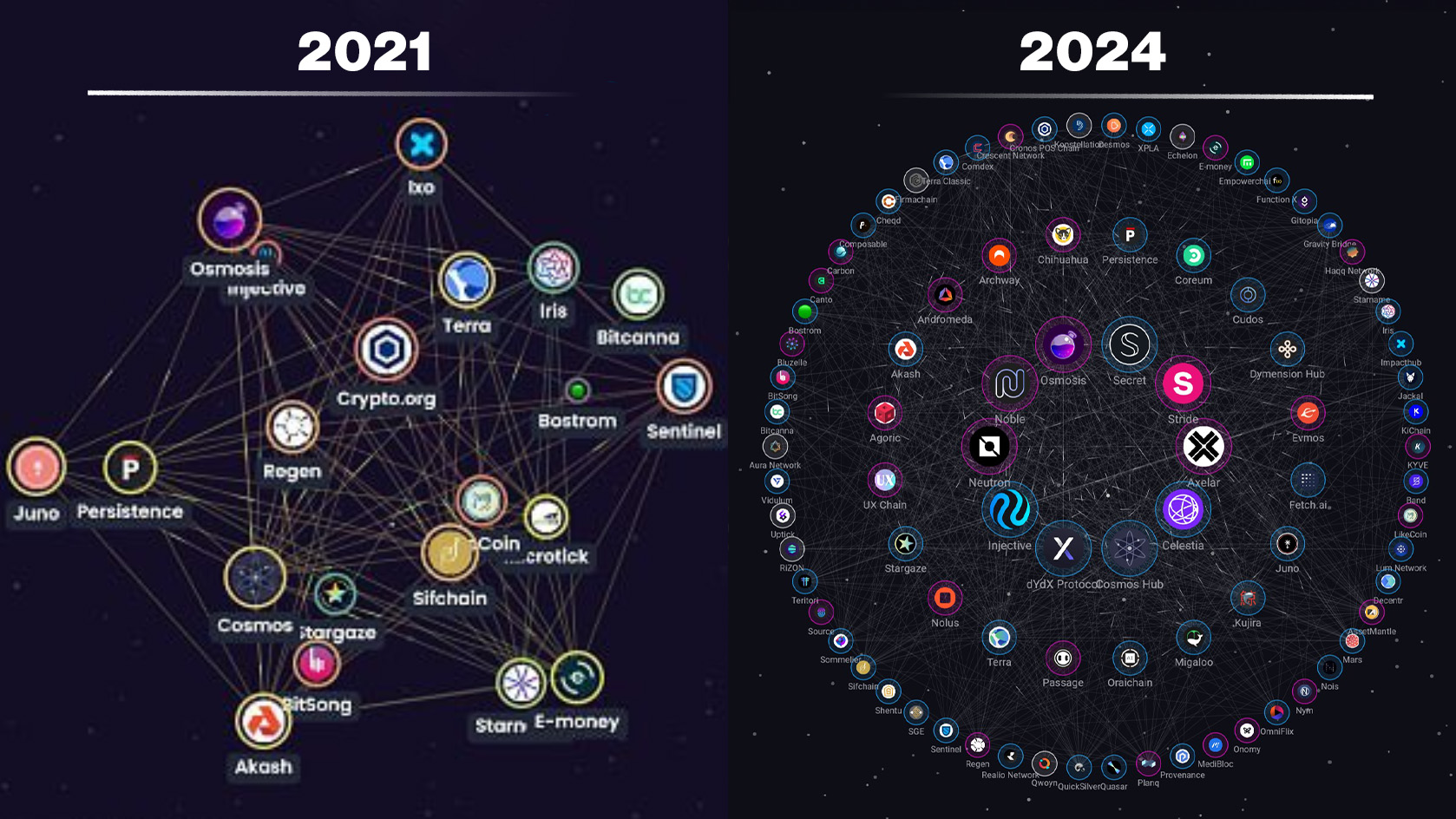

Now, unlike Injective, there is another protocol which investors might be interested in analysing.Cosmos blockchain is one network which hasn’t witnessed an all-out bullish breakout yet. This project is currently the base layer of multiple projects under the ‘trending category’ in 2024. Some of such projects include Celestia, Dymension, Injective, Akashnet, and Kujira.

It has strong tokenomics, good on-chain activity, and a strong community.

Like Solana, it faced a massive setback as the Terra Luna ecosystem was hosted on this interchain. It is proving its worth now, and the expansion speaks for itself.

This is the current chart of Cosmos. We will not infer anything further, but this could be a good starting point to begin a new fundamental analysis and develop a conviction.

Cryptonary’s take

As mentioned earlier, an approach to “buying crypto for maximum upside” is a very subjective topic.Still, if you follow a similar plan or include some of these fundamentals when you DYOR, you will be ahead of the game.

The objective remains to track projects that are at their lowest point in terms of sentiment when fewer investors are excited about them.

We're still early in this crypto bull run - the 2024/2025 cycle likely has much room left to run. As we've covered, this presents a prime opportunity to secure positions in overlooked gems before the herd piles in.

The keys are identifying true value discrepancies, spotting signs of a turnaround, and entering at opportune moments when volatility allows. However, patience and discipline are vital. The projects realizing 10x, 50x or more gains never get there in straight lines.

While certainly not without risks, by sticking to fundamentally sound crypto assets that have shown the previous ability to deliver, history suggests the odds of life-changing returns are firmly in your favour.

Imagine where you could be when this cycle reaches its peak.

Will you take the steps now to become one of the winners in this run? We're here to give you the tools, insights and conviction needed to win.

Remember, you make a profit when you buy and realize it when you sell.

So, stick to the script: buy low, sell high.

Don’t fumble the bag!

Find the Next 10x Crypto Before the Crowd

We’re still early in this bull run, and the biggest gains go to those who spot value discrepancies before the masses catch on. That’s exactly what we do at Cryptonary.🚀 Our research helped members get into SOL at $22 before its 400% surge. 🚀 We called AVAX before its breakout.

Now, we’re tracking the next undervalued gems. Want in? Join Cryptonary today!