Pssst! I Wanna Buy Some LSD!

What’s all the hype about LSD? No, not that LSD. Liquid Staking Derivatives are all the fuss at the moment. In January alone, Lido DAO (LDO) was up 130%+, Rocket Pool (RPL) rose 90%+, and StakeWise (SWISE) advanced by 100%+.

Liquid staking allows users to stake ETH while continuing to use their assets in the form of derivative tokens.

LDO is the top dog in the LSD sector - but for how long?

An upgrade coming in Q1 2023 is set to change the status quo. No longer will ETH be locked in the staking contract. It’ll be free to wander! But where? Which LSD token do we think will outperform the others?

Let’s find out.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR (Because I’m too lazy):

- Liquid staking (LS) allows users to stake ETH while continuing to use their assets in the form of derivative tokens.

- LDO is the market leader and most popular LS protocol (~75% Ethereum market share) – it’s been around the longest.

- RPL is another liquid staking provider. It has experienced impressive growth and has better tokenomics than LDO.

- The Shanghai Upgrade will allow staked ETH to be withdrawn for the first time. This will cause a reshuffling in the segment.

- RPL is well-positioned to benefit from this reshuffling.

First, what is liquid staking?

Let’s use a good old analogy to explain liquid staking…Imagine you want to pay for a car with cash, but all your money is locked up in your mortgage. How do you get around this? By using the house as collateral for a loan.

This is similar to liquid staking. An asset is locked up yet can still be used for other purposes.

A user stakes ETH and is issued an LSD token (like stETH or staked ETH), and can spend or earn with that token. All the while, they’re earning ETH staking rewards in return for contributing to Ethereum’s security.

Thanks to liquid staking protocols, those assets can be used elsewhere simultaneously.

Here's the issue, though

ETH staking is not that popular. Only around 13.4% of circulating ETH is currently staked. Compare this with other L1s:- ADA ~70-72%.

- SOL ~66-68%.

- AVAX ~62-64%.

People aren't comfortable staking for an unknown stretch of time. However, this is about to change.

The Shanghai Upgrade for Ethereum is due around March 2023. This upgrade will allow stakers to stake any amount of ETH and the freedom to use the liquidity elsewhere.

There will likely be a reshuffling of staked ETH once withdrawals are enabled. At the end of the day, people want the most yield. The money will flow to the protocol that offers the hottest deal.

Lido DAO (LDO) stands at the top of the LSD sector right now, but for how long? Let’s dive in deeper and compare Lido with its closest competitor…

Lido DAO

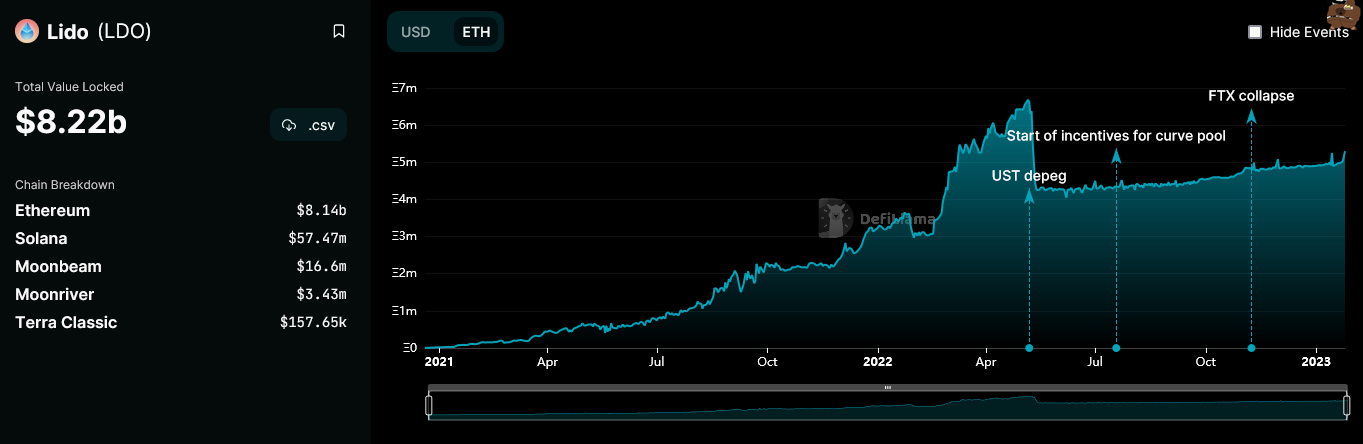

LDO is Lido DAO’s governance token. Beyond that, there’s not much utility. Lido’s Total Value Locked (in ETH) has seen consistent growth over the last few months.

- Market Cap: $2B.

- FDV (Fully Diluted Valuation: the theoretical market cap of the crypto if all tokens were in circulation): $2.4B.

- TVL (Total Value Locked: a measure of all assets staked/bonded/deposited with a protocol): $8.1B.

RocketPool

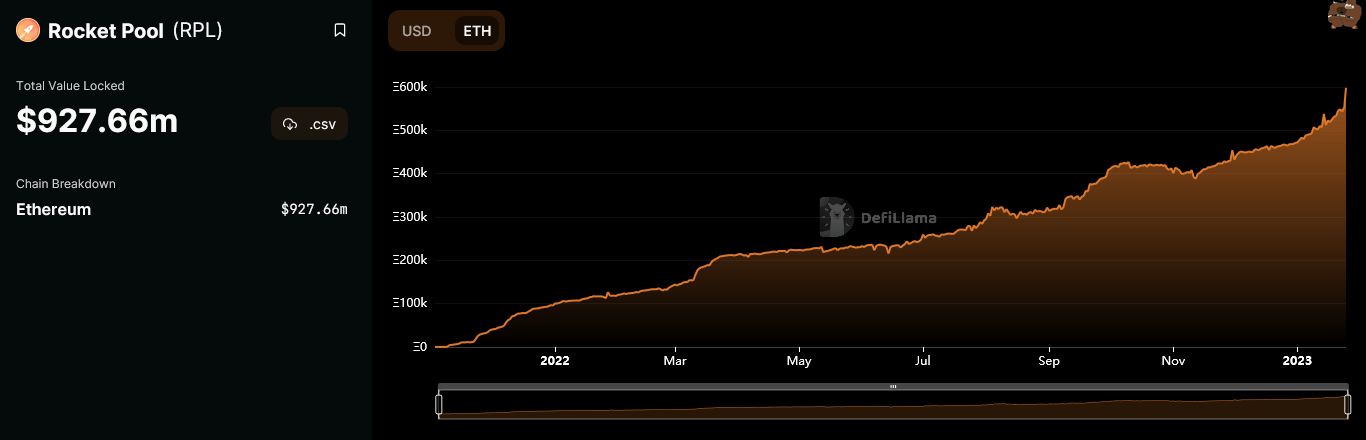

RocketPool is the third-largest ETH liquid staking protocol after Lido and Coinbase.RPL is RocketPool’s governance and utility token. Anyone running a node using RocketPool must stake 50% ETH and 50% RPL. This represents positive price pressure through a reduction in circulating supply. Operators earn RPL rewards as well as a commission (and, of course, the base ETH staking rewards). RocketPool has seen consistent growth in TVL over the last year.

Stats:

- Market Cap: $720 million.

- FDV: $720 million.

- TVL: $922 million.

Will RPL kill LDO?

We think Lido will remain top dog. However, it’ll find itself losing significant share to the other protocols. Many participants are currently locked in their chosen option - some for a significant amount of time.For the most part, the popularity of a protocol determines its token performance. LDO is the leader here, and its performance reflects that. However, it’s clear RocketPool (RPL) is growing in popularity. It has a smaller MCap than LDO, which means more room for growth. RPL has built-in value accrual. Node operators must bond (stake) RPL along with ETH. This is similar to how THORChain requires users to deposit half their LP position in RUNE. Ultimately, it represents a lockup of RPL tokens.

Yes, LDO has first mover advantage, but this may soon act against it. Those who staked with Lido years ago have not had a choice. They’ve been stuck, sometimes for years. With the Shanghai Upgrade, stakers will now have a decision to make - stay, or move. A redistribution of staked ETH is inevitable.

We've established the main driver of LS token price is protocol popularity. Thus, it can be argued that redistribution will negatively affect LDO. That ETH must go somewhere. So, by that logic, a redistribution will positively affect the other protocols. RPL’s tokenomics give it an advantage over LDO. RPL won’t kill LDO, but it’s well-positioned to steal market share.

Cryptonary’s Take

To take advantage of this opportunity:- We think it’s worthwhile to move some LDO exposure to RPL.

- These positions should be scaled out as we get closer to the Shanghai Upgrade. We expect significant volatility in LS tokens until the dust settles. We’re essentially chasing the build-up to the event. “Buy the rumour, sell the news”.

- RPL has moved well since the start of the year. Here are some key levels of interest:

This is the weekly chart for RPL with the most recent data we could find on TradingView. As you can see, it is currently at resistance which needs to be reclaimed to confirm more upside.

If reclaimed, an ideal entry point for RPL now would be at the $37 level, as it will be turned into support. Following that, we highlighted what could happen to RPL in the short term, which is a move to $50.25 and potentially higher than that.

In case RPL is rejected at resistance, it would be best to wait for $25.50 (white line) before getting in. This is our closest support if RPL isn't able to reclaim $37, and can also act as an ideal entry point if the first scenario doesn't play out.