In that report, we noted that MKR has likely realised the bulk of near-term gains compared to other coins that were suppressed during the bear market.

Long story short, we concluded that MKR is better suited for the bear market than the bull market.

At the time of writing, this thesis was substantiated by the fact that MKR experienced a 26.75% decrease in value against ETH.

However, we recently spoke with the MakerDAO team about their roadmap. This discussion gave additional context about MakerDAO's intended milestones.

Now, with this updated understanding, were we wrong about MKR?

Let’s dive in

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

A glimpse into MakerDAO's roadmap

Our last report examined MakerDAO's current state at the time. However, the protocol is now rolling out a major strategic overhaul called Endgame. This multi-year plan aims to reinforce the resilience and decentralisation of MakerDAO's DAI stablecoin.Currently, MakerDAO acknowledges that its DAI stablecoin is not yet optimally decentralized. It is at risk of shocks both within the crypto ecosystem and from external threats due to its reliance on the U.S. dollar and centralized forces.

However, the goal of the EndGame is for DAI, its stablecoin, to achieve full decentralization through multiple phases and become the most censorship-resistant and decentralized stablecoin. You can read more about it here.

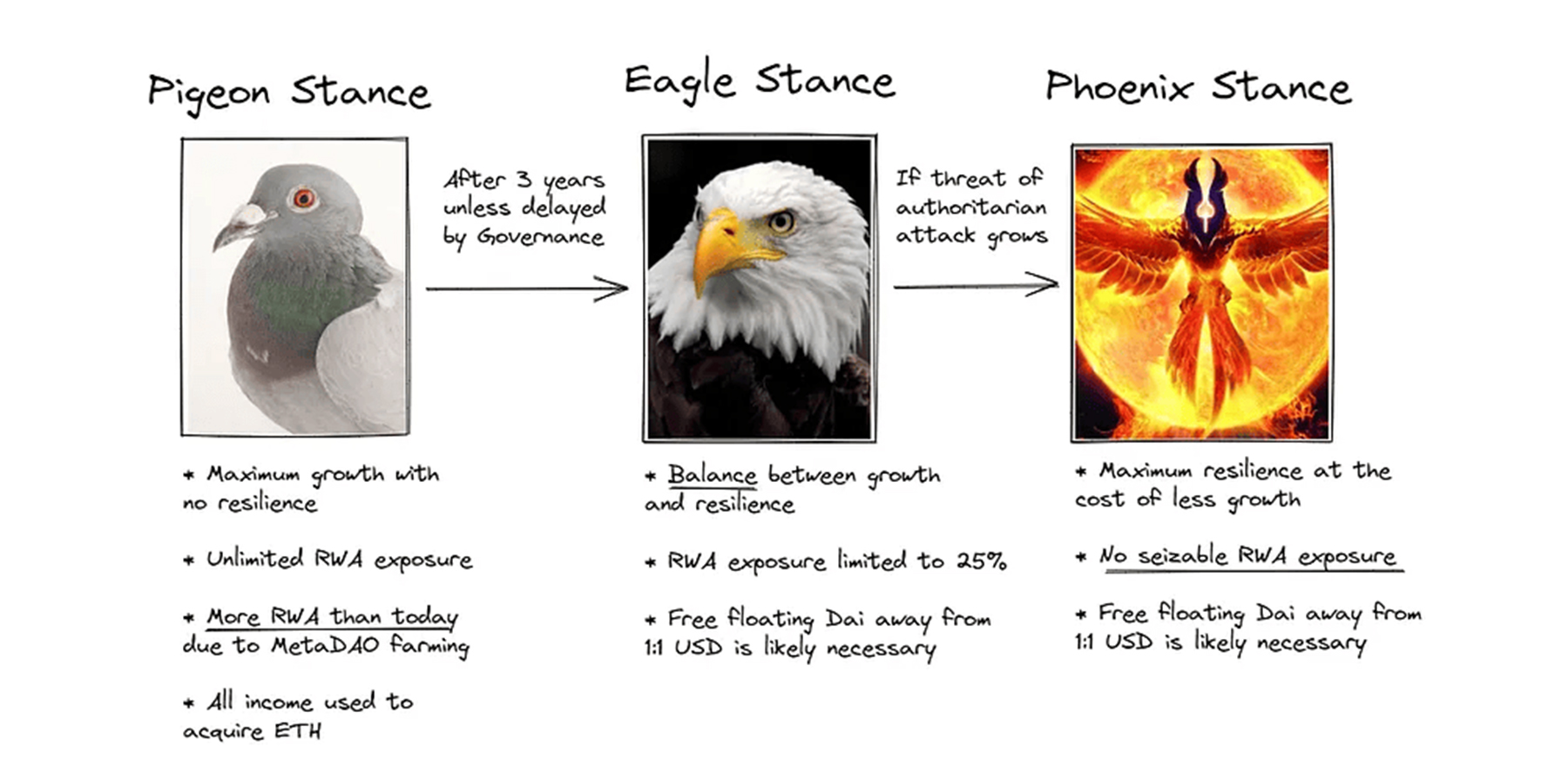

Endgame starts with an initial "Pigeon Stance" phase, running until approximately 2025. This phase prioritises rapid growth and accumulating ETH collateral to bolster DAI's durability against potential threats.

There is no limit on real-world asset debt exposure during this period.

The next stage, "Eagle Stance", balances external dependencies against decentralisation – capping real-world asset collateral at 25% of all debt.

The most conservative "Phoenix Stance" phase removes reliance on real-world assets.

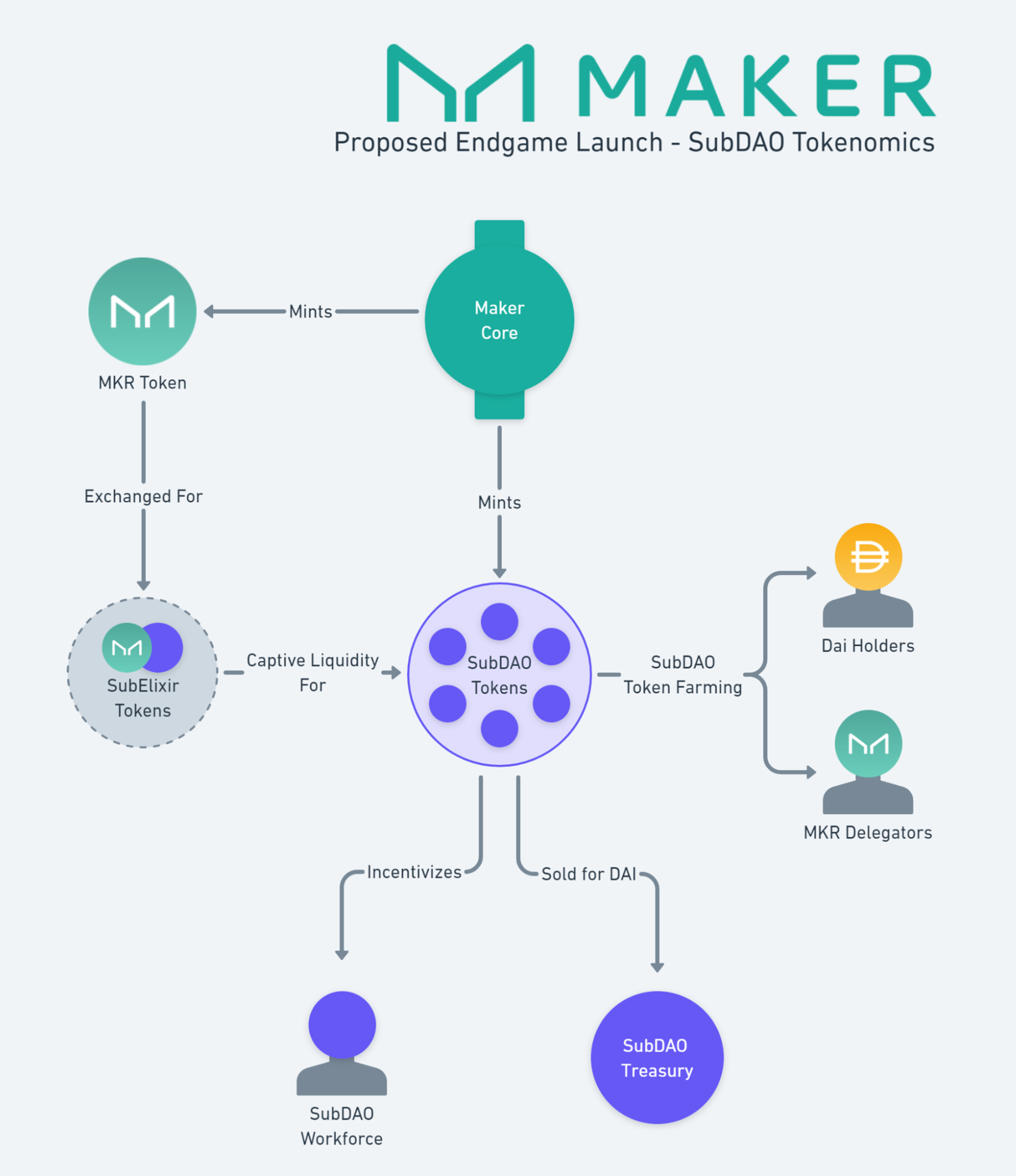

Another significant change MakerDAO is undergoing as part of this Endgame strategy is the establishment of so-called SubDAOs, which aim to help MakerDAO move towards greater decentralization by altering its organizational structure.

These subDAOs divide the organisation into smaller, more manageable groups responsible for tasks like risk management, software development, marketing, and new protocols within MakerDAO.

Each SubDAO has its governance token and unique governance processes to attract specialised contributors. DAI and MKR holders who want to hold SubDAO tokens and participate in governance decisions can earn these new tokens.

The first SubDAO set to be created is SparkDAO, which will oversee MakerDAO's DeFi infrastructure, including its lending protocol, Sparklend. Its launch, along with the other SubDAOs, is scheduled for May 2024.

Creating SubDAOs introduces both risks and opportunities for the Maker ecosystem. One key concern revolves around the potential dilution of MKR's intrinsic value. As SubDAOs generate more governance tokens, MKR might likely lose its value due to the growing number of these SubDAO governance tokens.

However, this situation also opens doors for DAI holders, offering a way to navigate the volatility associated with MKR. They can participate in farming SubDAO tokens, thereby gaining exposure to various aspects of the ecosystem. These SubDAO tokens might appreciate over time.

Moreover, individuals with specialized skills can actively engage in SubDAOs, potentially generating income from their expertise. Maintaining a vigilant eye on the development and potential of SubDAO tokens, such as Spark, is essential. Choosing to hold DAI instead of other stablecoins can be a strategic move for those interested in farming these tokens, should they prove valuable.

Expanding collateral with private credit?

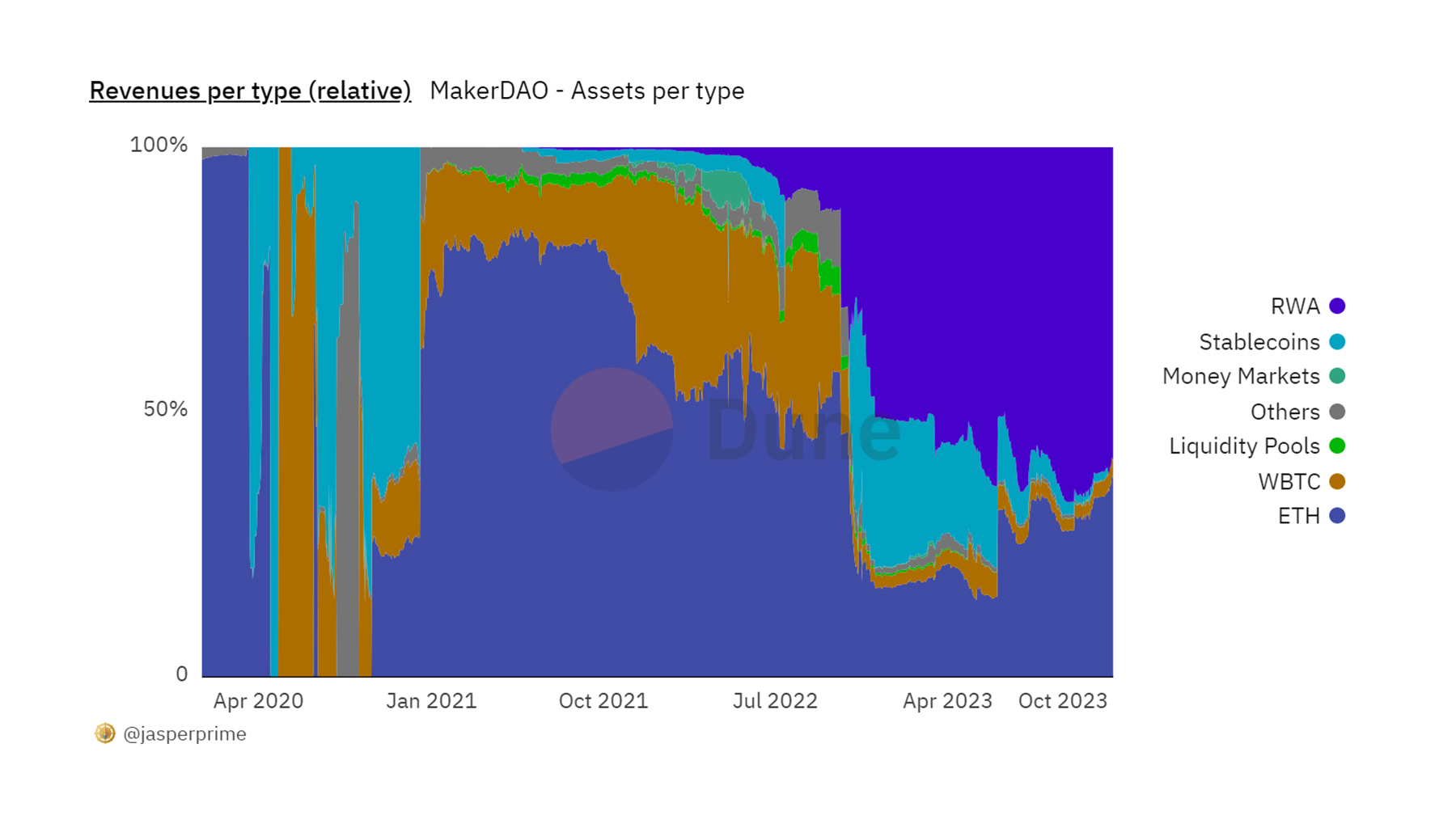

Now, let's delve into the heart of our initial thesis – MakerDAO's Real real-world asset (RWA) strategy. This is especially pertinent since MakerDAO's primary focus until 2025 will be RWA.Our primary concern in this context pertains to the anticipated rate cuts in 2024, which could result in MakerDAO losing a substantial revenue stream derived from its U.S. treasuries.

MakerDAO relies heavily on this type of revenue, with approximately 60% of its income derived from its RWA strategy. This reliance on RWA means that rate cuts could substantially impact their revenues, especially considering their significant exposure to the U.S. Treasury market.

As a potential solution to this problem, the MakerDAO team has explained the possibility of expanding into private credits and collateralised loan obligations (CLOs). While MakerDAO is not currently pursuing this venture, it could be proposed to the community for a vote shortly.

While we do appreciate this strategy, especially the potential inclusion of CLOs, which historically have offered higher levels of income for a lower level of risk, even during periods of lower interest rates, it remains the case that with this strategy, a significant portion of their income will still be correlated with the macroeconomic environment.

This correlation exists even though CLOs generally have lower sensitivity to changes in interest rates compared to other financial instruments.

This still places MakerDAO in a basket of assets that benefit from a high-yield environment. However, this is the opposite of what crypto benefits from, given its positive correlation to a low-yield environment. Hence, it is more of an uncorrelated asset.

Suppose MakerDAO decides to move away from Treasury yields into higher-risk debt instruments. In that case, it will be essential to monitor whether these instruments, such as CLOs, enable MakerDAO to generate competitive yields compared to the other yield sources we see in crypto, such as lending or ETH staking.

If that is the case, and private credit or CLOs remain elevated even in a lower-rate environment, we could change our stance, as MakerDAO's revenues would remain high.

The role of MKR and DAI in a portfolio in 2024

How has this conversation with MakerDAO changed our perspective on MKR and DAI?We remain consistent in our thesis that MKR is not the asset to hold in a bull market where the focus is on growth and cash flows start to matter less and less.

However, we do see MKR and DAI as tools in a toolbox for a well-diversified portfolio, and we believe that these assets have a role to play as we head into 2024-2025.

The potential role for MKR in a portfolio.

MKR's return profile exhibits a clear divergence from BTC and ETH. MKR outperformed BTC and ETH earlier in the year as it intensified its RWA efforts and benefitted from rising interest rates.However, in Q4, as BTC and ETH surged in anticipation of a more accommodative macroeconomic environment in 2024, including the potential BTC ETF, MKR experienced a decline.

The positioning of MKR highlights its value within a diversified portfolio. It serves as a protective asset, safeguarding against unexpected macroeconomic shifts, particularly excelling in high-interest rate conditions.

When other cryptocurrencies face significant declines, MKR stands out, especially as the focus shifts towards assets thriving in high-yield environments.

Consequently, MKR is a valuable tool for long-term, low-risk investors seeking uncorrelated returns. While it may lag in a bull market, MKR can act as a buffer in the face of potential macroeconomic challenges, such as delayed Federal Reserve interest rate cuts.

The potential role for DAI in a portfolio

Regarding the potential role of DAI in your portfolio, we can be more straightforward.Like most investors, you may have a basket of stablecoins on standby, and we consider DAI to be the most attractive stablecoin for such purposes.

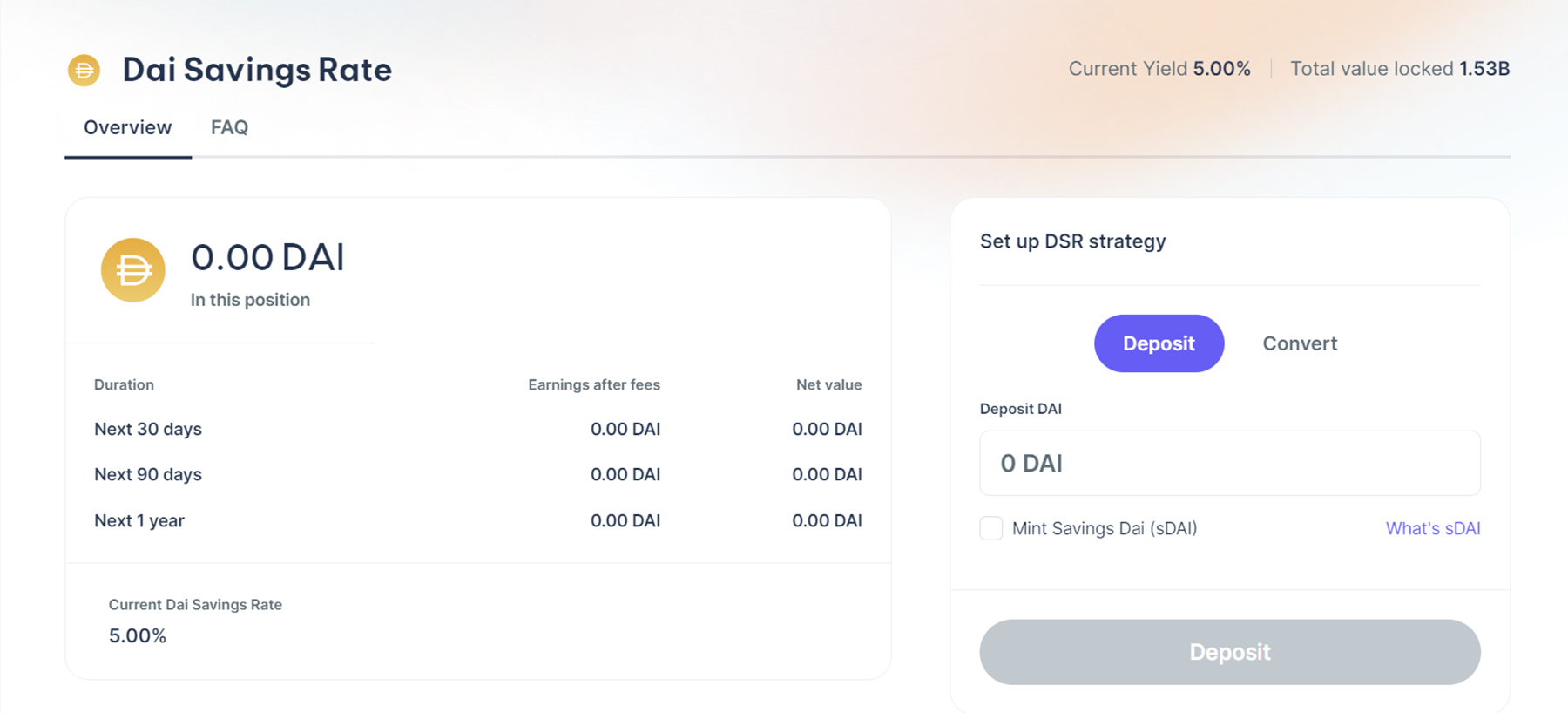

If you choose to park profits or keep capital on the sidelines, DAI currently offers a 5% return to stablecoin holders, along with instant deposits and withdrawals on platforms such as Summer.fi.

While we certainly recommend a diversified approach to stablecoins, considering the smart contract and collateral risks, especially for investors managing higher net worth portfolios where a 5% return can have a significant impact, allocating to DAI appears to be a straightforward choice.

It serves as an excellent option to park profits from a bull market, allowing you to continue generating yield and keep capital on the sidelines. This way, your funds won't remain idle in USDC or USDT, and the risk profile remains comparatively low compared to most other stablecoin yield opportunities.

Another benefit we discovered during our conversations with MakerDAO is the expected issuance of SubDAO governance tokens, many of which will be available for farming by DAI holders.

By positioning yourself in DAI and closely monitoring the launch of SubDAOs in May 2024, you may have the opportunity to farm a diverse array of SubDAO tokens, which could potentially hold value.

Crypotonary’s take

In conclusion, our conversations with MakerDAO have provided valuable insights into the evolving landscape of MKR and DAI within the crypto space.While we maintain that MKR may not be the ideal asset for a bull market focused on growth, it certainly holds its place as a protective asset within a diversified portfolio.

Its ability to thrive in high-interest rate conditions and provide a buffer during challenging macroeconomic situations makes it a valuable tool for long-term, low-risk investors.

On the other hand, DAI emerges as a compelling stablecoin choice, particularly for investors looking to park profits and generate yield while keeping capital readily accessible. With its current 5% return and instant deposit and withdrawal features, DAI stands out among stablecoins as an attractive option.

As MakerDAO continues evolving its roadmap, especially with a potential shift towards private credits and collateralised loan obligations, we'll closely monitor whether these strategies enable MakerDAO to maintain competitive yields even in a lower-rate environment.