Public to private: Exploring crypto’s privacy sector

Imagine a world where every dollar you spend is watched, every transaction scrutinised, and your financial freedom hangs by a thread. Privacy coins offer a lifeline—a powerful tool to reclaim control in an age of relentless surveillance and eroding personal autonomy. Let’s dive in…

In this report:

- Introduction to privacy coins

- Analysis of major privacy projects

- Our top pick in the privacy sector

- Risks and challenges

- Cryptonary’s take

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Invisible money?

So, what are privacy coins? At their core, privacy coins address the fundamental need for more confidentiality in increasingly surveillance societies. While most cryptocurrencies, like Bitcoin or Ethereum, offer pseudonymity, they fall short of true anonymity.Essentially, even though your transactions don't have your name on them, once connected to a centralised broker, people can see everything you have done from the start of time on that address.

Privacy coins close this gap by allowing us to have transactions that conceal who the sender is, who the receiver is, and even transaction amounts. This unique capability gives them a wide range of use cases, spanning from personal use to professional and even societal needs.

For people like us, privacy coins can protect our financial activities, whether they shield personal wealth from the public eye or facilitate donations to potentially sensitive topics. Businesses can use these coins, or rather the chains themselves, which can be useful to secure confidential transactions, like paying your ~employees or even moving funds around from secure locations.

On a larger scale, privacy coins help empower people in an evermore authoritarian world to bypass censorship, ensuring their access to a free financial system.

That being said, this doesn't come without risks; the same features that make privacy coins useful for legitimate privacy can also attract bad actors. Their ability to obscure transactions has led these bad actors to use them to launder money and evade taxes. This dual-edged nature places privacy coins under intense scrutiny under the law, and rightfully so! So, without further ado, let's get into the nitty-gritty of privacy coins, from what projects we like to the risks around their use.

The thesis

So why are we so bullish on the idea of privacy chains? Well, it mostly comes from how unprivate and restricted our lives are now. Financial systems are becoming more transparent, not for the benefit of individuals but for institutions and governments that monitor every transaction.Whether it’s shutting down your bank accounts because of crypto purchases or freezing your accounts because of supporting a cause you believe in, the level of control over our personal finances has reached an all-time high. Privacy coins flip the script, giving power and freedom back to individuals. Let's get into some specific ideas…

In traditional finance (TradFi), access to your money isn’t always 100% guaranteed. At any moment, your bank account could be frozen at the discretion of centralised entities like the government or even the bank officials themselves. Privacy chains fix this by being borderless and censorship-resistant, enabling anyone with an internet connection to transact freely, no matter the government they live under or the causes they support.

Then there’s the issue of living in an evermore surveillance economy. Today, every purchase you make and every transaction you process is logged and easily accessible not only just to you but to banks, corporations, and even governments. Privacy chains change this. By using these tools, you are the only person privy to your financial activities. They keep your actions private, your data secure, and your financial life confidential.

But let’s talk about the real dangers of financial surveillance. It’s not just about companies tracking your spending to serve you ads or governments monitoring large transactions for tax purposes. It’s about the power of such surveillance and how easily it can be abused. For example, imagine a world where your financial activity determines your social standing.

That would be insane, right? However, in certain areas of the world, there are social credit systems. In such systems, “undesirable” spending—like buying alcohol or funding things that go against the government—can lower your score, restricting access to loans, jobs, or even public transportation.

Now, think about how centralised financial control could extend this further. Governments could freeze the accounts of political dissidents, and amazingly enough, that has already happened. During the 2022 protests in Canada, for instance, accounts of the protestors were frozen by the government to attempt to silence them. But this isn't a Canada-specific issue.

In fact, in other countries, activists fighting for fundamental rights have found their access to banking services entirely revoked, leaving them unable to receive donations or fund their causes.

Lastly, there is the looming rise of Central Bank Digital Currencies (CBDCs), which takes this even further. While pitched as technological advancements, CBDCs could enable programmable money, where governments set conditions on how you can spend your hard-earned money. Thinking about this deeper, you could essentially get flagged for buying “unhealthy” foods or spending on “non-essential” items like travel or luxury goods when you are supposed to be capped to meet climate targets.

So, as we can see, the need for privacy chains isn’t just theoretical; even recent history itself shows us how financial systems can become tools of oppression and ways to force the government's agendas. Privacy coins are one of our few defences against this type of overreach, which is becoming more and more common; they are the way to ensure financial freedom in a world that increasingly threatens to take it away.

Overview of the privacy sector

Now that we understand the importance of this technology let's dive into some assets within this category. We'll analyse them and identify a standout contender, as the winner has the potential for significant growth.Zcash

Zcash is a privacy coin that is built on top of a public blockchain. While that seems like it would be counter-intuitive, it can do this by using its core technology called zk-SNARKs. This allows transactions to be validated without revealing the information about them, such as the sender/receiver or the transaction amounts.Another added advantage is that users can disclose their transaction details if they are ever audited or need to provide them for compliance reasons. This makes a strong case for corporations to use this as it keeps everything private but also in a way where, if needed, regulatory standards can be met.

Tokenomics

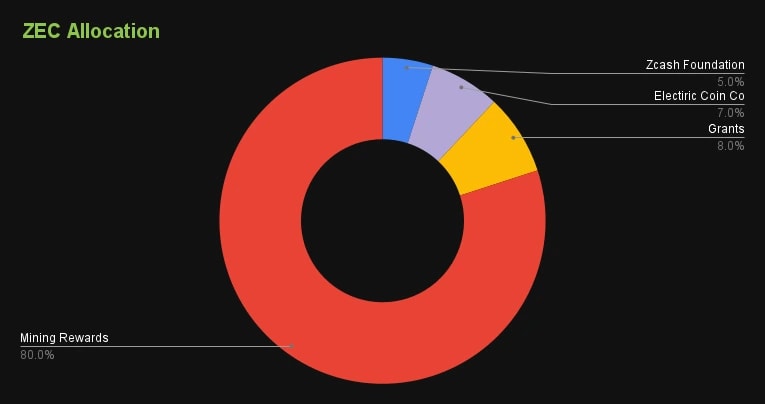

ZCash has the same supply as Bitcoin, with a maximum supply of 21 million tokens. On top of this, as we can see below, most of the supply is given out to miners over time.

Because of how simple their tokenomics are, we really cannot find something bearish on this, which is definitely a good thing as, typically, a lot of coins are held down by a mass amount of supply consistently unlocking. However, with Zcash, this isn't the case!

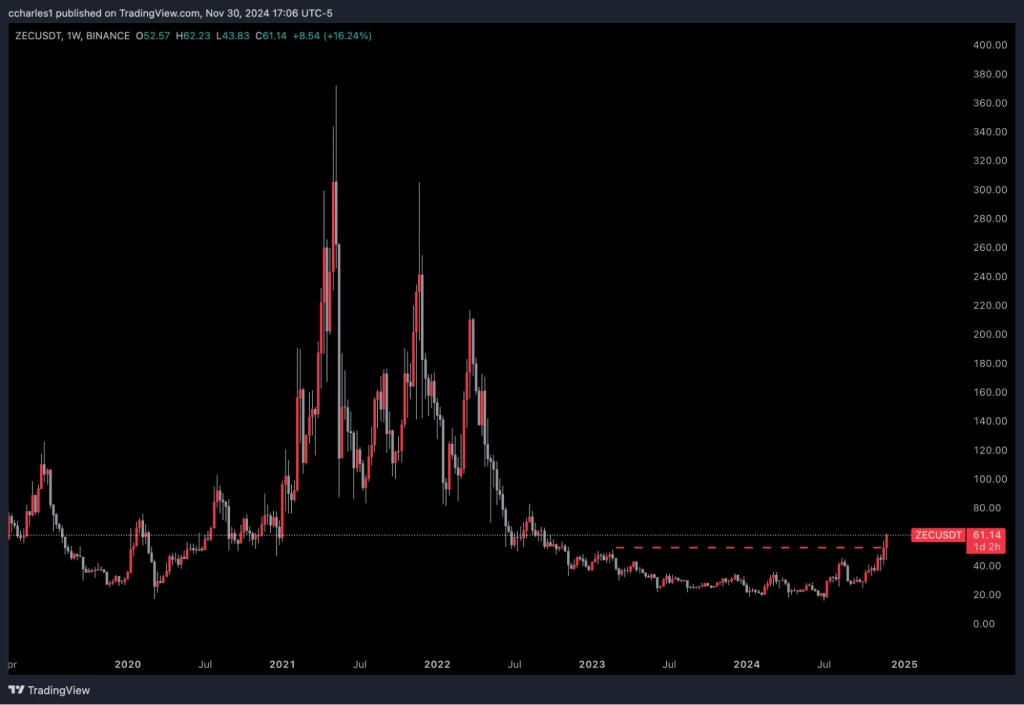

Technical analysis

Regarding the chart, we can see that the price action is bullish, especially this week; it seems to be breaking and closing above its 2023 highs. Because of this, we do expect further upside this cycle to continue for ZCash, likely putting it over $100.

Overall, we think ZCash is a good product with a viable use case; on top of this, the supply isn't a problem. Combine that all with a bullish chart such as this, and we think there is an investment opportunity here, even though this is not our top pick among privacy coins.

Monero

Monero is also a privacy-focused chain where transactions on it are hidden to the point where the sender, the receiver, and the amounts of each are unknown. But the main difference between the two is that on Monero, privacy isn't optional. It is 100% there at all times and cannot be turned off like ZCash.As far as adoption, we can see that the recent delistings of centralised exchanges such as Binance and Kraken make it difficult to say that Monero is growing in popularity. This further shows the issue with adoption and privacy coins because they consistently fall into muddy waters.

Tokenomics

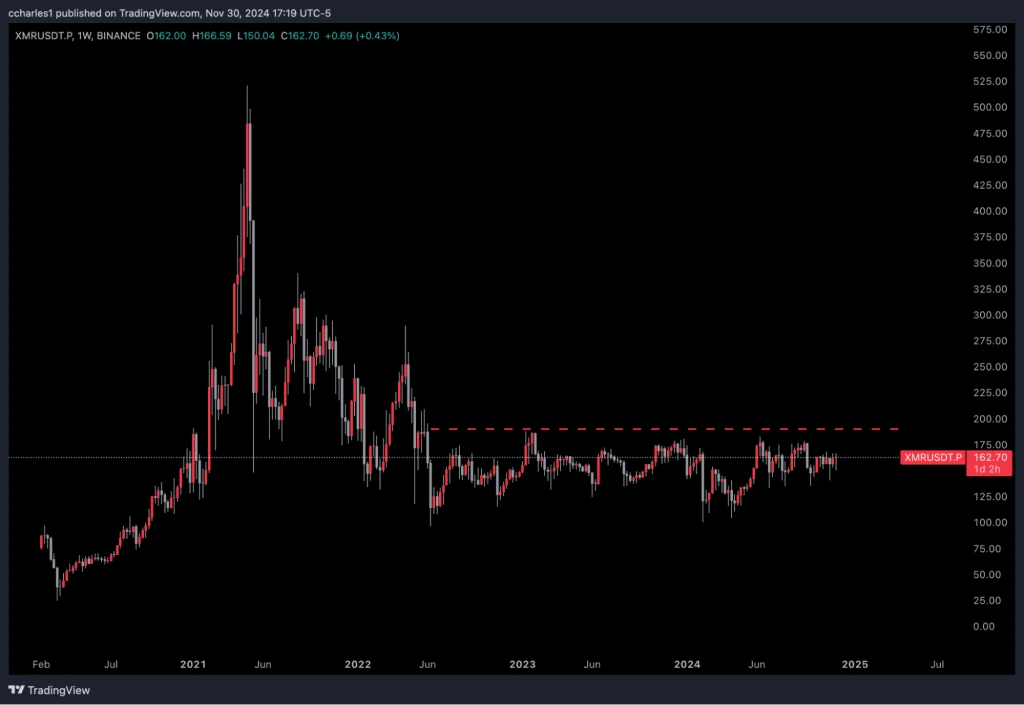

Regarding tokenomics, XMR was an utterly fair launch, meaning it has been 100% decentralised from the start, and all the tokens are available through mining operations. On top of this, there is also a cap of 18 million coins, meaning supply won't be a long-term issue. When it comes to distribution, it is not available to be seen as XMR isn't an EVM chain.Technical analysis

When it comes to the chart, in our opinion, there isn't anything to say the price has been stuck in the range for almost 1000 days and without a break above first, there is likely no position to be taken here.

While Monero is the biggest privacy coin in the space, we think that the regulatory concerns around it, along with the dead chart, do not provide a good layup for an investment. So, for the time being, we wouldn’t take a position in the coin. But keep reading; we will cover our top pick soon…

0x0 AI

0x0 is another privacy-based platform, but instead of being only a privacy chain like the others, it has tools specifically aimed at enhancing user privacy. The first is their AI-powered smart contract analyser. This tool uses advanced algorithms to find risks and vulnerabilities in smart contracts that could lead to scams or exploitation.The second one is their privacy mixer, which allows users to send funds into the mixer, which then essentially mixes a ton of different coins and transactions together and then disperses the funds back out to you in another wallet in an untraceable manner. Their newest tool is their privacy DEX, which is essentially a dex with added security and privacy details like coin mixing and encryption.

Tokenomics

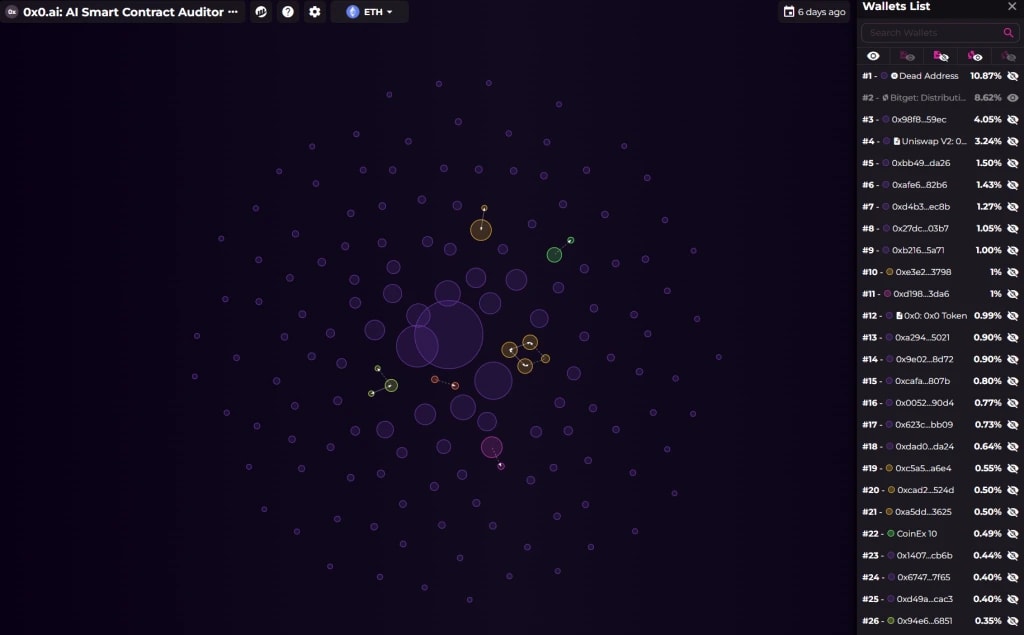

When 0x0 was launched, it was launched fairly, with 1 billion tokens in circulation and 2ETH in liquidity. There were no tokens reserved for the team; however, there is a 5% sales tax on each transaction, wherein 1% is used for buybacks, 2% to the team, and the final 2% for marketing.The distribution is quite alright as well. With the biggest “holder” being burned tokens and the second being an exchange, it seems that there has been quite a fair distribution since launch.

Technical analysis

Now, let’s look at the chart. As we can see on the daily chart 0x0 has clearly broke market structure to the upside and could now possibly try for a new all-time high this year as long as the breakout holds. Overall, 0x0 is shipping out some really cool and useful tools. On top of the tokenomics, distribution and the chart, all look quite constructive. Therefore, we think 0x0 is a very good bet if you want to capitalise on the privacy narrative as long as we maintain this high timeframe uptrend. Now, let's finally cover our top pick...

Overall, 0x0 is shipping out some really cool and useful tools. On top of the tokenomics, distribution and the chart, all look quite constructive. Therefore, we think 0x0 is a very good bet if you want to capitalise on the privacy narrative as long as we maintain this high timeframe uptrend. Now, let's finally cover our top pick...

Our top pick: Tornado Cash

Tornado Cash is a cryptocurrency mixer built on top of the ETH blockchain. What a mixer does is once you send your crypto tokens through it, it mixes your tokens with other people's tokens with a delay so that when you receive the tokens at the address you sent them to, it is untraceable in connection to your original address.While the concept of mixing isn't new, this product itself is quite interesting because it is built on top of ETH, so it can easily secure a lot of users. In other news, it was recently ruled in court that the U.S. treasury had no right to sanction Tornado Cash’s smart contracts. This was because it was deduced that the code is self-running and is not considered a “property” that the government could sanction.

This is a huge win for the privacy sector and smart contracts overall! This is a big reason why a lot of privacy coins have started repricing upwards. Through this ruling, it is now seen that the bad actors will be punished, not the protocols or the tech.

Tokenomics

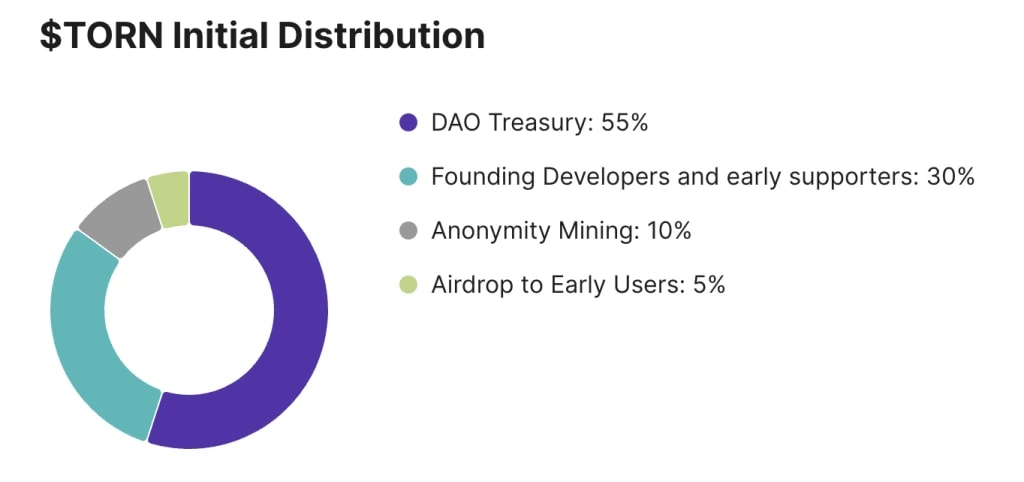

As we can see through the tokenomics, the initial distribution of $TORN was quite abysmal. With 30% going to the insiders and 55% in the treasury a lot of the supply was definitely able to be considered overhanging. Typically, with skews like this, we oftentimes see price having a hard time moving as the parties who hold this supply constantly dump the coin.

When we look at the distribution today, we see something quite interesting: about 70% of the circulating tokens are held in Tornado Cash governance contracts. These are staking and governance contracts, meaning that users and holders deposit the tokens they own into the contract to vote or potentially receive staking rewards.

While this makes it hard to now know the exact distribution of supply, we do think it is bullish that most of the supply is going towards helping sustain and grow the project itself.

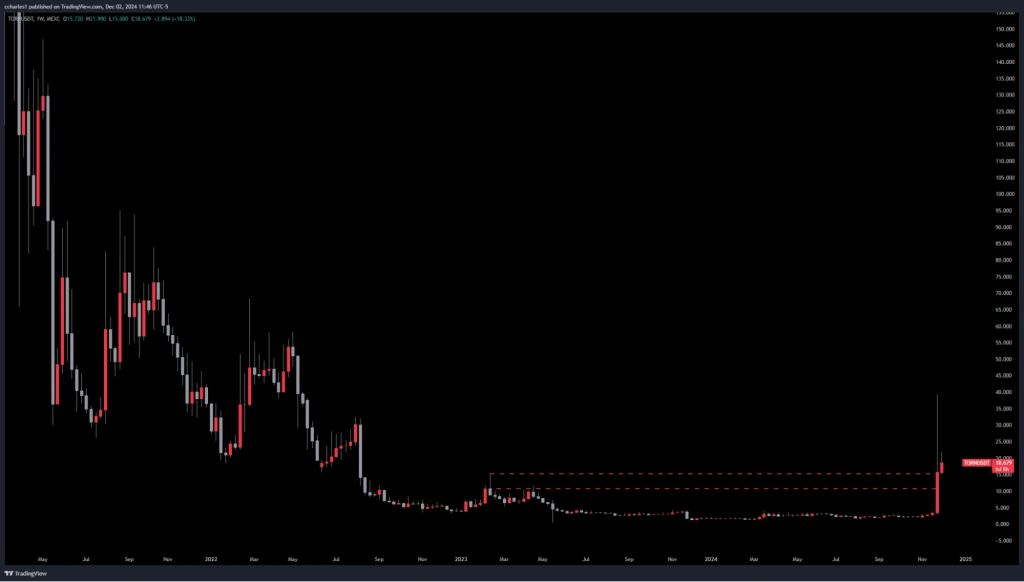

Technical analysis

Looking at the weekly chart, it is hard not to be bullish on this token. With it sticking the weekly close over the highest close of 2023, we can officially call it a break of the trend. And this price pump isn't for no reason, either. The change court ruling also provides a massively bullish legal headwind as well. All this, combined with over 800 days of range being broken out of all, sets up for a strong move in the future.

So, what do we think of $TORN from an investment standpoint? We think that out of all the coins on this list, this is the asset we are most bullish on for the time being. With the ruling changing and the un-sanctioning of Tornado Cash contracts, the use of the tool will pick up, and since it is on ETH itself, it should be able to amass a fair amount of privacy-focused volume.

On top of the supply, it seems to be in good hands, and the chart is bullish. With all this in mind, we do indeed think that this coin is a good investment.

Risks: Regulatory uncertainty & delisting

While the recent court ruling freeing the Tornado Cash smart contracts is a massive win for the privacy space overall, there still are some issues with regulations, especially when it comes to exchanges. Due to regulation issues a lot of exchanges chose not to list privacy tokens, and some have even begun to delist privacy tokens they have previously listed, which we think is bearish when it comes to long-term token price and adoption.Risks: Competition

Another risk is competition. While competition is common in the Dapp world, there is a unique case here. The case arises especially regarding privacy chains themselves. We think that with the legality now of privacy tools on top of Ethereum, it will be significantly harder for privacy-based chains to grow in adoption. This is because ETH is already the biggest tech-focused chain in crypto and has already passed regulations and is also an official ETF.With this in mind, there isn't regulatory concern regarding the chain itself, which puts most users at ease with storing their wealth on the chain VS the unregulated privacy chains. Because of all this, we think that ETH will continue to grow in terms of “privacy volume” and will eclipse the other chains quite quickly with the tooling being built.

This is bearish long term for the privacy chains, in our opinion, and we also think it could be bearish long term for the coins associated with them. However, this is bullish for privacy apps.

Cryptonary's take

Overall, we believe privacy chains play a crucial role in addressing the massive gap in today’s overly transparent financial systems. Unlike regular chains that risk exposing your entire transaction history when linked to your identity, privacy chains like Zcash and Monero keep transactions private. This makes them invaluable for protecting personal finances, enabling freedom of support, and helping businesses secure confidential transactions.However, with the recent unbanning of Tornado Cash’s contracts, our perspective has shifted from being bullish on privacy chains to being bullish toward the broader privacy concept and the tools that enable it.

In short, we do think privacy chains will have their niche users, but we firmly believe that privacy tools/dapps like Tornado Cash represent the future and are the best play to bet on privacy narrative. As the world becomes increasingly less private, the demand for privacy solutions will only grow, solidifying their place as a cornerstone of financial freedom in the 20th century. That's all for us.

Cryptonary, OUT!