PumpFun’s demise: Clearing the froth for cult memes’ comeback

Over the past year, PumpFun's meteoric rise turned memecoin mania into a Wild West gold rush until the saloon burned down. From minting millions in fees to crashing under scams and rug pulls, could its fall be the reset memes desperately need? Let's find out…

Disclaimer: This is not financial or investment advice. You are responsible for your own capital decisions.

The rise and fall of PumpFun

Let's set the stage. Pumpfun was the undisputed champ of Solana's meme coin boom, a token factory that churned out over 8.1 million coins over its lifetime, raking in a jaw-dropping $500 million in fees.At its peak, PumpFun's daily revenue hit $15.4 million, and its trading volume soared to $3 billion, fueled by a frenzy of retail speculators and a platform design that made launching a token as easy as posting a selfie. It was the Wild West of crypto, and PumpFun was the saloon where every gambler wanted a seat.

For the uninitiated, PumpFun is a decentralised token launch platform built on the Solana blockchain, designed to democratise the creation and trading of meme coins. Think of it as a turbocharged meme factory where anyone with an idea, a catchy name, and a few bucks in SOL could mint their own token in minutes, with no coding skills required.

The platform's core innovation was its "bonding curve" model, a mechanism that automatically sets the price of a newly launched token based on its supply and demand. Here's how it works: when a token is created, its price starts low, but as more people buy in, the price rises along a predetermined curve, incentivising early adopters to jump in and creating a self-reinforcing hype cycle.

With its slick bonding curve and a 1% cut on every trade, it sat comfortably among the top 10 fee-generating protocols for a long time, pulling in a million a day while users gambled on tokens with lifespans shorter than a TikTok trend.

But fast forward today, that crown's slipped off-Pumpfun is out of the top 10. What happened? The memecoin market imploded, and Pumpfun took the hardest hit.

The meme coin implosion

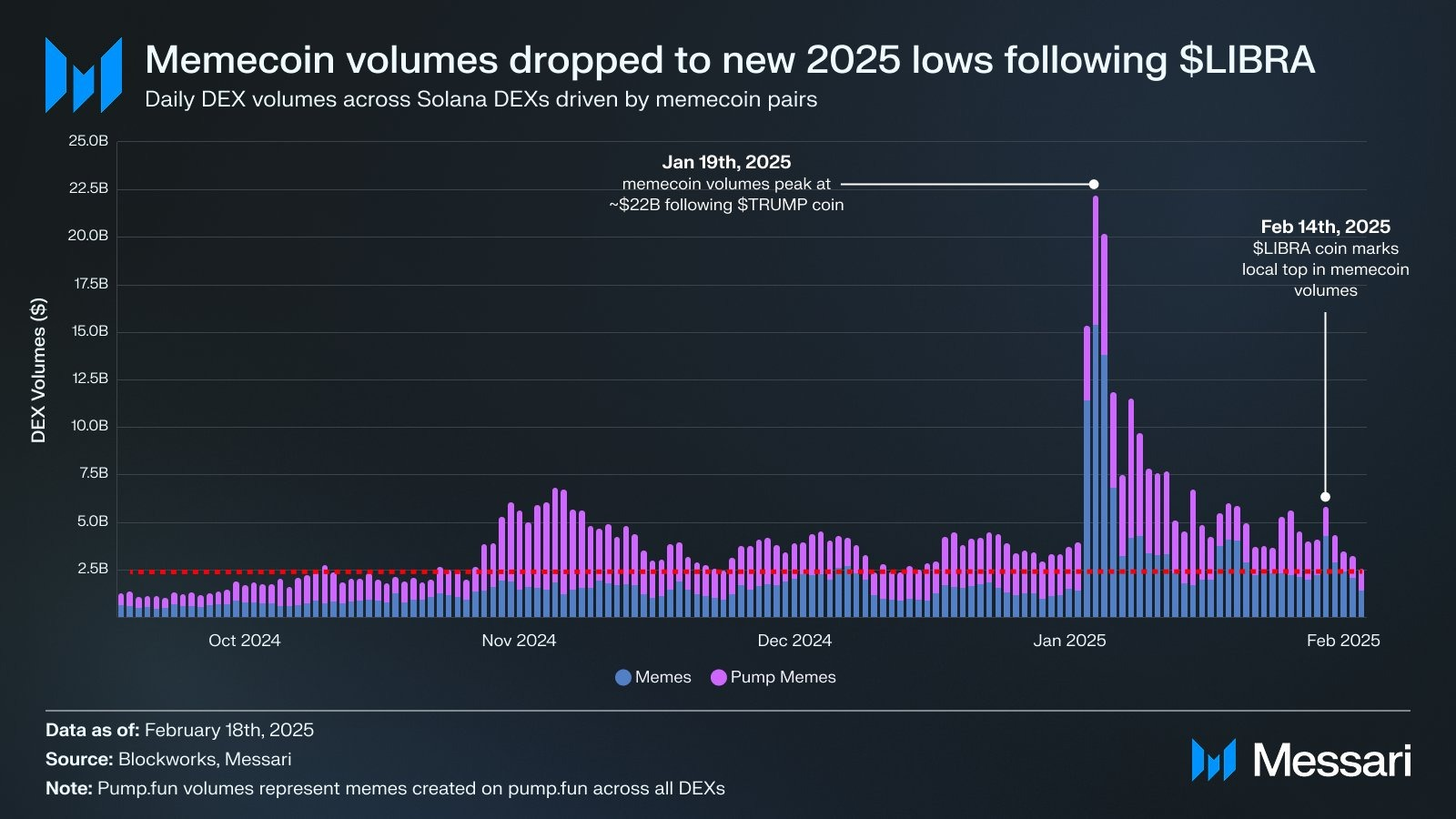

The cracks in PumpFun's dominance emerged through a series of high-profile disasters, starting with Donald Trump's Official Trump (TRUMP) token, launched January 18, 2025, which soared to a $14.5 billion market cap before crashing 76% as insiders cashed out, followed by Melania Trump's Solana-based memecoin the next day, now down over 90%, and the Central African Republic's president-endorsed token, which also spiked and cratered, joining the pile of exploited projects.However, the biggest blow came with Argentina's Javier Milei-backed Libra (LIBRA) token, which hit a $4.4 billion market cap before plummeting 94% in hours as insiders pulled $107 million in liquidity, sparking public outrage, impeachment calls for Milei, a tanking Argentine stock market.

Blockchain analysts at BubbleMaps tied wallets to both the MELANIA and LIBRA rugs, with team lead Hayden Davis admitting on Coffeezilla's stream to sniping MELANIA, calling it "a plan gone miserably wrong." However, the public labelled it a blatant rug pull.

These high-profile failures weren't just isolated incidents-they exposed a deeper, systemic rot within meme coins and PumpFun's ecosystem. Each crash revealed a pattern of exploitation, insider manipulation, and a platform design that seemed to enable bad actors while punishing retail investors. As the dust settled, things became clearer:

- Bad actors snip the supply early and manipulate the market

- Only 4 tokens from PumpFun ever reached a $100m market cap

- Over $500m extracted in fees from the market

- Weird livestreams: Animal cruelty, self-harm, suicide threats.

- Pump, predominantly, became the playground for scams and rug pulls

But beyond the high-profile scams, PumpFun's downfall was also a story of technical flaws in its design. At the heart of its model was the bonding curve, a mathematical formula that dictated a token's price based on its supply-essentially, the more tokens bought, the higher the price climbed along a predefined curve.

In PumpFun's case, the curve started with a low entry price to entice early buyers, but this design inherently favoured "snipers"-bots or insiders who could buy large quantities of tokens at the lowest possible price, often within seconds of a token's launch.

These early snipers could then sell at a profit as retail investors piled in, driving the price up the curve. This created a predictable pattern: a sharp initial pump followed by a dump once the snipers cashed out, often before the token even graduated to a DEX.

Retail got tired of being extracted, and the broader market switched from risk-on to risk-off. As a result, the platform's daily launches, once 10,000+, slowed as liquidity dried up and trust in the memecoin sector evaporated.

Add in the reputational damage from high-profile rugs and the bizarre livestreams-suicides, humans in dog cages and all-and users bolted. Memecoin mindshare tanked, and Pumpfun, once a fee-generating titan, is slowly dying out.

Some speculate that the platform's staggering $500 million in fee revenue- which is $15.4 million daily- wasn't just sitting idle. Following a common business playbook, where companies often reinvest 20%-30% of revenue into marketing, it's plausible that PumpFun funnelled millions into partnerships with key opinion leaders (KOLs) to inflate the memecoin narrative artificially.

These influencers, armed with massive followings on platforms like X, could have been paid to push narratives, driving retail FOMO. Ultimately, PumpFun could have benefited from increased interest in meme coins, generating more fees and revenue from people gambling on their platform.

There is no hard evidence for this, and it remains speculation and guesswork. However, one thing is clear: trust has evaporated, and the reputation of PumpFun has been damaged, and now it is slowly dying out.

Cryptonary's take: The silver lining

But here's the silver lining in this drama: PumpFun's demise is sort of good for memes, and it's setting the stage for something better. As we said, this isn't the end of meme coins, just the garbage ones, overnight hypes churned out by PumpFun and high-profile grifters looking to extract millions from retail bagholders.

True cult coins, the OGs like DOGE, SHIB, and PEPE, are still standing tall, unfazed by the carnage. But for the real deal, the fair and funny memes, this is a healthy reset.

We need to remember that memes are inherently valuable and remain the purest dopamine hit as well as a part of internet culture. They are the cultural glue of the online world, evolving from animal pics to brands, movements, and entertainment.

However, PumpFun's model encouraged low-quality, exploitative projects that undermined the sector's legitimacy, as seen in the rug pulls and market crashes. Therefore, PumpFun's fall is clearing the trash, and is good for memecoins coming back when the broader market environment improves.

When the risk-on environment comes roaring back, the meme narrative will rise from the ashes, fueled by organic hype, genuine communities, and a renewed trust in their chaotic, joyful power. Why?

- There is still room for new multi-cycle cults to form and break the $3b-$5b ceiling when the time is right

- People still want to catch the next 100x, and memes are the purest speculative tool for that

- Flight to quality is coming as the market learnt not to ape the next celeb or president coin

- DOGE ETF in 2025 approval odds is 70%

- Memes are fun and proven to work. See DOGE, PEPE, SHIBA, WIF, etc

Piece!

Cryptonary, OUT!