Despite recent setbacks, there are signs that this profitable gambling juggernaut still has some tricks up its sleeve.

Rollbit may be down, but don't count it out just yet.

In today’s deep dive, we provide an insider look at Rollbit's plans to restart its hot streak.

With the right moves, the casino could bring back big wins for RLB holders.

The state of Rollbit

As you may recall from our October 2023 report, Rollbit is a gaming and gambling platform with three distinct product lines: a casino, a sportsbook, and a futures trading platform.Each category generates revenue for Rollbit and contributes to the buy-back and burn program.

Yesterday, our team sat down with the community to discuss the latest developments in Rollbit and what they mean for the project from technical and fundamental perspectives.

You can watch the session recording here.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Rollbit by the numbers

Let's look at the numbers for these categories to understand Rollbit's current standing - numbers don’t lie.Casino revenue is still the bread and butter of the business, generating an impressive $47M in revenue over the last 30 days. Of this, 10% is contributed to buybacks and burns.

However, crypto futures revenue has overtaken sports book revenue, with $8.6M compared to $6.2M for sports betting. Crypto futures contribute 30% to buybacks and burns, while sports betting contributes 20% of revenue to buying back and burning RLB.

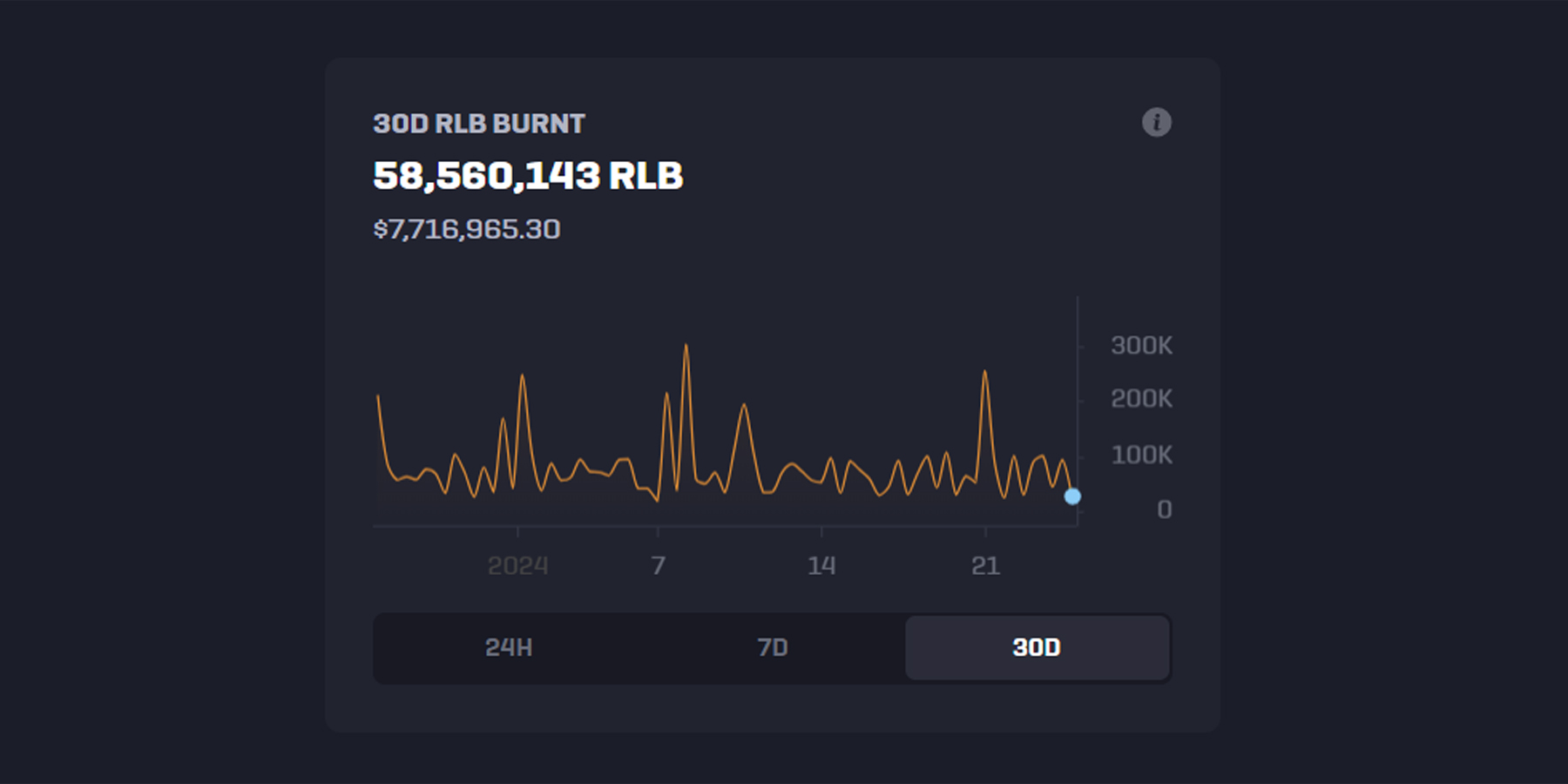

With these figures, Rollbit has burned 58,560,143 RLB in the last 30 days, valued at $7,716,965.30.

To put this into perspective, GMX, the perpetual exchange that generates the most revenue, earned $4.11 million in fees over the last 30 days. So, the amount Rollbit burned is much more than GMX earned.

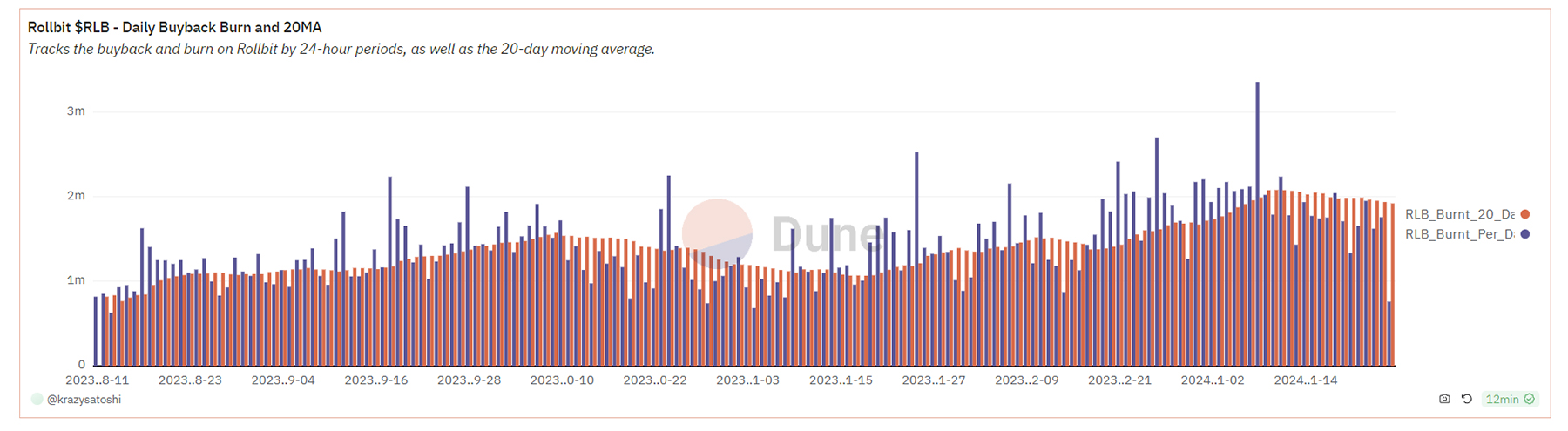

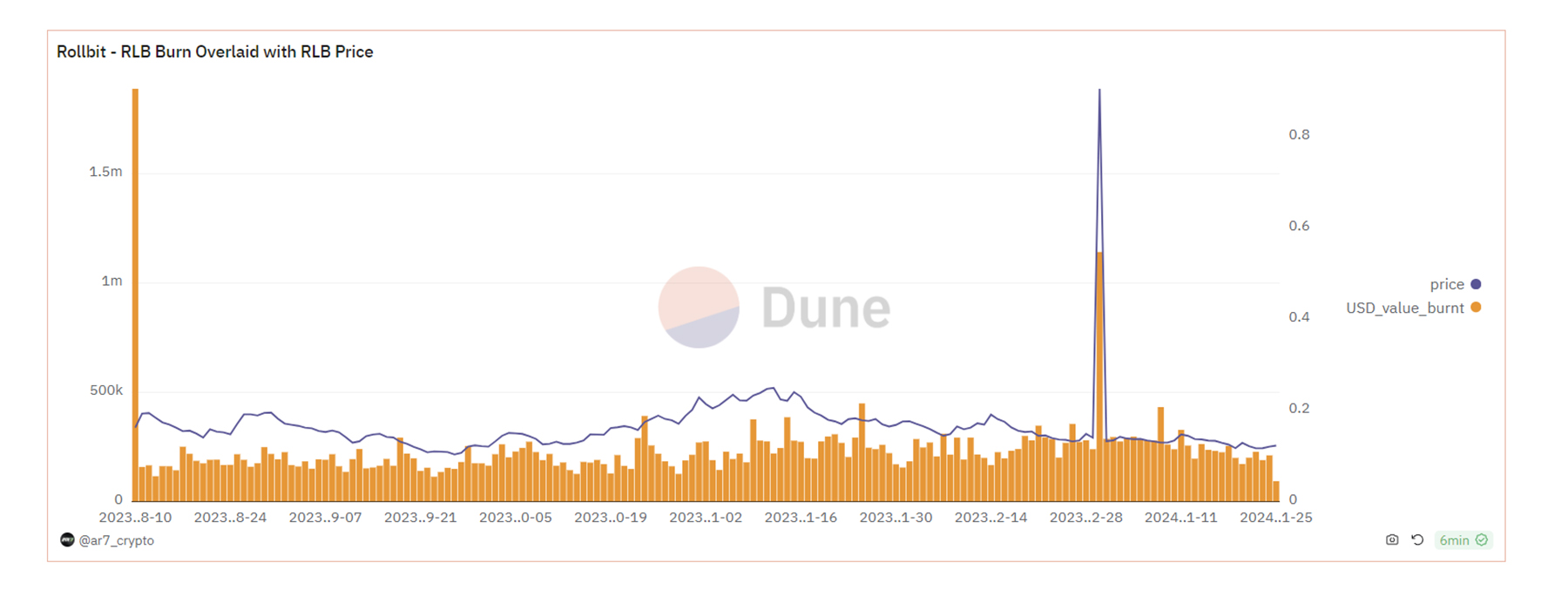

But how does this monthly figure compare to the historical data of Rollbit's buy-back and burn program since its launch?

We observe a rising trend if we examine the 20-day moving average of RLB being burned.

However, this trend of more RLB being burned is primarily due to decreased RLB value. In terms of the dollar amount being burned, it has remained very stable, not decreasing but mostly staying flat since November. It has hovered between $150K burned on a slow day and $400K on a good day.

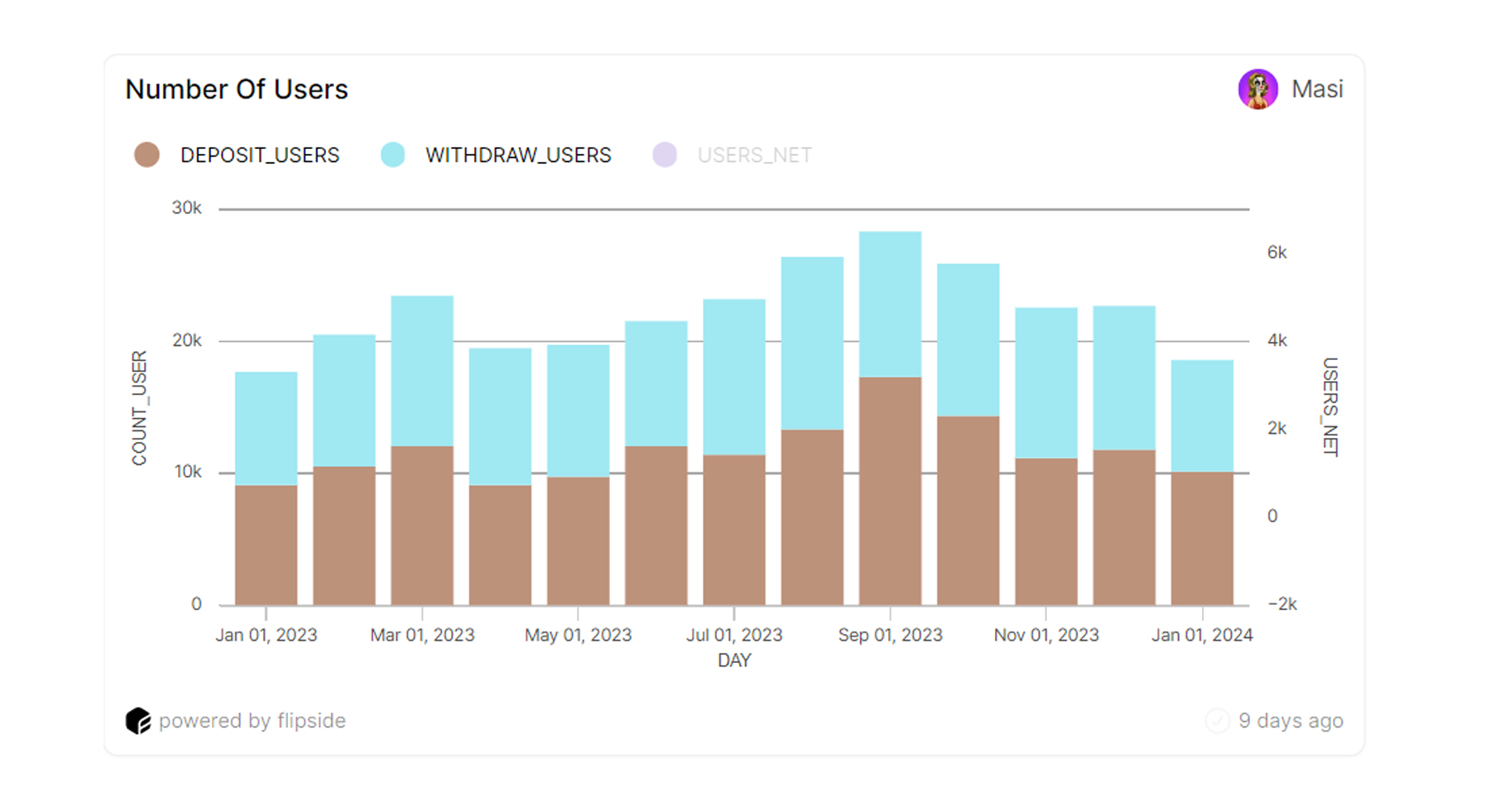

If we look at the number of users measured by those depositing into Rollbit from Ethereum or withdrawing from Rollbit, we see a bit of a slump. The amount of users depositing peaked in September at around 17K and now sits at around 10K.

These are obviously not the best metrics, as many users already have funds on Rollbit, and it does not measure deposit amounts. However, it does indicate that in terms of user acquisition, there has been a slowdown.

So, how does Rollbit plan to increase these numbers further and acquire new users after a few months of slowdown?

Let's examine some initiatives they have launched since our last report.

Evaluating Rollbit's latest initiatives

Rollbit has launched two major initiatives in the past few months: the Duel Arena game and a significant partnership with an esports team.We believe that one of these was a wise investment. The other? Not so much.

Can you guess which is the wise investment? Let's dive into it.

Rollbit's Duel Arena

Rollbit unveiled its first major release in November - a new PvP game called Duel Arena inspired by Runescape.

- Players battle in gladiator-style duels based on luck, with each player having a 50% chance to win.

- Rollbit takes 0% commission on wins/losses, ensuring a 0% house edge and fair gameplay.

- Initially, Duel Arena was expected to contribute to buybacks and burns. However, Rollbit made commissions of 0% to acquire users.

Our assessment of Duel Arena

Without internal data, it's hard to evaluate Duel Arena’s impact precisely.But it has likely not significantly contributed to Rollbit's growth since launching.

Resources may have been better spent improving the sportsbook and crypto futures products.

Overall, we think Duel Arena was a misallocation of time and effort.

FaZe Clan partners with Rollbit

This month, Rollbit announced a landmark sponsorship deal with FaZe Clan, one of the most prominent esports organisations.The deal focuses on sponsoring FaZe's Counter-Strike team, currently #1 ranked globally, and is one of the largest deals in Counter-Strike and esports history, according to FaZe.

This deal aligns well with Rollbit's global growth strategy beyond the US market.

Partnering with an influential brand like FaZe Clan allows Rollbit to tap into a massive new demographic in the lucrative esports vertical.

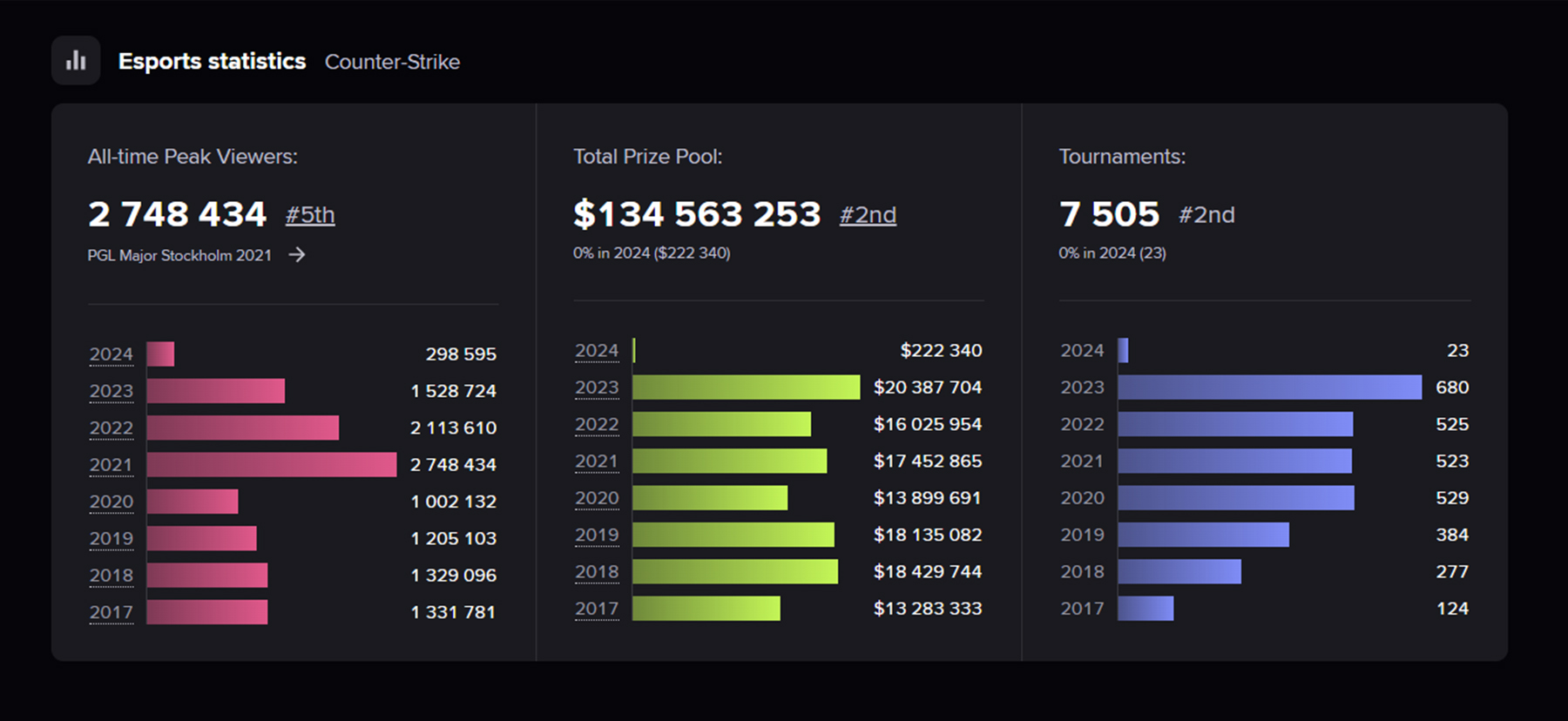

CS:GO games receive millions of views, ranking as the fifth largest game in esports. FaZe Clan itself has a total social media reach of more than 509M that Rollbit can leverage.

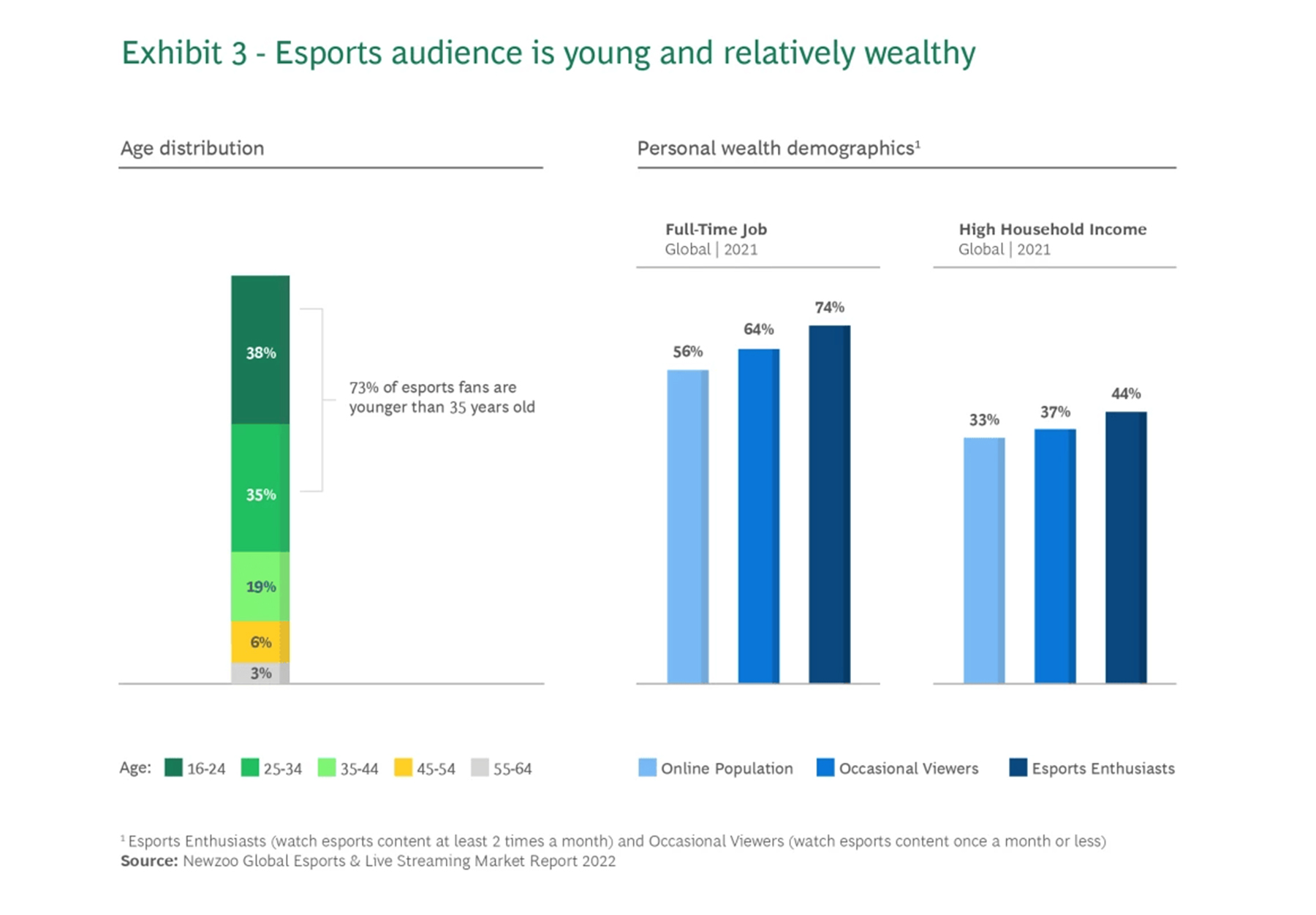

Another point making this a great partnership is that the esports audience overlaps well with the crypto and gambling audience.

According to a BCG report, 73% of esports fans are under 35 years old and, on average, more wealthy than the general population, with many having full-time jobs and high household incomes.

While we don't have data yet on the impact of this recent partnership, we anticipate that, if well-executed by FaZe, it could significantly drive new players to Rollbit.

This deal has clear potential to substantially boost Rollbit's brand awareness and user acquisition, which is needed given the apparent slowdown in its user growth.

Factors behind RLB's recent underperformance

RLB has declined 53.8% from its all-time high on November 11, 2023, despite the overall market rallying in that period.At the current price of $0.1224, RLB's valuation stands at $363 million.

This concerning underperformance has raised some questions, but our research hasn't identified any immediate issues with Rollbit's operations as the cause.

We did find three likely reasons the market has moved away from RLB since November:

1. Buybacks provided liquidity for early investors to exit

Rollbit's buyback program, while beneficial in the long term, gave whales liquidity to cash out substantial gains.With RLB up over 850% in 2023, many early investors were massively profitable. By buying their tokens, Rollbit enabled them to exit, creating unexpected selling pressure.

2. Market shifted focus from profits to growth potential

Investors valued profitability in late 2022 and early 2023 as markets looked bearish.Rollbit, generating huge revenues, was rewarded. But as macro conditions improved, attention shifted to high-growth plays like layer 1s and meme coins.

Despite strong cash flows, Rollbit’s growth prospects were viewed as more limited.

3. Reduced social media presence from the team

Historically silent during development, reduced founder social media activity since November signalled a vacuum of newsflow.This likely contributed to the negative sentiment around the underwhelming Duel Arena launch.

The good news is that Rollbit's founders have re-engaged on social media in 2024.

Implementing new tokenomics

With all these factors currently impacting RLB, what measures is Rollbit taking to reverse this trend and enhance RLB's performance?Fortunately, we have some good news: serious considerations are underway for changes to improve the RLB token.

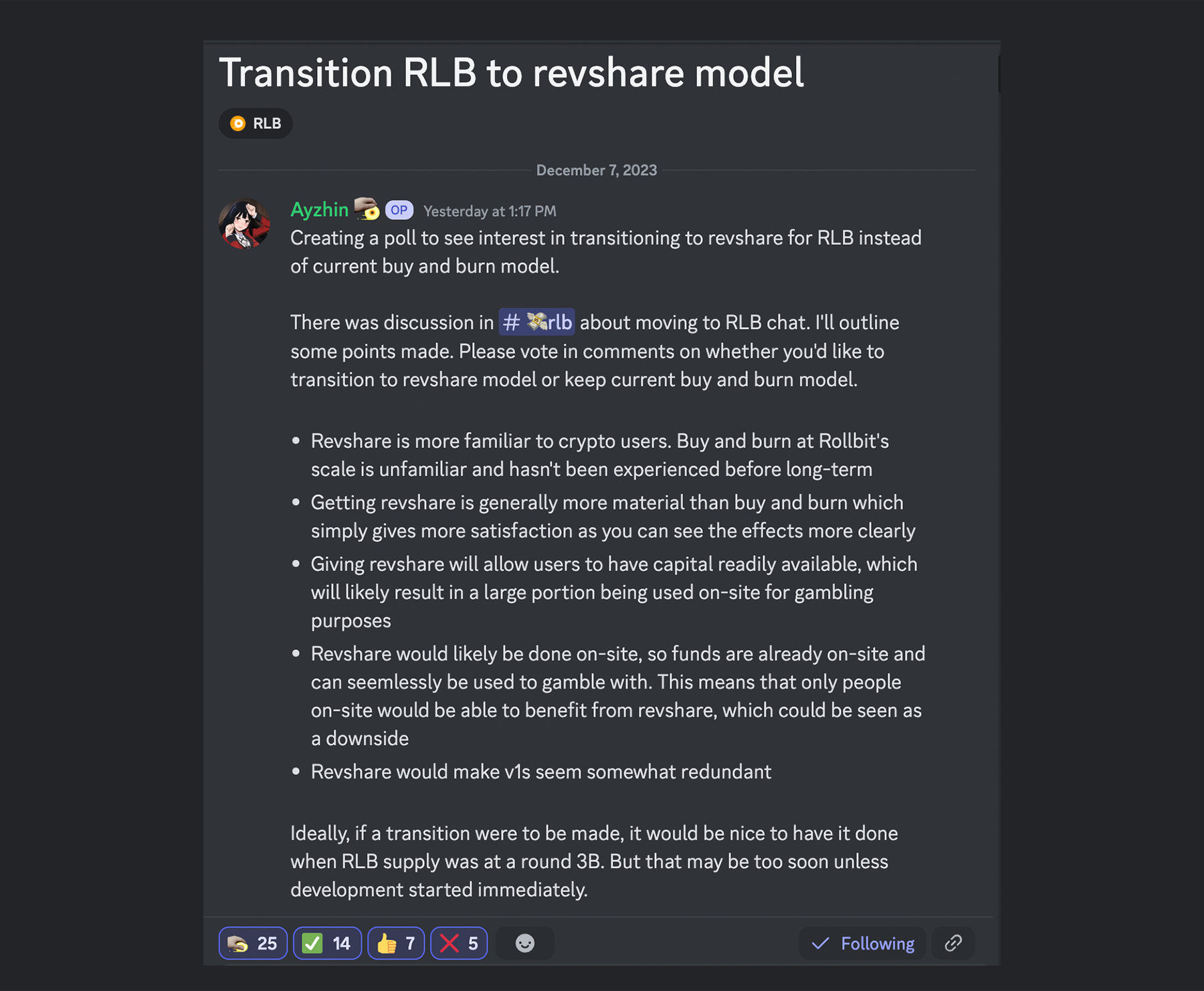

On December 7, a discussion was started in the Rollbit Discord to transition RLB from a buyback and burn model to a revenue-sharing model.

While no official decision has been made yet by the team, this would represent a major change for Rollbit.

With revenue sharing, RLB holders could stake their tokens to receive passive income from Rollbit's revenues instead of removing supply from circulation like the current burns.

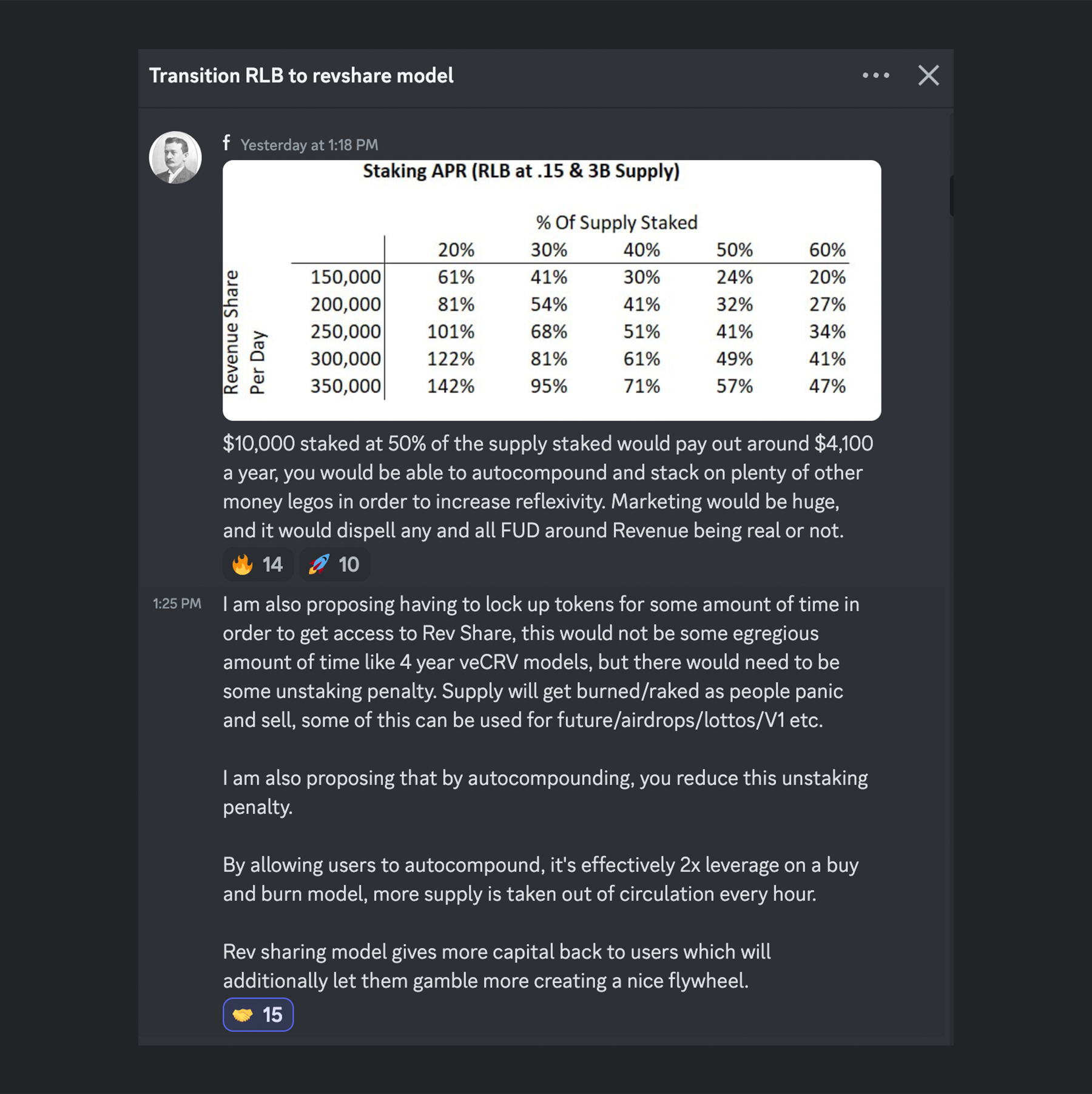

For example, at 50% of the supply staked, holders would earn around $4,100 per 10,000 RLB staked annually.

This recurring yield could cause a rebound in RLB's price as holders are incentivised to buy and stake.

There is also potential to use autocompounding to increase gains.

The marketing aspect of this change would be huge as it proves Rollbit's revenue is real as it lands in users' pockets.

While still under consideration, a rev share model would align incentives between Rollbit and RLB holders - driving growth for both.

The discussions demonstrate that Rollbit is actively exploring options to reinvent RLB's utility for 2024 and beyond.

Aside from revenue sharing, some other major developments for Rollbit could help the token regain the spotlight in 2024.

Rollbit's strategy for rebounding in 2024

In our view, two significant developments for Rollbit in 2024 are its shift to mobile and the launch of its in-house sportsbook, which we believe could help put RLB back on the map.Launching a mobile app

After the big FaZe announcement, there was more positive news from Rollbit.They teased an image confirming rumours that the team is working on a mobile app, which could be a significant development for Rollbit in 2024 to increase usage.

With the increasing penetration of smartphones and access to high-speed internet, mobile gambling is poised to dominate the market in 2023.

According to Gitnux, 58% of all online gambling activity occurs on mobile devices, presenting a significant market opportunity for Rollbit to tap into.

While there is no specific date for the launch of a mobile app, this development would be a significant step for Rollbit.

We eagerly anticipate the launch, which will enable the project to tap into most of the online gambling market.

Creating an in-house sportsbook

One area where Rollbit has struggled to keep pace with competitors over the past year is in its sportsbook offering.Rollbit uses an external sportsbook provider, Betby, which is common among many crypto casinos.

However, this prevents Rollbit from offering the most competitive betting lines and limits its edge in sports betting.

There have been hints that Rollbit is looking to upgrade its sportsbook, potentially moving to an in-house solution, according to comments from a moderator on Rollbit's Discord.

While not yet officially confirmed, launching a proprietary sportsbook would be a major development for Rollbit in 2024. An upgraded, in-house sportsbook could finally allow Rollbit to take full advantage of the massive sports betting market and drive more revenue growth.

Overall, Rollbit's sportsbook remains an area lagging behind its competitors due to the lack of competitiveness. If Rollbit delivers a robust sportsbook upgrade, it will transform its ability to compete in this lucrative sector.

We'll monitor for official announcements, as a revamped sportsbook product could significantly strengthen Rollbit's market position.

Cryptonary’s take

Rollbit has faced some challenges over the past few months, with RLB declining over 50% from its all-time high in November despite the overall market rallying. This price action was more severe than anticipated.The shift in market focus away from profitable projects like Rollbit towards higher growth opportunities in late 2023 played a role. Rollbit did not deliver any major developments or catalysts during this period to drive substantial new user growth.

However, our research indicates that Rollbit remains a strong long-term investment based on its fundamentals.

Revenue generation has stayed robust, with over $60M generated last month.

The Rollbit team is making the right moves, like exploring a transition to revenue sharing and launching a mobile app this year.

These catalysts could enable RLB to rebound and start performing well again. We maintain conviction in our price targets from our report in October, which is $1.13 long-term.

However, we recognise that Rollbit may follow a slower growth trajectory than other speculative, high-growth crypto startups.

As a profitable cash cow business, Rollbit is unlikely to deliver explosive short-term gains.

However, the project has staying power and retains significant upside from current levels.

Once market attention returns to fundamentals, we expect RLB will be repriced higher.

Cryptonary OUT!