This is the value that the Real World Assets (RWAs) sector provides.

RWAs have struggled to attract users and capital in the last few years. However, the narrative has resurged in the past few weeks, and you can't spend an hour on crypto Twitter without seeing hashtags around it.

Trending narratives indicate momentum, but should you jump in and chase this RWA narrative?

Let's find out!

TLDR

- Real World Assets (RWAs) are the on-chain representation of physical assets, enabling decentralised management of traditional non-digital assets.

- The RWA market has seen a recent uptick in user activity, signalling potential growth ahead despite past stagnation.

- The investment management giant BlackRock has entered the RWA space with its new blockchain arm, BUIDL.

- Fully decentralised RWA protocols face an uphill battle against BlackRock's scale and resources.

- Projects that offer RWA products along with other services or infrastructural support for other RWA projects may be better positioned. We highlight two plays for you.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

What are RWAs?

Most of the global wealth—your car, house, debt, artwork, or stocks—exists off-chain. The world's total net worth is around a staggering $430 trillion. That's a number so incomprehensible that it's pointless trying to explain it (roughly 20 years of all measurable value that the U.S. produces in a given year).RWAs are the on-chain representation of offline assets to bridge the gap between physical and digital assets. With RWAs, we can enable the on-chain management of any asset, from gold to intellectual property.

Blockchain technology enables the decentralised management of natively digital assets like crypto; RWAs help extend that decentralisation to traditional non-digital assets.

While the tokenisation of RWAs is a relatively new frontier in DeFi, there are signs that the sector is attracting renewed interest.

The current state of RWAs

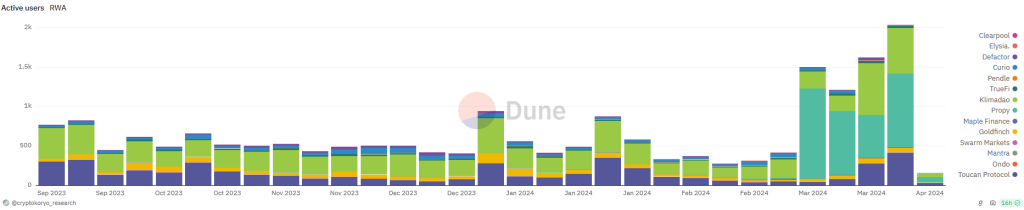

Apart from a couple of outliers like Maple Finance, the market for real-world assets stagnated throughout 2023 as the market was in the depths of despair (literally). Users, TVL, token price—you name it, RWAs weren't performing. But recently, that has changed.

As you can see from the above chart, active users began to spike across most RWA products in March, and we would assume this trend will continue throughout April. Although not a significant number of users in the grand scheme of things (just over 2000), this represents a "trigger" for us to take a deeper look into the sector in anticipation of further growth.

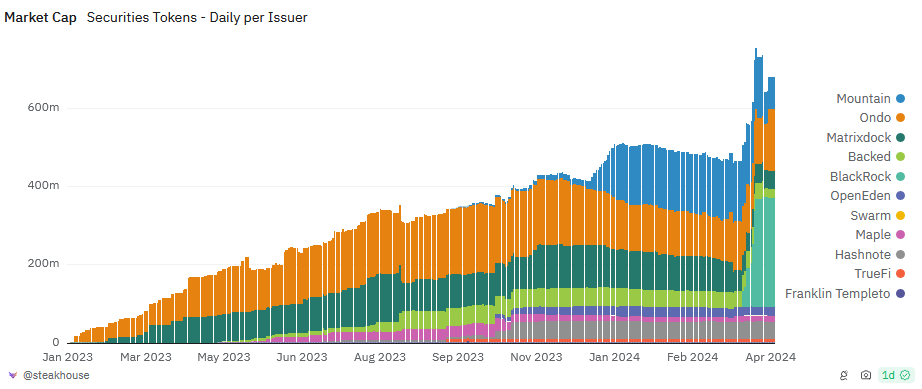

The market has grown rapidly but not significantly in terms of overall securities TVL (tokenised stocks, etc.). This is important because we're potentially seeing the snowflakes begin to snowball - i.e., we're still early.

The market had very few contenders previously. In the chart above, you can see that as of this time last year, there were really only two major players in the tokenised securities sector (Matrixdock and Ondo). Now, it appears that newcomers have mostly supplanted them, but that's by the way.

This is off-topic, but it is a prime example of why you should never buy and hold things indefinitely. Having a first-mover advantage is huge, for sure, but it is not a game-winning formula. Always assess your bags, and don't become too attached because when the time comes to make the correct decision, your emotions will play too big a role in the final decision.

Back to RWAs. The tokenised securities sub-sector within RWAs only represents a small portion of the TVL.

Here's the most bullish part - RWAs represent a minuscule portion of the overall tokenised assets, including fiat-backed on-chain dollars (like USDT/USDC/DAI, etc.).

Even if the rest of the crypto market stagnates, the potential for growth is huge. If everything was tokenised, the potential market RWAs could tap into would be epic in proportions.

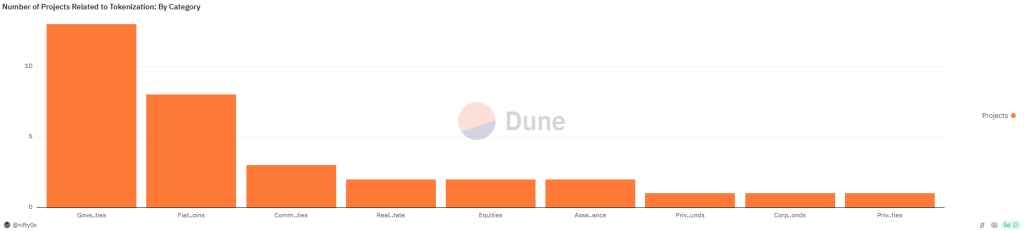

Further to this thesis, only a handful of projects still cover potential tokenisation sectors within RWA. However, as researchers, we can't afford to think that historical performance is a pure predictor of future performance.

So, in terms of players, where does that leave us?

You can't fight fate (BlackRock)

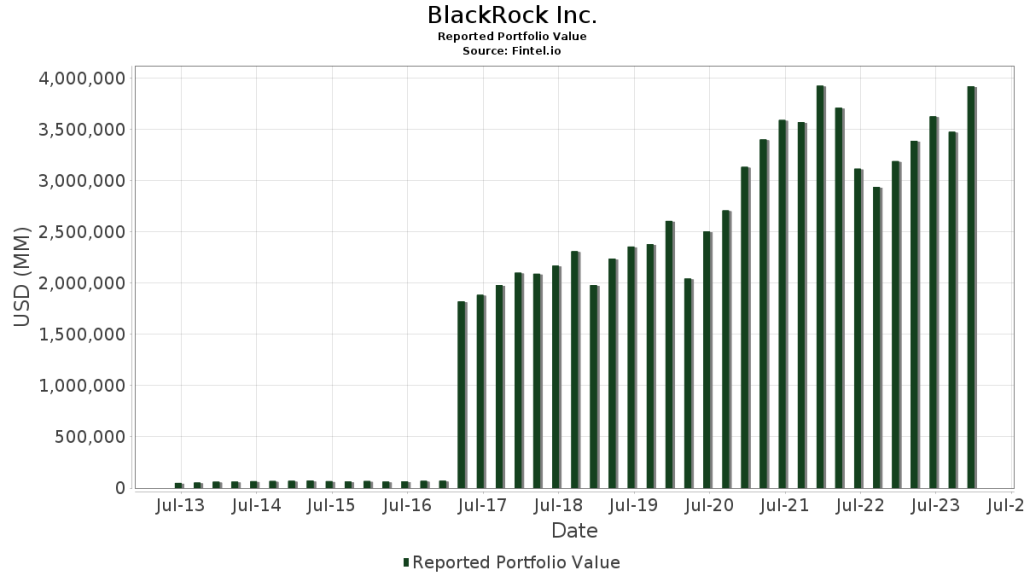

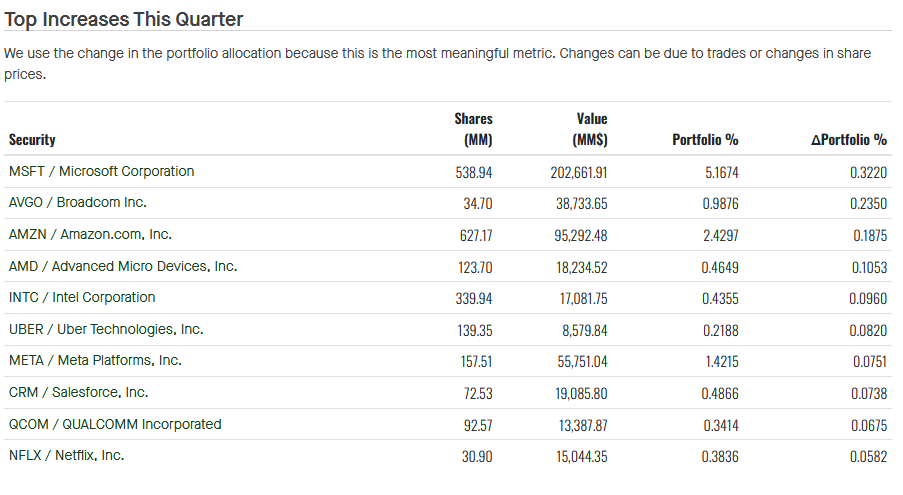

By and large, the newcomer who has quite literally ripped onto the RWA scene is BlackRock. With a renewed green light and legitimising effect that a Bitcoin ETF has presented, TradFi mega-funds like BlackRock have dipped their toes in the RWA scene.Considering BlackRock's portfolio of nearly $4 trillion worth of RWAs, it makes sense that they'd start toying around with the idea of tokenising some of those assets.

BlackRock's mentality in taking over the RWA sector is very straightforward.

We can't have every cake and eat it, but we can have enough slices of every cake to reassemble 4 trillion cakes and eat them all.

If anyone's played Grand Theft Auto at any point, the Sims, or any game with money, there's usually a cheat code to give yourself obscene amounts of cash.

This is basically BlackRock's playbook - for all intents and purposes, they have unlimited funds.

Unlimited funds

Towards the end of March, BlackRock launched their blockchain arm - BUIDL. We have to give it to them; they hit the mark with the name, a play on HODL. You HODL, we BUIDL, that kind of thing.BUIDL stands for BlackRock USD Institutional Digital Liquidity Fund.

BUIDL is a tokenised fund that will handle BlackRock's investments in the crypto space. "Just wait till institutions arrive," bro; we're here already. Concurrent with the launch of the BUIDL fund, BlackRock made a strategic investment in its on-chain RWA arm, Securitize.

If we're being sincere, it is hard to see any other competitor in the RWA space outdoing BlackRock in this sector.

BlackRock offers a bullshit-free and risk-free alternative to being scammed, rugged, or robbed of funds by a rogue DeFi project. They already have the assets that could back any project that Securitize launches.

If you aren't a degen, ask yourself, "Would I rather buy tokenised securities backed by BlackRock, knowing they actually have the collateral, or some random 3-month-old project with anonymous devs who may/may not rug in a few weeks?" This is why centralised exchange remains in business despite the custodial risks and all the warnings about "Not your keys, not your coins". Even after the FTX fiasco, Coinbase and Binance are still thriving.

The key selling point for alternative projects would be decentralisation, but decentralisation comes with tradeoffs. At some point, someone has to be holding the collateral somewhere.

The case for multi-role RWA projects

Since BlackRock has thrown some loose change at crypto, we should be looking at multi-purpose projects instead of those focusing solely on providing tokenised securities, etc. Betting against BlackRock here would be equivalent to throwing punches at a tsunami while it carries you away in whatever direction it happens to be going. You can only fight as long as you can hold your breath, and then you're toast.A better strategy would be to grab a surfboard and ride that wave. Of course, before the wave hits, you should grab whatever you can and stuff it in a bag.

We're not here to make money, not to take down BlackRock. So, our RWA playbook is designed to ride the wave that BlackRock's ship stir up instead of fighting against the inevitable.

Protocols that offer RWA products will do well in the short term as the tide rises; those who offer RWAs and something else (the surfboard) will have something to fall back on while capitalising on the renewed interest in RWAs.

Here are two such projects for your consideration.

Propy (PROP)

One of the newer kids on the block, Propy, allows users to link property ownership to an NFT or other digital asset. This enables the development of an on-chain real estate market.

You can buy a house on-chain using crypto - the future is now.

Propy utilises AI technology within its infrastructure to check over property documentation and other legal aspects of home ownership. Take a look at their explainer here.

The gamification of real estate is huge and has the potential to revolutionise the real estate market down to a few simple clicks. It's like going through a self-checkout at the supermarket—no more paying thousands of dollars in fees when buying or selling a property.

From the users' perspective, in the charts shown previously, we can see that Propy accounts for a significant amount of the new user count within the RWA space.

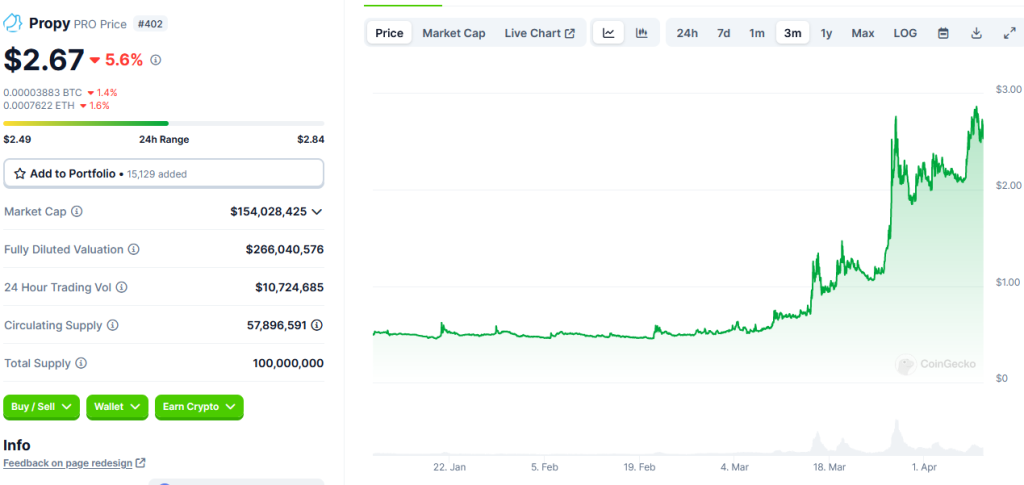

Token performance provides further confluence with this thesis:

PRO is an ERC-20 token used for governance and utility. It is heavily involved in minting new property deeds and performing other basic functions within the ecosystem.

With a relatively low market cap (considering the protocol's function), PROP presents the best current bet on the RWA sector outside of the securities and bond subsector.

BlackRock is unlikely to launch a similar product until Securitize is tested, receives regulatory approval, and launches a securities tokenisation branch.

MakerDAO (MKR)

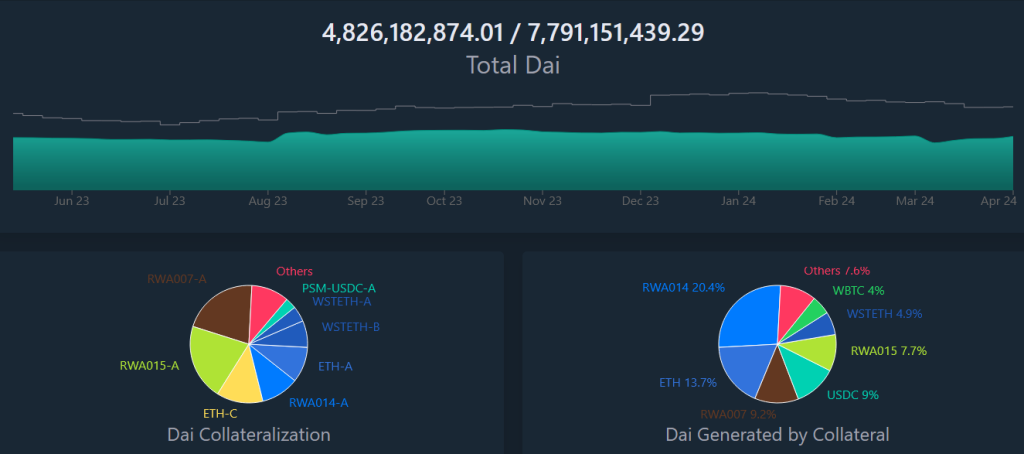

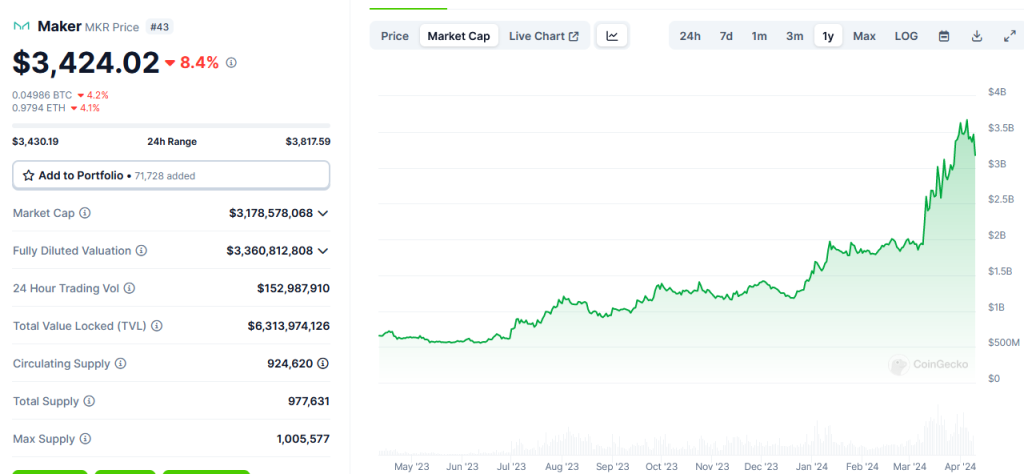

MKR is still one of the best ways to get exposure to a basket of RWAs and will continue to provide a MicroStrategy-type bet. Currently, around 37% of all collateral supporting the DAI stablecoin comprises RWAs.

The overall proportion of the total collateral backing DAI (which is overcollateralised by ~300%) is around 52.5%. These are huge figures - around $3.8 billion worth of RWAs managed through the DAO.

The MKR token itself mimics the PROP bet in that neither directly provides royalties, fees, etc., but provides a medium to gain exposure to the RWA operations of their respective protocols.

Cryptonary's take

BlackRock's arrival in the RWA space has thrown a spanner in the works.We would have loved to place a bet on any of the relative underdogs like Ondo or Matrixdock, but based on the realities on the ground, that would be an emotional rather than rational call.

Many of the RWA protocols we've previously covered, like Maple Finance and ClearPool, have been unable to get off the ground significantly. Now, they, and many other protocols purely focused on the RWA side of things, are facing an existential crisis with Blackrock's arrival.

The only way we can envision fully decentralised RWA products succeeding is if BlackRock forces KYC regulations on any holders of their tokenised assets. If that were to happen, many of the decentralised RWA plays would become attractive again.

But realistically, BlackRock can't enforce the KYC requirement without destroying the product and shooting themselves in the foot. Granted, they can enforce KYC at the point of redemption. However, once an asset is out on-chain, there's not much BlackRock can do to stop people from trading it.

Other subsectors, such as tokenised real estate (Propy) and RWA basket funds (MakerDAO), are safe for now.

Propy represents the higher-risk bet but also offers a product/service that BlackRock wouldn't dare create for the foreseeable future.

Although it's well within BlackRock's capability to finance a stablecoin like MakerDAO, we have no reason to believe that's their intention at the moment (even though BUIDL is pegged to a dollar). Rather, they are using BUIDL to then back tokenised securities on-chain.

Ultimately, the big fish have arrived, and the smaller fish will have to prove their worth in a lopsided, BlackRock-rigged financial world.

We hate to be the bearer of "bad news" on the RWA narrative, but it is what it is.

Cryptonary, Out!