We explore recent developments for FXS and RBX, from halving impacts to future catalysts.

But our journey doesn't stop there – we also have our sights set on an emerging token that's catching the attention of savvy investors.

Re-evaluating the FXS halving trade

On December 8, we wrote a report about Frax Finance and it's halving event planned for December 20. The halving occurred on Wednesday, but the price has not responded as we had hoped.

One thing we have noticed dragging FXS down during this halving is its close correlation to ETH, which acts as a high-beta asset (meaning that when ETH goes up, FXS tends to go up even more).

However, recently, as ETH began to underperform going into December after initially being more closely correlated with BTC, this has had a negative impact on FXS.

For FXS to truly shine, it must decouple from ETH and establish its price discovery.

Alternatively, we would need to witness ETH gaining support and outperforming BTC once more, which appears unlikely until the BTC ETF launch.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make is your full responsibility.

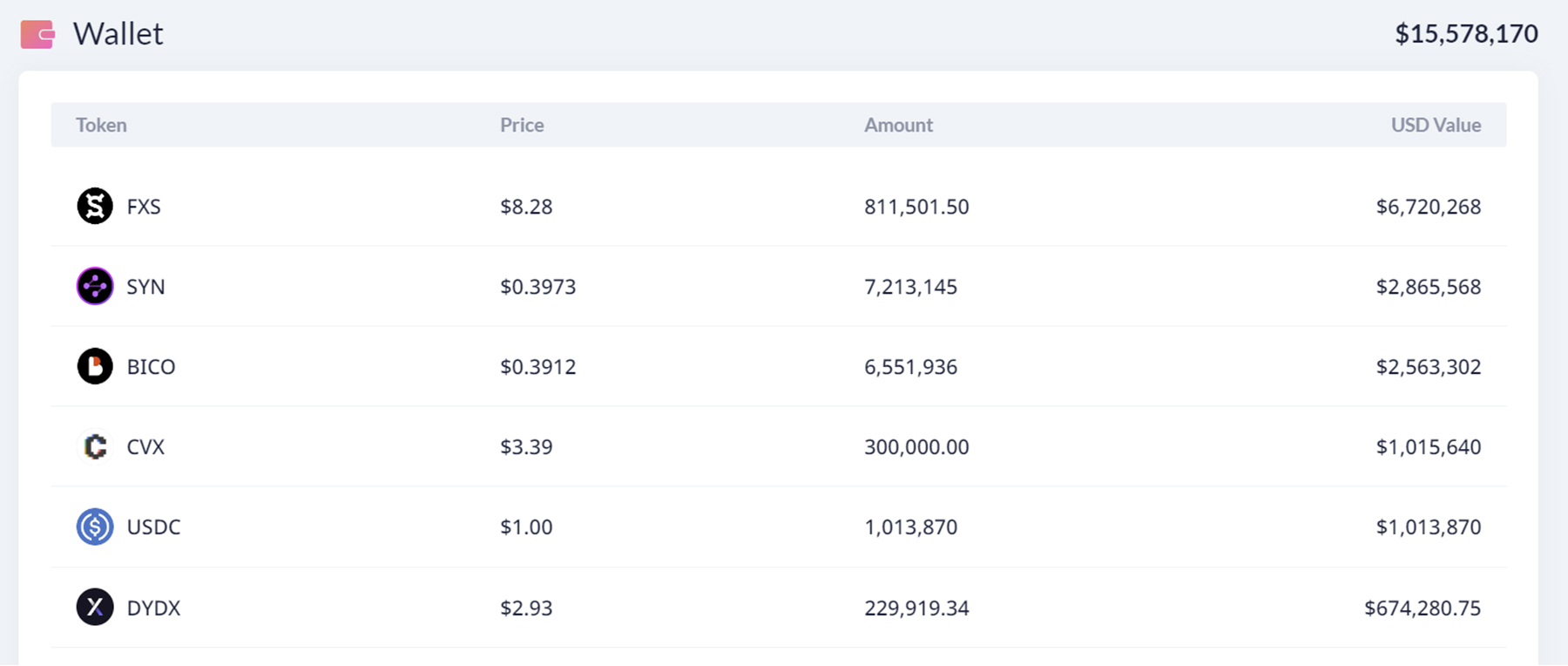

Are our whales still holding?

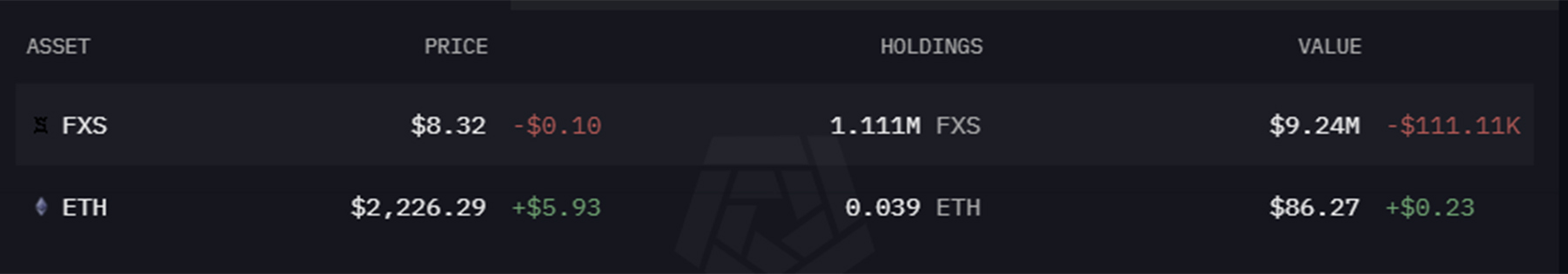

Our first whale address, likely belonging to the crypto trading firm Amber Group, did not view the halving as a 'sell the news' event and has added to its FXS position.It bought another 100,000 FXS worth $876,990 on December 15, 2023, at 15:36:59 UTC on Binance. This was added to the tracker wallet, increasing its total FXS position to 811,501.50 FXS worth $6,720,268.

Our other whale wallet, likely belonging to DragonFly Capital, has yet to make any changes to its position so far.

This should be more of a long-term investment for them rather than a trade, as the funds are stored in a BitGo custody wallet.

When would the FXS halving trade be invalidated?

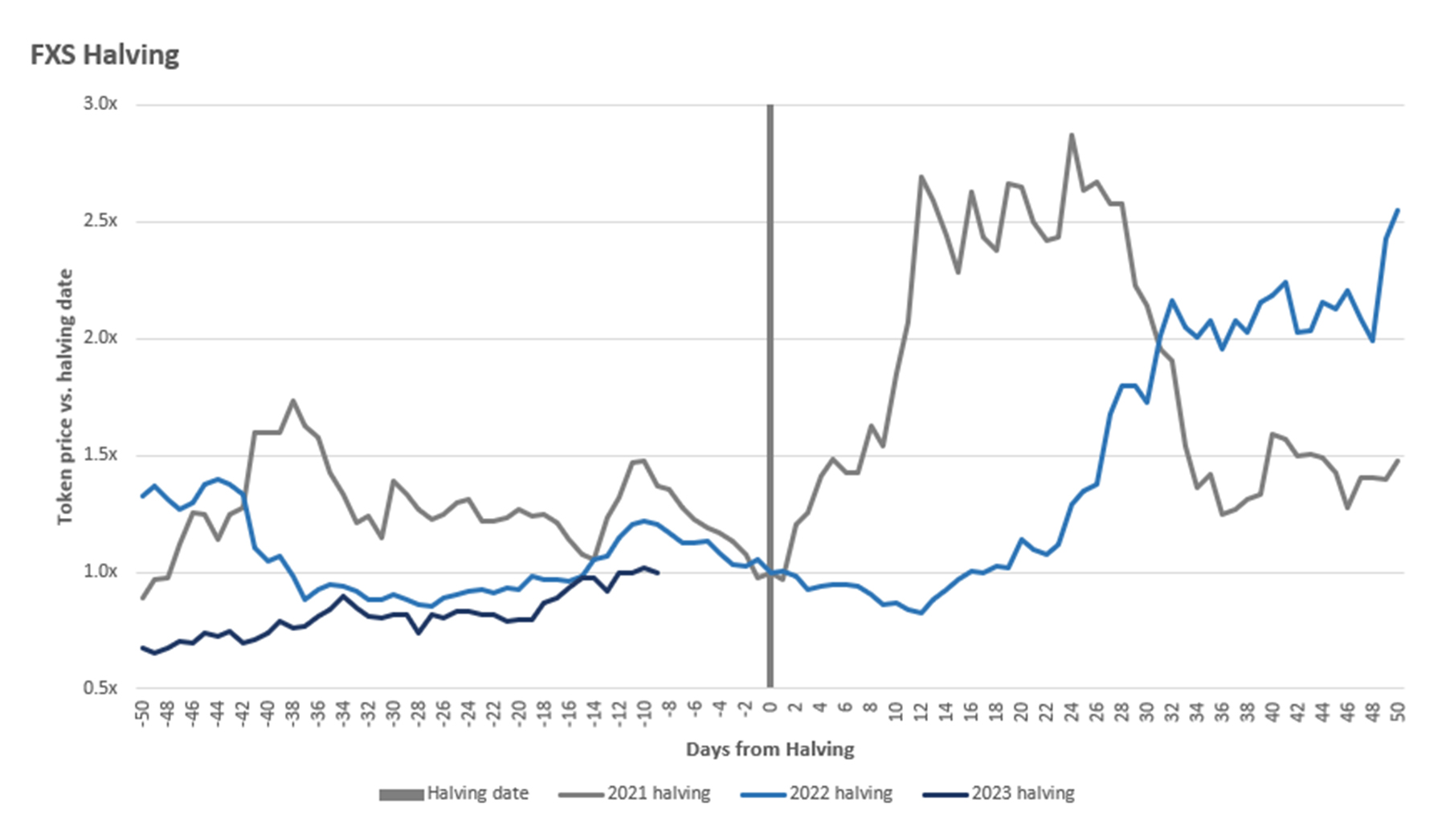

The fact that the price has yet to move is not new for FXS. The price usually took 2 to 12 days to pick up during previous halvings.If you're currently trading FXS, it's essential to consider historical performance.

Previous halving events for FXS have shown promising results, with a 2.9x increase in the 2021 halving and a 2.5x rise in the 2022 halving, although these peaks occurred at different times.

We would consider invalidating this trade if, within the two weeks following the halving, FXS does not demonstrate significant strength compared to BTC or ETH.

Suppose FXS fails to show meaningful performance during this period after the halving.

In that case, it might be advisable for traders to consider cutting their positions, especially if the halving was the primary reason for holding FXS.

Key catalysts for FXS in 2024: A long-term approach

If you're not in FXS solely for trading the halving and believe in the fundamentals of FXS, some promising catalysts are awaiting you as a long-term holder.FraxChain

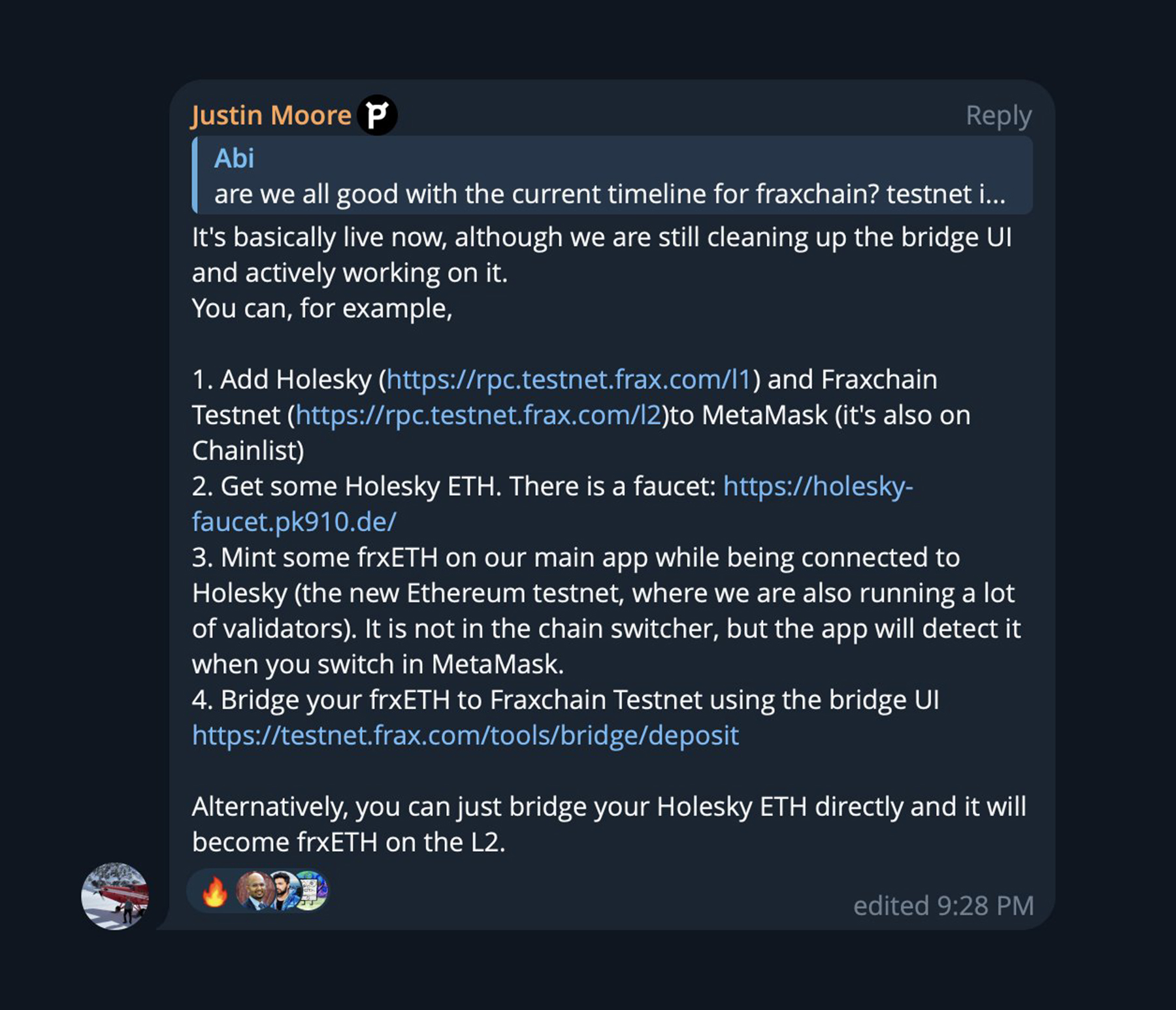

The first significant catalyst for Frax Finance in 2024 will be the launch of FraxChain, which is likely scheduled for early Q1.The testnet for FraxChain is already live, so it's not just a promise; a tangible testnet is available.

You can try it out by following the instructions provided here.

FraxChain, a hybrid Optimistic and zk-Rollup solution, is set to employ frxETH as a gas token.

What sets FraxChain apart from other Layer 2 solutions is its commitment to decentralised sequencers right from the outset, with FXS holders actively participating in the governance and receiving sequencer revenue.

If you want to understand better what FraxChain is capable of, check out our article here, where we delve into the details.

This significant development marks a pivotal step for Frax Finance in expanding its ecosystem and enhancing the utility of the FXS token..

Borrow AMM

BAMM, short for 'Borrow AMM,' enhances automated market makers (AMMs) by incorporating borrowing capabilities.This DeFi innovation allows users to leverage their crypto investments securely without requiring external oracles for price feeds.

For example, say you hold a token valued at $1,000 and want to increase your farming yields. Traditionally, you would need to rely on oracles to provide accurate price data to leverage your position.

BAMM creates a new decentralised market where you can borrow stablecoins against your token collateral without external data sources.

As the founder of Curve Finance highlighted, BAMM represents one of the most significant innovations in DeFi.

What's promising for Frax Finance is that BAMM can help bridge the collateralisation gap. FRAX currently lacks a 100% collateral ratio - a key reason for FXS's lagging performance. Further, all revenue now goes towards filling this gap.

BAMM offers a solution by incorporating LP tokens into Frax's balance sheet. As BAMM replaces FraxSwap as the exclusive AMM on FraxChain, it represents a significant catalyst for Frax.

Cryptonary’s take

While the FXS halving has not immediately sparked a price rally as hoped, there remains optimism for FXS in the long run.Key players still seem confident, with whales continuing to accumulate.

Before invalidating the trade, traders should give it another 1-2 weeks to allow historical post-halving patterns to emerge. If no strength manifests in that timeframe, cutting positions may be reasonable.

For long-term holders, 2024 offers encouraging catalysts like the FraxChain launch and BAMM adoption. These developments can expand the Frax ecosystem, enhance FXS utility, and help resolve the collateralisation shortfall hindering performance.

RBX pulled back to attractive levels but catalysts are coming

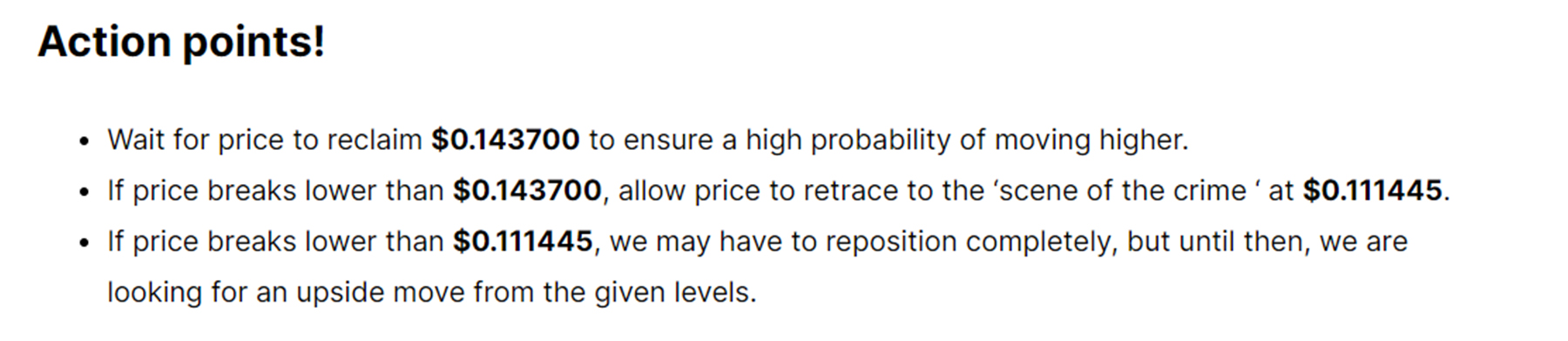

Moving on to RBX, a token we highlighted in our smart money report on December 14. In the article, we suggested an entry point at around $0.1437 to increase the likelihood of a higher move.

While the price has come closer to our recommended entry point, it has yet to reach that level, as demand surged when the price was about to drop below $0.15.

What are our whales doing?

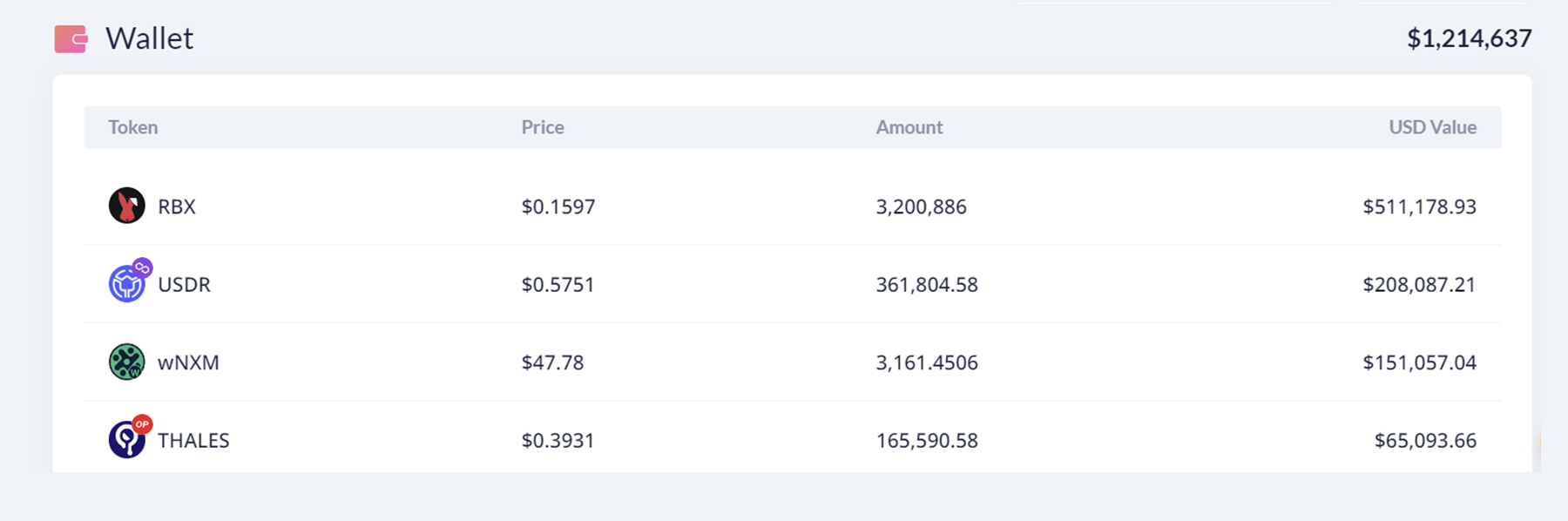

The largest RBX whale we have been tracking made a major acquisition on December 6th, amassing over 3.2 million RBX tokens worth over $500,000 at the time.

Despite the downturn, this whale has firmly held its RBX position without flinching. This steadfast conviction signals a strong belief in RBX's long-term potential.

Looking across our other major RBX whales, conviction has remained firm despite market conditions:

- Wallet #2, holding 1.85 million RBX, has maintained its position.

- Wallet #3, with 2.34 million RBX acquired at $0.19 and $0.21, continues to hold its full stake.

- Wallet #4 retains its 1.63 million RBX position as well.

Important catalysts for RBX going into 2024

Potential listings on larger exchanges?

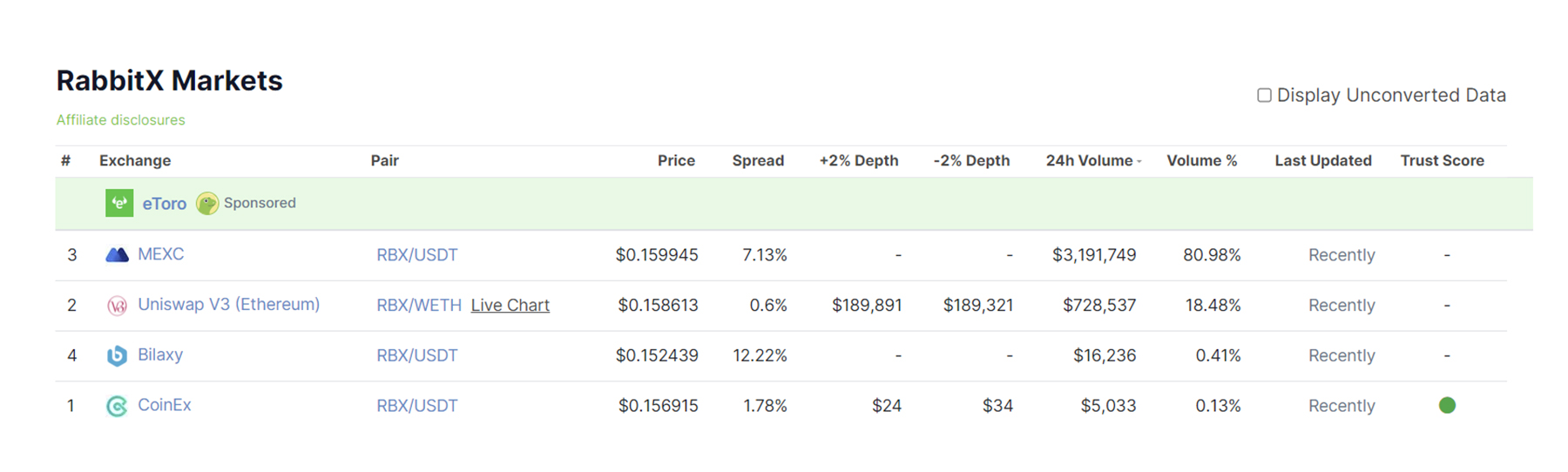

Liquidity has recently proven to be an Achilles’ heel for RBX. With trading activity currently fragmented between Uniswap and the smaller MEXC exchange, RBX lacks the depth to absorb larger sell orders without volatility spikes.This fragility was highlighted when a single $200k order was dumped on Uniswap, crystallising losses for the seller and triggering a cascade of additional sell-side activity. The sizable order in this illiquid environment sent RBX prices plunging sharply before finally stabilising.

Such episodes underscore the risks of RBX’s thin liquidity conditions, relegated to lighter-volume DEXs and second-tier CEXs. When major holders sell portions of their supply, the imbalance crashes prices because there is insufficient depth to maintain equilibrium.

However, RabbitX’s founder acknowledged shoring up liquidity as a top priority in a recent podcast.

He revealed intensifying efforts to list RBX on top exchanges, even mentioning serious conversations with the crypto exchange Bybit.

In summary, temporary liquidity shortfalls explain RBX’s recent price woes, but priorities are set to resolve this.

Landing a top exchange listing could catalyse a significant turnaround for RBX holders in 2024 by resolving its Achilles’ heel around fragility.

RBX staking

The second catalyst we eagerly anticipate for 2024 is RBX staking. Currently, the RBX token lacks the much-needed utility we seek in a token. However, what sets RBX apart is the forthcoming launch of staking towards the end of Q1.Staking will introduce a revenue-sharing mechanism, adding intrinsic value to the token, so this is a development we are eagerly looking forward to.

Crypontary’s take

RBX has displayed a recent pullback, approaching the recommended entry zone of $0.1437, which presents an attractive opportunity for potential buyers.Our observations of RBX's whales have been noteworthy, as they have maintained their positions despite market fluctuations, reflecting a strong belief in RBX's long-term potential.

Looking ahead to 2024, RBX offers exciting catalysts for growth. The focus on improving liquidity and securing listings on larger exchanges, such as potential partnerships with platforms like Bybit, could address liquidity challenges occasionally affecting RBX's price stability.

We are also actively engaging with the RabbitX team to address community questions. As a result, you can expect a more detailed report on RBX once these conversations with the RabbitX team have concluded.

Smart money is quietly accumulating MUBI

Over the past week, one token has garnered significant attention as its price soared, piquing the interest of savvy investors.

We're excited to introduce you to MultiBit Bridge, a groundbreaking project that closely monitors and capitalises on this smart money activity surrounding MUBI.

Meet MultiBit

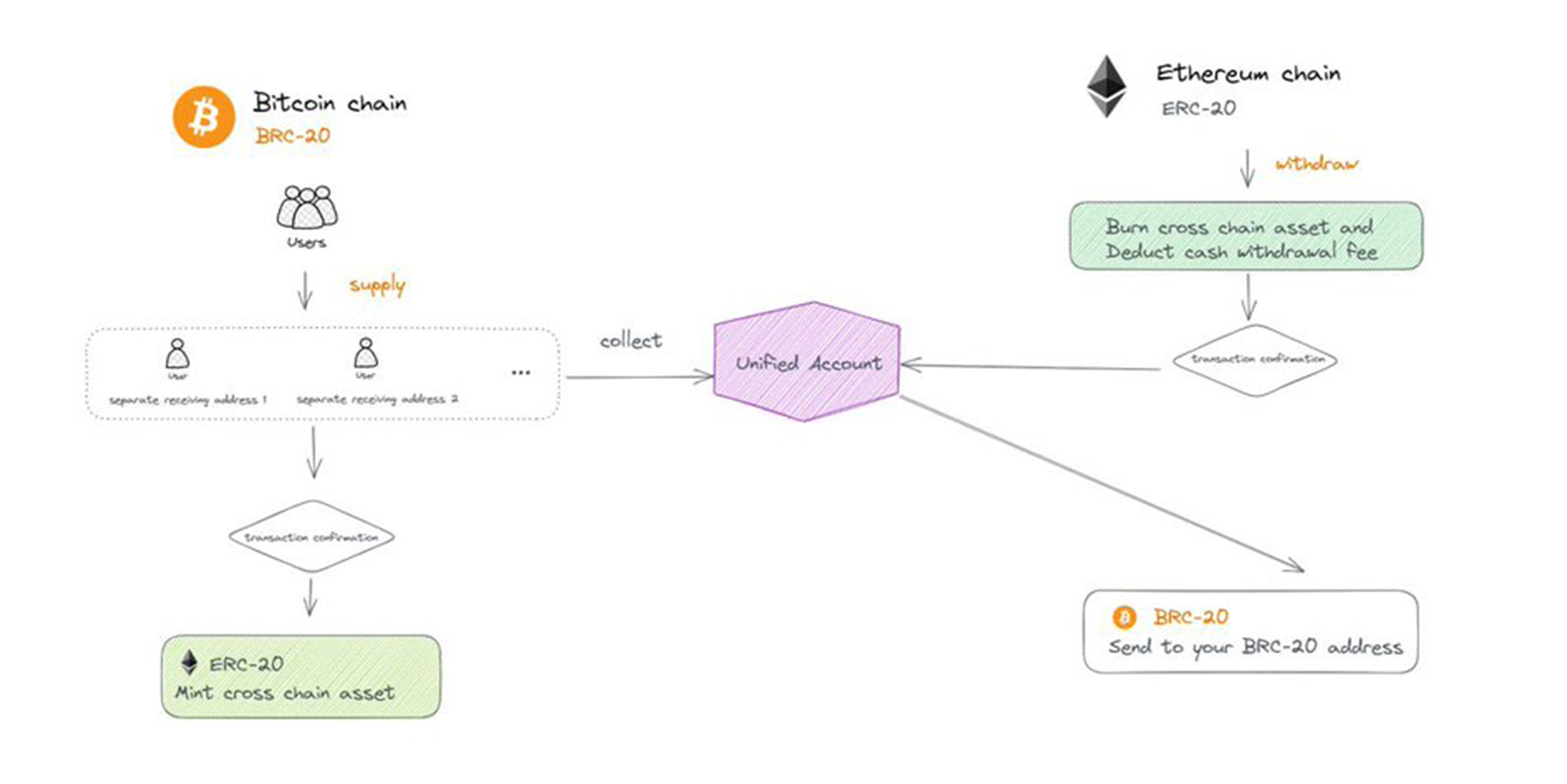

Behind the MUBI token lies an innovative project - MultiBit Bridge. As a dual-sided bridge, MultiBit facilitates seamless transfers between BRC20 and ERC20 tokens across networks. Impressively, it has processed a staggering $624 million in volume since its launch.The operational workflow of the MultiBit Bridge unfolds as follows:

- Token Deposit: Commence by depositing BRC-20 tokens into a designated MultiBit address.

- Token Minting on EVM Chain: The bridge initiates a token minting process on the Ethereum Virtual Machine (EVM) chain, ensuring compatibility and functionality within the Ethereum network.

- Secure Token Transfer: At regular intervals, tokens are securely transferred to a cold wallet to maintain the highest level of security in token management.

- Withdrawal Process: When it comes time to withdraw tokens, the protocol seamlessly burns them on the EVM chain, facilitating a straightforward withdrawal process.

MultiBit's overarching goal is to become the go-to destination for individuals seeking to bridge Ordinals and BRC-20 tokens to other networks, such as Ethereum. This will empower users to trade these tokens on popular NFT marketplaces like OpenSea and Blur or seamlessly integrate them into decentralised finance (DeFi) ecosystems.

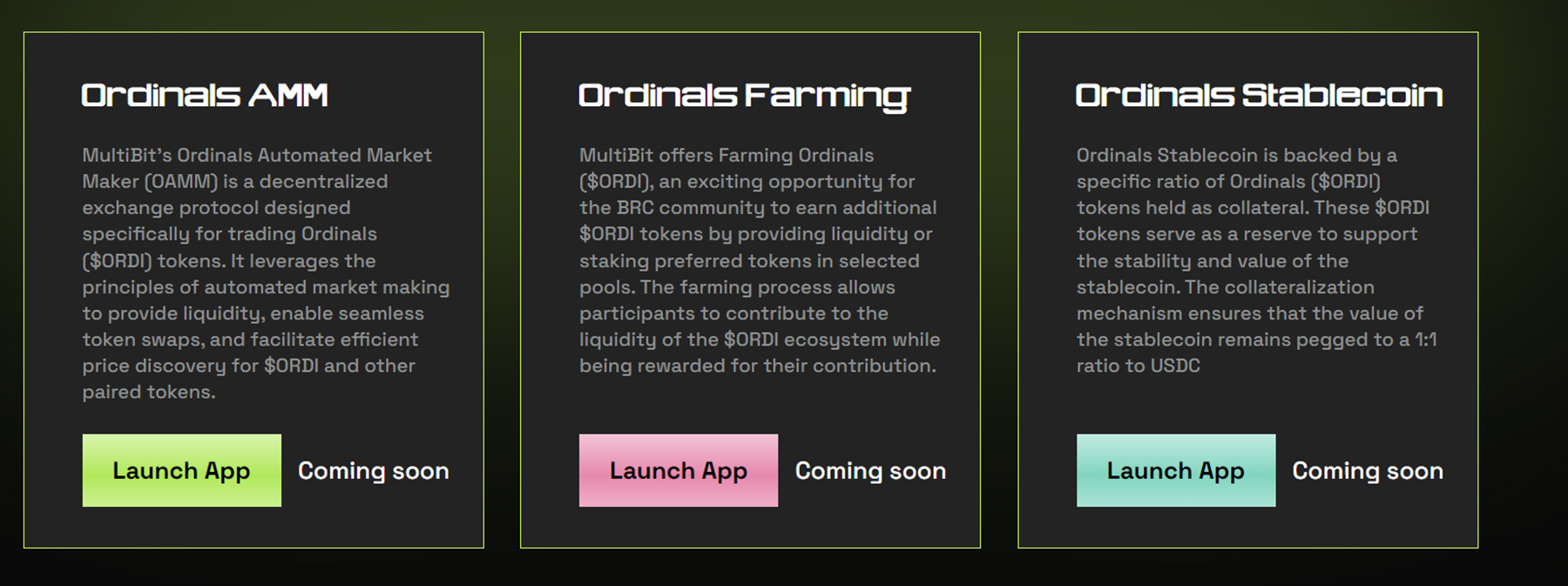

MultiBit aims to build a robust ecosystem atop its bridge, positioning itself as a pivotal player in the BRC-20 and Ordinals space within the Bitcoin network.

Whale transactions

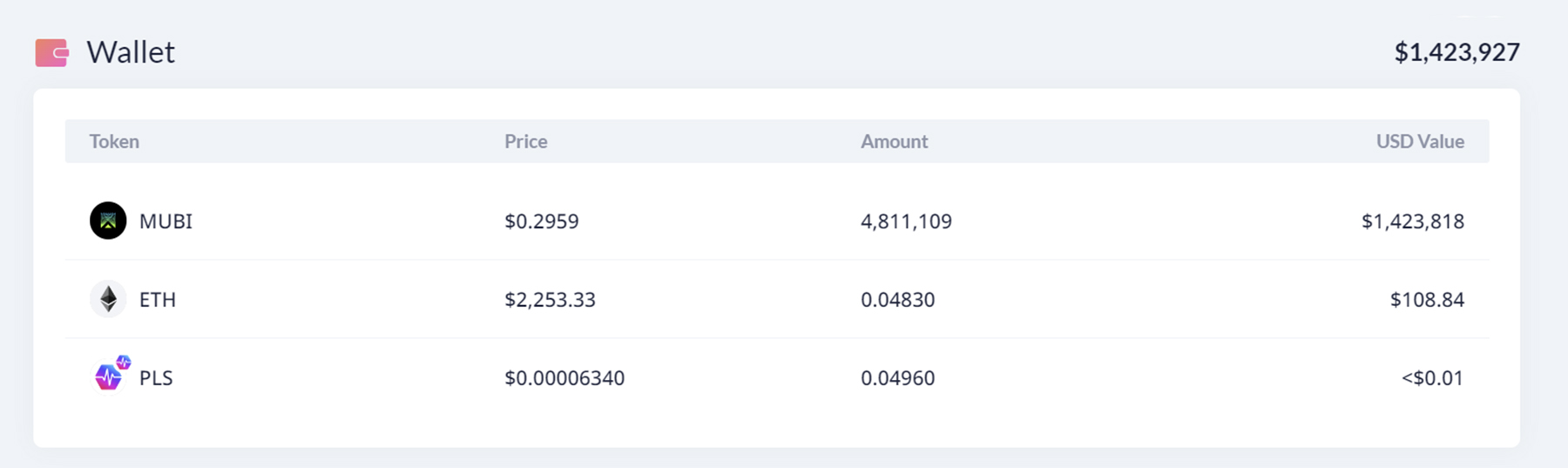

Beyond the tech, some noteworthy whale activity shows investor confidence. Between December 18-20th, wallet 0xf8a8 acquired 4.8 million MUBI worth $1.46 million at $0.30 per token.

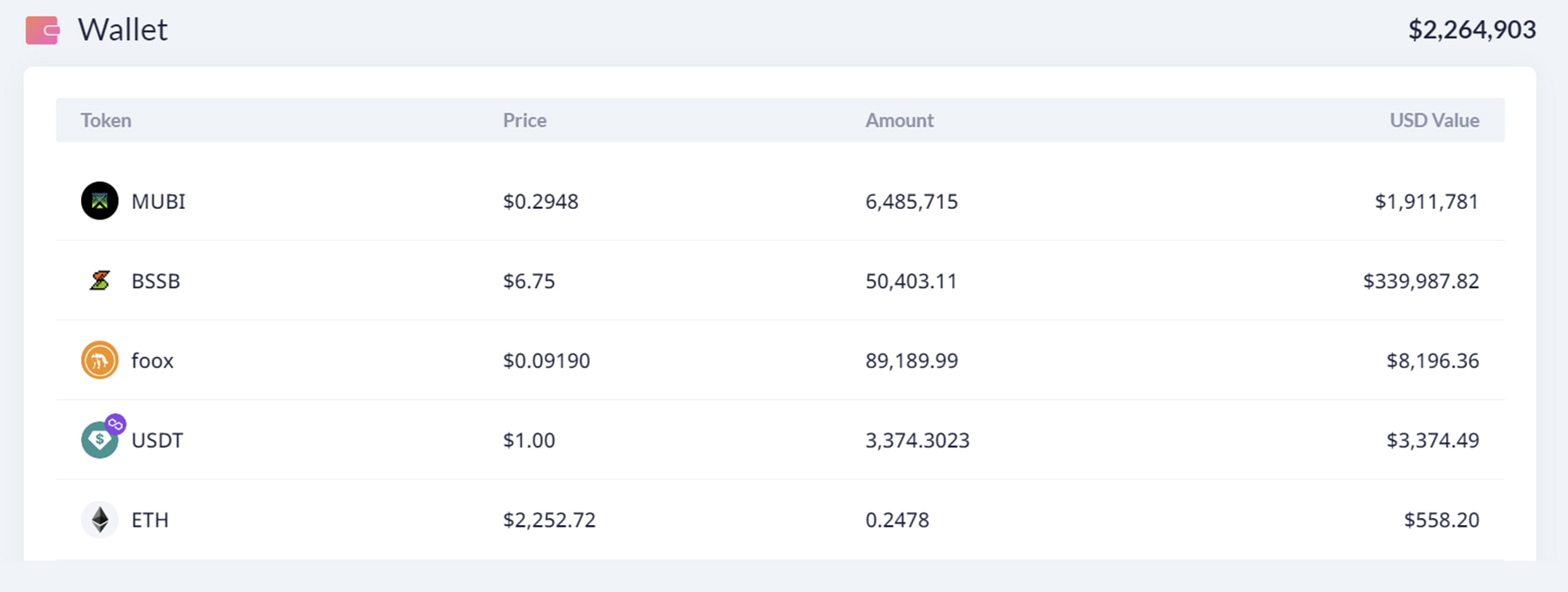

Separately, another whale wallet purchased 6.5 million MUBI between December 15th and 21st, worth $1.67 million at approximately $0.258 per token.

Potential catalysts for MUBI

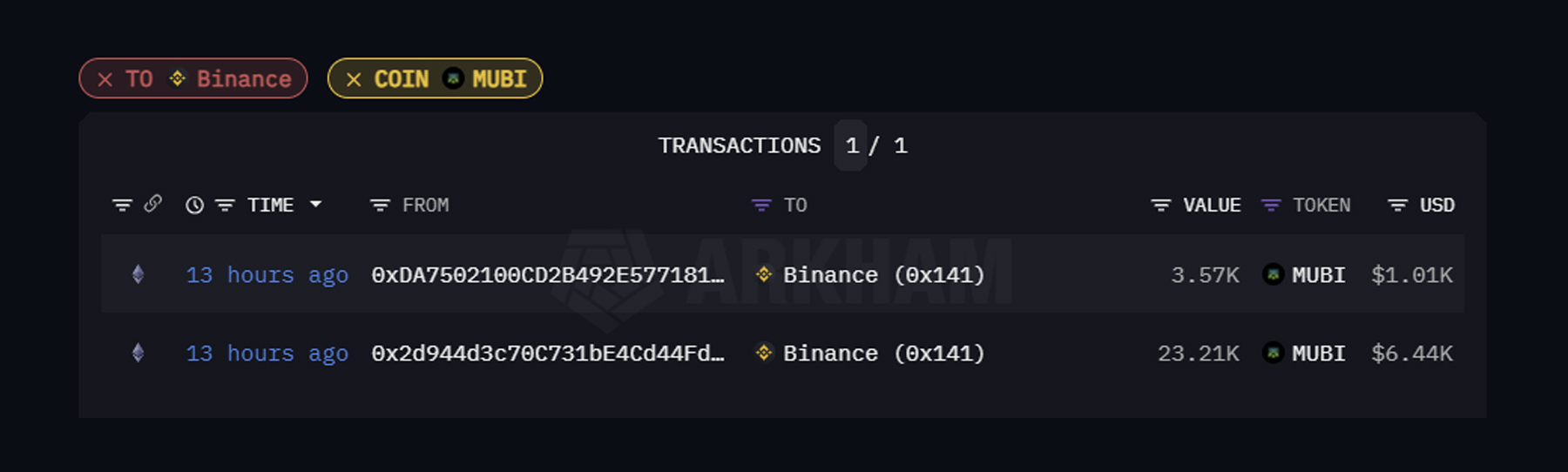

Listing on Binance? A rumour has been circulating that $MUBI is on the verge of being listed on Binance. This speculation arose after potential test transactions, possibly sent and received by Binance, were discovered.

While not fully confirmed, a potential listing on Binance could significantly expand MUBI's market reach.

Revenue sharing for MUBI holders

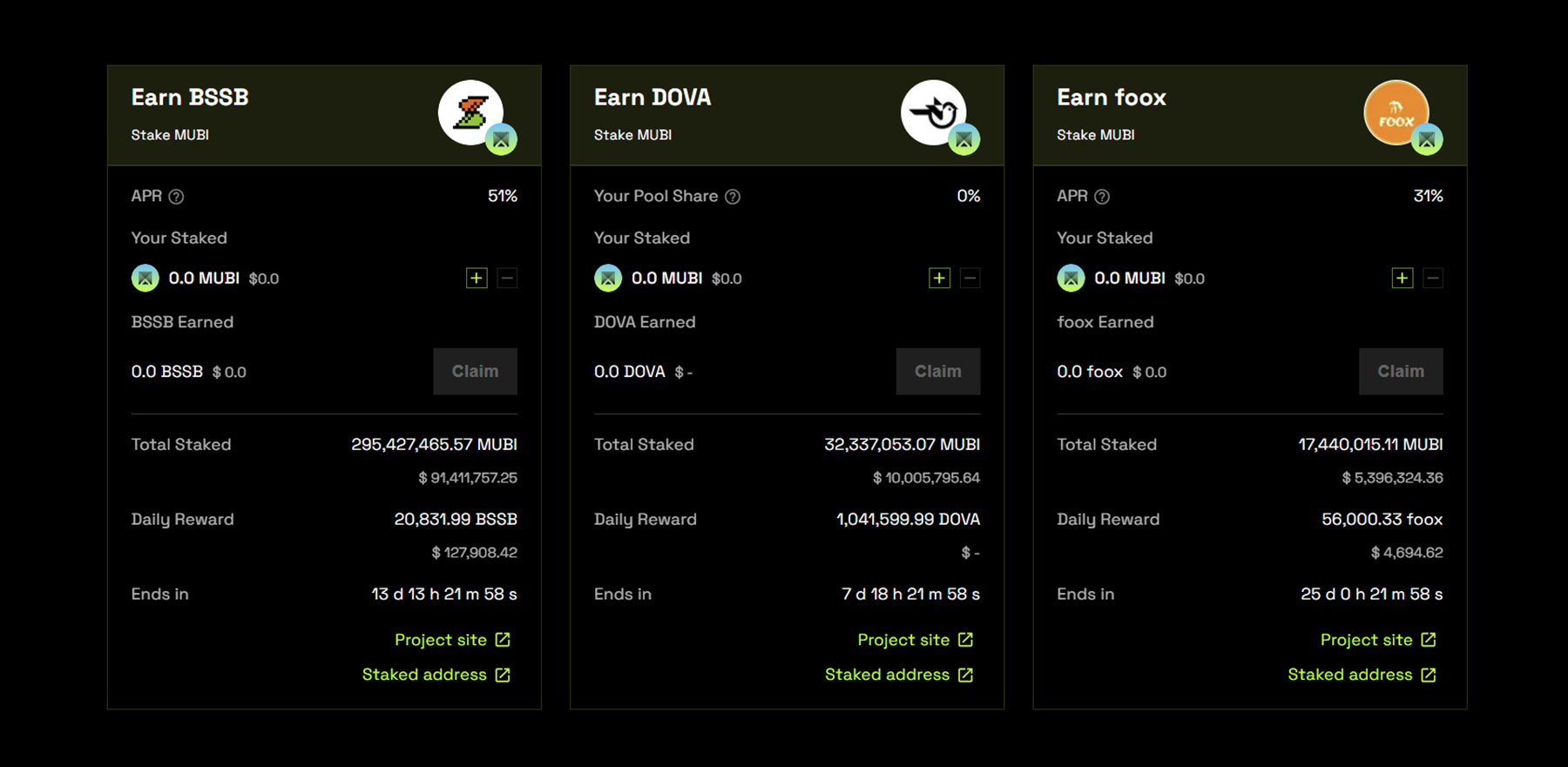

MUBI stakers currently receive %APY in the form of new tokens integrated into Multibit.

Stakers have the ability to influence which tokens get integrated into Multibit, essentially creating a launchpad where the community can vote on new BRC-20/Ordinals that should be added to the bridge. This system has become a vibrant marketplace where new BRC20/Ordinal projects can establish staking pools for MUBI holders to incentivise them to vote for their inclusion on the bridge.

What's even more significant is that the team has hinted at future plans to allow stakers to earn fees from the bridging process. This potential development could serve as another major catalyst for MUBI's growth.

If its volumes continue to increase as BRC-20 and Ordinals gain more adoption, this potential revenue could be substantial.

Cryptonary’s take

With accelerating development, major investments, and strong fundamentals, MUBI is undervalued around the $0.20 level compared to the growth achieved.

Should the market correct and trigger such a pullback, we view it as an appealing opportunity to buy into an overlooked project starting to gain momentum. But the potential remains high even from current levels.