Spotting outperformers: The 3 biggest gainers since BTC bottom

When Bitcoin bounces, the market pays attention. But during this latest rally, three tokens stole the spotlight, each for very different reasons. We believe these are going to be outperformers. Let's dive in…

Crypto doesn't wait for permission. After weeks of chop, volatility, and sideways sentiment, the market roared back to life. Bitcoin rallied from $74,500 on April 7th to nearly $97,000 by May 2nd, a clean 30% bounce. The total crypto market cap jumped from $2.31 trillion to $3 trillion, coming close to key psychological territory. Ethereum climbed 35%, while Solana ripped nearly 65% during its April local low and recent bounce highs between April 7th and April 25th.

But this wasn't just a major-asset rotation or passive ETF-driven strength. Something else was happening underneath. As majors bounced, select altcoins surged much harder, leading the move, not lagging behind it. Each of these came from a different corner of the market.

This report dives into these three assets, not because they're guaranteed winners, but because they reveal what the market cares about right now. When liquidity returns, the first to move often signals where capital, attention, and risk appetite are headed next.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

1. SUI

SUI is a Layer 1 blockchain alternative to Ethereum and Solana. It has been one of the quiet standouts during this market bounce, climbing from $1.72 lows in early April to $3.87 by May 2nd, delivering a near 125% rally. This was a multi-pronged narrative upgrade, driven by real announcements, institutional signals, and product rollouts across DeFi, gaming, and Bitcoin.The ETF filing that got everyone talking

On May 1st, 21Shares filed an S-1 with the U.S. SEC for a SUI ETF. While approval may take time, the signal was loud and clear: institutions are eyeing SUI seriously. The news came during SUI's flagship event, Basecamp 2025, and acted as an immediate catalyst. In the 24 hours following the filing, SUI's price surged by over 10%.This ETF narrative positions SUI in the same conversation as Solana and Ethereum, two other chains with ETF ambitions, giving it credibility and boosting liquidity prospects over time.

Bringing Bitcoin to SUI: sBTC integration

Alongside the ETF filing, the Sui Foundation announced sBTC integration, a wrapped Bitcoin asset developed by the Stacks ecosystem. This opens the door to BTCfi, a growing narrative that seeks to unlock Bitcoin's trillion-dollar liquidity for DeFi use cases.Notably, SUI isn't just integrating Bitcoin assets. The foundation also runs a validator on the Stacks network, hinting at deeper infrastructure alignment. With over $200M in BTC TVL already on SUI, it's emerging as a serious player in the race for Bitcoin-native DeFi.

Gaming & consumer rails: SuiPlay0X1 and Mogul

The launch of SuiPlay0X1, a dedicated gaming handheld built with Playtron, signals an aggressive push by Sui into consumer products. This device supports native SUI games, as well as traditional libraries like Steam and Epic. The ambition? Bring Web2 gamers into Web3 without compromising UX.Then there's Mogul, a fantasy Hollywood league by MoviePass. Built entirely on SUI, it allows users to draft actors, predict movie performance, and compete for rewards. With over 400,000 users on the waitlist, this could be one of SUI's viral loops into mainstream attention.

DeFi's layered maturation

Beyond narratives, SUI's DeFi layer is also maturing. Protocols like Suilend are rolling out permissionless LST creation, democratizing yield products. Over 10 teams have launched LSTs, and Suilend recently initiated a $2M SEND token buyback to reward ecosystem participants. Additionally, usage of the protocol has jumped 300% since December, with over 240,000 active wallets.This is real usage stacking behind the chain.

Narrative convergence and ecosystem strength

What makes SUI stand out is how many lanes it's driving in: ETF speculation, Bitcoin DeFi, gaming, retail culture, and DeFi innovation. These plays are intersecting narratives, building momentum together.The numbers behind the run

- Price (May 7): $3.45

- Market cap: $11.2B

- TVL: $1.8B in TVL and over $200M in Bitcoin assets

- Monthly active wallets: peaked at 17.6M in Feb 2025

- Developer grants funded 80+ projects with over $5M

Technical analysis: SUI/USD and SUI/BTC

SUI/USD posted a sharp upside move in April, bouncing from around $2 on April 16th to a high of $3.80, an explosive 90% rally in under a week. This move marked a strong shift in short-term momentum.The rally was triggered after SUI tapped into a key weekly demand zone between $1.6 and $2.12. The midpoint of this zone, around $1.866, acted as a solid base, with SUI bottoming out at $1.71 on April 7th before reversing.

Currently, SUI is consolidating after rejecting just below the $3.94 resistance, failing to clear the $3.87-$3.94 supply zone. On the downside, it's holding support at $3.19, a level that's being tested repeatedly.

If $3.19 fails to hold, the next key support lies at $2.816. But structurally, the chart still would look strong even if price retraces and tests support zones, as it would likely be a bullish retest.

SUI/BTC

SUI/BTC saw a strong rally from August 2024 to January 2025, outperforming Bitcoin by over 500%. This move peaked at level 6, marking SUI's all-time high on the pair against BTC.After topping, it retraced nearly 57% down to level 2, forming a tight falling wedge between level 4 and level 2. This structure lasted from February to late April, showing compressed volatility and waning sell pressure.

In early April, SUI put out its local bottom around level 2, eventually leading to a breakout of the wedge, flipping level 3 and running into resistance at level 4. It's now pulling back, and whether level 3 holds will decide the next leg.

The breakout marks a shift in structure. If level 3 holds as support, SUI/BTC could continue its recovery. If it fails, we're likely back inside the range.

What's next

SUI caught the ETF buzz, but another alt rallied 125% on real usage and protocol upgrades- are institutions already moving behind the scenes?2. HYPERLIQUID

Hype was one of the clearest strengths of leaders in the DeFi sector. HYPE rallied from under $10 ($9.3) in early April to $21.7 by May 1, a near +125% gain. While Hyperliquid's core remains its low-latency perps exchange, the broader ecosystem around it is quietly unlocking new use cases for the HYPE token, and these developments are coming not just from the protocol team itself, but from the apps building on top.Staking & fee reform: Value now flows through HYPE

One of the most anticipated updates for HYPE is its new staking and fee discount system, going live on May 5th. This introduces a tiered discount model for traders, offering up to 40% off trading fees based on how much HYPE is staked. For example:- 10 HYPE = 5% discount

- 100K HYPE = 40% discount (Platinum)

- 500K HYPE = 40% discount (Diamond)

Add to this the account linking feature that allows users to connect staking and trading accounts permanently, and you get clear stickiness built into the protocol's design.

Cypher's integration: Spending HYPE in the real world

In late April, Cypher, a third-party payments solution, integrated HYPE into its network, allowing users to spend their tokens at 100M+ merchants across 150+ countries, including support for Apple Pay and Google Pay. While this wasn't a native Hyperliquid initiative, it's a meaningful win for token utility.The takeaway? Hyperliquid didn't push for this, builders did. The market demand to make HYPE spendable is growing, and projects are responding on their own. That's a powerful sign of ecosystem-led adoption.

HyperEVM & DeFi expansion

Hyperliquid's long-term thesis is evolving into a full DeFi platform. HyperEVM allows external projects to build on Hyperliquid's infrastructure, secured by the chain's custom HyperBFT consensus.Early signals are strong: the first AI-native hedge fund (by Spectral Labs) was just announced to launch on Hyperliquid. That's a bold bet on its infra stack.

Meanwhile, its Assistance Fund (AF) continues to reinvest trading revenue into daily HYPE buybacks, currently holding 1.16% of the total supply and executing ~$1M in daily repurchases. This is perhaps the most consistent on-chain buy pressure among current L1/L2 tokens.

Spot markets on Hyperliquid, Thanks to the unit protocol

Hyperliquid has been historically focused on derivatives, but the first spot listings are now live-starting with BTC and ETH, and soon expanding to assets like Solana and even trending assets like Fartcoin. These listings are being enabled by Unit Protocol, a dApp building within the Hyperliquid ecosystem.This shift marks the beginning of a broader transformation. Will the Hyperliquid Spot listing be the new Binance Spot listing?

The numbers behind the run

- Price (May 7): $21

- Market Cap: $7B

- Volume (24h): $159.9M

- Circulating Supply: 333.9M

- ATH: $34.96 (Dec 2024)

- Up from April low: +125%

- Buy pressure: $1M/day from AF

- TVL: Hype Bridge TVL: $2.25B, Hype L1: TVL $800M

Technical analysis: HYPE/USD and HYPE/BTC

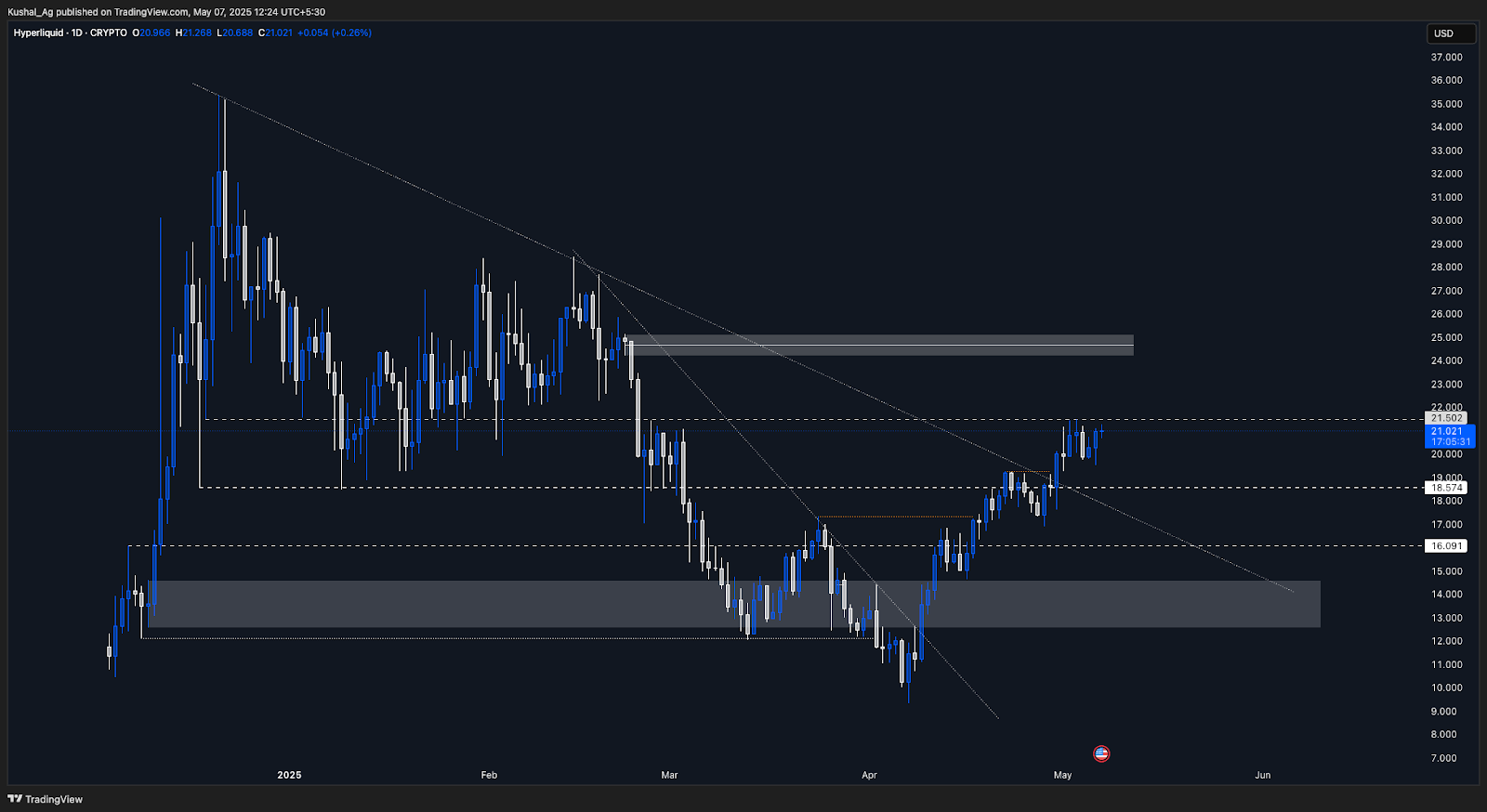

HYPE/USD

HYPEUSD broke out of its downtrend in late April and is currently consolidating under the $21.5 resistance. Price is hovering around $21, forming a base just below the marked supply zone. The move comes after a strong bounce from April lows.Immediate support sits at $18.57, with stronger support at $16 and a key demand zone between $12.6 and $14.6. This grey box was the reversal area during HYPE's brief dip to $9.3 earlier in April, a deviation that was quickly reclaimed, reinforcing the zone's importance.

Since then, HYPE has formed two bullish structure shifts on the daily chart, showing continued strength. There hasn't been a clean retest of the breakout trendline yet, so any pullback toward $16 or the demand zone could offer attractive entries.

On the upside, $21.5 is the first barrier. If broken, HYPE could target the broader supply zone from $24.2 to $25.1.

HYPE/BTC

HYPE/BTC shifted structure bullish in mid-April, breaking the orange trendline to the upside and marking its first significant structural change on the daily timeframe. Price took support from the grey box zone before shifting structure, a prior consolidation area from December 2024, acting as a major demand zone this time around.The pair initially took resistance at level 2 after the breakout, retraced back to level 1, and then bounced cleanly from there. This bounce led to a reclaim of level 2, where it's now consolidating above. This base-building above prior resistance is typically a bullish sign, hinting at strength.

If the current structure holds, HYPE/BTC may now push toward the next resistance at level 3. The consolidation phase just above level 2 suggests that buyers are accumulating and preparing for another leg higher if Bitcoin stays steady.

As of now, the pair has completed one confirmed bullish shift and may be on the verge of another. A breakdown below level 2 would weaken the short-term outlook, but the structure remains intact unless level 1 is lost.

3. FARTCOIN

It's not a joke anymore. Born out of AI, laced with absurdist humour, and deployed on Solana, Fartcoin has managed to push beyond meme status, at least for now.You can laugh at the name, but you can't ignore the chart. Before Bitcoin bounced, before Solana reclaimed strength, before Ethereum even showed signs of life, Fartcoin had already taken off.

While the broader market hit its local bottom in early April, Fartcoin bottomed nearly a month earlier, on March 10th, at approximately $0.199. From there, it ran hard, climbing over 550% to hit $1.28 by May 1st. It wasn't just early, but it was very loud as well.

That early strength also brought traction. Holder count has been rising, and Fartcoin's presence is now cemented with one of the biggest validations it could get: a Hyperliquid spot listing ticker. Outside of Bitcoin and Ethereum, barely any coins, let alone memes, have secured a native spot listing on the platform. Fartcoin did it first, ahead of the curve.

All of this while Solana continues to outperform Ethereum, and Fartcoin leads as Solana's most prominent meme breakout. If meme coin rotation flows toward SOL-led narratives in the coming months, Fartcoin already has the head start.

It didn't wait for the market to flip bullish; it front-ran the bounce and rode it 550% up. When the air gets thin at the top, Fartcoin's already used to floating.

As they all say, hot air rises…

The numbers behind the run

- Local Bottom: $0.199 on March 10th, 2025

- Local Top: $1.28 on May 1st, 2025

- Bounce: +550% in under two months

- Market Cap (as of May 2nd): ~$1.19 billion

- 24H Volume: ~$207 million

- Holders: 148,000+

- Socials: 75K+ followers on X, top meme engagement on Solana

Technical analysis: FART/USD and FART/BTC

FART/USD

Fartcoin bottomed earlier than the broader market in early March around $0.198 and went on to rally nearly 540% in just 50 days, topping out at $1.28. This made it one of the first memecoins to not just recover, but lead.The rally was supported by an uptrend that held from early April to early May, which has now broken. Fartcoin is currently retesting previous structure support at $0.98, a key level to watch. Below that, supports lie at $0.78-0.71, and deeper at $0.641 if momentum weakens further.

On the upside, the broken trendline now acts as immediate resistance. Reclaiming it could reestablish bullish structure. Above that, resistance zones are seen at $1.3 and $1.61, with the latter marking a high-conviction breakout level.

FART/BTC

FART/BTC saw a powerful 400% outperformance vs. Bitcoin over 50 days, but momentum has cooled since early May. The pair lost the uptrend and has broken below Level 3, now heading toward the grey box demand zone, a key area sitting between Levels 2 and 3 on the chart.If the grey zone fails to hold, a retest of Level 2 becomes likely. On the flip side, reclaiming Level 3 could trigger a range-bound phase between Levels 3 and 4, with a chance to resume upside if strength returns.

What the bounce tells us

The recent bounce across crypto was sharper and perhaps more revealing than most expected. Bitcoin rallied 30%, the total crypto market cap added over $700 billion in just a few weeks, and Solana did a wild 65% between April 7th and April 25th before cooling slightly. But what made this bounce stand out wasn't just the velocity; it was where that capital flowed.This wasn't a uniform, ETF-driven move. It was asymmetric, led by coins that, until recently, weren't even on most people's radar. We saw SUI, a Layer 1 that had been relatively quiet, suddenly attract institutional attention through ETF filings and strategic BTC integrations. We saw Hyperliquid, a DEX running its own chain, break out as traders rotated into perp-first ecosystems with real traction. And we saw Fartcoin, a Solana meme coin launched by an AI, rip higher with a 500%+ rally, dragging retail back.

This tells us a lot about where the market is mentally. First, meme coin speculation isn't dead. It just needed a spark. Second, traders are done waiting for stale narratives to play out. They're hunting for new execution, new products, new catalysts. Platforms that are shipping, Hyperliquid's fee program, and SUI's BTC integration are finally getting rewarded. And third, institutions are paying attention again, not just to Bitcoin, but to alt L1s with clean narratives and capital pathways.

The bounce could be a narrative reshuffle. This is a market that's moving fast, choosing winners early, and repricing the next cycle's themes before most even realize the last one's over.

Cryptonary's take

When the market bounces, it doesn't just reward strength, but also reveals it. This rebound was a signal. In choppy markets, money flows back in where there's energy, narrative, and structure. Coins that are quietly building strength, holding range lows, or shifting back into bullish market structure, those are the ones to watch.Our team is constantly tracking these shifts. Whether it's a meme coin showing relative strength, a Layer 1 reclaiming momentum, or a new narrative surfacing, we're on it. The job now is not to chase every pump, but to understand which moves are real, which have follow-through, and which are simply echoing liquidity rotations.

We'll continue to surface those insights, coin by coin, narrative by narrative, as the market unfolds. We have identified 3 assets that are showing relative strength. If the market were to correct as we expect, these assets are the ones to start DCAing if you plan to hold for the next 3, 6, or 9 months.

Peace!

Cryptonary, OUT!