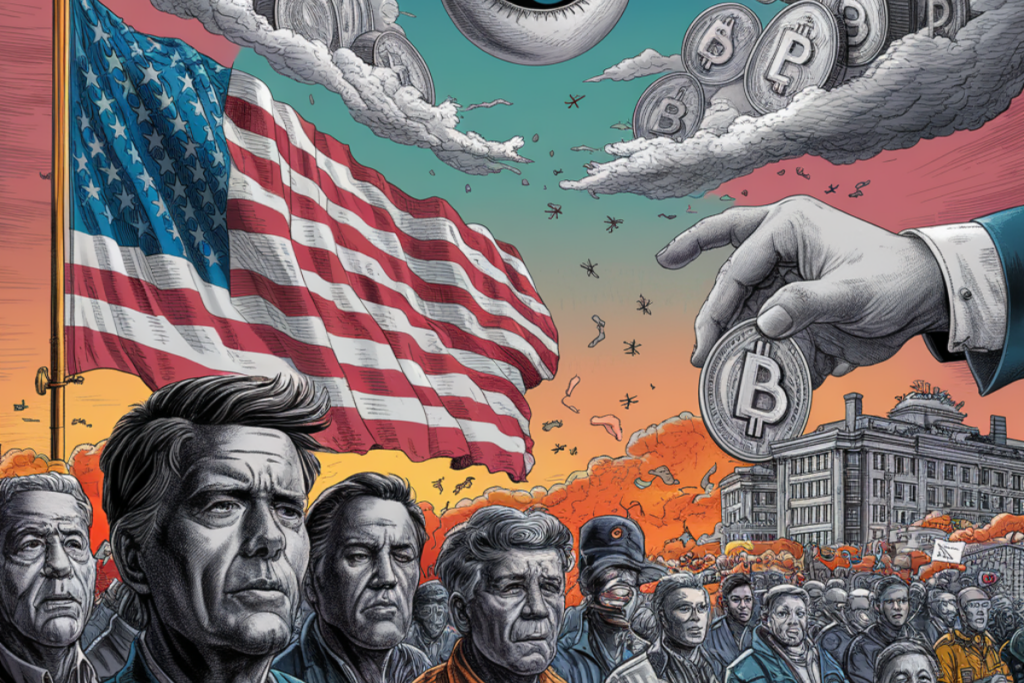

Once viewed with scepticism and negativity, the tides have started to turn as a new wave of acceptance sweeps across the crypto industry.

This shift is not just a fleeting trend; it reflects the growing maturity and legitimacy of digital currencies, and nothing makes this more apparent than the runup to the 2024 U.S. presidential election.

For the first time, both major candidates are actively courting the crypto community, a move that holds promising implications for the future of digital assets in the global economy.

This is good for the industry and definitely good for your portfolio.

Let's dive in

TLDR

- The 2024 U.S. presidential election is not just another political event. It's a potential game-changer for the crypto market, poised to propel it to new heights in the coming months.

- Both major candidates, President Joe Biden and former President Donald Trump, are making unprecedented overtures to the crypto community.

- Trump's acceptance of crypto donations and Biden's legislative efforts to foster digital asset innovation signal a potentially transformative era for the industry.

- Meanwhile, the rejection of a central bank digital currency (CBDC) and the historic approval of Bitcoin and Ethereum ETFs mark a significant shift in the regulatory landscape, providing a sense of stability and confidence for the crypto market.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the R.R. trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Crypto becomes a focal point in the U.S. election

Imagine a world where the race for the most powerful office on the planet hinges not just on traditional issues like the economy, healthcare, and national security but also on the future of crypto. In the 2024 U.S. presidential election, this scenario is becoming a reality.

We, Cryptonary, understand the stakes and laid out strategy on how to play the presidential race here.

But what is interesting about the 2024 election is that President Joe Biden and former President Donald Trump are making significant efforts to appeal to the crypto community as they prepare for it.

Trump has directly embraced cryptocurrencies by accepting donations for his campaign in digital currencies. This move is a landmark moment for digital assets and a sign of Trump's pro-crypto stance. Moreover, being aware of the anti-crypto stance of Democrats and Gary Gensler (The head of SEC), he directly stated that he is "fine with crypto" and that the current administration doesn't understand crypto. By doing so, Trump actively appeals to the crypto community and positions himself as a more crypto-friendly candidate than Biden.

In response to Trump's moves, Biden and Democrats have also been changing their stances. Biden has been working with Congress on legislation to promote the "responsible development of digital assets and payment innovation" in the United States, indicating a more favourable stance towards cryptocurrencies than before. This shift in policy is likely a response to Trump's recent success in appealing to crypto communities.

All in all, both parties are actively trying to be more crypto-friendly than the other, which can be a significant propeller for crypto assets and platforms to gain more legitimacy and adoption from the general population.

The Fed can't launch a CBDC

The United States is a key player in global markets, and its economic pulse often dictates the rhythm of the world economy. As we've often said, U.S. macroeconomics also moves the crypto market.While our macro outlook often focuses on the things we want to see in the U.S. economy, sometimes, the things we don't want to see are usually as powerful. For instance, we don't want a U.S.-powered CBDC.

Thankfully, the U.S. House of Representatives passed the CBDC Anti-Surveillance State Act, which prohibits the Federal Reserve from developing or launching a government-backed digital currency. This is bullish because it prevents a U.S.-backed CBDC and signals other countries to reconsider such plans.

The bill received support from 213 Republicans and 3 Democrats, with a final vote of 262 in favor and 192 against.

This legislation aims to prevent the government from issuing a Central Bank Digital Currency (CBDC), which is argued to lead to increased surveillance and control over individual financial transactions.

This is very positive for crypto, as it shows that U.S. politicians understand the threats of CBDC. Crypto's ethos is to solve these issues, and the ban on CBDC will help true crypto platforms and assets continue to innovate and be accepted by both governments and the general public.

BTC and ETH ETFs are approved

The approval of spot Bitcoin ETFs in 2024 has significantly impacted the crypto market by increasing liquidity, legitimising Bitcoin as an investment asset and attracting institutional investors into the crypto market.

The demand for Bitcoin ETFs has been incredible, as it fueled BTC price to reach its all-time highs even before the halving, which is very unusual. However, since the BTC ETF approval, the next biggest asset in line was ETH.

However, given the negative stance of Gary Gensler on ETH and the rest of the market, many were anticipating the rejection of ETH ETFs.

Thankfully, the recent shift in the political landscape led to a pleasant surprise on ETH ETFs. The U.S. Securities and Exchange Commission has just approved 19b-4 applications from 8 financial institutions to issue spot Ethereum ETFs, marking a significant development for ETH as an asset class.

This approval is seen as a validation of Ethereum's status as a non-security even though Gary Gensler repeatedly refused to give clarity on Ether's status and was leaning towards classifying it as a security. But, at the end of the day, it appears that what is security and what is crypto is a matter of politics, and things can change 180 degrees in a matter of days.

But don't be too euphoric. The recent approval is not the final say in the ETH ETFs case. They still need to have their S-1 registration statements become effective before trading can begin, but we believe things will be fine on that front as well.

Overall, we are very pleased with this development as it legitimises crypto and opens the door for other cryptocurrencies and future ETFs to enter Wall Street.

FIT21 received bipartisan support

Another proof that the U.S. is becoming pro-crypto after so many years of being hostile to it is the fact that The U.S. House of Representatives passed the Financial Innovation and Technology for the 21st Century Act (FIT21) with bipartisan support, aiming to establish a clear regulatory framework for digital assets in the United States.

The legislation includes provisions for enhanced investor protection, addressing issues related to stablecoins, and clarifying regulatory jurisdiction between the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC).

Moreover, The White House has indicated that it will not veto the legislation, marking a significant step towards providing regulatory clarity for the cryptocurrency industry.

What else do you need? The U.S. is embracing crypto, and the future looks bright.

Cryptonary's take

We are in the most positive period in the history of crypto.Politicians are fighting to appear more crypto-friendly. Ethereum is getting an ETF, which will inject liquidity and potentially start an altcoin season. Crypto-related bills are getting bipartisan support, and cabal stablecoins (CBDCs) are getting banned.

The stars are aligned for the continuation of the bull run.

We are very bullish about crypto's prospects in the mid-and long-term. However, we are still wary in the short term due to the macro environment. We hope for a resurgence in the bullish rally but acknowledge that it may not happen until liquidity begins to pick up again in Q3 or if there are big inflows into the ETH ETFs when they start trading.

The future has never been brighter for crypto; the market has never had it better, and there's no reason to panic.

Crypto is here to stay; don't yield the advantage, don't get shaken out of your positions, don't fumble the bag.

Cryptonary, Out!