State of the memecoin market

The memecoin market has always been a wild ride, but lately, it's gone from unpredictable to insider games. Political figures, entire nations, and deep-pocketed insiders have been blatantly extracting value from the market, leaving retail investors scrambling. But we have a thesis. Let's explore where the memecoin market is headed next.

In this report:

- Rugs and insider games

- What is next for memes?

- Cryptonary's take

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is happening in the memecoin market?

Alright, buckle up, because the memecoin sector has been an absolute rollercoaster lately, and we've got the front-row scoop for you. As someone who's been deep in the trenches of this market, we can tell you it's no secret that things have gone completely off the rails with the recent memecoin launches.Let's start with the big one: Donald Trump, after launching NFT and DeFi projects, decided to jump into the memecoin game. He launched his Official Trump (TRUMP) token on January 18, 2025, right before his inauguration. The thing exploded-skyrocketed to a $14.5 billion market cap at its peak, with retail investors piling in trying to catch the move.

But here's the kicker: instead of building something sustainable, it turned extractive fast. Insiders and early snipers cashed out big, and the token's now down over 76% from its high. Classic pump-and-dump vibes-except this time, it's got the Trump brand stamped on it.

Not to be outdone, Trump's wife Melania launched her own memecoin on Solana the very next day, January 19. It surged too, but the memecoin honeymoon didn't last down over 90% now, leaving retail bagholders in the dust while insiders walked away with millions again.

Now, seeing Trump's playbook, the Central African Republic decided to hop on the memecoin train as well and promptly rugged it. The Central African Republic's president endorsed a token that shot up, then tanked hard, again allowing insiders to extract millions from the market.

But the real fireworks hit when Argentina's President Javier Milei got in on the action with the Libra (LIBRA) token. Backed by Milei, it hit a $4.4 billion market cap only to crash 94% in hours after insiders yanked $107 million in liquidity.

Turns out, a VC firm was in on it, and the whole thing reeks of coordinated extraction. The team behind (led by Hayden Davis) sniped the launch of their own token, and later, he pulled over $100m in liquidity, so the chart nuked to zero, extracting over $100m from the trenches.

Seeing all of this, public outcry has been unreal, Milei's facing impeachment calls now, and Argentina's stock market took a dive. It's a mess.

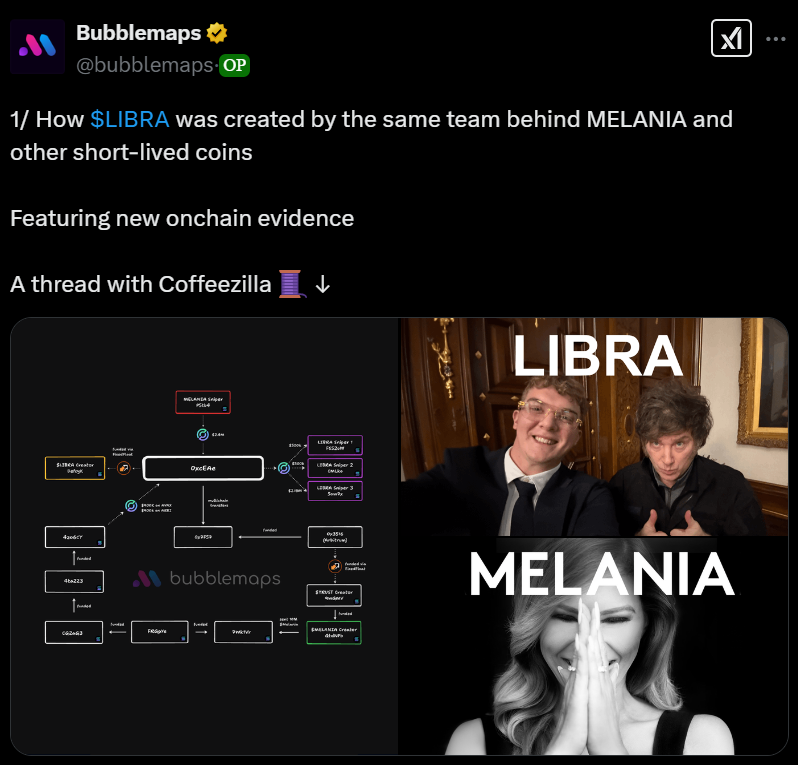

Here's where it gets juicy, though: the Melania-Trump-Libra connection. Blockchain sleuths at Bubblemaps dropped a bombshell, linking the same wallets-like one dubbed "0xcEA"-to both the MELANIA and LIBRA snipes. These insiders knew the game, snagged early positions, and cashed out at the top.

Hayden Davis even admitted on Coffeezilla's stream that he sniped MELANIA too, calling the whole fiasco "a plan gone miserably wrong" rather than a rug.

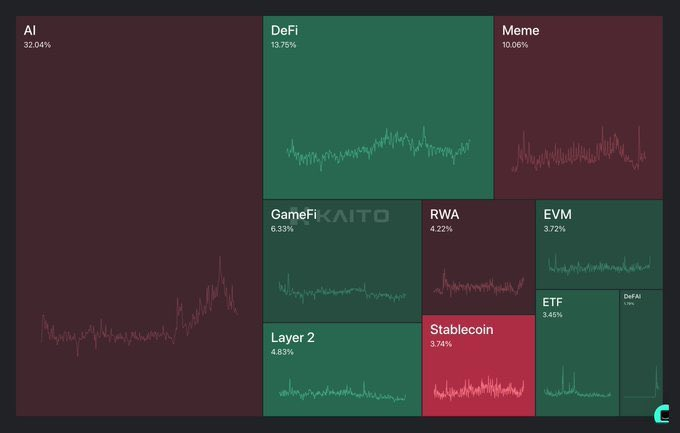

Unfortunately, the public didn't share his views. As a result, the memecoin market has experienced one of the strongest reputational damages while memecoin mindshare has decreased as are result.

What is next for memes?

Alright, so after all the insanity in the latest sh*tfest, we think we're actually heading somewhere good. Yeah, it's been a trainwreck, but hear us out: it's not the end of memes, just the end of the garbage ones. The market will heal and we'll see a comeback of true cult coins-not that rug-pull nonsense, but real communities that stick around.Remember, real memecoins communities are:

- At least 6-12 month old

- Recovered multiple 80% drawdowns

- Fully community-owned; no central figure or celebrity involved

- Create and push content every day

- Create art, culture and merch

- With funny one-liners and memes

- Organic and fair distribution

- Bond over a common goal or mission

Therefore, it is important to differentiate memecoins and know what you are playing with. We won't go into themes like animal, politifi, country, etc but there are some types of memecoins:

- OG memes

- Cult memes

- Lifestyle & Culture memes

- Overnight memes

- Extractive memes

Are we bullish?

We'd bet that memecoins aren't going anywhere. Cult memes like DOGE and PEPE are still fine. Furthermore, there were already ETFs filed for DOGE and BONK memecoins. Polymarket estimates that the probability of DOGE ETF being approved in 2025 is 75% as of the time of writing. It suggests there is an addressable market for memes among TradFi investors. The meme narrative is likely to get a push off this ETF approval if it happens.Furthermore, people still wanna strike it rich, and as long as that's true, it is unlikely for memecoins to fade into irrelevance. The desire to gamble and win big will always be there, and the memes are still the purest speculative tool to "make it". Additionally, for risk-savvy investors, they are the easiest way to get a dopamine hit when the risk-on environment returns.

Let's also not forget about the impact of memes on internet culture. Memes are funny and unite people in the era where everyone is increasingly online, they provide community and bond people with similar interests and views. Memes are also evolving, starting from animal memes, the sector is spanning into brands, multi-cycle cultures, movements and entertainment accounts on social media (e.g. Pudgy Penguins) in real-time.

But bad actors and rugs? Yes, but every now and then, it happens in almost every market: the stock bubble in 2001, the mortgage crisis in 2008, ICOs, NFTs, and DeFi. Whenever there is a new booming market, it invites bad actors to capitalise on the hype. However, over time market exposes them, and then it heals and evolves further. Therefore, we are likely to see a flight to quality in memes as well.

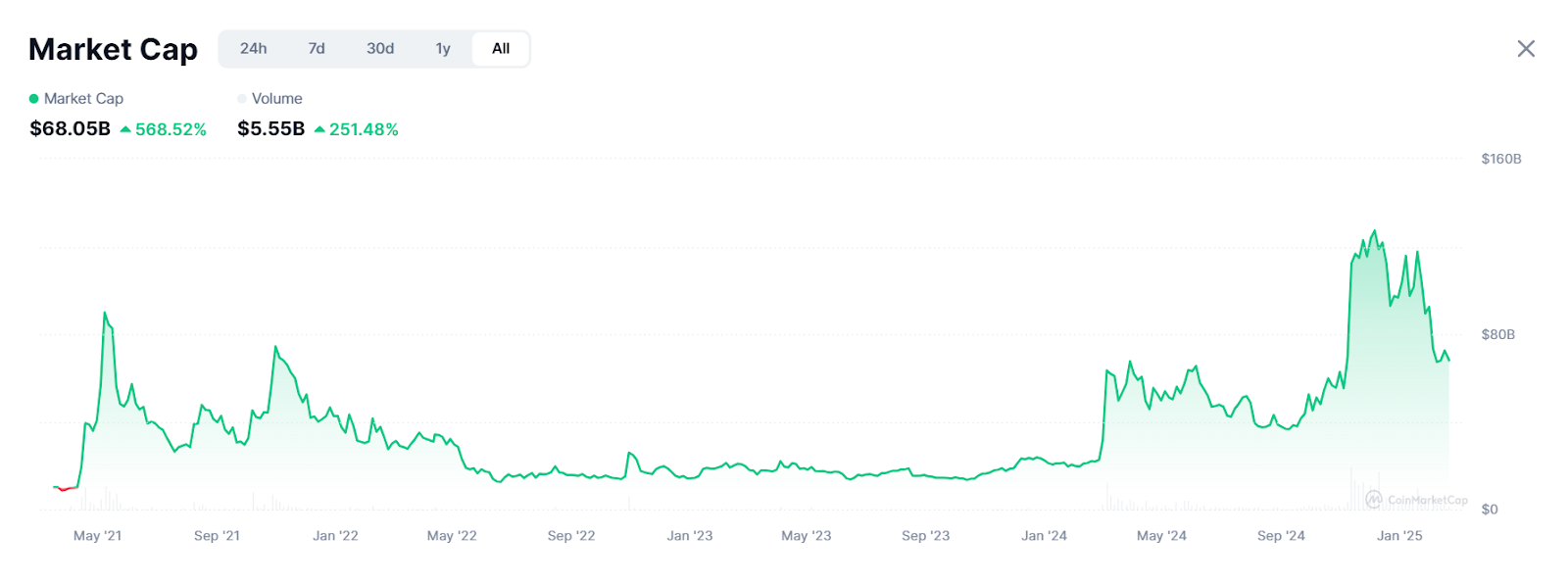

Let's look at the historical market cap of all memes; despite almost a 50% drop from the recent highs of $130b, the meme sector is still valued at almost $70b mcap, and it is testing last cycle highs currently. When zoomed out the sector is still fine despite all the blood.

Okay, memes are staying, so what? We will likely see new runners or winners emerge in this category in the next part of the cycle. As we know, due to dispersion, none of this-cycle cults have managed to break the $3b-$5b market cap ceiling. And none of them could sustain above $1b as well.

We haven't seen any new community enter the PvE meme club led by DOGE. That means there is still space in the next 12 months, when risk-on returns, for new cults to try their luck, reach an escape velocity and create real wealth for their communities.

We will see communities strive to get approval from the market and enter the ranks of multi-cycle memes. The winners are likely to come from sub $100m mcap but from real cult communities that will form. There should be an upside for meme lovers to fuel the momentum, therefore, it is likely that it will be new cults that will lead the next leg up in memes.

Cryptonary's take

So, yeah, this is how we see the memecoin sector playing out. For now, we are risk-off, and we recommended allocating to stablecoins a month ago. Many memes, altcoins, and even majors have been down and struggling since then. We expect the market to be choppy, with further downside on the cards.But that's not necessarily a bad thing. This cooldown gives the market time to reset, shaking out bad actors and letting trenches heal. As the dust settles, we will see a flight to quality, where only strong community-driven memes will thrive.

The key now is patience. The memes are staying and great opportunities will still emerge when the market turns risk-on again. Stay sharp, stay patient, and be ready.

Cryptonary, OUT!