Prices change by the second, new opportunities constantly emerge, and keeping it all straight can feel like a full-time job.

But Telegram bots are here to save the day. These simple applications built on Telegram allow you to monitor prices, execute trades, farm airdrops, and more - there is no need to toggle between multiple apps.

Today, we'll explore how Telegram bots can make the crypto experience smoother. We'll analyze two popular bots, spotlight the opportunities, and alert you to the risks.

And we haven't forgotten the investor in you - we'll be sharing an under-the-radar token related to Telegram bots that we believe could be a smart investment opportunity.

Let's dive into how Telegram crypto bots can simplify your crypto experience while potentially padding your portfolio.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Introducing Telegram bots

Telegram bots are user-programmed applications on Telegram that can help automate tasks like trading, price checking or airdrop-farming.The subsection of Telegram bots that appear to have found product-market fit are the crypto trading bots. These bots can connect to DEXes and execute transactions based on predefined rules.

The advantages of using crypto trading bots include:

- Faster transactions

- Convenience

- Ability to get into new tokens at the very launch or when there is large liquidity being added (Telegram Snippers)

- Anti-rug features (the bot can front-run a developer attempting to rug users by detecting such transactions in mempool and pulling out of the liquidity before the rug pull is executed.

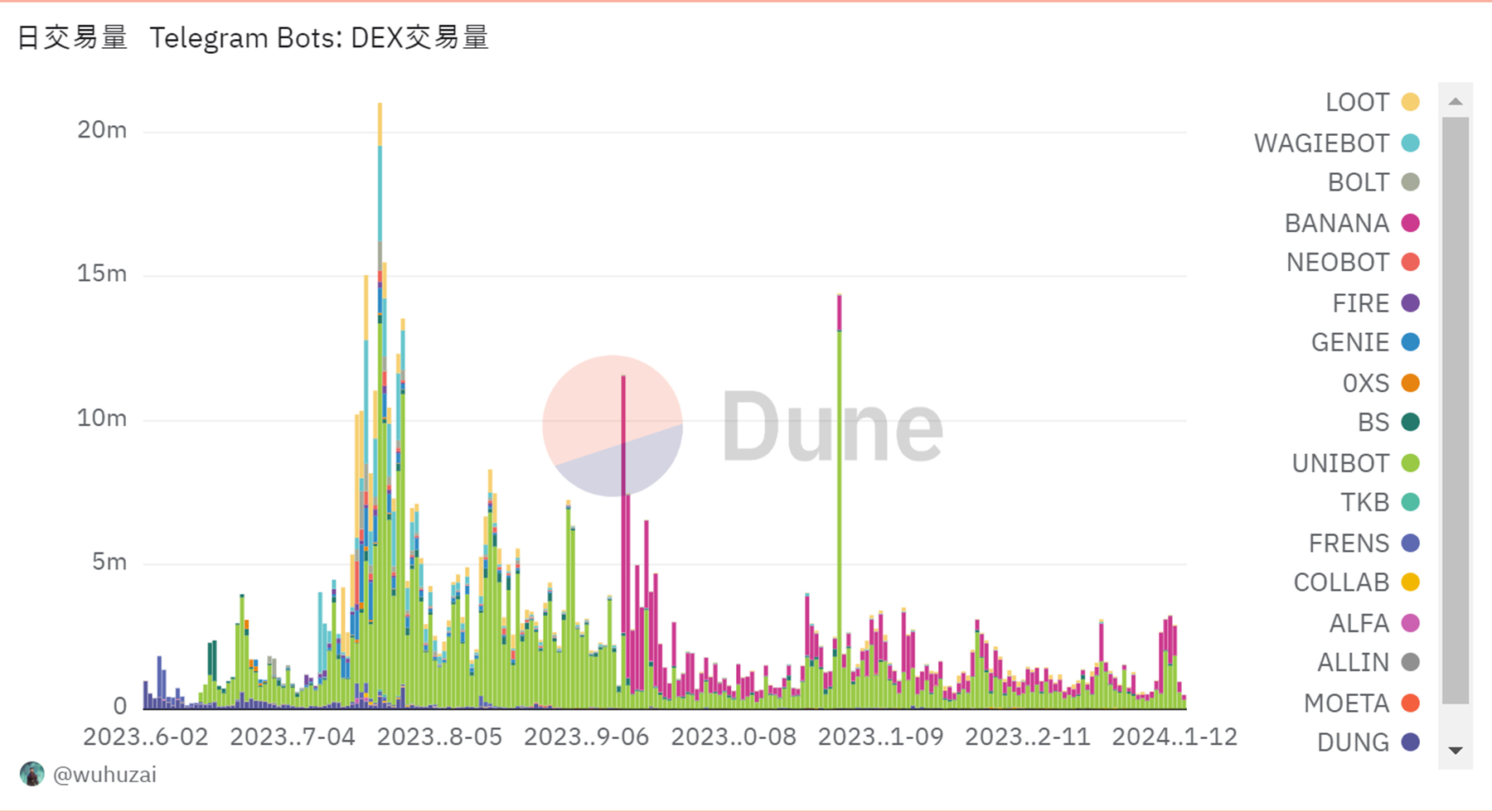

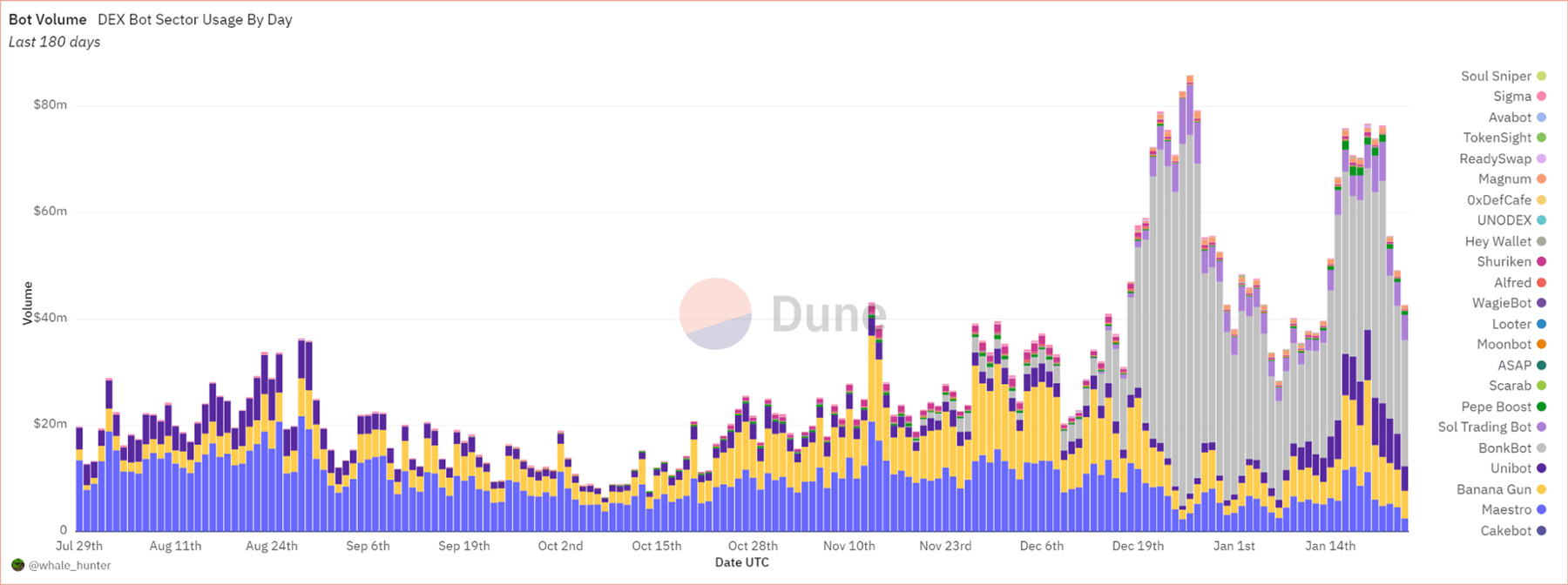

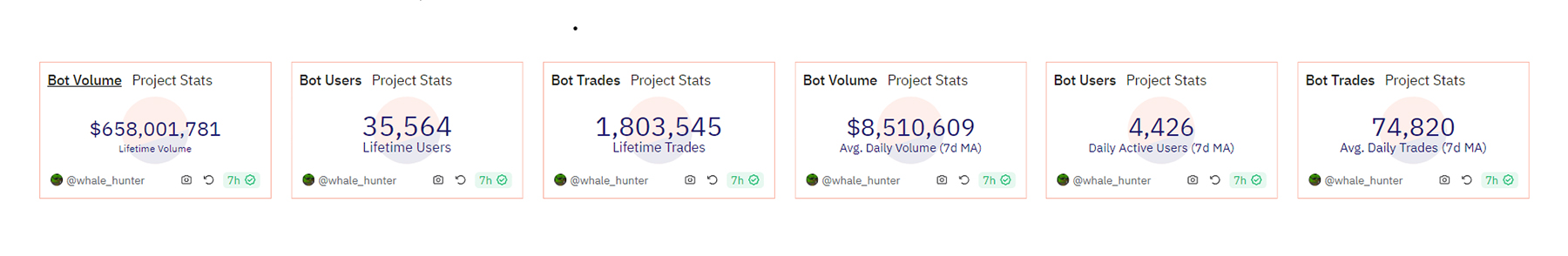

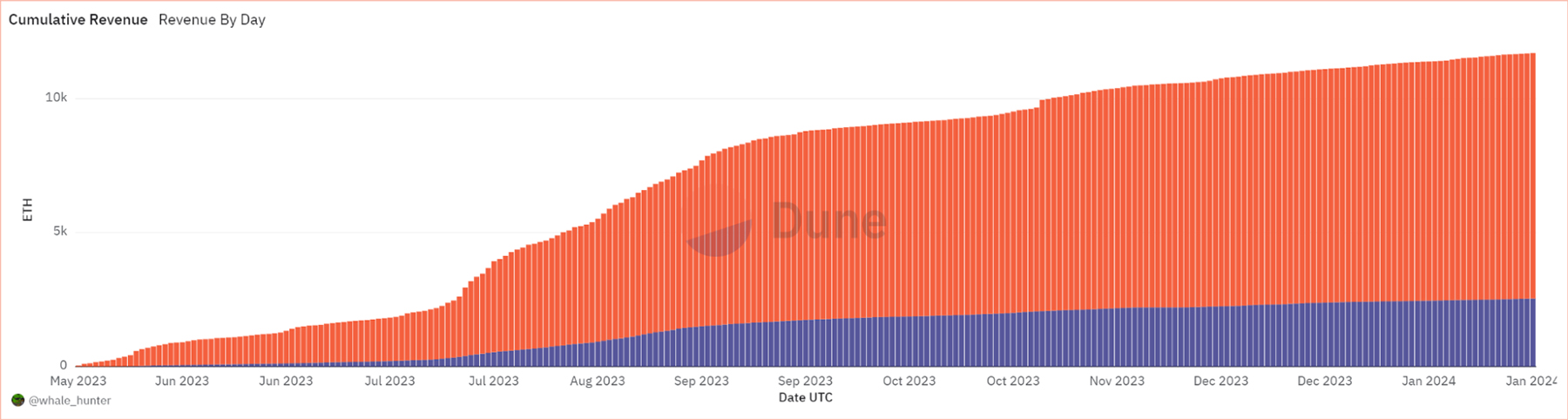

For instance, the volume generated by these bots peaked around July 2023 at over $20m per day and has gradually decreased since then.

However, the volume has been on the uptrend since November 2023, peaking at over $80m in late December.

The first pump in volume, we suspect, was a test pump (or novelty pump), and the second pump is telling us that these bots have found their user base and that they are here to stay.

The first pump in volume, we suspect, was a test pump (or novelty pump), and the second pump is telling us that these bots have found their user base and that they are here to stay.

The risks of using trading bots

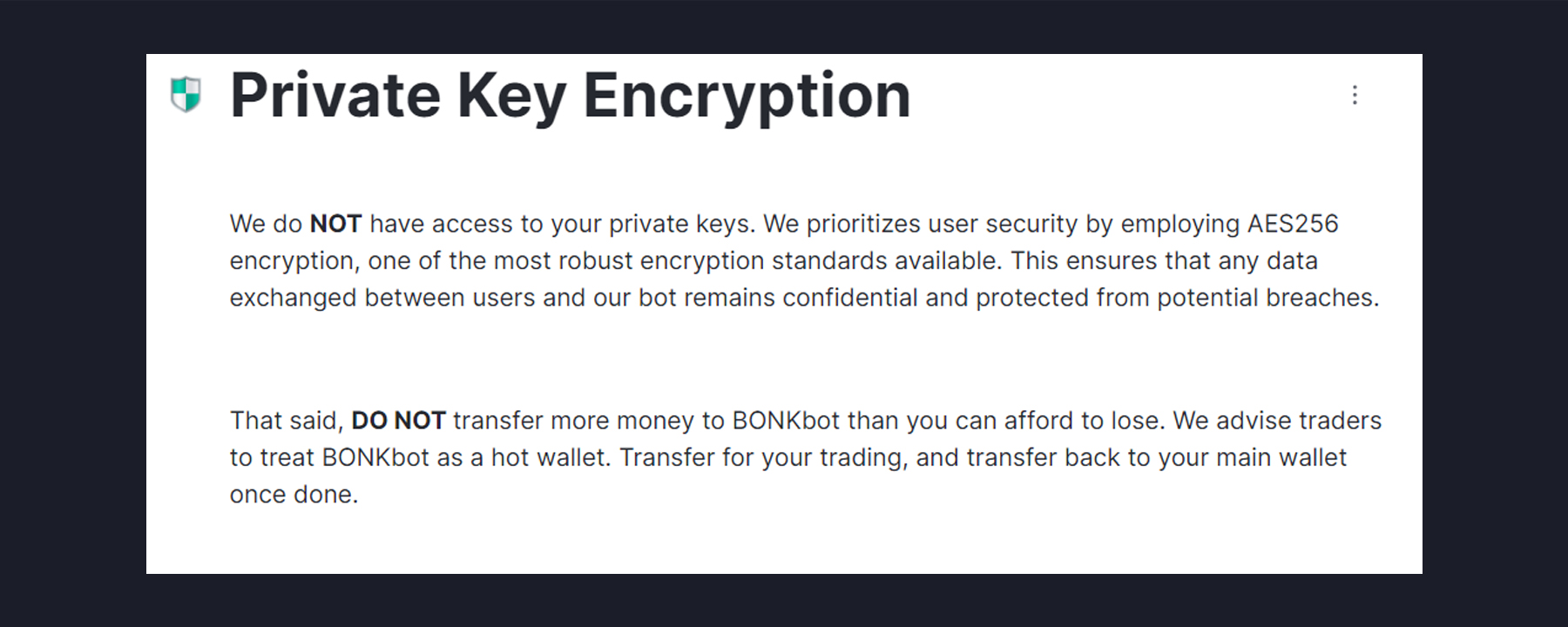

While using trading bots can be convenient and efficient, they have some inherent risks.The biggest risk is that a 3rd party may have access to your private keys.

The bots sign transactions on your behalf to execute trades automatically and efficiently.

You are essentially handing over your wallet to a bot (or the developer) – this is a serious security risk.

Interestingly, many of these bots claim to have no access to users’ private keys. However, we recommend caution as these tools are relatively new and not battle-tested.

To be safe, we recommend creating a new wallet and not importing your main wallet into the bot. So, create a new wallet, transfer only the funds you are comfortable with to the bot, and use that wallet exclusively for your crypto bot activities.

In this report, we will overview two popular trading bots, and at the end of the report, we will share a Telegram Bot we believe could be an excellent investment opportunity.

So let’s get started.

UniBot

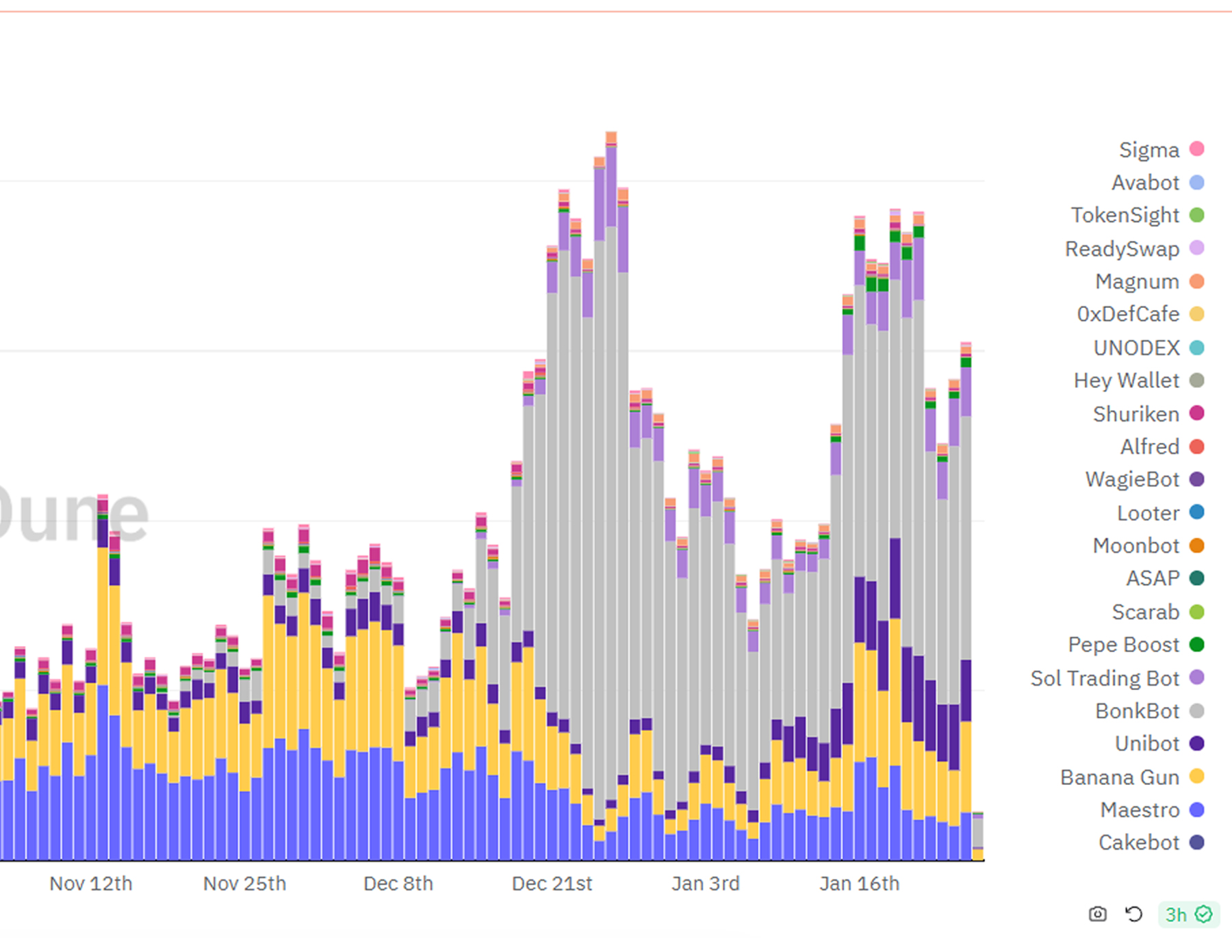

Unibot, launched in May 2023, has become one of the most popular trading bots in the market.The bot provides MEV-resistant swaps, copy trading, limit orders, and 40% revenue share with token holders.

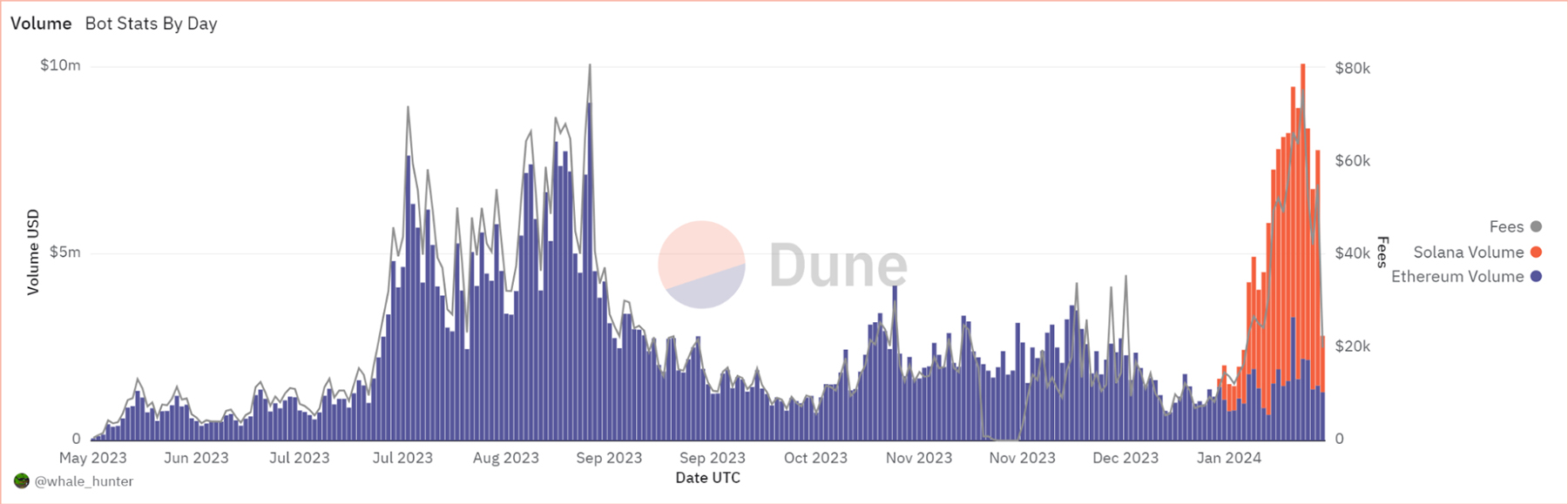

Recently, UniBot launched on Solana and experienced a surge in transaction volume and fees.

As of today, the bot facilitated over $600m of trading volume with an average of 4000 daily active users.

For comparison, the CoW protocol (another MEV-resistant aggregator) facilitated over $7.6b in trading volume in the same period.

We found it very interesting that despite 10x times more trading volume, the CoW protocol generated ten times less revenue to distribute to its token holders.

How?

UniBot has a 5% tax on all Buy/Sell transactions, with 2% of that allocated to UniBot holders as revenue.

As we can see from the above image, tax revenue (orange) is consistently much higher than trading Fees (blue).

We have seen a couple of projects adopting this strategy as a source of revenue.

Undoubtedly, during a bear market, taxes wouldn’t work, and they’ll most likely discourage all the trading activity on the project.

However, in a bull market, taxes seem a nice addition as a revenue source.

However, we must note that it makes the project very centralised since devs can change % taxed at any time.

Since we introduced you to Unibot, below is a video of how the project works in practice.

BonkBot

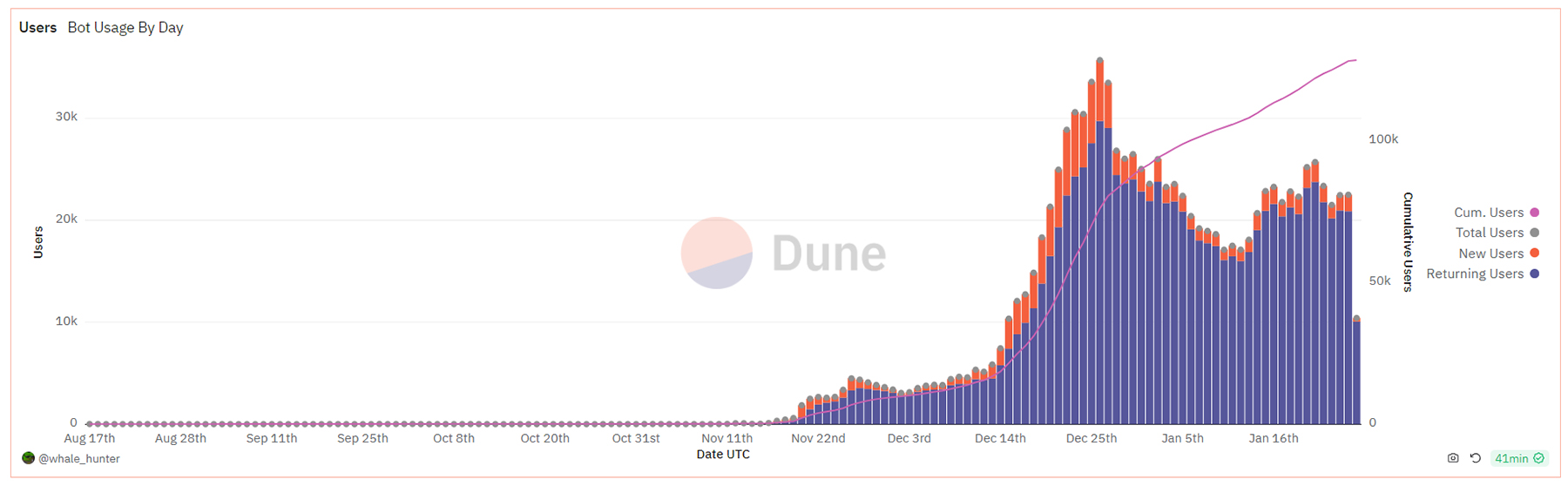

BonkBot is a popular trading bot on the Solana blockchain. It is one of the fastest ways to trade crypto assets in the market right now. As the name suggests the project was born out of the Bonk community on Solana. In the documentation, it is described as the only official partner of $BONK Community.Since its launch in November 2023, BonkBot has taken over the trading bots market by storm and quickly became one of the most used bots.

The number of BonkBot users has exploded since the launch.

It is one of the most used TG bots in the market.

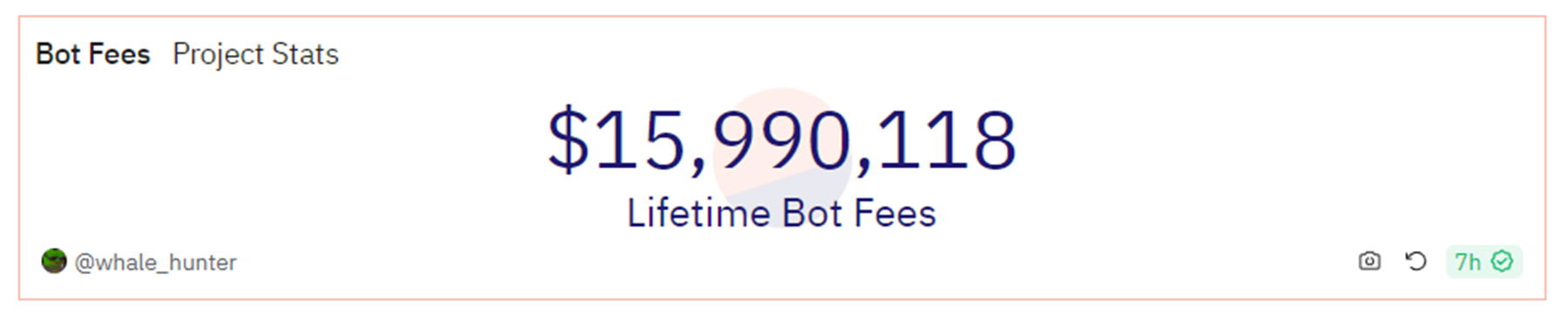

In 3 months, it has generated almost $16m in fees. That is potentially $64m in fees annually.

All these fees are used to buyback $BONK from the market and distribute to the BONK ecosystem participants. 10% of the bought-back $BONK is instantly burnt.

We covered BONK as a memecoin investment here.

You can find more information on how to use Bonkbot here.

Now, moving to the bot that we are most excited about

LootBot

LootBot, launched in July 2023, is a Telegram bot that allows automated airdrop farming. It helps users automate their repetitive on-chain interactions and is designed to make it easier for users to farm various airdrops stress-free.The team has successfully sybilled the Arbitrum airdrop in the past and is offering LootBot to maximise the chances of receiving airdrops by making each wallet unrelated and uncorrelated.

Recently, they have been successful in “Looting” zkFair and Manta airdrops for their users and tokenholders.

Basic information

- Market cap: $3m

- Circulating supply: 84%

- Market cap (fully diluted): $3.5m

Business model

The LootBot team developed a Telegram bot for efficiently farming various airdrops, including Manta, Linea, zkSync, Wormhole, etc. Users can subscribe to the “Freemium” plan, which is basically a free version of the bot. Users can use the bot to farm airdrops for free; however, when an airdrop is received the user receives only 80% of the airdrop amount. The LootBot retains 20%Alternatively, users can pay $30 per month/chain and receive 100% of their airdrop. In this scenario, 75% of the revenue from subscriptions is shared with token holders.

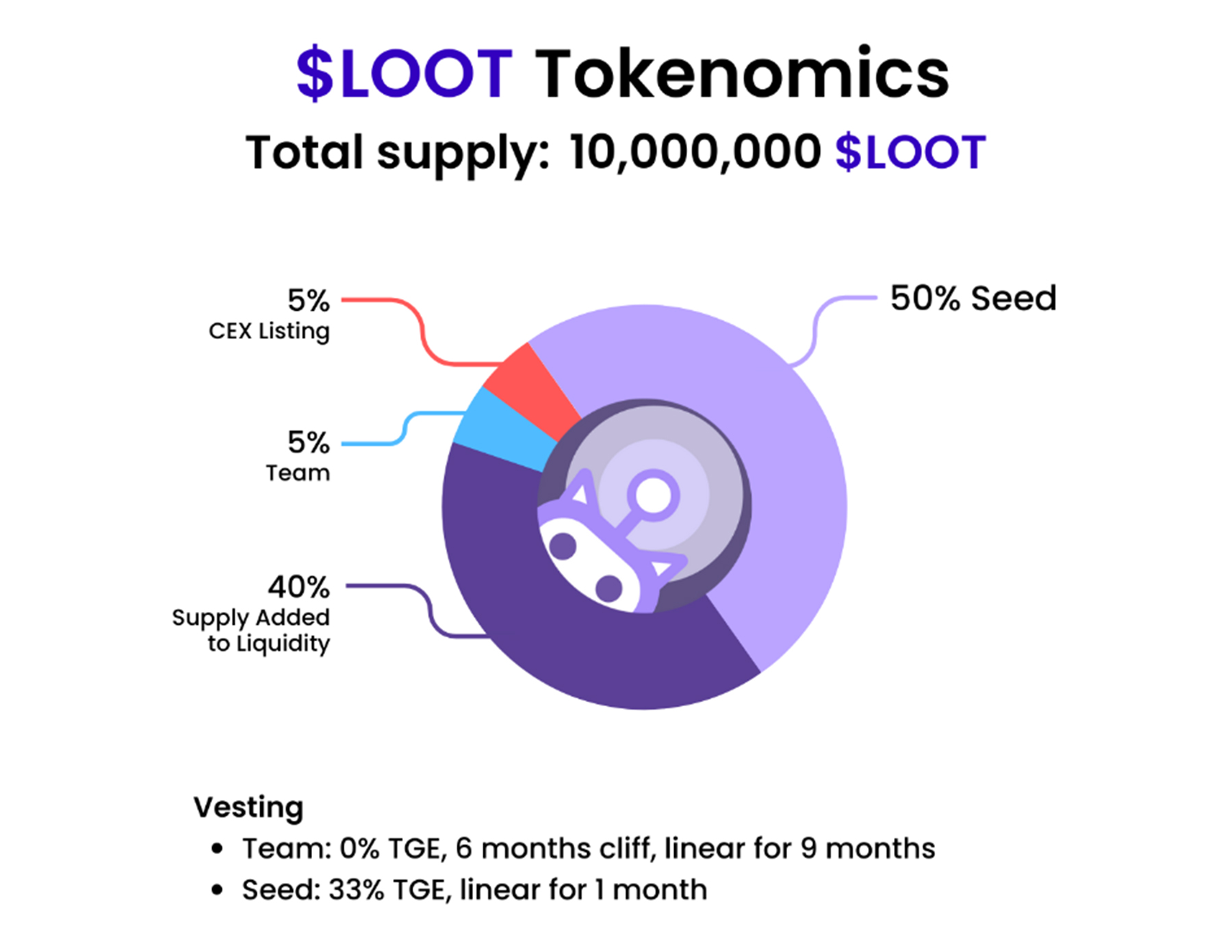

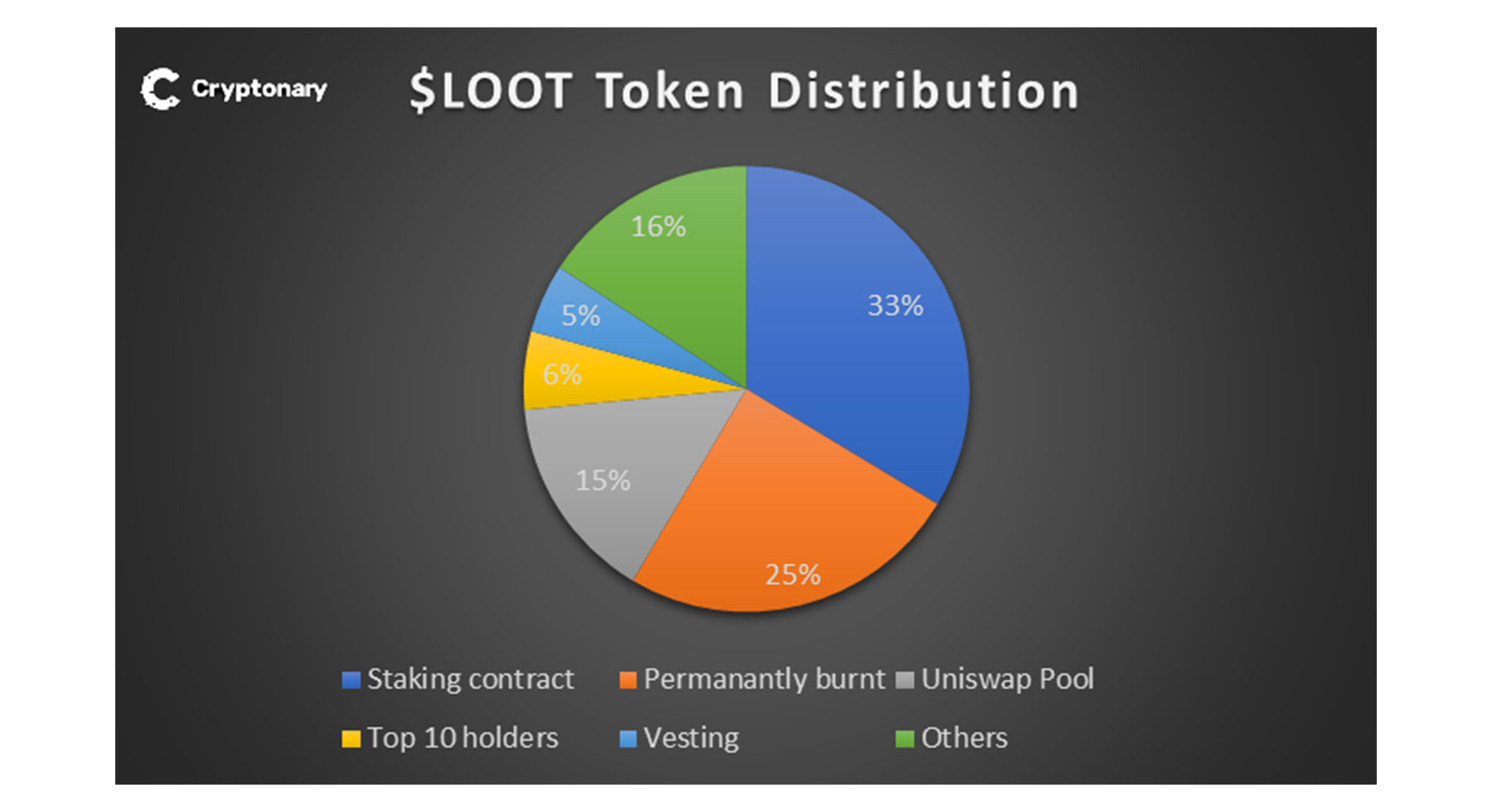

Tokenomics

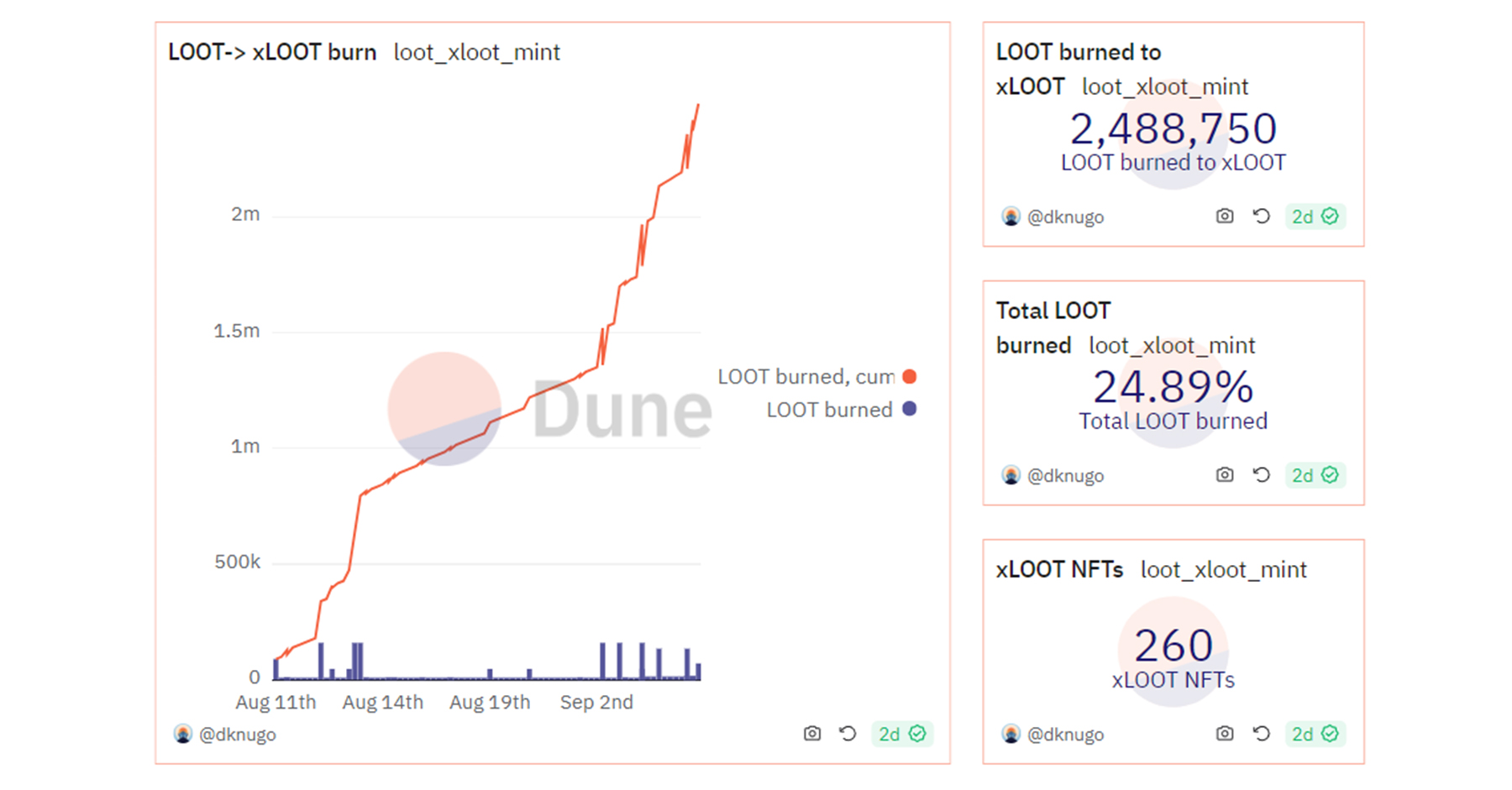

The tokenomics of Lootbox is very intriguing.They have two tokens, $LOOT and $xLOOT. $xLOOT holders receive more revenue and airdrops share than $LOOT stakers. However, to mint $xLOOT, a user must irreversibly burn $LOOT tokens, which makes this token deflationary.

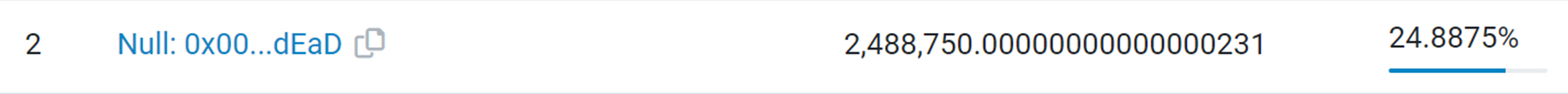

To date, almost ¼ of the total supply of the tokens has been irreversibly burnt. We can verify it on-chain.

$LOOT and $xLOOT holders get a revenue share from subscription fees paid by LootBot’s premium subscribers. Additionally, tokenholders receive a 20% cut from “Freemium” users’ airdrops. Additionally, $LOOT holders can get a 50% discount for the “Premium” subscription plan. Lastly, there is a 5% tax on Buy/Sell transactions, 1% of which is distributed to LPs, 2% to token holders, and 2% to the team.

To date, they have generated $647,304 in revenue in ETH in 6 months. $219,109 came from subscription fees, and the rest came from trading taxes. Additionally, tokenholders got 20% of “Freemium” users’ airdrops in ZKF and Manta.

We are quite impressed. Generating almost $650k in 6 months, which translates to a $1.3m annual revenue, is an impressive feat for a $3m mcap token.

Token distribution

Initial token distribution heavily favoured early investors, allocating 50% of the supply vested over one month.

Fortunately, the project is six months old, so all the selling pressure from seed investors has already been absorbed.

Current token distribution is much more favourable.

There are currently 2.5K tokenholders. 33% of the supply is currently locked in a staking contract. 24.89% of the supply has been permanently burned. 15% of the supply is in the Uniswap pool. The top 10 wallets hold around 6%, and 5% of the supply is vesting.

Current distribution seems to be much better and more investable.

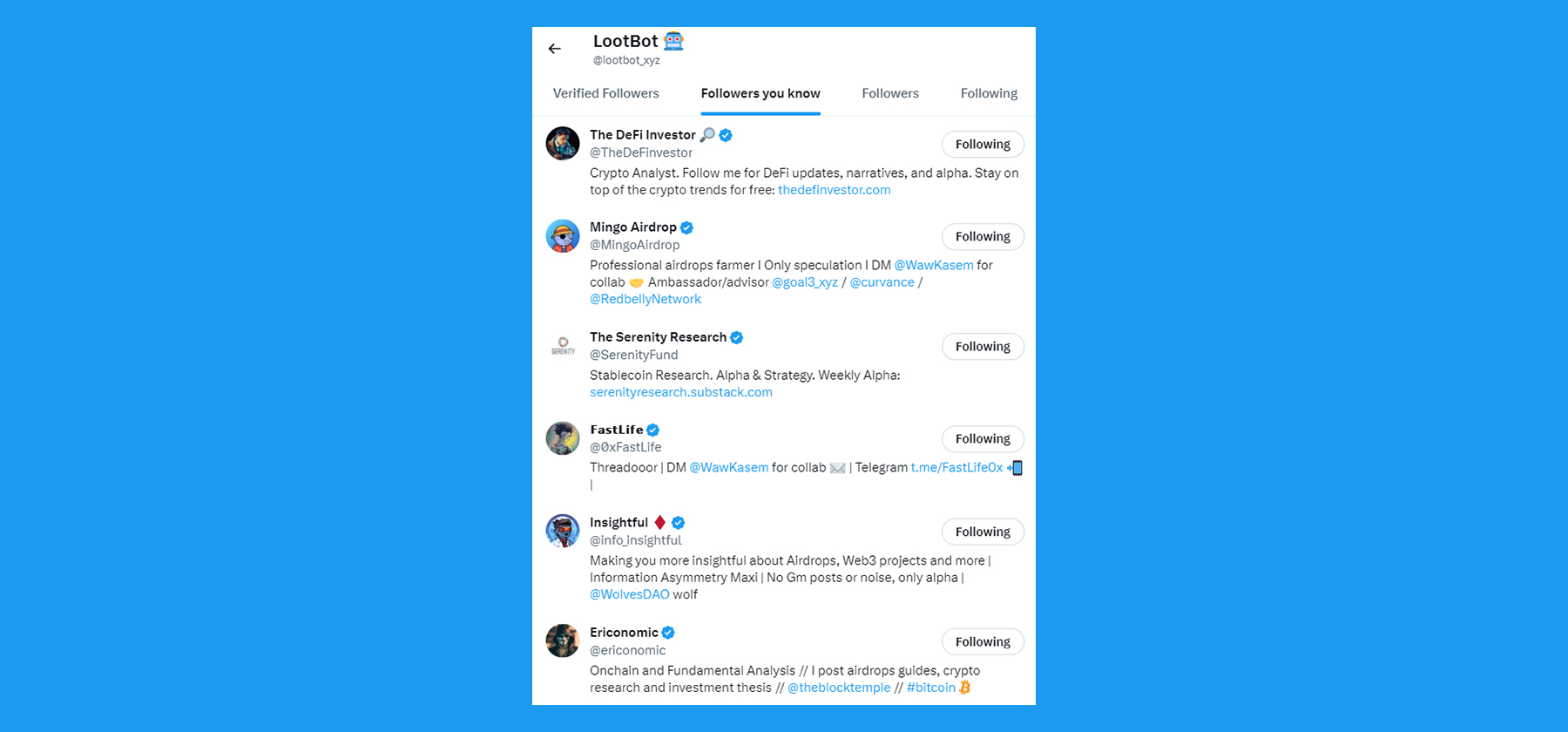

Is this project legit?

The team is anonymous. However, the official Twitter account is being followed by many legitimate people.

Of course, this, by itself, doesn’t mean the project is legit. However, it adds some confidence that the project is under the radar of people who have solid reputations.

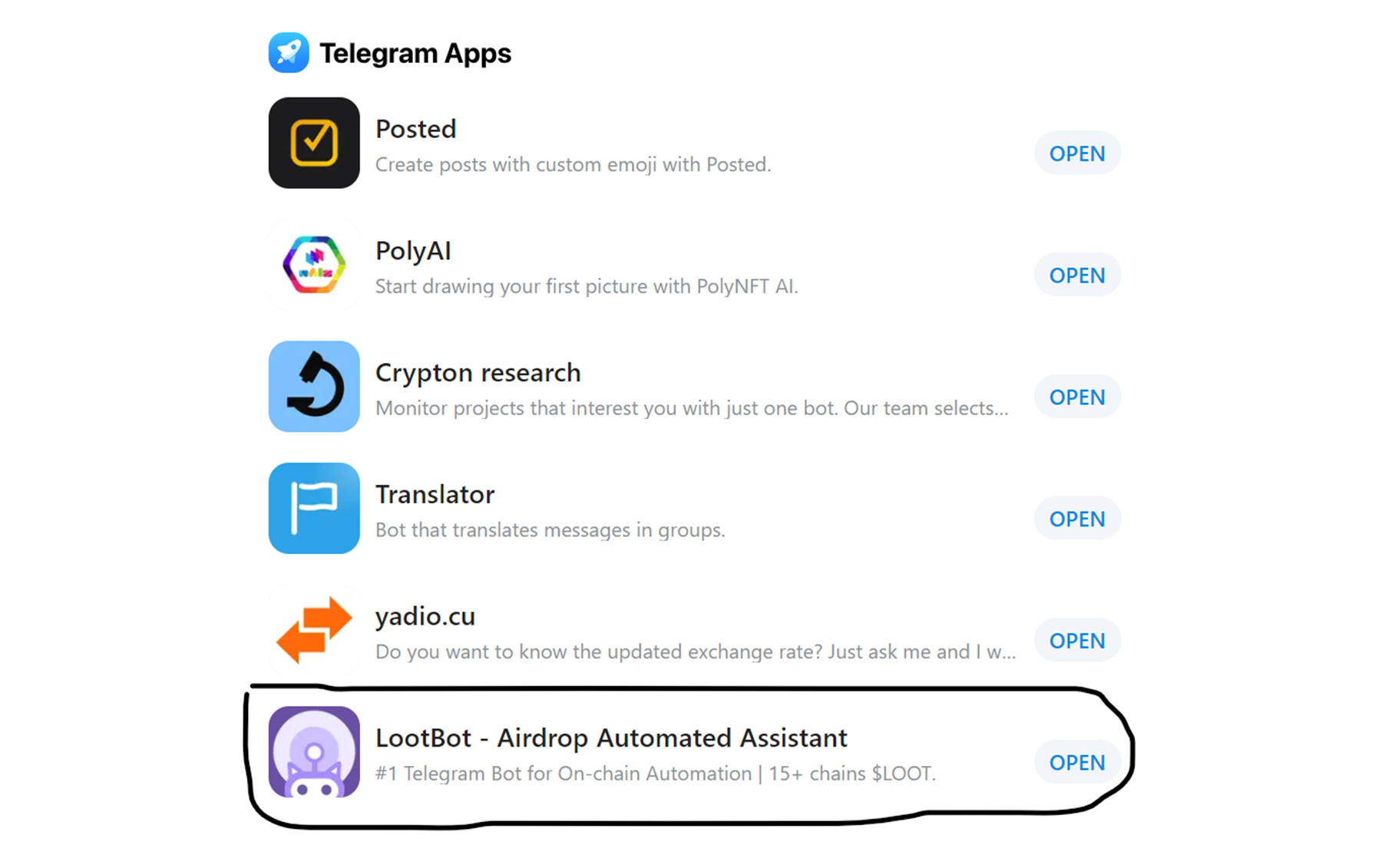

A better sign is LootBot’s announcement in Aug 2023 that they have partnered with TON Foundation and will work closely with the Telegram team to integrate the bot natively with an in-built Telegram wallet and the wider Telegram ecosystem.

Additionally, they have announced that LootBot will be listed in the official Telegram App Center as one of the verified TG bot partners. And as of Jan 2024, the bot is listed indeed.

This partnership with the Telegram team and consequent listing on the App Center adds reasonable confidence to assume that the project is legitimate and potentially investable.

Investment thesis

As airdrops continue to gain mindshare during the bull run, $LOOT can offer another way to profit from the narrative even if you aren’t actively farming airdrops.2024 is a big year for airdrops. Many tokenless protocols will be launching their tokens (Wormhole, LayerZero, zkSync, Linea, etc). Keeping up with all of them is tiring and time-consuming. LootBot can be a great tool to automate the airdrop farming process.

Simply put, the popularity of airdrop-hunting will potentially increase $LOOT’s revenue and trading activity. Relative to the bot’s revenue in the last six months, the market capitalisation is undervalued (mCap: $3m vs annualised revenue: $1.3m).

The tokenomics also look great: well-distributed with real-yield flow and deflationary features. With the bull market, many people might be tempted to permanently burn their $LOOT to mint $xLOOT, creating permanent supply shrinkage, which is good for investors.

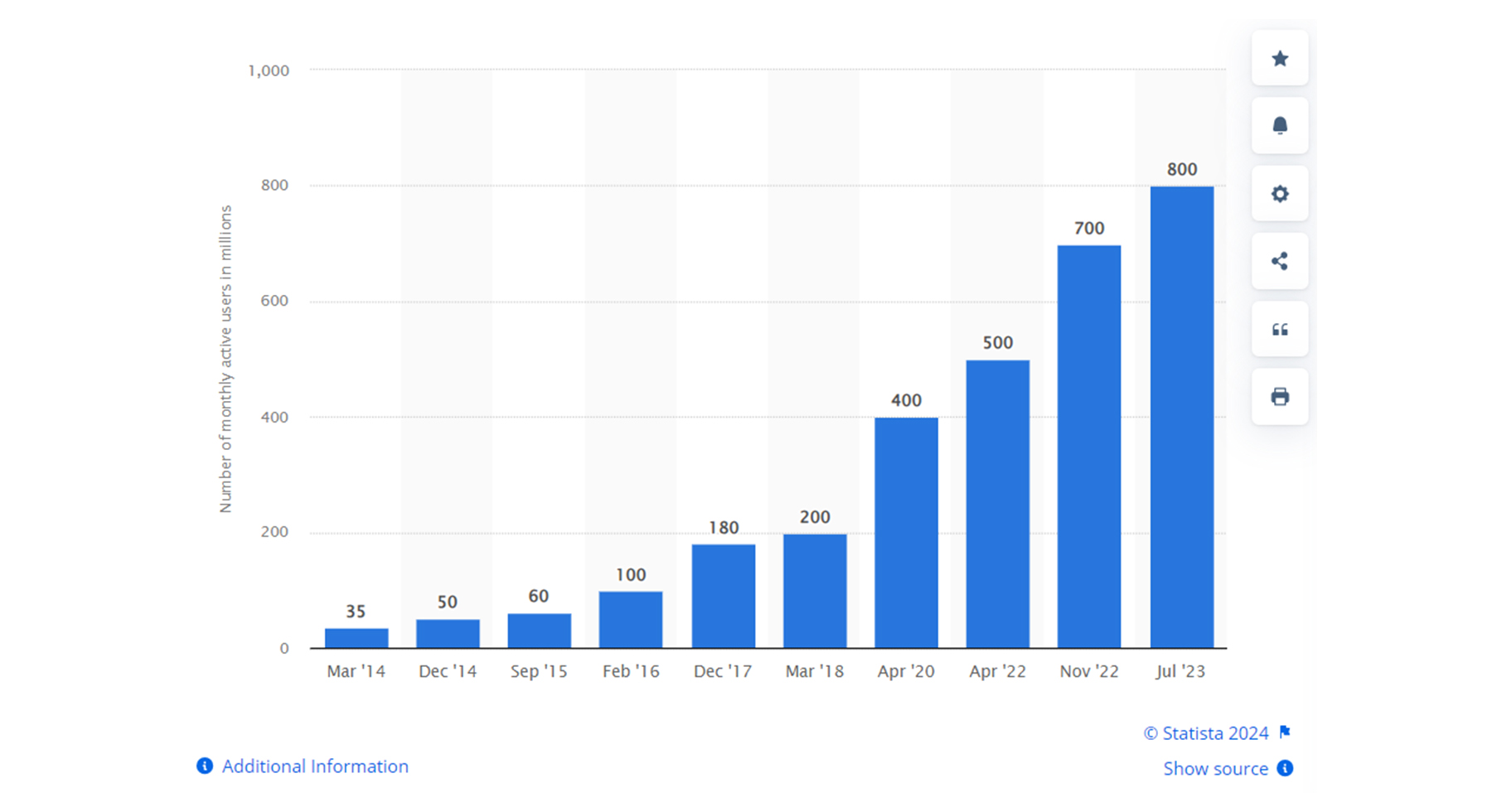

Lastly, Telegram’s success will also translate into the success of TG bots like Lootbox. As a platform, Telegram has been consistently growing its user base, and it now has 800 million monthly users.

Telegram is betting heavily on the Web3 space, and the smooth integration of crypto bots shows this pro-crypto stance.

People can have 5-6 bots for different purposes and never leave the Telegram App. Many people won’t even know that they are using DEXes.

Price targets for $LOOT

Base case

Based on the revenue generated, we believe the $LOOT token should have a 10x-15x P/E ratio to have a fair value.If revenue stays the same, that should put mCap in the range of $13ml - $19.5m. However, we should also consider the potential airdrops tokenholders can receive, which should result in some form of premium.

We estimate that mCap can reach $15m - $21m (5x-7x from current prices) in a base case.

Bull case

We assume the protocol will grow and increase its revenue in the bull case. We will assume subscription and trading fees will double. That would be $2.6m in annual revenue.A P/E ratio of 10x-15x (usually conservative for crypto space) would give Lootbox a mCap of $26m - $39m.

That would give us roughly 9x-13X.

Considering the deflationary nature of the token, we estimate that in the bull case, it can reach 10x-15x.

How to buy $LOOT

There are two possible ways to buy $LOOTThrough a DEX

- Go to Uniswap and connect your wallet

- Click on “Select token” and paste the following address: 0xb478c6245e3d85d6ec3486b62ea872128d562541

- Enter an amount and perform the swap

You can use centralised exchanges such as Coinex to buy and sell $LOOT without any gas fees or buy/sell taxes.

However, bear in mind all the risks involved with centralised exchanges. Don’t store the majority of your funds on CEXes.

However, if you understand the risks involved, you can deposit only a small amount and use a CEX to buy $LOOT.

Technical analysis for $LOOT

There are a few key horizontal levels at $0.31 and $0.22 that price will need to hold to then eventually break out from its downtrend line.

However, due to this coin being very small by mCap at $8m, waiting for the perfect entry is less important, particularly as price has halved in the last month.

Therefore, we'd consider layering orders down from the current price to $0.22, but ideally we'd like to see $0.31 hold and therefore we'd be willing to have reasonable size down to that price in the hope we can bounce from there.

Cryptonary’s take

UniBot and BonkBot are leading Telegram bots that can help execute trading activity faster and more efficiently. We can potentially see a new trend emerging where projects distribute more revenue based on trading activity rather than real yield.LootBot offers a great investment opportunity. It has a tiny mCap, great tokenomics, and great token distribution, and it is undervalued relative to the revenue they have generated and is part of the emerging ecosystem.

While we are bullish on the project, we want to clarify that we think of it as a bet for the bull market (next 12-18 months) hinged on the popularity of airdrops. We do not consider it to be a long-term bet.

Nonetheless, we think it deserves an allocation. However, since it’s a small-cap coin, you should size your bets accordingly. We wouldn’t recommend allocating more than 5% of your portfolio to $LOOT.

Cryptonary, OUT!