With the West currently in a period of economic hardship, investors have less capital to throw around. This has had a direct effect on the crypto market - less cash, less pumping.

As a result, Asia has taken centre stage. Japan is very pro-crypto on both the national and local levels. And Hong Kong is looking to become a crypto hub, which is in direct contradiction with previous Chinese policies. It’s also a welcome development.

This means the tokens that are popular in the Asian market are set to outperform. And there’s one token in particular we believe presents a fantastic opportunity this year…

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

TLDR

- Asia currently has the strongest influence on the crypto market.

- Tokens that appeal to the Asian market should outperform in the next couple of months.

- Astar Network has been making big moves with the likes of Sony & and Toyota.

- Additionally, they’re working with the Japanese government to advance Web3.

- We believe ASTR presents an opportunity between now and Q3 2023.

- Short-term target: $0.17, mid-term target $0.30. Invalidation of the opportunity would be a daily closure under $0.055.

The Asia Pivot

Since the beginning of the year there’s been a pivot in the crypto market. To Asia.“Hold on a minute, Cryptonary,” we hear you protest. “Didn’t China essentially ban Bitcoin in 2021?”

Well yes, inner voice of reader, yes they did. This caused an exodus of Bitcoin miners from China to other places. Kazakhstan, the US, and Europe, for example.

Yet, regulatory pressure is mounting - specifically in the West. The US and EU are fast becoming the most anti-crypto jurisdictions on the planet. There are individual states in the US that are more open to adoption but, at least at the Federal level, policy is not favourable for crypto enterprises. The same goes for the EU and Europe in general.

This is coupled with the fact that the West is currently in a period of quantitative tightening (tight economic policy aimed at combating inflation). There’s simply less money going around to invest.

This is not the case in Asia. China recently started to open up after its Zero-Covid policy. This includes quantitative easing (the opposite of quantitative tightening). There’s also been a regulatory pivot in Hong Kong.

Although it belongs to China, Hong Kong, is governed under a “1 country, 2 systems” policy. The enclave is opening up to the idea of becoming a crypto hub. Surprisingly, Chinese officials have participated in various crypto gatherings. This suggests Hong Kong’s stance is low-key backed by the Beijing government.

So, there are funds available, but most are in Asia. This is why we believe the tokens that the Asian market likes should outperform tokens popular in the West.

And yes, we have a favourite…

Astar (ASTR) makes moves in Japan

Web3 will usher in a more democratic internet that’s censorship-resistant and open to all. This contrasts with Web2, which is dominated by a handful of large corporations. Japan is at the forefront of this new decentralization effort.Astar Network is a smart contract hub built on Polkadot. The network’s creators, Astar Foundation, announced in November 2022 they’ll be working with Japan’s largest mobile carrier, Docomo (think 02 in the UK, or AT&T in the US).

Japan is the world’s third-largest economy, and Docomo has over 80 million customers. This is a huge reach, in a highly developed G7 economy.

Combining Docomo’s technical capabilities with Astar Networks' technology and industry knowledge, the partnership aims to raise awareness of Web3 and its potential.

Astar Japan Lab has also been working on a strategic partnership with Fukuoka, Japan’s second-largest port city with a population of over 2.5M. Fukuoka is set to become the Silicon Valley (and crypto hub) of Japan, full of large tech firms and startups alike. What better way to accelerate this goal than through Web3 adoption?

More recently, Astar announced an incubation program with Sony. This is a big one – Sony, of course, needs no introduction. The massive tech company is testing the waters to see how Web3 could help solve industry problems. For instance, it’s exploring the idea of integrating NFTs with artists associated with the Sony music label.

Sony’s Web3 incubation program:

- Will run from mid-March to mid-June.

- Is to provide funding and expertise (from both Astar and Sony) for up to 15 Web3 projects.

- Will feature a demo day in June at Sony headquarters in Tokyo.

In another move, Astar announced a Hackathon sponsored by Toyota. Like Sony, the sprawling, multinational auto company aims to implement Web3 solutions to streamline their operations.

Toyota wants developers to build a DAO tooling solution on the Astar Network. The idea is to allow employees to create groups, issue tokens, and vote without knowing they’re actually using blockchain technology. The goal is to improve transparency and efficiency within its organisation.

Cryptonary’s Take

Most partnerships between crypto and TradFi are usually BS. They tend to take the form of some obscure tech support program that the crypto project can label as a “partnership”. When, in reality, anyone can apply for it and receive a grant. That is not the case here.We believe Astar is in a unique position, as it enjoys:

- Cooperation with large businesses (Sony, Toyota).

- Cooperation with government and regulators (Fukuoka City).

- Relatively loose economic conditions.

- A huge addressable market.

- Very loud, very public announcements with high-profile companies.

Astar has performed well since the start of the year. With the Sony and Toyota announcements, we believe a precedent has been set. Projects developing through these incubation programs will launch on Astar Network. Another contributing factor will be the added network usage and transactions.

For those unfamiliar with ASTR tokenomics, click here.

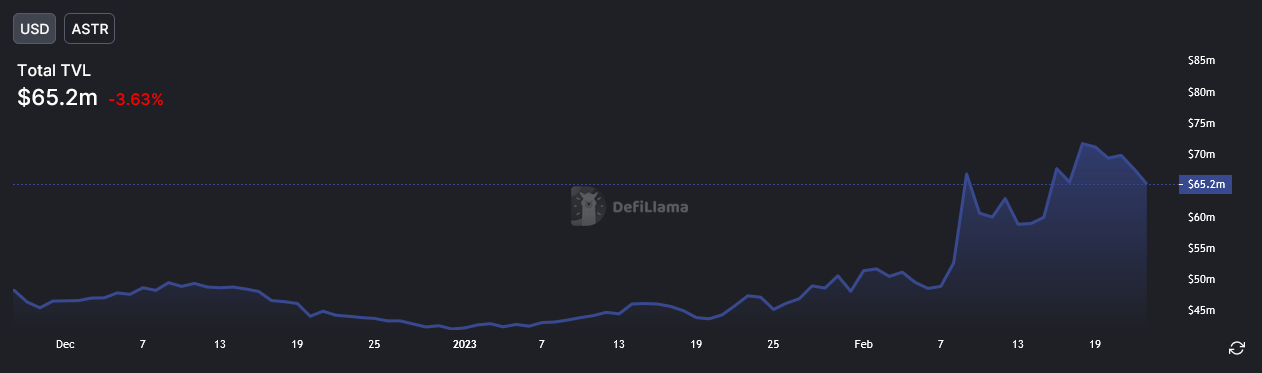

The Total Value Locked (TVL) growth also reflects the growing utility and awareness of the project:

TVL, excluding ASTR staking, is up ~55% since the start of the year ($45 million to $65 million). This is after a period of stagnation through the second half of 2022. Astar had a staking festival at the start of 2022. This locked up huge amounts of ASTR. After that ended, there were not enough projects launched yet to sustain the lockup. Hence, the stagnation. We expect TVL to continue to grow as new users and projects adopt Astar.

ASTR tokenomics:

- Circulating Supply: 4.15 billion.

- Total Supply: 7.8 billion.

- MCap: $370 million.

- FDV: $690 million.

Action Points

- We believe dollar cost averaging into ASTR up to mid-March, as it has a high risk-reward ratio.

- The short-term target is $0.17, mid-term $0.30. These levels represent previous resistances and likely areas of pullback.

- Invalidation of this opportunity is a daily candle closure under $0.055.