The time has now come to gain exposure to this fascinating sector for massive upside!

We often compare Layer-1s (L1s) to Web2, where L1s will support multi-trillion companies like Amazon. You’re probably wondering which L1s and why. Well, this is what we will be covering in this research finale.

Our picks are selected from our list of contenders.

“If you don’t believe it or don’t get it, I don’t have the time to try to convince you, sorry.” – Satoshi Nakamoto.

Well, at Cryptonary, we do have time to convince you, so let’s get cracking!

TLDR

- Web1 was the first version of the internet where people could only read information like a digital newspaper.

- Web2 became interactive and social through platforms like Facebook, but it also became centralised and owned by a few big businesses that feed on our data.

- You’ve probably heard the term ‘Web3’ before, but the first thing that crossed your mind was likely gaming, the Metaverse and NFTs - a common misconception.

- Web3 is the vision of a decentralised internet that gives users back control of their data and, most importantly, ownership of digital assets.

- Layer-1s are at the heart of the innovation of Web3, so there is a massive upside for growth!

The Winners

In our thesis, we covered the attributes we’re looking for in a fundamentally solid L1. Based on our thesis, we’ve chosen the winners. There is no perfect blockchain out there. Every blockchain has pros and cons, but certain ones tick boxes more than others.

Ethereum (ETH)

Ethereum is not an Alternative L1, but it is the most prominent L1 in DeFi. Ethereum captures the most liquidity and generates the most revenue. Most tokens are ERC20 tokens, and most L1s are either compatible with Ethereum or have a bridge connected to Ethereum to share liquidity. Therefore, most DeFi activity will always revolve around Ethereum.There is no point covering Ethereum in depth again because there are hundreds of reports covered in Cryptonary Pro. Instead, we’ll look to the future.

The Merge has finally shipped, and Ether’s value accrual has improved superbly.

ETH can now be staked and burned, which creates immense upside pressure on price because ETH will be removed from the circulating supply. This scenario will be effective in a bull market where demand is very high, and supply is low. If more ETH is burned than issued, it will create a deflationary effect - simple supply and demand. ETH’s yearly inflation decreased from 4.5% to 0.6%, creating less supply, which confirms the supply and demand logic.

Not only has Ethereum improved its economic value, but ETH scarcity has also been created.

Ethereum now offers a staking yield (currently at 4%) that will be attractive to DeFi users and TradFi institutions - who doesn’t love passive income through the power of compound interest?

Also, more institutional capital will flow into ETH as Ethereum’s energy consumption dropped by 99% after The Merge. Previously it relied on Proof of Work which consumed high amounts of energy. ESG (environmental social governance) investors will be interested in buying ETH if they want to have crypto exposure.

One final event on Ethereum’s roadmap is anticipated in 2023-2024, which is danksharding. A network upgrade that will boost adoption massively because Ethereum will ultimately become fast and cheap.

Solana

Blockchain tech is still new and although on paper general projects seem the fastest and perfect, it is under load and adverse conditions that we see how the tech truly performs. Only Solana, Bitcoin and Ethereum were able to take on high user count and congestion and still continue to perform.Solana received a lot of criticism in 2022 due to an outage problem that caused the chain to go down over 10 times. This is a consequence of Solana’s design for trying to achieve high scalability. However, adoption and usage weren’t affected by the chain downtime.

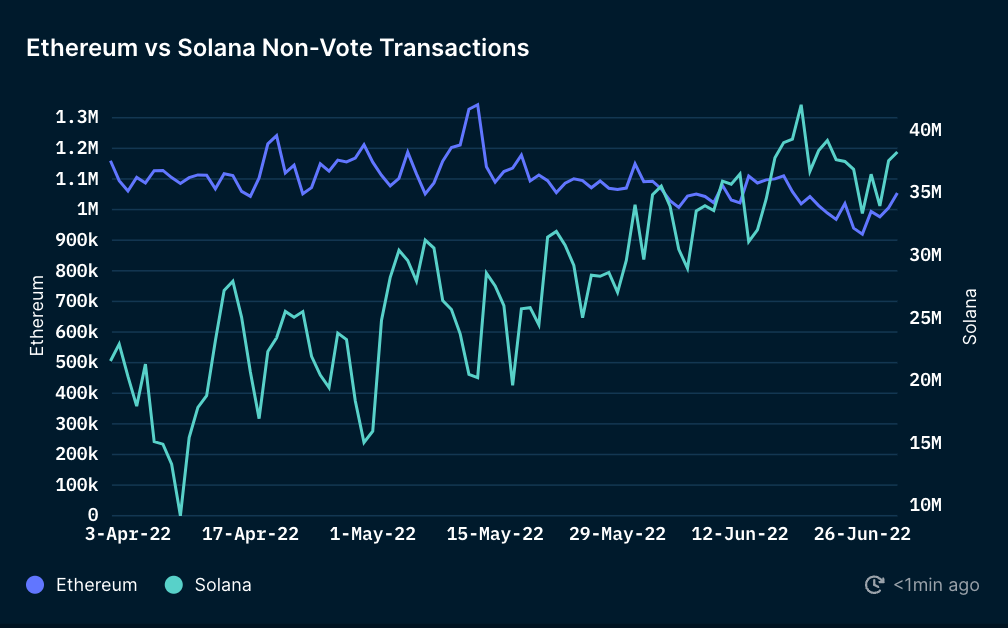

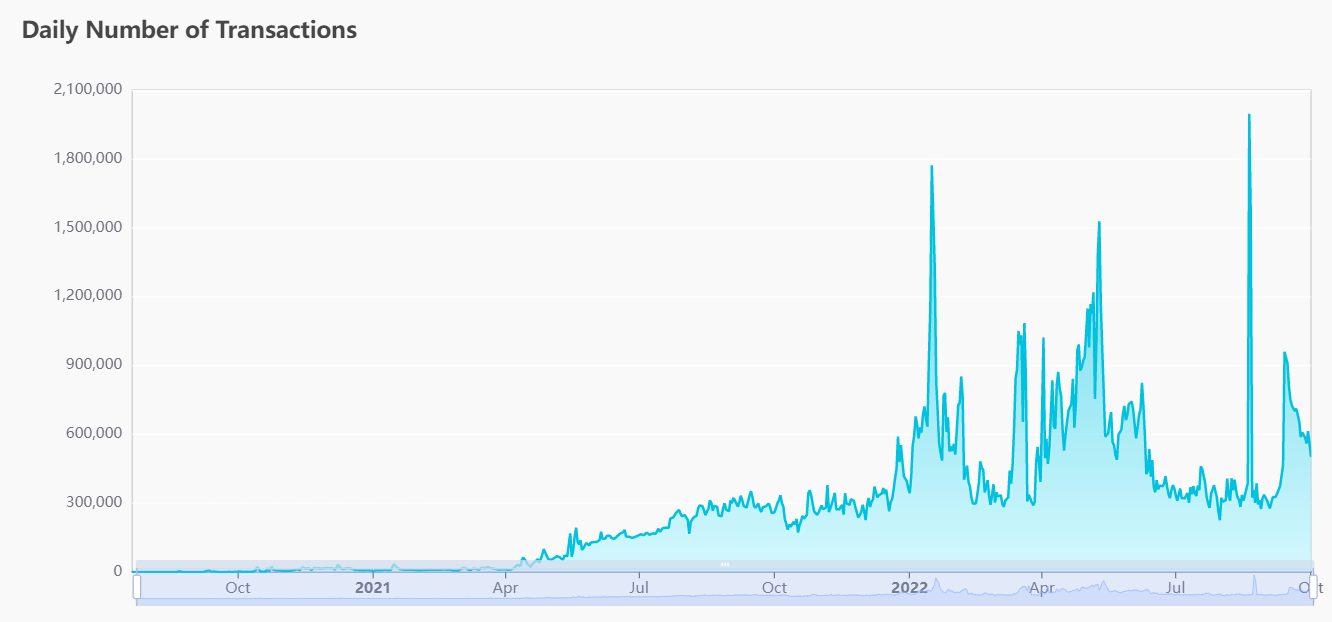

Solana surpassed Ethereum in Q2 transactions, reaching over 40 million transactions per day.

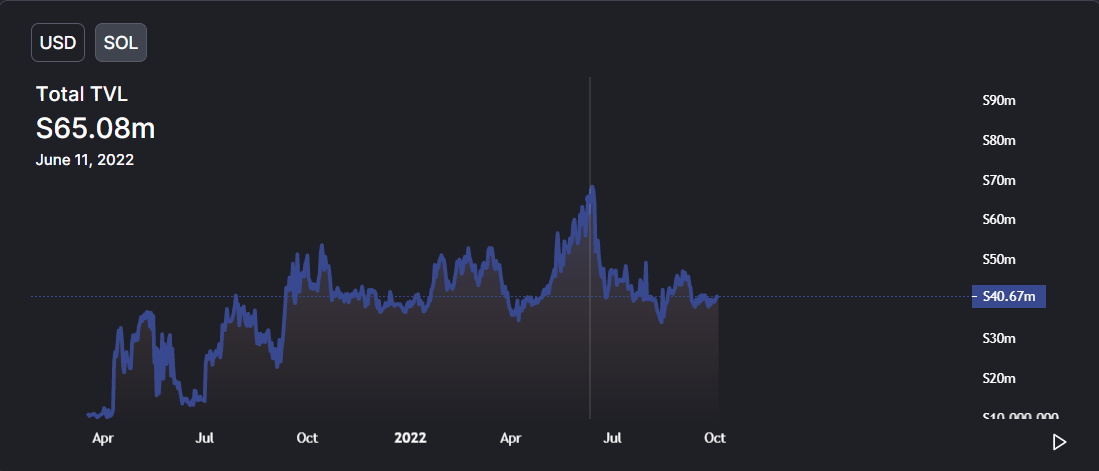

Total value locked (TVL) is still relatively high and reached an all-time high (ATH) of 70 million SOL locked.

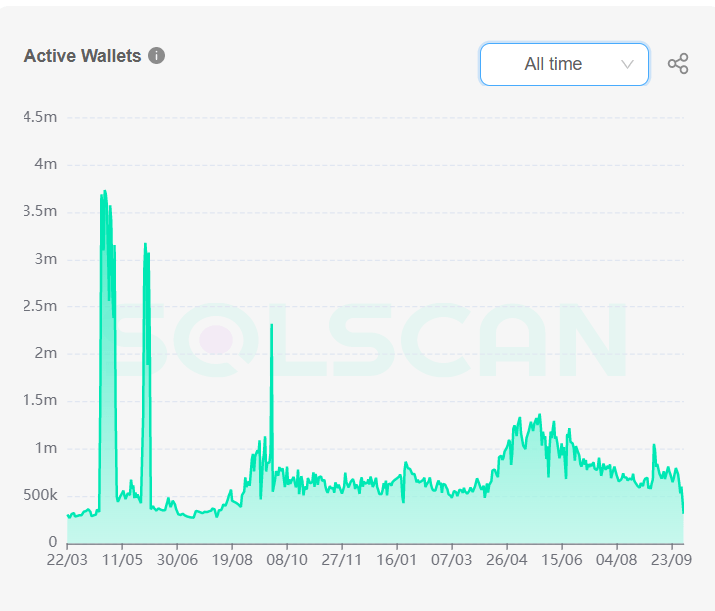

500k daily active users that transacted at least once.

The outage problem has not affected activity over the short term but it must be fixed for activity and liquidity to continue to increase. There are solutions being implemented through, QUIC (a protocol that acts as a layer between Solana and the internet for better data transmission), Stake-weighted QoS (a methodology to control data traffic on Solana based on stake) , Fee markets (An option for users to pay a premium to have their Txns processed faster) and Jump validator client (a second validator client that runs alongside Solana). All these solutions will improve transaction processing and congestion of the network. These solutions are currently being tested.

Solana is integrating scaling solutions built on Cosmos such as Nitro and Eclipse. These solutions tend not only to improve scalability but offer cross-chain communications liquidity transfers between Solana and Cosmos. This is a great development because it will drive and share liquidity between both ecosystems. In other words, Decentralised Apps (dApps) from Solana can exist on Cosmos. The goal behind this innovation is to pioneer the Solana-virtual machine (SVM) like the Ethereum-virtual machine (EVM) so it can be supported by multiple chains.

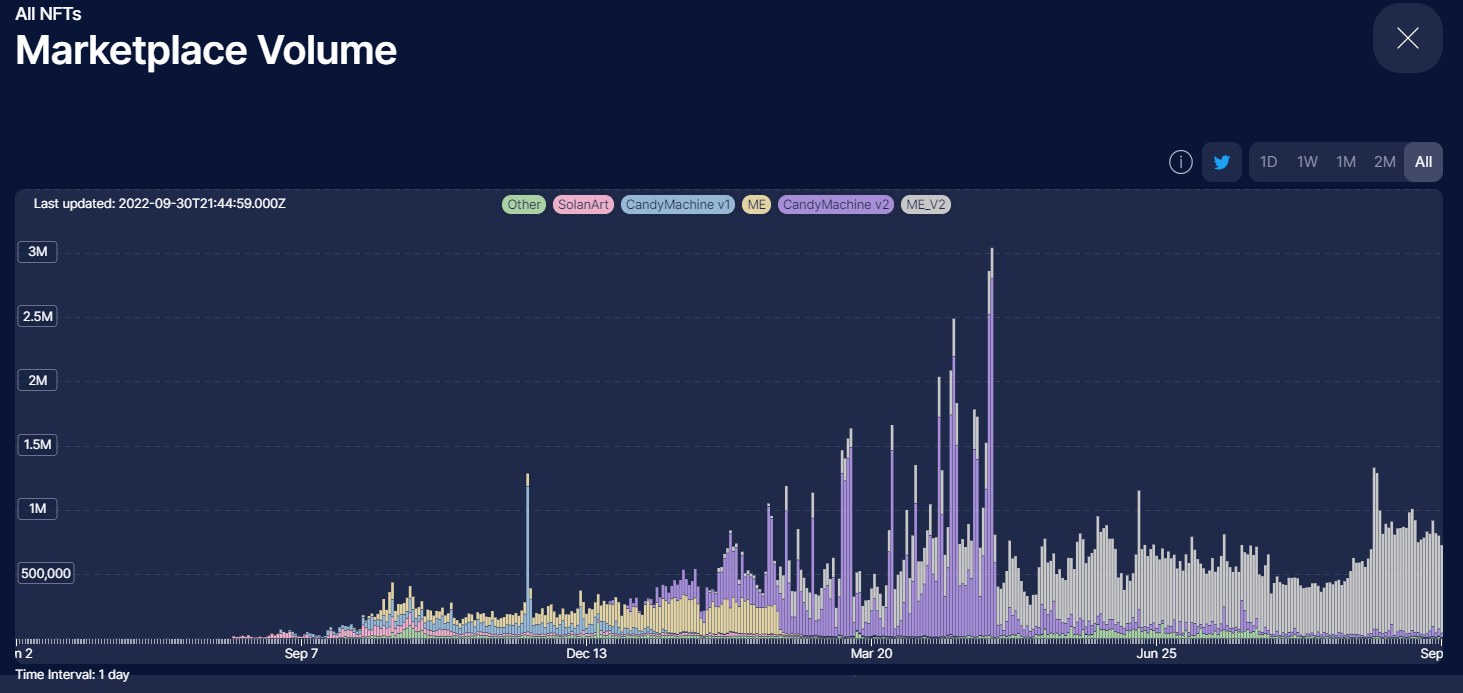

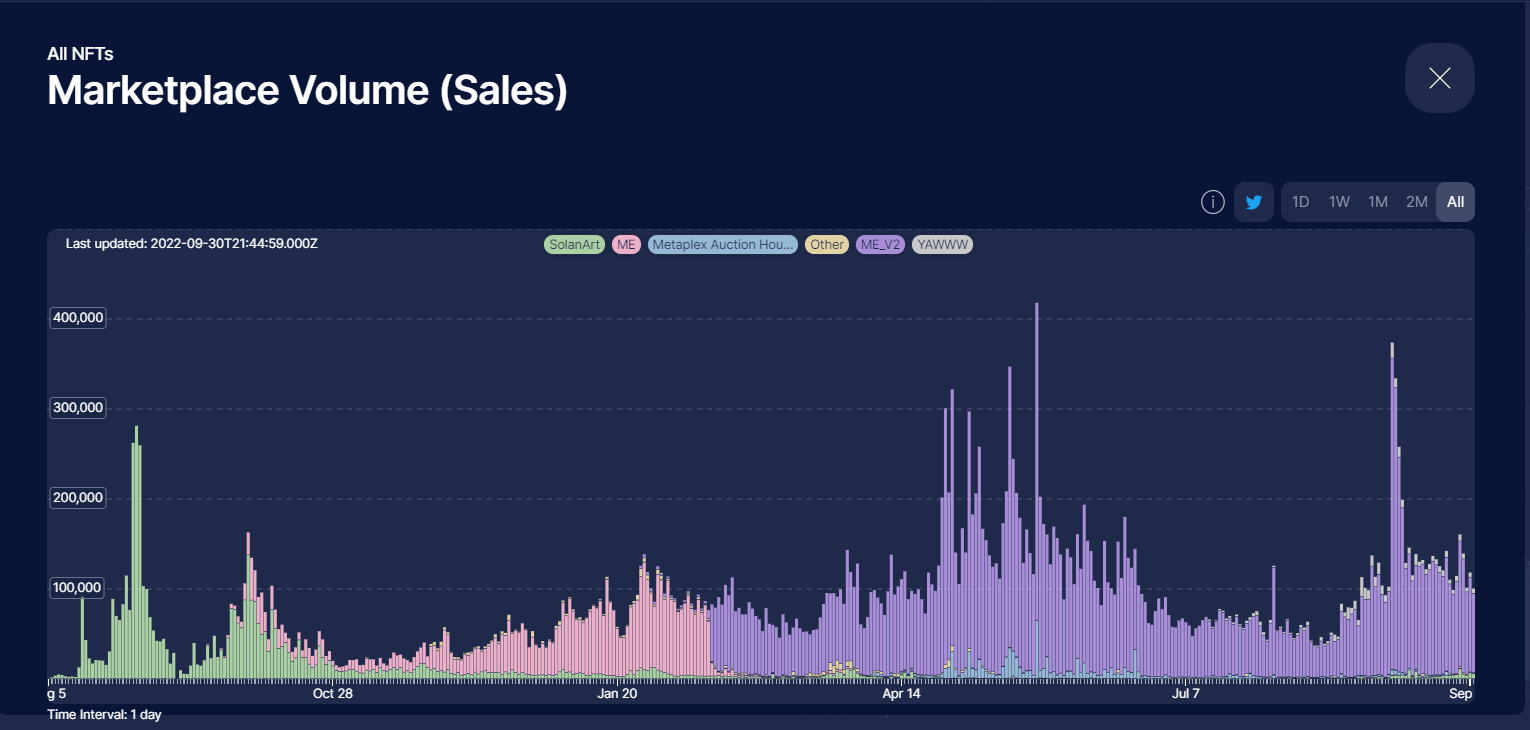

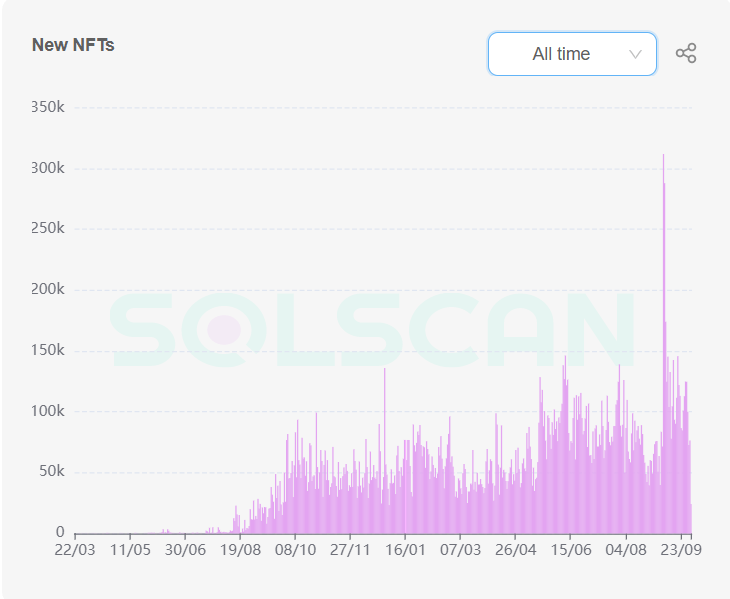

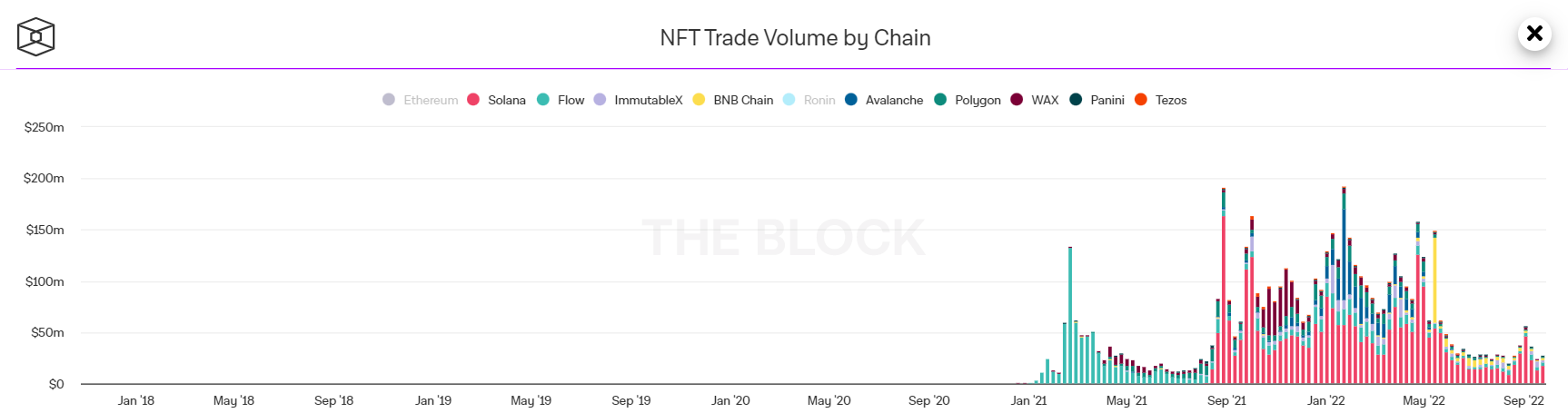

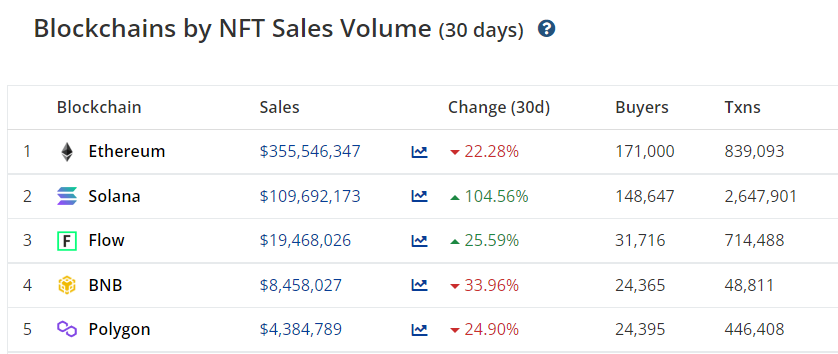

NFT volume in sales and transactions across Solana marketplaces has reached an ATH in 2022, and these figures are gradually increasing over time.

Daily NFTs minted have been increasing every day to almost 150k.

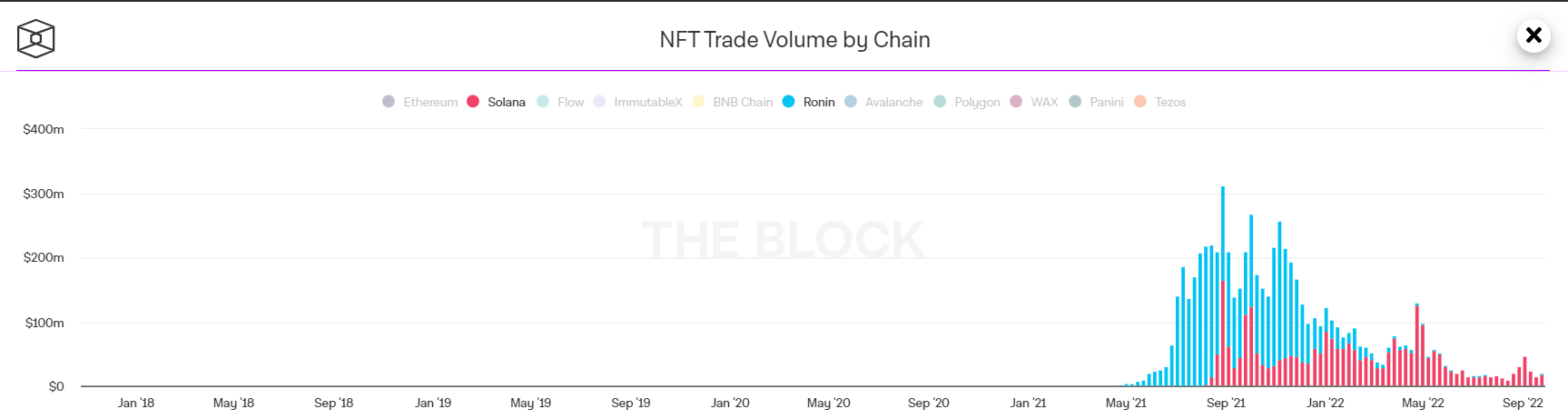

Solana is the most chain in volume and sales after Ethereum.

Ethereum accounts for the most expensive collections (Crypto punks & Bored Ape Yacht Club), while Solana has more affordable and innovative ones. From the above data, there is a clear demand for Solana NFTs despite the current macroeconomic situation and decreased hype for NFTs.

In the past year based on sales, volume, buyers & sellers, Ethereum and Solana are the go-to blockchains for NFTs. We presume that Solana and Ethereum will acquire the most liquidity, with Ethereum being the leader nowadays. However, we expect this to change over time and Solana becomes the NFT chain.

Ethereum NFTs were live since 2017 and everyone uses Ethereum because it is the most trusted. But, Solana’s growth has been immense in the past year and has future potential to become number 1 over the long term as the chain matures.

Solana’s growth potential.

Near Protocol

Near protocol is a new one to watch out for. Near gained traction and usage in September 2021 and has great growth potential. Near is fast and cheap because it implements its version of sharding called Nightshade. The Near network will become fully sharded in late 2023 after the completion of phase 3. Phases 0 and 1 are complete.NEAR’s value accrual comes from staking that achieves network security and reduces supply by locking NEAR. The Near network burns 70% of transaction fees. Near incorporates higher supply burning levels than Solana’s 50% and Ethereum’s priority fee. Near can become deflationary if more supply is burned than issued. This is great for token holders, but less incentivising for stakers securing the network as they receive only block rewards from inflation.

The other 30% of the fees go to smart contract creators. This is a special incentive for developers to build on Near, because if a developer builds a dApp that is used extensively, then they manage to secure a steady stream of income through collected fees - something like Uniswap that generates $1 million a day in fees.

Smart contract languages like Solidity and Rust are very specific to learn for Web2 developers. Near opens the door for Web2 developers to build smart contracts using JavaScript. There are millions of Web2 developers that can take advantage of that aspect and migrate from Web2 to Web3 by building dApps on Near using the JavaScript SDK.

Try bridging from Ethereum to Near using the Rainbow Bridge for a great UI/UX. The Rainbow Bridge relies on the security of both Ethereum and Near instead of the bridge protocol. The Rainbow Bridge is a trustless bridge and more secure than regular bridges.

Despite current macroeconomic conditions in the past year, Near’s revenue has been up by 2000% compared to Ethereum’s 400% and Solana’s 460%.

Daily transactions have been increasing as well.

There has not been much hype nor a lot of development regarding Layer-1s in 2022, but Near Protocol was certainly one of the few that saw great traction. NEAR managed to hit an ATH ($20) in January 2022, which confirms our reasoning for its potential.

Although Near offers great fundamentals, it currently has only 9 protocols in its ecosystem and liquidity is mainly dominated by one. In order for Near to acquire market share from other L1s, its main focus should be to build and integrate as many protocols as possible. This will be the main thing to watch out for going forward. If there aren’t many protocols, activity and revenue will decrease and so will hype, which will affect the token price negatively.

Near recently integrated USDT into its ecosystem and will integrate USDC by end of the year. This will boost and drive liquidity massively as both USDT and USDC have the largest supply of stablecoins.

Future Anticipation

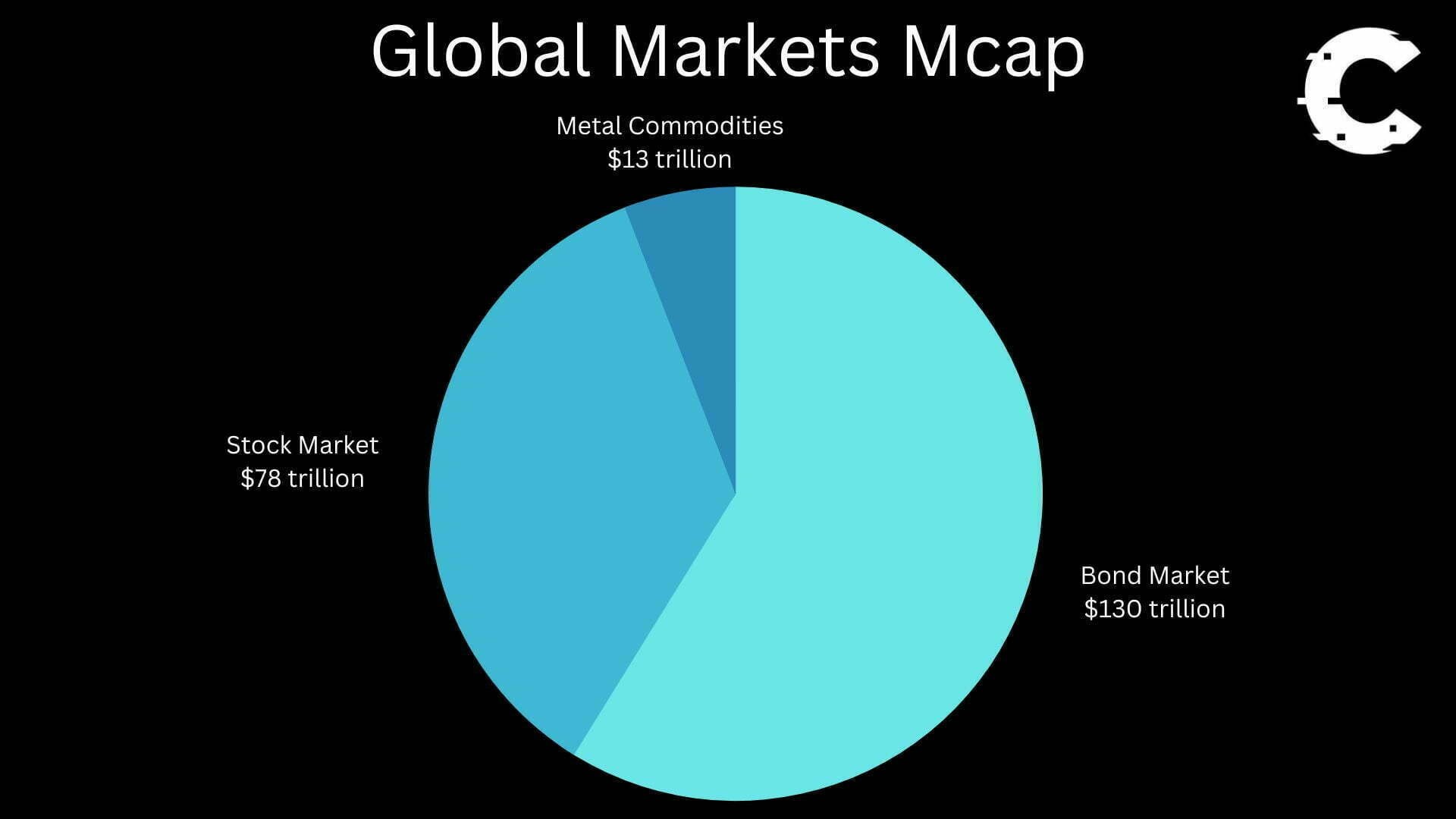

Traditional Finance (TradFi) institutions invest in bonds, commodities and a few stocks. The current total global market cap (Mcap) represents $221 trillion. Crypto is currently less than $1 trillion.

As crypto and blockchain tech evolves, and after good regulations pass on, we all know these institutions will eventually buy crypto. If we were to presume conservatively that 5% ($11 trillion) from the total global Mcap flows into crypto then this confirms our thesis of crypto being multi-trillion, where asides from Bitcoin, Layer-1s will capture the most market share based on liquidity and activity.

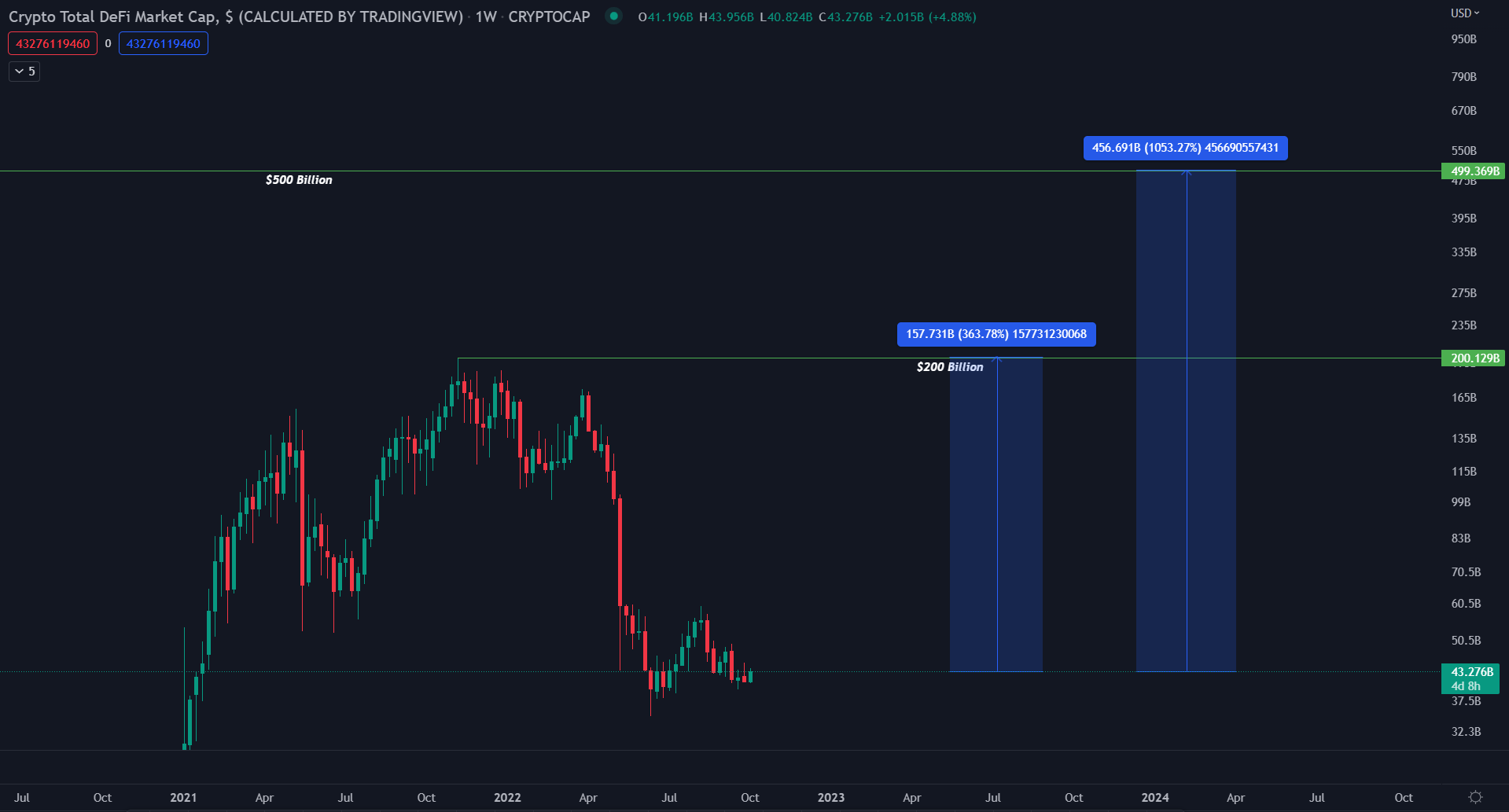

Activity on DeFi slows down when market conditions are bearish because a lot of liquidity gets withdrawn from protocols due to falling crypto prices. In a bull market, the opposite happens. Liquidity flows into protocols. In the last bull market, DeFi’s Mcap gained 150X in return. Instead of a 150X, we are betting on a 10X from here which puts DeFi’s Mcap at $500 billion - while being conservative. Our bet is for Ethereum to acquire 50% of that Mcap, Solana 10% and Near 5% - if everything goes accordingly to plan.

Also, based on the backing, developers’ interest, and how Layer-1 chains are gaining traction, we find it reasonable for these assets to thrive in a bull market.

Risks and Concerns for Ethereum

- Staking pools are owned by LIDO 29.9%, unknown 19.3%, Coinbase 13.4%, Kraken 8%, and Binance 6%. 76.6% of staked ETH is controlled by major centralised entities, increasing centralisation and censorship risks.

- 25% of Ethereum blocks are OFAC-compliant regulations due to Tornado cash. OFAC is the Office of Foreign Assets Control, a division of the United States Treasury Department that manages and imposes sanctions. 25% of the Ethereum network transactions can be censored if validators were to comply with OFAC sanctions.

- Regulatory risk. While there isn’t a framework yet on regulations, it is always good to be aware of potential ones. There is a risk that ETH could be classified as a security because it possesses the attributes of security that share revenue and holders hold the token in profit from it.

Risks and Concerns for Solana

- Top validators on Solana represent 1%-2.6% of the total supply.

- Solana bugs and outages are really common and need to be fixed to continue adoption for Solana. Otherwise, this hinders performance over the long term.

- The Solana chain has been restarted many times throughout 2022. This highlights centralisation risks as certain parties have a very big influence on the network.

- Solana’s Nakamoto coefficient is 30. If 30 validators from the entire Solana network get together, they can control more than 33% of the network. These entities impose censorship risks and can halt transactions. This means that Solana’s top 30 validators make up roughly 33% of the total delegated SOL that is staked through the chain.

- A few DeFi protocols on Solana can be classified as great but the rest has very little liquidity and activity.

- Regulatory risk.

Risk and Concerns for Near Protocol

- 100k NEAR is needed to run a node - high barriers to entry.

- The protocol has a cap on the number of validators at 200-400 currently. However, It will increase in the future.

- Top validators of Near control 3%-6% of the entire stake of the network.

- Near’s Nakamoto coefficient is 7.

- Near is pretty centralised compared to Ethereum and Solana, which has more centralisation and censorship risks.

- There are only 9 functioning DeFi protocols on Near - mainly dominated by Reef Finance. A very small number of protocols to capture market share from other L1s.

- Near’s sidechain Aurora has more protocols in its ecosystem and at one time captured more TVL - the ability to steal liquidity from Near.

- USN, Near’s stablecoin. We know the SEC will regulate stablecoins harshly because of the UST collapse which sparked systemic risk in the industry.

- Near’s marketing isn’t as strong as Ethereum and Solana, so work needs to be done to reach more people.

- The protocol is still in its early days and thus needs to prove itself among other prominent L1s.

- Regulatory risk.

Final Words

Layer-1s nowadays are the backbone of DeFi, NFTs and Web3. If you don’t agree, read this series again, and take the time to understand the information well before passing judgement.Ethereum is currently the most popular L1, but when more risks associated with centralisation are enforced (read above), this creates an opportunity for L1s like Solana and Near to capitalise from users migrating to them for wanting a more decentralised chain by garnering more liquidity.

If Solana keeps expanding in NFTs, it can overtake Ethereum in terms of market share for NFTs. DeFi is more difficult for Solana to compete with because it has fewer protocols, so liquidity is less, therefore it generates less revenue.

The same is true for Near, since they are introducing sharding before Ethereum, they could end up stealing market share if things go as planned as more liquidity flows into it for being so fast and cheap, alongside building more protocols to attract liquidity.

The market currently is immature, which presents a significant opportunity for growth. Moving from Ethereum to Solana to Near imposes higher risk, also a higher return potential.

We’ll continue to follow their development, as we’d like to see them progress to continue supporting our thesis.