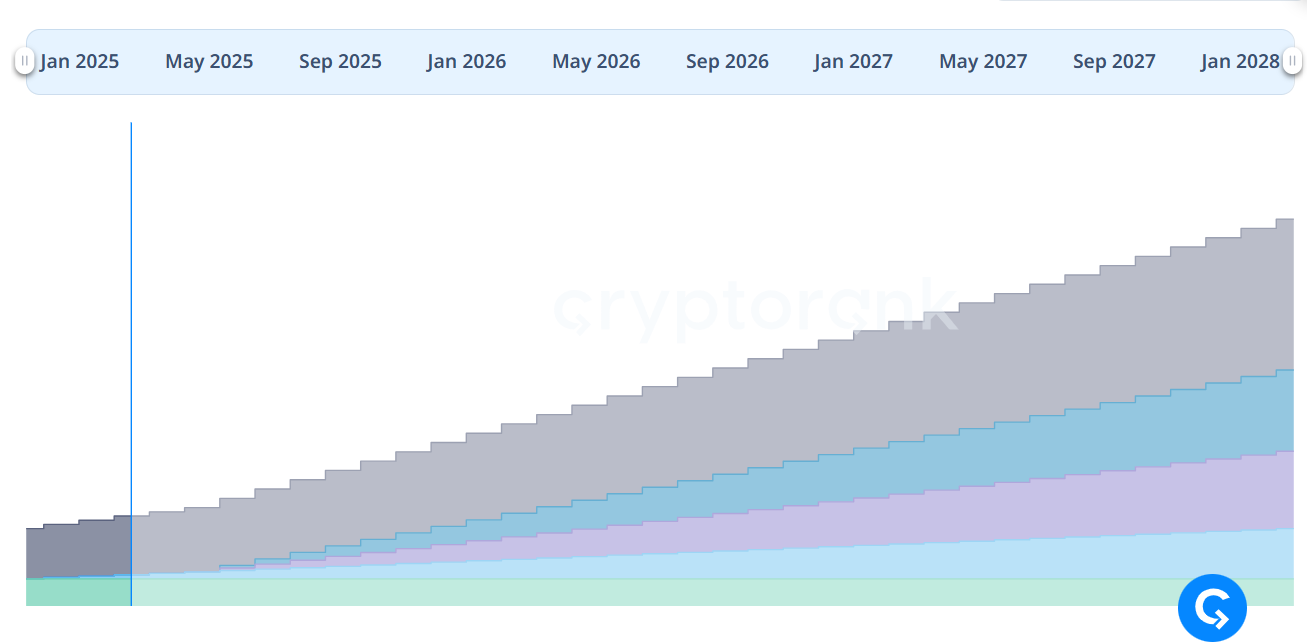

Tokenisation is the next logical step for crypto to go mainstream. BlackRock, Franklin Templeton, and JPMorgan are all in. Protocols like Centrifuge, Ondo, and Maker have already embedded RWAs into their models. And capital is flowing. The RWA sector has crossed $10 billion in TVL, and top forecasts predict a trillion-dollar market by the end of the decade.

But for all the hype, most of crypto's RWA efforts are fragmented, isolated token issuers, patchwork data bridges, and compliance nightmares. That's where Plume enters the story.

Plume is an L1 chain purpose-built for RWAs. From token issuance and on-chain data feeds to gasless smart wallets and modular compliance rails, Plume aims to make RWAs as seamless as ERC-20s, composable, programmable, and deeply integrated into crypto-native flows like lending, staking, and yield generation.

Plume's traction is real, too. It has over 180 projects already live or building, backed by TradFi giants like Apollo and Brevan Howard, and $ 4 B+ in tokenised assets committed.

Still, the question remains: can Plume scale and survive in a space where regulatory clarity is slow, competition is heating up, and new L1s often fail to retain attention post-launch? That's what this report explores.

We'll break down Plume's architecture, ecosystem, tokenomics, funding, and positioning in the RWA market. We'll also highlight the risks, unanswered questions, and what's next for the $PLUME token.

So let's dive in!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is Plume Network?

In the race to bring real-world assets on-chain, Plume stands out by building the entire infrastructure layer from the ground up. At the core, Plume is a purpose-built Layer-1 blockchain tailored for Real-World Asset Finance (RWAfi), a concept that doesn't just tokenise assets like real estate or treasuries, but makes them usable in crypto-native ways: staking, lending, farming, and even derivatives. This is quite an interesting innovation.Plume is launched with a vision to bridge traditional finance (TradFi) and decentralised finance (DeFi) and is solving for composability, compliance, and scale. With over 180 projects already integrated, including use cases ranging from music royalties and private credit to pre-IPO funds and carbon credits, Plume is evolving into a full-fledged RWA hub.

Its architecture is backed by some heavy hitters. The network is EVM-compatible, powered by Arbitrum Nitro, and equipped with native account abstraction, gasless transactions, and real-time data oracles through its Nexus module. Tools like Plume Arc, the protocol's tokenisation engine, drastically lower onboarding time for asset issuers, making it easier for institutions and developers to bring RWAs on-chain without navigating the regulatory mess alone.

$PLUME, the network's native token, serves multiple roles: gas, governance, staking, liquidity provisioning, and validator incentives. It launched in January 2025, now trades on major exchanges and is supported by a who's who of backers, Apollo Global, Haun Ventures, Brevan Howard, Galaxy Digital, and more. Plume has $ 30 M+ in funding, $ 4 B+ in tokenised assets, and a testnet that supported 3.75 million users and 265 million transactions, these numbers are big boy numbers.

But the competition is heating up. Rivals like Centrifuge, Ondo, and TradFi players like BlackRock are entering the field., Plume's ability to stay agile, deliver real-world integrations, and scale demand will define whether it becomes foundational infrastructure or just another RWA narrative.

RWA market context

Real-world assets are fast becoming crypto's most credible bridge to institutional capital. The sector has seen a sharp uptick in traction: as of March 2025, the total value locked (TVL) in RWA protocols crossed $10 billion for the first time, with top platforms like BlackRock's BUIDL, Franklin Templeton, Ondo, and Centrifuge leading the charge.This momentum isn't retail-driven. It's institutions stepping in. BlackRock tokenised over $1 billion in treasuries, JPMorgan launched programmable funds, and Apollo, managing over $700 billion in TradFi assets, invested directly into emerging on-chain platforms like Plume. In many ways, 2024 was about experimentation; 2025 is about execution.

What's driving this shift is a convergence of readiness. The infrastructure is maturing. Regulations are evolving. And the need for programmable, transparent, and global capital markets is becoming harder to ignore. In the U.S., stablecoin frameworks are gaining bipartisan support. In Asia, Singapore and Japan are racing ahead with tokenization sandboxes and regulatory pilots. Europe's MiCA is already laying the groundwork.

For Plume, the timing couldn't be more aligned. With RWAfi, a vision that treats RWAs as an active component in crypto-native finance, Plume is riding a new narrative arc. It's not just about putting real estate or bonds on-chain. It's about using those assets in lending, yield farming, staking, and derivatives, opening up entirely new liquidity layers and risk markets.

As TradFi capital enters and infrastructure tightens, RWA protocols that can balance compliance with crypto-native utilities stand to lead. And in that race, Plume's full-stack approach puts it in a strong early position.

Plume's positioning

If the first wave of RWA protocols was about putting traditional assets on-chain, the next wave, what Plume calls RWAfi, is about making those assets programmable, liquid, and usable in the crypto economy.Plume's core thesis is simple: tokenising RWAs is only half the job. The real unlock comes when those tokenised assets can be used natively in DeFi, as collateral, for yield farming, for structured products, even in derivatives. This goes beyond the "TradFi on-chain" model that replicates traditional capital markets infrastructure. Instead, Plume is building the foundation for an entirely new type of capital market, one that originates, prices, and trades real-world assets through a crypto-native lens.

Unlike competitors that rely on Ethereum or build on Layer 2s, Plume integrates core RWA infrastructure (like KYC, AML, cap table management, and custodianship) directly at the protocol level. This modular approach allows applications to plug in and go, with no need to rebuild backend rails or navigate compliance complexity from scratch.

The platform's architectural stack, Plume Arc (tokenisation engine), Smart Wallets with native account abstraction, and Nexus (real-world data integration), reflects this thesis. It's about building a composable ecosystem where tokenized real estate, carbon credits, royalties, and commodities can all interact with lending pools, prediction markets, and collateralized trading strategies.

In short: Rather than competing to be the best tokenisation platform, Plume is competing to be the best infrastructure layer for programmable real-world finance.

Architecture & infrastructure

Plume's architecture is purpose-built for real-world asset finance (RWAfi), with a modular stack that addresses the full lifecycle of RWA onboarding, compliance, and DeFi composability. Rather than Plume embeds critical infrastructure at the protocol level instead of retrofitting on top of general-purpose blockchains, allowing for scale, efficiency, and regulatory alignment.Arc - The tokenisation engine

Arc is Plume's full-stack framework for onboarding real-world assets. It connects issuers with a full suite of service providers, including custodians, legal entities, KYC/AML platforms, and registrars. Whether it's real estate, music royalties, carbon credits, or private credit, Arc allows for plug-and-play tokenization via the ERC-3643 standard. Assets issued through Arc have been compliant from day one and are ready to be composed within DeFi applications.Smart wallets - Native account abstraction

Every user account on Plume is a programmable smart wallet by default. This native account abstraction removes the need for separate smart contracts and allows complex interactions like gasless transactions, collateral management, staking, and wallet upgrades. Fully audited by Trail of Bits, Plume's wallet architecture is tailored to simplify the RWAfi experience while enhancing security and UX.Nexus - The data highway

Nexus serves as the real-world data oracle for the Plume ecosystem, bringing off-chain inputs (e.g., commodity prices, macroeconomic indicators, real estate appraisals) on-chain via secure TLSNotary proofs. This data layer unlocks use cases like data-driven lending, event-based derivatives, and tokenized prediction markets. Nexus supports over 1,000 verified data feeds, making Plume a high-fidelity platform for financial data.Compliance engine

Embedded KYC/AML protocols are part of the Plume base layer, streamlining onboarding for institutions and enabling compliant asset issuance and trading. The protocol supports modular compliance logic, allowing projects to adapt to jurisdictional requirements while maintaining composability.Built on Arbitrum Nitro

Plume leverages Arbitrum Nitro as its foundation, offering Ethereum compatibility with the scalability and speed of a rollup framework. This allows seamless interoperability with the Arbitrum Orbit ecosystem while maintaining low transaction costs and EVM tooling support.$PLUME Tokenomics

As the native asset of the Plume Network, $PLUME plays a critical role in securing the chain, powering transactions, and incentivising ecosystem participation. Its design reflects Plume's long-term thesis: align value accrual with protocol usage, governance, and liquidity growth across the RWAfi ecosystem.Token Utility

$PLUME serves as the backbone of the network through five primary functions:- Gas Fees: All on-chain activity, RWA tokenisation, trading, data queries, and wallet actions use $PLUME as payment.

- Governance: Token holders can propose and vote on protocol upgrades, economic parameters, and grants through on-chain governance.

- Staking & Delegation: Validators and delegators stake $PLUME to secure the Proof-of-Stake network and earn rewards.

- Ecosystem Incentives: $PLUME is used to bootstrap adoption via grants, airdrops, validator rewards, and developer funding.

- Collateral & Liquidity: Within DeFi protocols on Plume, $PLUME can be used for liquidity provisioning and as collateral.

Allocation breakdown

The total supply of $PLUME is fixed at 10 billion tokens, with a long-term release schedule.- Community, Ecosystem, and Foundation: 59%Includes grants, validator rewards, liquidity provisioning, marketing, and airdrops.

- Early Backers: 21%Strategic investors and partners, fully locked at TGE with linear vesting.

- Core Contributors: 20% of engineers and builders of the protocol were also locked and released gradually.

Unlock schedule & next cliff

As of April 2025:- Circulating Supply: ~2 billion (20% of total supply).

- Next Unlock Event: April 21, 2025108.34 million $PLUME (~$16.8M at current price) will be released, comprising 1.08% of total supply.

Price & market cap performance

- Price (April 16, 2025): $0.1538

- Market Cap: ~$307.67M

- Fully Diluted Valuation (FDV): ~$1.54B

- All-Time High (ATH): $0.247 (March 19, 2025)

- Performance: Currently down ~38% from ATH but up 82.7% from ATL.

Take on dilution risk

With 80% of the token supply still locked, the primary concern is dilution from future unlocks. However, this is partially offset by:- Utility demand from staking, fees, and DeFi participation.

- Token emissions are being distributed into active ecosystem growth (e.g., grants, rewards).

- Institutional backing and roadmap clarity are attracting long-term holders over short-term speculators.

Ecosystem & projects

One of Plume's most defining strengths is its traction. In less than a year since its launch, the network has grown into one of the largest and fastest-moving ecosystems in the RWA space, with over 180+ protocols, 18 million+ wallet addresses, and 280 million transactions recorded. This is some real deployment.

Key projects live on Plume

A number of flagship protocols across diverse sectors have launched or are building on Plume:- Credbull: private credit marketplace offering fixed-yield credit opportunities. Its "LiquidStone" fund launched with $100M capacity and has since scaled up to $500M, offering yields up to 15% APY for 90-day lock-ups.

- DigiFT: A regulated on-chain exchange licensed by Singapore's MAS, connecting tokenized RWAs like UBS's uMINT fund to institutional investors.

- Music Protocol: Brings music royalties on-chain by tokenising intellectual property. Through $mbUSD bonds backed by streaming revenues, artists can monetize IP while investors earn income from royalties.

- Jarsy: Offers DeFi access to U.S. ETFs and private funds starting at $10. Retail-first RWA investing, abstracted through Plume's Smart Wallets.

Ecosystem metrics

Plume's testnet and mainnet metrics reflect genuine usage, especially notable given the nascency of the RWA vertical:Backers, funding & strategic momentum

While many RWA protocols are still trying to find product-market fit, Plume has already secured significant backing from top-tier venture and institutional players, both crypto-native and TradFi. This level of support speaks to both its design and its timing in a sector that's finally getting serious attention.Funding snapshot:

- Total Raised: Over $30 million

- Seed Round (May 2024): $10M led by Haun Ventures, with participation from Galaxy Ventures, Superscrypt, and A Capital.

- Series A (Dec 2024): $20M led by Brevan Howard Digital, joined by Lightspeed Faction, Hashkey, and Nomura's Laser Digital.

- Apollo Global (April 2025): Seven-figure strategic investment from one of the world's largest asset managers ($ 700 B+ AUM), signalling deep institutional conviction.

Strategic partners

Plume has gone beyond DeFi-native integrations by forging connections with players across TradFi, tokenization, and on-chain infrastructure:- Rome Protocol: Facilitates seamless asset transfers across Ethereum, Solana, and Plume.

- Ondo Finance: Collaborates on tokenized treasuries and yield-bearing RWA strategies.

- DigiFT: Licensed by MAS Singapore, offering regulated access to tokenized securities (like UBS's uMINT fund).

- Superstate: Working on RWA-based investment fund structures and compliant DeFi rails.

Latest developments: Strategic tailwinds

- Apollo Investment (April 2025): A turning point for Plume's institutional optics. It puts Plume on the radar of major TradFi allocators.

- Grayscale Watchlist Inclusion (Q2 2025): Plume was officially added to Grayscale's "Assets Under Consideration" list, potentially laying the groundwork for future inclusion in investment products like trust offerings or ETF vehicles.

Technical analysis

Plume is currently retracing and consolidating following its breakout in mid/late March 2025. On the 12-hour timeframe, the token managed to print a new higher high shortly after launch, and has since retraced to retest both the breakout diagonal trendline and two key demand zones.The first 12h demand zone is between $0.156 and $0.144, and Plume is currently attempting to form a base above this level. This zone aligns with the breakout structure and has seen multiple taps over the past few days. On April 7th, Plume dipped into the second demand zone, between $0.132 and $0.122, and printed a low of $0.1306, which effectively tested the diagonal breakout level before bouncing back into the upper zone. This behaviour suggests active buyers in both zones, though conviction remains moderate.

If the current consolidation above $0.144 holds and broader market sentiment turns constructive, we're eyeing $0.185 as the first upside target in the short-to-medium term. Should $0.185 be reclaimed convincingly, the next leg up would target $0.231, though this would require stronger confirmation from both Plume and the wider market.

On the downside, if both current demand zones fail to hold, the next major support lies at $0.106, the base structure formed between January and March 2025. This would represent a full retrace to Plume's origin range and indicate a breakdown in market structure.

For now, the technicals suggest a range-bound setup with a neutral/bullish bias if demand zones continue to absorb sell pressure. All trades here depend on continuation or breakdown confirmations, especially from the wider market context.

Risks, challenges & competitive landscape

Despite Plume's strong architecture, funding, and narrative fit, the RWAfi sector remains early, fragmented, and full of moving parts. Plume is well-positioned, but it's far from risk-free. This section outlines the key headwinds and how they stack up against other players in the race.Regulatory uncertainty

While Plume is built with compliance in mind, embedding KYC/AML flows and working with regulated partners like DigiFT, the global regulatory environment is still evolving. Jurisdictions are inconsistent, and regulatory treatment of tokenized securities or fractional ownership models could shift, especially in the U.S. and EU. Navigating this minefield will require constant legal adaptation.Token overhang and dilution

Plume's tokenomics are community-focused, but 80% of the supply is still locked. With over 10 billion total tokens and only 2 billion in circulation, the unlock schedule could exert sell pressure over time if not managed carefully. This is a common issue for L1 protocols, especially when token utility (governance, staking, gas) isn't directly tied to demand from institutional flows yet.Early-network technical risk

As a new Layer 1, Plume must prove it can scale securely. Smart wallet logic, tokenization flows, and data integrations (e.g., Nexus) must all function reliably across use cases like lending, derivatives, and secondary trading. Any critical failure, security breach, faulty oracle data, or regulatory misstep could derail momentum.Competition is heating up

Plume is not alone in chasing the tokenization opportunity. Heavyweights like:- Securitize (SEC-registered platform focused on compliant asset tokenization),

- Ondo Finance (tokenizing treasuries and yield-bearing RWAs)

- Superstate, Maple, Goldfinch, and now even BlackRock and Franklin Templeton

Cryptonary's take

Everyone's racing to bring real-world assets on-chain, but most are building fragmented tools and protocols. Plume is taking a full-stack swing, offering everything from tokenisation engines to smart wallets to compliance rails. The ambition is massive, and they're not shy about it.They're not alone in this space, but their traction is undeniable. Their bet on "RWAfi"-making tokenised assets usable across lending, derivatives, and speculation- sets them apart from competitors still focused on just wrapping assets and parking them.

That said, it's early days. The mainnet isn't live yet. What we've seen so far is testnet numbers, speculative capital, and bold promises. Risks like dilution and regulatory whiplash loom large. Partnerships are generating buzz, but execution is what will make or break this.

Here's where we stand: our team sees huge potential in Plume. Some of us are genuinely excited and would love to invest when the timing feels right or when the price hits the levels we've outlined in our technical analysis section. The "RWAfi" thesis is compelling, and the long-term narrative around real-world assets is one we're bullish on. But for now, we're holding off on long-term bets until the network proves itself.

For traders, the short- to medium-term opportunities are clear- check our key levels in the analysis above. For the long haul, we're keeping Plume high on our watchlist, and we're ready to move when risk-on sentiment returns in the coming weeks or months. Don't get caught off guard. Stay tuned to our market updates and research to be prepared.

Peace!

Cryptonary, OUT!