But here's the twist—right now, we're not just bracing for rain; we're dancing in a downpour of golden opportunities courtesy of the current bull market.

We've already shared our thoughts on the much-anticipated V3 of Synthetix. You might want to read that report if you haven't checked out.

But there's more to the story. Beyond the big names and headlines, there's a smaller project out there that's gearing up for some big moves fueled by the expansion of Synthetix to Base.

So, let's dive into what this project is all about and why it's worth your attention.

TLDR

- Kwenta is a decentralized derivatives trading platform built on top of Synthetix.

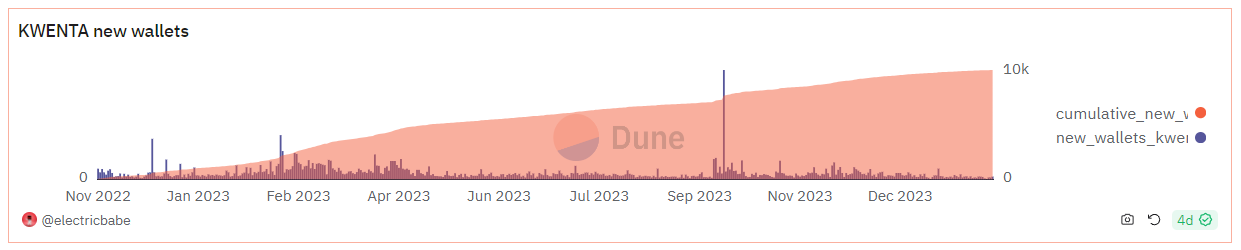

- Successfully bootstrapped the platform with their token, which resulted in a sticky userbase.

- It is getting ready to launch on Base with improved tokenomics and low inflation.

- The market hasn’t priced the catalysts and developments yet, so there is an opportunity for us to invest.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Kwenta

Kwenta is a decentralized derivatives trading platform built on top of Synthetix. It leverages Synthetix’s debt pool and offers perpetual futures with up to 50x leverage.Simply put, Kwenta is a front-end for the Synthetix, just like Thorswap is the front-end platform for the Thorchain.

Currently, it is live only on Optimism, but soon, it will fully expand to Base along with Synthetix and potentially to Arbitrum.

Before we present our play, let’s get familiar with the basics.

Basic information

- Mcap (circulating): $30m

- Mcap (FDV): $45.4m

- Last 365-day fees generated:$19.3m

- Last 365-day trading volume: $40.6B

- Daily active users on average: 250+

Over the last year, Kwenta has generated $19.3m in fees, which is great for the token with a $30m valuation.

Initially, it incentivised the trading activity with its own token, $KWENTA.

However, the platform gradually decreased the incentives as the protocol matured.

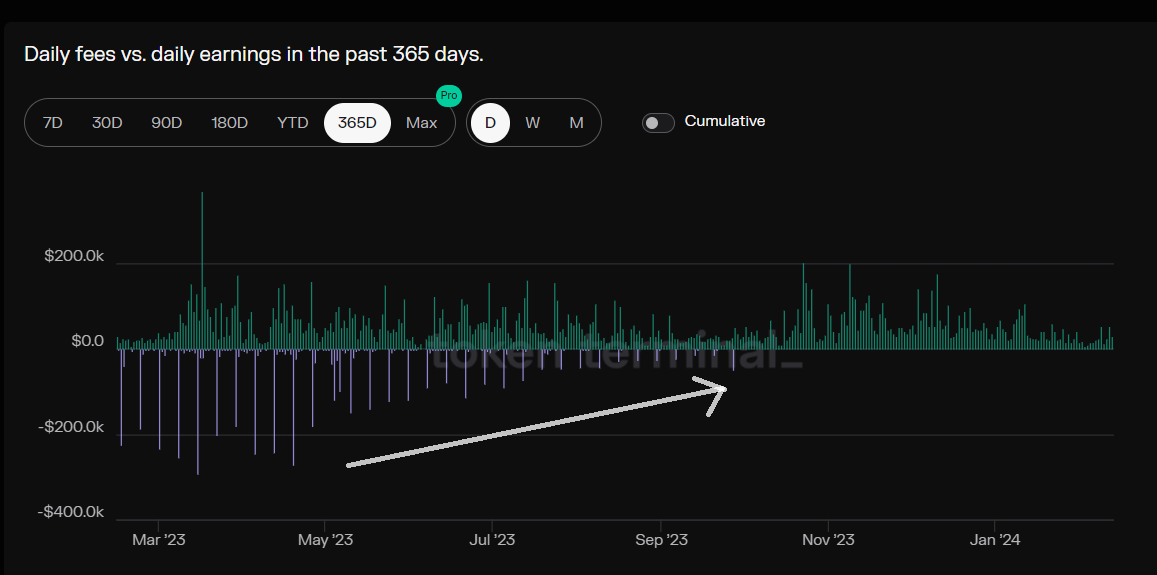

Below, you can see trading fees (green) and earnings (purple - revenue minus $KWENTA incentives)

This is a great case study of effectively utilising the protocol's token to bootstrap the platform.

As you can see in the chart, fees have been steady over the course, even with decreasing incentives. The team used the protocol’s token to incentivise trading initially, and they've gradually removed the incentives without affecting the trading activity.

Kwenta has done a great job of properly using its token to gain market share and foster stickiness to the platform.

Since we can now see that the volume is sticky even without incentives, it is a great time to look closer at the asset as a potential investment opportunity.

Let’s start with tokenomics

Tokenomics

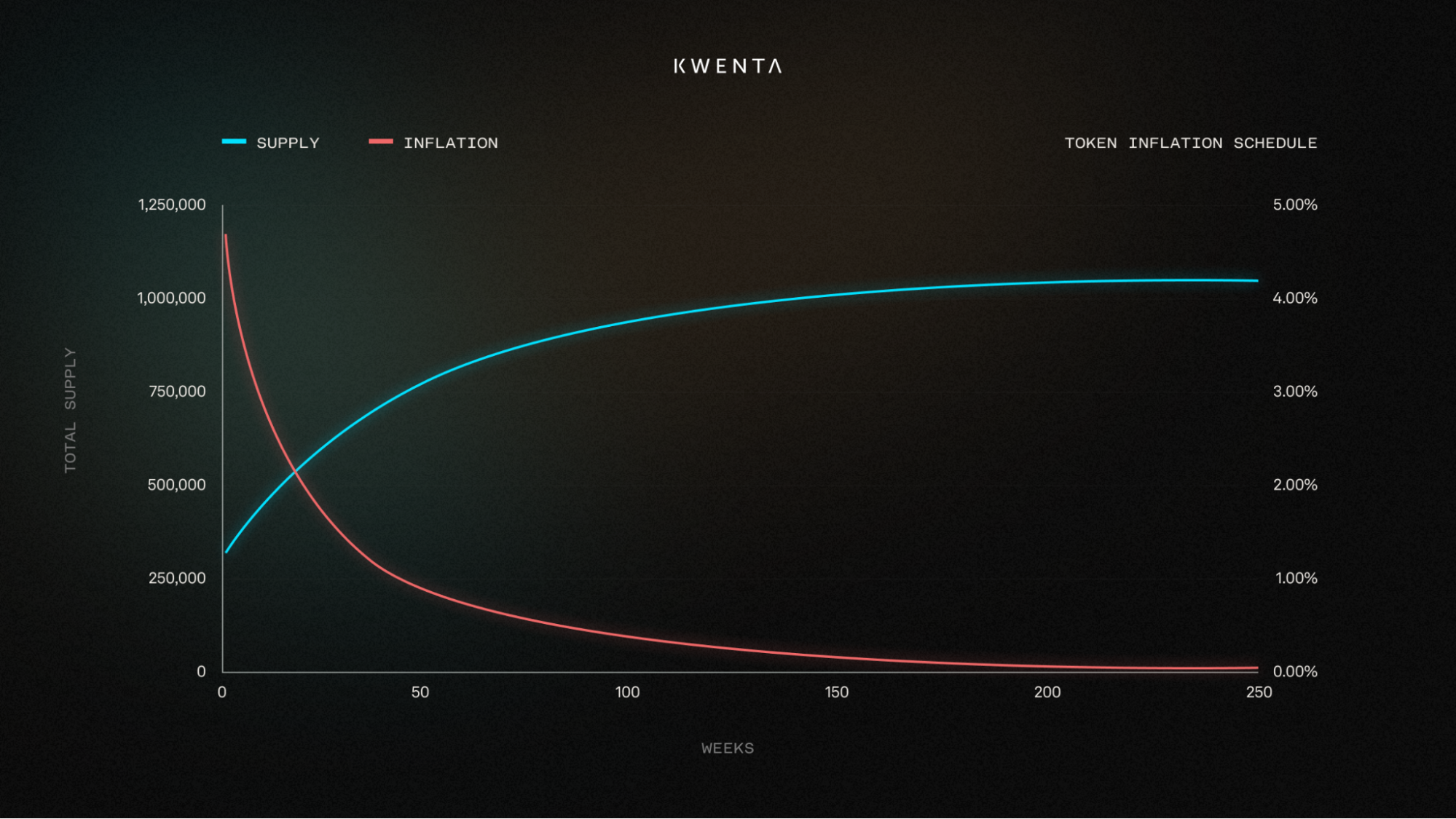

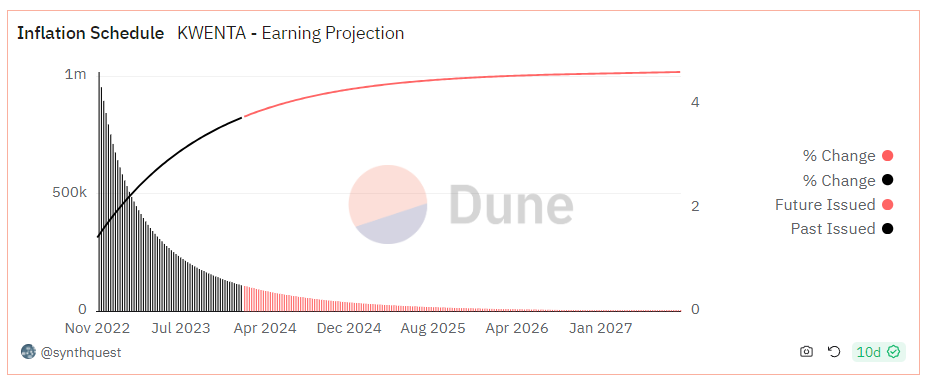

$KWENTA is an inflationary token. As mentioned earlier, it is currently used for governance and as an incentive to traders and stakers.Initially, there were 313,373 $KWENTA tokens, with weekly emissions starting at 14,463.37 $KWENTA in the first week and decreasing to around 200 $KWENTA (1% APY) at the end of four years. This results in a total supply of 1,009,409.43 $KWENTA at the end of the four years.

The inflation schedule of Kwenta looks like this:

20% of inflation is routed to the treasury, 20% of inflation is dedicated to trading rewards (with 15% earmarked for future trading incentives by the treasury), and 60% of inflation is routed to stakers.

This enables the DAO to fund roles sustainably while allowing the community to utilise the entire token supply as needed.

There is also a vesting mechanism for $KWENTA printed via inflation.

The lock-up period lasts one year, during which there is a 90% fee for vesting $KWENTA early. This fee decreases linearly over time. After one year, the fee reaches 0%, and no tokens are withheld.

Over the last months, the token has undergone heavy inflation, which is reflected in its price.

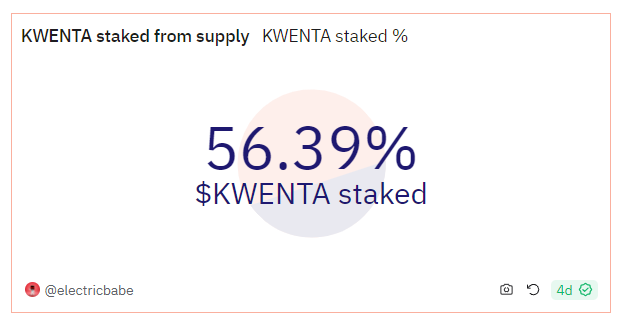

Since more than half of the supply is currently staked, the price action potentially comes from users/treasury dumping received incentives generated via inflation.

And we cannot blame them for that.

There has been no reason to hold the token; in its current form, $KWENTA is not attractive as an investment.

But don't write off KWENTA just yet.

Investment thesis

Despite generating substantial fees and volume and having a relatively small market cap, the main criticism of Kwenta as an investment is that its tokenomics are poor. It has a P/E ratio (circulating) of just 1.65 and a P/E ratio (fully diluted) of 2.78 – these are ridiculously low. For comparison, DYDX has a P/E (fully diluted) of 77.7One of the primary reasons for this low ratio is that none of the fees generated by Kwenta goes to its stakers. 100% of the fees currently go to SNX debt holders. This leaks away the value accrual from the $KWENTA token to the SNX debt holders.

Another reason is that, as mentioned earlier, Kwenta had an aggressive inflation to bootstrap the platform. The Kwenta token was leaking value through significant dilution, rewarding traders and stakers but simultaneously crashing the price of $KWENTA.

Overall, currently, there is no reason to hold value-leaking tokens from an investment perspective.

Therefore, despite generating substantial fees, the market capitalisation has been very low, which resulted in a tiny P/E ratio.

However, with the launch of Synthetix on Base, things are about to change for $KWENTA.

KWENTA's tokenomics should get better from here

Every week, inflation goes down.As of now, most of the inflation has already occurred, and the inflation rate will continue to go down.

As we can see from the image above, the upcoming inflation is almost insignificant.

Unfortunately, the market is still potentially pricing KWENTA as an aggressively inflating token.

There is still little inflation ahead, of course, but when the market reaches a consensus regarding the non-inflationary status of the token, the investment opportunity will be already gone.

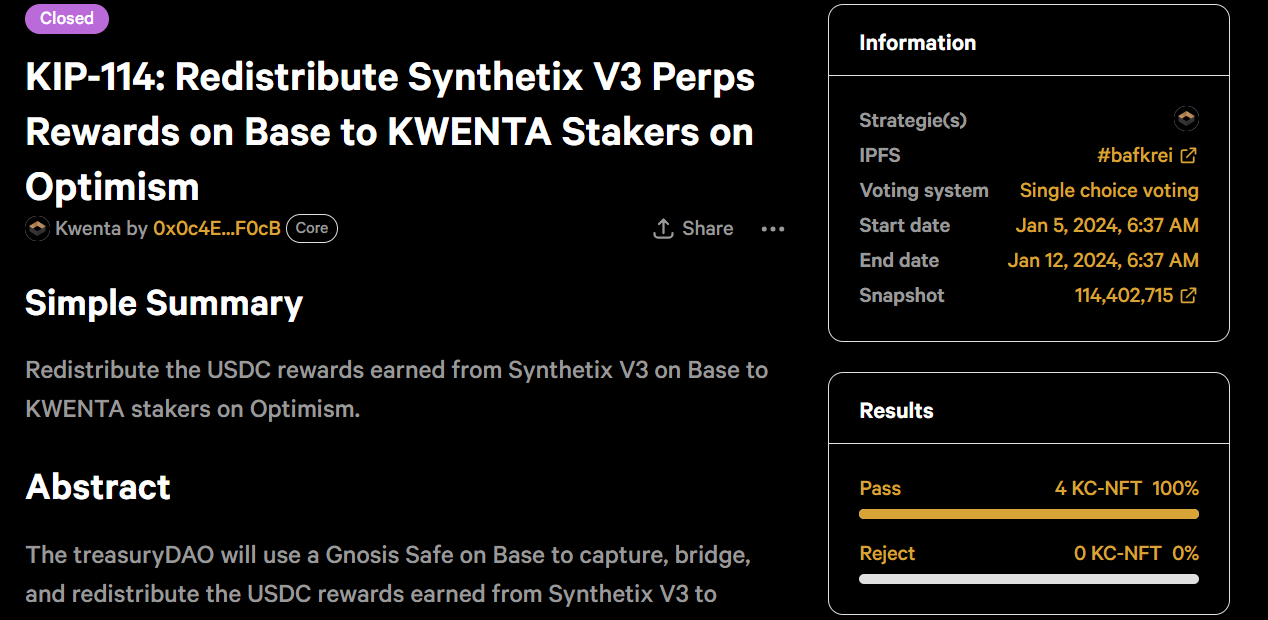

Secondly, Kwenta will be launching on Base as a front-end for Synthetix.

With the launch on Base, Kwenta will become a revenue-sharing token where revenue from Base will be redistributed to Kwenta stakers in USDC.

This addresses the second criticism regarding Kwenta’s tokenomics. Kwenta will transform from being a token used for governance and farm-and-dump strategies into a sound and revenue-generating token.

So, our investment thesis is simple: we have a token with a 1.65 P/E ratio with decreasing inflation and will soon transform from a governance token to a revenue-sharing token.

We believe the market hasn’t priced the upcoming catalysts and changes to the tokenomics.

There will potentially be a repricing of this asset once the market catches up.

On Optimism, Kwenta generates roughly $20m in fees. Assuming that on Base, it will generate half of that ($10m) and distribute that to stakers, we are potentially looking at a $100m - $200m valuation based on a 10x-20x P/E ratio.

That is roughly 3x-6x from current prices, depending on how successful Synthetix is on Base and what multiplier the market will give to this asset.

Technical analysis

Where we are now couldn’t be a more perfect place to buy from a TA perspective.

We have a break and retest of a very significant bearish trendline and have found the floor at 60.00

Which provides very solid support.

If you decided to invest, here is how to do it:

How to buy KWENTA

- You will need ETH on the Optimism network (You can get yours on Optimism by withdrawing from Centralized exchanges directly).

- Go to 1inch exchange and choose the Optimism network.

- Swap your ETH to Kwenta (in the “You receive” section, insert the following address 0x920Cf626a271321C151D027030D5d08aF699456b)

- Execute the trade

Cryptonary’s take

Kwenta is the flagship front-end for Synthetix.Both Kwenta and Synthetix are expected to launch on Base in February or early March.

We believe Kwenta is mispriced, given improvements in its tokenomics and upcoming catalysts.

Nonetheless, we still consider Kwenta a short-term trade to play the launch of Synthetix on Base (3-4 months; 1 month for the launch, 2-3 months for the market to catch up).

For the long term, Kwenta has very strong competitors in the derivatives market: dYdX, Hyperliquid, GMX and soon Infinex.

We will need to reevaluate how much more volume and fees Kwenta can generate on Base.

We believe there is still time to position ourselves early for this trade. It will be late once Twitter influencers catch up. So far, the sentiment is very quiet.

Therefore, despite the launch being weeks away, we still have time to position.

Are you ready to grab this opportunity?

We are already in the bull market.

Don’t fumble the bag!

Cryptonary, OUT