It starts with a vision of boldly reimagining the financial system as we know it. Larry Fink, CEO of BlackRock, envisions a future where every stock, bond, and asset exists on a unified ledger-digital, tokenized, and accessible to all.

This isn't a vague dream or a distant possibility. It's a revolutionary shift that's already in motion, reshaping how we understand and interact with finance.

Imagine a world where borders no longer restrict transactions, inefficiencies vanish, and trades happen in seconds, not days. This is the promise of tokenization, where blockchain technology merges seamlessly with traditional financial instruments. It's not just about improving what already exists; it's about rebuilding the foundation of global finance, making it faster, more transparent, and more inclusive.

Major institutions aren't just paying attention-they're leading the charge. From tokenized treasuries to real estate fractionalization, the largest players in finance are proving this isn't hype; it's the future. Tokenization is already unlocking once-impossible opportunities, creating markets that are fairer, more accessible, and primed for innovation.

Ready to know what it means for you? Let's dive in.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

The foundations of tokenization

At its core, tokenization is the process of converting real-world assets into digital tokens that exist on a blockchain. These tokens act as certificates of ownership, representing claims on physical or financial assets like real estate, stocks, or bonds.Blockchain technology provides the foundation, offering a secure, transparent, and immutable ledger for these transactions.

The process begins with off-chain standardization, where details such as asset value, ownership, and legal documentation are verified and digitized. Once this data is formalized, tokens are created on the blockchain.

These tokens can be divided into smaller units, allowing assets to be fractionalized and traded with ease. Finally, these digital tokens are listed on centralized and decentralized marketplaces, where they can be bought and sold globally.

A new era of financial inclusion

For decades, high-value assets like commercial real estate or fine art were accessible only to the wealthy or institutional investors. Tokenization is shattering these barriers. By enabling fractional ownership, it allows individuals to own shares in assets that were previously out of reach.The ability to divide assets into smaller, tradable units opens the door to a new class of investors. A retail investor can now own a fraction of a skyscraper in New York or a Picasso painting, investments that were once exclusive to ultra-high-net-worth individuals. Tokenization isn't just making finance more accessible; it's making it more inclusive.

Thus, it is becoming a vital tool for democratizing investment and enabling broader market participation. By transforming traditionally illiquid assets into easily tradable units, tokenization is unlocking immense potential for both individual investors and large institutions.

Moreover, this accessibility doesn't come at the cost of efficiency. Tokenized assets eliminate intermediaries, streamline transactions, and reduce costs. What once required extensive paperwork and weeks to settle can now be done in seconds on a blockchain.

Current status of RWA tokenization

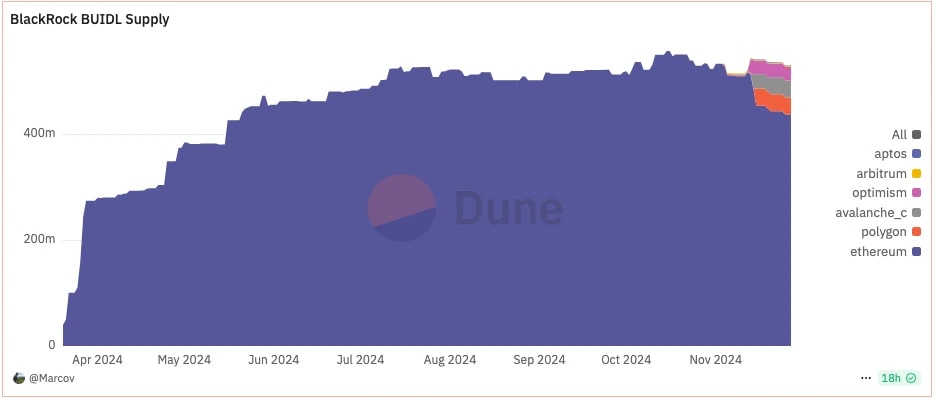

The tokenization market is rapidly gaining momentum. As of 2024, the total market cap of tokenized real-world assets has exceeded $13 billion, driven by sectors like tokenized U.S. Treasuries and private credit. This growth highlights the increasing adoption of blockchain technology by both traditional institutions and innovative startups.Institutional players like BlackRock and Franklin Templeton are leading the charge. BlackRock's BUILD Treasury product, a tokenized U.S. Treasury fund, has amassed over $530 million in assets, while Franklin Templeton's OnChain U.S. Government Money Fund (FOBXX) showcases how blockchain is redefining mutual funds.

However, this is just the beginning. Tokenized assets currently represent a tiny fraction of the global financial market, but their potential is immense. With continued adoption, the next few years could see tokenized assets becoming a cornerstone of the global financial system.

Market distribution of tokenized RWAs

The market for tokenized real-world assets (RWAs) has witnessed remarkable growth, reaching a total market size of $12 billion in 2024. This market comprises various financial instruments, each representing a distinct segment of the broader tokenization narrative. Below is an overview of how RWAs are distributed across key categories:1. Tokenized treasuries and bonds

- Market size: The tokenized treasury market has grown significantly, increasing from $769 million to over $2.2 billion in 2024, fueled by elevated U.S. interest rates.

- Key player: BlackRock's BUIDL Treasury fund leads this category with a market cap exceeding $500 million.

- Broader scope: Beyond U.S. Treasuries, the tokenized bond market, which includes non-U.S. products and corporate bonds, stands at nearly $80 million.

2. Private credit

- Market size: The on-chain private credit market has surged to $9 billion, reflecting a 56% growth over the past year.

- Dominant player: Figure leads this segment with $8.3 billion in Total Value Locked (TVL).

- Use cases: Private credit tokenization is providing institutional investors with new opportunities for diversification and liquidity.

3. Commodities

- Market size: The tokenized commodities market, largely dominated by gold products like PAXG and XAUT, has a total value north of $1 billion.

- Gold's dominance: Gold accounts for nearly the entire segment, with minimal contributions from other commodities such as silver, platinum, and uranium.

The potential of RWAs in the next decade

The growth potential for real-world asset (RWA) tokenization is immense, though projections vary significantly across industry reports. Boston Consulting Group (BCG), in its latest joint paper with Aptos Labs and Invesco, termed tokenization as "the third revolution in asset management."The report estimates that tokenized funds could account for 1% of global mutual funds and exchange-traded funds (ETF) assets under management (AUM) by 2030, representing over $600 billion in tokenized fund AUM. This reflects a measured but optimistic view of tokenization's growth in specific segments, particularly tokenized investment funds.

Meanwhile, McKinsey & Company offers a broader and slightly more optimistic outlook, projecting the total market size for tokenized RWAs to range between $1 trillion and $4 trillion by 2030. Their analysis suggests that adoption will expand beyond funds to include a wider range of real-world assets, albeit at a steady pace.

McKinsey notes that "broad adoption of tokenization is still far away" as the industry continues to overcome regulatory hurdles and shift from proofs of concept to scalable, real-world solutions.

A balanced perspective

Given the varying projections, our outlook suggests a market size of $500 billion to $1 trillion for tokenized RWAs by 2030. While this range is more conservative than McKinsey's broader estimate, it remains realistic, considering the challenges of regulatory clarity, technological infrastructure, and the cautious pace of institutional adoption.This market size would account for only about 0.2% to 0.4% of the global financial asset market, which is estimated at $250 trillion to $300 trillion. Though small in percentage terms, it represents a meaningful start to the integration of blockchain technology into traditional finance.

Early use cases in real estate fractionalization, tokenized bonds, and decentralized finance (DeFi) are already demonstrating the transformative potential of tokenization to improve liquidity, efficiency, and market accessibility.

As the infrastructure matures and trust in blockchain technology grows, tokenized RWAs could gradually expand their footprint, paving the way for more inclusive and efficient financial systems. While large-scale adoption remains a longer-term goal, the foundations being laid today indicate a promising future for tokenized assets.

The RWA goldmine: Key tokens to watch

Okay, we now know that RWA has massive potential, but how can you position yourself? Within this evolving landscape, several tokens have been offering an interesting potential, each addressing unique aspects of the RWA narrative- from enabling fractional ownership of the real estate to facilitating seamless interoperability between blockchains.Here, we delve into three standout projects- ONDO, PARCL, and CHEX- and analyze their roles in the tokenized economy and the opportunities they present for investors to capitalize on this groundbreaking trend.

1. ONDO

Overview: Ondo Finance is a pioneering platform that bridges blockchain technology with conventional financial assets. By focusing on the tokenization of RWAs such as bonds, ETFs, and U.S. Treasuries, Ondo Finance is positioned as a critical player in the RWA ecosystem.Key catalysts:

- SEC approval of spot Ethereum ETFs: Boosted market optimism and drove attention to Ethereum-related tokens like ONDO.

- Coinbase Listing: Increased visibility and trading volume by 130%, providing greater liquidity for ONDO.

- Institutional backing: Strategic partnerships and investments from venture capital giants like Pantera Capital, Coinbase Ventures, and Tiger Global Management lend credibility and long-term growth potential.

With regulatory clarity improving and institutional adoption accelerating, ONDO offers significant upside potential for investors looking to capitalize on the RWA trend.

Technical analysis

Daily timeframe insights

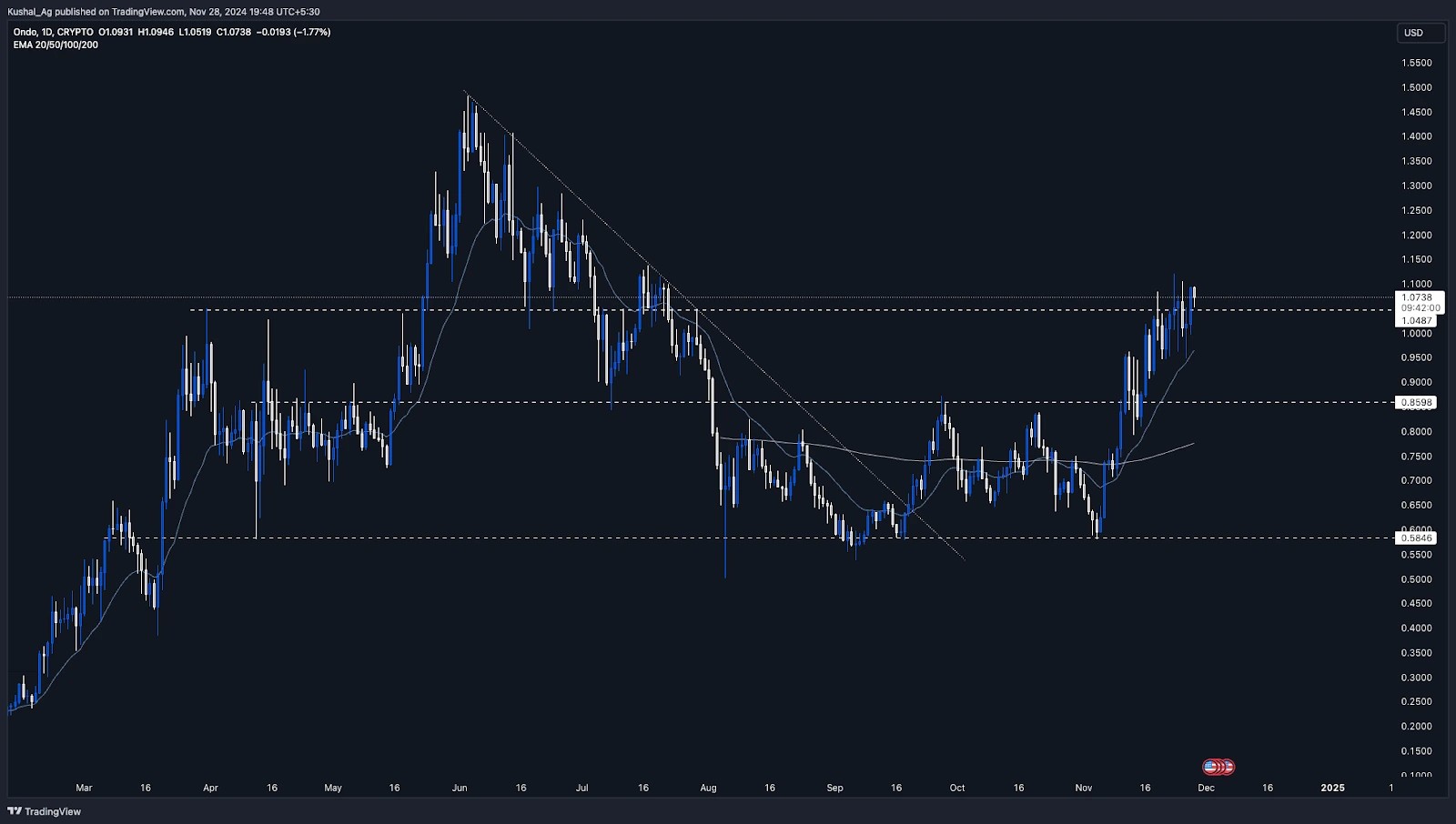

ONDO has shown a steady upward trajectory since November, rebounding strongly from the $0.584 region, a significant support area that acted as its November low. This level has historically served as a foundation for ONDO's bullish momentum.

The asset has surged approximately 94% from that low, currently trading at $1.06 after making a local high of $1.119 a few days ago. ONDO is battling resistance at $1.048, attempting to establish a base above this key level.

If sustained, this could lead to ONDO retesting its local high and possibly approaching the $1.48 ATH made in June.

Trendline and structure: The marked downtrend that began after its ATH has been decisively broken, signalling a shift in sentiment. ONDO's consolidation between $0.859 and $0.584 from August to November established a robust base, enabling the breakout in mid-November.

The subsequent rally has solidified the $0.859 region as a support zone, with the $1.048 level now acting as a critical area for continuation.

Outlook and key levels: ONDO's immediate trajectory depends on its ability to hold above $1.048 and continue its upward momentum. A breakout above $1.119 could spark a move towards its ATH at $1.48.

On the downside, the $0.859 and $0.965 (20 ema on the daily timeframe) levels remain strong support zones, with the latter being pivotal for long-term bullish sentiment.

2. PARCL

Overview: Parcl specializes in the tokenization of real estate, enabling fractional ownership and increasing the liquidity of these traditionally illiquid assets. The platform leverages blockchain technology to streamline real estate transactions, making the process more accessible and efficient for a broader audience.Key catalysts:

- Fractional ownership: Allows investors to purchase tokens representing portions of high-value properties, reducing barriers to entry for real estate investment.

- Streamlined processes: Blockchain-driven automation for rent distribution, property management, and other administrative tasks minimizes costs and time.

- Portfolio diversification: Investors can diversify geographically and across asset types, optimizing risk management and returns.

As the tokenization of real estate gains momentum, Parcl's innovative approach positions it as a key beneficiary of this trend.

Technical analysis

Daily timeframe overview: PARCL has demonstrated a remarkable recovery, moving from $0.2 in early November to a high of $0.57 in mid-November. This parabolic move of 180% was followed by a healthy retracement, allowing PARCL to consolidate and take support at key levels. Currently trading at $0.418, the asset is navigating resistance at $0.472 while maintaining support from the $0.323 region.

EMA support and resistance zones: The 20 EMA on the daily timeframe, positioned at $0.377, is providing dynamic support during this consolidation phase. Below it, the $0.323 support level aligns closely with the 200 EMA, trading at $0.293. These areas form a solid base for potential bullish continuation. On the upside, breaking the $0.482 resistance could lead to a retest of the $0.57 high, with prospects of further movement depending on market momentum.

Potential scenarios: For PARCL to sustain its bullish trajectory, it needs to flip the $0.482 level into support. Failure to do so might result in a retest of the $0.377 EMA or the $0.326 support zone. On the flip side, a successful breakout could see PARCL approaching its recent highs and exploring higher prices above $0.55.

3. Chintai (CHEX)

Overview: Chintai is a blockchain technology platform specializing in the tokenization of real-world assets (RWAs), including real estate, bonds, carbon credits, and alternative investments.By leveraging a permissioned blockchain, Chintai provides a compliant and scalable framework for businesses to issue, trade, and manage digital assets. Its innovations, such as the Chintai Nexus platform and Net Zero-X exchange, cater to a wide range of tokenization use cases, including sustainable investments.

Key catalysts:

- Chintai nexus platform: A comprehensive solution for issuing, trading, and managing compliant digital assets on-chain, supporting various RWAs like carbon credits and real estate.

- Net zero-X exchange: Connects institutional and accredited investors with verified climate tech projects, driving investments in net-zero solutions and sustainable initiatives.

- Regulatory compliance: Operates on a permissioned blockchain with strict adherence to AML regulations, ensuring trust and security for institutional adoption.

With a market cap of $255.31 million, Chintai presents an opportunity for investors seeking exposure to sustainable and compliant tokenization solutions. The platform's integration of DeFi features further enhances its appeal, creating a multifaceted investment case.

Technical analysis:

Daily timeframe overview: CHEX has been in a clear uptrend since bottoming out at $0.075 in early September, demonstrating strong bullish momentum with consistent higher highs and higher lows. The uptrend has been supported by a dotted white trend line, which has acted as dynamic support over the past few months.

Currently, CHEX is trading at $0.351, having recently broken through the $0.325 resistance level, which now serves as a key support.

![]()

Key levels and momentum: CHEX is approaching its all-time high of $0.428, and the momentum suggests the potential for a breakout if market conditions remain favourable. The $0.325 level, now a solid support zone, will be crucial for sustaining this rally.

On the downside, if CHEX fails to hold above this level, it could retrace to test the long-term trend line or the $0.25 support zone, both of which have historically provided strong buying opportunities.

Outlook and scenarios: For CHEX to maintain its bullish trajectory, it needs to consolidate above $0.325 and push higher toward its all-time high of $0.428. A breakout above this level could lead to new price discovery.

However, any breakdown below the $0.325 support could see CHEX retracing to $0.25 or the uptrend line for a potential rebound. Overall, CHEX looks solid technically and is positioned for strong performance if it maintains its current level.

Challenges on the path to adoption

Despite its potential, tokenization faces several hurdles. Regulatory uncertainty is perhaps the most significant challenge. Different jurisdictions have varying rules for tokenized assets, creating complexity for global adoption.Another challenge is the reliance on off-chain intermediaries, which can undermine blockchain's promise of decentralization. This creates potential risks for security and transparency. Additionally, managing tokenized assets requires robust technological infrastructure, which can be costly and complex to implement.

However, these challenges are not insurmountable. Innovations like zero-knowledge proofs, cross-chain bridges, and advanced security protocols are paving the way for scalable and secure tokenization solutions. The industry is still in its early stages, and the lessons learned today will shape its future.

Cryptonary's take

The RWA tokenization revolution is gaining momentum, and the best way to position yourself is by investing in the protocols and infrastructure powering this shift. Platforms like ONDO, PRCL, and CHEX are pioneering solutions in treasuries, real estate, and ESG-aligned assets, creating the backbone of this transformative ecosystem.With financial titans like BlackRock managing $11.5 trillion in assets and being bullish on tokenization, the market's potential is undeniable. BlackRock's involvement underscores the scale and credibility of this emerging sector, signalling that RWAs are not just a trend but the future of finance.

Now is the time to act. Betting on the infrastructure of tokenization today means positioning yourself at the forefront of tomorrow's financial revolution.

Peace!

Cryptonary, OUT!