Believe it or not, this is one of the dangerous phases in the market.

The market's been giving us a right yawn-fest with its never-ending sideways dance. This phase is a type of capitulation that's often overlooked.

While many people chat about the "price-based" capitulation (that sudden price drop that forces hesitant people to step back), we're smack in the middle of the "time-based" capitulation. This type of capitulation tests our patience — because there’s no clear signal for when it will end.

But remember, investing is mostly like watching paint dry: 80% dull, 20% thrill (yet 100% worth it). Now's the time to accumulate more tokens and tweak your game plan. Your moves today will pave the way for those shiny bull-market days ahead.

So, what's on our agenda? Here are our three moves:

- Selling LBR and SPA.

- Buying BTC, ETH, USH, and LINK.

- Optimising our portfolio allocations to maximise profits WITH MATHS (video below).

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

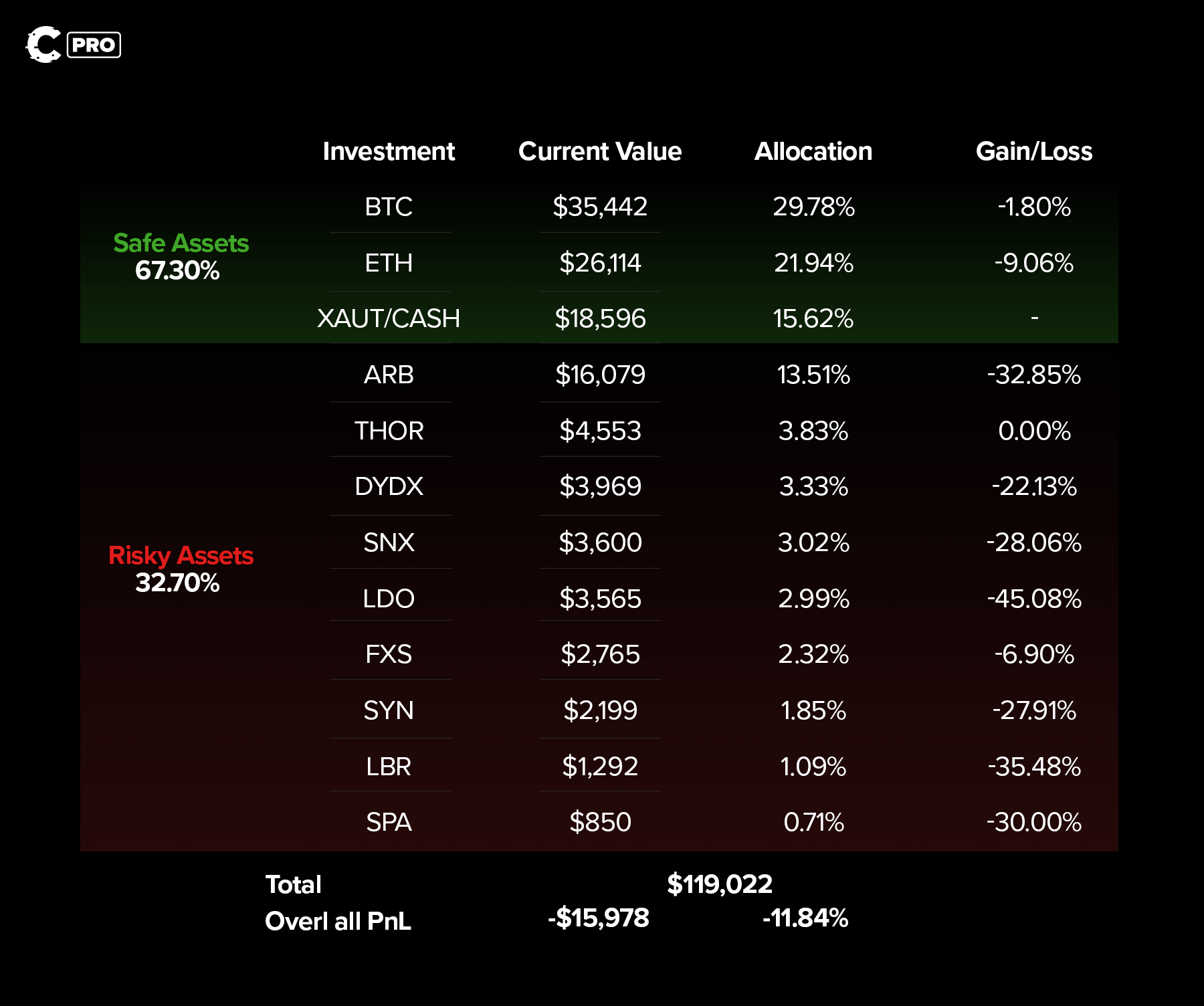

Portfolio update 📊

“Capital Preservation” is the name of the game, and it even comes before “Capital Appreciation”.

Our mission is to maintain our exposure to the crypto market, stay afloat and keep betting on the assets that are fundamentally strong. That way, when the bull market comes around, we will be strategically positioned to make a killing.

Otherwise, if we were to go balls-deep into altcoins today, we’d be at much larger losses that are difficult to recoup.

September moves 💵

This month, given the market's current uncertainty, we're putting $10,000 on the table. But before diving into our new investments, let's cover what we're selling.We’re dumping these tokens

- LBR | Lybra Finance Sticking to the plan is key. Our initial strategy set a cut-off at $0.94. Since we've hit that target, it's time to bid LBR goodbye.

- SPA | Sperax Finance We've reached our predetermined exit point of $0.0035. So, this one's on its way out, too.

- SYN | Synapse [EXCEPTION | Invalidated but not selling] SYN's price dropped past our benchmark, a risky zone known as price discovery. Yet, a unique situation - a single entity (Nima Capital - a VC) offloading 9M SYN in a minute - led to this dip. For more details, check our CPro Assets Update. Given our modest stake in SYN, we're giving it a bit more time.

How we are allocating $10,000

Our trust in the crypto economy remains unshaken. Hence, we're directing funds into the usual suspects: BTC and ETH, even if their recent moves have been, well, uneventful.There's chatter about a potential game-changer: the approval (not just talk) of an ETF. This could funnel much more capital into BTC and, by association, ETH. While the air's thick with speculation, we're all ears, ready to jump in with a significant amount when the time's right. Meanwhile, it's the patient game for us.

The other two assets we’re investing in are:

LINK | Chainlink

We're seeing LINK hover within its accumulation zone, between $4.60 and $9.50. With the recent launch of CCIP, LINK's game has significantly stepped up, setting it up for a promising run in the next cycle.

While LINK's fundamentals are looking up, and its chart seems promising, its traction, especially with developments like CCIP, isn't where we'd like it to be. The revenue below $90,000 in two months has us hesitating to pin a "final target" on LINK. Hence, we're treading carefully:

- Entry: ~$7.21 (today)

- Invalidation: $4.50

- Target 1 (selling 50%): $18

- Target 2 (selling 25%): $35

- Target 3 (selling 25%): TBD (pending better revenue data)

Think of unshETH as the crypto equivalent of the S&P 500 but for liquid staking derivatives (LSDs) like Lido. We're not typically into crypto indexes, but unshETH is on a mission to decentralise the LSD space, ensuring Ethereum's security. This makes us bullish on USH, the governance token, as this centralisation issue in LSDs needs addressing.

For a deeper dive into USH, check out our detailed write-up here.

Our strategy for USH, tweaked for its risk profile, looks like this:

- Entry: $0.030 (today)

- Invalidation: $0.023

- Target 1 (selling 50%): $0.060

- Target 2 (selling 50%): $0.423

- Target 3 (selling 25%): $0.837

Investment summary ✍️

- Portfolio Re-Balancing (details in the video above)

- SOLD 1,615 LBR for 1,480 USDT

- SOLD 242,835 SPA for 780 USDT

- Invested $2,600 into BTC

- Entry price: $26,000

- Size: 0.108 BTC

- Invested $1,400 into ETH from New Capital and $5,500 from Alt Sales (re-allocations).

- Entry price: $1,592

- Size: 4.33 ETH

- Invested $2,375 into LINK, selling 50% at $18, 25% at $35, and 25% TBD.

- Entry price: $7.48

- Size: 318.70 LINK

- Invested $3,250 into USH, selling 50% at $0.06, 25% at $0.423, and 25% at $0.837.

- Entry price: $0.03

- Size: 106,255 USH

SITG addresses ⛓️

- Bitcoin: bc1q04yt39u4rzryz539jtd7nkkk7qy2tkscxyad9j

- Ethereum: 0x938A75511F44325b9a5EB75eBe445BBaeb29F305

- Arbitrum: 0xD1693AEAd7545470A1e3ED30600Dc18c0E3Bf01d

- zkSync: 0x603F02750e21cEFB1E30D6bE27EdCCcBFe1d9455