WINR Protocol: Infrastructure leader or a risky bet in GambleFi?

In August, we highlighted WINR Protocol as a promising prospect in the emerging GambleFi sector, even naming it a potential trading wildcard in September.

Over the last three months, we’ve singled out Rollbit and WINR as strategic bets within the high-upside GambleFi niche.

True to form, WINR Protocol and Rollbit's native tokens have generated considerable returns, affirming our early thesis.

However, smart investing requires continuously reevaluating market leaders to ensure the opportunity remains intact.

We recently conducted an in-depth reevaluation of Rollbit – and it upheld its robust value proposition. Now it's time to take a second look at WINR Protocol to assess whether this infrastructure play still warrants an allocation in your portfolio.

Let’s dive in!

Overview of WINR Protocol

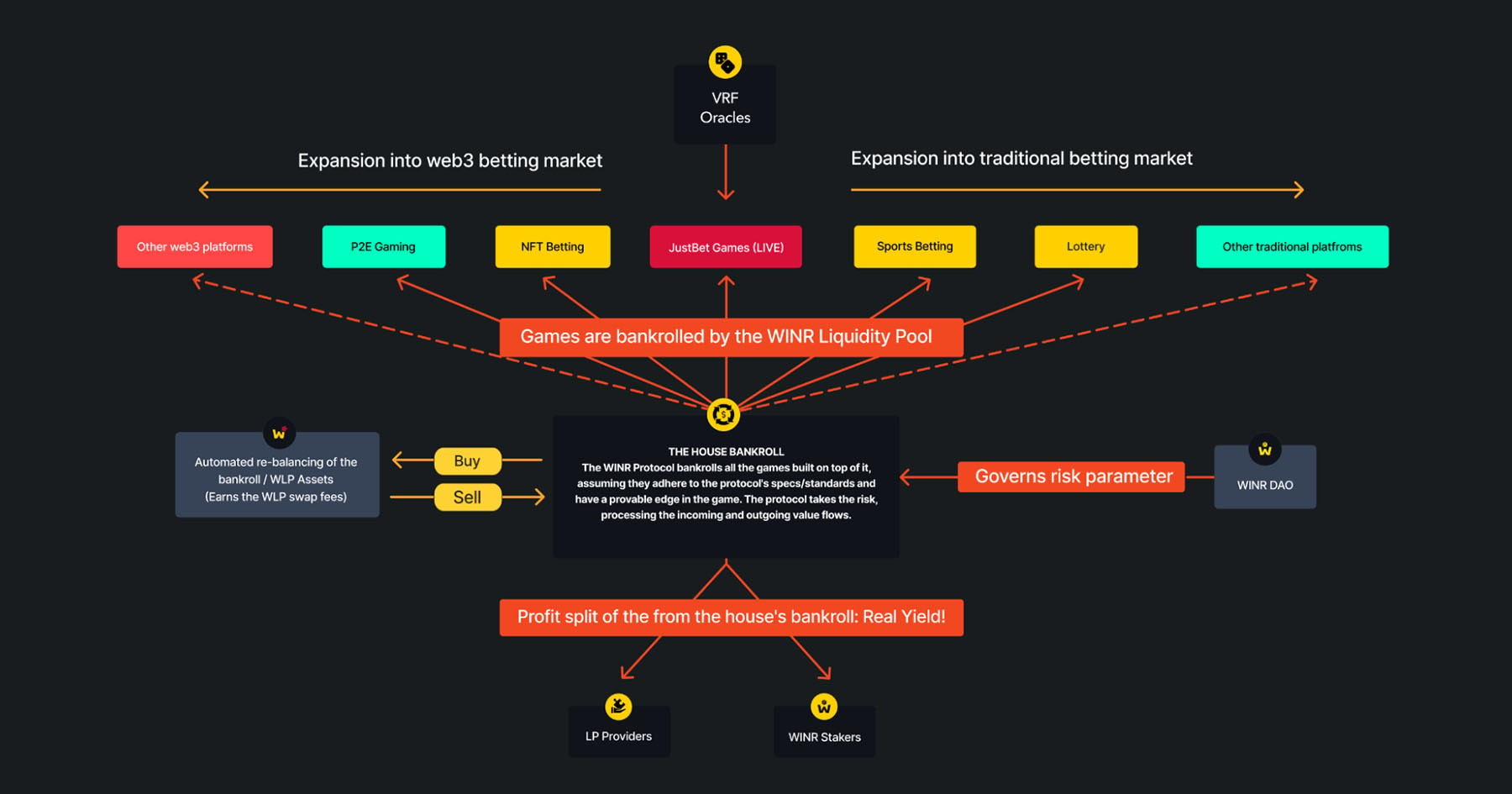

The WINR Protocol is constructing the foundational infrastructure for the next wave of decentralised gambling and gaming platforms.It functions as a B2B provider to decentralised casinos and supplies the crucial backend plumbing for developers seeking to launch games. The comprehensive infrastructure includes an on-chain random number generator, ensuring a fair gameplay experience.

Additionally, WINR streamlines the process by offering a pre-built "house" for managing payouts. This frees developers from the operational burden of acting as the bankroll. WINR also organises a shared liquidity pool that developers can seamlessly integrate to create on-chain gambling apps and casinos. Games connect to WINR's shared liquidity reserves, so they draw funds from a collective pool to pay winners. This, in turn, enhances the system's overall efficiency.

WINR didn't go out to create another decentralised casino. WINR aims to empower hundreds or thousands of unique, decentralised casinos, prediction markets, esports betting, and more. The goal is to generate revenue by providing liquidity and infrastructure for all these platforms.

Casinos launched on top of WINR Protocol

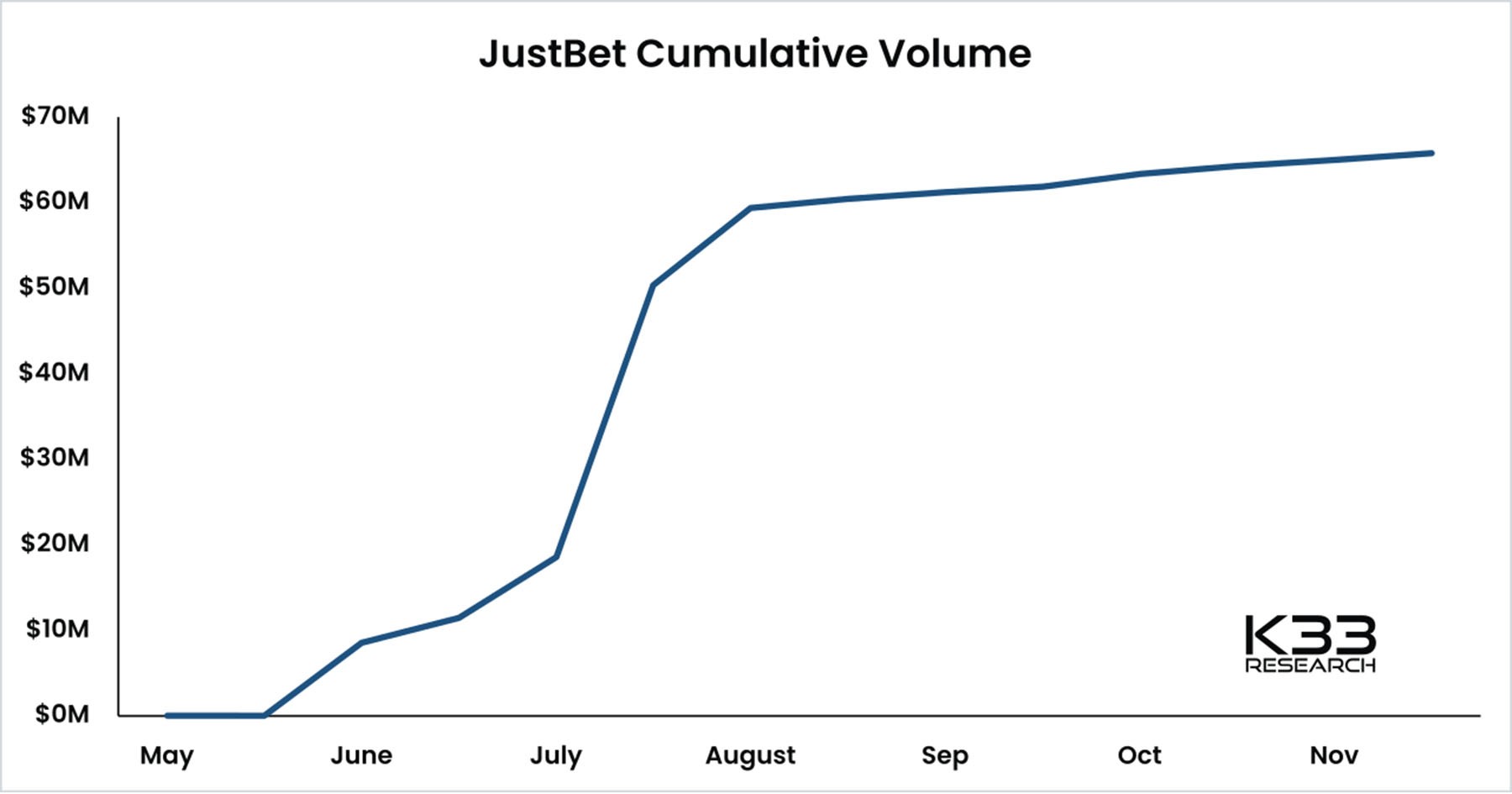

It is one thing to have great plans, and it’s another to execute those plans. WINR Protocol has a functional GambleFI infrastructure already in place. Currently, two live casinos, JustBet and DegensBet, already leverage WINR Protocol’s infrastructure.JustBet

JustBet, a decentralised casino, offers a streamlined user experience with unlimited withdrawals and a no-KYC policy. Notably, its on-chain infrastructure enhances transparency, giving users visibility into the platform's inner workings.

DegensBet

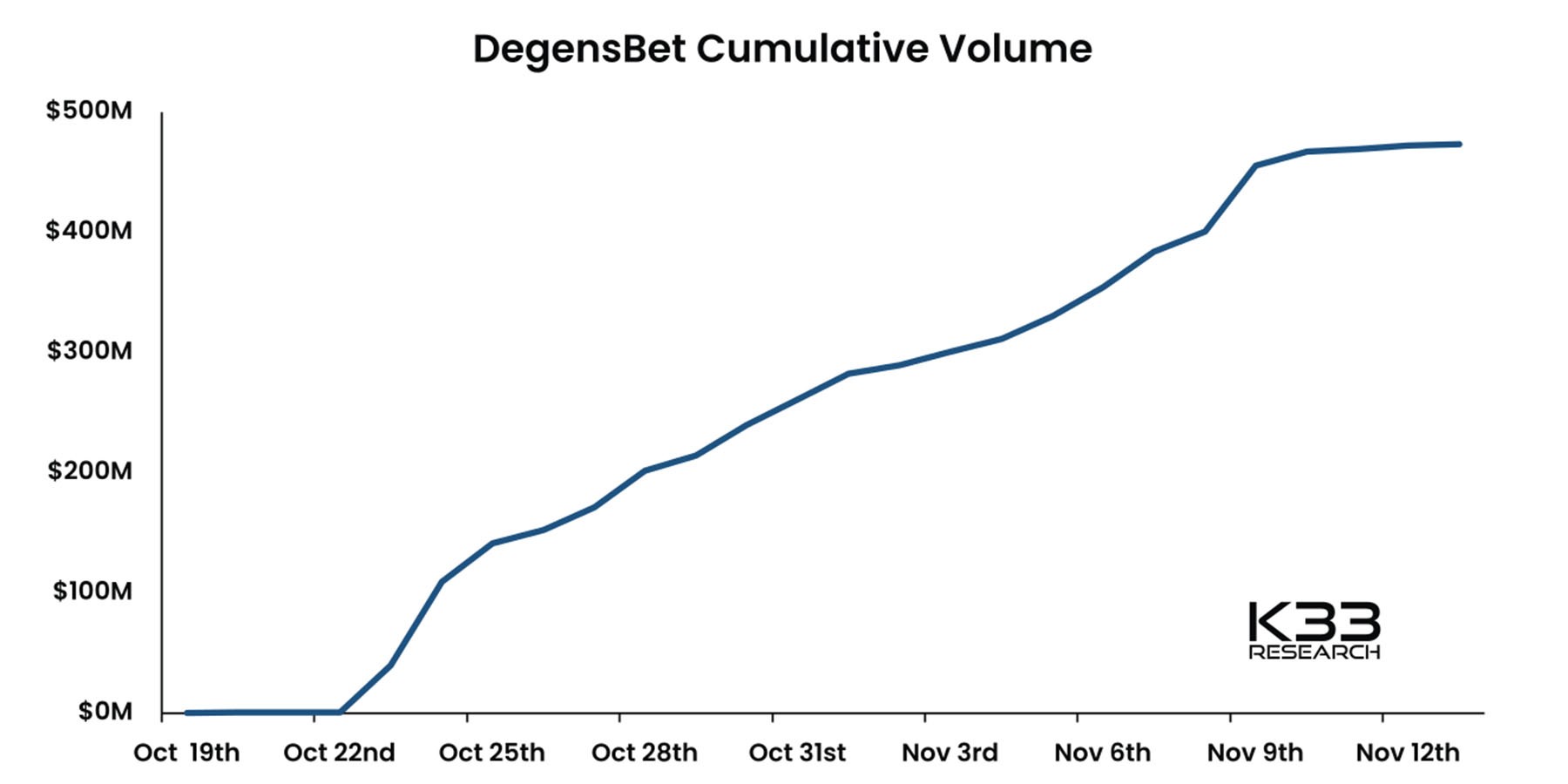

DegensBet is a high-risk, high-reward trading platform, particularly for Bitcoin (BTC) and Ethereum (ETH). It allows users to trade with up to 1000x leverage. This aggressive approach surpasses traditional centralised platforms that typically offer up to 100x leverage.

The relationship between the WINR Protocol and the WINR token

So, now that we understand the business model of the WINR Protocol let's explore how the WINR token is connected to this model and how WINR holders can benefit from the protocol's success.To do this, we must delve into two tokens, WLP and WINR, each playing a distinct role in the ecosystem.

WLP

WLP, short for WINR Liquidity Provider token, functions as a stake in the vital liquidity pools of WINR Protocol. It serves as the financial backbone for integrated gambling platforms.The composition of WLP is algorithmically determined, maintaining a fixed ratio of 50% DAI, 35% WETH, and 15% WBTC. This balance is meticulously upheld through periodic rebalancing swaps, ensuring the stability and reliability of WLP.

Holders of WLP enjoy additional benefits in the form of vWINR incentives, rewarded for their liquidity provision. At the token launch, 7.5% of the supply was allocated.

In simpler terms, liken WLP's role to GLP’s in the perpetual exchange GMX. Like GLP acting as a counterpart to trades, WLP operates comparably. If players win, WLP experiences losses, resulting in a decrease in its price. Conversely, when players lose, WLP gains, leading to an increase in its price.

The games in which WLP holders provide liquidity benefit from a mathematical advantage, creating a consistent edge that results in profits for the WLP pool, effectively functioning as the house. Since its inception, this strategic edge has already generated $378,796 in revenue, compelling individuals to participate in liquidity provision for the WINR Protocol.

The intriguing part unfolds during every player transaction, where WLP allocates a small portion as a "bribe" to the WINR Protocol system. While it may seem counterintuitive for WLP holders to contribute a share of their profits, it functions as WLP's way of bolstering the fairness and strength of the entire system, ensuring that WLP holders and the entire ecosystem prosper.

The collected bribe money is then distributed across various channels: 60% contributes to a pool benefiting WINR and vWINR holders, 20% is allocated to buy back and burn (a strategy aimed at reducing the total token supply), and the remaining 20% supports the core developers.

WINR

Next to WLP, you then have WINR, the governance token of the protocol, enabling investors to bet on the growth of the WINR Protocol.Beyond governance, WINR tokens have additional utility. If you stake WINR, it can receive a share of protocol fees, with the WLP pool allocating 60% of its bribes to WINR and vWINR stakers.

Part of the WINR supply is designated as vWINR (vested WINR), used as a reward distributed to platform users for their activity. The reward system actively encourages users to engage with the protocol.

Another way in which WINR holders benefit directly from the growth of WINR is through the buyback and burn mechanism, making the token deflationary. Specifically, 20% of the bribes are allocated to this mechanism.

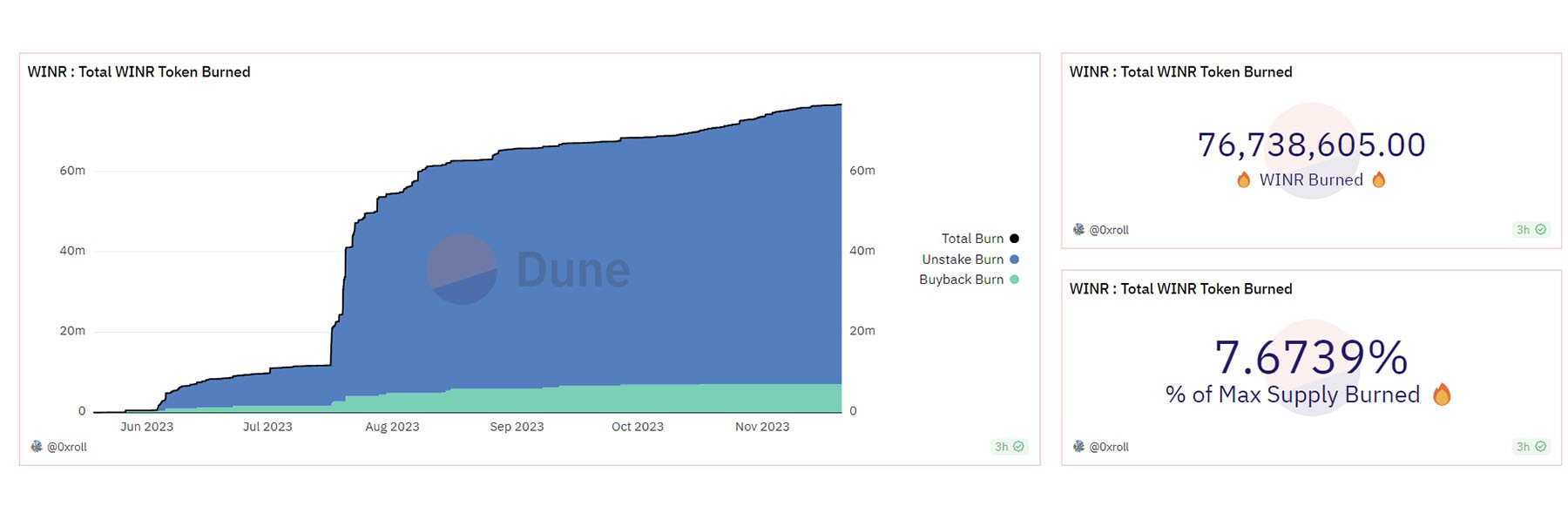

Up to now, 7.67% of the supply has already been burned, demonstrating a direct connection between the success of the WINR Protocol, its infrastructure, and WINR token holders.

By employing a dual-token structure, WINR establishes a synergy between investors holding the governance token (WINR) and platform users earning usage rewards (vWINR).

The token's deflationary characteristics, achieved through buybacks and burns, coupled with its receipt of a share of profits generated from the WLP Pool, create a direct link between the protocol's growth and the upside potential of the token.

The bull case for WINR Protocol

Consider the gold rush analogy: individuals who sold shovels during that time often earned more money than those directly engaged in gold prospecting. This analogy mirrors the situation with the WINR Protocol. Instead of operating a casino, WINR Protocol sells the infrastructure to casinos, generating revenue for liquidity providers and WINR token holders.

All WINR Protocol must ensure that it can onboard more casinos to build on top of its infrastructure. This creates the possibility that one of them might become as big as Rollbit, generating significant revenue. This revenue is then distributed to liquidity providers holding WLP and WINR stakers and used to buy back and burn the WINR token, decreasing the overall supply.

Looking ahead, WINR Protocol is broadening its horizons beyond the initial business strategy. Introducing its own layer 3 chain, 'WINR Chain,' powered by Arbitrum Orbit, is a strategic move. This development grants WINR Protocol complete control over its ecosystem and implements account abstraction to enhance the user experience.

Users will enjoy a fully gasless system on the front end, making the on-chain betting platform feel seamless and user-friendly.

What WINR Chain also enables is an increased utility for the WINR token. While users are relieved from dealing with gas fees on the front end, behind the scenes, the WINR token covers the gas fees on the chain.This implies that casinos utilising WINR Protocol's infrastructure must acquire WINR for backend transactions. A portion of these acquired WINR tokens is then burned, and the remaining portion is distributed among the validators of the chain, as they are used to pay for the fees, further reducing the supply of WINR.

The bullish case becomes evident with these imminent catalysts for the WINR Protocol. So far, Degensbet has amassed a total volume of $645,467,235, and JustBet has contributed $66,533,785 in total volume, burning 7.6731% of the WINR supply.

Given the current low valuation of WINR, standing at $19,160,047, all the WINR Protocol requires for a substantial increase in the price of WINR is the launch of more casinos on the platform.

If one of these casinos not only launches successfully but also manages to acquire market share from Rollbit, this success story will significantly amplify the amount of WINR burned, particularly in the context of WINR's current valuation.

Risks and concerns

However, the two key risks we discovered during our in-depth exploration of the WINR Protocol have complicated matters for us.We won’t be considering WINR as a long-term investment based on these two factors, despite the potential bull case we presented earlier.

Now, we will present you with these risks so you can make an informed investment decision about the project. You can also delve into the WINR Protocol's history to uncover some of these concerns.

Token launch history

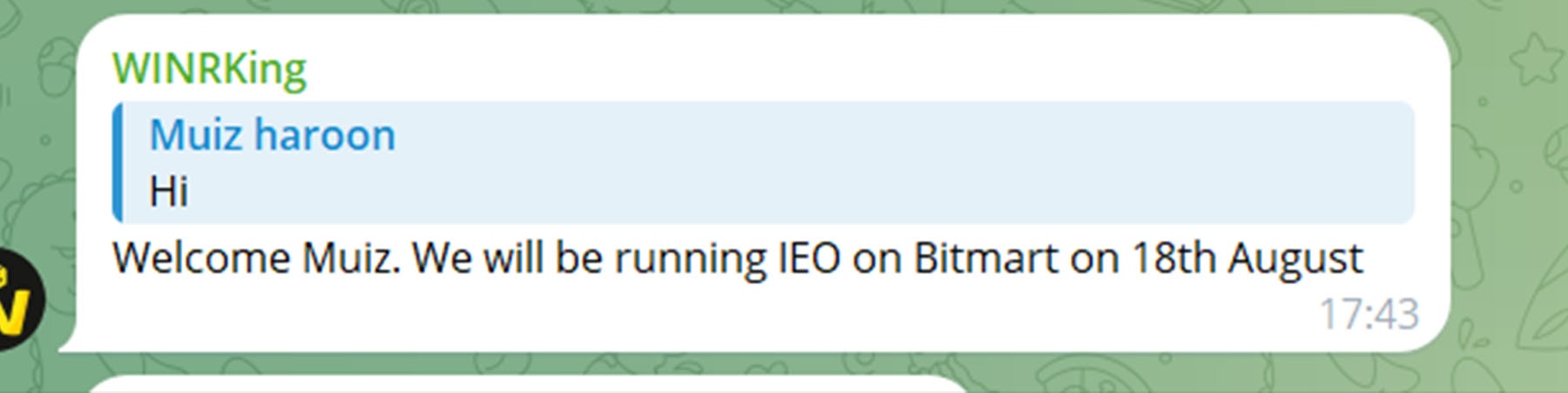

The initial WINR token was launched on the Bitmart exchange in August 2020. Early investors received a significant portion of the supply at low prices.

However, based on reviewed messages, the team needed help to deliver on promises, leading to the token's delisting and dissatisfaction among early investors.

After this rocky start, WINR went quiet for two years without providing updates to investors. The old tokens became nearly worthless.

Then, in late 2022, the team returned and offered a token swap, exchanging the old tokens for new 2023 WINR tokens. However, investors only received a 1% allocation of the new supply despite holding 17% of the deprecated tokens. This led to perceptions of unfair treatment by some early investors.

While WINR has since pivoted to an improved model, the opaque handling of the 2020 situation raises questions. It is difficult to ascertain from the outside whether any special deals were made or if founders improperly profited from pumping the original token. This history introduces the possibility of misconduct, although no direct evidence has surfaced.

When considering investments in a project, it's reasonable for investors to expect founders with an ethical track record. The WINR situation in 2020, while not inherently unethical (given that teams can experience project failures), becomes a concern due to the lack of transparency. The challenge arises from early investors feeling mistreated, making it difficult for us to assess the team and its overall reliability thoroughly.

We did not find a detailed post where WINR addressed its history, admitted mistakes, and shared lessons learned. More transparency about 2020 would help assess risks and gain conviction in the team.

Insufficient transparency on backers and investor alignment

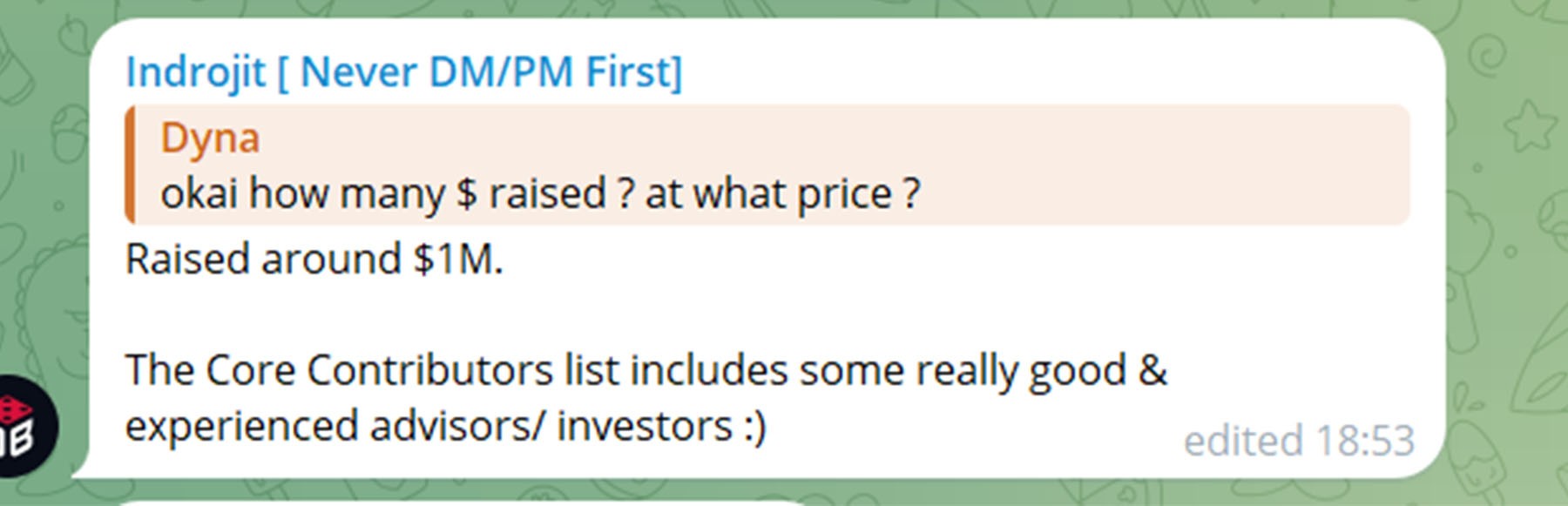

The second concern related to the WINR Protocol revolves around tokenomics, particularly the need for increased transparency regarding the $1 million funding round highlighted in their Telegram channel.

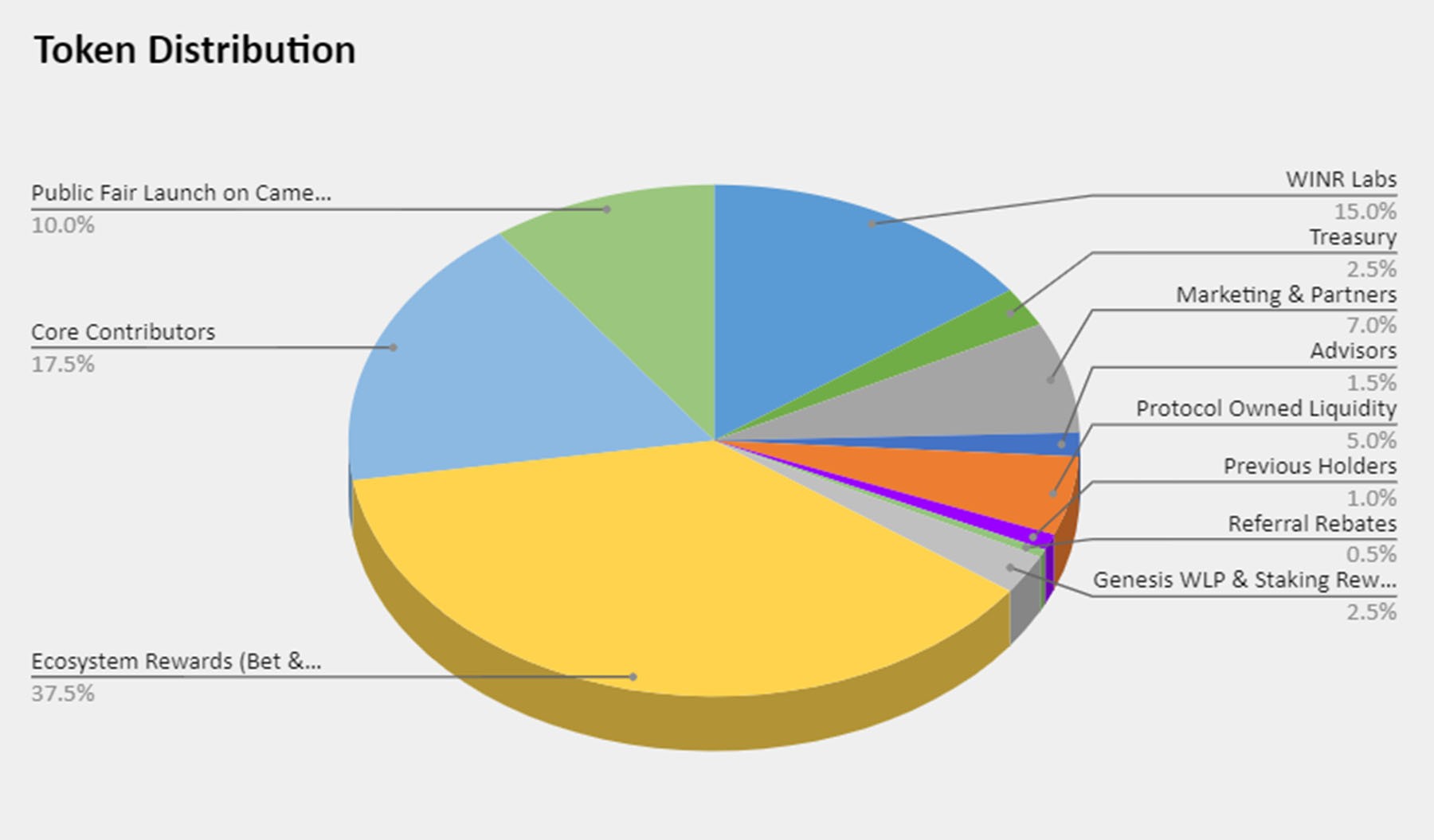

The WINR Protocol outlines the allocation of its total token supply, with 17.5% designated for core contributors, 7% for marketing and partners, and 1.5% for advisors. Collectively, these categories account for approximately 26% of the entire token supply within the WINR Protocol.

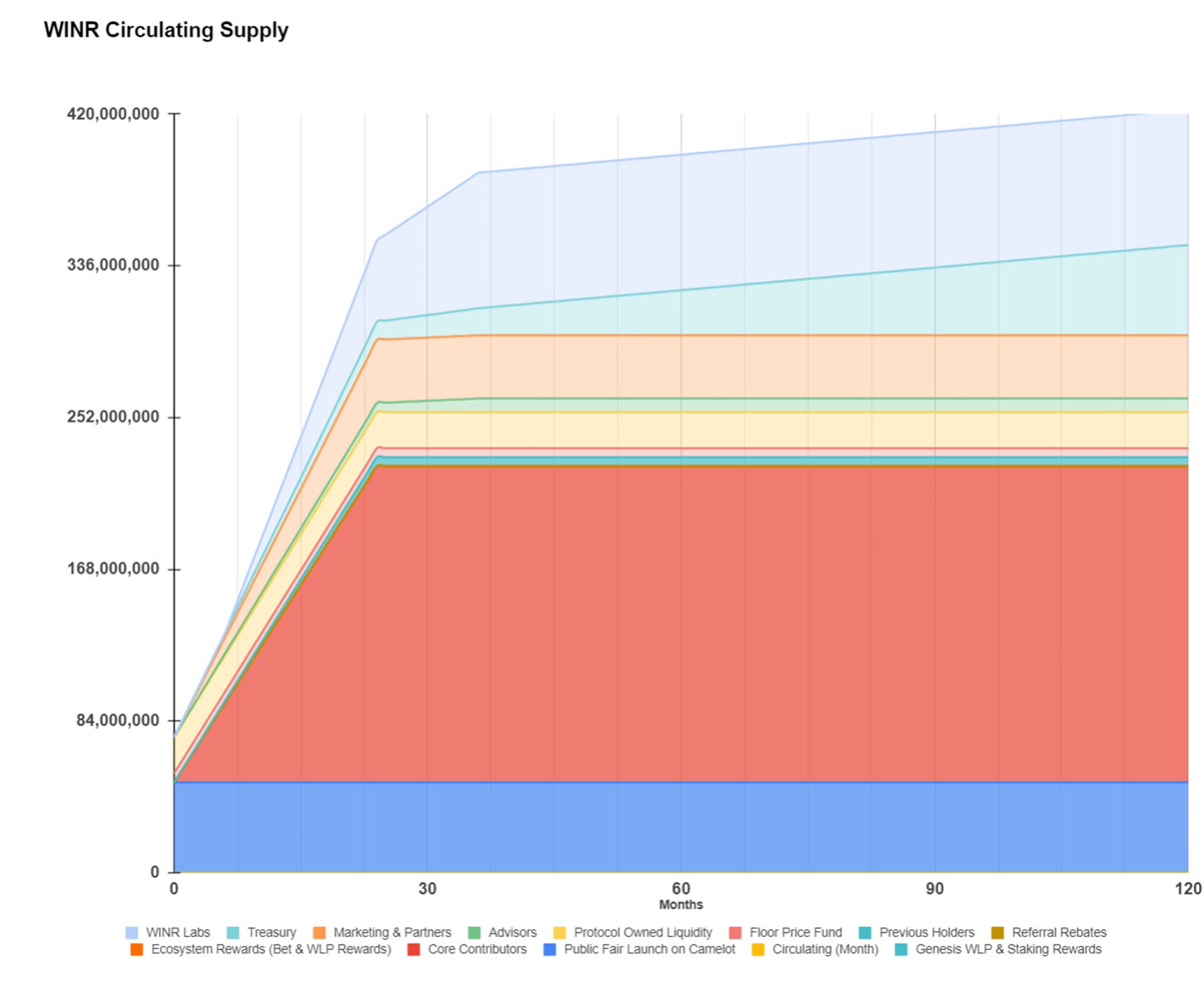

Considering the gradual release facilitated by linear vesting schedules in the first 12 months of the WINR Protocol, approximately 10.75% of the overall token supply will be made available for sale from these allocations.

Allocations to insiders are not inherently problematic. Many projects engage in token sales to private investors or distribute tokens for marketing and advisory purposes. Our concern stems from the lack of details surrounding WINR Protocol's $1 million funding round – a standard practice for most projects announced through press releases. This omission hinders investors from thoroughly assessing their alignment with the project.

Allocations to insiders are not inherently problematic. Many projects engage in token sales to private investors or distribute tokens for marketing and advisory purposes. Our concern stems from the lack of details surrounding WINR Protocol's $1 million funding round – a standard practice for most projects announced through press releases. This omission hinders investors from thoroughly assessing their alignment with the project.

Specifically, for core contributors, which encompasses private investors, 0.7292% of the WINR supply becomes available for them to either hold or sell each month.

The potential lack of alignment among these investors raises the possibility of selling pressure on the WINR token, which could explain why the WINR Protocol has experienced high sell pressure in recent months following rallies.

Furthermore, Moonrock Capital, a venture capital firm known for its involvement in various scandals, according to on-chain analyst Zachxbt, appears to be actively promoting WINR on Twitter and is recognised as one of the thought leaders in the community.

This raises questions about their motivation for actively promoting the protocol. Due to insufficient transparency around the $1 million raise and the identities of those who participated, it remains challenging to verify the motivations and position of Moonrock Capital in the protocol, given the absence of a publicly available list of private investors.

It would be beneficial if the team could publish more details about this private round and its investors.

Cryptonary's take

We acknowledge that the WINR Protocol demonstrates potential as an infrastructure player in the expanding crypto-gambling ecosystem. However, the identified risks give us pause in fully recommending it as a long-term investment at this time.The handling of the 2020 token swap and the lack of transparency around private investors are valid causes for concern. It is challenging for us to fully validate WINR's improved positioning today with clarity on these past events.

However, dismissing WINR solely based on its early stumbles would be short-sighted. The revamped tokenomics and deflationary incentives are cleverly designed. Integrations with JustBet and DegensBet demonstrate that market demand exists. The plan to launch WINR Chain indicates continued ambition by the team.

We believe adopting a “wait and see” stance on the WINR Protocol is prudent at this stage. Increased transparency from the project regarding its private investors, priorities, and the events of 2020 would help us build more conviction around WINR.